Binary options trading is becoming a popular choice among traders in Taiwan, offering a simplified approach to participating in financial markets. Selecting the best binary brokers in Taiwan is an essential step to ensure security, reliability, and a positive trading experience. Factors such as regulation, ease of use, and quality of customer support play a key role in determining the right platform for both beginners and experienced traders. This guide aims to provide clarity on what to look for when evaluating binary options brokers.

The trading landscape in Taiwan benefits from oversight by the Financial Supervisory Commission, which promotes a safer environment for traders. By understanding the features and services offered by various brokers, you can choose a platform that aligns with your trading needs. From accessible tools to responsive customer support, finding the right fit is essential for a smooth binary options trading experience. This overview will help traders weigh the pros and cons and make informed decisions for their trading journey.

Why Choosing the Binary Options Broker in Taiwan is Important

Choosing the right binary options broker in Taiwan is crucial for a secure and successful trading experience. The broker you select directly impacts your access to markets, the quality of customer support, and the overall reliability of your trades. Making an informed choice ensures that your investments are protected and that you have the necessary tools to make educated trading decisions.

Here are key reasons why selecting the appropriate broker is essential:

- Regulatory Compliance: Opting for brokers regulated by reputable authorities, such as the Financial Supervisory Commission in Taiwan, ensures adherence to industry standards and offers a layer of protection for your investments.

- Platform Usability: A user-friendly binary options trading platform enhances your trading experience, making it easier to execute trades and monitor market movements effectively.

- Customer Support: Reliable customer support is vital for addressing any issues or questions that may arise during trading, providing peace of mind and assistance when needed.

- Financial Security: Choosing a broker with robust security measures protects your funds and personal information from potential threats.

- Educational Resources: Access to educational materials and tools can help you understand the pros and cons of different trading strategies, aiding in more informed decision-making.

- Minimum Deposit Requirements: Brokers with reasonable minimum deposit thresholds allow traders to start with an investment level that suits their financial situation.

- Asset Variety: A diverse range of trading options, including forex trading, commodities, and indices, enables you to diversify your portfolio and explore various markets.

- Payout Rates: Competitive payout rates can significantly affect your profitability, making it important to choose brokers that offer favorable returns on successful trades.

- Demo Accounts: The availability of demo accounts allows you to practice trading without risking real money, helping you to become familiar with the platform and develop your trading skills.

- Reputation and Reviews: Researching broker reviews and reputations provides insight into the experiences of other traders, guiding you toward trustworthy and reliable brokers.

The 10 Best Binary Brokers in Taiwan

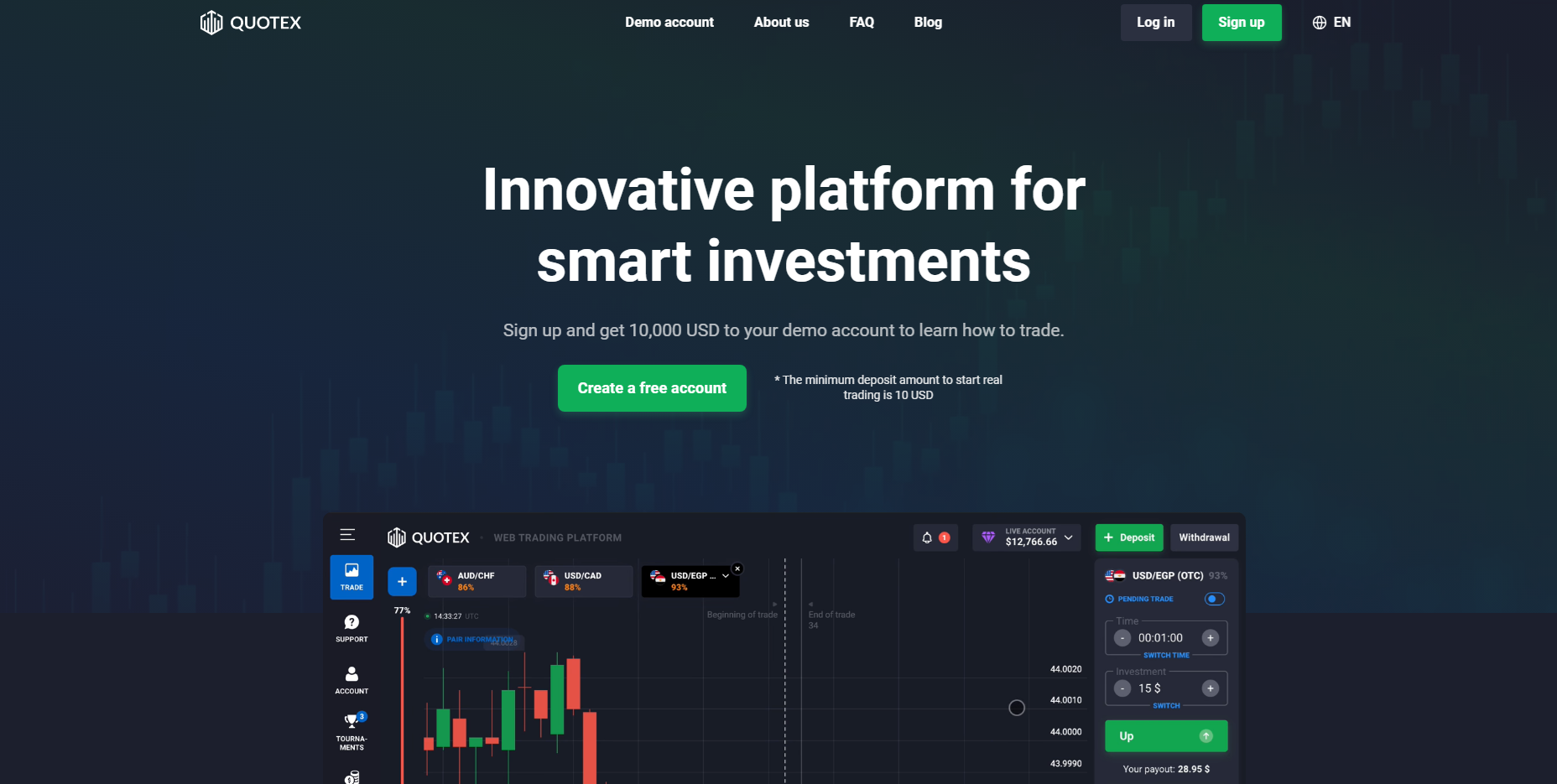

#1. Quotex

What is Quotex?

Quotex is a binary options broker established in 2019, designed to provide a simple and efficient trading experience. With its intuitive platform, Quotex allows traders to access over 100 assets, including forex, commodities, indices, and cryptocurrencies. A key feature is its minimum deposit of $10, making it accessible for beginners and experienced traders alike. Quotex is known for its lightning-fast trade execution and customizable trading interface, allowing traders to set up the platform to meet their individual needs. The broker is regulated by the International Financial Market Relations Regulation Center (IFMRRC), ensuring compliance with industry standards. Traders in Taiwan appreciate Quotex for its focus on secure transactions, competitive payout rates, and reliable customer service, solidifying its position as one of the best binary brokers in Taiwan.

Advantages and Disadvantages of Quotex

Quotex Commissions and Fees

Quotex is a cost-effective choice for traders, as it does not charge deposit or withdrawal fees, which is a major advantage over many competitors. Additionally, there are no direct commissions on trades, allowing traders to keep more of their earnings. However, the profit percentages for trades vary based on the asset and market conditions, which can indirectly impact returns. For inactive accounts, a small inactivity fee may apply, but this is clearly outlined in their terms and conditions. Overall, the broker remains transparent about its fee structure, ensuring traders have a clear understanding of costs.

#2. Pocket Option

What is Pocket Option?

Pocket Option, founded in 2017, is a binary options broker widely recognized for its user-friendly platform and innovative features. The broker supports over 100 trading instruments, including forex, commodities, cryptocurrencies, and stocks, appealing to a diverse group of traders. Its minimum deposit of $50 is slightly higher than some competitors but justified by the variety of features it offers. Regulated by the International Financial Market Relations Regulation Center (IFMRRC), Pocket Option ensures a secure and trustworthy trading experience. The platform is particularly known for its social trading feature, which allows traders to observe and copy the trades of successful peers, a great option for beginners. Pocket Option also supports multiple payment methods and offers regular bonuses and promotions, further enhancing its appeal to traders in Taiwan.

Advantages and Disadvantages of Pocket Option

Pocket Option Commissions and Fees

Pocket Option does not impose fees on deposits or withdrawals, which is a significant benefit for frequent traders. There are no commissions on trades, making it easier for traders to calculate potential profits without worrying about hidden costs. However, payout percentages can vary significantly depending on the asset and market volatility, influencing the overall returns. The platform also offers a transparent fee policy, including any potential costs for specific payment methods or prolonged inactivity. This clarity ensures traders can focus on their trading without unexpected charges.

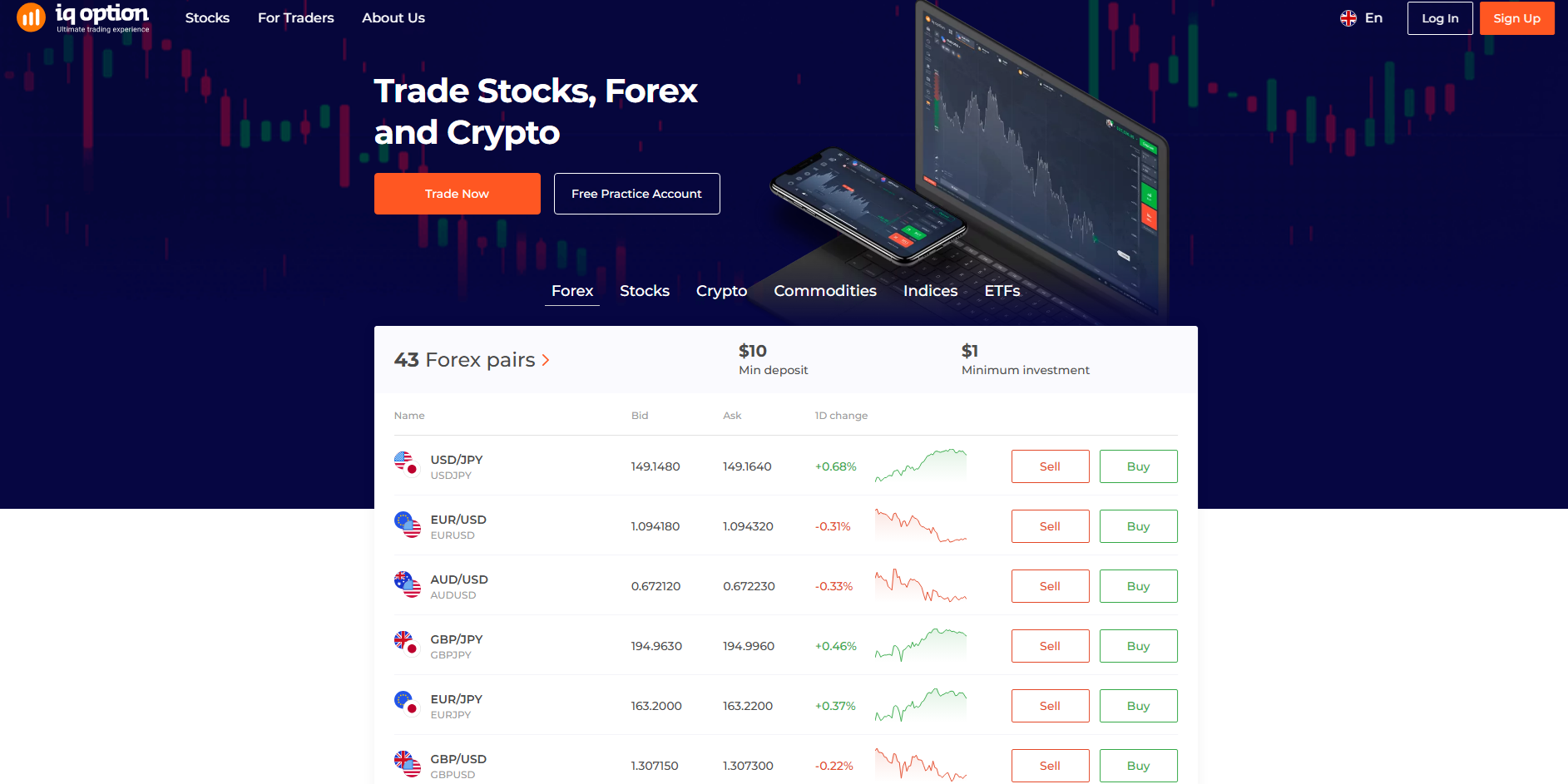

#3. IQ Option

What is IQ Option?

IQ Option is a well-known binary options broker offering a robust and feature-rich platform suitable for traders of all levels. Founded in 2013, it has built a strong reputation for providing a wide range of trading options, including forex, stocks, cryptocurrencies, and commodities. With a minimum deposit of $10, IQ Option is accessible to new traders while also offering advanced tools and features for experienced users. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with strict financial regulations. IQ Option’s platform includes detailed charting tools, technical indicators, and a sleek mobile app, making it a favorite for Taiwanese traders who value functionality and flexibility. The broker also provides extensive educational materials, including tutorials and webinars, to support traders in enhancing their skills.

Advantages and Disadvantages of IQ Option

IQ Option Commissions and Fees

IQ Option operates with a transparent fee structure, charging a 2.9% commission on cryptocurrency trades, which is competitive compared to other brokers. Deposits and withdrawals are generally free, although bank transfers may incur additional fees depending on the provider. The broker also charges an inactivity fee of $10 for accounts that remain dormant for 90 days or more. Traders benefit from high payout rates on binary options, but these rates can vary based on the chosen asset and market conditions. Overall, IQ Option remains one of the more cost-effective brokers, particularly for active traders.

#4. Olymp Trade

What is Olymp Trade?

Established in 2014, Olymp Trade is a prominent binary options broker known for its user-friendly platform and commitment to trader education. The platform offers access to a diverse range of assets, including forex, commodities, indices, and cryptocurrencies, catering to both novice and experienced traders. With a minimum deposit of $10, Olymp Trade ensures accessibility for a broad audience. The broker is a member of the International Financial Commission (FinaCom), which provides an additional layer of security and dispute resolution services for traders. Olymp Trade’s platform is equipped with various analytical tools, educational resources, and a demo account, allowing traders to practice and refine their strategies without financial risk.

Advantages and Disadvantages of Olymp Trade

Olymp Trade Commissions and Fees

Olymp Trade maintains a transparent fee structure, with no charges for deposits or withdrawals, making it cost-effective for traders. The platform does not impose commissions on standard trades; however, for Forex trading, a commission ranging from 0.8% to 15% of the total investment value may apply, depending on the asset and market conditions. Additionally, an inactivity fee of $10 is charged if an account remains dormant for 180 days. Overall, Olymp Trade’s fee policy is straightforward, enabling traders to manage their costs effectively.

#5. ExpertOption

What is ExpertOption?

Founded in 2014, ExpertOption is a binary options broker that emphasizes speed and reliability in trade execution. The platform offers access to over 100 assets, including forex, commodities, stocks, and cryptocurrencies, providing traders with diverse opportunities. With a minimum deposit of $10, ExpertOption is accessible to traders with varying budget levels. The broker is regulated by the Financial Services Authority of Saint Vincent and the Grenadines, ensuring adherence to international financial standards. ExpertOption’s platform features a range of analytical tools, social trading capabilities, and educational materials, supporting traders in making informed decisions.

Advantages and Disadvantages of ExpertOption

ExpertOption Commissions and Fees

ExpertOption does not charge fees for deposits or withdrawals, offering a cost-effective trading environment. The platform does not impose commissions on trades; however, payout percentages vary depending on the asset and market conditions, which can influence overall profitability. An inactivity fee of $10 per month is applied to accounts that have been inactive for 90 days. ExpertOption’s transparent fee structure allows traders to plan their trading activities without concern for hidden costs.

#6. Binomo

What is Binomo?

Binomo is a binary options broker recognized for its user-friendly platform and commitment to trader education. The platform provides access to a variety of assets, including forex, commodities, indices, and cryptocurrencies, catering to a wide range of trading preferences. With a minimum deposit of $10, Binomo is accessible to both new and experienced traders. The broker is a member of the International Financial Commission (FinaCom), offering an additional layer of protection and dispute resolution services for traders. Binomo’s platform includes various analytical tools, educational resources, and a demo account, enabling traders to practice and develop their strategies without financial risk.

Advantages and Disadvantages of Binomo

Binomo Commissions and Fees

Binomo does not charge fees for deposits or withdrawals, providing a cost-effective trading environment. The platform does not impose commissions on trades; however, payout percentages vary based on the asset and market conditions, which can affect overall returns. An inactivity fee of $10 is charged if an account remains dormant for 30 days. Binomo’s transparent fee policy allows traders to manage their costs effectively.

#7. Deriv

What is Deriv?

Deriv is a binary options broker that offers a versatile trading platform with access to a wide range of assets, including forex, commodities, indices, and cryptocurrencies. With a minimum deposit of $5, Deriv is accessible to traders with varying budget levels. The broker is regulated by multiple authorities, including the Malta Financial Services Authority (MFSA), ensuring compliance with international financial standards. Deriv’s platform features advanced analytical tools, automated trading options, and educational resources, supporting traders in making informed decisions.

Advantages and Disadvantages of Deriv

Deriv Commissions and Fees

Deriv does not charge fees for deposits or withdrawals, offering a cost-effective trading environment. The platform does not impose commissions on trades; however, payout percentages vary depending on the asset and market conditions, which can influence overall profitability. An inactivity fee of $25 is applied to accounts that have been inactive for 12 months. Deriv’s transparent fee structure allows traders to plan their trading activities without concern for hidden costs.

#8. BinaryCent

What is BinaryCent?

BinaryCent is a binary options broker that offers a user-friendly platform with access to a variety of assets, including forex, commodities, indices, and cryptocurrencies. With a minimum deposit of $250, BinaryCent caters to traders seeking a higher entry point. The broker is regulated by the Vanuatu Financial Services Commission (VFSC), ensuring adherence to international financial standards. BinaryCent’s platform includes features such as social trading, a demo account, and 24/7 customer support, providing a comprehensive trading experience.

Advantages and Disadvantages of BinaryCent

BinaryCent Commissions and Fees

BinaryCent does not charge fees for deposits or withdrawals, offering a cost-effective trading environment. The platform does not impose commissions on trades; however, payout percentages vary depending on the asset and market conditions, which can affect overall returns. An inactivity fee of $25 is applied to accounts that have been inactive for 6 months. BinaryCent’s transparent fee policy allows traders to manage their costs effectively.

#9. RaceOption

What is RaceOption?

RaceOption is a binary options broker that provides a user-friendly platform with access to a variety of assets, including forex, commodities, indices, and cryptocurrencies. With a minimum deposit of $250, RaceOption caters to traders seeking a higher entry point. The broker is regulated by the Vanuatu Financial Services Commission (VFSC), ensuring compliance with international financial standards. RaceOption’s platform features include social trading, a demo account, and 24/7 customer support, offering a robust experience for traders who value accessibility and service quality. RaceOption is popular among traders in Taiwan for its competitive payouts and quick trade execution, making it a reliable choice for those seeking to trade binary options.

Advantages and Disadvantages of RaceOption

RaceOption Commissions and Fees

RaceOption does not charge fees for deposits or withdrawals, making it cost-effective for active traders. The platform does not impose direct commissions on trades, although payout percentages vary based on the chosen asset and prevailing market conditions. An inactivity fee of $25 applies to accounts that remain dormant for six months or more. RaceOption’s straightforward fee policy ensures traders can plan their activities without unexpected costs, providing peace of mind while trading.

#10. Binarium

What is Binariums?

Binarium is a well-established binary options broker offering a simple and intuitive platform for traders at all skill levels. With a minimum deposit of $10, the broker is accessible to both beginners and experienced traders. Binarium provides a diverse range of assets, including forex, cryptocurrencies, and commodities, ensuring a variety of trading opportunities. The broker is a member of the International Financial Commission (FinaCom), adding an extra layer of security for traders by ensuring compliance with industry regulations. Binarium also includes a demo account for practicing trades and offers responsive customer support, making it an attractive option for traders in Taiwan.

Advantages and Disadvantages of Binarium

Binarium Commissions and Fees

Binarium maintains a trader-friendly fee structure with no charges for deposits or withdrawals, ensuring cost-effective transactions. There are no commissions on trades, but payout rates fluctuate depending on the asset and current market conditions, affecting potential returns. For inactive accounts, a fee of $10 per month is charged after 30 days of dormancy. Binarium’s transparent approach to fees allows traders to operate with clarity and focus on optimizing their trading performance.

How to Get Started with a Binary Broker in Taiwan

Step 1: Choose a Reputable Broker

Begin by selecting a trusted binary options broker that operates in Taiwan. Look for brokers with a solid reputation, user-friendly platforms, and responsive customer support. It’s essential to verify that the broker complies with local regulations and offers a secure trading environment.

Step 2: Register an Account

Once you’ve chosen a broker, visit their website and click on the “Sign Up” or “Register” button. You’ll need to provide some personal information, such as your name, email address, and phone number. Ensure that all details are accurate to avoid any issues during verification.

Step 3: Verify Your Identity

To comply with financial regulations, brokers require identity verification. This process typically involves submitting a copy of your ID card or passport and a recent utility bill or bank statement as proof of address. Verification helps protect against fraud and ensures a secure trading environment.

Step 4: Fund Your Account

After verification, it’s time to deposit funds into your trading account. Most brokers offer various payment methods, including bank transfers, credit/debit cards, and e-wallets. Choose the option that suits you best, keeping in mind any associated fees or processing times.

Step 5: Practice with a Demo Account

Before diving into live trading, take advantage of the broker’s demo account. This feature allows you to practice trading with virtual funds, helping you get familiar with the platform and develop your trading strategies without risking real money.

Step 6: Start Trading

With practice under your belt, you’re ready to start live trading. Begin with small investments to manage risk effectively. Monitor the markets, stay informed about financial news, and continuously refine your strategies to improve your trading performance.

Conclusion

Choosing the best binary brokers in Taiwan is an important step toward successful trading. The right broker can offer a secure platform, user-friendly tools, and reliable customer support, making your trading experience smooth and rewarding. Take the time to compare brokers, check for regulation, and test their features using demo accounts. Whether you’re a beginner or a seasoned trader, understanding your goals and preferences will help you pick the broker that best fits your needs. Start small, stay informed, and trade with confidence to make the most of your trading journey in Taiwan.

Also Read: The 5 Best Forex Brokers in Taiwan in 2024

FAQs

What is the minimum deposit required by most binary brokers in Taiwan?

Most brokers in Taiwan have minimum deposit requirements ranging from $5 to $250. It depends on the platform you choose, so always check the terms before signing up.

Are binary brokers in Taiwan regulated?

Some brokers are regulated by international bodies like the Financial Supervisory Commission or other recognized authorities. It’s crucial to check a broker’s regulation to ensure your funds are secure.

Can I practice trading without using real money?

Yes, many brokers offer demo accounts where you can practice trading with virtual funds. This is a great way to learn and build confidence before investing real money.