Binary options trading has surged in popularity in Singapore, offering a flexible way for investors to capitalize on market trends. With so many brokers available, how do you choose the right one? In this guide, we’ll dive into the 10 best binary brokers in Singapore in 2024, evaluating them on reliability, features, and overall user experience. Whether you’re new to trading or a seasoned investor, our list ensures you’ll find a platform that meets your needs. Ready to make smarter trades? Let’s get started!

What Are Binary Brokers?

Definition and Role in Trading

Binary brokers facilitate binary options trading, where traders predict whether an asset’s price will rise or fall within a specific timeframe. These brokers provide platforms to access binary options markets and manage trades, offering various assets like forex, stocks, and commodities.

How Binary Options Trading Works

In binary options trading, investors choose an asset, predict its price movement, and set a trade expiration time. If the prediction is correct, the trader earns a fixed payout; if not, the initial investment is lost, making it a high-risk, high-reward trading method.

Key Factors to Consider in Singapore

When selecting a binary broker in Singapore, prioritize MAS regulation for security, competitive payout rates, a user-friendly platform, and transparent fee structures. Additionally, consider brokers offering educational resources and responsive customer support to enhance your trading experience.

Regulatory Framework for Binary Brokers in Singapore

Overview of MAS Regulations

The Monetary Authority of Singapore (MAS) serves as the central bank and financial regulatory authority in Singapore, overseeing all financial institutions and markets, including binary options trading. MAS mandates that all binary options brokers operating within Singapore must obtain a Capital Markets Services (CMS) license. This licensing ensures that brokers adhere to stringent financial standards, maintain transparency, and implement robust consumer protection measures.

Importance of Regulatory Compliance

Engaging with MAS-regulated brokers is crucial for traders due to several reasons:

- Investor Protection: Regulated brokers are required to follow strict guidelines that safeguard investors’ interests, including the segregation of client funds and adherence to fair trading practices.

- Transparency: Compliance with MAS regulations ensures that brokers provide clear and accurate information regarding their services, fees, and the inherent risks associated with trading.

- Dispute Resolution: In the event of disputes, MAS provides a structured framework for resolution, offering traders a formal channel to address grievances.

Brokers Adhering to Local and International Regulations

While specific lists of MAS-licensed binary options brokers are not readily available, traders are advised to verify the regulatory status of any broker before engaging in trading activities to avoid losing money rapidly. Brokers regulated by reputable international authorities, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, are generally considered trustworthy. However, it is essential to ensure that these brokers are also authorized to operate in Singapore. Traders can consult the MAS Financial Institutions Directory or contact MAS directly to confirm a broker’s licensing status.

In summary, adhering to MAS regulations and choosing compliant brokers are vital steps in ensuring a secure and transparent trading environment for trade binary options in Singapore.

Features to Look for in the Best Binary Brokers

Trading Tools and User Interface

Top binary brokers offer intuitive and user-friendly platforms equipped with tools like real-time charts, technical indicators, and customizable dashboards. These features help traders make informed decisions and execute trades efficiently.

Asset Variety

Look for brokers providing a diverse range of tradable assets, including forex, commodities, indices, and cryptocurrencies. A wide selection ensures flexibility and the ability to diversify trading strategies.

Mobile Apps and Platform Accessibility

Mobile apps with seamless functionality and real-time updates are essential for trading on the go. Accessibility across multiple devices ensures that traders can monitor and execute trades anywhere, anytime.

Customer Support and Educational Resources

Reliable customer support, available 24/7 via live chat, email, or phone, is crucial for resolving issues promptly. Educational resources like tutorials, webinars, and market analysis enhance traders’ skills and confidence.

The 10 Best Binary Brokers in Singapore in 2024

#1. Pocket Option

What is Pocket Option?

Pocket Option is an online trading platform established in 2017, offering binary options and CFDs across various assets, including forex, cryptocurrencies, stocks, commodities, and indices. It provides a user-friendly interface accessible via web and mobile applications, catering to both novice and experienced traders. The platform is regulated by the International Financial Market Relations Regulation Center (IFMRRC), ensuring a degree of oversight and credibility.

Advantages and Disadvantages of Pocket Option

Pocket Option Commissions and Fees

Pocket Option maintains a 0% fee policy, meaning there are no commissions on trades, and no fees for deposits or withdrawals. However, certain payment providers, like Perfect Money, may charge their own fees (e.g., a 0.5% fee on withdrawals). Additionally, while Pocket Option doesn’t impose inactivity fees, currency conversion fees may apply if transactions involve currencies other than USD.

OPEN AN ACCOUNT NOW WITH POCKET OPTION AND GET YOUR WELCOME BONUS

#2. IQ Option

What is IQ Option?

IQ Option is an online trading platform established in 2013, offering a variety of financial instruments, including forex, stocks, cryptocurrencies, commodities, and ETFs. It provides a proprietary, user-friendly platform accessible via desktop and mobile devices, catering to both novice and experienced traders. The platform boasts a low minimum deposit requirement, making it accessible to a broad audience.

Advantages and Disadvantages of IQ Option

IQ Option Commissions and Fees

IQ Option maintains a transparent fee structure with no commissions on most trades. However, a 2.9% fee applies to long cryptocurrency positions. Overnight funding fees, ranging from 0.01% to 0.5%, are charged for positions held overnight, affecting CFDs on forex, ETFs, cryptocurrencies, and commodities. An inactive account fee of €10 per month is imposed after 90 days of inactivity.

OPEN AN ACCOUNT NOW WITH IQ OPTION AND GET YOUR WELCOME BONUS

#3. Olymp Trade

What is Olymp Trade?

Olymp Trade is an online trading platform established in 2014, offering users access to a variety of financial instruments, including Forex, stocks, and commodities. It provides a user-friendly interface and extensive educational resources to support both novice and experienced traders. The platform operates globally, serving clients in over 130 countries.

Advantages and Disadvantages of Olymp Trade

Olymp Trade Commissions and Fees

Olymp Trade offers competitive spreads, with average spreads on major currency pairs like EUR/USD around 1.1 pips. The platform charges commissions up to 15% on standard trading contracts. Notably, it requires a low minimum deposit of $10 and does not impose deposit fees, making it accessible for traders with varying capital levels.

OPEN AN ACCOUNT NOW WITH OLYMP TRADE AND GET YOUR WELCOME BONUS

#4. Binomo

What is Binomo?

Binomo is an online trading platform that enables users to trade a variety of assets, including currencies, commodities, and stocks. It offers a user-friendly interface suitable for both beginners and experienced traders, providing tools for market analysis and strategy development. The platform supports short-term trades, allowing users to capitalize on quick market movements.

Advantages and Disadvantages of Binomo

Binomo Commissions and Fees

Binomo operates on a commission-free model, meaning users are not charged fees for executing trades. However, certain deposit and withdrawal methods may incur fees, depending on the chosen payment provider. It’s important for users to review the terms and conditions associated with their selected payment methods to understand any potential charges.

OPEN AN ACCOUNT NOW WITH BINOMO AND GET YOUR WELCOME BONUS

#5. ExpertOption

What is Expert Option?

Expert Option is an online trading platform that offers users the ability to trade a variety of financial instruments, including binary options, stocks, commodities, and cryptocurrencies. The platform is known for its user-friendly interface and educational resources, making it accessible to both novice and experienced traders. Additionally, Expert Option provides a demo account feature, allowing users to practice trading strategies without financial risk.

Advantages and Disadvantages of Expert Option

Expert Option Commissions and Fees

Regarding commissions and fees, Expert Option does not charge commissions on trades, allowing users to execute transactions without additional costs. However, the platform may apply spreads, which are the differences between the buying and selling prices of assets. Users should also be aware of potential withdrawal fees and inactivity fees that could apply under certain conditions.

OPEN AN ACCOUNT NOW WITH EXPERTOPTION AND GET YOUR WELCOME BONUS

#6. Deriv

What is Deriv?

Deriv is an online trading platform offering diverse financial instruments such as forex, commodities, and synthetic indices. It caters to traders of all levels with its user-friendly interface and advanced tools. Deriv emphasizes flexibility, providing platforms like DTrader, DBot, and MetaTrader for customized trading experiences.

Advantages and Disadvantages of Deriv

Deriv Commissions and Fees

Deriv maintains competitive fees, with no charges for deposits or inactivity. Spreads are variable, depending on the asset traded, ensuring transparency. While commissions are generally low, synthetic indices may incur slightly higher costs. Deriv also offers fee-free withdrawals for specific payment methods, enhancing its affordability.

OPEN AN ACCOUNT NOW WITH DERIV AND GET YOUR WELCOME BONUS

#7. RaceOption

What is RaceOption?

RaceOption is an online trading platform offering services in binary options and CFD trading. It caters to traders worldwide with access to a wide range of assets, including forex, commodities, and cryptocurrencies. The platform emphasizes fast withdrawals, user-friendly design, and 24/7 customer support to enhance the trading experience. RaceOption is especially popular for its simplified trading process and bonus offerings.

Advantages and Disadvantages of RaceOption

RaceOption Commissions and Fees

RaceOption charges trading fees primarily through spreads and overnight fees for CFD trades. Binary options trading involves fixed risk but does not have additional trading commissions. There may be withdrawal fees depending on the payment method selected. While the platform offers competitive rates, traders should review its fee structure to understand potential costs.

OPEN AN ACCOUNT NOW WITH RACEOPTION AND GET YOUR WELCOME BONUS

#8. BinaryCent

What is BinaryCent?

BinaryCent is an online trading platform offering binary options, forex, and CFD trading. It is designed for beginners and professionals, providing access to multiple financial markets with a low minimum deposit of $10. BinaryCent stands out with features like 24/7 trading, high payouts, and a simple interface.

Advantages and Disadvantages ofBinaryCent

BinaryCent Commissions and Fees

BinaryCent charges competitive trading fees, but users may encounter additional costs like withdrawal fees of 5% for certain methods. The platform also applies overnight fees for holding trades beyond a trading day. Despite its attractive payouts, the lack of transparency on all fees can be a drawback for some traders. These factors make BinaryCent suitable for traders aware of fee structures.

OPEN AN ACCOUNT NOW WITH BINARYCENT AND GET YOUR WELCOME BONUS

#9. Spectre.ai

What is Spectre.ai?

Spectre.ai was a broker-less financial trading platform that operated on the Ethereum blockchain, enabling users to trade various assets directly without intermediaries. It utilized smart contracts to facilitate trades, aiming to enhance transparency and reduce conflicts of interest inherent in traditional brokerage models. However, as of October 2023, Spectre.ai ceased operations and is no longer active.

Advantages and Disadvantages of Spectre.ai

Spectre.ai Commissions and Fees

Prior to its closure, Spectre.ai did not charge traditional commissions on trades. Instead, it applied tight spreads, with examples such as 0.58 pips for the EUR/USD pair and 0.9 pips for the GBP/USD pair. Additionally, there were no inactivity fees, and the platform aimed to minimize transaction costs for its users.

OPEN AN ACCOUNT NOW WITH SPECTRE.AI AND GET YOUR WELCOME BONUS

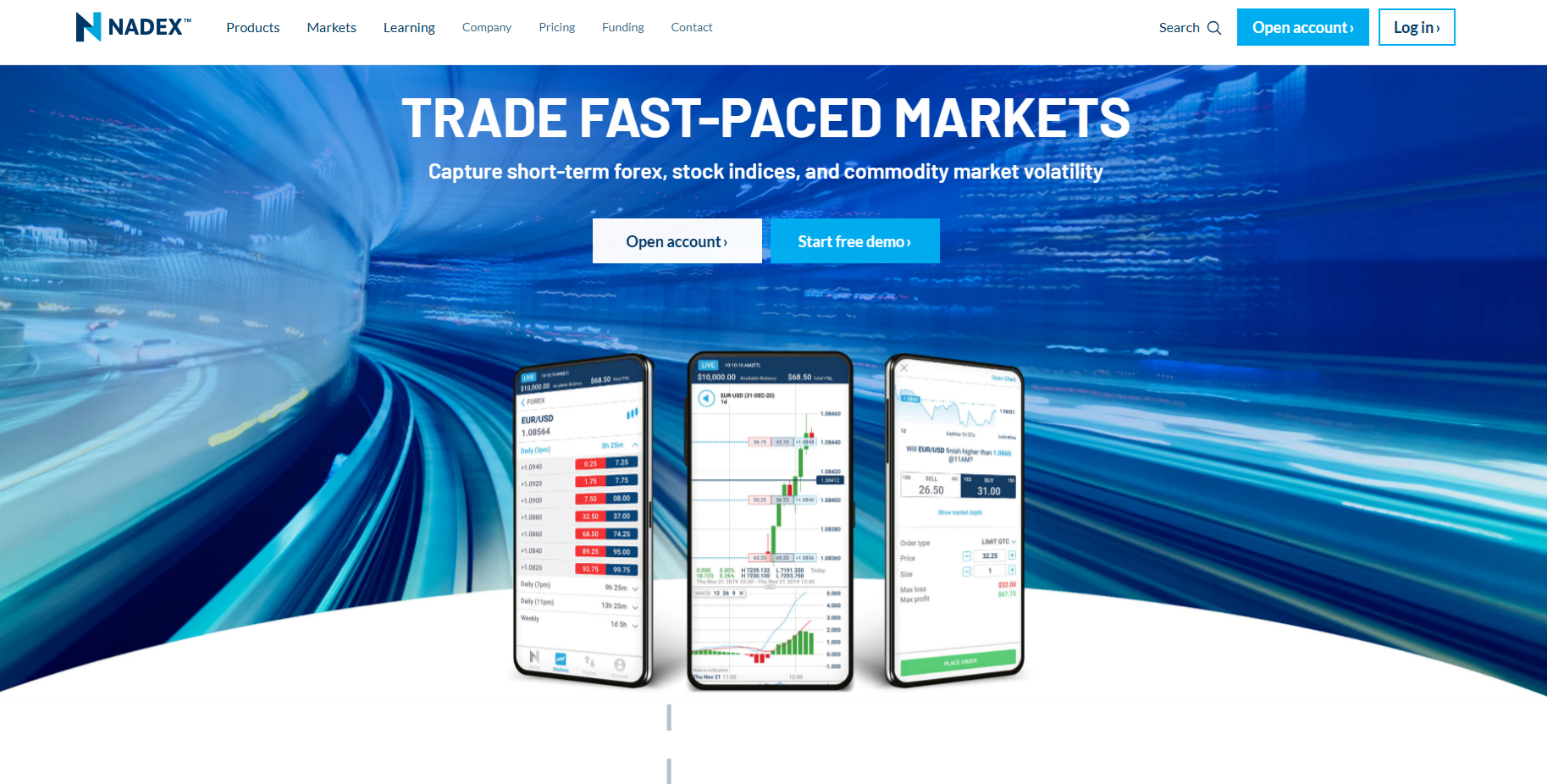

#10. Nadex

What is Nadex?

Nadex, the North American Derivatives Exchange, is a U.S.-based, CFTC-regulated exchange specializing in binary options, knock-outs, and call spreads across various markets, including forex, commodities, and stock indices. It offers traders a platform to speculate on short-term price movements with limited risk and transparent pricing.

Advantages and Disadvantages of Nadex

Nadex Commissions and Fees

Nadex employs a straightforward fee structure, charging a $1 fee per contract for both opening and closing positions. If a contract expires out-of-the-money, no settlement fee is applied. Deposits via ACH are free, while wire withdrawals incur a $25 fee.

OPEN AN ACCOUNT NOW WITH NADEX AND GET YOUR WELCOME BONUS

Pros and Cons of Using Binary Brokers

Benefits of Binary Options Trading

Binary options offer simplicity, as traders only need to predict price movement (up or down). They provide quick results with short expiration times and allow trading with minimal capital, making them accessible to beginners.

Risks Involved and How to Mitigate Them

Binary options are high-risk due to their all-or-nothing nature, with potential losses equal to the full investment. To mitigate risks, trade with regulated brokers, start with small amounts, and develop a sound trading strategy backed by market research.

Tips for Making the Most of Binary Brokers’ Features

Utilize demo accounts to practice strategies risk-free and explore educational resources offered by brokers. Leverage trading tools like technical indicators and market analysis, and prioritize platforms with user-friendly interfaces and responsive customer support.

How to Open an Account with a Binary Broker in Singapore

Step-by-Step Guide to Signing Up

- Choose a regulated binary broker that suits your trading needs.

- Visit the broker’s website or app and click “Sign Up.”

- Provide basic information like your name, email, and phone number, then create a secure password.

KYC and Verification Requirements

Complete the Know Your Customer (KYC) process by uploading a valid ID (e.g., NRIC or passport) and proof of address (e.g., utility bill or bank statement). Verification ensures compliance with MAS regulations and secures your account.

Tips for Funding and Withdrawing from Your Account

Use trusted methods like local bank transfers, PayNow, or credit cards for funding, ensuring funds are in SGD or supported currencies. For withdrawals, confirm fees and processing times, and always adhere to the broker’s account verification requirements to avoid delays.

Asia Forex Mentor Expert Tips for Successful Binary Options Trading

Importance of Market Analysis and Risk Management

Thorough market analysis helps identify trends and improve prediction accuracy in binary options trading. Implement strict risk management practices, such as limiting investment per trade to 1–2% of your capital, to minimize losses and protect your portfolio.

Leveraging Demo Accounts for Practice

Demo accounts allow traders to practice strategies without risking real money. Use them to familiarize yourself with the platform, test various approaches, and build confidence before trading live.

Avoiding Common Pitfalls in Binary Options Trading

Avoid emotional trading and over-reliance on “gut feelings”; instead, base decisions on data and analysis. Steer clear of unregulated brokers and unrealistic promises of guaranteed returns, focusing instead on consistent, disciplined trading strategies.

Also Read: The 5 Best Stock Brokers in Singapore in 2024

Conclusion

Binary options trading offers exciting opportunities for traders in Singapore, but success hinges on choosing the right broker. From regulations to trading features, the 10 best binary brokers in Singapore in 2024 provide secure and user-friendly platforms to suit every trader’s needs. Start trading today and unlock your financial potential!

FAQS

What is binary options trading?

Binary options trading is a financial trading method where traders predict whether an asset’s price will go up or down within a set time frame.

Are binary brokers in Singapore regulated?

Some brokers are regulated by international authorities like CySEC or CFTC, while others may operate under offshore licenses.

What are the top binary brokers in Singapore?

Popular brokers include IQ Option, Quotex, Pocket Option, Olymp Trade, and Binomo.