Japan has become one of the best crypto exchanges for in the world, driven by a surge in interest from both experienced traders and newcomers. With its well-regulated market and growing adoption of crypto assets, the Japanese market offers unique opportunities for crypto traders seeking to trade in Japanese yen and explore diverse trading strategies. As crypto trading gains traction, the importance of choosing the best crypto brokers in japan cannot be overstated.

Selecting a trustworthy trading platform is crucial for a seamless trading experience, whether you’re focusing on advanced trading tools, margin trading, or strategies like copy trading. Evaluating factors like trading fees, robust security measures, and japan crypto exchanges regulations helps traders optimize their crypto portfolio and navigate the crypto market with confidence. This guide outlines the key criteria to identify the top Japanese crypto exchanges, ensuring both professional traders and active traders can maximize their trading opportunities.

Key Criteria for Evaluating Crypto Brokers

When evaluating the best crypto brokers in Japan, several factors are critical for ensuring a seamless trading experience. A reliable crypto exchange should cater to Japanese top crypto exchanges by offering advanced trading tools suitable for both beginners and experienced traders. Access to the cryptocurrency trading with features like margin trading, copy trading, and futures trading provides diverse trading opportunities.

The Japanese market is unique, governed by Japanese crypto regulations under Japan’s Financial Services Agency, ensuring crypto trading legal status. Brokers must provide competitive trading fees, secure bank account integrations, and two-factor authentication for robust security measures. For Japanese traders, a user-friendly interface, mobile trading app, and support for Japanese yen are essential. Whether focusing on advanced trading features or low fees, the top crypto traders and crypto businesses benefit from brokers with helpful customer support and tools for technical analysis, ensuring efficiency and maximize profits.

The 5 Best Crypto Brokers in Japan in 2024

#1. bitFlyer

What is bitFlyer?

bitFlyer is a Japanese cryptocurrency exchange founded in 2014, offering services across Japan, the United States, and Europe. It provides platforms for both beginners and professional traders, including the bitFlyer Lightning exchange for advanced trading in the stock market. The company is recognized for its strong security measures and compliance with regulatory standards.

Advantages and Disadvantages of bitFlyer

bitFlyer Commissions and Fees

bitFlyer offers free account creation and no trading fees on standard buy/sell orders to experience real trading positions; however, it applies a spread typically ranging from 0.1% to 6%, which can exceed this margin during sudden price changes. On the bitFlyer Lightning platform, trading fees are based on a user’s 30-day trading volume, starting at 0.10% for volumes less than $50,000 and decreasing to 0.03% for volumes exceeding $500 million. Bank deposits and withdrawals via ACH transfer are free, while wire withdrawals incur a $20 fee.

#2. Bitbank

What is Bitbank?

Bitbank, established in 2014, is a Japanese exchange that facilitates the trading of digital assets like Bitcoin and Ethereum against the Japanese yen (JPY). Operating under the regulation of the Japanese Financial Services Agency (JFSA), Bitbank ensures compliance with stringent financial standards, enhancing its credibility and security. The platform is accessible via both desktop and mobile applications, offering users flexibility in managing their cryptocurrency portfolios.

Advantages and Disadvantages of Bitbank

BitbankCommissions and Fees

Bitbank employs a maker-taker fee structure, where makers receive a rebate of 0.02% for adding liquidity, effectively earning a small fee for their trades. Takers, who remove liquidity, are charged a fee of 0.12%, which is considered competitive within the industry. The platform does not impose deposit fees; however, withdrawal fees vary depending on the specific cryptocurrency. For instance, withdrawing Bitcoin incurs a fee of 0.0006 BTC, which is slightly above the global industry average.

#3. Coincheck

What is Coincheck?

Coincheck is a Tokyo-based cryptocurrency exchange and digital wallet service founded in 2012. It facilitates transactions between cryptocurrencies like Bitcoin and Ethereum, as well as fiat currencies, primarily serving the Japanese market. In April 2018, Coincheck was acquired by the Monex Group for 3.6 billion yen (approximately $33.4 million).

Advantages and Disadvantages of Coincheck

Coincheck Commissions and Fees

Coincheck offers commission-free trading for its users, meaning there are no fees for buying or selling cryptocurrencies on the platform. However, fees are applicable for deposits and withdrawals, varying based on the method and currency involved. For instance, withdrawing Japanese yen incurs a fixed fee of ¥407 per transaction. Additionally, cryptocurrency withdrawals have specific fees; for example, withdrawing Bitcoin costs 0.0005 BTC.

#4. Bybit

What is Bybit?

Bybit is a cryptocurrency exchange founded in 2018, offering a platform for trading digital assets, including spot and derivatives markets. Headquartered in Dubai, United Arab Emirates, it has rapidly grown to serve over 10 million users worldwide. Bybit provides advanced trading features such as up to 100x leverage on Bitcoin trades and a testnet environment for risk-free practice.

Advantages and Disadvantages of Bybit

Bybit Commissions and Fees

Bybit employs a maker-taker fee model across its trading platforms. For spot trading, both maker and taker fees are set at 0.1% for non-VIP users. In derivatives trading, non-VIP users incur a maker fee of 0.02% and a taker fee of 0.055%. Bybit also offers a tiered fee structure, providing reduced fees for users with higher trading volumes or those participating in its VIP program.

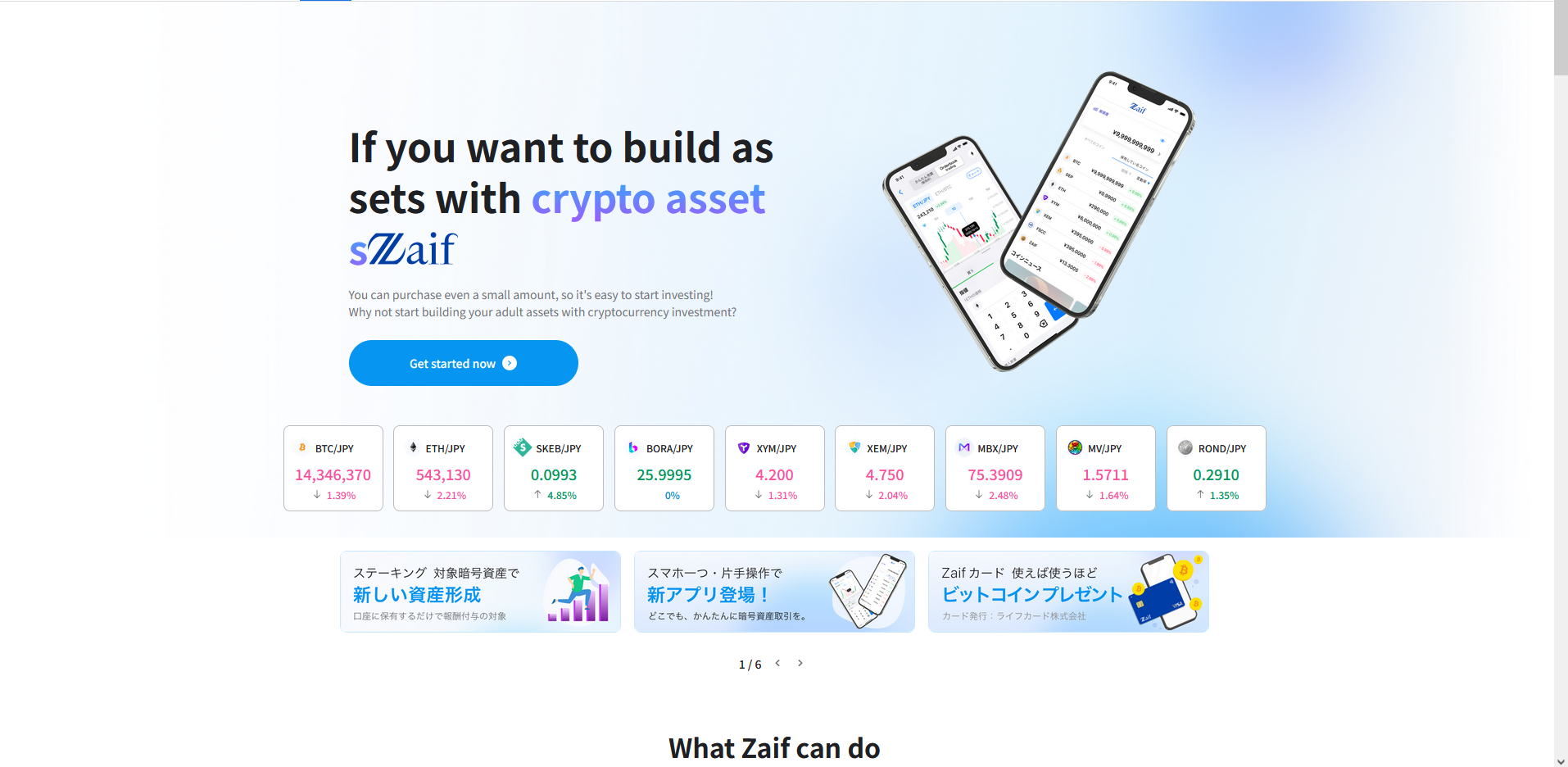

#5. Zaif

What is Zaif?

Zaif is a Japan-based cryptocurrency exchange established in 2014, recognized as the first licensed platform by the Japanese Financial Services Agency (JFSA). It offers services such as spot trading, margin trading with up to 7.7x leverage, and a referral program. The platform supports over 40 cryptocurrencies, including its native Zaif Token (ZAIF), and facilitates trading against Bitcoin (BTC) and Japanese Yen (JPY).

Advantages and Disadvantages of Zaif

Zaif Commissions and Fees

Zaif implements a maker-taker fee structure, with maker fees set at 0% and taker fees ranging from 0.1% to 0.3%, depending on the trading pair. Withdrawal fees vary by cryptocurrency; for instance, Bitcoin withdrawals incur a fee between 0.0001 and 0.01 BTC. Deposits in Japanese Yen are subject to fees based on the method and amount, such as 495 JPY for amounts less than 30,000 JPY via convenience deposit.

Tips for Choosing a Crypto Broker in Japan

When selecting the best crypto brokers in Japan, consider factors that align with your trading goals and expertise. Japanese crypto exchanges offer various features, but prioritize those regulated by Japan’s Financial Services Agency to ensure compliance with Japanese crypto regulations under the Payment Services Act. Look for platforms with robust security measures like two-factor authentication and user-friendly interfaces to protect your crypto assets and optimize your trading experience.

Evaluate the platform’s offerings, such as advanced trading tools, margin trading, and copy trading, to cater to experienced traders or beginners. Analyze the trading fees, withdrawal fees, and trading volume on the top Japanese crypto exchanges to ensure cost-effective and efficient transactions. Platforms that support fiat currency like Japanese yen, multiple exchanges, and payment methods such as bank transfers or credit or debit cards can enhance your seamless trading experience. Lastly, consider brokers with educational resources, helpful customer support, and features like mobile trading apps to adapt to evolving market trends in the crypto market.

Also Read: The 5 Best Trading Platforms in Japan in 2024: Elevate Your Investments

Conclusion

For those exploring the best crypto brokers in Japan, it’s crucial to assess platforms offering competitive advantages like robust crypto exchange options tailored to japanese crypto exchanges. The market caters to a variety of needs, providing advanced trading tools and a secure environment for both novice and experienced traders. Engaging with the crypto market in Japan ensures access to diverse trading platforms and features that align with crypto trading legal frameworks.

Key considerations include trading fees, trading volume, and adherence to japanese crypto regulations under Japan’s Financial Services Agency. Platforms with features like copy trading, margin trading, and advanced trading features are especially appealing. With seamless mobile trading apps, efficient bank transfers, and low fees, Japanese traders can enjoy a seamless trading experience while managing crypto assets for both passive income and maximize profits.

FAQS

Is crypto trading legal in Japan?

Yes, crypto trading is legal in Japan and regulated by the Japan’s Financial Services Agency under the Payment Services Act.

What are the best crypto brokers in Japan?

The best crypto brokers in Japan offer competitive trading fees, robust security measures, and user-friendly trading platforms suitable for japanese traders.

Can I use Japanese Yen to trade crypto?

Yes, many japanese crypto exchanges allow trading with Japanese Yen, providing seamless bank transfers and other payment methods.