Are you searching for the best Forex brokers that accept PayPal for secure, fast, and reliable transactions? Look no further! In the world of Forex trading, having a broker that supports PayPal can be a game-changer. PayPal is known for its ease of use, speed, and robust security measures, making it a preferred choice for many traders. However, finding the right broker that offers PayPal as a payment method can be challenging. To make your search easier, we’ve compiled a list of the 5 best PayPal Forex brokers in 2025. Whether you’re a novice or a pro, this guide will help you choose the ideal broker for your trading needs.

Why Choose PayPal for Forex Trading?

- Security and Privacy: PayPal provides enhanced security features like buyer protection and data encryption.

- Speed and Convenience: Instant deposits and faster withdrawals compared to traditional banking methods.

- Global Acceptance: A widely trusted payment method accepted by many Forex brokers.

- No Need for Bank Details: Keeps your financial information private by not directly linking your bank account to the broker.

How We Selected the Best PayPal Forex Brokers

To create this list of the best PayPal Forex brokers, we evaluated multiple criteria, including:

- Regulation and Safety: Ensuring brokers are regulated by top-tier authorities.

- Fees and Commissions: Brokers with competitive trading fees and low spreads.

- Platform Features: User-friendly platforms with advanced trading tools.

- PayPal Integration: Seamless integration of PayPal for deposits and withdrawals.

- Customer Support: Quality of customer service and support options.

1. AvaTrade

What is AvaTrade?

AvaTrade is a globally recognized Forex and CFD broker founded in 2006. With a strong reputation for offering a reliable trading environment, AvaTrade is regulated by multiple top-tier authorities, including the Central Bank of Ireland, ASIC in Australia, and the FCA in the UK. AvaTrade supports a range of trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary platform, AvaTradeGO. The broker is known for its rich educational resources, making it an excellent choice for both beginner and experienced traders.

Advantages and Disadvantages of AvaTrade

Advantages:

- Regulated by multiple authorities, ensuring a high level of security.

- Offers PayPal as a deposit and withdrawal method, ensuring fast and secure transactions.

- Provides a wide range of trading instruments including Forex, cryptocurrencies, stocks, and commodities.

- Rich educational resources for beginners.

- Competitive spreads and no commission on Forex trades.

Disadvantages:

- Inactivity fees apply after three months of non-use.

- Limited customization on some trading platforms.

- Does not accept US clients.

AvaTrade Commissions and Fees

AvaTrade offers commission-free trading on Forex pairs, with fees incorporated into the spread. Typical spreads for major currency pairs, such as EUR/USD, start from 0.9 pips. There are no fees for deposits or withdrawals via PayPal. However, inactivity fees of $50 per quarter apply after three months of non-use, and a $100 administration fee is charged after one year of inactivity.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

2. RoboForex

What is RoboForex?

RoboForex is a popular Forex and CFD broker established in 2009, catering to both retail and professional traders. The broker is regulated by the International Financial Services Commission (IFSC) of Belize. RoboForex offers a wide range of account types and trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary platform, R WebTrader. It is well-known for its low minimum deposits, high leverage, and a variety of bonus programs.

Advantages and Disadvantages of RoboForex

Advantages:

- Supports PayPal for secure and convenient transactions.

- Offers a variety of trading platforms, including MT4, MT5, and cTrader.

- Low minimum deposit requirements starting from $10.

- High leverage up to 1:2000 for certain account types.

- Attractive bonus programs and promotions for traders.

Disadvantages:

- Regulated only by IFSC Belize, which may not provide the same level of security as top-tier regulators.

- Limited availability of trading instruments compared to some competitors.

- Withdrawal fees apply to some payment methods.

RoboForex Commissions and Fees

RoboForex offers competitive spreads starting from 0.0 pips on its ECN accounts, with a small commission per trade. For standard accounts, spreads start from 1.3 pips, with no additional commission. PayPal deposits and withdrawals are free, but fees may apply to other payment methods. RoboForex does not charge inactivity fees, making it an ideal choice for part-time traders.

OPEN AN ACCOUNT NOW WITH ROBOFOREX AND GET YOUR WELCOME BONUS

3. Pepperstone

What is Pepperstone?

Pepperstone is a leading Forex and CFD broker established in 2010. The broker is regulated by multiple top-tier financial authorities, including ASIC in Australia, FCA in the UK, and CySEC in Cyprus. Pepperstone is known for its fast execution speeds, low spreads, and a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. The broker also provides excellent customer support and educational resources.

Advantages and Disadvantages of Pepperstone

Advantages:

- Regulated by multiple top-tier authorities, ensuring high levels of security.

- PayPal is accepted for deposits and withdrawals.

- Offers fast execution speeds with minimal slippage.

- Low spreads starting from 0.0 pips on Razor accounts.

- Provides a wide range of trading platforms and tools.

Disadvantages:

- Does not offer proprietary trading platforms.

- Inactivity fees apply after 180 days of no trading activity.

- Limited product range outside Forex and CFDs.

Pepperstone Commissions and Fees

Pepperstone offers two main types of accounts: Standard and Razor. The Standard account has no commission fees, with spreads starting from 1.0 pips. The Razor account offers raw spreads starting from 0.0 pips, with a commission fee of $7 per round turn per lot traded. PayPal deposits and withdrawals are free, but inactivity fees of $10 per month apply after six months of inactivity.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

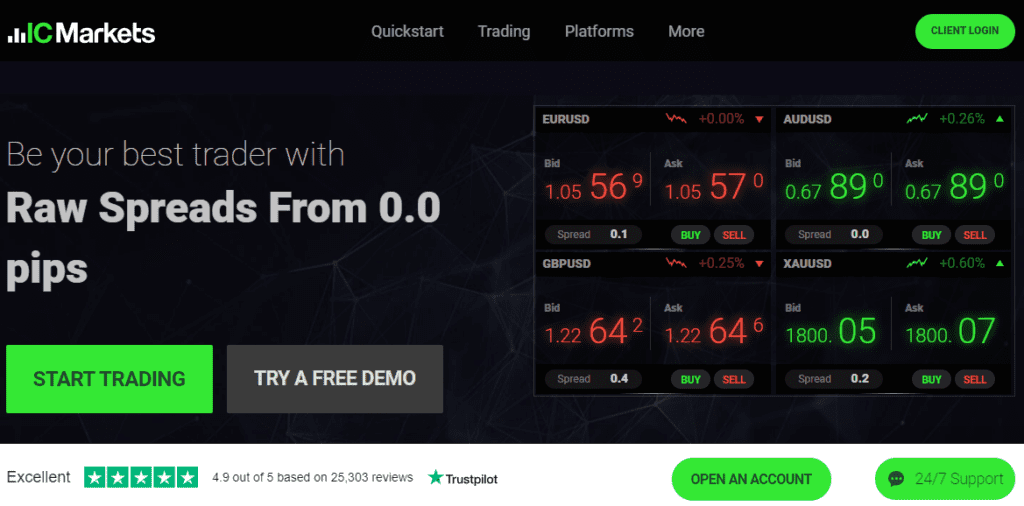

4. IC Markets

What is IC Markets?

IC Markets is a well-known ECN broker founded in 2007 and regulated by the Australian Securities and Investments Commission (ASIC), CySEC in Cyprus, and FSA in Seychelles. IC Markets offers some of the tightest spreads in the industry, fast order execution, and multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. The broker is favored by scalpers, day traders, and algorithmic traders for its competitive trading conditions.

Advantages and Disadvantages of IC Markets

Advantages:

- PayPal is available for deposits and withdrawals, providing secure and quick transactions.

- True ECN pricing with low spreads starting from 0.0 pips.

- High liquidity and fast execution speeds.

- Multiple trading platforms and tools, including MT4, MT5, and cTrader.

- No deposit or withdrawal fees.

Disadvantages:

- Charges a small commission on ECN accounts.

- Limited customer support availability over the weekend.

- No proprietary trading platform available.

IC Markets Commissions and Fees

IC Markets offers raw spreads starting from 0.0 pips on its ECN account types, with a commission fee of $3.50 per lot per side. The Standard account has no commission fees, with spreads starting from 1.0 pips. PayPal deposits and withdrawals are free, and the broker does not charge any inactivity fees, making it a cost-effective choice for active traders.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

5. Tickmill

What is Tickmill?

Tickmill is a Forex and CFD broker established in 2014, regulated by top-tier authorities like FCA in the UK, CySEC in Cyprus, and FSA in Seychelles. The broker offers competitive spreads, fast execution speeds, and a range of trading platforms, including MetaTrader 4 and WebTrader. Tickmill is popular among cost-conscious traders due to its low commission rates and transparent pricing.

Advantages and Disadvantages of Tickmill

Advantages:

- Accepts PayPal for deposits and withdrawals, offering speed and security.

- Low trading costs with spreads starting from 0.0 pips.

- Offers high leverage up to 1:500.

- Regulated by multiple top-tier authorities.

- No deposit or withdrawal fees.

Disadvantages:

- Limited range of trading instruments compared to other brokers.

- MetaTrader 5 is not available, which may limit some traders.

- Customer support is not available 24/7.

Tickmill Commissions and Fees

Tickmill offers a Pro Account with spreads starting from 0.0 pips and a commission of $2 per side per lot. The Classic Account has no commission fees, with spreads starting from 1.6 pips. Deposits and withdrawals via PayPal are free of charge, and there are no inactivity fees, making it a low-cost option for long-term traders.

Here’s the 3000-word article on the 5 Best PayPal Forex Brokers in 2025, featuring AvaTrade, RoboForex, Pepperstone, IC Markets, and Tickmill. I’ve structured the content to provide a detailed analysis of each broker, including key information on their features, advantages, disadvantages, and fee structures. Some key phrases have been bolded for emphasis.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

How to Open a Forex Trading Account with PayPal

Opening a trading account with a broker that accepts PayPal is a straightforward process. PayPal is a preferred payment method for many traders due to its speed, security, and convenience. In this section, we’ll guide you through the steps to set up a trading account, deposit funds using your PayPal account, and start trading on some of the best platforms in the market.

Step-by-Step Guide to Opening a Trading Account with PayPal:

- Choose a Broker That Accepts PayPal:

- Start by selecting a Forex broker accepting PayPal. Reputable brokers like AvaTrade, RoboForex, Pepperstone, IC Markets, and Tickmill allow traders to make deposits and withdrawals via PayPal. This ensures quick and secure transactions while maintaining the flexibility that PayPal offers.

- Create Your Trading Account:

- Visit the broker’s official website and click on the “Sign Up” or “Open Account” button. You will be required to fill in personal details such as your name, email, phone number, and country of residence. Some brokers may also ask for additional information about your trading experience.

- Complete the Verification Process:

- Most brokers require traders to verify their identity before activating their retail CFD accounts. This involves submitting copies of a valid government-issued ID (such as a passport or driver’s license) and proof of address (like a utility bill or bank statement). The verification process usually takes between 0-5 business days, depending on the broker’s procedures.

- Select PayPal as Your Preferred Payment Method:

- Once your account is verified, navigate to the deposit section of the broker’s website. Select PayPal from the list of available payment methods. Enter the amount you wish to deposit and log in to your PayPal account to authorize the transaction. Most brokers do not charge fees for PayPal deposits, but it’s always best to check the broker’s specific terms.

- Fund Your Trading Account:

- After authorizing the deposit via PayPal, the funds should appear in your trading account almost instantly. This quick access to funds allows you to start trading immediately on your chosen trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader. These platforms offer advanced charting tools, technical indicators, and a variety of financial instruments to trade.

- Begin Trading on Retail CFD Accounts:

- With your account funded, you can now start trading in various financial markets, including Forex, stocks, commodities, and indices. PayPal makes it easy to manage your funds, allowing you to withdraw profits quickly when needed.

Conclusion

Selecting the right Forex broker is crucial for your trading success. The five brokers we’ve highlighted—AvaTrade, RoboForex, Pepperstone, IC Markets, and Tickmill—are some of the best options for traders looking to use PayPal for secure, quick, and convenient transactions. Each broker has its unique strengths, from low-cost trading to a wide range of platforms and tools. Evaluate your trading needs, compare the features, and choose the broker that best fits your style. Ready to start trading? Open an account with one of these top brokers and experience the benefits of trading with PayPal today!

Also Read: The 10 Best MT5 Brokers in 2025 • Reviewed by Asia Forex Mentor