Binary trading has gained significant traction among New Zealand traders as an accessible way to invest in the global financial markets. This trading method involves predicting the price movements of financial instruments, such as currency pairs, precious metals, or soft commodities, over short time frames. While its simplicity attracts beginner traders, success heavily relies on choosing the best binary brokers in New Zealand to ensure both profitability and security.

Selecting the right binary options broker is crucial for safeguarding client funds and enhancing trading experience. Factors like a broker’s regulatory status—for instance, compliance with the Financial Markets Authority in New Zealand or oversight by bodies like the Commodity Futures Trading Commission—are vital for secure trading. Moreover, brokers offering various risk management tools, low trading costs, and advanced online trading platforms are better suited for intermediate and advanced traders. Features such as a demo account, wide range of trading instruments, and robust trading tools allow traders to test strategies, develop trading skills, and manage losing trades effectively. By aligning your goals with a broker’s services, you can confidently start trading in the financial markets.

Criteria for Selecting the Best Binary Brokers

Regulation and Compliance: Ensuring a binary broker is regulated by authorities like the Financial Markets Authority in New Zealand, Cyprus Securities, or the Vanuatu Financial Services Commission protects traders. Regulatory oversight secures client funds, mandates negative balance protection, and enforces transparency. For New Zealand traders, a licensed derivatives issuer ensures credibility when engaging in binary options trading.

Ease of Use and Platform Features: The broker’s platform should offer an intuitive interface, efficient trading tools, and features like a demo account for beginners to test trading strategies. Advanced platforms for intermediate and advanced traders should include tools for technical analysis, access to various risk management tools, and a diverse range of trading instruments such as currency pairs, precious metals, and exchange-traded funds.

Payout Percentages and Fees: Evaluate brokers based on competitive trading costs, high payouts on binary options, and reasonable fees. Platforms should support trading in major asset classes like forex, soft commodities, and underlying assets.

Customer Support and Educational Tools: Brokers offering resources to improve trading skills, including guides on risk management, strategies for binary trading, and insights into global financial markets, are ideal. Reliable customer support ensures swift assistance, especially for Zealand traders navigating the foreign exchange market.

Selecting the best binary brokers in New Zealand requires a balance of secure financial services, user-friendly trading platforms, and educational opportunities to enhance your trading experience.

The 5 Best Binary Brokers in New Zealand

#1. IQ Option

What is IQ Option?

IQ Option is a popular trading platform that offers a range of financial instruments, including forex, stocks, cryptocurrencies, and options. It is known for its user-friendly interface and tools designed for both beginner and experienced traders. The platform provides access to real-time market data and customizable charting tools to support trading decisions.

Advantages and Disadvantages of IQ Option

IQ Option Commissions and Fees

IQ Option charges competitive fees, with no commission on trades for most assets. Spreads may vary depending on the instrument, and there are overnight fees for leveraged positions. The platform imposes withdrawal fees for certain payment methods and inactivity fees for dormant accounts. Its low trading costs make it appealing for traders seeking affordability.

OPEN AN ACCOUNT NOW WITH IQ OPTION AND GET YOUR WELCOME BONUS

#2. Pocket Option

What is Pocket Option?

Pocket Option is an online trading platform that specializes in binary options trading. It offers a user-friendly interface suitable for beginners and advanced traders alike. With a wide range of assets, including forex, stocks, and cryptocurrencies, it provides flexibility in trading choices. Pocket Option also features social trading, allowing users to replicate the trades of experienced professionals.

Advantages and Disadvantages of Pocket Option

Pocket Option Commissions and Fees

Pocket Option offers competitive trading with no hidden fees for deposits or withdrawals. While it charges a spread on trades, these fees remain lower compared to some competitors. Additionally, Pocket Option does not levy inactivity fees, making it ideal for casual traders. However, withdrawal options might involve third-party processing charges, which vary by method.

OPEN AN ACCOUNT NOW WITH POCKET OPTION AND GET YOUR WELCOME BONUS

#3. Olymp Trade

What is Olymp Trade?

Olymp Trade is a popular online trading platform offering users access to forex, stocks, and various digital assets. It is designed for beginners and advanced traders with intuitive tools and a user-friendly interface. The platform provides educational resources, demo accounts, and low entry barriers to help users start trading efficiently. Regulated operations ensure a secure and reliable trading experience.

Advantages and Disadvantages of Olymp Trade

Olymp Trade Commissions and Fees

Olymp Trade offers competitive trading fees, with no hidden charges or excessive costs. It primarily earns through spreads and commission rates that vary by asset type and market conditions. Traders benefit from transparent fee structures that include minimal non-trading fees, such as account maintenance. This approach makes it accessible and cost-effective for most users.

OPEN AN ACCOUNT NOW WITH OLYMP TRADE AND GET YOUR WELCOME BONUS

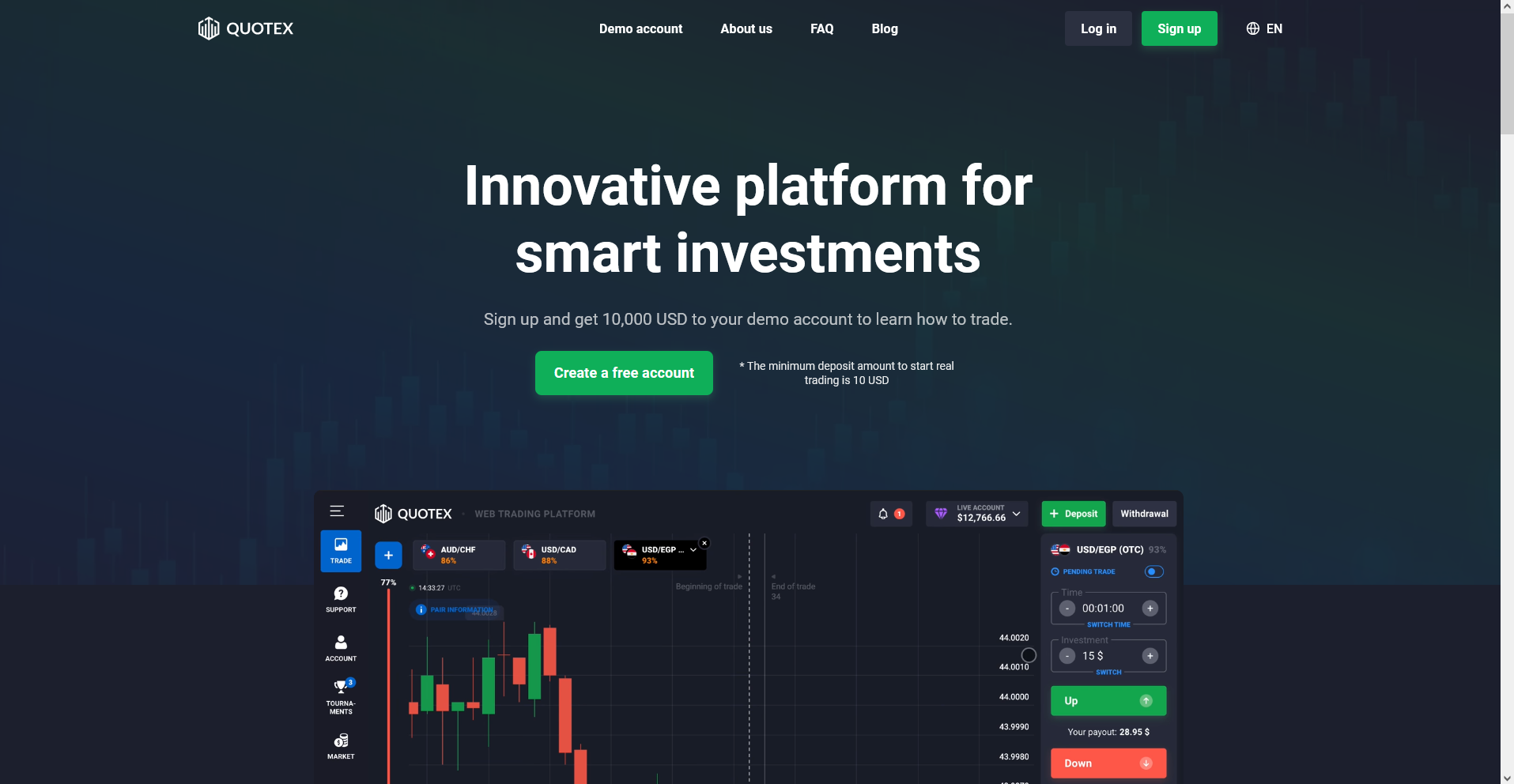

#4. Quotex

What is Quotex?

Quotex is a digital trading platform specializing in binary options, offering a user-friendly interface and diverse trading instruments. It caters to traders seeking simplicity, with minimal setup and quick execution. The platform supports multiple payment methods and provides tools like technical indicators and signals to assist decision-making. Quotex’s mobile app ensures accessibility for traders on the go.

Advantages and Disadvantages of Quotex

Quotex Commissions and Fees

Quotex operates with no direct trading commissions, making it appealing for cost-conscious traders. However, profits are derived from predefined payouts, which may vary by asset. Withdrawal fees depend on the payment method, with some options offering free transactions. The platform maintains transparency in its fee structure, ensuring users can calculate costs accurately.

OPEN AN ACCOUNT NOW WITH QUOTEX AND GET YOUR WELCOME BONUS

#5. Deriv

What is Deriv?

Deriv is a user-friendly trading platform that offers a wide range of financial instruments, including forex, commodities, and synthetic indices. It is designed for both beginner and experienced traders, providing intuitive tools and features. With customizable interfaces and seamless access across devices, Deriv aims to simplify the trading experience.

Advantages and Disadvantages of Deriv

Deriv Commissions and Fees

Deriv maintains competitive spreads and fees, catering to traders looking for cost-effective solutions. Most trading accounts come with no commission, but specific products like synthetic indices may have unique cost structures. Withdrawal fees and payment options are generally transparent, enhancing overall affordability for users.

OPEN AN ACCOUNT NOW WITH DERIV AND GET YOUR WELCOME BONUS

Why Trade Binary Options in New Zealand?

Binary options trading is gaining traction among New Zealand traders, offering opportunities to participate in global financial markets. The region provides a robust regulatory framework through the Financial Markets Authority, ensuring client funds are safeguarded while promoting fair practices. Traders can benefit from a variety of trading platforms, including binary options trading platforms, that offer access to diverse asset classes such as currency pairs, precious metals, and soft commodities. With growing support from licensed derivatives issuers and financial services providers, binary trading appeals to both beginner traders and experienced traders.

New Zealand’s financial markets offer competitive conditions, including negative balance protection and access to various risk management tools. Retail investor accounts can utilize demo accounts to test trading strategies before committing funds, while professional traders can leverage advanced trading tools for technical analysis. Paired with low minimum deposit requirements and flexible trading costs, traders can focus on enhancing their trading skills and implementing effective risk management. The region’s appeal is bolstered by its strong ties to the foreign exchange market, making it an attractive hub for forex traders and CFD trading enthusiasts.

Also Read: The 5 Best Binary Brokers in Spain in 2025: Seamless Trades

Conclusion

The best binary brokers in New Zealand stand out for their robust features tailored to different trading needs. These brokers provide access to financial markets, support binary options trading, and offer user-friendly online trading platforms. Whether you’re trading forex, CFDs, or binary options, each broker ensures a seamless trading experience with advanced trading tools, secure client funds, and competitive trading costs.

To start trading, select a broker that aligns with your goals, skill level, and preferred trading strategy. Evaluate options based on their broker’s regulatory status, range of financial instruments, and availability of features like a demo account or negative balance protection. By choosing the right broker, New Zealand traders can enhance their trading skills and confidently navigate global financial markets.

FAQs

What are binary options?

Binary options are financial contracts where traders predict the price movement of assets within a set timeframe.

Is binary trading legal in New Zealand?

Yes, binary trading is legal in New Zealand, but traders should ensure brokers are regulated.

What is the minimum deposit to start trading?

Minimum deposits vary by broker, typically ranging from $10 to $50.