The foreign exchange market is one of the most exciting, fast-paced markets in the financial world. Unfortunately, it is also one of the most volatile, with large swings in currency values commonplace. As a result, choosing the best forex broker for your needs can take time and effort.

To start with forex trading, you just need to explore the best forex brokers and open an account with one that suits your trading style. However, you must do some initial research to find the best forex broker. You can easily find the most suitable broker according to your trading experience and needs.

In this guide, we will discuss how to choose the best forex brokers, why you should start forex trading, the pros and cons of forex, and more. Besides that, to help you choose the best broker, we will compare the features and benefits of some of the leading brokers in the industry to give you an overview of each offer. So, let’s get started.

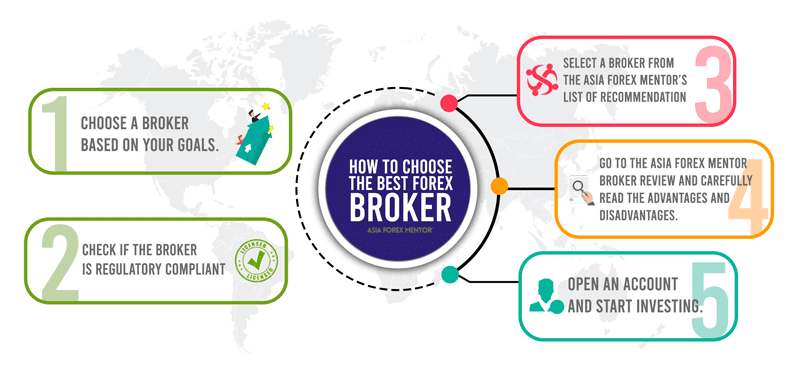

How to Choose the Best Forex Broker

When looking for the best forex brokers, there are several things you need to consider. These include:

1. Regulatory Compliance

The first and foremost thing you need to check is whether a reputable body regulates the broker. A good way to check this is to see if the broker is listed on a major exchange. If they are, then they are most likely to be regulated. For example, a reputable forex broker in the USA will be an NFA member registered with the Commodity Futures Trading commission.

2. Trading Platform

The next thing you need to consider is the trading platform. This is the software that you will use to place trades. It is important to ensure that the trading platform is user-friendly and has all the necessary features. Some of the things you might want to look for include:

- Ease of use

- Real-time quotes

- Technical analysis tools

- Charting tools

- Order management tools

- Mobile trading

3. Account Features

When choosing a forex broker, you must consider the account features. Some of the things you might want to look for include:

- Minimum deposit requirements

- Leverage ratios

- Commissions and spreads

- Initial Deposit

- Commission fees

- Leverage and Margin

- Ease of Deposits and Withdrawals

4. Customer Support

A broker’s customer service should be accessible since Forex trading takes place 24 hours a day, seven days a week. In addition, think about whether it’s easy to get an actual person on the phone. A quick call to a forex broker can indicate their customer service and average wait periods.

What is a Forex Broker?

A forex broker is an intermediary between traders and the foreign exchange market. They provide a platform where traders can buy and sell currencies and other services such as margin trading, which allows traders to borrow money to trade with.

The role of the forex brokers has become more important in recent years as the forex market has become more accessible to retail investors. Only large financial institutions and banks traded forex in the past, but now many online brokers allow retail investors to trade forex.

Generally, online forex brokers enable traders to largely use electronic trading platforms that the broker supports to execute forex deals. In addition to offering their own software for trading, many popular online forex brokers also support 3rd party MetaQuotes platforms, including MetaTrader 4 and 5 (MT4/5).

In addition, many forex brokers also provide extensive educational information for beginners, which may be utilized to improve their trading knowledge. They might also provide expert Forex market analysis and financial news feeds to assist you in making better trading decisions. Moreover, forex brokers make their money by charging commissions and spreads on the transactions they facilitate.

Why Trade Forex?

A forex transaction is the simultaneous purchase of one currency and the sale of another at a set exchange rate. Forex traders profit by selling one currency pair cheap and expensive or buying one pair high and selling it low.

A significant number of individuals trade forex because it’s a relatively easy process to get started. Once you open a trading account, download a free platform like MetaTrader. Trades can be executed quickly and easily, so traders have the flexibility to set their own pace. Plus, making money is another big motive for why people engage in forex trading.

This is usually where investors begin since they can gain a handle on the market without being overwhelmed by the asset they’re trading.

How Do I Know If My Forex Broker is Regulated?

It is important to know if your forex broker is regulated. This will ensure that your broker is held accountable to a higher standard and that your funds are protected. The best way to find out is to check the broker’s website or contact them directly.

It is also good to check the regulator’s website to see if the broker is listed. For example, in the United States, you can check with the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC). Moreover, check the reviews for your broker to see what other traders have to say about their experience.

Here is how you can determine if your forex broker is regulated:

- Check their license number: All regulated brokers will have a license number. You can check this against the regulator’s list of licensed brokers to ensure it is valid.

- Check their registration status: Besides having a license, brokers must also be registered with the regulator. Again, you can check this on the regulator’s website.

- Find their membership status: Some regulators require brokers to be members of a self-regulatory organization (SRO). For example, in the United States, brokers must be National Futures Association (NFA) members.

- Verify Details: If you question the authenticity of a website or brand, reach out to the regulator through the phone number or email address provided on their website.

- Global availability: Make certain that the broker you’re looking into can take on customers from your home country. If they lack proper regulation to do so in your country, see if they at least legally can accept clients from your nation (for example, if an alternate yet suitable jurisdiction regulates the broker).

10 Best Forex Brokers

#1. Avatrade – Best Overall

Avatrade is a regulated forex broker that offers online trading services in more than 250 instruments across multiple markets, including forex, indices, commodities, shares, and cryptos. In addition, it carries seven regulations on seven different continents, including UAE, South Africa, Japan, Australia, Europe, and the British Virgin Islands.

With Avatrade, you can start trading with a minimum deposit of $100 and leverage of up to 400:1. Traders can also take advantage of the broker’s numerous bonuses, including a welcome bonus of up to $10,000 and an Avapoints loyalty program to earn extra points.

In addition, traders can trade several instruments, including forex pairs, commodities, stocks, indices, bonds, ETFs, and Vanilla Options. Furthermore, AvaTrade is regulated by seven international commissions to ensure the safety of our customers: CBI (EU), B.V.I. FSC (British Virgin Islands), ASIC (Australia), FSCA (RSA), FRSA (UAE), FSA, and FFAJ (Japan).

Advantages

- Regulated by multiple financial authorities

- Leverage up to 400:1

- Negative Balance Protection

- Multiple account types and platforms

Disadvantages

- No US clients accepted

- Variable spreads

#2. Plus500

Plus500 is a global multi-asset fintech group founded in 2008, offering a user-friendly trading platform that provides access to over 2,800 financial instruments, including Contracts for Difference (CFDs) on forex, commodities, indices, shares, ETFs, and cryptocurrencies.

The company operates under stringent regulatory oversight from top-tier authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Monetary Authority of Singapore (MAS), ensuring high standards of client protection. Plus500’s proprietary WebTrader platform is acclaimed for its intuitive design, making it accessible to both novice and experienced traders. The platform also features innovative tools like +Insights, offering valuable market sentiment data.

Additionally, Plus500 is a publicly traded company listed on the London Stock Exchange and is a constituent of the FTSE 250 Index, reflecting its financial stability and industry recognition. These attributes contribute to Plus500’s reputation as one of the leading forex brokers globally.

Advantages

- User-friendly platform

- Low fees and tight spreads

- Regulated by top-tier financial services provider

- Range of tools and features to help traders make informed decisions

Disadvantages

- Limited educational resources for beginners

- Limited research tools for advanced traders

#3. FP Markets

FP Markets, established in 2005, is a global CFD and forex broker renowned for its comprehensive trading services. The company is regulated by multiple authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring adherence to stringent financial standards.

FP Markets offers access to over 10,000 trading instruments, encompassing forex, equities, commodities, and indices, available through advanced platforms like MetaTrader 4, MetaTrader 5, cTrader, and Iress. Traders benefit from tight spreads starting from 0.0 pips, fast execution speeds, and 24/7 multilingual customer support.

The firm’s commitment to excellence is reflected in its receipt of over 40 industry awards, including being recognized as the ‘Best Global Forex Value Broker’ for five consecutive years.

Advantages

- Tight spreads starting from 0.0 pips

- Fast execution speeds

- Supports MetaTrader 4, MetaTrader 5, and cTrader

- High leverage options up to 1:500

- Wide range of tradable assets

Disadvantages

- No proprietary trading platform

- Limited educational content for beginners

- Withdrawal fees may apply

#4. Alpari

Alpari is a global trading company founded in 1998 by three partners in Russia. The company has acquired extensive experience and expertise over the years of operation and has become one of the largest Forex brokers.

Alpari is committed to offering high-quality services for trading on the foreign exchange currency market. With over a million clients in 150 countries and offices around the globe, Alpari has a reputation for reliability and excellence.

With the leverage of Up to 1:3000 and spread from 0.2 pips, Alpari is suitable for scalpers as well as long-term traders. The company also provides a demo account to test strategies and get familiar with the trading platform.

Advantages

- A wide variety of account types with low minimum deposit requirements

- Leverage up to 1:3000

- Excellent customer support

- Several ways to deposit and withdraw quick funds

Disadvantages

- No trades on weekends

- Several perks are only available on VIP accounts.

- Swap-free Islamic accounts just for MetaTrader 4.

#5. FXChoice

FXChoice is a good choice for beginner forex traders as it offers multiple account types and 100:1 leverage. In addition, it is a MetaTrader-only broker that provides access to the MT4 and MT5 platforms.

FXChoice offers leverage of 1:200 on all account types, and spreads start from 0.1 pips on the ECN account. The minimum deposit is $100, which may be too high for some beginner traders. The spreads and swaps of FX CHoice are modest, the collaboration program is useful, and the loyalty program is decent.

This online broker also provides a demo account and multiple payment methods to deposit and withdraw funds. Moreover, there are plenty of currency pairs and other assets to trade. However, it doesn’t accept clients from the USA.

Advantages

- Regulated by the IFSC

- Leverage up to 1:200.

- MetaTrader 4 and MetaTrader 5 platforms

- ECN trading available

Disadvantages

- Does not accept US clients

- Withdrawals take 4-5 days (wire transfers)

#6. JustForex

JustForex is an online broker that offers a wide range of assets, including currency pairs, precious metals, cryptocurrency, and stock indices. The company was founded in 2012 and is headquartered in St. Vincent and the Grenadines. JustForex provides services to clients from over 100 countries.

JustForex offers several account types with leverage of up to 1:3000 and spreads starting from 0.0 pips. The minimum deposit is $1, making it accessible to beginner traders with a small budget.

This brokerage company is ideal for traders who use various trading strategies. You’re allowed to utilize expert advisors, trade news, and copy trades. The broker is also great for clients who prefer long-term and medium-term trading styles and those adhering to Islamic principles.

Advantages

- Negative balance protection for traders’ deposit protection

- EA trading to trade automatically

- Hedging to prevent risk chances

- Allows traders to trade cryptos

- Automated copy trading for copying successful trades

Disadvantages

- No PAMM accounts

- A small selection of trading instruments

- Traders may experience delays in withdrawals, and there are withdrawal fees

#7. FXTM

FXTM (FXTM) is another forex broker that began operations in 2011. It enables investors to profit by executing active trading or investment strategies. The organization is governed by the CySEC (Cyprus Securities and Exchange Commission), South African FSCA (Financial Sector Supervision Authority), UK FCA (Financial Conduct Authority), and FSC (Mauritius Financial Supervisory Commission).

The Micro account requires a minimum deposit of $10, allowing novices to grasp the basics of trading and study the market’s operational principles without risk or major investments. However, the Standard account requires a $100 deposit with 0.01 lots and spreads from 1.3 pips.

In addition, FXTM offers a leverage of up to 1:2000, which is significantly higher than the industry average. You can also open swap-free accounts and use powerful trading platforms like MetaTrader 4, MetaTrader 5, and cTrader.

Advantages

- 1:2000 leverage ratio

- Segregated accounts

- Negative Balance Protection

- Ultra-low spreads are from 0.0 pips

Disadvantages

- Only copy trading is offered for investment

- Brokers are not available on weekends

#8. InstaForex

InstaForex International Company has been providing services to currency traders since 2007. Presently, more than 7 million traders utilize our services worldwide. We offer them access to 300 different trading instruments, such as the PAMM Investment system and ForexCopy — a tool for copying successful trades of other traders.

The user-friendly interface of InstaForex allows traders to quickly and easily get started with trading. The minimum deposit is just $1, and the maximum leverage ratio is 1:1000. You can also use InstaForex’s web-based platform or mobile trading app for Android and iOS devices.

In addition, InstaForex is the perfect broker for those who want to combine active trading with passive investment. The best conditions and the proposed trading platforms can increase the profitability of passive investment and minimize the financial risks of the trader. The ForexCopy trade copying system, PAMM accounts, and an affiliate program are the most beneficial services for extra income.

Advantages

- Best trading conditions for the novice traders

- Various instruments for trades, including futures, stocks, and cryptocurrencies

- Passive income with PAMM accounts and copy trading

- Hedging trader’s currency risks

- Fixed spread options and optional average market spread

Disadvantages

- Traders may experience intermittent trading terminal freeze

- Some reviews show the ignorance of customer support

- The mobile trading app is not as comprehensive as the web trading platform

#9. XM

XM Group is a forex and CFD broker founded in 2009. For over ten years, XM Broker has provided technology-based solutions to more than 5 million traders. The company is now experiencing significant growth and recognition in the industry, including awards for being the Fastest Growing Broker and Best Forex Service Provider.

XM Broker is ideal for trading professionals due to the high order processing speed and low level of commitment. Additionally, XM Broker has licenses from three leading international regulators: ASIC (Australia), FCS (Belize), and CySEC (Cyprus). The broker offers a leverage of up to 1:888 and a minimum deposit of $5.

XM is the best choice, especially for beginner traders. With its high-tech trading platforms, such as MetaTrader 4, Webtrader 4, and Mobile trading app, XM provides the perfect environment to learn and practice forex trading with virtual money before moving on to a live account.

Advantages

- XM Broker promises that all orders will go through, with 99.35% completed almost immediately.

- No additional fees on tight market margins

- Offers more than 1000 trading instruments and more than 55 currency pairs

- No commissions on money withdrawals

Disadvantages

- Filing claims with the regulator for small amounts is not practical due to the subsequent financial and time costs

- No support on weekends

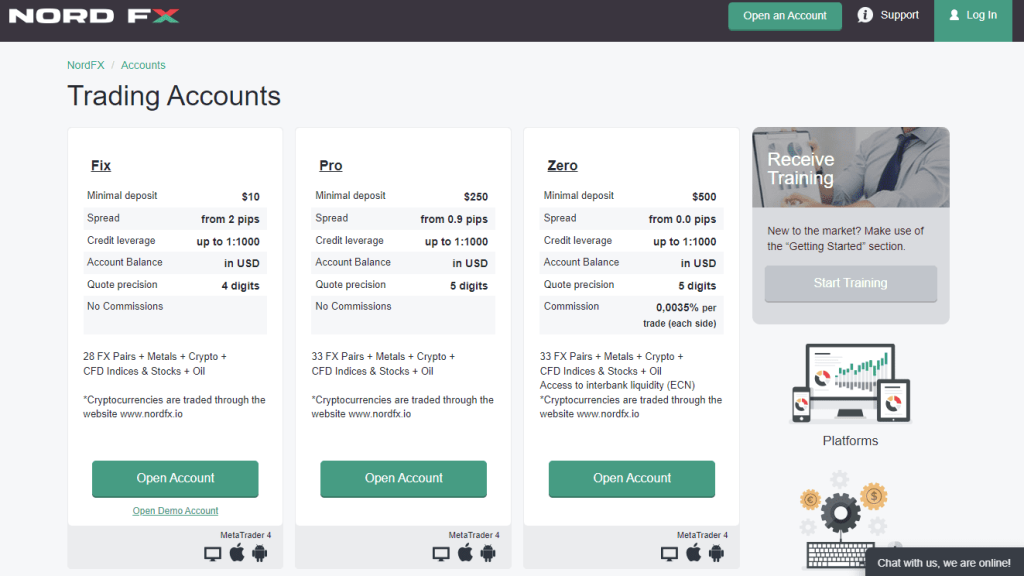

#10. NordFX

NordFX is an international forex broker providing online trading services since 2008. The company is headquartered in Mauritius and regulated by the Financial Services Commission (FSC). NordFX offers its clients a wide range of forex pairs, CFDs, and metals for trading.

NordFX is a good choice for beginner traders as it offers a demo account with $10,000 in virtual money. This allows newbies to practice trading strategies before moving to a live account. The broker also has an extensive education center covering all forex trading basics.

This broker offers leverage of up to 1:1000 and spreads 0.9 pips for floating and two pips fixed on major currency pairs. Overall, NordFX offers optimal trading conditions for both beginner and experienced traders.

Advantages

- Allows trading on currency pairs, cryptocurrencies, metals, oil, and major stock indices

- Advanced customer reporting with traffic tracking and commission statistics

- Reliable trading options as NordFX has stable servers

- Offers multilingual support in different languages

Disadvantages

- The regulator does not consider the claims of traders with small amounts.

- No support on weekends

How We Rank the Best Forex Brokers

To choose the best forex brokers, we focused on identifying mobile-friendly platforms with competitive spreads and trading fees, a wide range of currency pairs, and robust customer support. We also looked for regulated brokers who have been in operation for at least five years.

At Asia Forex Mentor, we consider reviews on popular forex forums. However, we only go by what other traders say. We conduct our due diligence, gathering as much information as possible to ensure that our list is as accurate and up-to-date as possible. As a result, according to our evaluation criteria, we calculate the overall score of each broker and choose the top-rated forex brokers to recommend to our readers.

Conclusion

Now that you know the ins and outs of some of the best forex trading platforms, it’s time to find the best forex broker. The brokers on this list have been carefully selected based on their fees, features, and regulation. So no matter what your trading style is, you should be able to find a forex broker that suits your needs.

Take a test drive of some of these best forex broker platforms and see which is the right fit. Happy trading!

Best Forex Brokers FAQs

Which Forex brokers are the cheapest?

There is no such thing as the “cheapest” Forex broker. The cost of trading depends on your account type, the currency pairs you trade, and the broker’s commission. Some brokers charge no commission, while others charge up to $10 per lot traded.

What is the best forex broker in 2024?

The “best” forex broker will depend on your needs and trading style. For example, if you are a beginner trader, you may want a low-cost broker with a user-friendly platform. On the other hand, an experienced trader may want a broker with various currency pairs and a high leverage ratio. For a beginner, we recommend IQ Option or eToro. For an experienced trader, we recommend FXTM or Tickmill.

Which forex brokers are legit?

All of the forex brokers on this list are regulated by at least one financial authority, and most are regulated by multiple. This ensures that your broker is held to high financial stability and customer protection standards. If you are looking for a specific regulator, you can check out our list of forex brokers by regulator.