When you briefly dig into Bitcoin’s history and details, you’ll find an almost unbelievable story about how one can create money from nothing. I know, that would’ve sounded cray two decades ago, but today, Bitcoin remains the best-renowned version of digital currencies in use around the world.

To help you wrap your head around this cryptocurrency, what it is, the things it does, and how you can get started with bitcoin mining, I’ve pulled together this detailed bitcoin for dummies guide you can use. It goes over everything listed above, and some more.

Before delving deeper into the guide, remember that investing in crypto tokens and digital currencies is extremely speculative and the general cryptocurrency market remains highly unregulated. As such, it makes sense that anyone considering investing in this space should be extremely vigilant.

Without further ado, here is our detailed bitcoin for dummies that’ll get you right up to speed.

Also Read: Straddle: Learn the Basics of This Options Strategy

Contents

- Early History of Bitcoin

- What Is Bitcoin?

- Is Bitcoin Backed By Anything? And How Does Bitcoin Work?

- What Is Bitcoin Mining And How Does It Work?

- How To Buy Bitcoin for Dummies and How Store It

- Lightning Network

- The Exit of Satoshi Nakamoto

- Silk Road

- Conclusion

Early History of Bitcoin

In the 19th and 20th centuries, most of the world’s popular and physical currency options could be converted into a fixed size and amount of gold, silver, or any other precious metal. However, most nations worldwide would go on to abandon the gold standard between the 20s and the 70s, mainly due to financial strains brought about by funding the two world wars as well as worldwide gold production’s failure to keep up with the pace of economic development.

Previously, physical valuables like silver and gold were what people traditionally used to trade products and services. But these physical assets were tiresome to carry around and prone to theft and loss, which is why banks and other central entities, like banks, jumped in, retained them from users, and gave notes in return to confirm the users’ bank holdings.

Fast forward to the 21st century, and citizens of different nations still solely depended on banks to safeguard their funds and maintain the value of their networth. This would prove to be a “not-so-fool-proof” in 2008 and 2009 when several banks and other finance-related organizations failed and governments had to kick in and bail them out at every taxpayer’s expense.

This failure of ‘the guardians of public funds’ was what first highlighted just how fragile the modern financial system can be and why decentralization is required in the financial realm if the customer experience is to be enhanced. Most, at the time, saw Bitcoin as the ideal response to the Great Financial Crisis and a reliable means to end reliance on banks as intermediaries of all financial transactions.

The original idea of anything akin to the current bitcoin software was first introduced by W. Scott Stornetta and Stuart Haber in 1991 in a paper they had written, called “How To Time-Stamp a Digital Document.”

In the paper, the two exhaustively explained how continuous chains of timestamps could be used to record info securely.

When the Bitcoin network was first created, its role was to solely facilitate the exchange of Bitcoin cryptocurrencies as hypothesized by W. Scott Stornetta and Stuart Haber. However, the first bitcoin investors and adopters quickly discovered that the technology had far greater potential and vast amounts of use cases that could be exploited. For that reason, the bitcoin blockchain network would go on to be used to store more than just data on the currency’s movement. More on these uses later.

What’s more? The bitcoin blockchain was also designed to use P2P transactions (peer to peer), which allowed such a system to operate without requiring any third party or bank to manage any bitcoin transactions. It also allowed people to make online payments directly to recipients without taking the funds through any traditional fiat bank.

For those who are beginners to the realm of cryptocurrency investing, the term peer to peer simply implies that all computers that are part of the said network are equal to one another and no “special nodes” exist. All the nodes on the network also share the burden of offering network services.

The bitcoin network is made up of tens of thousands of bitcoin nodes that keep the entire bitcoin protocol running. The protocol then safeguards and establishes the entire blockchain. Now let’s take a better look into what Bitcoin is, how it came to be, and how it works.

What Is Bitcoin?

In 2008, an individual or group of people called Satoshi Nakamoto created the Bitcoin Protocol to get rid of central authority over money because every financial central entity, like banks, had repeatedly been failing the world. Satoshi Nakamoto also published a whitepaper called the bitcoin whitepaper and it outlined sets of computational rules that determined the new type of distributed database that would eventually be known as the blockchain technology.

When the initial block, also known as the genesis block, was officially mined on January 3, 2009, the bitcoin blockchain was officially launched. Less than a week later, the first test transaction took place, after which bitcoin was officially available to miners. At the time, Bitcoin had no real worth. Miners (the machines that solve complex mathematics problems to find new bitcoins and verify that any pending transactions are accurate and valid) at the time would simply exchange bitcoins with each other for fun.

The 1st economic bitcoin transaction on the platform took place more than a year later when a man from Florida agreed to pay 10,000 Bitcoins for two $25 Papa John’s Pizzas. The transaction took place on May 22, 2010, and is still celebrated to this day as Bitcoin Pizza Day. The first value or price of Bitcoin was set at just four BTC per penny because of the aforementioned pizza transaction.

Now, fast forward more than a decade and bitcoin still remains the most well-known cryptocurrency on the blockchain. Like the US dollar, cryptocurrencies are digital means of exchange that use encryption techniques that oversee the establishment of monetary units and verify financial transfers.

How does the bitcoin blockchain work? Easy! The bitcoin blockchain uses digital data stored in “blocks” of info that’re linked together in a permanent “chain”, so to say. Each block is a collection of bitcoin transactions. Several stacks of blocks are piled onto each other, with every new block depending on the previous ones, resulting in a chain of blocks (hence the term ‘BLOCKCHAIN’.)

Anytime a new block is added to the blockchain, it makes all previous blocks unmodifiable, ensuring that every block and every transaction data is more secure over time. This brief look at how the blockchain works has also perfectly demonstrated how and why the Bitcoin technology has been revolutionizing how financial and banking transactions are getting made.

Also worth noting, the bitcoin blockchain is more than merely a cryptocurrency. It’s also the technology that almost every digital currency is built upon, including bitcoins. It’s also unique in that it’s highly accurate when it comes to validating transactions. As we’ve just highlighted, every action on the blockchain is recorded and the network doesn’t leave out anything. And once the action is recorded, stored, and validated on any of the digital information blocks, it’s secured, time-stamped, and made available to all bitcoin use else on the system.

What’s more? As briefly highlighted earlier, the Bitcoin network is also decentralized, which implies that the digital currency isn’t controlled by any specific company or stored in a single computer. This decentralized currency is distributed across multiple computers all connected to the blockchain network.

Inside the bitcoin blockchain created by Satoshi Nakamoto, you’ll also find codes known as a hash. Each hash is unique to each block on the blockchain and the entire hashing algorithm allows every bitcoin and blockchain user to identify the blocks. The algorithm also directs these blocks in the blockchain. So in essence, a hash is basically a fixed-length string generated once any length of input data in the blockchain ne

With everything in mind, it’s safe to conclude that critical parts of the blockchain include the chain, hash, block, and records. Transaction and block records are the two kinds of records you’ll find in the blockchain. Transaction records include ownership, price, and asset data that have been settled, approved, and recorded across all nodes. On the other hand, a block carries the most recent bitcoin transaction data that is yet to be recorded in any preceding block.

Is Bitcoin Backed By Anything? And How Does Bitcoin Work?

Unlike traditional currency options, Bitcoins are neither issued by central banks nor backed by governments or any single entity. This, in turn, ensures that economic growth indicators, monetary policies, and inflation rates that traditionally influenced money do not apply in the realm of bitcoins.

The digital chain of blocks on the bitcoin blockchain are similar to google docs that everyone can edit. They’re not owned or controlled by any single person, but anyone with the link can contribute. If you, for instance, have access and contribute, your copy will also get updated as others on the platform make changes to the platform.

We know! The idea that anyone is able to make edits to the blockchain appears unsafe. Contrary to that belief, however, it’s precisely what keeps the blockchain secure and trustworthy. Before any transaction block gets included in the Bitcoin blockchain, bitcoin minders decide, and it only gets included if a majority of them validate it.

To get verified, the unique codes on the block used to identify bitcoin wallets and transactions of bitcoin users must follow the right pattern. Since each of these unique codes is long random figures, counterfeiting any of them is virtually impossible. The statistical randomness required for each blockchain verification code is what has dramatically minimized the likelihood of any fraudulent bitcoin transactions making it into the bitcoin network.

What Is Bitcoin Mining And How Does It Work?

Bitcoin mining is a process through which valid blocks are created so they can add bitcoin transaction records to the bitcoin public ledger, also known as the blockchain. The mining process is an essential component of the bitcoin network because it’s responsible for solving the so-called “double-spend problem.”

For those getting started with bitcoin basics, the double-spend problem simply refers to the issue of having to find consensus on any transaction’s history. Remember, ownership of bitcoins is proven through public-key cryptography. Unfortunately, cryptography alone can’t guarantee that any particular coin hasn’t been previously sent to a different person.

So, in order to create a shared transactions history, the platform needs an agreed-upon ordering system based on, for instance, the time of the creation of every transaction. Any external inputs can get manipulated by whoever provides them, requiring participants to rely on third parties.

So, how does bitcoin mining work? We thought you’d never ask.

Bitcoin mining follows the same process one would follow when mining any other cryptocurrencies. Decentralized third parties order transactions and receive monetary rewards for correct behavior. On the contrary, any misbehavior by these third parties results in a loss of economic resources, as long as the majority remains honest.

In Bitcoin mining’s case, this result is attained by the creation successions of blocks that are mathematically proven to have been stacked in the right order with a certain commitment of resources. The whole process relies on the mathematical properties of cryptographic hashes – the way of encoding data in a standardized manner.

Remember the hashes we mentioned earlier? During bitcoin mining, they’re a one-way encryption tool, implying that decrypting their input data is nearly impossible – unless one can run every single possible combination until they come across a result that aligns with any given hash.

So, during mining, bitcoin miners cycle through trillions of distinct hashes every second until they come across a single one that satisfies a blockchain condition known as “difficulty.” Both the hash and the difficulty are extremely large numbers that are expressed in bits, so the condition is that the hash has to be lower than the difficulty.

Every hash generated by a bitcoin minder is used as a particular block’s identifier and is made up of data found in the block header. The most essential hash components include the previous block’s unique hash, and the Merkle root (a different aggregated hash encapsulating the signatures of every transaction in that block.)

This implies that altering even the smallest component of any block will change its expected hash noticeable – as well as that of any following block. If that happened, nodes would reject the incorrect version of the blockchain instantly, thereby safeguarding the network from any tampering.

As you can see, through this difficulty requirement, the whole system guarantees that every bitcoin miner will have to put in real work (the electricity, time, and internet connection spent in hashing through millions of different combinations) before getting a block reward. That’s why bitcoin’s consensus protocol is called a “proof-of-work” one.

In order for hackers or other malicious entities to attack the network, they have no other way than to recreate the entirety of bitcoin’s mining power. That would cost billions of dollars.

Regarding the rewards, there are two types that bitcoin miners earn for their work. The first one is earning a portion of the new bitcoins created with each block, and fees paid by users to transact on the blockchain network.

Also worth noting, the reward to be a miner of Bitcoin is halved at fixed intervals of approximately four years so that eventually, no additional bitcoins will be mined and transaction fees will be the only reward bitcoin miners get.

In 2020, the mining reward amounted to 6.25 Bitcoins. By 2040, however, this reward will have decreased to below 0.2 bitcoins and only approx.. 80,000 bitcoins out of 21 million will have been left up for grabs. Bitcoins as a reward is expected to end after 2140.

Also worth noting, even though the block reward decreases over time, every halving is amply compensated by the steep increase in Bitcoin price.

Also Read: Where To Buy Chia Coin | An In-Depth Guide

How To Buy Bitcoin for Dummies and How Store It

The easiest and simplest way to buy bitcoin is online through a reliable cryptocurrency exchange. Another option is finding a bitcoin ATM (there are hundreds of thousands of them around the world.) as of the writing of this article, the leading cryptocurrency exchange in terms of users and trading volume is Binance. You can even buy Bitcoins using your credit card on CryptoPotato on Binance.

Regarding where to store your Bitcoins, you’ll need a digital bitcoin wallet. Every digital wallet has a public digital address where the coins can be received. The address in question is a string of English letters and numbers (approximately 30 characters long.)

Creating a wallet is free of charge and there isn’t a limit to the number of wallets you can create.

Lightning Network

For any alternative digital currency system to compete and potentially replace established global payment systems like Mastercard or Visa, it has to be capable of handling a myriad of day-to-day transactions required in all our lives.

Bitcoin, in its original state, wasn’t equipped to handle hundreds, let alone, thousands of transactions per second like Mastercard can, so when builders and developers in the space started increasingly debating the scalability of the cryptocurrency, myriads of scaling solutions would be quickly proposed.

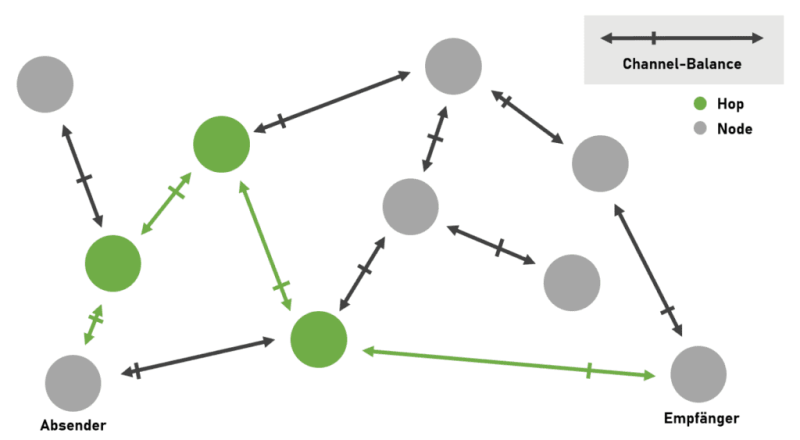

On January 14, 2016, Thaddeus Dryja and Joseph Poon would release a white paper that detailed the Lightning Network, they layer-two scaling solution for Bitcoin. It proposed that every bitcoin transaction could occur over off-chain payment channels before getting cryptographically verified and settled on-chain later on. This would, in turn, reduce the transaction load on the blockchain while simultaneously allowing for cheaper, faster transactions.

The Lightning Network system has been operational on Bitcoin’s mainnet since March 2018 and continues to mature as one of Bitcoin’s key cryptography infrastructures.

As described on the system’s website, the Lightning Network facilitates “instant payments” that are “lightning-fast without one having to worry about block confirmation times.” Lately, however, Bitcoin has been taking on a more “store-of-value” role as opposed to its initial function as a transactional currency. As such, transaction costs and speeds have become arguably less important.

The Exit of Satoshi Nakamoto

On April 26, 2011, Satoshi Nakamoto departed the bitcoin project and handed its development reins to the open-source community and Gavin Andresen. Until that point, Bitcoin’s development and unrolling had been primarily led by Satoshi, whoever he/they may be.

In retrospect, however, the inventor’s anonymity could’ve been at the project’s persistence and success. With enforcement agencies seriously cracking down on nefarious cryptocurrency uses in the following years after bitcoin’s unleashing, it’s only natural that Satoshi would’ve met the same fate as Ulbricht had he been identified (which would’ve in turn hindered the early growth that bitcoin experienced.)

Even the decision to walk away was essential, as it ensured that Bitcoin essentially remained true to its founding as a resilient, decentralized, and trust-minimized financial system.

Silk Road

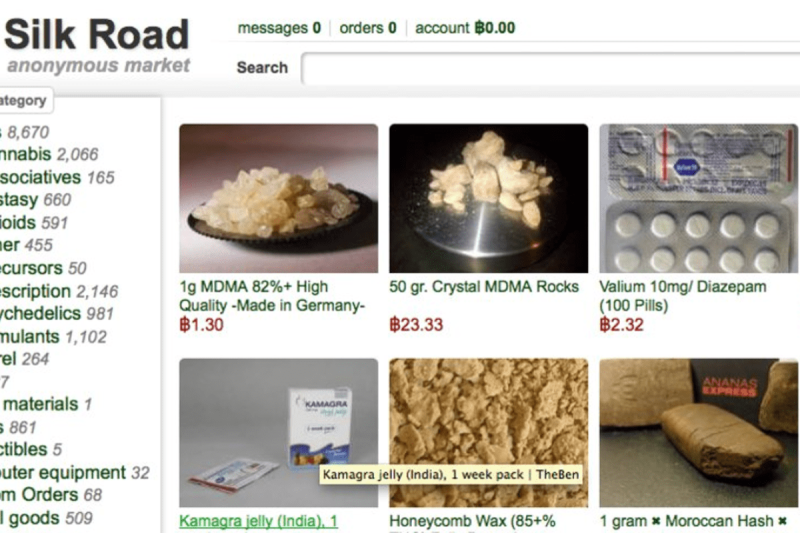

No bitcoin for dummies guide would be complete without at least a single chapter on Silk Road. Started by Ross Ulbricht in February 2011, Silk Road was an infamous online darknet marketplace accessible to users only through the Tor browsing service and with Bitcoin as its main transaction currency. Ross used the pseudonym “Dread Pirate Roberts,” derived from the character in the “Princess Bride” movie.

The Silk Road web platform was a free, open bazaar where individuals could freely transact with each other outside the constraints of government regulation. As with all other marketplaces, the website also boasted forums in which individuals could discuss crypto-anarchism, libertarianism, and other dissident views. It even boasted a reputation system in addition to its automated escrow system intended to minimize fraud.

As expected, Silk Road would shortly become a haven for drugs and all sorts of criminal commerces. As a result, federal law enforcement started investigating its operations, which culminated in Ross Ulbricht’s arrest on October 2, 2013. He is currently serving multiple life sentences without any possibility of parole.

The founding of Silk Road was a key point in the history of bitcoin because the notion of Bitcoin as the currency of choice for criminals stemmed from cases such as those on the Silk Road marketplace. What had been started as the best expression of personal liberty and libertarian idealism around free markets would quickly become the most legendary black market in modern date.

We should also note that the US Marshals Service auctioned off almost 30,000 bitcoins that they seized during the arrest of Ulbricht, which further lends credence to the legality of Bitcoins. So despite Silk Road’s dark turn in its history and use cases, it still did exhibit the capability of bitcoins to facilitate peer to peer trading in an open market.

Conclusion

So evidently, the jury is still out on whether Bitcoin will eventually achieve everything that its proponents have been predicting, including the total replacement of the need for centralized, government-controlled money.

That said, we can all expect the next several years to give us a lot more insight regarding the future of bitcoin as well as the whole network upon which it’s built. This should also bring about the growth and maturity of the digital currency as well as the blockchain technology as a whole.