BlackBull Markets Review

BlackBull Markets, founded in 2014 in New Zealand, has emerged as a formidable player in the forex industry, providing access to a wide array of financial markets. The firm operates under the New Zealand Financial Markets Authority, assuring traders of its credibility and trustworthiness.

Recognized for its ECN trading execution, transparent pricing model, and robust MetaTrader platforms, BlackBull Markets ensures efficient and flexible trading conditions. Despite minor areas for improvement, such as enhancing educational resources, the platform’s comprehensive features, diverse financial instruments, and unwavering commitment to customer satisfaction make it an attractive choice for traders worldwide.

In this review, we delve into the specifics of BlackBull Markets, offering an unbiased evaluation of its services, features, pros, cons, and how it stands against other popular brokers and more. We will understand the BlackBull Markets safe measurement and security protocols in place to ensure the protection of BlackBull Markets clients.

What is BlackBull Markets?

BlackBull Markets is a renowned online brokerage firm that provides a platform for trading various financial instruments. Based in Auckland, New Zealand, and operating since 2014, the broker specializes in forex trading but also offers opportunities to trade commodities, indices, and Contracts for Differences (CFDs).

The company was created with a vision to provide a superior trading environment that meets the needs of different traders, focusing on aspects like transparency, execution speed, and competitive pricing. BlackBull Markets achieves this by offering Electronic Communications Network (ECN) execution, meaning that trades are directly processed in the market without any dealer intervention. This model guarantees traders fair and real-time market prices.

The broker provides its services via MetaTrader 4 and MetaTrader 5, two of the most popular and powerful trading platforms in the industry. These platforms offer a wide array of tools and features, including automated trading capabilities and advanced charting, which can cater to both beginner and experienced traders.

BlackBull Markets operates under the regulatory oversight of the New Zealand Financial Markets Authority, which provides assurance to traders regarding the safety of their funds and the integrity of the broker’s operations. Thus, traders can concentrate on their trading activities with confidence and peace of mind.

Advantages and Disadvantages of Trading with BlackBull Markets?

Trading with BlackBull Markets presents a variety of advantages and disadvantages that traders should consider when selecting a forex broker. These factors contribute to the overall trading experience, and understanding them can help traders align their choice with their trading goals and preferences.

Benefits of Trading with BlackBull Markets

Indeed, before diving into the benefits of trading with BlackBull Markets, it’s important to understand that the choice of a broker can significantly impact your trading journey. The right broker not only provides a platform for executing trades but also offers the tools, resources, and services to facilitate successful trading outcomes.

As a well-established and respected broker, BlackBull Markets brings numerous advantages to the table that can enhance your trading experience. Here, we delve into the key benefits of choosing BlackBull Markets as your trading partner.

Broad Range of Tradable Assets

Traders have access to a wide variety of markets, including forex, commodities, indices, and CFDs. This allows traders to diversify their portfolio under one platform.

ECN Execution

BlackBull Markets uses Electronic Communications Network (ECN) execution, ensuring that trades are processed quickly and at the best available market prices. This also reduces the likelihood of price manipulation.

Competitive Pricing

The firm provides competitive spreads and low commission rates. This helps traders keep transaction costs low and increases the potential for profits.

Regulation and Safety of Funds

BlackBull Markets is regulated by the New Zealand Financial Markets Authority, adding a layer of trust and security. Moreover, client funds are kept segregated from the firm’s operational funds, ensuring their safety.

Sophisticated Trading Platforms

Offering MetaTrader 4 and MetaTrader 5, traders get access to advanced trading tools and features, which can enhance their trading decisions.

Customer Support

BlackBull Markets has a dedicated and responsive customer support team, available through live chat, email, and phone to assist with any issues or queries.

Scalability

With multiple account types to choose from, BlackBull Markets caters to different trading styles and levels of experience, making it a suitable choice for both novice and experienced traders.

No Dealing Desk Intervention

As an ECN broker, BlackBull Markets operates with a no-dealing desk model, meaning there’s no interference in trades, reducing the chance of conflicts of interest.

BlackBull Markets Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making. Here are some key advantages and disadvantages associated with BlackBull Markets:

Pros

- ECN Execution: BlackBull Markets is an ECN broker, ensuring direct market access with faster execution and minimal slippage.

- Regulation: Being regulated by the New Zealand Financial Markets Authority provides a secure trading environment.

- Trading Platforms: The broker offers MetaTrader 4 and MetaTrader 5, both renowned for their advanced tools and user-friendly interfaces.

- Diverse Trading Instruments: From forex to commodities and indices, BlackBull Markets offers a wide range of trading assets.

- Transparent Pricing: The broker provides competitive spreads and commissions with a transparent pricing model.

- Customer Service: BlackBull Markets has a responsive customer service team, available through various channels.

Cons

- Limited Educational Resources: The broker’s educational content is less comprehensive compared to some competitors, which may be a drawback for new traders.

- No Fixed Spread Accounts: The absence of fixed spread accounts may be a disadvantage during periods of market volatility.

- Limited Non-Forex Assets: Compared to some competitors, the range of non-forex assets such as shares and cryptocurrencies is limited.

BlackBull Markets Customer Reviews

Customer reviews often serve as invaluable resources when selecting a forex broker, as they provide insights into the experiences of other traders. They can reveal the strengths and weaknesses of a broker’s services, platform functionality, and customer support, among other key factors. However, interpreting these reviews requires a discerning eye to separate individual experiences from consistent patterns.

Keep in mind that reviews can be subjective and are often based on personal experiences, so it’s wise to look for patterns and consistent feedback among multiple reviews. Remember, while user reviews can be helpful, they should not be the only factor considered when choosing a forex broker.

BlackBull Markets Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It’s not just about the trading platform’s capabilities or the variety of markets available to trade.

Costs associated with each trade can quickly add up and impact your bottom line, especially for active traders. In this section, we’ll examine the fee structure at BlackBull Markets and how it may affect your trading experience.

As an ECN broker, BlackBull Markets offers variable spreads that can adjust based on market conditions. For the major forex pairs, spreads can be quite low, sometimes starting from 0.1 pips for the ECN Prime and ECN Institutional accounts.

For the ECN Standard account, the spreads start slightly higher. Keep in mind that spreads can widen during periods of high volatility or low liquidity.

BlackBull Markets does not typically charge additional fees such as deposit or withdrawal fees, which is a significant advantage for traders. However, there may be fees associated with specific payment methods, so it’s important to check this before proceeding with transactions.

BlackBull Markets applies different commission structures depending on the account type. For their ECN Standard account, there is no commission, as costs are included in the spread. For the ECN Prime and ECN Institutional accounts, a commission per lot is charged on each trade. The specific rate may vary, so it’s recommended to check their website for the most accurate information.

It’s worth noting that like many brokers, BlackBull Markets might charge an inactivity fee if an account remains dormant for a specific period. You should review the broker’s terms and conditions to understand any additional charges that might apply.

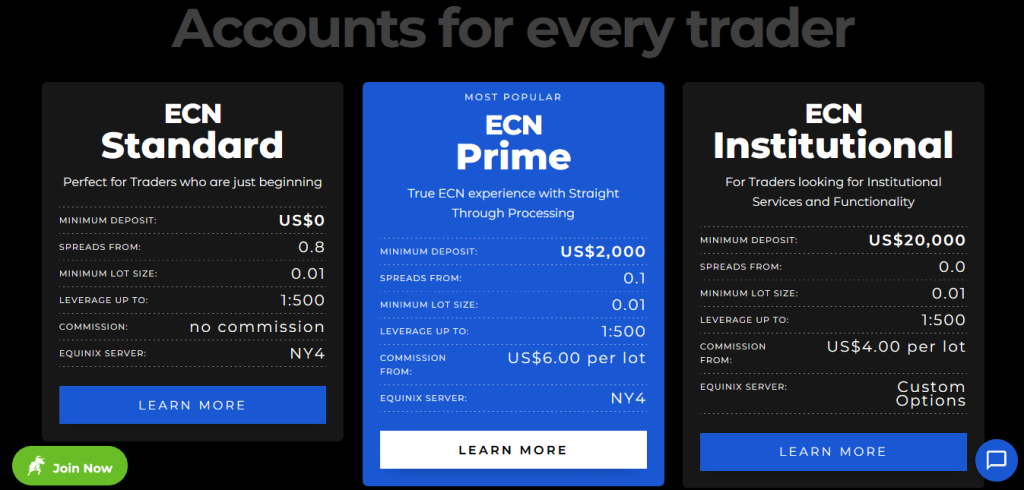

Account Types

BlackBull Markets offered three main types of trading accounts, each catering to different types of traders based on their trading needs, experience, and capital. Please note that specifics may have changed, and I recommend checking BlackBull Markets’ official website for the most accurate, up-to-date information. Here’s an overview:

ECN Standard Account: This account type is best suited for beginner traders or those with a lower initial deposit. The ECN Standard Account usually requires a lower minimum deposit and does not charge any commission on trades, as costs are included within the spread. This account provides access to the MetaTrader 4 and MetaTrader 5 platforms.

ECN Prime Account: The ECN Prime Account is tailored towards more experienced traders who trade with larger volumes. It usually requires a higher minimum deposit compared to the ECN Standard Account. This account offers tighter spreads and charges a commission per lot traded. ECN Prime Account holders also have access to both MetaTrader platforms.

ECN Institutional Account: This account type is designed for professional traders and institutional clients. It offers the tightest spreads and requires the highest minimum deposit. Commission rates may vary and can be negotiated based on the trading volume. ECN Institutional Account holders have access to both MetaTrader platforms and can benefit from dedicated account management services.

How To Open Your Account?

Opening an account with BlackBull Markets is a straightforward process. Here’s a step-by-step guide. Be sure to check BlackBull Markets’ official website for any changes to this process.

Visit the BlackBull Markets website: Start by going to the BlackBull Markets official website.

Sign Up: Click on the “Register” or “Open Live Account” button, usually located at the top right of the website.

Complete the Registration Form: You’ll be asked to fill out a form with personal details, including your name, email address, phone number, and country of residence.

Choose an Account Type: Select the account type that best fits your trading needs and deposit requirements – ECN Standard, ECN Prime, or ECN Institutional.

Verify Your Identity: To comply with financial regulations, BlackBull Markets will require proof of identity and proof of residence. This can usually be completed by uploading a scanned copy of a valid passport or ID for proof of identity, and a utility bill or bank statement for proof of residence.

Fund Your Account: Once your account is verified, you can deposit funds. BlackBull Markets offers several funding options, including bank transfer, credit/debit cards, and various online wallets. Select the method that suits you best and follow the instructions to complete the deposit.

Start Trading: After your deposit has been processed, you can start trading. Download the trading platform, log in with your account details, and begin your trading journey.

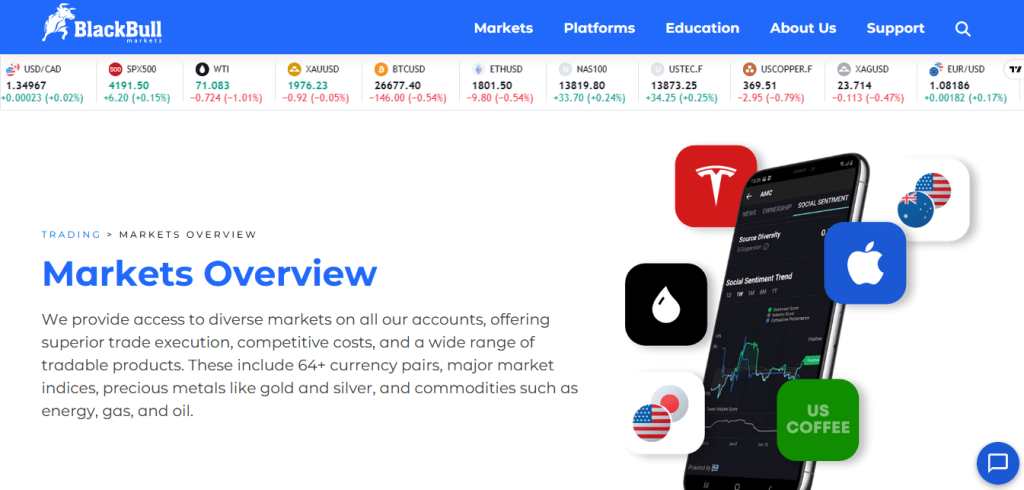

What Can You Trade on BlackBull Markets?

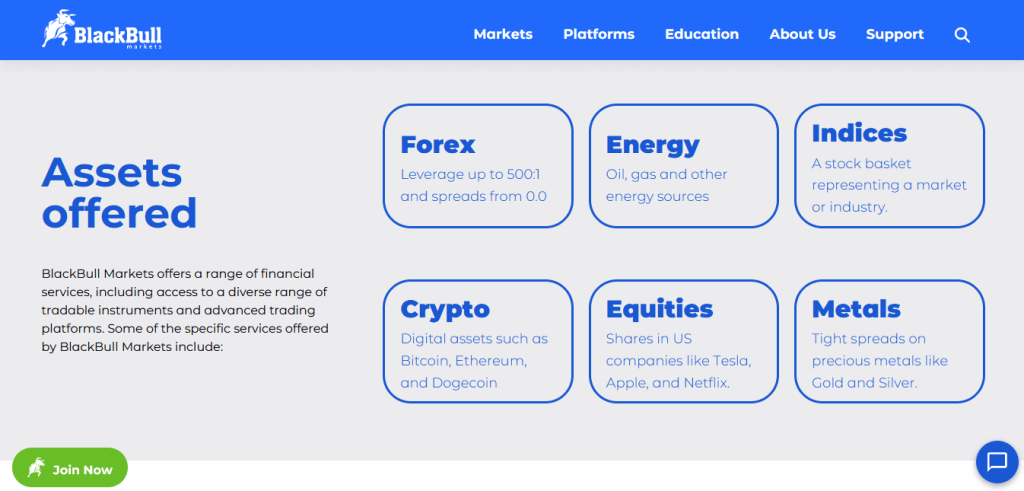

BlackBull Markets provides a diverse range of financial instruments for trading, allowing traders to access multiple markets from a single platform. While specific offerings may evolve over time, here are some of the common instruments you can trade on BlackBull Markets:

Forex: Trade a wide variety of major, minor, and exotic currency pairs, including EUR/USD, GBP/USD, USD/JPY, and more.

Commodities: Access popular commodities such as gold, silver, crude oil, natural gas, and agricultural products like wheat, corn, and soybeans.

Indices: Trade major global stock market indices, including the S&P 500, NASDAQ, Dow Jones, FTSE 100, DAX, and more.

Shares: Some brokers may offer the ability to trade shares (stocks) of publicly traded companies. Please check with BlackBull Markets to see if this is available.

Cryptocurrencies: Depending on the broker and current market conditions, you may have the opportunity to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others.

CFDs: Contracts for Differences (CFDs) allow traders to speculate on price movements of various financial instruments without owning the underlying asset. This may include CFDs on forex, commodities, indices, and more.

It’s important to note that the availability of specific instruments may vary depending on your location and the account type you choose. Additionally, market conditions and new product offerings may introduce additional tradable instruments.

BlackBull Markets Customer Support

BlackBull Markets prides itself on providing reliable and efficient customer support to assist traders with their inquiries and concerns. The broker offers multiple channels for customer support, ensuring that assistance is readily available when needed.

Here’s an overview of BlackBull Markets’ customer support:

Live Chat: BlackBull Markets provides a live chat feature on its website, allowing traders to engage in real-time conversations with customer support representatives. This can be an efficient way to get quick responses to queries and receive immediate assistance.

Email Support: Traders can reach out to BlackBull Markets’ customer support team via email. This allows for more detailed or complex inquiries and provides a written record of communication.

Phone Support: BlackBull Markets offers phone support, allowing you to speak directly with customer support representatives. This can be particularly useful for urgent matters or situations that require immediate attention.

The customer support team at BlackBull Markets aims to provide prompt and helpful assistance to address any issues or questions raised by traders. They strive to ensure a positive customer experience and assist traders in navigating the platform, resolving technical difficulties, or answering general inquiries.

It’s worth noting that the availability of customer support channels, response times, and language options may vary based on factors such as the trader’s location and the specific service package they have chosen.

Advantages and Disadvantages of BlackBull Markets Customer Support

When considering the customer support provided by BlackBull Markets, it’s important to assess both the advantages and disadvantages to gain a comprehensive understanding. Here are some potential advantages and disadvantages of BlackBull Markets’ customer support:

Security for Investors

BlackBull Markets prioritizes the security of investor funds and operates under regulatory oversight to ensure a safe trading environment.

Here are some key aspects of security for investors provided by BlackBull Markets:

It is important to note that the advantages of robust security measures typically outweigh the potential disadvantages. Investors should prioritize the safety of their funds and personal information when selecting a broker, understanding that security measures are in place to protect their interests in the long run.

Withdrawal Options and Fees

BlackBull Markets offered various withdrawal options for traders to access their funds. However, it’s important to note that specific withdrawal options and associated fees may have changed since then. To obtain the most accurate and up-to-date information, I recommend visiting the official BlackBull Markets website or contacting their customer support.

Here are some general considerations regarding withdrawal options and fees:

Withdrawal Options: BlackBull Markets typically provides several withdrawal methods, which may include:

Bank Transfer: You can choose to withdraw funds directly to your bank accounts. This option often requires providing banking details and can involve processing time based on interbank transfers.

Credit/Debit Cards: If the deposit was made using a credit or debit card, BlackBull Markets may allow withdrawals to be processed back to the same card.

Online Payment Processors: BlackBull Markets may support popular online payment processors, such as Skrill, Neteller, or other similar platforms, for convenient and swift fund withdrawals.

To proceed with a withdrawal, traders typically need to log in to their BlackBull Markets account, navigate to the withdrawal section, and follow the specified steps based on the chosen withdrawal method.

Withdrawal Fees: Regarding withdrawal fees, it’s important to note that BlackBull Markets generally does not charge withdrawal fees from their side. However, some payment processors or banks may impose fees on their end for processing the transaction. These external fees are beyond BlackBull Markets’ control and vary based on the chosen payment method and the recipient’s location.

It’s advisable to carefully review the terms and conditions or consult with BlackBull Markets directly to understand the specific withdrawal options available, any potential fees involved, and any minimum withdrawal amounts that may apply.

BlackBull Markets Vs Other Brokers

When comparing BlackBull Markets to other brokers, it’s essential to consider various factors that can impact the trading experience. Here, we’ll explore the comparisons between BlackBull Markets and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. BlackBull Markets Vs AvaTrade

BlackBull Markets specializes in ECN execution with direct market access, offering fast execution and competitive spreads. They prioritize transparency and provide a trading environment suitable for traders seeking direct market participation.

BlackBull Markets primarily focuses on forex trading, although they also offer access to other instruments such as commodities and indices. They are regulated by the New Zealand Financial Markets Authority (FMA) and provide the popular MetaTrader platforms (MT4 and MT5). The broker is known for its customer support and responsive service.

AvaTrade, on the other hand, offers a broader range of financial instruments beyond forex. They provide access to forex, stocks, commodities, indices, and cryptocurrencies. AvaTrade is regulated by multiple authorities, including the Central Bank of Ireland and the Financial Services Commission of the British Virgin Islands. They offer both MetaTrader platforms (MT4 and MT5) as well as their proprietary platform, AvaTradeGO, designed for mobile trading.

Verdict: If you prioritize ECN execution and direct market access, with a focus on forex trading, BlackBull Markets may be a suitable choice. They are known for their fast execution and competitive spreads, particularly for their ECN account types.

On the other hand, if you are looking for a broader range of financial instruments beyond forex, including stocks, commodities, and cryptocurrencies, AvaTrade may be more suitable. They offer a diverse selection of instruments and have established themselves as a well-known broker in the industry.

#2. BlackBull Markets vs. RoboForex

BlackBull Markets specializes in ECN trading with direct market access, providing traders with fast execution and competitive spreads. They prioritize transparency and offer a trading environment suitable for traders seeking direct market participation.

BlackBull Markets primarily focuses on forex trading, although they also provide access to other instruments such as commodities and indices. They are regulated by the New Zealand Financial Markets Authority (FMA) and offer the popular MetaTrader platforms (MT4 and MT5). The broker is known for its customer support and responsive service.

RoboForex, on the other hand, offers a broader range of account types and trading platforms. They provide flexibility for traders by offering multiple account options, including cent accounts, ECN accounts, and more.

RoboForex supports various trading platforms, including MetaTrader and their proprietary platform, allowing traders to choose the setup that suits their preferences. They offer a diverse range of instruments, including forex, stocks, commodities, indices, and cryptocurrencies. RoboForex is regulated by different authorities depending on the region and entity.

Verdict: If you value ECN trading with direct market access, fast execution, and competitive spreads, BlackBull Markets may be a better fit for you. Their focus on ECN execution can appeal to traders looking for transparency and direct access to the market.

On the other hand, if you prioritize flexibility in account types and trading platforms, RoboForex might be more suitable. They offer a variety of account options and multiple trading platforms, allowing traders to choose the setup that aligns best with their preferences.

#3. BlackBull Markets vs. Alpari

BlackBull Markets specializes in ECN execution with direct market access, providing fast execution and competitive spreads, particularly for their ECN account types. They primarily focus on forex trading but also offer access to other instruments such as commodities and indices.

Regulated by the New Zealand Financial Markets Authority (FMA), BlackBull Markets provides the popular MetaTrader platforms (MT4 and MT5) and is known for its customer support and responsive service.

Alpari, on the other hand, offers a wider range of account types and trading platforms, including both MetaTrader platforms and their proprietary platform. They provide a diverse selection of financial instruments, including forex, commodities, indices, and stocks. Alpari is regulated by various authorities depending on the region and entity.

Verdict: If you prioritize ECN execution, direct market access, and a focus on forex trading, BlackBull Markets may be the better choice for you. They specialize in ECN execution, provide fast execution and competitive spreads, and are known for their customer support and responsive service.

If you value a broader range of financial instruments beyond forex and desire flexibility in account types and trading platforms, Alpari could be a suitable option. They offer a diverse selection of instruments, including forex, commodities, indices, and stocks, and provide various account types and trading platforms to cater to different trading preferences.

Conclusion: BlackBull Markets Review

After conducting a comprehensive review of BlackBull Markets, it is evident that they are a reputable and well-regulated broker in the forex industry. Their specialization in ECN execution and direct market access sets them apart, offering traders fast execution and competitive spreads. The broker’s focus on transparency and customer support further enhances the trading experience.

It’s important to note that while BlackBull Markets excels in ECN trading, it may not be the ideal choice for traders seeking a broader range of financial instruments beyond forex. However, for those primarily focused on forex trading, BlackBull Markets offers a reliable and transparent platform.

This comprehensive BlackBull Markets review highlights the strengths and offerings of this reputable forex broker. With a focus on ECN execution, direct market access, and excellent customer support, BlackBull Markets is a preferred choice for retail traders. The availability of a mobile trading platform ensures convenience and flexibility for traders on the go. With a minimum deposit requirement suitable for retail investor accounts, BlackBull Markets caters to traders at various levels.

As a regulated broker under the New Zealand Financial Markets Authority (FMA), BlackBull Markets prioritizes the safety and security of client funds. Traders can access a wide range of currency pairs and benefit from comprehensive technical and fundamental analysis tools to support their trading decisions.

BlackBull Markets offers secure deposit and withdrawal options, including bank transfers, ensuring efficient fund management. With a strong emphasis on trading performance and a range of services, BlackBull Markets provides retail traders with a leading online financial technology platform.

BlackBull Markets is a safe and reliable forex broker that prioritizes the needs of retail traders, offering them the necessary tools and support to succeed in their trading endeavors.

BlackBull Markets Review FAQs

Is BlackBull Markets regulated?

Yes, BlackBull Markets is regulated by the New Zealand Financial Markets Authority (FMA). This regulatory oversight ensures that the broker operates in compliance with established financial rules and regulations, providing a level of security and trust for traders.

What trading platforms does BlackBull Markets offer?

BlackBull Markets offers the popular MetaTrader platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their advanced charting capabilities, extensive technical analysis tools, and the ability to automate trading strategies through expert advisors (EAs).

What account types are available at BlackBull Markets?

BlackBull Markets provides various account types to cater to different trading needs. They offer ECN account options, which provide direct market access and tight spreads. Additionally, they may offer different account types with varying features such as leverage, minimum deposit requirements, and commission structures. Traders can choose the account type that best aligns with their trading goals and preferences.