Thinking about getting into commodities trading? It’s one of the most exciting markets out there, but picking the right broker can make all the difference! The right broker can boost your investments, cut down on fees, and give you access to great tools. With so many brokers to choose from, it can feel overwhelming.

But don’t worry—we’ve got you! In this guide, we’ll walk you through the 5 best commodities brokers for 2025, looking at everything from their platforms to their fees and customer service. Whether you’re a pro trader or just starting out, these brokers are set up to help you succeed. Let’s get started!

What is a Commodities Broker?

A commodities broker is basically your go-to person (or company) for trading commodities like oil, gold, or agricultural products. They act as a middleman between you and the market, helping you buy and sell commodities through a trading platform. Whether you’re interested in commodity futures or other types of trades, they handle the technical side of things, making it easier for you to focus on your investments.

When you work with commodities brokers, they give you access to trading platforms where you can place orders, monitor prices, and use different trading tools to make smarter decisions. Some of the best commodities brokers even offer advanced futures trading platforms for those who are more experienced and want to trade futures contracts. These contracts allow you to agree on a price today for something you’ll trade in the future—super handy for people looking to plan ahead in volatile markets.

For those new to the game, a commodity trading broker can be really helpful in getting started. They often provide tutorials and support so you can start trading commodities without diving in blindly. Plus, they offer tips and guides on how to improve your trading experience over time.

Key Factors to Consider When Choosing a Commodities Broker

- Fees: Always check the fees involved, including trading fees, account maintenance fees, and withdrawal costs. Even small fees can add up, affecting your overall returns.

- Trading Platform: A user-friendly, reliable platform with essential features like charts, analysis tools, and real-time data is crucial for making informed decisions.

- Available Assets: Make sure the broker offers the commodities you’re interested in trading, whether that’s oil, gold, silver, or agricultural products.

- Regulation and Safety: Ensure your broker is regulated by a well-known financial authority. This adds a layer of protection for your funds.

- Broker Reputation and Reviews: Take the time to read customer reviews and check the broker’s reputation. This will give you an idea of how reliable they are and how good their customer support is.

- Educational Tools for Beginners: If you’re new to commodities trading, it helps if the broker offers educational resources like tutorials, webinars, or demo accounts to help you learn before risking real money.

The 5 Best Commodities Brokers in 2025

#1. AvaTrade

What is AvaTrade?

AvaTrade is a globally recognized broker, offering a wide range of trading options, including commodities, forex, cryptocurrencies, and stocks. Established in 2006, it has earned a reputation for providing a secure and user-friendly platform with access to over 1,250 financial instruments. What sets AvaTrade apart is its strong regulatory oversight across multiple jurisdictions, which ensures a safe trading environment. The broker also offers fixed spreads, meaning the cost remains stable, even in volatile markets, making it ideal for traders who value cost predictability. With features like MetaTrader 4/5 and the proprietary AvaTradeGo app, it caters to both beginners and experienced traders. These reasons, combined with rapid order execution and a variety of educational resources, make AvaTrade a top choice for trading commodities.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

AvaTrade operates on a spread-only model, meaning traders don’t pay commissions on trades. Instead, AvaTrade makes its money through the bid-ask spread, which remains relatively competitive. For example, the spread on major forex pairs like EUR/USD starts at around 0.9 pips, making it a cost-effective option for many traders. One major plus is that AvaTrade does not charge any deposit or withdrawal fees, but keep in mind there is an inactivity fee of $50 after three months of no activity and a $100 fee after 12 months of inactivity. This transparent fee structure makes AvaTrade a strong choice for those looking to minimize trading costs.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Plus500

What is Plus500?

Plus500 is a leading provider of Contracts for Difference (CFDs), offering trading facilities on shares, forex, commodities, indices, and more. The company is listed on the London Stock Exchange’s Main Market and is a constituent of the FTSE 250 Index. Plus500 operates under multiple regulatory authorities, ensuring compliance with strict financial regulations. The platform is robust and user-friendly, enabling quick trade execution and real-time market monitoring. Advanced risk management tools help traders minimize losses and secure profits. With advanced charting tools, economic updates, and price alerts, traders stay informed of market movements. These features make Plus500 one of the best brokers for commodities trading.

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 primarily earns revenue through spreads and does not charge commissions on trades. However, overnight funding fees may apply when holding positions beyond a specified time. A currency conversion fee of up to 0.7% is charged when trading instruments in a different currency than your account. An inactivity fee of $10 per month is applied if you don’t log in for at least three months. No deposit or withdrawal fees are charged, but third-party fees may apply. Additionally, using a Guaranteed Stop Order to limit risks comes with a wider spread.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

OPEN A DEMO ACCOUNT ON PLUS500

#3. Pepperstone

What is Pepperstone?

Pepperstone is widely regarded as one of the best brokers for commodities trading due to its low spreads, fast execution speeds, and support for advanced platforms like MetaTrader 4, MetaTrader 5, and cTrader. Established in 2010, Pepperstone is regulated by leading financial authorities like ASIC and FCA, providing a secure and transparent trading environment. What sets it apart is the combination of its competitive pricing and access to various trading instruments, including commodities, forex, cryptocurrencies, and CFDs, making it an excellent choice for both beginners and experienced traders looking for versatility and reliability.

Advantages and Disadvantages of Pepperstone

Pepperstone Commissions and Fees

When it comes to commissions and fees, Pepperstone offers a transparent and competitive structure. Its popular Razor account charges a $3.50 commission per side per lot, while the cTrader account reduces this further to $3 per side. Traders preferring to avoid commissions can opt for the Standard account, which has wider spreads but no commissions. Additionally, Pepperstone does not charge for most withdrawals, though an inactivity fee of $15 applies after six months of no trading activity, making it cost-effective for active traders.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

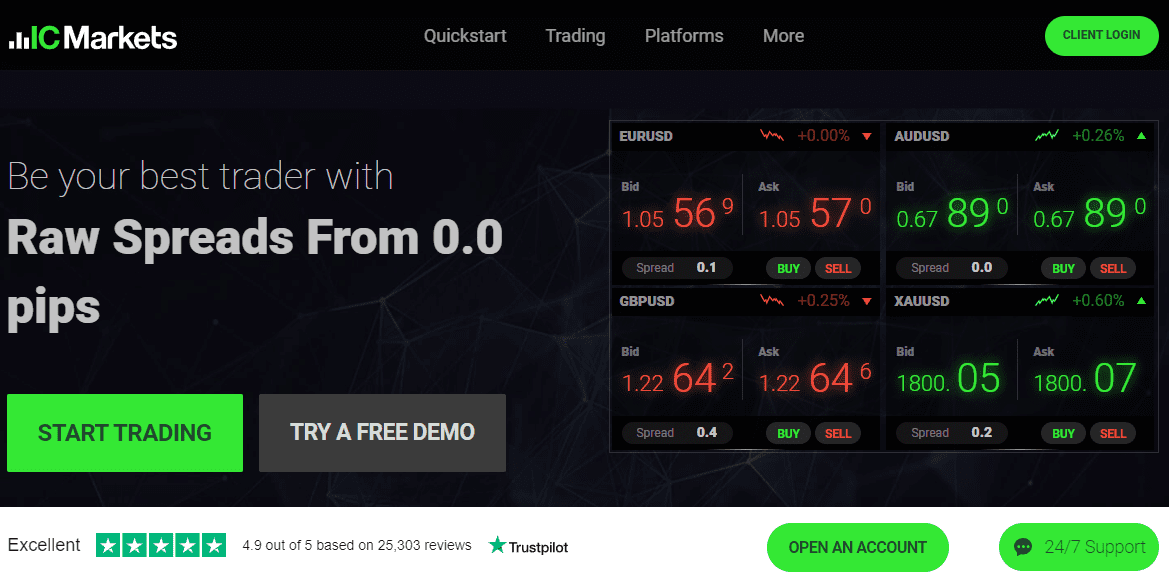

#4. IC Markets

What is IC Markets?

IC Markets is highly regarded as one of the best brokers for commodities trading due to its fast execution speeds, low spreads, and reliable trading environment. Established in 2007 and regulated by top-tier authorities such as ASIC and CySEC, IC Markets offers access to a broad range of financial instruments, including commodities, forex, indices, cryptocurrencies, and more. It’s especially popular among algorithmic traders thanks to its compatibility with advanced platforms like MetaTrader 4, MetaTrader 5, and cTrader, making it a top choice for traders seeking low latency and a robust trading experience.

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

IC Markets is known for its competitive pricing structure. The Raw Spread and cTrader accounts charge a commission of $3.50 per lot per side, with spreads starting from 0.0 pips, while the Standard account operates commission-free but comes with slightly higher spreads. The broker does not charge for deposits or most withdrawals, except for international bank transfers, which carry a $20 fee. Additionally, there are no inactivity fees, making IC Markets one of the most cost-effective brokers for both active and occasional traders.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#5. IG Markets

What is IG Markets?

IG Markets is a well-established global broker, known for providing access to over 18,000 financial markets, including commodities, forex, stocks, and cryptocurrencies. With nearly five decades of experience, it’s regulated by top-tier authorities like the FCA and CFTC, making it a highly trusted platform for commodities trading. IG Markets also offers excellent trading platforms, including both proprietary software and MetaTrader 4, along with comprehensive educational resources, making it a solid choice for both new and experienced traders.

Advantages and Disadvantages of IG Markets

IG Markets Commissions and Fees

IG Markets primarily operates on a spread-based model, meaning there are no direct commissions for most trades. Spreads on popular forex pairs, like EUR/USD, start from 0.6 pips, which is competitive. However, IG charges an inactivity fee of $12 per month if there’s no trading activity for 24 months, and fees may apply for some withdrawal methods. Despite these costs, its broad market access makes it a cost-effective option for many traders.

OPEN AN ACCOUNT NOW WITH IG MARKETS AND GET YOUR WELCOME BONUS

Tips on Trading with a Commodities Broker

- Know the Fees: Be aware of all the fees involved, like commissions or spreads, and choose a broker that offers low-cost trading to maximize your profits.

- Use the Right Tools: Make sure your broker offers easy-to-use trading platforms with good charting tools and market analysis.

- Start Small: If you’re new, start with small trades to get comfortable with how commodity markets move.

- Stay Updated: Keep an eye on market news and events that can impact commodity prices.

- Diversify: Don’t put all your money in one type of commodity. Spread your investments across different commodities to reduce risk.

Also Read: The 10 Best CFD Brokers in 2025 • Reviewed by Asia Forex Mentor

Conclusion

In conclusion, finding the right commodities broker is all about matching your needs with the best platform. Whether you’re aiming to keep costs low, want a user-friendly trading platform, or need access to a variety of commodities, there’s a broker for you. The brokers we’ve listed offer a mix of great features, from low fees to strong support. Take your time, figure out what matters most to you, and choose a broker that helps you trade confidently in 2025.