Italy has witnessed a surge in interest in cryptocurrency trading, with more individuals exploring the potential of crypto assets as part of their personal finance strategies. With the rise of digital assets, Italian traders are increasingly looking for crypto trading platforms that align with their trading needs.

Choosing a reliable and secure crypto exchange is crucial, especially given the complexities of complex instruments like margin trading and trading CFDs. For both inexperienced traders and advanced traders, selecting a user-friendly platform with features such as two-factor authentication, negative balance protection, and regulatory compliance ensures safe and efficient trading. This article highlights the 5 best crypto brokers in Italy for 2024, offering insights into their trading fees, educational materials, and advanced trading tools.

Criteria for Choosing the Best Crypto Brokers

Choosing the best crypto brokers in Italy involves evaluating critical factors like regulatory compliance, security measures, and the overall quality of trading platforms. Brokers adhering to EU regulations and the Financial Instruments Directive ensure enhanced investor protection for both retail traders and professional traders. Prioritize platforms with robust security features like two-factor authentication and negative balance protection to safeguard client funds and mitigate the risk of losing money rapidly.

For an optimal trading experience, look for user-friendly platforms offering advanced trading tools, competitive trading fees, and educational materials. Brokers with diverse trading instruments, including cryptocurrency trading, forex trading, and derivatives trading, cater to various trading strategies and experience levels. Whether you’re buying Bitcoin, engaging in futures trading, or exploring margin trading, reliable crypto services with low transaction fees and flexible payment methods like bank transfer or Google Pay are vital for Italian traders.

The 5 Best Crypto Brokers in Italy in 2024

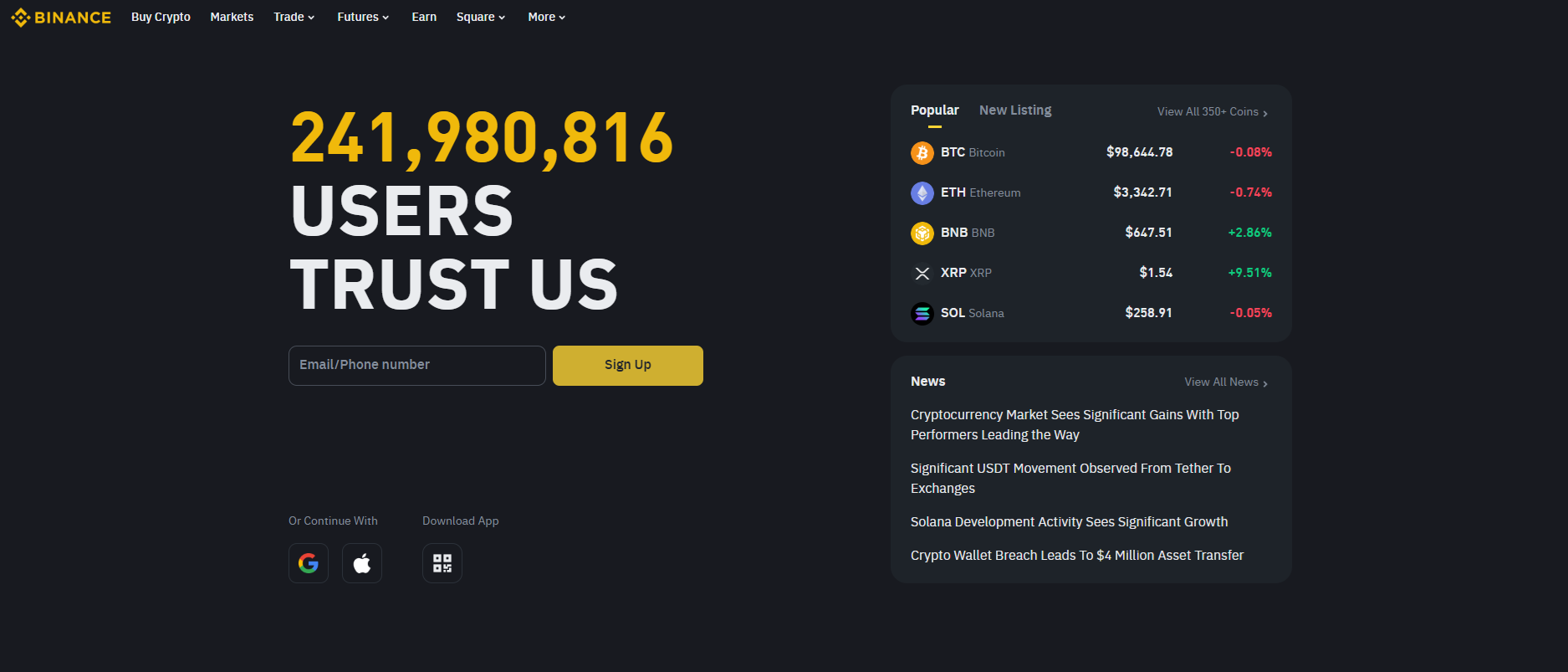

#1. Binance

What is Binance?

Binance is a globally recognized cryptocurrency exchange offering a wide range of digital assets for trading. Known for its user-friendly interface, it supports various financial products such as futures, staking, and savings. The platform is popular for its high liquidity and competitive fees, attracting millions of users worldwide.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance offers low trading fees, starting at 0.1% per transaction, which can be further reduced by using Binance Coin (BNB). The platform also provides discounts for high-volume traders and loyalty perks for frequent users. However, withdrawal fees may vary depending on the cryptocurrency, making it essential for users to review costs beforehand.

#2. eToro

What is eToro?

eToro is a social trading platform offering access to a wide range of financial instruments, including stocks, cryptocurrencies, and forex. Known for its CopyTrading feature, it allows users to replicate the strategies of successful traders. The platform is user-friendly, making it suitable for beginners and experienced investors alike.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro offers zero commission on stock trading, making it appealing for cost-conscious investors. However, spreads on forex and crypto can be relatively high compared to competitors. The platform charges a $5 withdrawal fee and inactivity fees after 12 months. Overall, its fee structure is transparent but varies depending on the asset traded.

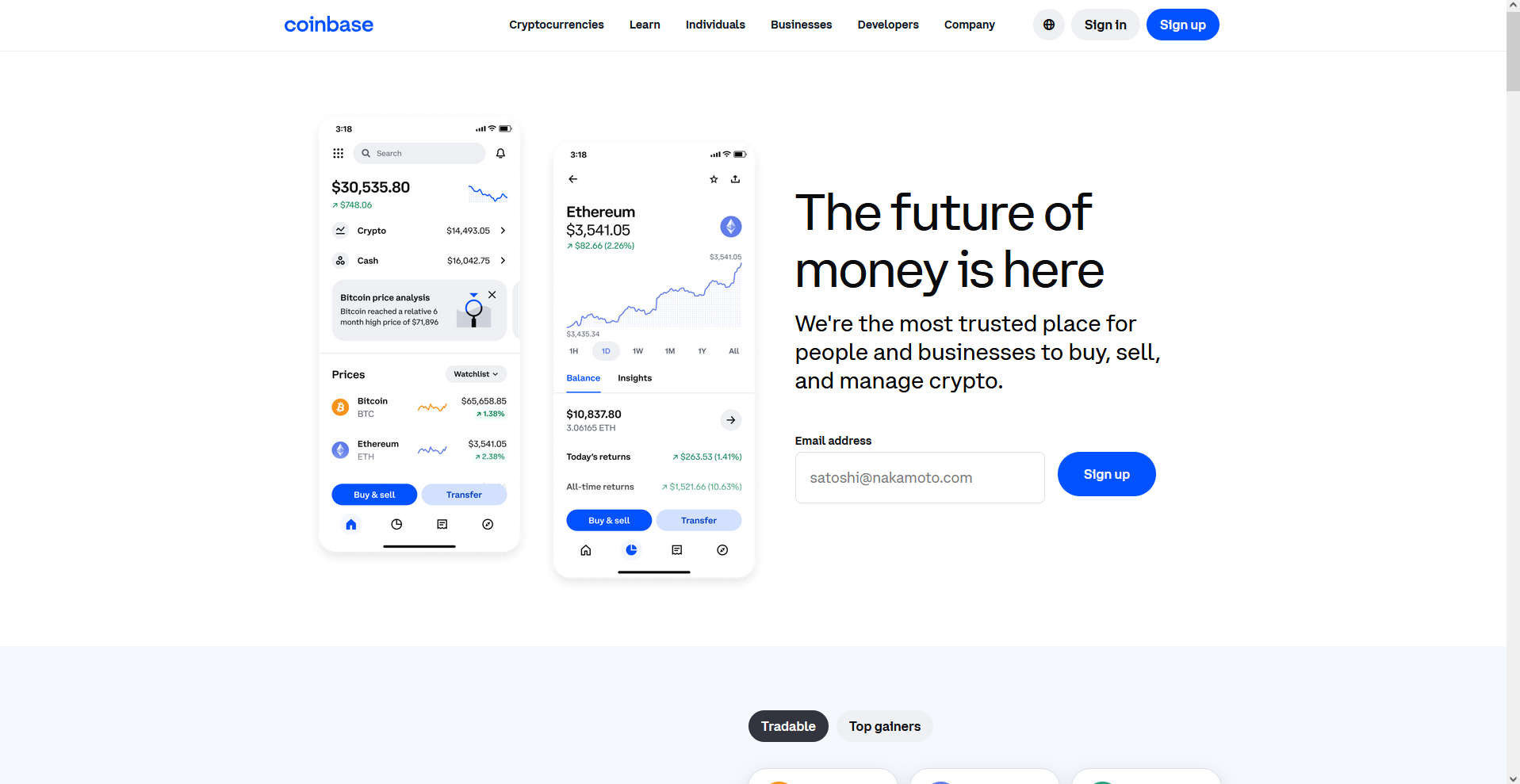

#3. Coinbase

What is Coinbase?

Coinbase is a cryptocurrency exchange platform offering users a secure and straightforward way to buy, sell, and manage digital currencies. Known for its user-friendly interface, it caters to beginners and experienced traders alike. Coinbase provides a range of services, including wallets and educational resources, to enhance the crypto trading experience.

Advantages and Disadvantages of Coinbase

Coinbase Commissions and Fees

Coinbase charges higher-than-average fees compared to other platforms, which include trading fees and a spread. These fees can vary depending on the transaction amount and payment method. While the platform’s transparency in fee disclosure is commendable, its high fees remain a concern for frequent traders.

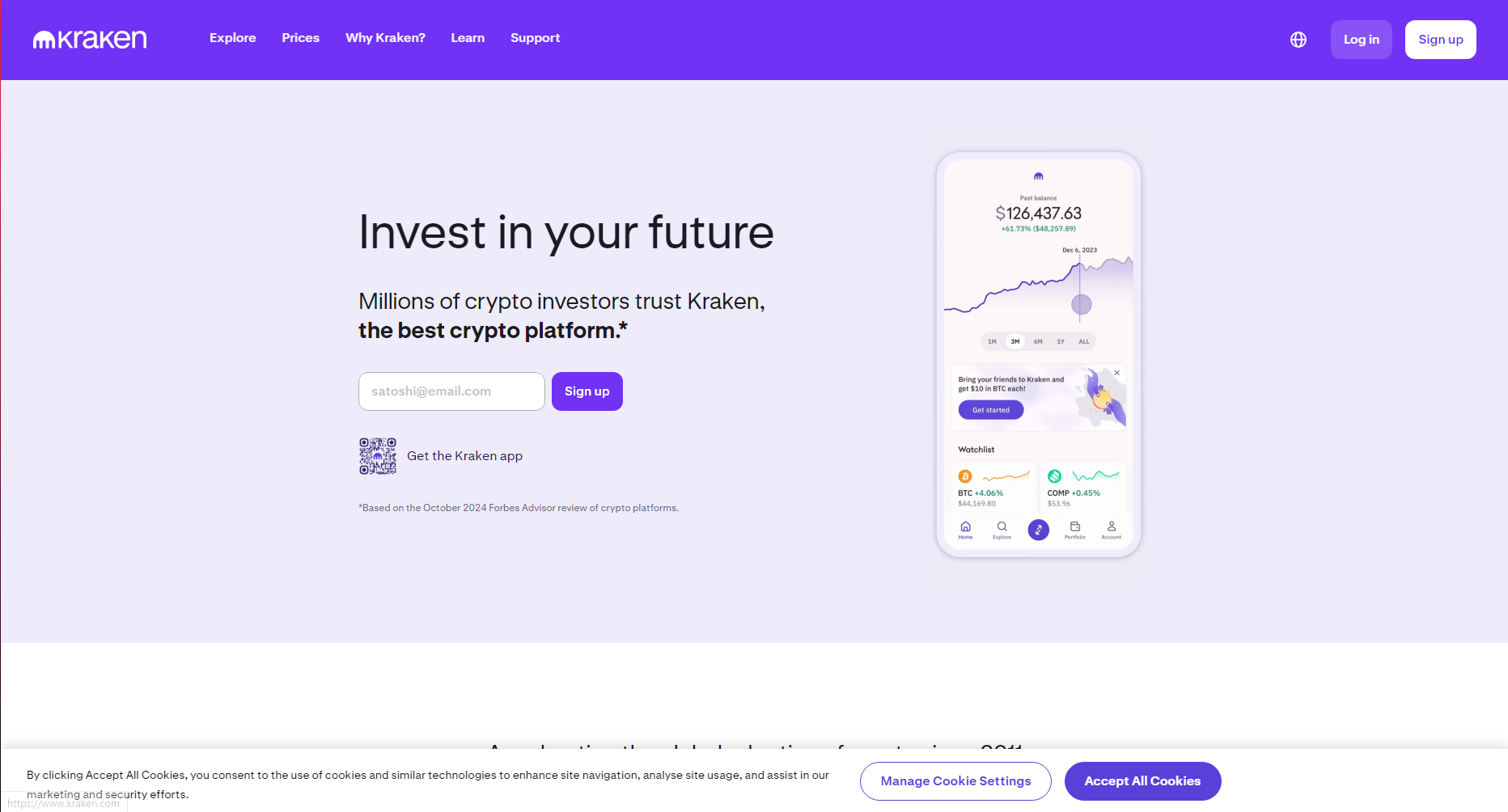

#4. Kraken

What is Kraken?

Kraken is a globally recognized cryptocurrency exchange offering a wide range of digital assets for trading. Known for its advanced security measures, Kraken provides a user-friendly platform suitable for beginners and experienced traders. It also supports staking and futures trading, making it versatile for various investment strategies.

Advantages and Disadvantages of Kraken

Kraken Commissions and Fees

Kraken charges competitive fees based on a tiered structure, where trading costs decrease with higher volumes. Spot trading fees range from 0% to 0.26%, depending on the user’s activity. Additionally, Kraken offers transparent pricing for deposits and withdrawals, though costs may vary by region and method.

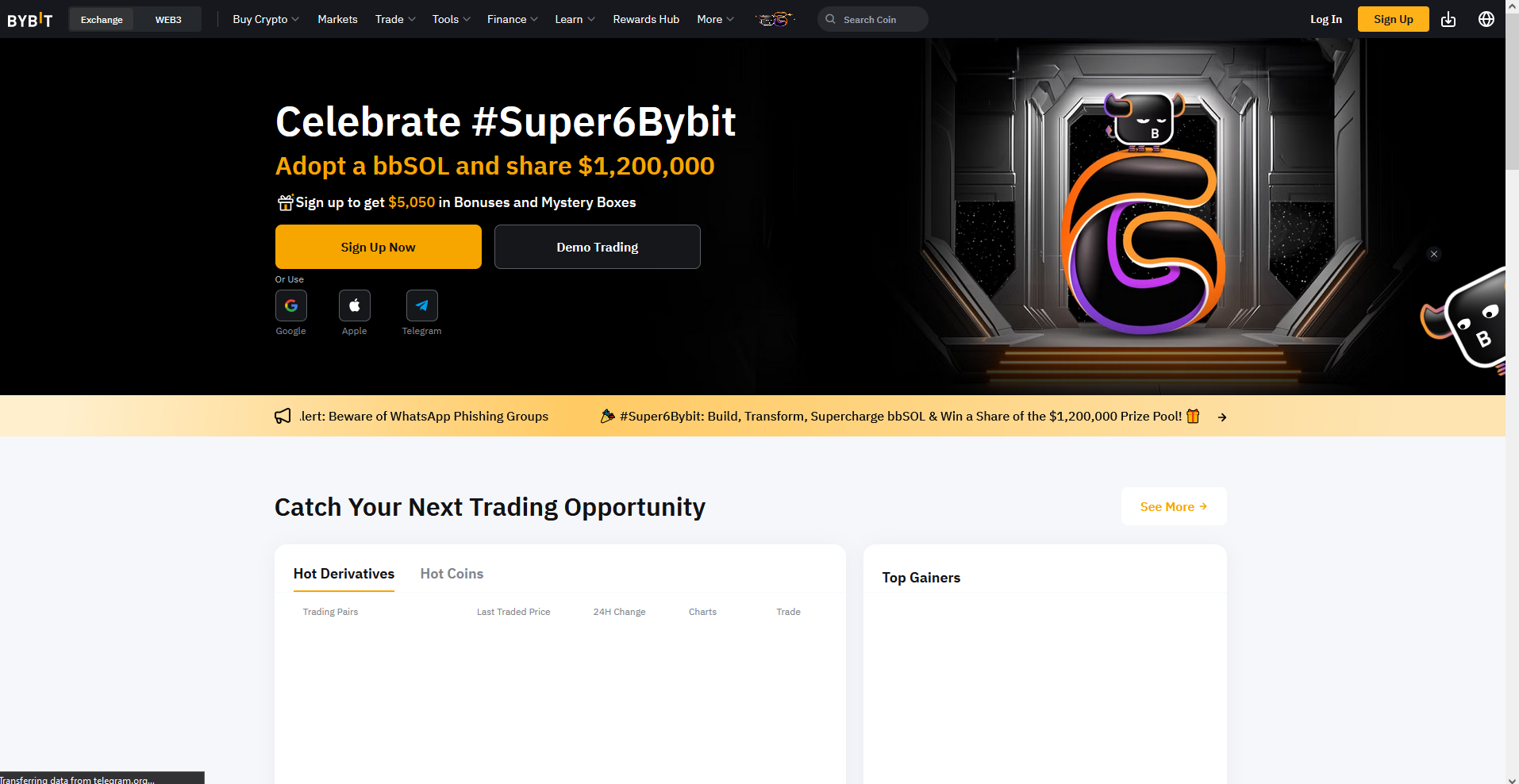

#5. Bybit

What is Bybit?

Bybit is a cryptocurrency exchange designed for futures trading, offering a user-friendly interface and robust trading tools. It supports high leverage, allowing traders to maximize their positions with minimal capital. Bybit’s platform is known for fast trade execution and strong security measures, catering primarily to experienced traders.

Advantages and Disadvantages of Bybit

Bybit Commissions and Fees

Bybit uses a maker-taker fee structure with competitive rates starting at 0.01% for makers and 0.06% for takers. The platform does not charge deposit fees but applies withdrawal fees based on the cryptocurrency. Bybit’s transparent fee policy ensures users can easily calculate their trading costs, appealing to both novice and professional traders.

Advantages of Using Secure Crypto Brokers in Italy

Using secure crypto brokers in Italy offers multiple benefits for both novice and experienced traders. These platforms comply with EU regulations like the Financial Instruments Directive, ensuring regulatory compliance and robust investor protection. They provide negative balance protection, safeguarding retail investor accounts from excessive losses, especially in financial markets like cryptocurrency trading and forex trading. Additionally, security measures such as two-factor authentication and insured client funds offer peace of mind, while seamless deposit and withdrawal options, including bank wire and Google Pay, cater to diverse payment methods.

These brokers enhance the trading experience with user-friendly platforms equipped with advanced trading tools, copy trading, and features for automated trading. Italian traders benefit from access to deep liquidity, competitive trading fees, and tools for margin trading, trading CFDs, and futures trading. Moreover, educational resources and personalized customer support, including phone support, help inexperienced traders improve their trading strategies. Whether trading digital assets or engaging with crypto exchanges, secure brokers provide the foundation for safe and efficiently trade crypto.

Also Read: The 5 Best Binary Brokers in Italy in 2024: Profitable Choices

Conclusion

When choosing the best crypto brokers in Italy, it’s essential to weigh their unique advantages to align with your trading goals. Top brokers offer diverse features such as advanced trading tools, low trading fees, and deep liquidity, catering to both novice traders and experienced traders. Forex brokers and crypto exchanges provide robust trading platforms with features like copy trading, automated trading, and access to margin trading, ensuring tailored support for different skill levels. Prioritizing regulatory compliance and security measures is crucial for safeguarding client funds and personal data.

Retail traders should focus on understanding their trading strategies and leveraging brokers’ educational materials to minimize risks. Factors like negative balance protection, maximum leverage, and average execution speed can significantly impact trading outcomes. Conducting thorough research on trading fees, deposit and withdrawal options, and customer support quality, including phone support and platforms like Google Pay, ensures a better experience. Before diving into futures trading, trading CFDs, or crypto trading, evaluate the broker’s offerings in digital assets, fiat currencies, and security features to make informed decisions.

FAQs

What are the best crypto brokers in Italy for 2024?

The best brokers include Binance, eToro, Coinbase, Kraken, and Bybit, all offering secure and feature-rich platforms.

Are crypto brokers in Italy regulated?

Yes, top brokers adhere to local and EU regulations to ensure secure trading environments so it is safe to for purchasing crypto.

How do I choose a crypto broker in Italy?

Focus on factors like regulation, security, fees, user experience, and available trading tools.