A situation where the present price of a given asset is larger than the prices transacted in the market for futures is called backwardation. The ideally customizable backwardation is a market circumstance where the futures contract price is presently being transacted much lower than the spot price of the given asset.

This is a counter option than the contango, which is not as frequently encountered, and the reason is that backwardation influences markets with cyclic phases of supply and demand in a normal market.

Also Read: How to Trade Futures – A Beginner’s Guide

Contents

- Futures Prices in a Market

- Why Is Backwardation Important

- The Basics of Futures Contract

- Backwardation vs. Contango

- Understanding Backwardation Futures Price

- Conclusion

- FAQs

Futures Prices in a Market

An example we can point to is a situation with the futures market about natural gas that is frequently in backwardation. The reason is that during the winter period, heating is a priority, natural gas is the preferred fuel, and there is a spike in demand for the resource that can create supply deficiencies.

Investors will assume a backwardation market position when they predict that the price of natural gas will decline. This situation is possible if there is a rise in supply, but demand for the product stays at preceding levels.

Why Is Backwardation Important

When there is a supply shortage in a given commodity, there is a probability the market will gravitate towards backwardation. Increased prices can confine demand and simultaneously will motivate manufacturers to improve output fast because there is the opportunity to exploit the larger delivery prices.

We can take another example of the price of cheese. If milk futures start climbing as a result of scarcity, consumers may choose to purchase cheese analogs such as soy cheese if it's a cheaper option at that moment. Other dairy producers will try to improve supplies of milk, so they can benefit from the increased larger prices.

The Basics of Futures Contract

The concept of futures contracts get based on a commitment of a buyer to acquire a given asset, like example crude oil, while the seller is obliged to sell the underlined asset at a prearranged future date, and that's the reason for the name. And the futures price is a price of a commodities futures contract that develops and concludes in the future.

For example, an October futures contract will ripen in October. The advantage of futures is that it permits traders to close a price, by purchasing or selling the basic asset. Every futures contract have predetermined prices and expiry dates. The contracts permit traders to assume control of a given asset at maturation or neutralize the contract by a trade. The net difference amid the buy and sale prices is cash-settled.

Also Read: Futures Trading Strategies You Can Try

Backwardation vs. Contango

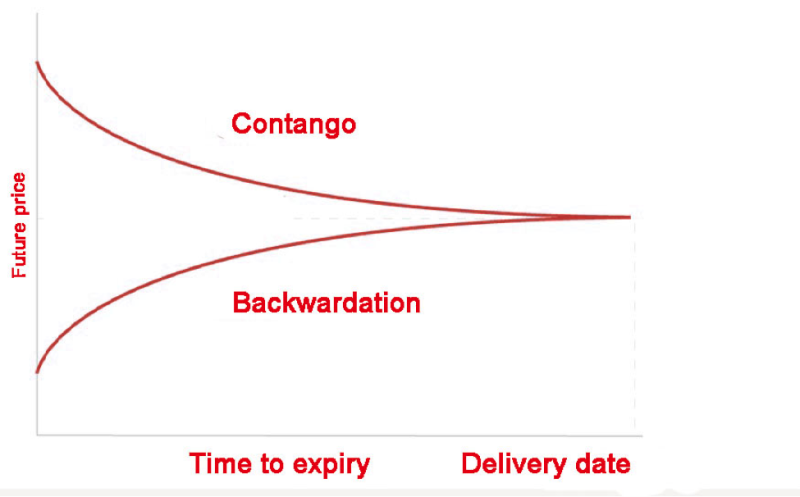

Contango is the product of a situation when the price of a futures contract that is presently trading higher when compared with the spot price of the asset.

When prices go up in the futures market with every consecutive date of maturity, this gets purported as the upward sloping forward curve, also known as the contango market.

With contango, the price of the April futures contract will be larger than May’s, which following the normal progression will be larger than June's. In a standard market situation, it's logical that the futures contract prices rise more than the date of maturity because they incorporate the expanse for the investment, things like transportation or storage expenses for an asset.

If futures prices are larger than the present prices, there's an opinion that the spot price is going to climb and combine with the futures price. For example, investors will sell futures contracts with higher future prices and buy the reduced spot prices. The effect is increased demand for the asset forcing the spot price to go higher. But the futures price and spot price will intersect.

The futures market can alter among contango and backwardation and stay in both for a prolonged or short period.

Understanding Backwardation Futures Price

The crucial element is the slope of the curve for prices of futures because it has the role of indicator of sentiment. The normal price of the given commodity is constantly fluctuating, with inclusion to the price of the future's contract, supply and demand, and trading positioning.

The spot price characterizes the present market assessment of a realistic price for a commodity. And the spot price indicates the present purchase or sell price that can fluctuate during the day and the reason for the changes in demand and supply factors.

If the strike price of a futures contract is smaller than the present spot price that signals an assumption that the present price is significantly larger, and the expected future price will finally decline in the future. Resulting in what is known as backwardation.

For investors, the backwardation reduces futures price and indicates that the present price is too high. The end effect of this situation is that the expected spot price will decline as the expiry dates nears.

Occasionally backwardation is mixed up with the inverted futures curve. Basically, the futures market anticipates larger prices during longer development and reduced prices as you near the day when a trader concentrates at the current spot price in the stock market.

Because the futures contract price is under the present spot price, traders are net-long on an asset and profit from the rise in prices of futures when both the spot price and futures price and spot price coincide. Plus, futures markets facing backwardation can be productive for short-term traders who can improve their position with arbitrage.

Still, traders can sustain losses from backwardation when the prices decline further, and the predicted spot price is stable because of events in the market. Investors that transact backwardation because of supply shortage in an asset, perceive the positions as subject to fast alterations when fresh suppliers enter the market or production intensifies.

Conclusion

Investors implement backwardation to estimate the present futures price in affiliation with the future expected spot price of an asset during delivery. This data instructs investors on the correct move about going long or short, and this is done on the expectation if the price of futures price is going to go up or decline under or connect with the spot price with the approach of the delivery date in commodities markets.

There is confusion about normal backwardation and the inverted futures curve. It's important to know that normal backwardation is a situation when the futures price is under the expected future spot price.

FAQs

Is Backwardation Bullish or Bearish?

When traders assume that prices in the long term will decrease, a market in backwardation is bearish.

What Are Backwardation and Contango?

Both backwardation and contango and backwardation explain the structure of the forward curve. A market that is in backwardation, means that the futures contract of the forward price is lower when compared to the spot price. The opposite is true of contango when the forward price of a futures contract is larger when compared with the spot price.

How do You Profit from Backwardation?

Profiting from backwardation is achieved when investors purchase a futures contract that trades under the expected spot price and the profit comes over time after the futures price coincides with the spot price.

What does Backwardation in Oil Mean?

Backwardation in oil means the present value is larger than prices for the upcoming period and inspires traders to sell and reduce supplies.