Japan’s trading scene in 2024 offers vast opportunities for forex traders and professional traders, making the country a hub for some of the best international brokers in Japan. With increasing participation from retail investor accounts, the demand for forex trading platforms offering advanced trading tools and competitive spreads has surged. Many forex brokers now cater to japanese traders with trading services tailored for the Japanese market, ensuring compliance with the Japanese Financial Services Agency‘s stringent regulations.

The top online brokers in this dynamic environment provide trader education, market analysis, and best forex trading platforms designed for both beginner traders and algorithmic traders. Features such as low trading fees, negative balance protection, and advanced charting tools enhance the experience for active traders. Whether focusing on forex CFDs, currency pairs, or multiple asset classes, these online trading platforms offer robust trading apps and live trading accounts to navigate the global financial markets effectively while addressing the risks involved.

Key Features to Look for in International Brokers

When selecting international brokers, it is vital to prioritize features that ensure a smooth and secure trading platform and experience. A reliable broker should offer regulated broker services, ideally adhering to standards set by authorities like the Japanese Financial Services Agency for Japanese traders. Retail investor accounts should be equipped with negative balance protection, minimizing risks in volatile global financial markets. Forex traders and professional traders alike benefit from advanced trading tools like algorithmic trading and advanced charting tools to execute trading strategies effectively.

The best international brokers in Japan offer competitive spreads and low trading fees to help traders minimize trading costs. Access to multiple asset classes such as forex CFDs, currency pairs, and CFD trading ensures portfolio diversification. Beginners should seek brokers with trader education resources like a trading academy and market analysis, while active traders require commission-free trading, mobile trading platform and apps, and fast access to live trading accounts. Trusted names like Interactive Brokers and CMC Markets stand out for their best trading platform offerings and support for global markets. Always evaluate brokers through broker reviews to ensure they align with your needs and help you navigate the risks involved in complex instruments.

The 5 Best International Brokers in Japan for 2024

#1. Forex.com

What is Forex.com?

Forex.com, established in 2001, is a leading online forex and CFD broker offering access to over 80 currency pairs and a variety of CFDs, including commodities, indices, and cryptocurrencies. Owned by StoneX Group Inc., a NASDAQ-listed financial services company, it caters to both beginner and advanced traders worldwide. The platform provides multiple trading platforms, such as its proprietary WebTrader and MetaTrader 4/5, to accommodate diverse trading preferences.

Advantages and Disadvantages of Forex.com

Forex.com Commissions and Fees

Forex.com offers different account types with varying commission structures. The Standard Account operates on a spread-only basis, with no additional commissions. In contrast, the Commission Account features lower spreads but charges a fixed commission of $7 per $100,000 traded. Additionally, stock CFDs incur commissions, such as 1.8 cents per share for most U.S. stocks, with a minimum commission of $10.

OPEN AN ACCOUNT NOW WITH FOREX.COM AND GET YOUR WELCOME BONUS

#2. NinjaTrader

What is NinjaTrader?

NinjaTrader is a futures trading platform that offers advanced charting, market analytics, and trade simulation tools for active traders. It provides access to various markets, including futures and forex, through its brokerage services. The platform supports automated trading strategies and is customizable to fit individual trading styles.

Advantages and Disadvantages of Forex.com

Forex.com Commissions and Fees

NinjaTrader offers a tiered commission structure based on the selected account plan. The Free Plan charges $0.35 per side for micro contracts and $1.29 per side for standard contracts. Upgrading to the Monthly Plan at $99 per month reduces commissions to $0.25 per side for micro contracts and $0.99 per side for standard contracts. The Lifetime Plan, available for a one-time payment of $1,499, offers the lowest rates at $0.09 per side for micro contracts and $0.59 per side for standard contracts.

OPEN AN ACCOUNT NOW WITH NINJATRADER AND GET YOUR WELCOME BONUS

#3. Plus500

What is Plus500?

Plus500 is a London-based online trading platform offering contracts for difference (CFDs) across various financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. Established in 2008, it operates in over 60 countries and is regulated by multiple authorities, such as the FCA in the UK and CySEC in Cyprus. The platform is known for its user-friendly interface and a wide range of tradable assets.

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 primarily earns through the bid/ask spread, meaning the difference between the buying and selling prices of an asset. It does not charge commissions on trades, making it attractive to cost-conscious traders. However, additional fees may apply, such as overnight funding for positions held after a certain time and an inactivity fee if the account is dormant for an extended period.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

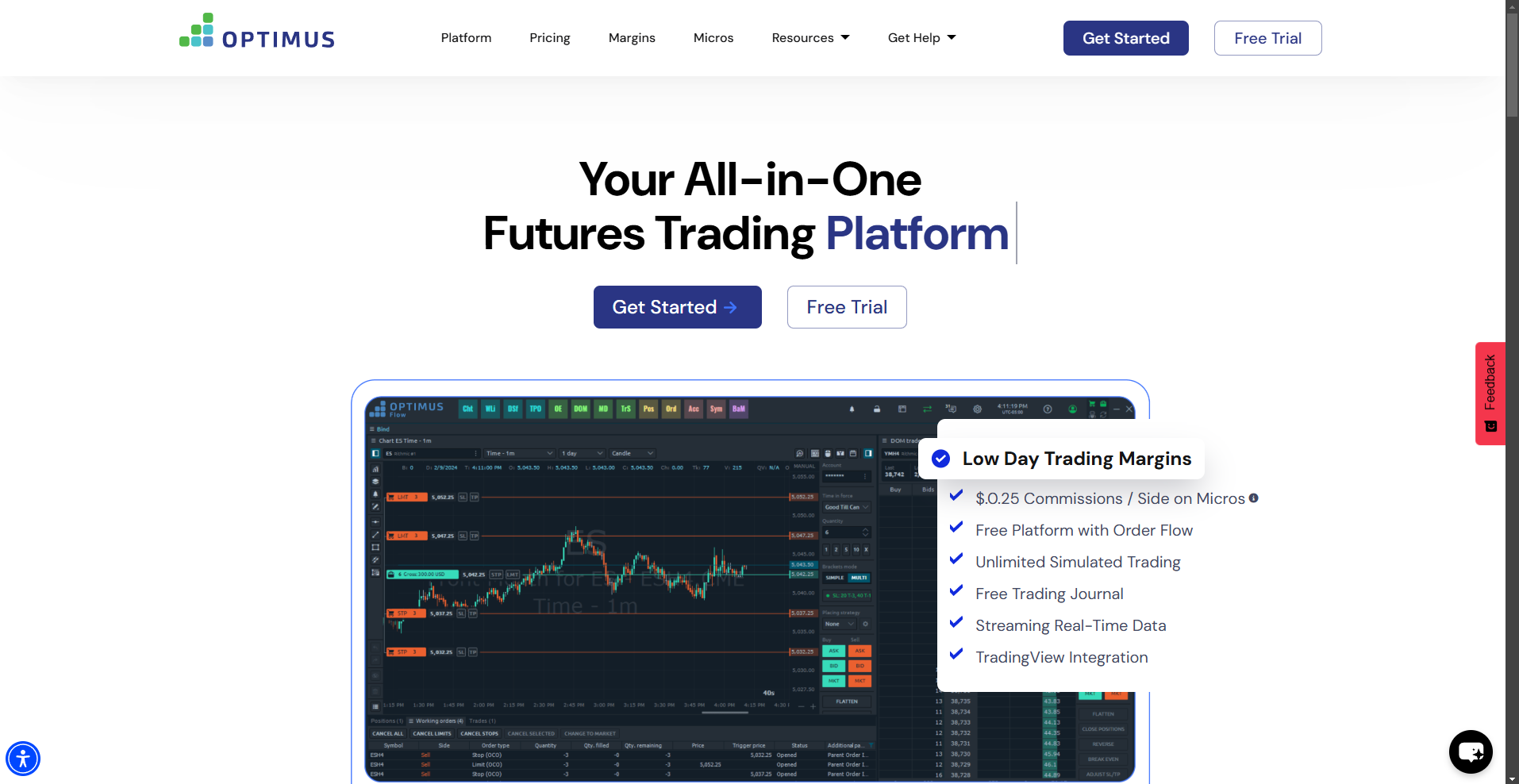

#4. Optimus Futures

What is Optimus Futures?

Optimus Futures is a licensed futures brokerage offering access to various global futures markets through multiple trading platforms and data feeds. They provide competitive commission rates, with volume-tiered pricing that benefits high-frequency traders. Clients can choose from a range of platforms, including their proprietary Optimus Flow and third-party integrations like TradingView and MetaTrader 5. The firm emphasizes transparency in fees and delivers robust customer support.

Advantages and Disadvantages of Optimus Futures

Optimus Futures Commissions and Fees

Optimus Futures offers commission rates starting at $0.25 per side for micro contracts and $0.75 per side for standard contracts, with potential discounts for high-volume traders. Additional costs include exchange, clearing, and NFA fees, which vary by product and exchange. The firm does not mark up these fees, ensuring transparency in pricing. However, withdrawal fees can be significant, especially for international wire transfers.

OPEN AN ACCOUNT NOW WITH OPTIMUS FUTURES AND GET YOUR WELCOME BONUS

#5. TradeStation

What is TradeStation?

TradeStation is an online brokerage platform offering advanced tools for trading stocks, ETFs, options, and futures. It caters primarily to active traders and technical analysts, providing comprehensive charting and analysis features. The platform supports custom strategy development through its proprietary EasyLanguage programming language. TradeStation operates under the Monex Group, a major Japanese financial services provider.

Advantages and Disadvantages of TradeStation

TradeStation Commissions and Fees

TradeStation offers commission-free trading for stocks and ETFs for U.S. clients, with certain conditions. Options trades incur a per-contract fee, and futures trades have their own fee structure. The platform charges various account fees, including for outgoing transfers and inactivity, which may be higher than some competitors.

OPEN AN ACCOUNT NOW WITH TRADERSTATION AND GET YOUR WELCOME BONUS

Regulatory Landscape for Brokers in Japan

The Japanese financial services agency (JFSA) plays a pivotal role in regulating brokers operating in Japan, ensuring transparency and fairness in the Japanese market. Brokers are required to comply with strict rules to safeguard retail investor accounts and offer protections such as negative balance protection to prevent clients from losing money rapidly. These measures make Japan a hub for reliable brokers, attracting both beginner traders and professional traders seeking secure platforms for forex trading, CFD trading, and trading spread bets.

Best international brokers in Japan often stand out by offering advanced trading tools, low trading fees, and robust market analysis. Platforms like CMC Markets and Interactive Brokers cater to forex traders and algorithmic traders with features like commission-free trading, advanced charting tools, and trading academies for trader education. With competitive spreads, diverse currency pairs, and access to global financial markets, these brokers support a range of needs from retail CFD accounts to live trading accounts. While the potential to lose money when trading remains a risk, a regulated broker in Japan provides comprehensive trading services and educational resources to help traders manage risks and minimize trading costs.

Tips for Choosing the Right Broker for You

Choosing the right broker can significantly impact your trading experience. For forex traders, look for a regulated broker, preferably authorized by the Japanese Financial Services Agency for Japanese traders. This ensures compliance with local laws and safety for retail investor accounts. A reliable broker will offer a forex trading platform with advanced trading tools, negative balance protection, and competitive spreads to help minimize trading costs. Features like a mobile trading app, trading academy, and educational resources are crucial for beginner traders, while advanced charting tools and algorithmic trading capabilities cater to professional traders.

Evaluate brokers like CMC Markets, Interactive Brokers, and others known for low trading fees, access to global financial markets, and support for multiple asset classes. The best platforms will provide commission-free trading, market analysis, and live trading accounts to suit diverse trading strategies. Remember, trading forex CFDs and other complex instruments involves risks, so focus on brokers with trustworthy reviews, excellent trading services, and features to support your diversified portfolio.

Also Read: The 5 Best Stock Brokers in Japan for 2024: Best Platforms for Investors

Conclusion

The conclusion of the article on forex trading highlights the importance of choosing the best international brokers in Japan for a seamless and efficient trading experience. With retail investor accounts requiring platforms that offer advanced trading tools and competitive services, traders should evaluate brokers based on their offerings like trading CFDs, negative balance protection, and low trading fees.

Whether you’re a forex trader, algorithmic trader, or a beginner learning through a trading academy, a reliable broker ensures better opportunities in global financial markets. By focusing on trading costs, market analysis, and regulated options like those under the Japanese Financial Services Agency, traders can navigate the risks involved while maximizing their strategies in forex trading platforms and mobile trading apps.

FAQS

What are the best international brokers in Japan?

The best international brokers in Japan include CMC Markets and Interactive Brokers, known for their regulated broker status, advanced trading tools, and competitive spreads.

What risks are involved in forex and CFD trading?

Trading forex CFDs and complex instruments carries a high risk of losing money rapidly, especially for retail investor accounts, due to leverage and market volatility.

How can I minimize trading costs?

Choose a broker with low trading fees, competitive spreads, and commission-free options while utilizing a reliable trading platform for efficient execution.