When it comes to binary options trading, finding the right platform can make all the difference for Malaysian traders. At Asia Forex Mentor, we know the importance of choosing binary brokers that offer a smooth trading process, great customer support, and the right trading tools to help you succeed. With market volatility always a factor, having reliable binary options brokers ensures you’re set up for success while staying on top of your risk management. In this guide, we’ll walk you through the 5 best binary brokers in Malaysia for 2024, each handpicked for their standout features and trader-friendly platforms.

Whether you’re just starting to trade binary options or you’re looking for the best binary options brokers to take your strategies to the next level, this list has you covered. From minimum deposit requirements to proprietary trading platforms and helpful trading signals, these platforms cater to binary options traders who want to make informed trading decisions in the competitive financial markets. Let’s simplify your search and get you started with the best binary trading platforms available today.

Why Choosing the Best Binary Brokers in Malaysia is Important

Choosing the best binary brokers in Malaysia is crucial for a successful and secure trading experience. The right broker not only provides a user-friendly online trading platform but also ensures your investments are protected. Here’s why making an informed choice matters:

- Regulation and Safety: Opting for brokers regulated by authorities like the Securities Commission Malaysia (SC) ensures adherence to legal standards, safeguarding your funds.

- User-Friendly Platforms: Top brokers offer intuitive binary trading platforms equipped with technical indicators and risk management tools, enhancing your trading efficiency.

- Diverse Asset Classes: Access to various asset classes such as forex, commodities, and indices allows for portfolio diversification, aligning with your investment goals.

- Educational Resources: Reputable brokers provide comprehensive educational resources, helping traders develop effective trading strategies and make informed trading decisions.

- Responsive Customer Support: Reliable customer support is essential for timely assistance, ensuring a smooth trading process.

- Flexible Account Options: Brokers with low minimum deposit and demo accounts enable traders to practice and start with amounts that suit their financial capacity.

The 5 Best Binary Brokers in Malaysia

#1. Quotex

What is Quotex?

Quotex is an online trading platform that allows users to engage in binary options trading across various asset classes, including forex, commodities, and cryptocurrencies. The platform is known for its user-friendly interface, making it accessible for both beginners and experienced traders. Quotex offers a demo account for practice, a low minimum deposit requirement, and a range of technical indicators to assist in making informed trading decisions. While Quotex is not registered with the Securities Commission Malaysia, it operates under the International Financial Market Relations Regulation Center (IFMRRC), providing a level of oversight and trustworthiness.

Advantages and Disadvantages of Quotex

Quotex Commissions and Fees

Quotex maintains a transparent fee structure, with no charges for deposits or withdrawals. The platform does not impose commissions on trades, allowing traders to maximize their profits. However, users should be aware of potential fees from payment providers during transactions.

OPEN AN ACCOUNT NOW WITH QUOTEX AND GET YOUR WELCOME BONUS

#2. Pocket Option

What is Pocket Option?

Pocket Option is a binary options broker established in 2017, offering a wide range of assets, including forex, stocks, commodities, and cryptocurrencies. The platform features a proprietary trading platform with advanced charting tools and supports social trading, enabling users to follow and copy successful traders. Pocket Option is regulated by the International Financial Market Relations Regulation Center (IFMRRC), ensuring adherence to industry standards.

Advantages and Disadvantages of Pocket Option

Pocket Option Commissions and Fees

Pocket Option requires a minimum deposit of $50 to start trading. The platform does not charge deposit or withdrawal fees, but traders should be mindful of any fees imposed by their payment providers. Additionally, Pocket Option offers competitive payout rates, with potential returns of up to 92% on successful trades.

OPEN AN ACCOUNT NOW WITH POCKET OPTION AND GET YOUR WELCOME BONUS

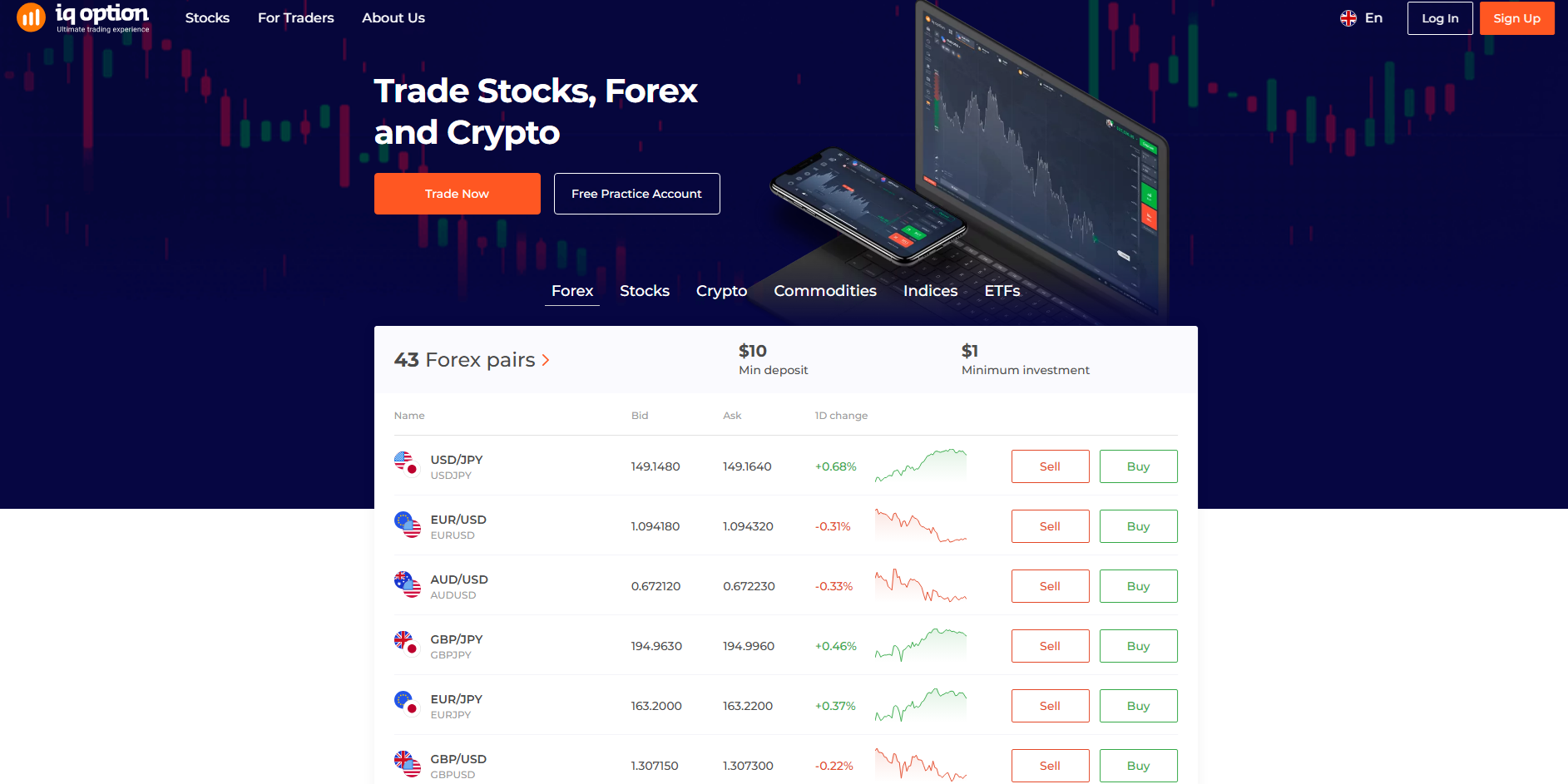

#3. IQ Option

What is IQ Option?

IQ Option, founded in 2013, is a well-established online trading platform offering a variety of financial instruments, including binary options, forex, stocks, and cryptocurrencies. The platform is renowned for its intuitive interface, comprehensive educational resources, and a demo account for practice. IQ Option is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a secure trading environment.

Advantages and Disadvantages of IQ Option

IQ Option Commissions and Fees

IQ Option has a minimum deposit requirement of $10, making it accessible for traders with varying budgets. The platform offers commission-free trades on certain assets, though traders should be aware of spreads that may apply. Withdrawals are processed promptly, with a minimum withdrawal amount of $2, and typically do not incur fees, depending on the chosen payment method.

OPEN AN ACCOUNT NOW WITH IQ OPTION AND GET YOUR WELCOME BONUS

#4. Olymp Trade

What is Olymp Trade?

Established in 2014, Olymp Trade is a binary options and forex broker known for its user-friendly platform and extensive educational materials. The platform caters to both novice and experienced traders, offering a variety of assets, including currencies, commodities, and indices. Olymp Trade is a member of the International Financial Commission (FinaCom), which provides a degree of regulatory oversight.

Advantages and Disadvantages of Olymp Trade

Olymp Trade Commissions and Fees

Olymp Trade requires a minimum deposit of $10, making it accessible to a wide range of traders. The platform does not charge deposit or withdrawal fees, but traders should be aware of potential fees from payment providers. Olymp Trade offers competitive payout rates, with returns of up to 92% on successful trades.

OPEN AN ACCOUNT NOW WITH OLYMP TRADE AND GET YOUR WELCOME BONUS

#5. Binarium

What is Binarium?

Binarium is a binary options broker offering a variety of assets, including forex, commodities, and cryptocurrencies. The platform provides a user-friendly interface, making it suitable for traders at all levels. Binarium offers a demo account for practice and supports various payment methods for deposits and withdrawals. However, specific regulatory information about Binarium is not readily available, so traders should exercise caution and conduct thorough research before engaging with the platform.

Advantages and Disadvantages of Binarium

Binarium Commissions and Fees

Binarium requires a minimum deposit of $10 to start trading. The platform does not charge deposit or withdrawal fees, but traders should be aware of any fees imposed by their payment providers. Binarium offers competitive payout rates, with potential returns varying based on the asset and market conditions.

OPEN AN ACCOUNT NOW WITH BINARIUM AND GET YOUR WELCOME BONUS

How to Get Started with a Binary Broker in Malaysia

Starting with a binary broker in Malaysia is straightforward and accessible. Here’s a simple guide to help you begin your binary options trading journey:

Step 1: Choose a Reputable Binary Broker

Select a broker that offers binary options trading in Malaysia. Look for platforms with a user-friendly interface, a variety of asset classes, and reliable customer support. Ensure the broker is regulated by authorities like the Securities Commission Malaysia (SC) or reputable international bodies. Popular options include Quotex, IQ Option, and Olymp Trade.

Step 2: Open a Trading Account

Visit the broker’s website and sign up for a trading account. You’ll need to provide personal information and verify your identity. Many brokers offer demo accounts—take advantage of these to practice without risking real money.

Step 3: Make a Deposit

After familiarizing yourself with the platform, proceed to fund your account. Most brokers have a low minimum deposit requirement, often starting at $10. Payment methods typically include bank transfers, credit/debit cards, and e-wallets. Choose the option that suits you best.

Step 4: Start Trading

With funds in your account, you can begin trading. Select the asset you want to trade, decide on the amount, and predict whether the price will go up or down. Utilize the platform’s trading tools and technical indicators to make informed trading decisions.

Step 5: Withdraw Your Earnings

If your trades are successful, you can withdraw your profits. Go to the withdrawal section of the platform, choose your preferred method, and follow the instructions. Be aware of any withdrawal fees and processing times associated with your chosen method.

Conclusion

Finding the best binary brokers in Malaysia is about more than just picking a platform; it’s about setting yourself up for a successful and secure trading experience. Reliable brokers offer user-friendly platforms, strong customer support, and essential tools like demo accounts and technical indicators to help you trade effectively. Whether you’re new to binary options trading or looking to fine-tune your strategies, the brokers we’ve highlighted provide the right mix of features to suit Malaysian traders. Remember to start with a small minimum deposit, use risk management tools, and always keep learning.

Also Read: The 5 Best Forex Brokers in Malaysia in 2024

FAQs

How can I know if a binary broker is safe in Malaysia?

Check if the broker is regulated by authorities like the Securities Commission Malaysia or reputable international bodies such as CySEC or IFMRRC. Reviews and user feedback can also help gauge trustworthiness.

What is the minimum deposit to start trading binary options?

Most brokers in Malaysia have a low minimum deposit requirement, ranging from $10 to $50, depending on the platform.

Can I practice trading before using real money?

Yes, most brokers offer demo accounts where you can practice trading with virtual funds before committing real money. This is a great way to get comfortable with the platform.