The Bank of England is set to release its latest monetary policy report this week, with financial markets predicting a 60%+ chance of an interest rate cut on Thursday at noon UK time. In the June meeting, the decision to maintain rates was described as ‘finely balanced,’ as annual inflation dropped to 2% in May, meeting the central bank’s target. Despite this, UK services inflation stayed high at 5.7%, slightly down from 6% in March, partly due to index-linked or regulated prices and volatile components, according to the MPC. If the UK Bank Rate isn’t cut this week, markets are fully pricing in a rate cut at the September 19 meeting.

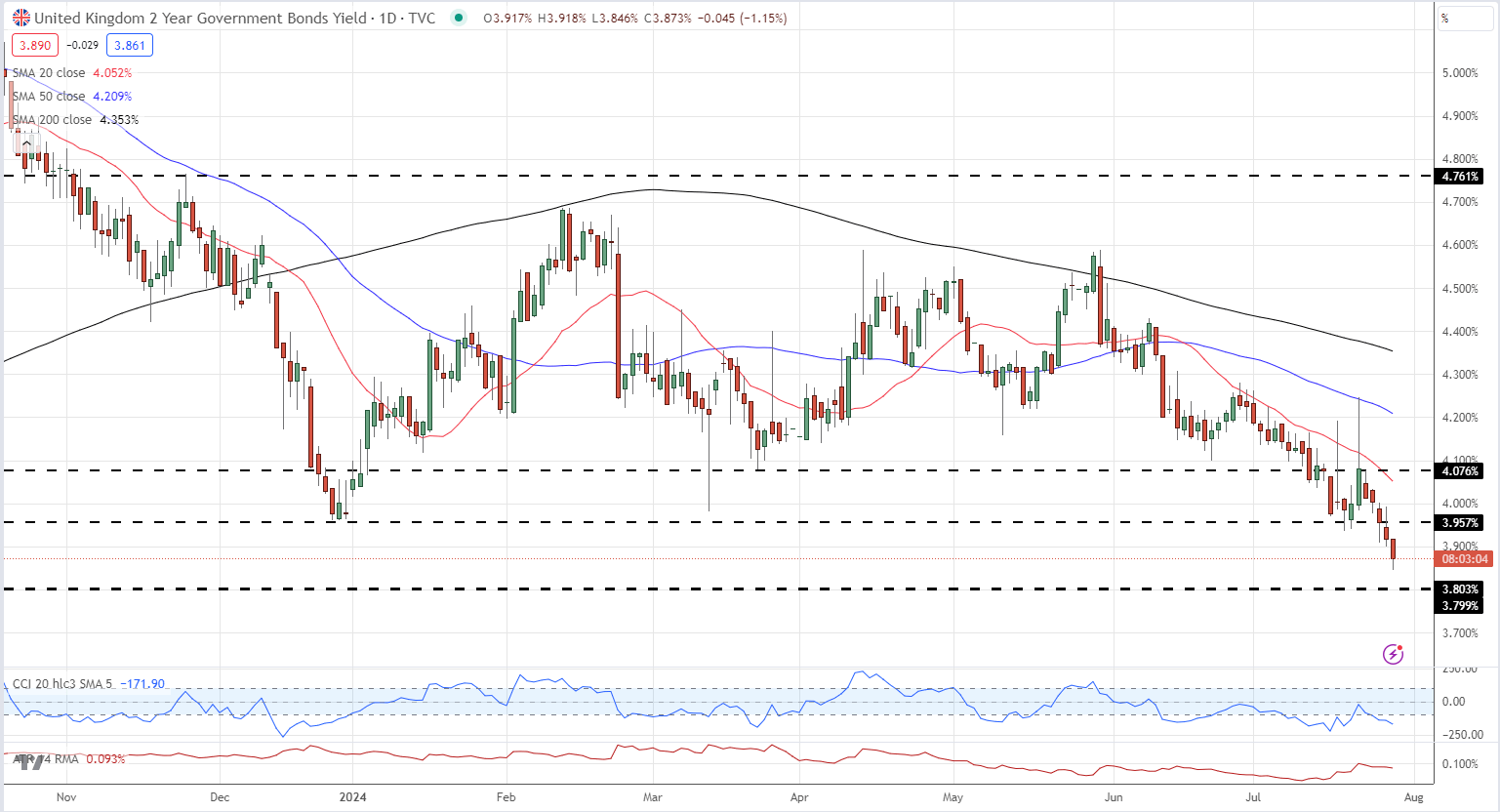

The anticipation of rate cuts has affected short-term UK borrowing costs, with the 2-year Gilt yield decreasing steadily since early June, reaching its lowest level in 14 months.

GBP/USD Fluctuations and Predictions

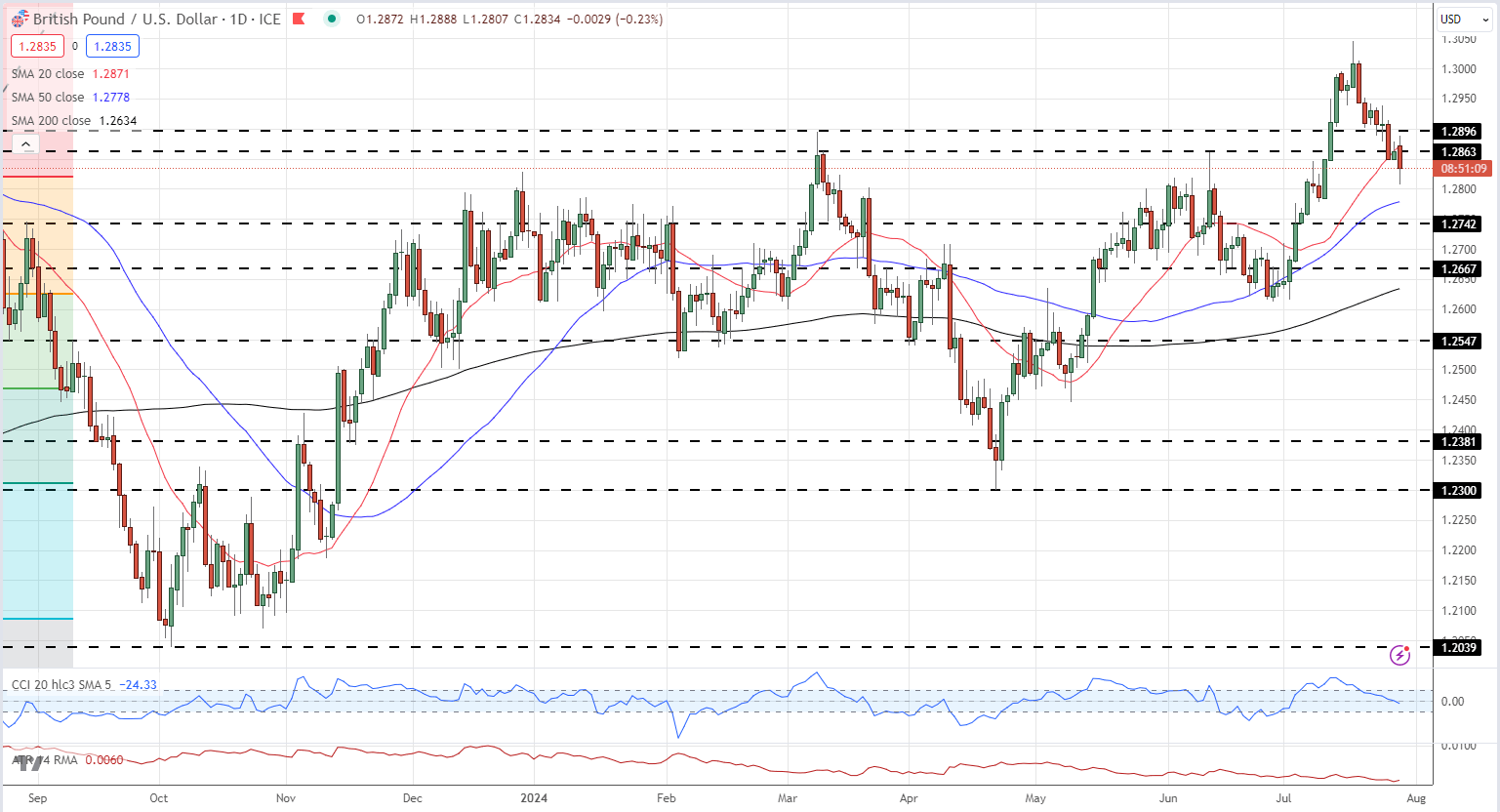

The GBP/USD hit a one-year high of 1.3045 in mid-July, driven by US dollar weakness. Since then, it has dropped about two cents due to lower bond yields and increasing rate cut expectations. The US Federal Reserve will announce its latest policy settings this week, a day before the BoE, with markets assigning only a 4% chance of a Fed rate cut. If this prediction holds, GBP/USD is unlikely to reach 1.3000 soon. A UK rate cut and a US rate hold will likely pressure the 1.2750 area in the short term, followed by 1.2667 and the 38.2% Fibonacci retracement level at 1.2626.

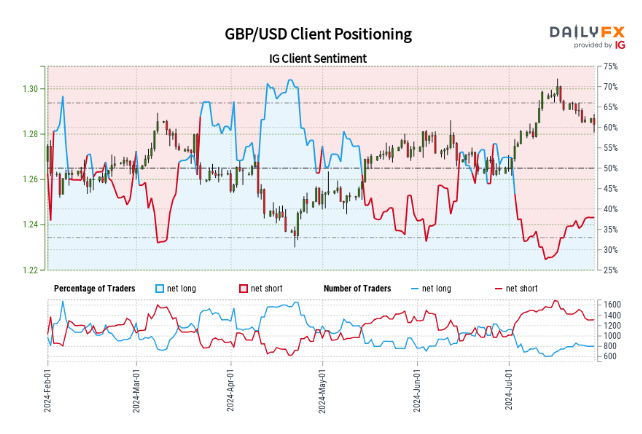

GBP/USD Sentiment Analysis

Retail trader data indicates 42.09% of traders are net-long, with a short-to-long ratio of 1.38 to 1. The number of traders net-long has increased by 10.30% since yesterday but decreased by 1.57% from last week. Conversely, net-short traders have decreased by 7.86% since yesterday and 19.09% from last week.

Analysts often take a contrarian stance to crowd sentiment, suggesting GBP/USD prices might continue to rise given the net-short positions. However, the reduction in net-short positions compared to yesterday and last week signals that the current GBP/USD price trend may soon reverse downward despite the prevailing net-short sentiment.