In 2025, crypto trading in New Zealand continues to grow, driven by increasing adoption of blockchain technology and evolving crypto market trends. With a focus on innovative trading strategies, crypto traders are actively seeking platforms that offer robust security, reliability, and user-friendly experiences to navigate the local market.

Selecting the right crypto exchanges is critical, especially with rising concerns about anti-money laundering regulations, identity verification, and consumer protection. This article highlights the top crypto exchanges for New Zealand users, evaluating their trading fees, trading options, and features like advanced charting tools and portfolio tracking. Among the platforms reviewed are Easy Crypto, Independent Reserve, and other leading exchanges, ensuring a comprehensive guide for both active traders and those looking to start trading.

Key Factors to Consider When Choosing a Crypto Broker

Choosing the best crypto brokers in New Zealand requires evaluating several critical factors to ensure a smooth and secure cryptocurrency trading experience. First, robust security measures, such as encryption, insurance, and compliance with anti-money laundering regulations, are essential. User-friendly trading platforms with intuitive interfaces, advanced charting tools, and portfolio tracking enhance the experience for both beginners and advanced traders. The broker’s offerings should include a wide range of crypto assets and trading pairs, enabling users to trade directly and diversify their investments.

Consider fees, commissions, and withdrawal options, including support for fiat currency like New Zealand dollars via bank transfers. Customer support, educational resources, and tools like copy trading or price alerts also add value. Look for brokers that comply with Financial Markets Authority regulations and cater to New Zealand users with localized options, such as easy deposits, income tax assistance, and support for crypto taxed transactions. Platforms like Easy Crypto and Independent Reserve often cater to zealand customers, making them reliable choices for crypto investing in the local market.

The 5 Best Crypto Brokers in New Zealand in 2025\

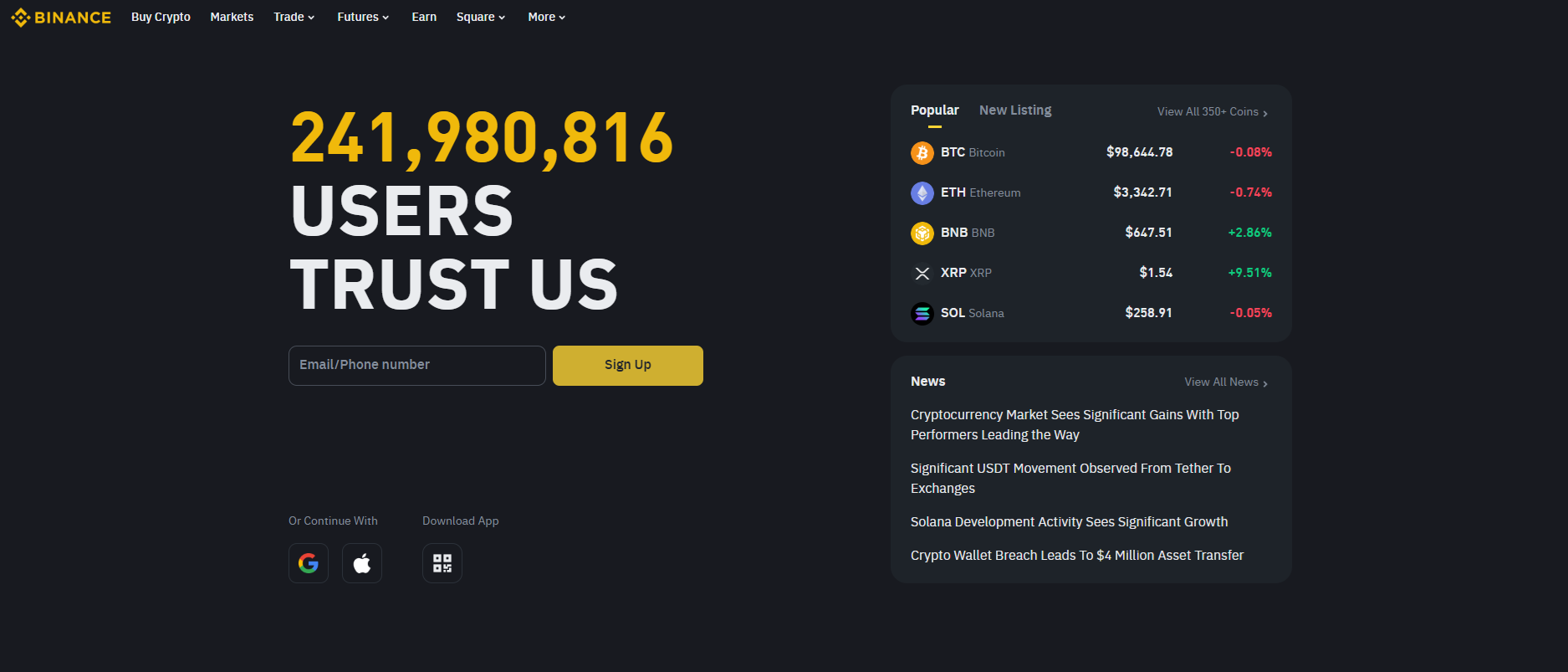

#1. Binance

What is Binance?

Binance is one of the largest cryptocurrency exchanges globally, offering a wide range of digital assets for trading, including Bitcoin and Ethereum. Known for its low transaction fees, Binance provides a user-friendly platform suitable for beginners and experienced traders alike. It also offers additional features like futures trading, staking, and a native cryptocurrency called BNB. With its strong security measures, Binance is a preferred choice for millions of crypto enthusiasts worldwide.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance is recognized for its competitive fee structure, with trading fees as low as 0.1% for spot trades. Users can reduce these fees further by using BNB, Binance’s native token, for payments. Additionally, the platform offers zero deposit fees and minimal withdrawal charges for most assets. These features make Binance appealing to cost-conscious traders.

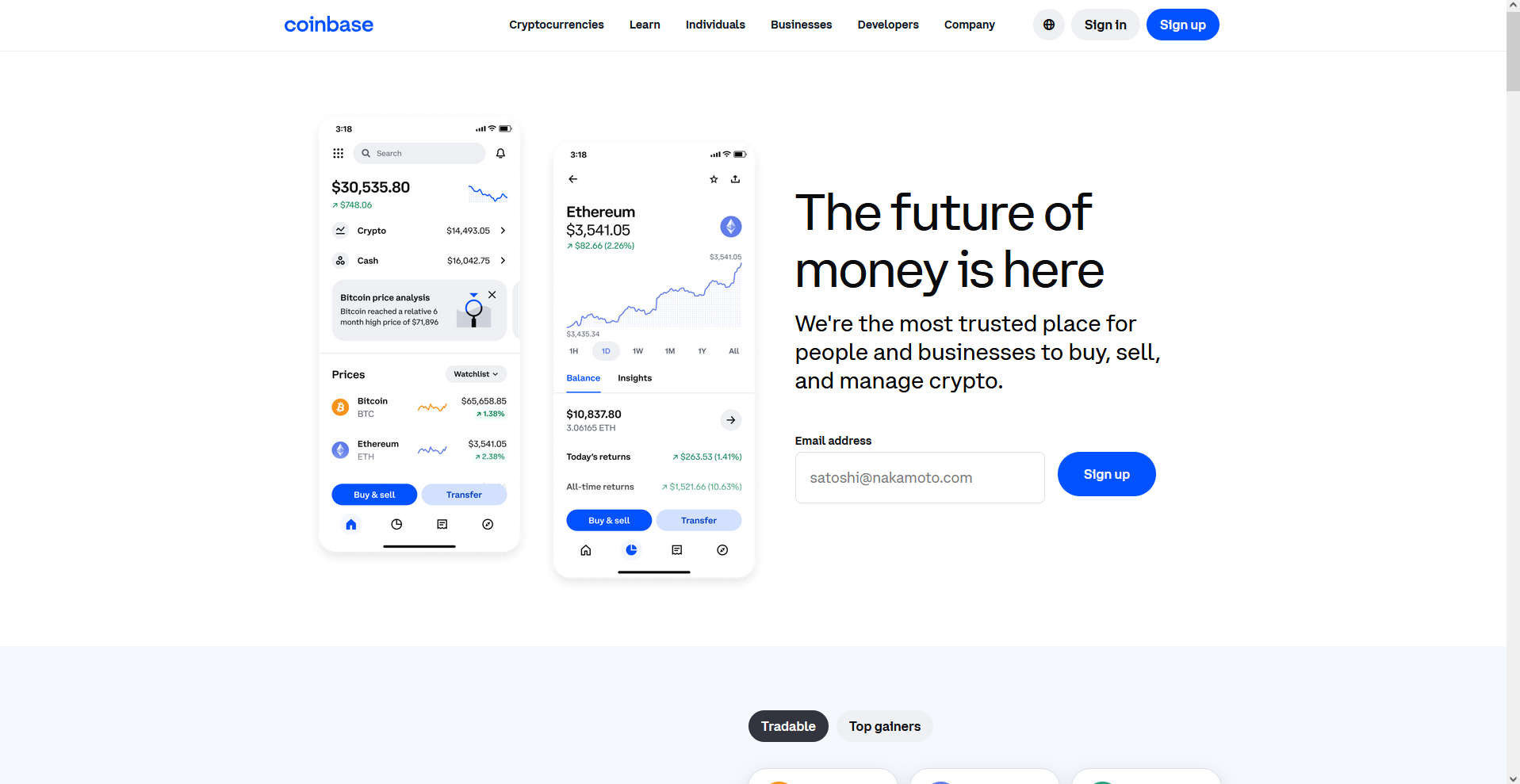

#2. Coinbase

What is Coinbase?

Coinbase is a popular cryptocurrency exchange platform designed for buying, selling, and storing digital assets. It is user-friendly and offers a secure environment for both beginners and advanced traders. With a presence in numerous countries, Coinbase supports various cryptocurrencies and provides additional services like staking and learning rewards. Its focus on compliance and security has made it a trusted choice in the crypto industry.

Advantages and Disadvantages of Coinbase

Coinbase Commissions and Fees

Coinbase charges fees based on the transaction amount, payment method, and region, which can make it more expensive than other platforms. For smaller transactions, the fees are flat, while larger transactions are charged a percentage. Coinbase Pro offers lower fees for traders who require advanced tools. Despite the cost, users often find its features and security worth the investment.

#3. eToro

What is eToro?

eToro is a leading social trading platform known for its innovative CopyTrader feature, allowing users to replicate trades of successful investors. It offers a wide range of assets, including stocks, cryptocurrencies, and forex, making it suitable for both beginners and experienced traders. The platform combines traditional trading tools with social networking features, fostering a collaborative trading experience.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro charges no commission on stock trades, making it attractive for long-term investors. However, it applies spreads on trades, which can be higher compared to other platforms. Additionally, there are withdrawal fees and an inactivity fee for dormant accounts. Despite these costs, its transparent fee structure appeals to many traders.

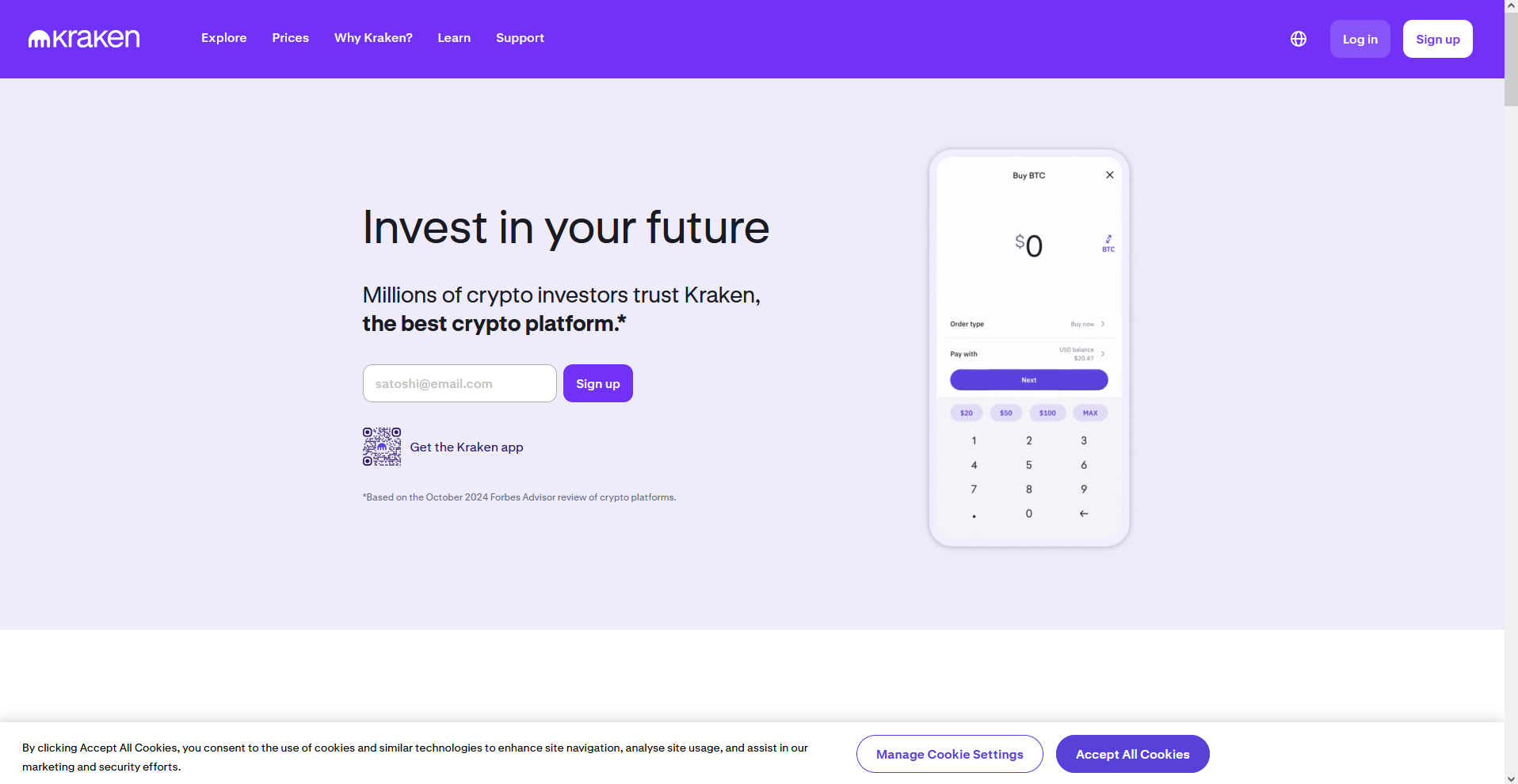

#4. Kraken

What is Kraken?

Kraken is a prominent cryptocurrency exchange known for its extensive selection of digital assets and robust security features. Established in 2011, it offers a user-friendly platform for trading, staking, and managing cryptocurrencies. Kraken is widely trusted due to its transparent fee structure and regulatory compliance, making it a preferred choice for both beginners and seasoned traders.

Advantages and Disadvantages of Kraken

Kraken Commissions and Fees

Kraken operates on a competitive fee structure, charging fees based on trading volume with rates as low as 0.16% for makers and 0.26% for takers. It provides transparency in fees, ensuring users understand costs upfront. Additional features like staking also come with minimal fees, making it attractive to investors. Kraken’s overall pricing is considered affordable compared to other major exchanges.

#5. BitPrime

What is BitPrime?

BitPrime is a New Zealand-based cryptocurrency platform offering brokerage services for buying and selling digital assets. It caters to both retail and institutional clients, providing over 100 cryptocurrencies with a focus on security and transparency. BitPrime is known for its customer support and non-custodial service, meaning users retain control over their assets during transactions.

Advantages and Disadvantages of BitPrime

BitPrime Commissions and Fees

BitPrime charges a premium fee for its brokerage services, typically higher than standard exchange rates. The fees are included in the price spread, offering transparency but making it less competitive for frequent traders. While convenient for beginners, experienced users may find BitPrime’s fees restrictive for high-volume trading.

Tips for Choosing the Best Broker

Choosing the best crypto brokers in New Zealand involves evaluating several key factors to ensure a seamless and secure cryptocurrency trading experience. Begin by identifying crypto exchanges that are licensed by the Financial Markets Authority to ensure compliance with anti-money laundering regulations and consumer protection laws. Platforms offering robust security measures, such as identity verification and protection against cyber threats, are vital for safeguarding your crypto assets. For beginners, look for an intuitive user interface and tools like portfolio tracking and price alerts to simplify trading.

Experienced traders should prioritize platforms with advanced charting tools, a variety of trading pairs, and features like copy trading and portfolio management. Consider exchanges with low trading fees, diverse payment methods like bank transfers and Zealand dollars, and support for popular digital assets such as Bitcoin. Additionally, assess trading volume and the availability of trading strategies to enhance your profitability. Platforms like Easy Crypto and Independent Reserve are well-regarded by New Zealand customers for their reliability and comprehensive offerings, making them leading choices for crypto investing.

Also Read: The 5 Best Binary Brokers in New Zealand in 2025: Profitable Choices

Conclusion

The best crypto brokers in New Zealand for 2025 stand out due to their robust trading platforms, intuitive user interfaces, and comprehensive offerings for both new and advanced traders. Key players like Easy Crypto and Independent Reserve dominate the crypto market with advanced charting tools, extensive trading pairs, and strong compliance with anti-money laundering regulations. These leading exchanges ensure a secure trading experience for New Zealand users, offering price alerts, portfolio tracking, and easy bank transfers for buying crypto or trading cryptocurrency assets like Bitcoin.

For new investors, prioritizing crypto platforms with robust security measures and registered financial services providers is critical. Starting with smaller investments, diversifying your portfolio, and learning trading strategies can maximize profitability. Leverage tools like copy trading and focus on consumer protection. Staying informed about income tax rules, identity verification, and the growing use of blockchain technology will safeguard investments while enhancing trading success.

FAQs

What should I look for in a crypto broker in New Zealand?

Prioritize security, low fees, diverse trading options, and excellent customer support.

Are these brokers regulated in New Zealand?

Yes, these brokers comply with local and international regulations for secure trading.

Can I trade in NZD on these platforms?

Most brokers like BitPrime and Binance offer NZD transactions for added convenience.