At Asia Forex Mentor, we know that selecting the right forex options broker is one of the most crucial decisions a trader can make. With over 90% of retail traders facing difficulties due to poor broker choices, it’s more important than ever in 2024 to choose wisely. Our team has analyzed the market to bring you the top 5 forex options brokers, each offering flexible options, transparent fees, and cutting-edge tools.

In this guide, the Asia Forex Mentor team has carefully analyzed and selected the top 5 forex options brokers for 2024. With our extensive knowledge and experience in the industry, you can trust us to guide you toward the best platform that suits your trading goals and maximizes your profits.

What to Look for in a Forex Options Broker

When it comes to finding the best forex options brokers, there are a few key things to consider. Whether you’re just starting with forex options trading or you’re an experienced forex trader, these points will help you choose the right broker for your needs.

Key Features That Make a Broker Stand Out

A good forex broker will have a reliable trading platform with fast execution speeds, allowing you to act on market opportunities quickly. You should also look for forex brokers with a strong reputation and good customer reviews. Additionally, they should offer tools for trading forex options such as real-time data, customizable charts, and detailed analysis tools. These features can make all the difference in helping you make informed decisions in the financial markets.

Importance of Regulation and Security in Forex Trading

When trading forex options, security should be a top priority. Always choose forex options brokers that are regulated by major authorities like the FCA or ASIC. This ensures that your funds are safe and that the broker follows strict rules to protect retail investor accounts. A regulated broker means you’re working with a company that has been approved by financial watchdogs, reducing the risk of fraud.

Why Platform Usability and Technical Tools Matter

An easy-to-use trading platform is essential. Whether you’re trading forex options or traditional currency pairs, you don’t want to struggle with a complicated system. Look for platforms that are intuitive, responsive, and offer technical tools that cater to both beginners and advanced options traders. The ability to access real-time data, analyze trends, and customize charts are all important features.

Types of Forex Options and How They Affect Your Broker Choice

Not all brokers offer the same types of forex options. The most common types include Vanilla options and SPOT options. Vanilla options give you the right, but not the obligation, to buy or sell at a specific price. SPOT options are typically faster-paced, often used by options traders looking for short-term opportunities. It’s important to choose a broker that offers the trade options that fit your strategy.

Overview of Fees, Commissions, and Account Types

Before choosing a broker, always review their fee structure. Some of the best forex options brokers offer competitive pricing with low spreads, while others may charge commissions or additional fees. Make sure to check the available account types as well, as some may have higher minimum deposits or extra features suited for professional forex traders. Knowing these details upfront will help you avoid surprises down the road.

The 5 Best Forex Options Brokers in 2024

#1. AvaTrade

What is AvaTrade?

AvaTrade is a well-established forex options broker known for its wide range of assets, including forex, cryptocurrencies, and stocks. Operating since 2006, it serves over 300,000 traders across 150 countries. AvaTrade stands out because of its regulation by top-tier authorities, providing a secure trading environment, and offering user-friendly platforms for both beginners and experienced traders. With a focus on fast execution and comprehensive trading tools, AvaTrade ensures that traders have everything they need for a smooth trading experience.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

AvaTrade operates on a spread-based fee model, meaning no commissions are charged on trades. For major pairs like EUR/USD, the typical spread starts at 0.9 pips, which is competitive. However, there are additional costs such as a $50 inactivity fee after three months and a $100 annual administration fee after 12 months of inactivity. While withdrawals are generally free, currency conversion fees may apply depending on your account’s base currency.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Pepperstone

What is Pepperstone?

Pepperstone is a highly regarded forex and CFD broker known for its low spreads and fast execution speeds, making it a top choice for traders. Established in 2010, it’s regulated by the FCA and ASIC, providing a secure and reliable environment. Pepperstone supports multiple platforms, including MetaTrader 4, MetaTrader 5, and cTrader, offering advanced tools that cater to both beginner and experienced traders. Its combination of tight spreads, strong regulatory oversight, and top-notch trading infrastructure makes it a preferred broker for those looking to optimize their trading experience.

Advantages and Disadvantages of Pepperstone

Pepperstone Commissions and Fees

Pepperstone offers two account types: the Razor account and the Standard account. The Razor account features spreads starting from 0.0 pips but charges a $3.50 commission per lot traded, ideal for those seeking low spreads. The Standard account has no commissions but wider spreads. There are no fees for deposits or most withdrawals, but an inactivity fee of $15 is applied after six months of no trading activity, making it a cost-effective option for active traders.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

#3. IG Markets

What is IG Markets?

IG Markets is a well-established global broker that provides traders with access to more than 18,000 markets, including forex, indices, stocks, commodities, and cryptocurrencies. Founded in 1974 and listed on the London Stock Exchange, IG Markets is one of the most reliable and regulated brokers, being overseen by top-tier authorities like the FCA and CFTC. It offers a range of advanced trading platforms, including its proprietary platform and MetaTrader 4, making it suitable for both beginners and advanced traders. Its extensive market access and robust regulatory oversight make IG Markets one of the top choices for forex options trading.

Advantages and Disadvantages of IG Markets

IG Markets Commissions and Fees

IG Markets operates primarily on a spread-based model. For most products, including forex pairs, the broker does not charge commissions, but the spreads can be higher compared to some competitors. For example, spreads on popular forex pairs like EUR/USD start from around 0.6 pips. Additionally, IG charges inactivity fees of $12 per month if no trades are made for 24 months. There are no deposit fees, but withdrawal fees may apply depending on the method.

OPEN AN ACCOUNT NOW WITH IG MARKETS AND GET YOUR WELCOME BONUS

#4. CMC Markets

What is CMC Markets?

CMC Markets is a well-established trading platform that has been around since 1989. It is known for providing access to a wide range of financial instruments, including forex, commodities, stocks, indices, and cryptocurrencies. One of the reasons CMC Markets is considered one of the best forex options brokers is its Next Generation trading platform, which offers advanced charting and analysis tools, making it an excellent choice for both new and experienced traders. The platform is also FCA-regulated, which adds a layer of security and trust for its users.

Advantages and Disadvantages of CMC Markets

CMC Markets Commissions and Fees

CMC Markets also primarily operates on a spread-based model, meaning most trades don’t incur direct commissions. The spreads are competitive, especially on liquid markets like forex. However, traders should be aware of overnight fees for positions held after market hours and a potential inactivity fee if the account remains dormant for 12 months. There may also be additional fees for premium services, depending on the assets traded.

OPEN AN ACCOUNT NOW WITH CMC MARKETS AND GET YOUR WELCOME BONUS

#5. IC Markets

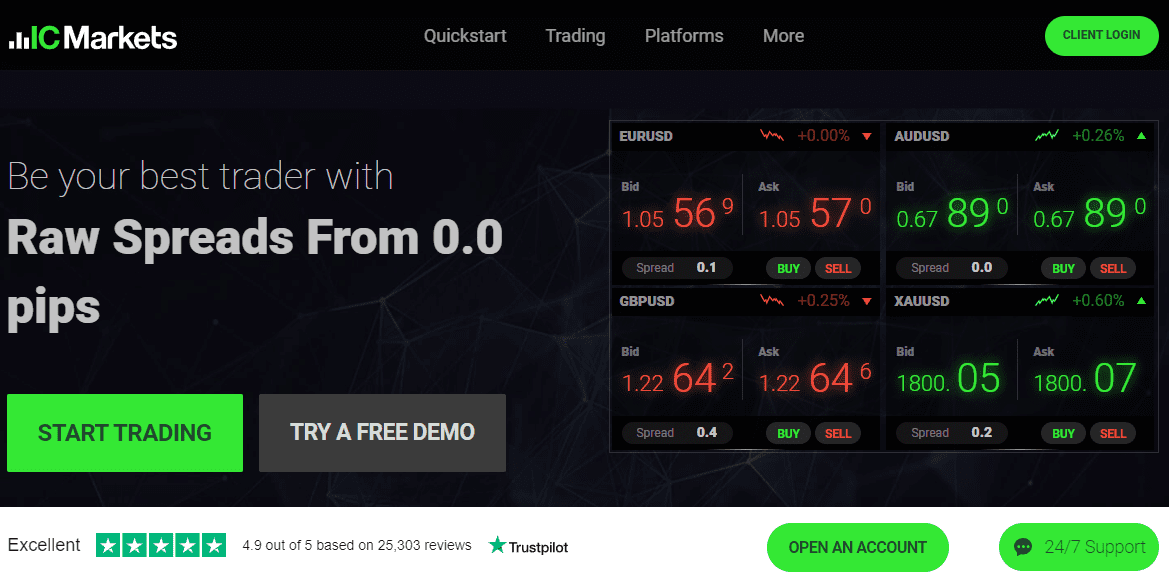

What is IC Markets?

IC Markets is a well-regarded forex broker, known for its competitive pricing, fast execution, and reliable trading environment. Established in 2007, IC Markets offers traders access to a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. The broker is especially popular with algorithmic traders due to its use of MetaTrader 4, MetaTrader 5, and cTrader, which support high-speed execution with minimal latency. Being regulated by top authorities like ASIC, CySEC, and the FSA, IC Markets ensures a secure and transparent trading environment, making it one of the best choices for both retail and institutional traders.

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

IC Markets offers three account types: Standard, Raw Spread, and cTrader accounts. The Standard account is commission-free but comes with slightly higher spreads, while the Raw Spread and cTrader accounts offer spreads starting as low as 0.0 pips, with a commission of $3.50 per lot per side. The broker does not charge fees for deposits or most withdrawals, though international bank transfers may incur a $20 fee. Importantly, IC Markets does not have inactivity fees, which makes it a cost-effective choice for both active and occasional traders.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

5 Tips for Choosing the Right Forex Options Broker

- Match the broker with your trading goals – If you’re a beginner, look for low fees and educational resources. Experienced traders might prioritize advanced tools and data.

- Understand your risk tolerance – Make sure the broker offers options and tools that align with your comfort level in managing risk.

- Test the platform with a demo account – Many brokers offer demo accounts, allowing you to try out their platform without risking real money.

- Check fees and commissions – Compare the broker’s fee structure, including spreads and commissions, to make sure it fits your budget.

- Balance costs with features – Don’t just go for the cheapest option. Sometimes paying a little more gives you access to better tools and support.

Also Read: The 5 Best Low Spread Forex Brokers in 2024 for Smart Trading

Conclusion

Choosing the right forex options broker is essential for achieving your trading goals. Key factors like regulation, fees, spreads, and platform usability are important if you want to make sure a secure and cost-effective trading experience. It’s important to assess your specific trading needs, whether you prioritize low costs, fast execution, or access to advanced tools. If you carefully evaluate these aspects, you can make an informed decision that supports both your trading style and financial objectives, ultimately enhancing your potential for success in the markets.