Crypto trading has become increasingly popular in Indonesia, driven by the growing interest in digital assets and the expanding crypto community. With most Indonesian crypto exchanges now offering diverse trading platforms and features, it’s vital for traders to choose a regulated broker that ensures security and compliance with Indonesian crypto regulations.

This article explores the best crypto brokers in Indonesia, highlighting essential aspects such as low trading fees, user-friendly interfaces, and the role of the financial services authority. Readers can expect insights into the Indonesian crypto market, tips for selecting trading platforms, and an overview of crypto services tailored to Indonesian traders.

What Makes a Crypto Broker Trusted?

A trusted crypto broker is essential for navigating the Indonesian cryptocurrency market, ensuring safety and a smooth trading experience. Key factors include robust regulatory compliance with the Financial Services Authority, which protects retail traders and their client funds. A regulated broker offers transparency and negative balance protection, critical for avoiding rapid losses in futures trading or margin trading.

Top Indonesian crypto exchanges provide low trading fees, secure crypto trading platforms, and support for multiple account types. For Indonesian traders, local support and user-friendly interfaces are vital, especially when managing deposit funds via bank transfers or other payment methods. Brokers offering advanced trading features, such as copy trading tools and competitive fee structures, cater to both experienced traders and beginners. In the crypto space, the best brokers also provide access to multiple trading platforms for diverse trading styles.

The 5 Best Crypto Brokers in Indonesia in 2024

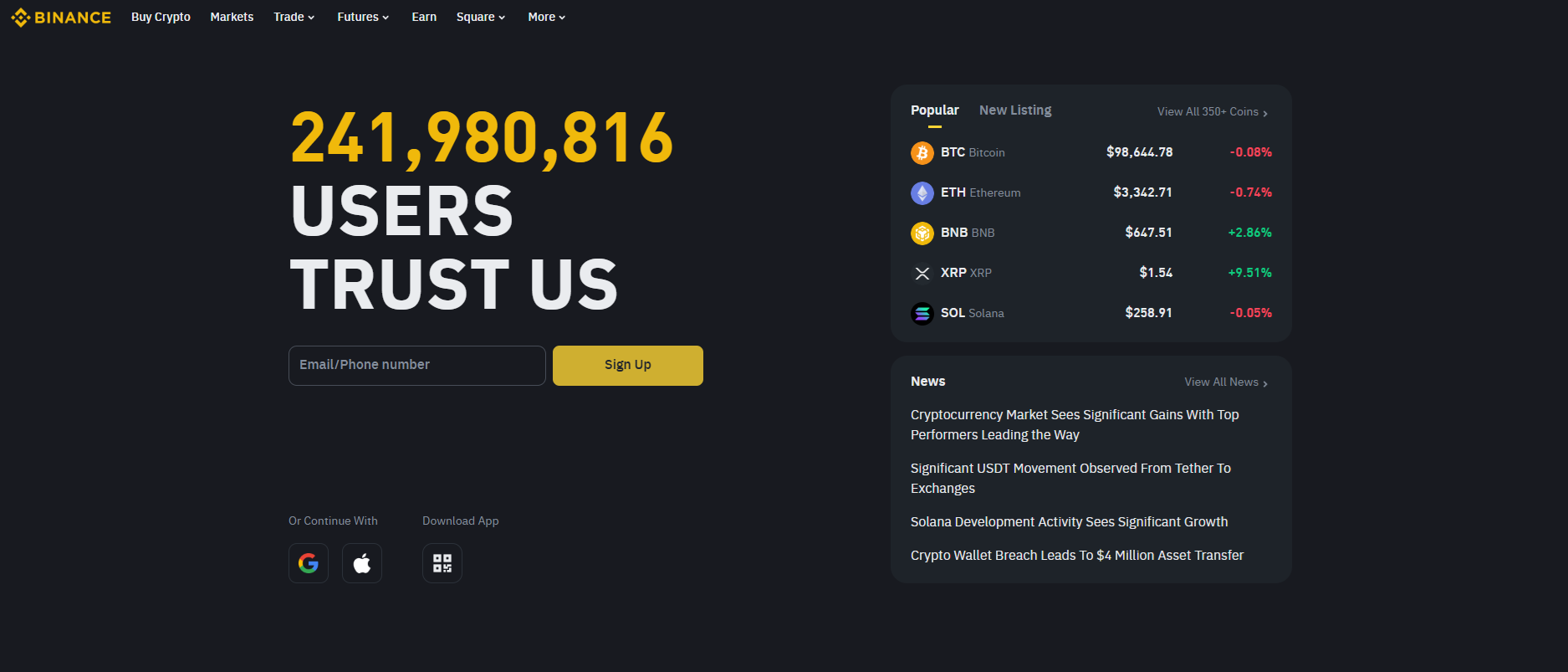

#1. Binance

What is Binance?

Binance is a globally recognized like many Indonesian crypto exchange offering a wide range of digital assets for trading. Known for its low transaction fees, it provides advanced tools suitable for beginners and seasoned traders. The platform supports spot trading, futures, and staking, making it a versatile choice in the crypto market. Binance is also accessible via its user-friendly mobile and desktop applications.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance operates with competitive trading fees, starting at 0.1% per transaction, making it one of the most affordable exchanges. Discounts are available for users holding Binance Coin (BNB), further reducing costs. Additional fees apply for deposits and withdrawals depending on the payment method and currency. Its transparent fee structure makes it appealing to cost-conscious traders.

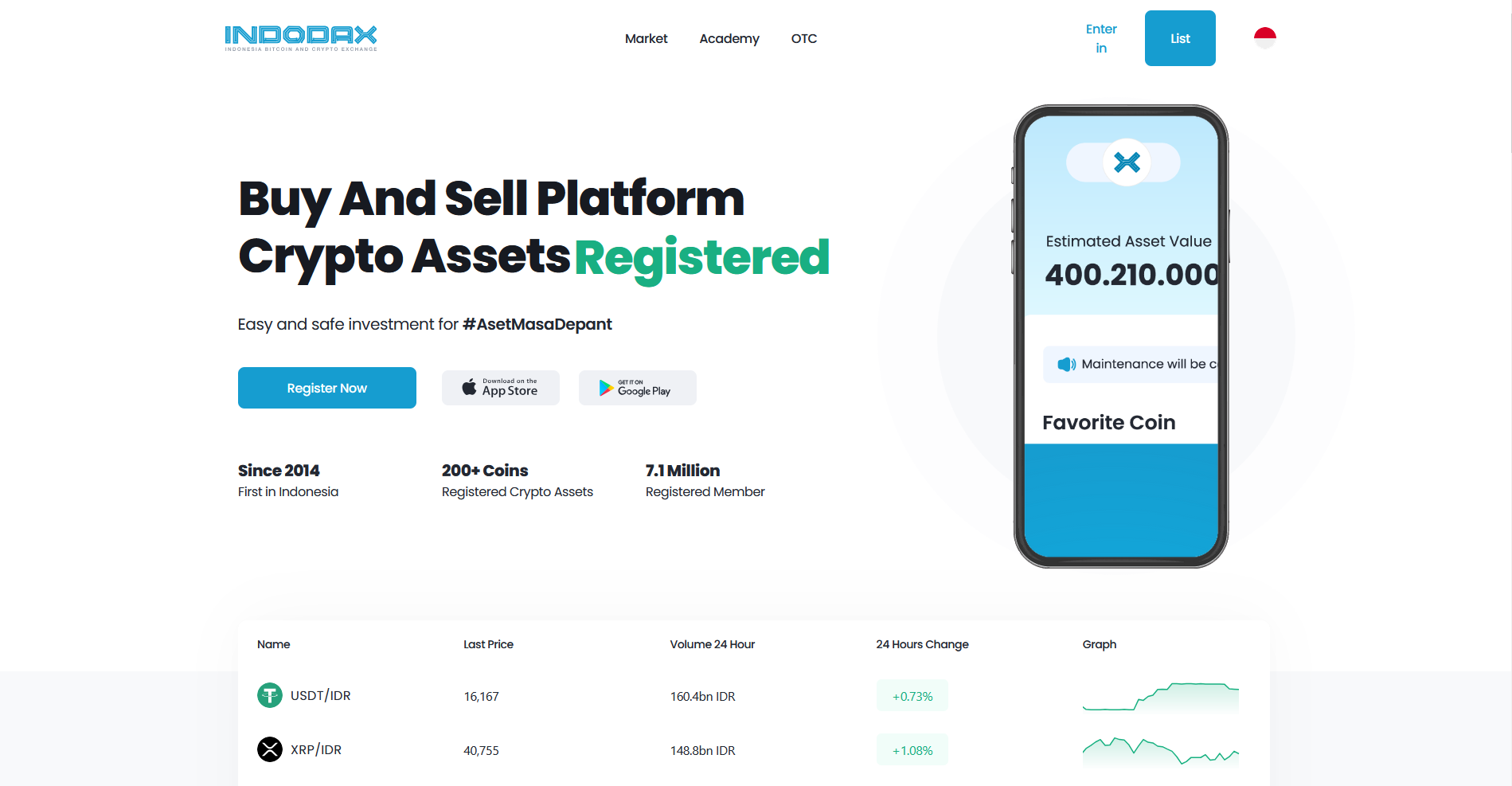

#2. Indodax

What is Indodax?

Indodax is a leading cryptocurrency exchange in Indonesia, catering to both beginners and experienced traders. It offers a user-friendly platform to buy, sell, and trade various digital assets securely. With support for Indonesian Rupiah (IDR), it enables seamless transactions and is regulated under local laws, ensuring reliability.

Advantages and Disadvantages of Indodax

Indodax Commissions and Fees

Indodax charges competitive trading fees, starting at 0.3% per transaction, which can decrease with higher trading volumes. Withdrawal fees vary based on the cryptocurrency, and IDR withdrawals incur a fixed fee. The platform provides clear details about costs, making it transparent for users. Its fee structure is straightforward and suitable for casual traders.

#3. eToro

What is eToro?

eToro is a leading social trading platform that allows users to trade a wide range of financial instruments, including stocks, forex, and cryptocurrencies. It is renowned for its CopyTrader feature, enabling users to replicate the strategies of successful traders. eToro combines an intuitive interface with educational tools, making it ideal for both beginners and experienced traders.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro offers commission-free stock trading, making it cost-effective for equity investors. However, users may encounter fees like withdrawal charges, inactivity fees, and spreads on trades. Spreads vary by asset, with higher rates for certain markets like cryptocurrencies. While transparent, these fees may impact frequent traders.

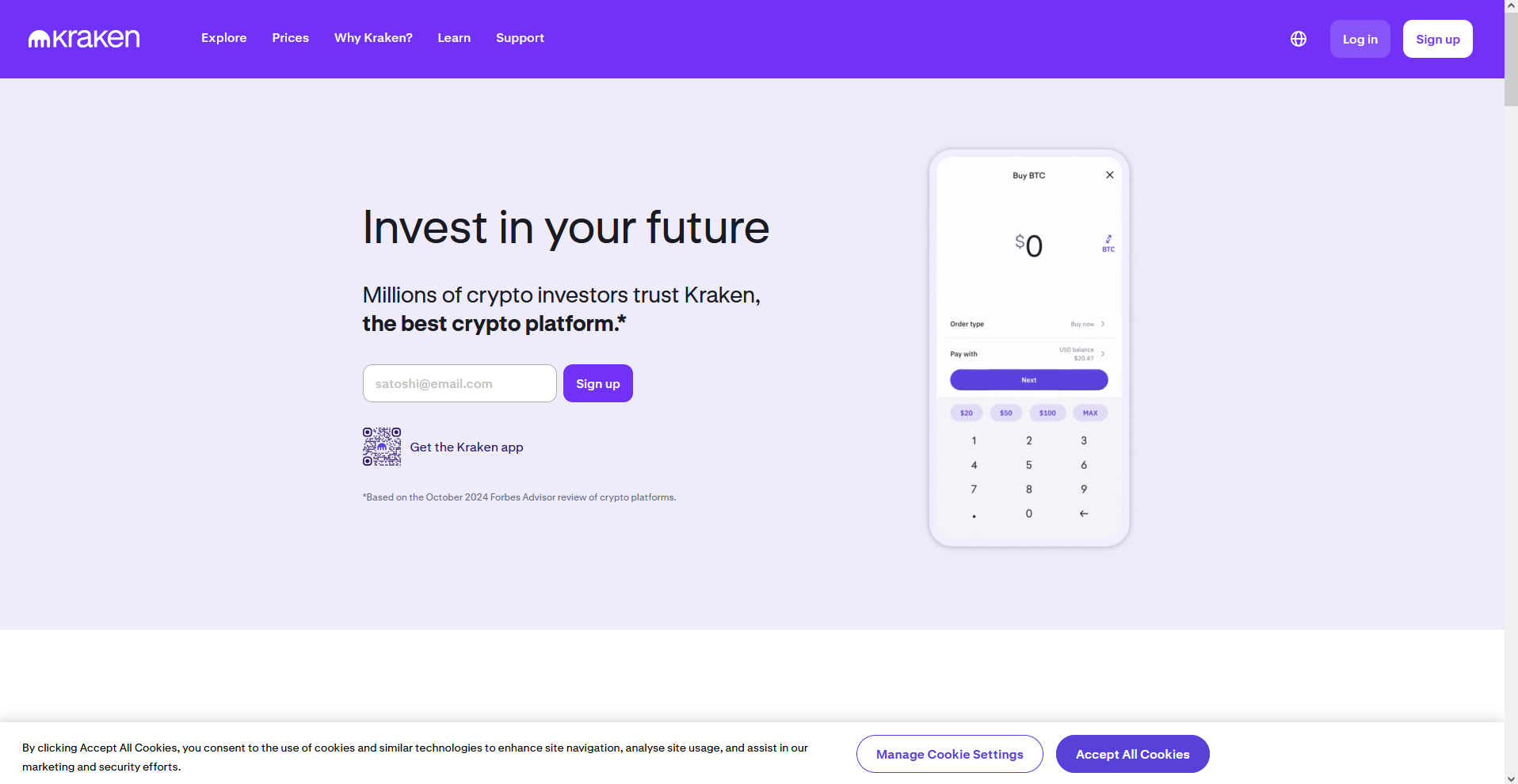

#4. Kraken

What is Kraken?

Kraken is a cryptocurrency exchange known for its robust security and extensive range of digital assets. It offers spot trading, futures contracts, and staking services for various cryptocurrencies. With a user-friendly interface and advanced trading tools, Kraken caters to both beginners and experienced traders.

Advantages and Disadvantages of Kraken

Kraken Commissions and Fees

Kraken operates a tiered fee structure based on trading volume, offering competitive rates for high-volume traders. Spot trading fees start at 0.16% for makers and 0.26% for takers, while futures fees vary. Kraken also charges withdrawal fees depending on the cryptocurrency. Its transparent fee system makes it a popular choice for cost-conscious traders.

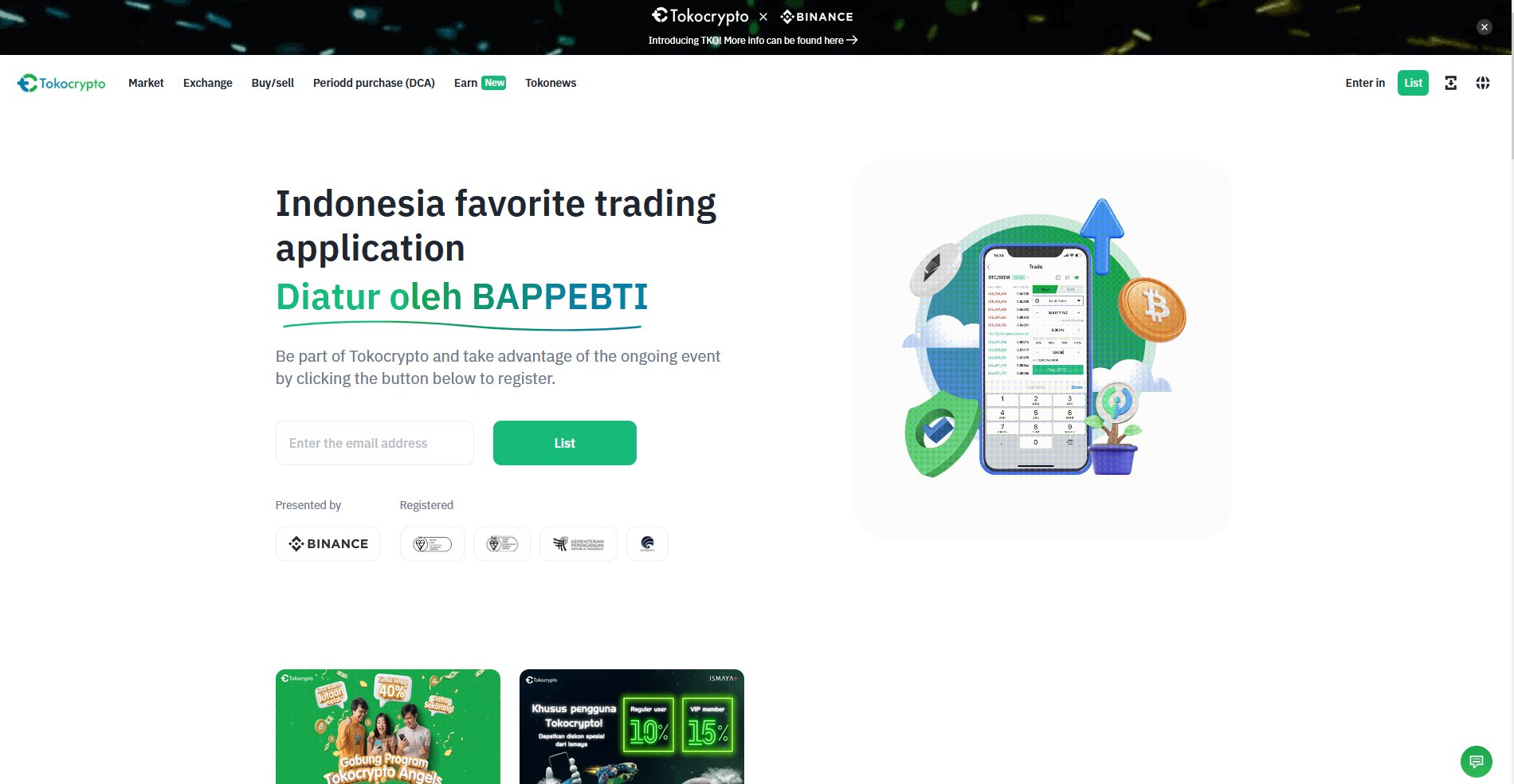

#5. Tokocrypto

What is Tokocrypto?

Tokocrypto is a cryptocurrency exchange based in Indonesia, offering a secure and user-friendly platform for trading digital assets. It supports a variety of cryptocurrencies and is backed by Binance, ensuring reliable technology. The platform is well-suited for both beginners and advanced traders, providing extensive educational resources. Tokocrypto emphasizes compliance with Indonesian regulations, promoting trust within the local crypto community.

Advantages and Disadvantages of Tokocrypto

Tokocrypto Commissions and Fees

Tokocrypto charges competitive trading fees, starting at 0.1% per transaction, which aligns with industry standards. The platform offers a tiered fee structure based on trading volume, rewarding higher activity. While trading fees are low, withdrawal fees can be relatively high for certain cryptocurrencies. Users should review the fee schedule carefully to optimize their trading costs.

Tips for Choosing the Right Crypto Broker in Indonesia

Choosing the best crypto brokers in Indonesia requires careful evaluation of key factors tailored to Indonesian traders. Start by considering your trading goals and ensure the platform aligns with your preferred trading strategies. Look for platforms offering low trading fees, negative balance protection, and competitive spreads to optimize your trading experience. Verify the broker is regulated by the Financial Services Authority to comply with Indonesian crypto regulations, ensuring security for client funds.

For ease of use, choose platforms with a user-friendly interface and multiple trading platforms catering to different trading styles, including copy trading tools for beginners or advanced trading features for professional traders. The ability to trade in Indonesian Rupiah, seamless bank transfers, and support for other payment methods simplifies deposit funds. Ensure the platform offers secure crypto services and access to diverse crypto assets, futures exchanges, and forex trades, all crucial for retail traders and advanced traders navigating the Indonesian cryptocurrency market.

Also Read: The 5 Best Stock Brokers in Indonesia in 2024: Best Options

Conclusion

The Indonesian crypto market offers a diverse selection of top Indonesia crypto exchanges, catering to both retail traders and professional traders. Platforms with user-friendly interfaces, advanced trading features, and low trading fees stand out as the best crypto exchanges. Notable players in the crypto space provide negative balance protection, support for different trading styles, and integration with multiple trading platforms, ensuring a tailored trading experience for Indonesian users.

To succeed in the Indonesian cryptocurrency market, traders should explore brokers offering competitive spreads, robust crypto services, and compliance with Indonesian crypto regulations enforced by the financial services authority. With a wide variety of crypto trading platforms, trading accounts for retail investor accounts, and deposit fund methods like bank transfers and other payment methods, traders can confidently navigate the crypto community. Always consider trading strategies and financial risks, as losing money rapidly is common in speculative markets. Start with a reliable and regulated broker to build a solid foundation for crypto trading or forex trades.

FAQs

What are the best crypto brokers in Indonesia?

Binance, Indodax, eToro, Kraken, and Tokocrypto.

Are these platforms secure for trading?

Yes, they are regulated and known for strong security measures.

Can I trade using Indonesian Rupiah (IDR)?

Platforms like Indodax and Tokocrypto support IDR trading.