Finding the best Forex brokers in the UAE is essential for traders looking to succeed in the fast-growing forex market in the region. With the rising popularity of forex and CFD trading, having a broker that provides competitive trading costs, secure platforms, and strong regulatory oversight from the Securities and Commodities Authority or the Dubai Financial Services Authority is critical. The forex trading platforms in our list of top brokers for 2025 offer a range of tools, from user-friendly interfaces for beginners to advanced analytics for seasoned traders, ensuring everyone can find the right fit for their trading journey.

The best forex brokers in the United Arab Emirates offer features such as Islamic accounts, low fees, and a variety of trading platforms like MetaTrader 4 and MetaTrader 5. These brokers provide access to forex and CFD trading with strong customer support and local banking options, making them ideal for UAE-based traders. Whether you’re a beginner or an expert, choosing a regulated broker ensures your funds are safe and that you’re trading with a trusted partner in the forex market.

Why Regulation is Key When Choosing a Forex Broker in the UAE

When trading Forex in the United Arab Emirates, choosing a regulated broker is critical for ensuring your funds are protected and the broker operates fairly. Regulatory bodies like the Dubai Financial Services Authority (DFSA), Abu Dhabi Global Market (ADGM), and the Securities and Commodities Authority (SCA) oversee the Forex and CFD trading markets in the UAE. These organizations enforce strict standards on brokers, ensuring they operate transparently and protect traders’ interests.

Overview of DFSA, ADGM, and SCA Regulatory Bodies

- DFSA (Dubai Financial Services Authority): Regulates brokers within the Dubai International Financial Centre (DIFC), enforcing high standards of transparency and protecting client funds.

- ADGM (Abu Dhabi Global Market): A financial hub in Abu Dhabi with its own regulatory body, ensuring strict compliance with international best practices.

- SCA (Securities and Commodities Authority): The main regulator overseeing Forex brokers across the UAE, ensuring brokers adhere to local laws and regulations to protect traders.

Importance of Choosing a Regulated Broker for Fund Protection

Choosing a regulated broker ensures your money is kept safe in segregated accounts, meaning your funds are separate from the broker’s operational money. This protects your deposits in case the broker runs into financial difficulties. Additionally, regulated brokers must comply with anti-money laundering (AML) and know-your-customer (KYC) protocols, adding further security to your trading experience.

What to Check in a Broker’s Regulatory Status

When selecting a forex broker, always verify their licensing by checking their registration with either DFSA, SCA, or ADGM. Ensure they follow client fund protection practices, maintain capital reserves, and offer transparent trading conditions. Brokers should publicly display their licenses, and you can confirm their status by contacting the regulatory bodies directly.

The 5 Best Forex Brokers in UAE

#1. AvaTrade: Best Overall for Traders in UAE

What is AvaTrade?

AvaTrade is a globally recognized Forex and CFD broker offering a wide range of trading instruments, including Forex, stocks, commodities, and cryptocurrencies. Regulated by multiple top-tier authorities like the Dubai Financial Services Authority (DFSA), ASIC, and the Central Bank of Ireland, AvaTrade ensures a secure trading environment for traders in the UAE. The broker provides access to popular platforms like MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO mobile app, making it a versatile choice for both beginners and experienced traders. With additional features such as Islamic accounts and social trading tools like ZuluTrade, AvaTrade is a popular choice for traders seeking flexibility and Sharia-compliant options.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

AvaTrade offers commission-free trading, with profits made through competitive spreads. For major pairs like EUR/USD, the spreads start at 0.9 pips, which is fairly standard in the industry. The broker also does not charge fees for deposits or withdrawals, and the Islamic accounts have no swap fees, making it ideal for Sharia-compliant trading. However, there is an inactivity fee for accounts that remain dormant for a period of time. Overall, AvaTrade provides transparent fee structures that cater to a wide range of traders in the UAE.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Plus500

What is Plus500?

Plus500 is a leading Contracts for Difference (CFDs) trading platform, offering access to a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. The platform is recognized for its user-friendly interface, real-time market data, and advanced charting tools, catering to both novice and experienced traders. Operating under multiple regulatory frameworks globally, Plus500 ensures compliance with international standards, providing traders in the UAE with a secure and reliable trading environment. Its commitment to transparent pricing, competitive spreads, and robust risk management features makes Plus500 a preferred choice among traders in the UAE.

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 operates on a commission-free model, primarily generating revenue through the bid/ask spread. Traders should be mindful of certain fees that may apply, such as the overnight funding fee, which is either added to or subtracted from your account when holding a position after a specified time. Additionally, a currency conversion fee of up to 0.7% is applied to trades on instruments denominated in a currency different from your account’s base currency. Notably, Plus500 does not charge for deposits or withdrawals, and there are no fees for inactive accounts. This transparent fee structure enhances Plus500’s appeal as a cost-effective trading platform for traders in the UAE.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

OPEN A DEMO ACCOUNT ON PLUS500

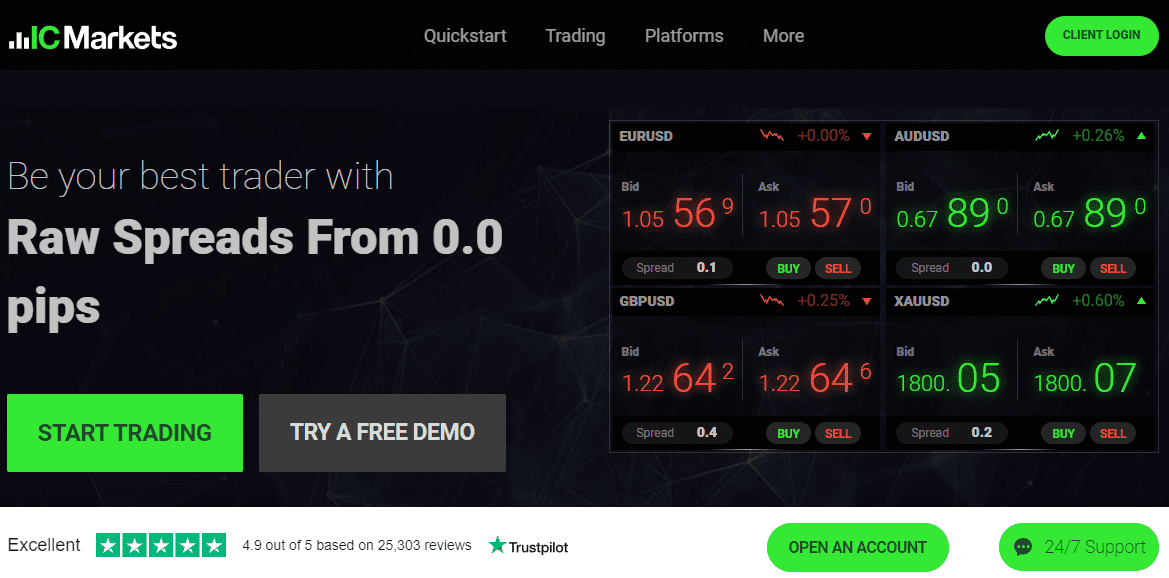

#3. IC Markets

What is IC Markets?

IC Markets is a highly regarded Forex and CFD broker known for its tight spreads, fast execution speeds, and reliable trading platforms. It is regulated by top-tier authorities like the Dubai Financial Services Authority (DFSA), ASIC, and CySEC, ensuring a secure and transparent trading environment for traders in the UAE. IC Markets offers access to a wide range of financial instruments, including Forex, commodities, indices, and cryptocurrencies, with popular platforms like MetaTrader 4, MetaTrader 5, and cTrader. Its reputation for low trading costs and Islamic accounts makes it a top choice for both beginners and experienced traders in the UAE.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets is known for its low spreads, especially on its Raw Spread accounts, where spreads start from 0.0 pips with a commission of $3.50 per lot per side. The Standard accounts offer commission-free trading, with spreads starting from 1.0 pips. There are no deposit or withdrawal fees, making it affordable for traders. Islamic accounts are also available, which allow traders to avoid overnight swap fees, adhering to Sharia law. This transparent and competitive fee structure makes IC Markets a favored broker in the UAE.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#4. Exness

What is Exness?

Exness is a globally recognized Forex and CFD broker, well-known for its low spreads, fast execution speeds, and user-friendly trading platforms. Founded in 2008, it is regulated by several top-tier authorities, including CySEC, FCA, and FSCA, ensuring high levels of security and transparency. Exness offers access to a wide range of markets, including forex pairs, metals, cryptocurrencies, and stocks, through popular platforms like MetaTrader 4 and MetaTrader 5. With its commitment to instant withdrawals and its offering of Islamic accounts for Sharia-compliant trading, Exness stands out as one of the best brokers for traders in the UAE.

Advantages and Disadvantages of Exness

Exness Fees and Commissions

Exness offers a variety of account types with different pricing structures. For example, the Standard and Standard Cent accounts have no commission fees and feature spreads starting from 0.3 pips. More experienced traders may prefer the Raw Spread or Zero accounts, which offer spreads starting from 0 pips but charge a commission of up to $3.5 per lot. The Pro account offers floating spreads from 0.1 pips with no commissions, making it suitable for those who want more comprehensive trading features.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#5. Tickmill

What is Tickmill?

Tickmill is a globally recognized Forex and CFD broker known for offering low-cost trading and tight spreads, making it a great choice for traders in the UAE. Regulated by top-tier authorities such as the Dubai Financial Services Authority (DFSA), FCA, and CySEC, Tickmill provides a secure trading environment for both beginner and advanced traders. The broker offers access to a wide range of financial instruments, including forex, commodities, indices, and bonds, through popular platforms like MetaTrader 4 and MetaTrader 5. Additionally, Tickmill provides Islamic accounts, which are swap-free, making it ideal for Muslim traders seeking Sharia-compliant trading options.

Advantages and Disadvantages of Tickmill

Tickmill Fees and Commissions

Tickmill offers competitive pricing. The Classic account features no commission with spreads starting from 1.6 pips, while the Raw account provides spreads as low as 0.0 pips with a commission of $2 per side per lot. For professional traders, the Pro account combines low spreads from 0.1 pips with no commission. This transparent fee structure makes Tickmill a favored choice for traders seeking cost-effective trading conditions in the UAE.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

How to Get Started with a Forex Broker in UAE

Getting started with a forex broker in the UAE is simpler than it seems. With the right steps, you can begin trading efficiently and securely. Here’s a step-by-step guide to help you start.

Step 1: Choose a Reputable Broker

The first and most crucial step is to select a regulated broker. In the UAE, look for brokers regulated by authorities like the Securities and Commodities Authority (SCA), Dubai Financial Services Authority (DFSA), or Abu Dhabi Global Market (ADGM). This ensures that your broker follows local laws and keeps your funds safe.

Step 2: Open a Trading Account

Once you’ve chosen a broker, you’ll need to open a trading account. Most brokers offer several types of accounts, including Islamic accounts for Sharia-compliant trading. You will need to provide some identification documents and proof of address to complete the process.

Step 3: Fund Your Account

After your account is set up, the next step is to deposit funds. Many brokers in the UAE offer local payment methods such as bank transfers and allow deposits in AED. Make sure the broker provides secure and transparent payment options.

Step 4: Start Trading on a Demo Account

Before committing real money, it’s a good idea to practice with a demo account. This allows you to trade with virtual funds and get familiar with the broker’s trading platform without risking your own money.

Step 5: Develop a Trading Plan

Once you’re ready to start live trading, create a trading plan. Set goals, define your risk tolerance, and stick to your strategy to avoid emotional decisions during trades. Having a solid plan is key to long-term success in forex trading.

Conclusion

In conclusion, finding the best Forex brokers in the UAE comes down to understanding your needs as a trader. Whether you’re looking for low spreads, advanced trading platforms, or Islamic accounts, the brokers we’ve listed offer great options. Brokers like Pepperstone, AvaTrade, and IC Markets stand out for their strong regulation under authorities like DFSA, competitive fees, and excellent customer support. Remember, choosing a regulated broker is key to ensuring your funds are safe and you have the best tools for trading success. Now, you’re ready to take the next step and start trading with confidence in 2025!

Also Read: The 5 Best Forex Brokers in Indonesia in 2025

FAQs

What is the best Forex broker for beginners in the UAE?

AvaTrade and Exness are great choices for beginners in the UAE. They offer user-friendly platforms, extensive educational resources, and demo accounts to help new traders get started.

Do Forex brokers in the UAE offer Islamic accounts?

Yes, many brokers in the UAE, including Pepperstone, IC Markets, and AvaTrade, offer Islamic accounts that are swap-free, adhering to Sharia law.

Is Forex trading legal in the UAE?

Yes, Forex trading is legal in the UAE and regulated by the Securities and Commodities Authority (SCA), ensuring that brokers follow strict guidelines to protect traders.