Looking for the best forex brokers in Malaysia in 2025? Whether you’re new to forex trading or an experienced trader, choosing the right broker is key to your success. In Malaysia, the forex market continues to grow, and with more traders joining in, it’s crucial to pick a broker that offers security, low fees, and reliable trading platforms. Plus, the Securities Commission Malaysia plays a big role in ensuring that the brokers you use are regulated and trustworthy.

In this guide, we at Asia Forex Mentor will highlight the top 5 forex brokers in Malaysia for 2025. We’ll help you understand their features, fees, and why they stand out. Whether you’re interested in copy trading, tight spreads, or a user-friendly trading platform, we’ve got you covered. Let’s find the perfect broker for you to trade forex with confidence!

How to Choose the Best Forex Broker in Malaysia

Choosing the best forex broker in Malaysia doesn’t have to be confusing if you focus on the right factors. First, make sure the broker is regulated by a reputable authority like the Securities Commission Malaysia (SC) to ensure your funds are secure and forex trading is legal. Beyond that, understanding the fees involved, the quality of the trading platforms, and the types of accounts offered can help you make a smart decision. Here are the key factors to keep in mind:

- Regulation: Ensure the broker has a Capital Markets Services License from the Securities Commission Malaysia or is regulated by other trusted authorities.

- Trading fees: Check for commission-free trading options and spreads, which can affect your profitability.

- Trading platforms: Look for brokers offering reliable trading platforms like MetaTrader 4 or MetaTrader 5 with tools for algorithmic trading and copy trading.

- Account types and minimum deposits: Choose a broker that offers flexible trading account options, including low minimum deposits for beginners or advanced accounts for experienced traders.

- Customer support and local services: Strong support, especially with local offices or brokers in Malaysia, can make a big difference when problems arise.

- Mobile trading: Make sure the broker’s platform is mobile-friendly, so you can trade anytime, anywhere.

- Negative balance protection: Ensure that the broker provides safety measures like negative balance protection to avoid losses beyond your initial deposit.

- Demo accounts: Always look for brokers offering demo accounts so you can practice trading forex before risking your funds.

The 5 Best Forex Brokers in Malaysia

#1. AvaTrade: Best Overall for Traders in Malaysia

What is AvaTrade?

AvaTrade is a well-established and globally regulated broker, making it one of the top choices for traders in Malaysia. It offers a wide range of trading instruments, including forex, commodities, cryptocurrencies, and stocks, all accessible through popular platforms like MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO app. One of the standout features is AvaProtect, a tool that helps manage risk by allowing traders to protect their trades from losses within a defined period. Additionally, AvaTrade supports Islamic accounts that comply with Sharia law, making it a great option for Muslim traders in Malaysia.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

In terms of fees and commissions, AvaTrade is highly competitive, offering commission-free trading on its Standard account with spreads starting as low as 0.9 pips for major currency pairs like EUR/USD. There are no deposit or withdrawal fees, which is great for cost-conscious traders. However, an inactivity fee of $50 applies after three months of inactivity, and a further $100 annual fee after 12 months of inactivity. With its transparent fee structure and favorable spreads, AvaTrade is a solid choice for traders of all levels in Malaysia.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Tickmill

What is Tickmill?

Tickmill is a highly reputable forex and CFD broker, making it a top choice for traders in Malaysia. One of the key reasons it stands out is its regulation by the Labuan Financial Services Authority (Labuan FSA), which ensures that it meets local regulatory standards, offering a secure trading environment for Malaysian traders. Tickmill provides access to over 60 currency pairs, stock indices, commodities, and bonds, and offers fast execution with high leverage up to 1:500. Its support for MetaTrader 4 and 5, along with features like negative balance protection and Islamic accounts, makes it an all-around favorite for traders seeking safety and flexibility.

Advantages and Disadvantages of Tickmill

Tickmill Commissions and Fees

When it comes to fees and commissions, Tickmill is highly competitive, particularly with its Raw account, which offers spreads starting from 0.0 pips and a $6 round-turn commission per lot traded. For traders preferring a simpler fee structure, the Classic account provides commission-free trading with spreads starting at 1.6 pips. There are no fees for deposits or withdrawals, and while there is an inactivity fee of $10 after a year of no trading, overall, Tickmill’s pricing is ideal for both beginners and high-frequency traders in Malaysia.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

#3. FP Markets

What is FP Markets?

FP Markets is a globally recognized broker, offering a comprehensive range of trading instruments like forex, commodities, indices, and shares CFDs. Known for its low spreads starting from 0.0 pips and fast execution speeds, it is especially appealing to both beginners and professional traders in Malaysia. The broker supports popular trading platforms such as MetaTrader 4, MetaTrader 5, and IRESS, providing flexibility for different trading styles. FP Markets is regulated by top-tier authorities like ASIC and CySEC, ensuring strong client fund protection, making it one of the most trusted brokers for Malaysian traders.

Advantages and Disadvantages of FP Markets

FP Markets Commissions and Fees

FP Markets offers two main account types. The Standard Account features commission-free trading with spreads starting from 1.0 pips, ideal for casual traders. For more active traders, the Raw Account provides tighter spreads from 0.0 pips, but with a $3 commission per lot per side. The minimum deposit is $100, making it accessible to most traders. This combination of low costs and high-quality service makes FP Markets a strong choice for those looking to minimize trading expenses while benefiting from advanced trading tools. FP Markets offers Islamic accounts for traders who adhere to Sharia law. These accounts are swap-free, meaning they do not incur or earn interest on overnight positions, which aligns with Islamic principles. The Islamic accounts are available for both Standard and Raw accounts, offering the same features without swap charges.

OPEN AN ACCOUNT NOW WITH FP MARKETS AND GET YOUR WELCOME BONUS

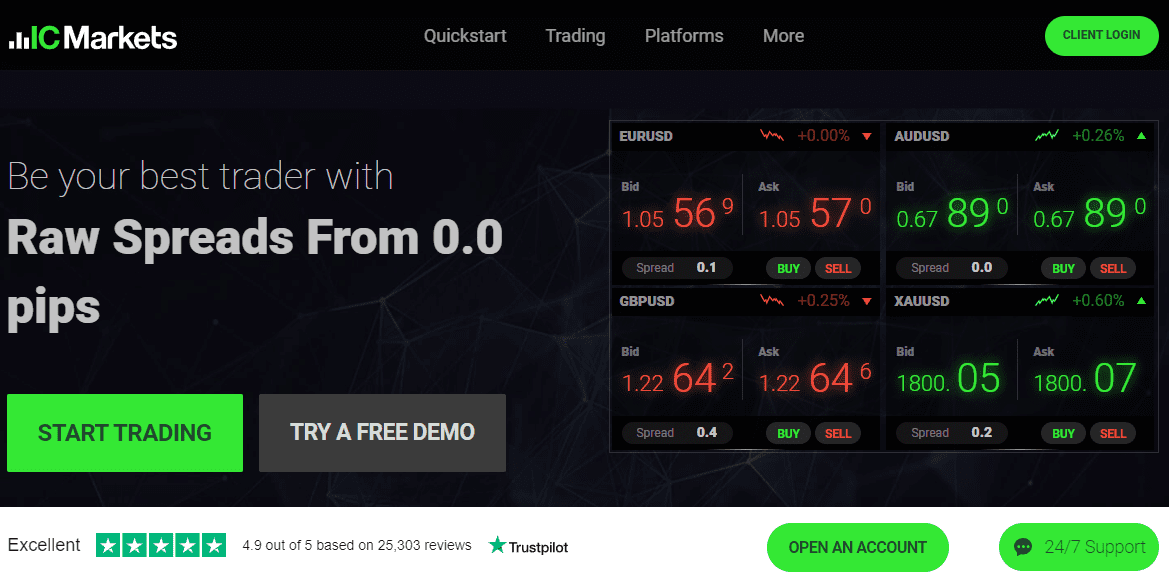

#4. IC Markets

What is IC Markets?

IC Markets is a highly reputable and globally regulated broker, making it one of the best choices for traders in Malaysia. Known for its fast execution speeds and low spreads, IC Markets provides access to over 60 currency pairs, commodities, indices, and cryptocurrencies. It supports popular platforms like MetaTrader 4, MetaTrader 5, and cTrader, which are perfect for both beginner and advanced traders. With no dealing desk (NDD) execution, IC Markets ensures transparent and direct market access, offering excellent conditions for high-frequency traders and scalpers. Its regulation by top authorities such as ASIC and CySEC further guarantees client fund safety, making it a reliable broker for Malaysians.

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

IC Markets offers highly competitive pricing. For the Raw Spread account, traders can enjoy spreads starting from 0.0 pips with a $3.50 commission per lot for MetaTrader users or $3 per lot on cTrader. The Standard account has no commission, with spreads starting at 0.8 pips. Additionally, there are no deposit or withdrawal fees, and IC Markets does not charge an inactivity fee, making it an affordable option for both active and casual traders in Malaysia.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#5. XM

What is XM?

XM is a well-established global broker known for offering a wide range of trading instruments, including forex, commodities, stocks, indices, and precious metals. It provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, making it ideal for both beginner and advanced traders. One of XM’s standout features is its low minimum deposit of $5, which allows traders to start with a small amount of capital. With leverage up to 1:1000, depending on account type and region, and the availability of negative balance protection, XM ensures that traders can manage their risk effectively. XM’s strong regulation, including oversight by CySEC and ASIC, adds an extra layer of trust for Malaysian traders.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM offers competitive pricing across its account types. The Standard and Micro accounts have commission-free trading, with spreads starting from 1 pip. For traders seeking tighter spreads, the Ultra-Low account offers spreads starting from 0.6 pips with no commissions. XM also supports Islamic accounts for swap-free trading, making it an inclusive option for all types of traders. Furthermore, there are no fees for deposits or withdrawals, though an inactivity fee applies after 90 days of no trading activity. These features make XM a cost-effective and accessible broker for Malaysian traders.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

How to Get Started with a Forex Broker in Malaysia

Starting your forex trading journey in Malaysia is pretty straightforward! Whether you’re a complete beginner or have some trading experience, choosing the right broker and setting up your account properly can make all the difference. Here’s a quick guide to get you on track.

Step 1: Choose a Regulated Forex Broker

The first step is picking a broker that’s well-regulated. In Malaysia, make sure your broker is authorized by respected authorities, such as the Securities Commission Malaysia (SC). This ensures that your funds are protected, and the broker adheres to fair trading practices. Look for features like negative balance protection and low trading fees to make your experience smoother.

Step 2: Open a Forex Trading Account

Once you’ve chosen a broker, the next step is to open your trading account. You’ll need to provide basic details like your ID, proof of residence, and possibly some financial information. Many brokers offer different types of accounts, including standard, micro, or even Islamic accounts, which comply with Sharia law.

Step 3: Deposit Funds

After setting up your account, it’s time to deposit funds. Most brokers in Malaysia allow you to deposit using methods like online bank transfers, credit/debit cards, and e-wallets like Skrill or Neteller. The minimum deposit requirements may vary, but it’s common to start with as little as $100 or $200.

Step 4: Practice with a Demo Account

Before you risk real money, it’s a great idea to practice with a demo account. This allows you to get familiar with the broker’s trading platform and test out different strategies without losing any funds. Most brokers offer this option, and it’s a fantastic way to build confidence before jumping into live trading.

Step 5: Start Trading

Once you’re comfortable, you can begin trading live! Stick to major currency pairs like EUR/USD or GBP/USD if you’re just starting out. Keep an eye on your trades and make sure you have a plan in place. Most brokers provide access to helpful tools like technical analysis charts, market news, and more to help you make informed decisions.

Conclusion

Choosing the best forex broker in Malaysia for 2025 comes down to finding the one that aligns with your trading style and needs. Whether you’re looking for low spreads, advanced trading platforms, or strong regulatory oversight, the brokers we’ve discussed offer a range of features that cater to different levels of traders. Each of these brokers is well-regulated and provides competitive pricing, making them reliable options for both new and experienced traders. Take the time to explore their demo accounts and see which platform feels right for you. Your choice of broker can significantly impact your trading experience, so it’s worth investing the time to make the best decision.

Also Read: The 5 Best Forex Brokers in Philippines in 2025

FAQs

What factors should I consider when choosing a forex broker in Malaysia?

When choosing a forex broker in Malaysia, look for one that is regulated by authorities like the Securities Commission Malaysia (SC) or other international regulators. Also, check for low trading fees, a reliable trading platform, and strong customer support. Many brokers offer Islamic accounts, which is an important feature if you need swap-free trading.

Is forex trading legal in Malaysia?

Yes, forex trading is legal in Malaysia, but it’s important to trade with a broker that is regulated by the Securities Commission Malaysia or reputable international bodies. Trading with unregulated brokers can pose risks to your funds and security.

How much do I need to start trading forex in Malaysia?

The minimum deposit required to start trading forex in Malaysia depends on the broker. Some brokers allow you to start with as little as $5, while others may require $100 or more. Be sure to choose a broker that fits your budget and offers suitable account types for your experience level.