Spain’s crypto market continues to thrive in 2025, fueled by increasing interest from crypto traders, investors, and institutions. With rising trading volumes and expanding adoption of crypto assets, the country has become a hotspot for digital assets trading, attracting both experienced traders and newcomers. Regulatory oversight from the National Securities Market Commission has strengthened the market’s credibility, making it essential for traders to prioritize regulatory compliance when choosing a crypto trading platform.

Selecting the best crypto brokers in Spain is critical for ensuring top-tier security, cost-effective trading fees, and access to advanced trading tools. Whether looking for low fees, multiple payment methods, or robust features like futures trading, Spanish users should evaluate crypto brokers based on their ability to support seamless crypto transactions, secure user assets, and provide a user-friendly interface.

Key Factors to Consider When Choosing a Crypto Broker

When choosing the best crypto brokers in Spain, prioritize regulation and security to ensure your investments are protected. Look for brokers registered with the National Securities Market Commission (CNMV) and offering top-tier security features like cold storage and anti-money laundering (AML) compliance. The platform’s deposit and withdrawal fees, trading fees, and taker fees should be transparent, especially for spanish users who rely on localized services.

A user-friendly interface is crucial, particularly for advanced traders or those engaging in derivatives trading. Assess the availability of crypto assets, including bitcoin cash, and ensure the platform supports crypto purchases via multiple payment methods like bank transfers, Google Pay, or a crypto debit card. The inclusion of tools like trading bots and educational resources benefits both experienced traders and those new to the crypto market. Select platforms with strong customer support, tailored to Spanish crypto brokers, to address regional needs effectively.

The 5 Best Crypto Brokers in Spain 2025

#1. eToro

What is eToro?

eToro is a social trading platform that enables users to trade a variety of assets, including stocks, cryptocurrencies, and forex. It is widely recognized for its CopyTrader feature, allowing investors to replicate the strategies of experienced traders. eToro is beginner-friendly and provides a seamless interface for trading and portfolio management.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro operates with a commission-free structure for stock trading, making it attractive for budget-conscious traders. However, it charges spreads on forex and cryptocurrency trades, which can vary depending on market conditions. Additional costs include withdrawal fees and inactivity fees, which users should consider when planning long-term usage. Overall, its pricing aligns well with the features it offers.

#2. Coinbase

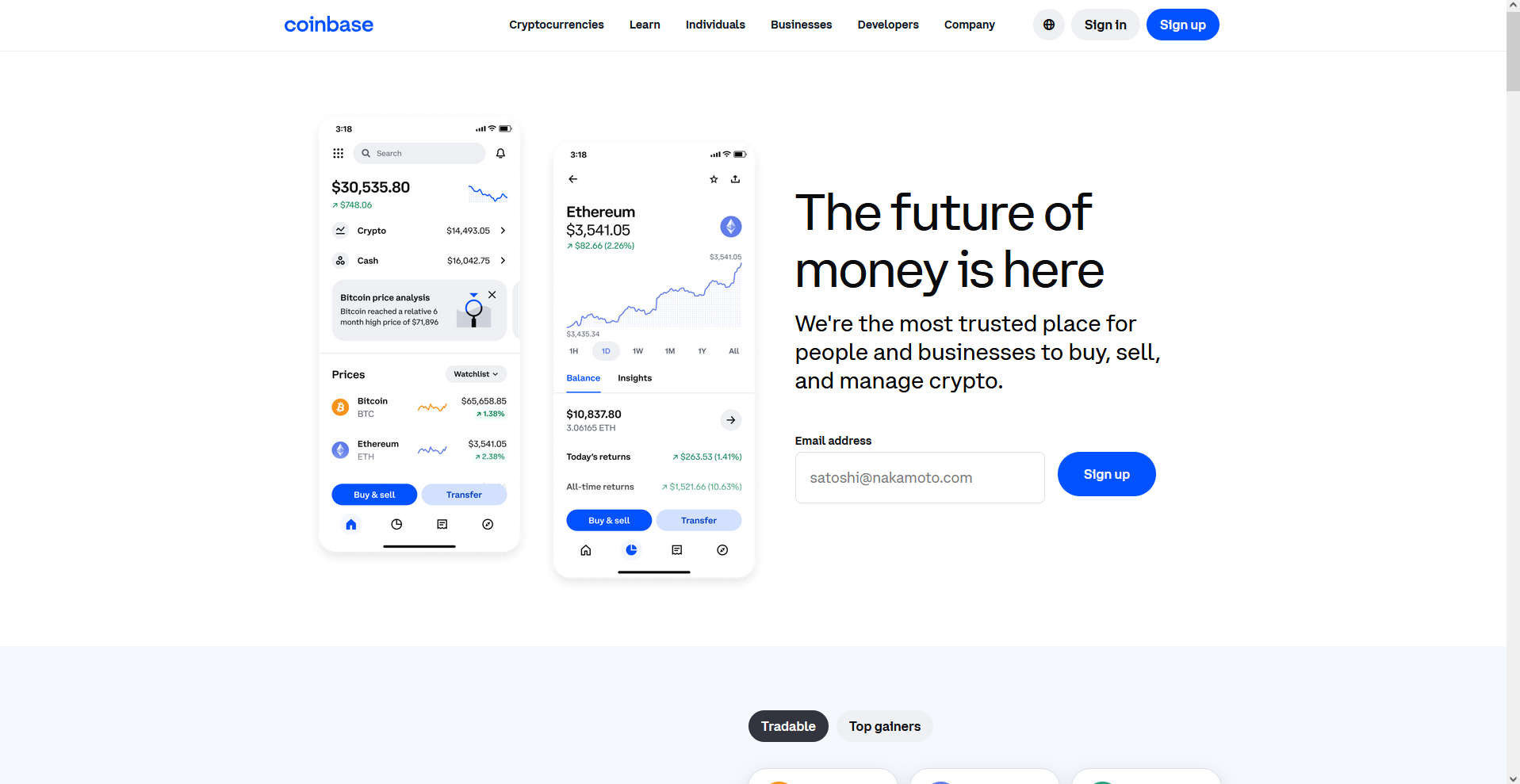

What is Coinbase?

Coinbase is a widely used cryptocurrency exchange that allows users to buy, sell, and trade various digital assets. Known for its user-friendly interface, it caters to both beginners and experienced traders. Coinbase offers features like a secure wallet, educational resources, and access to over 100 cryptocurrencies.

Advantages and Disadvantages of Coinbase

Coinbase Commissions and Fees

Coinbase charges a combination of spread fees and transaction fees depending on the amount and payment method. The platform’s fees can range from 1.49% to 3.99%, which is higher than many competitors. It provides a transparent fee structure but may not be cost-effective for frequent traders. Users can reduce fees by using Coinbase Pro, which offers lower transaction costs.

#3. Binance

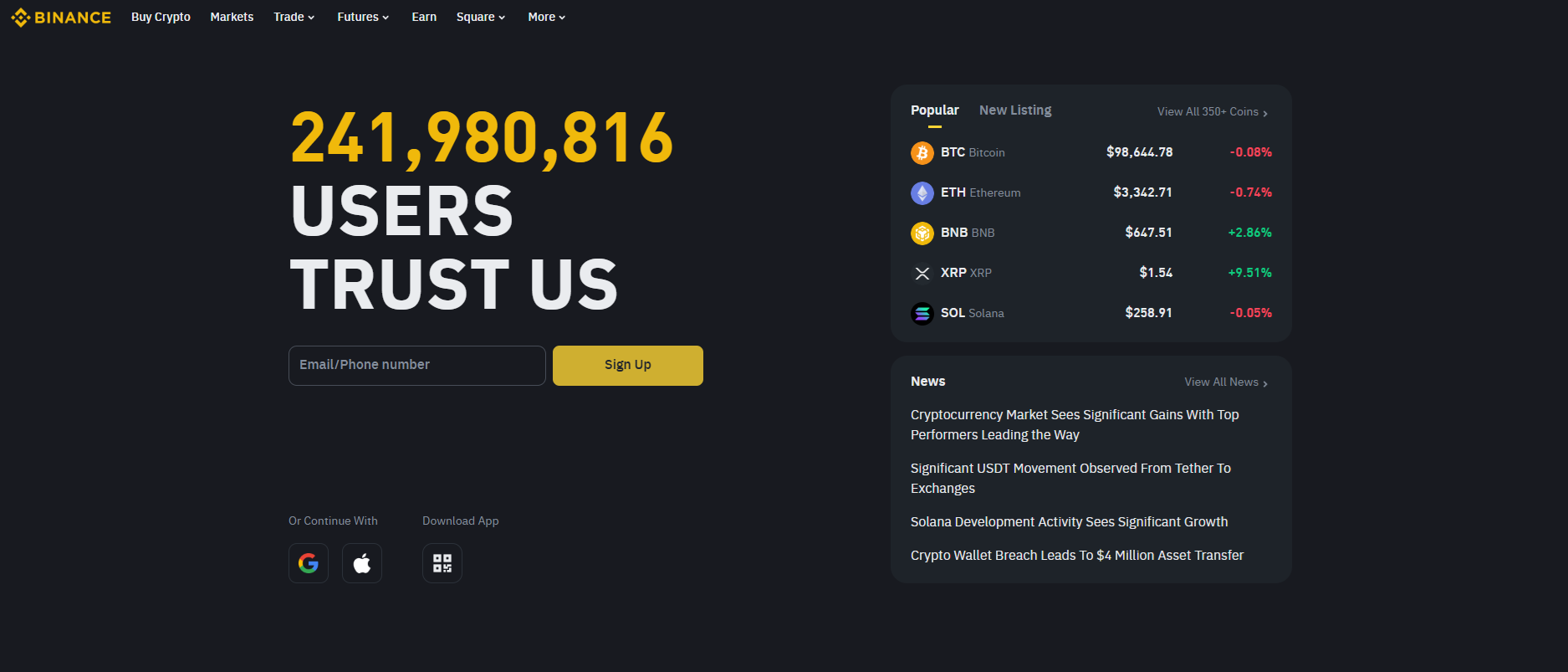

What is Binance?

Binance is a globally recognized cryptocurrency exchange offering a wide range of digital assets for trading. Known for its low trading fees and high liquidity, it supports numerous cryptocurrencies and advanced trading features. Binance also provides services like staking, futures trading, and savings products, making it a versatile platform for crypto enthusiasts.

Advantages and Disadvantages of Binance

BinanceCommissions and Fees

Binance stands out with competitive fees, starting at just 0.1% for spot trading, with discounts available for using its native token, BNB. Withdrawal fees vary depending on the cryptocurrency, making it essential to check specific rates. The platform also offers tiered fee reductions based on trading volume, appealing to high-frequency traders. This structure ensures affordability for users across all levels.

#4. Bitstamp

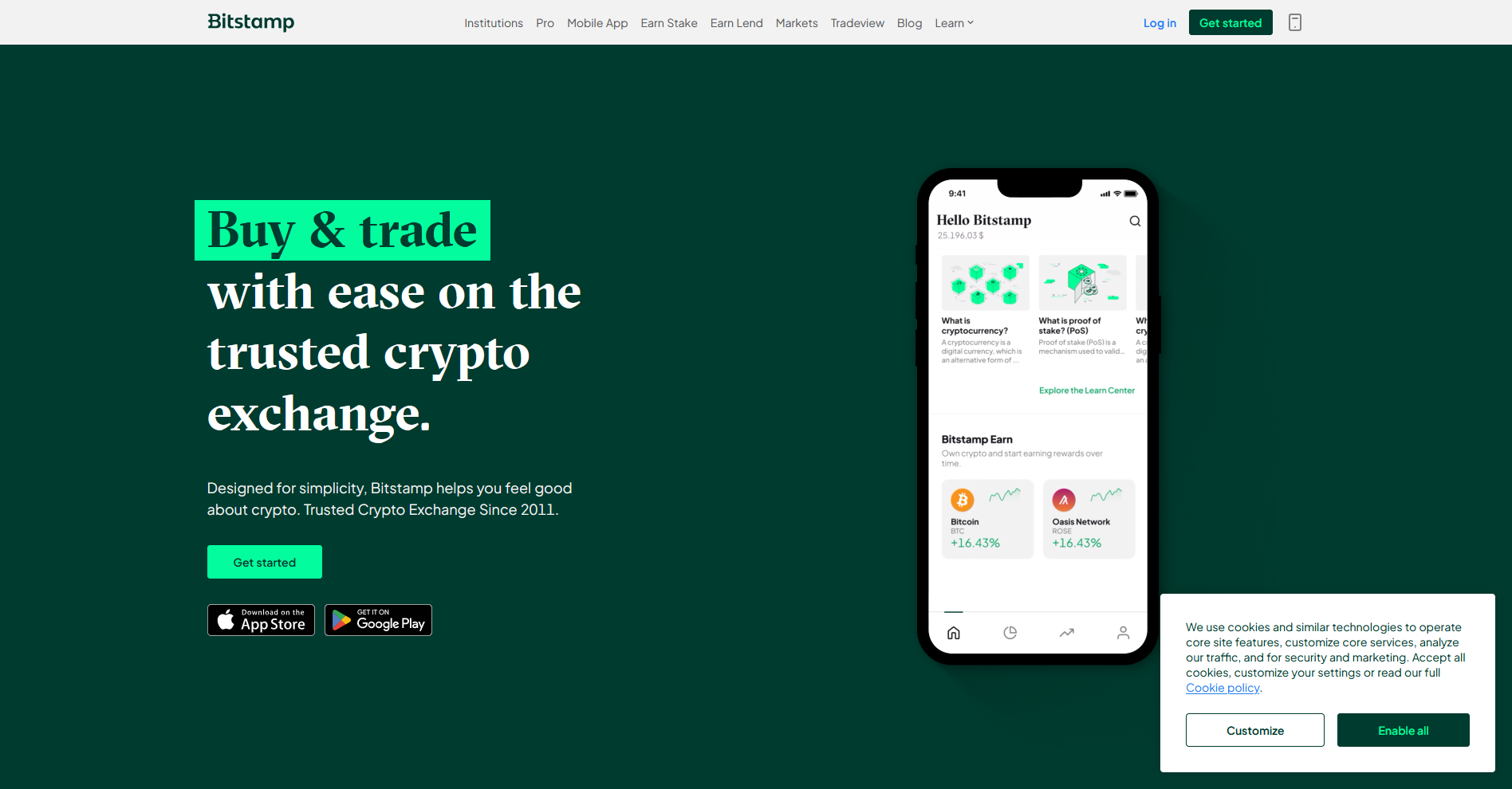

What is Bitstamp?

Bitstamp is a cryptocurrency exchange established in 2011, known for its reliability and secure trading environment. It offers a user-friendly platform for buying, selling, and storing various digital assets. Bitstamp is regulated, making it a trusted choice among global traders and institutions.

Advantages and Disadvantages of Bitstamp

Bitstamp Commissions and Fees

Bitstamp follows a transparent fee structure based on trading volume, with fees starting at 0.50% for monthly volumes below $10,000. Larger trading volumes enjoy reduced fees, dropping as low as 0.05% for top-tier traders. Additional fees may apply for certain withdrawals or deposits, depending on the payment method. Its competitive pricing makes it suitable for both beginners and experienced traders.

#5. Kraken

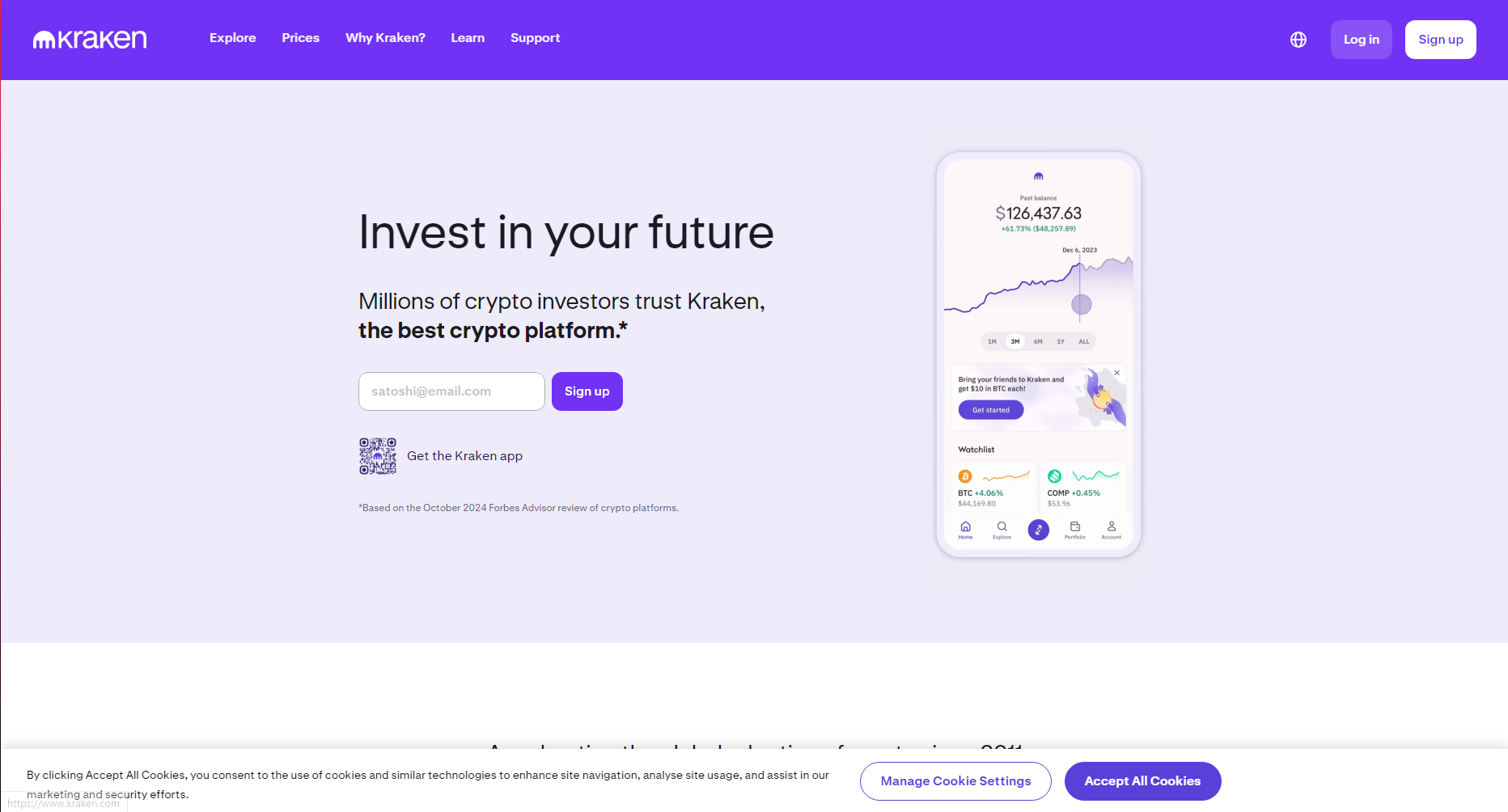

What is Kraken?

Kraken is a well-established cryptocurrency exchange that allows users to trade a wide range of digital assets. Known for its robust security features, it offers advanced trading options such as futures and margin trading. Kraken is popular among beginners and experienced traders due to its user-friendly interface and comprehensive educational resources.

Advantages and Disadvantages of Kraken

Kraken Commissions and Fees

Kraken uses a tiered fee structure based on trading volume, with maker fees starting at 0.16% and taker fees at 0.26%. For futures trading, fees range from 0.02% to 0.05%, depending on the trade type. Additionally, Kraken charges withdrawal fees, which vary by cryptocurrency. The platform is transparent about its costs, making it easy for traders to calculate their expenses.

Benefits of Trading Crypto in Spain in 2025

Spain continues to position itself as a hub for crypto enthusiasts, offering immense opportunities for both local and global markets. With the rise of crypto exchanges in Spain, traders can access innovative crypto trading platforms featuring advanced trading tools and top-tier security. The regulatory compliance enforced by the National Securities Market Commission ensures transparency and protection for crypto traders, fostering trust among Spanish users. Low deposit and withdrawal fees, user-friendly interfaces, and support for multiple payment methods like Google Pay and bank transfers make crypto purchases and trading seamless.

The Spanish crypto exchange environment supports crypto ownership with robust anti-money laundering measures and secure options like cold storage for customer assets. For professional traders, features like futures trading, derivatives trading, and crypto CFDs allow access to higher trading volumes and diverse crypto coins. Beginners benefit from educational resources and platforms with a user-friendly interface, while experienced traders enjoy tools such as trading bots and advanced trading features. Spain’s dynamic crypto market makes it ideal for anyone looking to trade crypto or explore the crypto space with confidence.

Also Read: The 5 Best Binary Brokers in Spain 2025: Seamless Trades

Conclusion

When evaluating the best crypto brokers in Spain, it’s essential to focus on platforms offering competitive trading fees, diverse crypto assets, and robust trading tools. These crypto exchanges cater to crypto traders of all levels, from beginners to advanced traders, with features like futures trading, crypto CFDs, and cold storage for added security. Platforms compliant with Spain’s National Securities Market Commission ensure regulatory compliance while supporting seamless transactions through bank transfers, crypto debit cards, and other multiple payment methods.

Selecting the best crypto exchange depends on individual preferences such as ease of use, top-tier security, and the availability of features like trading bots, educational resources, or advanced trading tools. For crypto traders looking to trade crypto or purchase assets like bitcoin cash, prioritizing low fees, a user-friendly interface, and strong security measures ensures a secure and efficient experience. Always assess the broker’s offerings to align with personal trading goals in the crypto market.

FAQs

Are crypto brokers regulated in Spain?

Yes, most reputable brokers operating in Spain adhere to EU financial regulations and local requirements for security and transparency.

What is the best broker for beginners in Spain?

Coinbase is an excellent choice for beginners due to its user-friendly interface and strong security measures.

Do these brokers support the Spanish language?

Most top brokers, including eToro and Binance, provide Spanish language support for their users.