The crypto market in Argentina has seen significant growth as more individuals and businesses adopt digital assets like Bitcoin and Ethereum for trading and investment. With increasing interest, selecting the best crypto brokers in Argentina has become essential for a seamless crypto trading experience. Choosing the right crypto exchanges ensures better security, low fees, and access to features like margin trading, deep liquidity, and competitive fees, catering to both beginners and experienced traders.

This list evaluates the top Argentine crypto exchanges based on key factors such as trading volume, trading fees, regulatory compliance, and user-friendly interfaces. Essential features like support for bank transfer deposits, local fiat currencies, and secure cold storage solutions are considered, ensuring that crypto traders can safely buy and sell assets like Bitcoin in Argentina. Whether you’re focusing on spot trading, multi-signature wallets, or price movements, this guide simplifies the process of finding a reputable exchange tailored to your needs.

Why Choosing the Right Crypto Broker Matters

Choosing the right crypto broker is crucial for ensuring a seamless and secure crypto trading experience. Brokers serve as the bridge between traders and the crypto market, providing access to digital assets like Bitcoin, Ethereum, and other cryptocurrencies. In Argentina, the demand for top Argentine crypto exchanges continues to grow as local traders seek platforms that offer deep liquidity, competitive fees, and user-friendly interfaces.

Key factors for selecting the best crypto brokers in Argentina include regulatory compliance, low trading fees, and a variety of payment methods like bank transfers and debit cards. Advanced traders often prefer platforms with features like margin trading and multi-signature wallets, while newcomers value intuitive designs and guidance on trading strategies. By choosing reputable cryptocurrency exchanges that prioritize security, ensure compliance with anti-money laundering regulations, and offer cold storage for user funds, traders can confidently navigate the crypto world and capitalize on price movements in cryptocurrency trading.

The 5 Best Crypto Brokers in Argentina in 2025

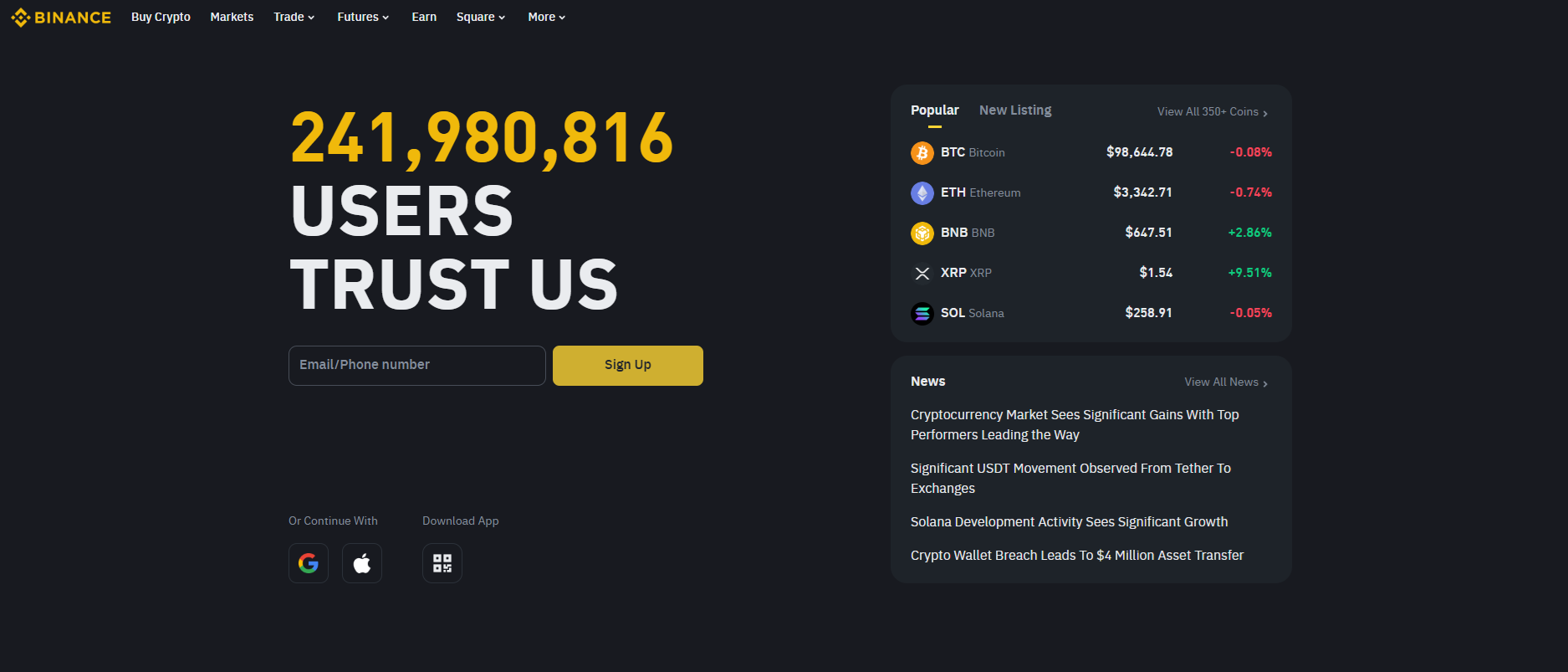

#1. Binance

What is Binance?

Binance is a leading cryptocurrency exchange that allows users to trade a wide range of digital assets. Known for its high liquidity and extensive trading pairs, it offers advanced trading tools for beginners and professionals alike. With its global reach and user-friendly platform, Binance has become a popular choice in the cryptocurrency market.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance charges competitive trading fees, starting at just 0.1% per trade, with discounts available for using its native token, BNB. Deposit fees vary depending on the payment method, while withdrawals incur minimal charges. Its tiered fee structure makes it attractive for high-volume traders.

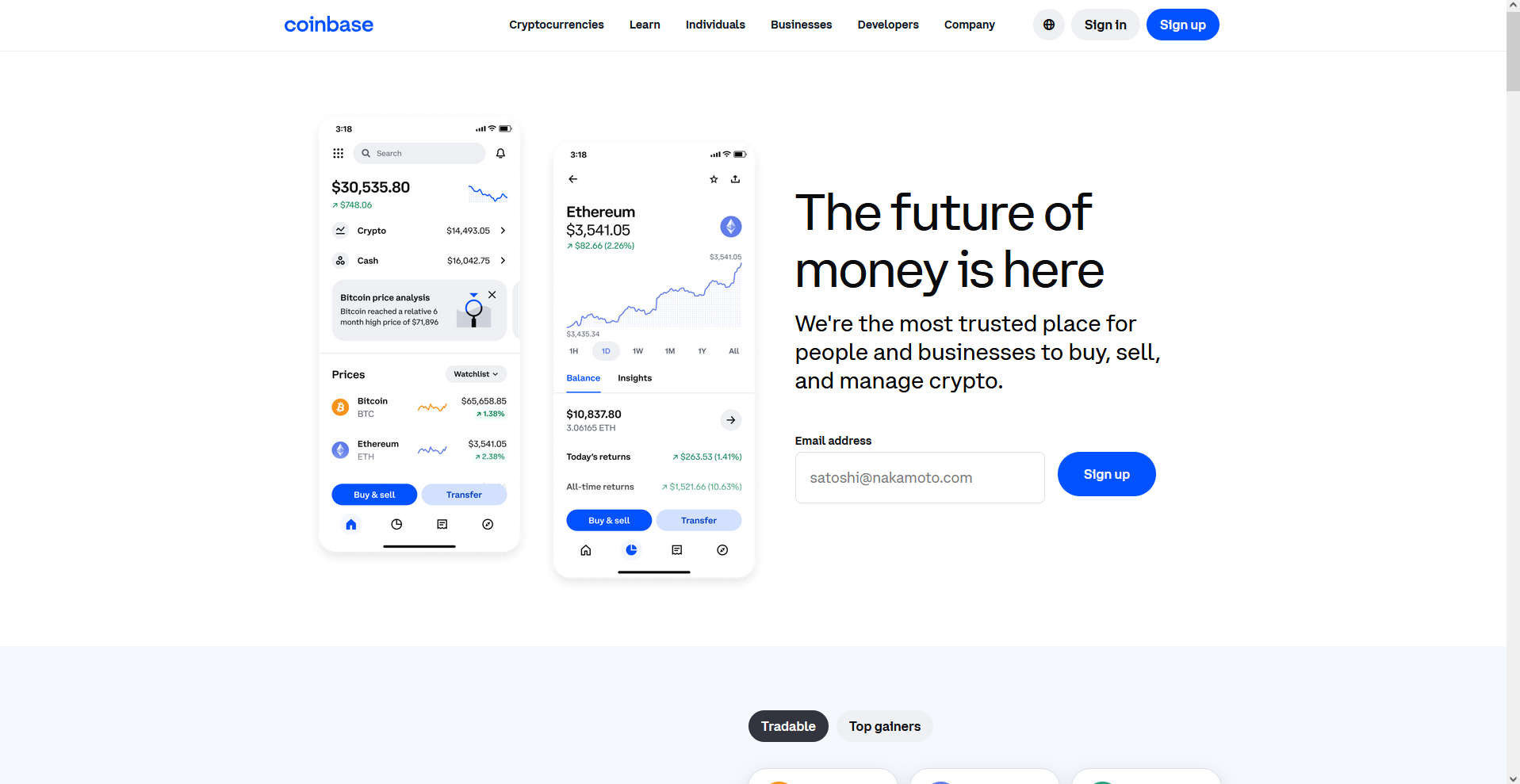

#2. Coinbase

What is Coinbase?

Coinbase is a popular cryptocurrency exchange that allows users to buy, sell, and store digital assets like Bitcoin and Ethereum. Founded in 2012, it provides a user-friendly platform suitable for beginners and experienced traders alike. Coinbase offers features such as secure storage, a wide range of cryptocurrencies, and a simple interface for seamless trading.

Advantages and Disadvantages of Coinbase

Coinbase Commissions and Fees

Coinbase charges relatively high fees, with costs varying based on payment methods and transaction size. A flat fee or a percentage is applied, typically higher for small transactions. The platform also charges for withdrawals and conversions, which may impact frequent traders. Despite this, Coinbase is known for its transparency in fee structure, ensuring users understand costs upfront.

#3. eToro

What is eToro?

eToro is a social trading platform offering a wide range of investment options, including stocks, forex, and cryptocurrencies. Known for its CopyTrading feature, it enables users to replicate the trades of experienced investors. The platform is accessible to both beginners and professionals, offering an intuitive interface and educational resources.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro charges no commission on stock trading, making it attractive for cost-conscious investors. However, it applies high spreads on certain assets, particularly forex and crypto. Additional fees include a $5 withdrawal charge and an inactivity fee after 12 months of dormancy. The fee structure is designed to be transparent but may not suit frequent traders.

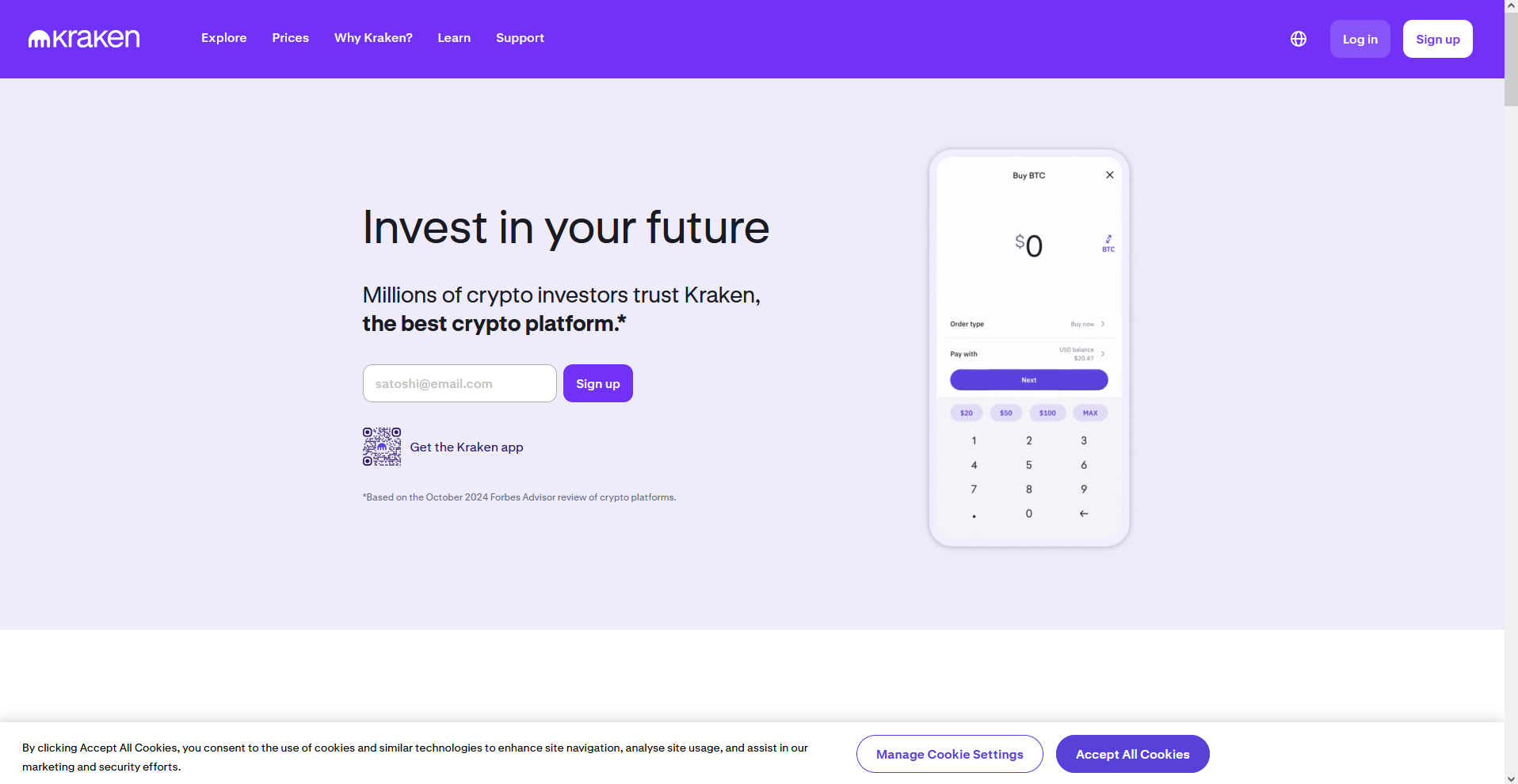

#4. Kraken

What is Kraken?

Kraken is a globally recognized cryptocurrency exchange platform established in 2011. It provides secure trading options for a wide range of cryptocurrencies, including Bitcoin, Ethereum, and altcoins. Known for its robust security measures, Kraken offers advanced trading tools, staking opportunities, and fiat currency support, catering to beginners and professional traders alike.

Advantages and Disadvantages of Kraken

Kraken Commissions and Fees

Kraken uses a tiered fee structure based on trading volume over 30 days, with maker fees starting at 0.16% and taker fees at 0.26%. For futures trading, fees range from 0.02% to 0.05%, depending on the transaction type. The platform charges withdrawal fees, which vary by cryptocurrency, and a small fee for fiat deposits. Low fees make it attractive to frequent traders seeking cost-efficient transactions.

#5. Bitso

What is Bitso?

Bitso is a cryptocurrency exchange platform that caters to users in Latin America, offering easy access to digital assets like Bitcoin and Ethereum. It provides a user-friendly interface for both beginners and experienced traders, emphasizing security and reliability. Bitso supports multiple fiat currencies, including Mexican pesos and Argentine pesos, making it accessible for local users.

Advantages and Disadvantages of Bitso

Binance Commissions and Fees

Bitso charges trading fees based on a maker-taker model, with rates ranging from 0.05% to 1%. Deposits are generally free, but withdrawal fees apply depending on the cryptocurrency or fiat currency used. Bitso provides competitive rates for most users, though high-volume traders may benefit the most from lower fees.

How to Choose the Best Broker for Your Needs

Choosing the best crypto brokers in Argentina requires evaluating several factors to match your needs. Start by defining your trading goals—whether it’s buying bitcoin, engaging in spot trading, or exploring margin trading. Assess the user-friendly interface and overall trading experience, as a smooth platform is essential for both beginners and experienced traders. Security features like multi-signature wallets, cold storage, and anti-money laundering compliance are critical to protect user funds.

Focus on trading fees and withdrawal fees, as they directly impact profitability. Look for exchanges offering low fees and competitive fees, especially if you trade high trading volumes. Payment options like bank transfer deposits, debit card, and local fiat currencies make transactions convenient for argentine users. Evaluate whether the crypto exchanges support a wide range of crypto assets and other cryptocurrencies for diversified investments. Platforms with deep liquidity and advanced tools for tracking price movements can benefit professional traders. Lastly, ensure the platform aligns with crypto regulation set by the Argentinian government for secure cryptocurrency trading.

Also Read: The 5 Best Binary Brokers in Argentina in 2025: Trusted Choices

Conclusion

Choosing the best crypto brokers in Argentina is crucial for navigating the dynamic crypto market effectively. With numerous cryptocurrency exchanges available, it’s important to assess trading fees, trading platforms, and user-friendly interfaces to find a reputable exchange that aligns with your needs. Factors such as local fiat currencies, preferred payment methods, and crypto regulation by the Argentinian government should guide your decision. Argentine crypto exchanges offer diverse features, from buying bitcoin to spot trading, ensuring both experienced traders and beginners can optimize their crypto trading journey.

Before you start trading, evaluate the trading experience, payment methods, and low fees provided by the top crypto exchanges. For argentine users, look for platforms offering cold storage, multi-signature wallets, and compliance with anti-money laundering policies to safeguard user funds. By understanding key aspects like deep liquidity, advanced users’ needs, and trading strategies, you can confidently select the best exchange to buy and sell crypto assets, ensuring a seamless transition into the crypto world.

FAQs

What is the best crypto broker for beginners in Argentina?

Coinbase is recommended for beginners due to its user-friendly interface and strong security features.

Are these crypto brokers regulated in Argentina?

While global brokers like Binance and Kraken may not be Argentina-specific, they adhere to international regulatory standards.

Can I trade cryptocurrencies with Argentine pesos?

Yes, Bitso allows trading with Argentine pesos, making it a popular choice among local traders.