Position in Rating | Overall Rating | Trading Terminals |

187th  | 2.7 Overall Rating |  |

Baxia Markets Review

Choosing the right Forex broker is crucial for anyone serious about trading. A good broker can provide you with the necessary tools, support, and environment to succeed, while a poor choice can lead to unnecessary complications and financial losses. When selecting a broker, it’s essential to consider factors like regulatory compliance, trading platforms, fees, and customer service.

Baxia Markets stands out among Forex brokers for several reasons. Founded in 2020, Baxia Markets offers a wide range of trading instruments including Forex, commodities, indices, and cryptocurrencies, with competitive spreads and a high leverage option of up to 1:500. They provide trading platforms such as MetaTrader 4 and MetaTrader 5, accessible on both desktop and mobile devices, making trading convenient and flexible.

In this detailed review, I aim to provide a thorough evaluation of Baxia Markets, emphasizing its unique selling propositions and potential drawbacks. I will supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Baxia Markets as your preferred brokerage service provider.

What is Baxia Markets?

Baxia Markets is a Forex broker that provides a range of trading services designed to cater to various trading needs. They offer access to multiple financial instruments, including Forex, commodities, indices, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of different market opportunities.

One of the standout features of Baxia Markets is their competitive trading conditions. They offer tight spreads and high leverage up to 1:500, which can significantly enhance trading potential. Additionally, the broker supports popular trading platforms like MetaTrader 4 and MetaTrader 5, which are available on both desktop and mobile devices, ensuring that you can trade on the go.

Benefits of Trading with Baxia Markets

Trading with Baxia Markets has several benefits that make it a strong choice for both new and experienced traders. One of the main advantages is the fast order execution and low latency. This ensures that trades are executed quickly and efficiently, which is crucial for taking advantage of market opportunities. The availability of MetaTrader 4 and 5 platforms adds to this efficiency, offering robust tools and a user-friendly interface.

Another benefit is the competitive spreads and high leverage options. With spreads starting from 0.0 pips and leverage up to 1:500, Baxia Markets provides the conditions needed to maximize trading potential. This is particularly beneficial for traders who need high leverage to increase their market exposure with relatively low capital.

Customer support at Baxia Markets is also commendable, with 24/5 availability via live chat, email, and phone. This multi-channel support ensures that any issues or questions can be resolved promptly, enhancing the overall trading experience. Additionally, the lack of inactivity fees and the variety of deposit and withdrawal options add convenience and flexibility for traders.

Baxia Markets Regulation and Safety

Baxia Markets operates under the regulation of the Securities Commission of the Bahamas (SCB) and the Financial Services Authority (FSA) of Seychelles. These regulatory bodies provide a basic level of oversight and security for your trading activities, ensuring that the broker adheres to certain standards and practices. It’s important to know this because regulatory compliance helps protect your investments and ensures that the broker operates fairly and transparently.

Trading with a regulated broker like Baxia Markets means your funds are held in segregated accounts, separate from the company’s operational funds. This separation is crucial because it adds an extra layer of protection against potential misuse of your money. Additionally, in the event of any financial issues within the company, your funds are safeguarded.

Another important aspect of Baxia Markets’ regulation is their membership with The Financial Commission, which provides an independent and impartial dispute resolution process. This membership ensures that any issues you might encounter are handled fairly and efficiently, giving you confidence in the integrity of the trading environment. Knowing these safety measures can give you peace of mind while trading.

Baxia Markets Pros and Cons

Pros

- Fast order execution

- Low minimum deposit

- Demo account available

- Variety of deposit and withdrawal options

- No inactivity fees

Cons

- No cent accounts

- Free VPS requires $1,000 deposit

- Higher spreads than many brokers

Baxia Markets Customer Reviews

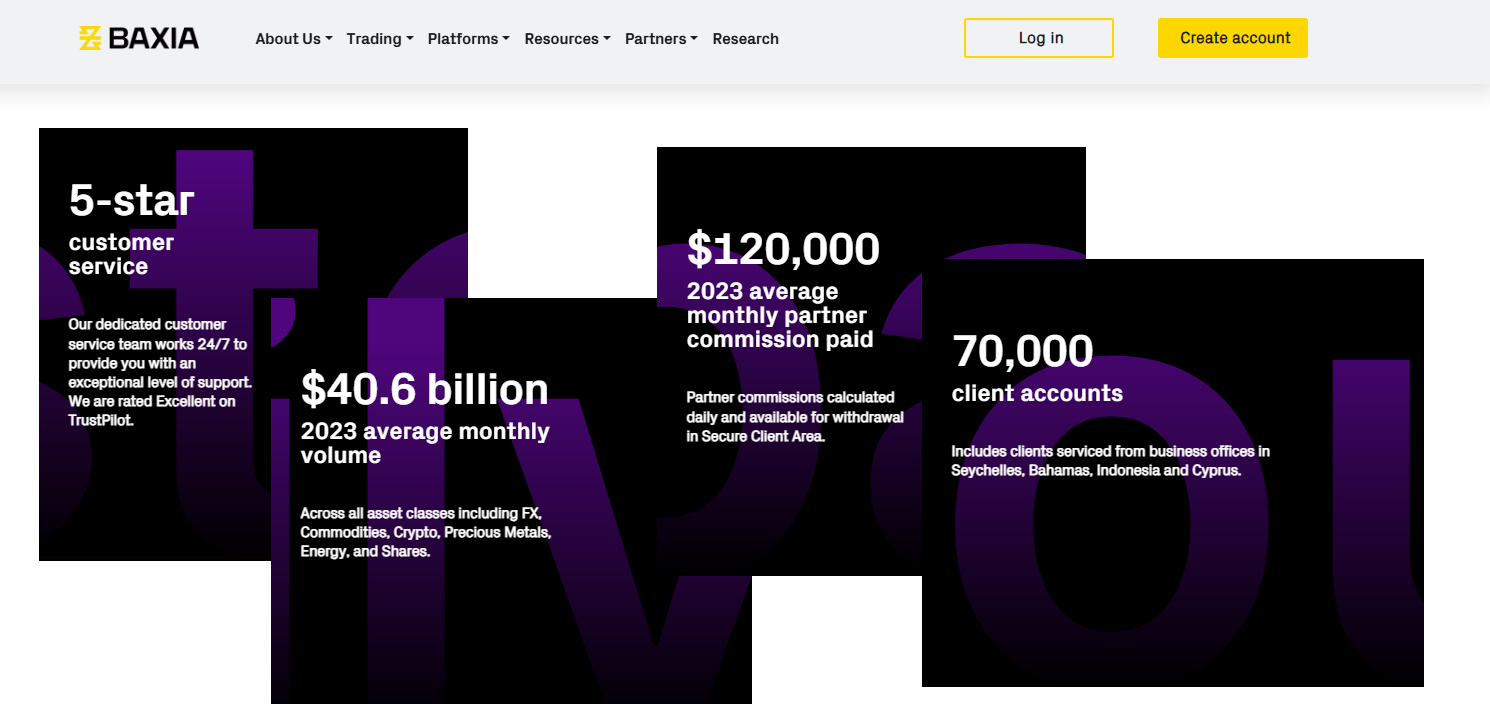

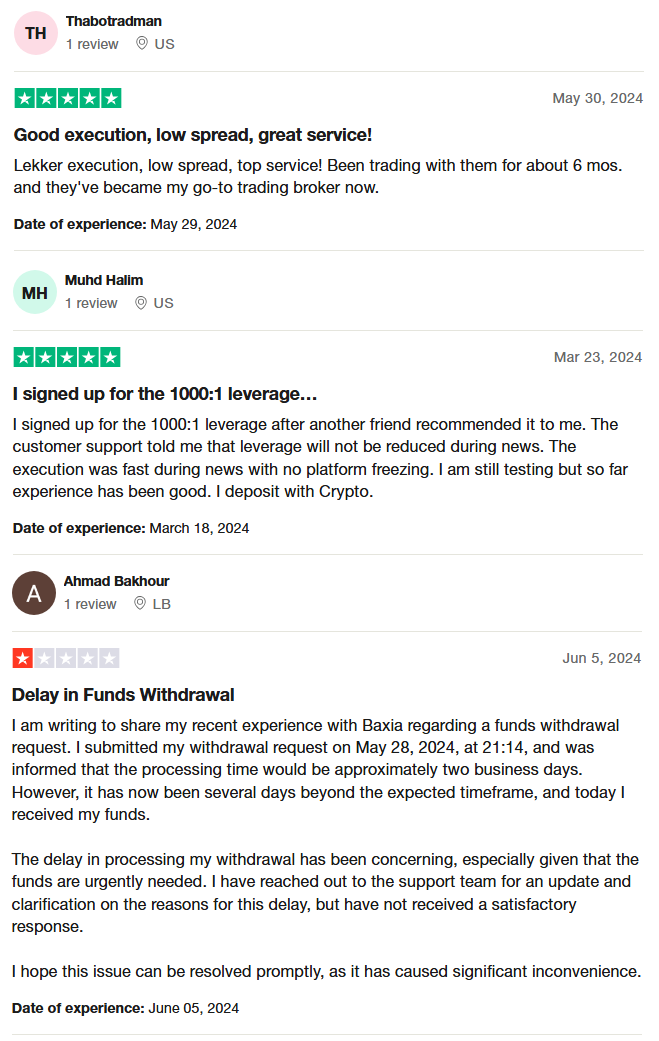

Customer reviews for Baxia Markets are generally positive, highlighting fast order execution and low spreads as key benefits. Many users appreciate the reliable customer service and the availability of high leverage options, with no platform freezing during high-impact news events. However, there have been some concerns about the withdrawal process, as one user experienced a delay beyond the expected timeframe, causing significant inconvenience. Overall, Baxia Markets is favored for its efficient trading environment and diverse deposit options, although improvements in withdrawal processing and customer support responsiveness are desired.

Baxia Markets Spreads, Fees, and Commissions

Baxia Markets offers competitive spreads, fees, and commissions, making it a viable choice for many traders. They provide two main types of accounts: the BxZero and BxStandard accounts. The BxZero account features spreads starting from 0.0 pips and charges a commission of $7 per round-turn lot, making it ideal for active traders who prioritize low spreads. On the other hand, the BxStandard account has spreads starting from 1.0 pips without any commission, catering to those who prefer straightforward cost structures.

In terms of non-trading fees, Baxia Markets stands out by not charging for deposits and withdrawals, although payment service providers might apply their own fees. This can be a significant advantage for traders looking to minimize additional costs. However, it’s worth noting that swap rates are applicable for positions held overnight, which is a common practice among brokers.

One notable feature is the absence of inactivity fees, which can save you money if you don’t trade frequently. Additionally, the broker ensures that traders can access a wide range of financial instruments, including Forex, metals, commodities, and indices, all within their robust trading platforms MetaTrader 4 and MetaTrader 5.

Account Types

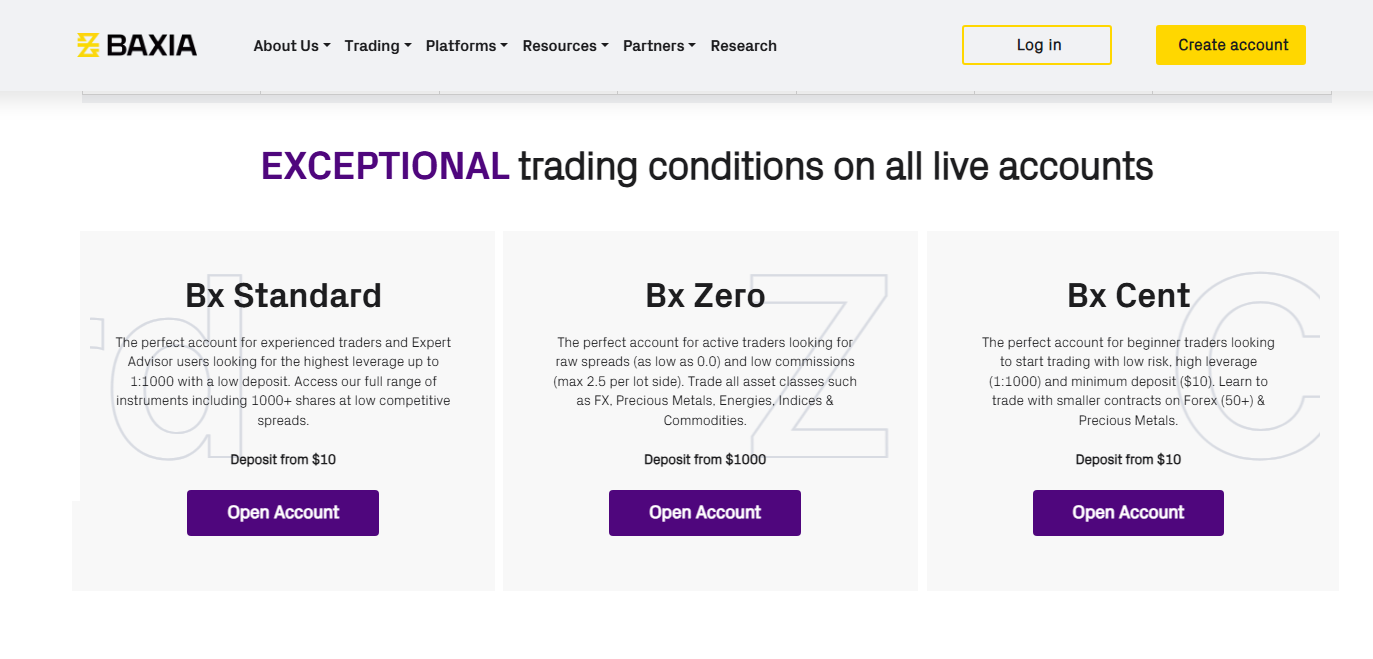

Baxia Markets offers three main types of trading accounts, each tailored to different needs:

Bx Standard Account

- Traditional spread pricing

- No commissions

- Spreads starting from 1.0 pip

- Minimum deposit is $10

Bx Zero Account

- Raw spreads from 0.0 pips

- Commission of $2.5 per side per 100,000 traded

- Ideal for experienced traders and scalpers

- Minimum deposit is $1000

Bx Cent Account

- Suitable for beginners and strategy testing

- Requires minimal investment

- Uses cent lots for low-risk trading

- Minimum deposit is $10

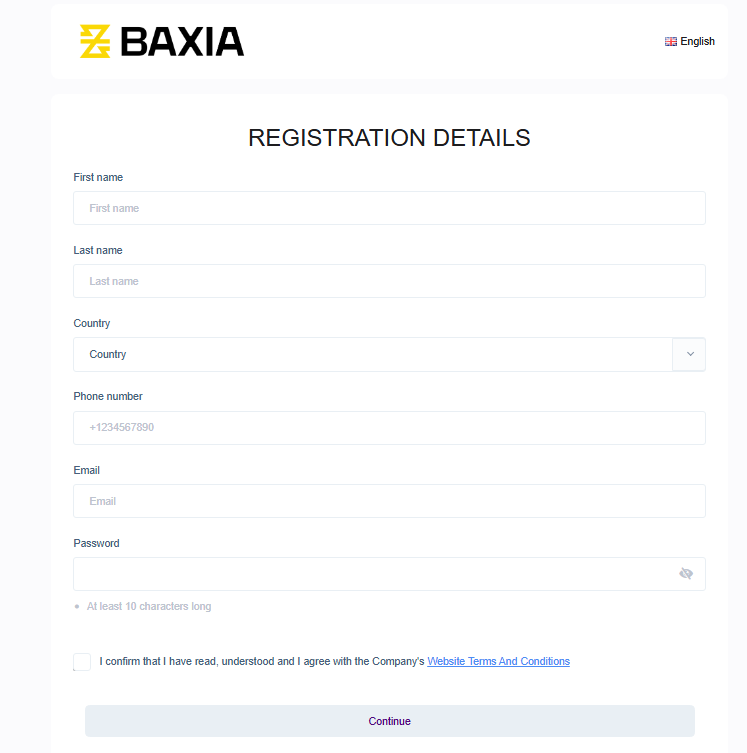

How to Open Your Account

- Visit the Baxia Markets website and click on “Create account” or “Start trading.”

- Complete the registration form with your name, surname, country, phone number, email, and password.

- Agree to Baxia Markets’ rules and conditions.

- Submit the registration form to create your account.

- Verify your email address by clicking the link sent to your email.

- Log in to your new account using your registered email and password.

- Upload the required documents for account verification.

- Once verified, deposit funds into your account to start trading.

Baxia Markets Trading Platforms

At Baxia Markets, traders can use both MetaTrader 4 and MetaTrader 5 platforms. MetaTrader 4 is well-known for its user-friendly interface and robust trading tools, making it ideal for both beginners and experienced traders. It offers various features like advanced charting tools, multiple order types, and automated trading capabilities through Expert Advisors.

MetaTrader 5, on the other hand, provides additional features and enhanced functionalities compared to its predecessor. It supports more order types, offers better charting tools, and includes a built-in economic calendar. Based on my experience, using these platforms allows for a seamless and efficient trading experience, catering to diverse trading needs.

What Can You Trade on Baxia Markets

Baxia Markets offers a diverse range of trading instruments, allowing traders to diversify their portfolios effectively.

- Forex Trading: Trade major, minor, and exotic currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Based on my experience, the forex market here offers competitive spreads and deep liquidity, making it suitable for various trading strategies.

- Precious Metals: You can trade CFDs on popular metals like Gold, Silver, Platinum, and Palladium. These instruments provide a hedge against inflation and are excellent for portfolio diversification.

- Cryptocurrencies: Trade CFDs on leading cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The platform offers tight spreads and fast execution, which is crucial for taking advantage of the volatile nature of crypto markets.

- Indices: Access CFDs on major global indices across Europe, Asia, and America. Trading indices allows you to speculate on the performance of a basket of stocks, providing broader market exposure.

- Energy: Trade CFDs on energy commodities like Brent oil, WTI, and Natural Gas. These instruments are essential for traders looking to benefit from price movements in the energy sector.

- Soft Commodities: Diversify further by trading CFDs on soft commodities such as soybeans, cocoa, wheat, and corn. These markets can offer unique trading opportunities based on global supply and demand factors.

- Shares: Trade CFDs on top public companies from the US, UK, and EU. This allows you to speculate on the stock prices of leading corporations, adding another layer of diversification to your trading portfolio.

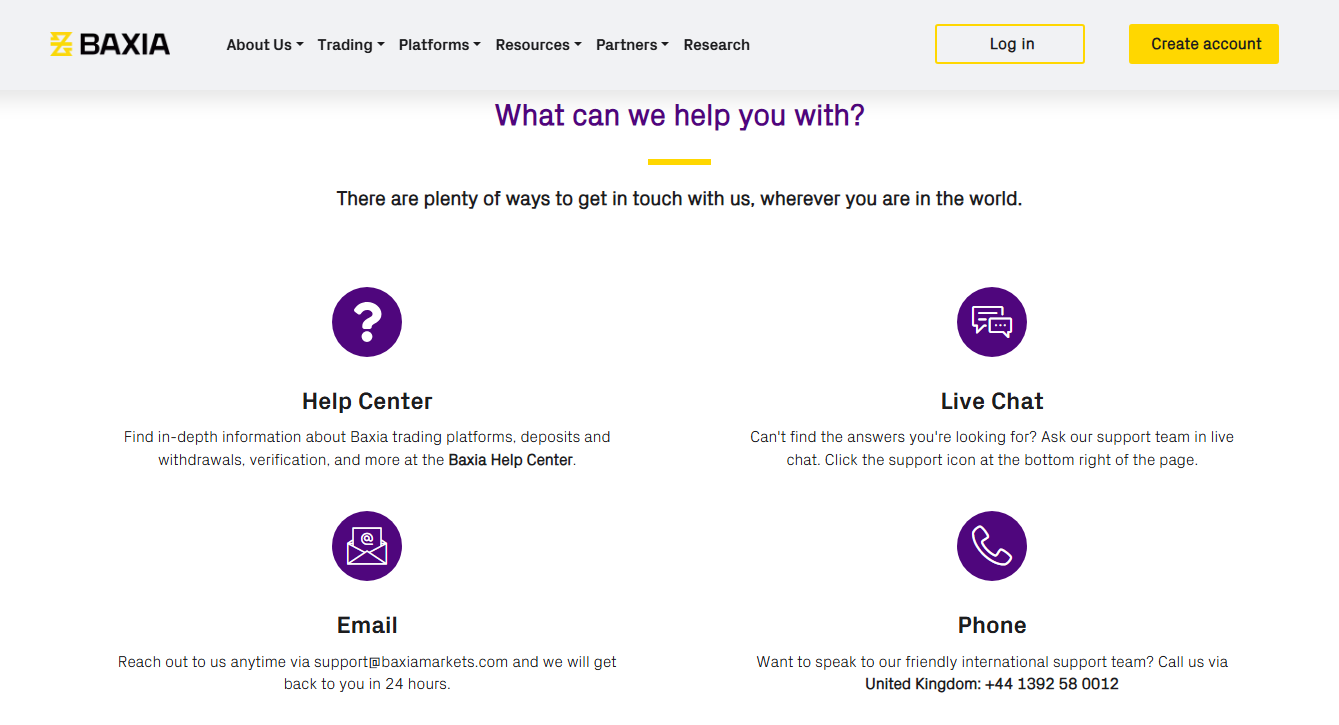

Baxia Markets Customer Support

Baxia Markets offers solid customer support designed to address your trading needs efficiently. The support team is available 24/5, ensuring you can get assistance whenever the markets are open. You can reach out via live chat for instant help, which I found particularly useful for quick queries and immediate assistance.

Email support is also available, and responses typically come within 24 hours, making it a reliable option for more detailed inquiries. Additionally, you can call their international support team for more direct communication. This multi-channel approach ensures that no matter what issue arises, you have a way to get it resolved promptly.

Advantages and Disadvantages of Baxia Markets Customer Support

Withdrawal Options and Fees

To withdraw funds from Baxia Markets, you’ll need to complete the account verification process first. This ensures the security and authenticity of your transactions. Based on my experience, the processing time for withdrawal requests can range from 2 to 5 days, depending on the method chosen.

You can withdraw funds using various options, including debit and credit cards, bank transfers, and payment systems like Astropay, Fasapay, Sticpay, PayRedeem, Mobile Money, and local transfers. Baxia Markets does not charge fees for deposits and withdrawals, but payment service providers might impose a commission fee of $5 and a bank transfer fee of $30.

It’s important to note that you can only withdraw funds using the same method you used for depositing. This policy helps maintain the security and integrity of your financial transactions.

Baxia Markets Vs Other Brokers

#1. Baxia Markets vs AvaTrade

Baxia Markets and AvaTrade both offer a range of trading instruments, but they differ significantly in their features. Baxia Markets provides high leverage up to 1:500 and ultra-low latency execution, making it ideal for high-frequency traders. AvaTrade, on the other hand, offers extensive educational resources and multiple trading platforms, including its proprietary AvaTradeGO. AvaTrade also has a longer track record and more comprehensive regulatory oversight.

Verdict: AvaTrade is better for beginners due to its educational resources and multiple platforms. Baxia Markets is more suitable for experienced traders seeking high leverage and fast execution.

#2. Baxia Markets vs RoboForex

Baxia Markets and RoboForex cater to different trading needs. Baxia Markets offers straightforward account types with competitive spreads and high leverage options. RoboForex provides a wider range of account types, including cent accounts and more trading platforms like cTrader and R Trader. RoboForex also offers more trading bonuses and promotions, which can be appealing to traders looking for additional perks.

Verdict: RoboForex is better for traders who want diverse account options and trading platforms. Baxia Markets stands out for its simplicity and high leverage, ideal for traders focusing on Forex.

#3. Baxia Markets vs Exness

Baxia Markets and Exness both offer high leverage, but Exness provides even higher leverage up to 1:2000. Exness also offers more advanced features like instant withdrawals and a wider range of financial instruments. Baxia Markets excels in providing low latency trading and a straightforward platform choice between MetaTrader 4 and 5, making it user-friendly and efficient.

Verdict: Exness is better for traders who need extremely high leverage and advanced features. Baxia Markets is preferable for those seeking low latency execution and a simple, effective trading environment.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH BAXIA MARKETS

Conclusion: Baxia Markets Review

Based on my insights and user feedback, Baxia Markets offers a solid trading experience with competitive spreads, high leverage, and efficient platforms like MetaTrader 4 and 5. The broker’s fast order execution and lack of inactivity fees are significant advantages, making it a suitable choice for both novice and experienced traders. However, there are some drawbacks, such as the absence of cent accounts and occasional delays in withdrawal processing.

Overall, Baxia Markets stands out for its user-friendly environment and diverse trading instruments. Nonetheless, potential users should be aware of the limited regulatory oversight and ensure they are comfortable with the broker’s specific terms and conditions before trading.

Also Read: MarketsVox Review 2024 – Expert Trader Insights

Baxia Markets Review: FAQs

What trading platforms does Baxia Markets offer?

Baxia Markets offers MetaTrader 4 and MetaTrader 5, both known for their user-friendly interfaces and robust trading tools.

Are there any fees for deposits and withdrawals with Baxia Markets

Baxia Markets does not charge fees for deposits and withdrawals, but payment service providers might impose their own fees.

How long does it take to process a withdrawal request at Baxia Markets?

Withdrawal requests typically take 2 to 5 days to process, depending on the chosen method.

OPEN AN ACCOUNT NOW WITH BAXIA MARKETS AND GET YOUR BONUS