At Asia Forex Mentor, we understand that choosing the best crypto brokers in Malaysia is essential for a smooth and secure crypto trading experience. With the growing interest in digital assets, it’s crucial to select a crypto exchange that aligns with your needs, offering a user-friendly interface, low trading fees, and a variety of payment methods like bank transfers and support for the Malaysian ringgit. Additionally, adherence to local financial regulations ensures your investments are protected.

Whether you’re new to the cryptocurrency market or an experienced trader, the right crypto trading platform can significantly impact your success. Our curated list of the top 5 cryptocurrency exchanges in Malaysia for 2024 focuses on platforms that provide robust security measures, access to diverse crypto assets, and advanced trading tools to help you develop effective trading strategies. Let’s explore these options to find the best crypto exchange that fits your trading preferences and goals.

Why Choosing the Best Crypto Brokers in Malaysia is Important

Selecting the right crypto broker in Malaysia is crucial for a smooth and secure cryptocurrency trading experience. A reliable broker not only offers a user-friendly interface but also ensures compliance with local financial regulations, safeguarding your investments. Here’s why making an informed choice matters:

- Regulatory Compliance: Opting for regulated exchanges ensures adherence to local financial regulations, providing an added layer of security for your investments.

- Security Measures: Top brokers implement robust security measures like two-factor authentication and cold storage to protect your digital currencies from potential threats.

- Trading Fees: Choosing platforms with low trading fees helps maximize profits, as high fees can significantly impact returns, especially for frequent traders.

- Payment Methods: Brokers offering diverse payment methods, including bank transfers and support for Malaysian Ringgit (MYR) trading pairs, provide convenience and cost-effectiveness when you buy bitcoin or other cryptocurrencies.

- Asset Variety: Access to a wide range of digital currencies allows for better portfolio diversification, aligning with your investment goals and trading strategies.

- User Experience: A user-friendly interface enhances the trading process, making it easier for both beginners and experienced traders to execute trades efficiently.

- Customer Support: Responsive customer service is vital for timely assistance, ensuring a seamless experience when issues arise.

The 5 Best Crypto Brokers in Malaysia in 2024

#1. Bybit

What is Bybit?

Bybit is a prominent cryptocurrency exchange offering a wide range of digital assets for trading. It provides a user-friendly interface and supports multiple languages, including Malay, making it accessible to Malaysian traders. Bybit offers various trading options, such as spot and derivatives trading, with leverage up to 200x. However, it’s important to note that Bybit is not a regulated exchange in Malaysia, and traders should exercise caution and be aware of the associated risks.

Advantages and Disadvantages of Bybit

Bybit Commissions and Fees

Bybit employs a tiered fee structure based on the user’s VIP level. For spot trading, both maker and taker fees start at 0.1% for non-VIP users. In derivatives trading, the taker fee is 0.055%, and the maker fee is 0.02% for non-VIP users. As traders’ 30-day trading volumes increase, they can achieve higher VIP levels, which offer reduced fees. Bybit also implements funding fees for perpetual contracts, which are periodic payments between long and short position holders to keep contract prices aligned with spot markets.

#2. Binance

What is Binance?

Binance is one of the world’s largest cryptocurrency exchanges, offering a vast selection of digital currencies and trading pairs. It provides a user-friendly interface, advanced trading tools, and supports various payment methods, including bank transfers in Malaysian Ringgit (MYR). Binance is known for its low trading fees and comprehensive suite of services, such as margin trading, futures contracts, and staking. However, it’s important to note that Binance has faced regulatory scrutiny in various jurisdictions, and its status in Malaysia may be subject to change.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance employs a tiered fee structure based on the user’s 30-day trading volume and BNB holdings. For spot trading, the maker and taker fees start at 0.1% and can be reduced by holding BNB or achieving higher VIP levels. For futures trading, the taker fee starts at 0.04%, and the maker fee starts at 0.02%. Binance also offers fee discounts for users who pay fees using BNB. Deposit fees vary depending on the payment method, while withdrawal fees depend on the specific cryptocurrency.

#3. Luno

What is Luno?

Luno is a digital asset exchange that caters to Malaysian traders, offering a user-friendly interface and support for major cryptocurrencies like Bitcoin and Ethereum. It provides educational resources to help users understand blockchain technology and cryptocurrency trading. Luno is registered with the Securities Commission Malaysia, ensuring compliance with local financial regulations and providing a secure platform for Malaysian investors.

Advantages and Disadvantages of Luno

Luno Commissions and Fees

Luno’s fee structure includes instant buy/sell fees, exchange fees, and withdrawal fees. The instant buy/sell fee is 2%, while exchange fees are based on a tiered structure, with maker fees starting at 0% and taker fees starting at 0.1%. Deposit methods include bank transfers, which are typically free, but withdrawal fees may apply depending on the method used.

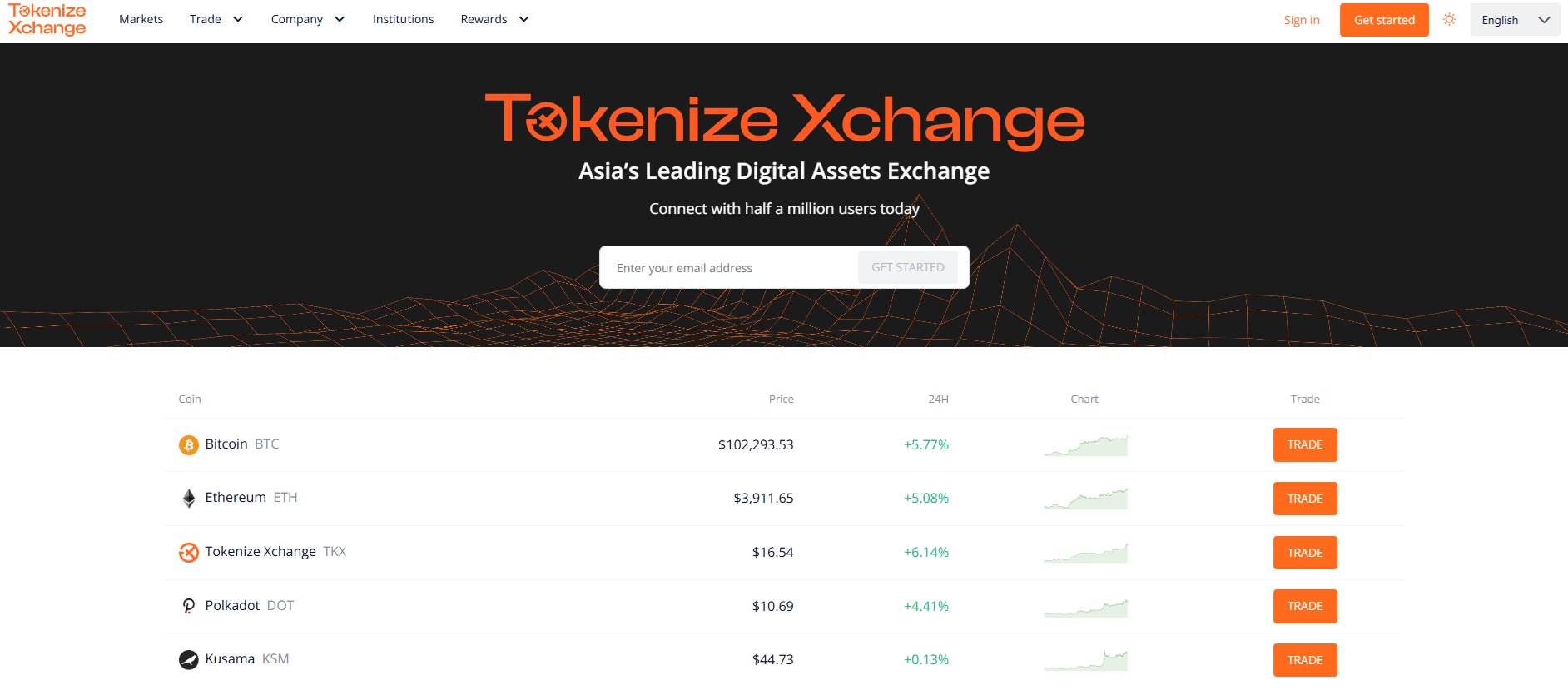

#4. Tokenize Xchange

What is Tokenize Xchange?

Tokenize Xchange is a digital asset exchange based in Malaysia, offering a platform for trading various digital currencies. It provides a user-friendly interface, supports MYR trading pairs, and complies with local financial regulations. Tokenize Xchange is registered with the Securities Commission Malaysia, ensuring a secure and regulated environment for Malaysian investors.

Advantages and Disadvantages of Tokenize Xchange

Tokenize Xchange Commissions and Fees

Tokenize Xchange employs a tiered fee structure based on the user’s 30-day trading volume. For spot trading, the maker and taker fees start at 0.25% and can be reduced by achieving higher membership tiers. Deposit fees vary depending on the payment method, with bank transfers typically being free, while withdrawal fees depend on the specific cryptocurrency.

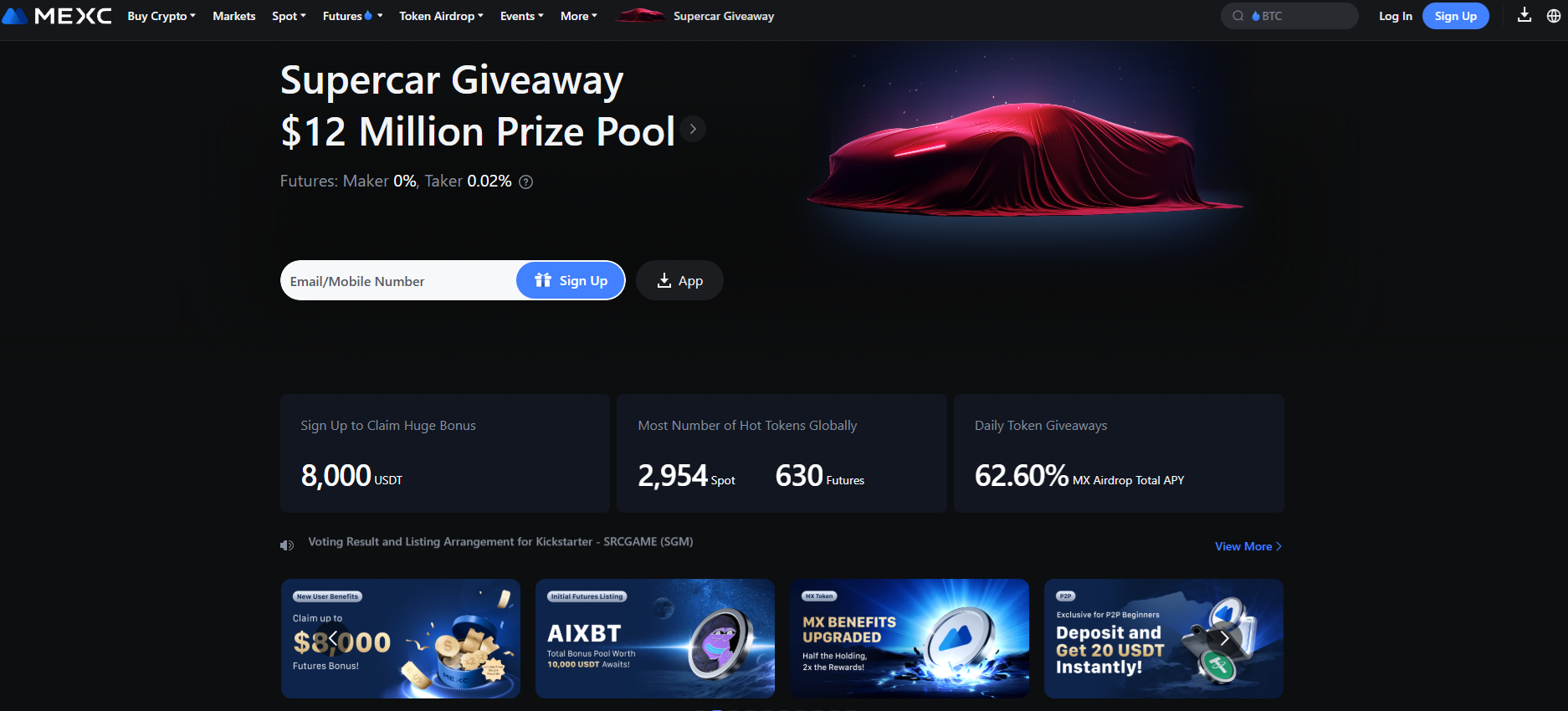

#5. MEXC

What is MEXC?

MEXC is a global cryptocurrency exchange that offers a wide range of digital assets and trading pairs. It provides advanced trading tools, including margin trading, futures contracts, and a variety of trading options to cater to both beginners and experienced traders. MEXC emphasizes security and compliance, implementing robust measures to protect user assets. However, it’s important to note that MEXC is not a regulated exchange in Malaysia, so traders should be aware of the associated risks.

Advantages and Disadvantages of MEXC

MEXC Commissions and Fees

MEXC employs a tiered fee structure based on the user’s 30-day trading volume and MX token holdings. For spot trading, the maker and taker fees start at 0.2% and can be reduced by holding MX tokens or achieving higher VIP levels. For futures trading, the taker fee starts at 0.06%, and the maker fee starts at 0.02%. Deposit fees vary depending on the payment method, while withdrawal fees depend on the specific cryptocurrency.

How to Get Started with a Crypto Broker in Malaysia

Getting started with a crypto broker in Malaysia is a straightforward process. Here’s a step-by-step guide to help you begin your cryptocurrency trading journey:

Step 1: Choose a Reputable Crypto Broker

Select a licensed cryptocurrency exchange operating in Malaysia. The Securities Commission Malaysia has approved platforms like Luno, SINEGY, Tokenize, MX Global, and Hata. These exchanges comply with local financial regulations, ensuring a secure environment for Malaysian traders.

Step 2: Create an Account

Visit the chosen exchange’s website and sign up for an account. You’ll need to provide personal information and complete the Know Your Customer (KYC) verification process, which may include submitting identification documents and proof of address.

Step 3: Deposit Funds

Once your account is verified, deposit funds using supported payment methods such as bank transfers or credit/debit cards. Some platforms accept deposits in Malaysian Ringgit (MYR), facilitating transactions for Malaysian investors.

Step 4: Start Trading

With funds in your account, you can begin trading cryptocurrencies. Explore various digital currencies available on the platform and execute trades based on your trading strategies. Many exchanges offer a user-friendly interface to assist both beginners and experienced traders.

Step 5: Secure Your Investments

Ensure the safety of your assets by enabling security features like two-factor authentication (2FA). Consider using hardware wallets for storing significant amounts of cryptocurrency, as they provide enhanced security compared to online wallets.

Conclusion

Finding the best crypto brokers in Malaysia is about ensuring your trading experience is secure, reliable, and user-friendly. Whether you’re just starting out or are an experienced trader, choosing the right platform with low trading fees, diverse payment methods, and compliance with local financial regulations is key. Platforms like Luno, Binance, and Tokenize Xchange offer a variety of digital currencies and features tailored for Malaysian traders. Always do your research, start small, and stay informed about the cryptocurrency market to make smart investment decisions.

Also Read: The 5 Best Binary Brokers in Malaysia in 2024

FAQs

What should I look for in a crypto broker in Malaysia?

Look for platforms that are licensed by the Securities Commission Malaysia, have low fees, and offer good security features.

Can I trade cryptocurrencies in Malaysian Ringgit?

Yes, some brokers like Luno and Tokenize Xchange allow you to trade using MYR, making transactions convenient for local users.

Are crypto brokers in Malaysia safe?

Brokers regulated by the Securities Commission Malaysia are generally considered safe, but it’s always wise to enable security features like 2FA.