If you’re looking to start trading forex in 2025, choosing the right forex broker is key to success, especially in a fast-growing hub like Dubai. The United Arab Emirates (UAE) has become a hotspot for both beginner traders and seasoned pros thanks to its strong regulatory environment, with authorities like the Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA) keeping things in check. But with so many options, how do you know which are the best forex brokers in Dubai?

We’ve put together a list of the top forex brokers regulated in the UAE to help you make an informed choice. Whether you’re interested in forex and CFD trading, need a solid trading platform, or want lower trading costs, we’ve got you covered. From beginner traders to experienced traders, this guide will help you find the best forex broker that fits your trading style and goals in the forex market. Let’s get started!

What to Look for in a Forex Broker in Dubai

When it comes to forex trading in Dubai, choosing the right forex broker is essential for success. But what exactly should you look for in a broker? From regulation to customer service, there are several factors that can make or break your trading experience. Let’s break it down so that whether you’re a beginner or an experienced trader, you can pick the best forex broker for your needs.

Here are the key factors to consider:

- Regulatory framework: Make sure your broker is regulated by trusted authorities like the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority. This helps ensure that the forex brokers you deal with follow the laws of the United Arab Emirates and provide a safe trading environment.

- Trading platforms: Look for brokers offering top platforms like MetaTrader 4 or MetaTrader 5. These platforms are ideal for both beginner traders and advanced traders, offering a range of tools to fit different trading styles.

- Fees and spreads: You want to minimize trading costs. Compare brokers that offer competitive spreads and low fees to get the most out of your trades. Always check if they charge for withdrawals or account maintenance.

- Customer service: Especially in the United Arab Emirates UAE, having access to responsive customer service in both English and Arabic can be a game changer. Look for brokers that offer local support, helping you resolve issues quickly.

- Security: Your money’s safety should be a priority. Choose brokers that provide secure deposit and withdrawal options, ensuring your funds are well-protected.

The 5 Best Forex Brokers in Dubai

#1. AvaTrade: Best Overall for Traders in Dubai

What is AvaTrade?

AvaTrade is a well-established global forex and CFD trading broker that has been operating since 2006. It is regulated by multiple top-tier authorities, including the Central Bank of Ireland and the Securities and Commodities Authority (SCA) in the United Arab Emirates (UAE). AvaTrade is known for offering a wide range of trading platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO platform. With Islamic accounts available and strong regulatory backing, AvaTrade is one of the best brokers in Dubai, ensuring safe and compliant trading for its clients.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

AvaTrade offers commission-free trading on most accounts but compensates with spreads starting at 0.9 pips on EUR/USD. There are no fees for deposits or withdrawals, but the broker charges inactivity fees for dormant accounts after three months.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Pepperstone

What is Pepperstone?

Pepperstone is a top-rated forex broker offering low spreads, fast execution, and access to over 60 currency pairs. It is regulated by the Dubai Financial Services Authority (DFSA) and offers Islamic accounts for traders in the UAE. Pepperstone is known for its versatile range of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, making it ideal for both beginner and experienced traders looking for advanced tools and low-cost trading.

Advantages and Disadvantages of Pepperstone

Pepperstone Fees and Commissions

Pepperstone provides competitive pricing with spreads starting from 0.0 pips on its Razor account, with a small commission on each trade. The Standard account offers commission-free trading with slightly higher spreads. There are no deposit or withdrawal fees, but inactivity fees may apply.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

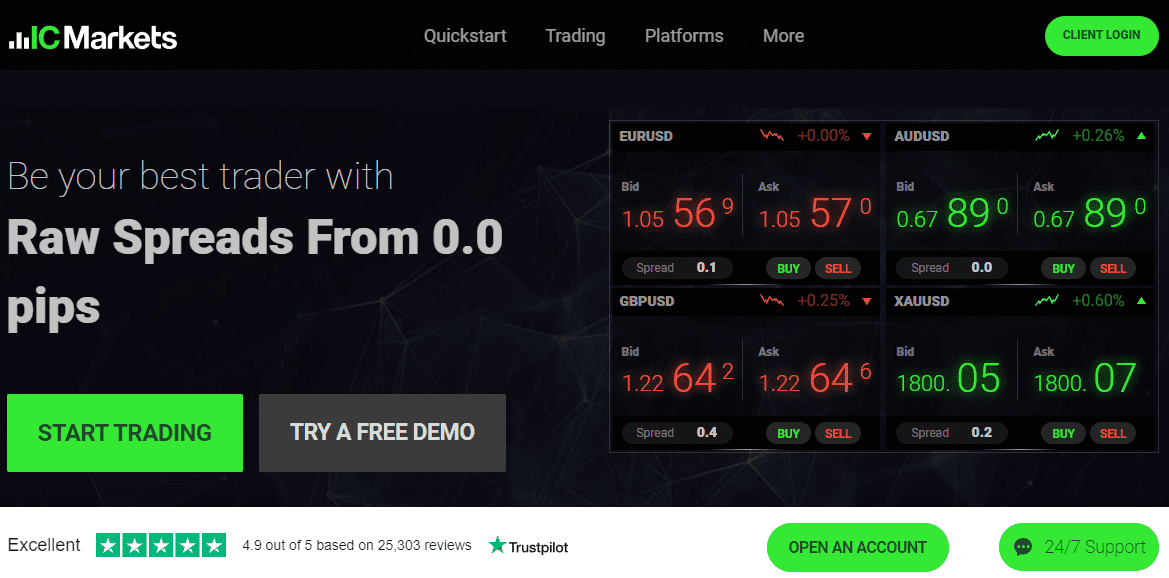

#3. IC Markets

What is IC Markets?

IC Markets is a popular choice for forex traders in Dubai due to its ultra-low spreads, lightning-fast execution, and support for Islamic accounts. Regulated by the Securities and Commodities Authority (SCA) in the UAE, IC Markets is a great option for traders who need access to algorithmic trading with platforms like MetaTrader 4, MetaTrader 5, and cTrader. It stands out for its strong focus on institutional-grade liquidity and minimal slippage.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets offers raw spread accounts with spreads starting from 0.0 pips and charges a small commission per trade. The Standard account offers commission-free trading, but with higher spreads. There are no fees for deposits or withdrawals, but an inactivity fee applies.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#4. Exness

What is Exness?

Exness is a highly trusted forex broker that is known for its high leverage options and ultra-fast withdrawals. It offers Islamic accounts to its Dubai clients and is regulated by the Securities and Commodities Authority (SCA) in the UAE. Exness offers access to both MetaTrader 4 and MetaTrader 5, with a focus on providing a seamless and flexible trading experience for both retail and professional traders.

Advantages and Disadvantages of Exness

Exness Fees and Commissions

Exness is known for its zero-commission trading on many accounts, offering spreads as low as 0.3 pips. The broker does not charge for deposits or withdrawals and offers tight spreads with no overnight fees for Islamic account holders.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#5. Tickmill

What is Tickmill?

Tickmill is a highly respected forex broker in Dubai, offering Islamic accounts and low trading costs. It is regulated by multiple authorities, including the Securities and Commodities Authority (SCA) in the UAE. Tickmill stands out for its user-friendly interface and fast order execution on platforms like MetaTrader 4. With tight spreads and zero commission on certain accounts, it’s a great choice for both beginners and advanced traders.

Advantages and Disadvantages of Tickmill

Tickmill Fees and Commissions

Tickmill offers commission-free trading on its Classic account, with spreads starting from 1.6 pips. For its Pro account, spreads start as low as 0.0 pips, with a small commission per trade. There are no hidden fees for deposits or withdrawals.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

How to Get Started with a Forex Broker in Dubai

Getting started with forex trading in Dubai is pretty straightforward, especially with so many brokers offering services tailored to beginner traders. If you’re new to forex or just unfamiliar with the process, here’s a simple step-by-step guide to help you get going.

Step 1: Choose a Regulated Forex Broker

The first thing you need to do is pick a forex broker that’s regulated in the United Arab Emirates. Look for brokers licensed by the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority (SCA). These regulations ensure your trading is secure and compliant with local laws. Brokers like AvaTrade, Pepperstone, and IC Markets offer Islamic accounts, which is essential if you want to avoid interest on overnight trades.

Step 2: Open a Trading Account

Once you’ve chosen a broker, head to their website and open a trading account. You’ll typically need to provide personal details like your name, email, and phone number. Some brokers may also ask for a small initial deposit to activate your account, so have your funds ready. Many brokers offer multiple account types, so choose the one that suits your trading goals.

Step 3: Verify Your Identity

Before you can start trading, you’ll need to verify your identity. This is usually a quick process where you’ll upload copies of your passport or Emirates ID, along with proof of address, such as a utility bill. This step ensures the broker complies with Know Your Customer (KYC) regulations, keeping your account secure.

Step 4: Deposit Funds

After verifying your account, it’s time to deposit funds. Most brokers offer various options like bank transfers, credit cards, or e-wallets such as PayPal. Make sure to check if the broker charges any fees for deposits and withdrawals. Also, check if your broker provides an Islamic account if you want to avoid interest charges on your positions.

Step 5: Choose a Trading Platform

Most brokers in Dubai offer popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms provide tools for technical analysis and real-time price tracking. Some brokers also have their own platforms, which might be more beginner-friendly.

Step 6: Start Trading

Now that your account is set up and funded, you’re ready to start trading forex! Begin with small trades if you’re new to the market, and take advantage of any demo accounts offered by the broker to practice your strategies before investing real money. Don’t forget to keep an eye on spreads and fees to maximize your profits.

Conclusion

In conclusion, picking the best forex broker in Dubai depends on your individual trading needs, whether you’re a beginner trader or an experienced one. Brokers like AvaTrade, Pepperstone, and IC Markets offer excellent platforms, competitive spreads, and Islamic accounts for traders who follow Sharia law. When selecting a broker, make sure they are regulated by trusted authorities like the Dubai Financial Services Authority or the Securities and Commodities Authority to ensure your trading is secure. Ultimately, choosing the right broker can make a huge difference in your forex trading experience, so it’s worth taking the time to research and compare options.

Also Read: The 5 Best Forex Brokers in UAE in 2025

FAQs

What is an Islamic Forex account?

An Islamic forex account is designed for traders who follow Sharia law and wish to trade without paying or earning interest, which is prohibited in Islam. These accounts replace swap fees with an administration fee.

How do I verify a broker’s regulation in Dubai?

To verify if a forex broker is regulated in Dubai, check if they are listed with the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority (SCA). Most regulated brokers will display their license information on their website.

Can beginners trade Forex in Dubai?

Yes, beginner traders can easily start forex trading in Dubai. Many brokers offer demo accounts and educational resources to help new traders learn the basics before trading with real money.