Contents

- What is Backtesting?

- Understanding Backtesting

- The Importance of Backtesting with Historical Data

- What is the Best Way to Backtest a Trading Strategy?

- Backtesting and Forward Testing

- Backtesting and Scenario Analysis

- Backtest Technical Indicators

- The Benefits of Backtesting

- The Limitations of Backtesting

- Backtesting Software

- Backtesting in Forex

- Conclusion

- FAQs

What is Backtesting?

Backtesting is the checking of a trading strategy performance based on historical data. Backtesting allows you to know, beforehand, how a trading strategy performs. It is a necessary step for developing and implementing a profitable trading strategy.

There are an unlimited number of methods to choose from, and even minor changes can drastically impact the outcome. Backtesting is vital since it determines whether some settings will perform better than others.

To be able to backtest, you would need a trading strategy. Regardless of the outcome of a trade, backtesting helps inform you if you need to make any adjustments to your strategy. A strategy helps you know when not to take a trade and when to take one.

Backtesting can be done in two popular ways. They include automated testing, which may involve using an automated backtesting software that shows the historical performance of a strategy over a given period.

It also shows the manual testing which involves testing your strategy against historical data by yourself. Both methods can be either straightforward or complex.

Also Read: Best Forex Strategy For Consistent Profits

Understanding Backtesting

Backtesting gives you an idea of possible outcomes and the risks involved before using a particular trading strategy.

Backtesting a trading strategy that gives positive results would make traders gain confidence in that strategy. In a case where a strategy gives negative results after backtesting, traders may be forced to change the strategy or stop using it completely.

Any quantitative trading idea can be backtested. The services of developers may be needed by traders who wish to use software to backtest a trading strategy. This entails a programmer converting the concept into the trading platform's proprietary language.

The Importance of Backtesting with Historical Data

Many traders lose money because they do not make trading decisions based on tested trading strategies and backtesting results.

The main factors to consider when creating a solid trading strategy are risks, rewards, and the difference between them. Backtesting allows you to estimate the value of those factors while showing the potential performance of a trading or investment strategy.

Backtesting gives traders or investors an idea of how their strategies would fair under present market volatility. It tests the strength of a strategy to know if it is worth implementing under real market conditions.

The loopholes in a trading plan will be discovered after proper backtesting. Sometimes a trading strategy just needs a few tweaks to its strategy parameters. This modification can help improve the integrity of a trading plan.

You may wash off any concerns, increase your tools and methodologies, and develop confidence in your trading plan by completing a proper backtest. When your strategy is used in live market circumstances, it will result in a satisfactory result.

What is the Best Way to Backtest a Trading Strategy?

These are several methods you can use to manually backtest trading strategies. For proper backtesting, historical data on the price action of the necessary currency pair is required. Historical data for some weeks or months is needed.

Define the parameters

The first step needed to carry out manual backtesting is to identify the strategy parameters.

The formalization, rationalization, and emphasis design elements all imply a planned approach, as suggested by conventional notions of the strategic planning process.

Identify the market and time frame

Before backtesting any strategy or plan, you should have specific financial markets and time frames your strategy works with. Narrowing down your strategy makes backtesting and trading less complicated.

If your strategy works best on lower time frames, then backtest and trade on the lower time frames. Financial markets can be very broad. Find the best asset classes to trade and backtest with. This would help keep things simple and easy.

Gather historical data for your strategy

Look for trade setups for your strategy with specific markets and timeframes. When manually backtesting a trading plan, you should check the outcome of your trading strategy against previous price patterns from days, weeks, months, or even years ago while maintaining a specific time frame and trading pair. It can be done using technical analysis.

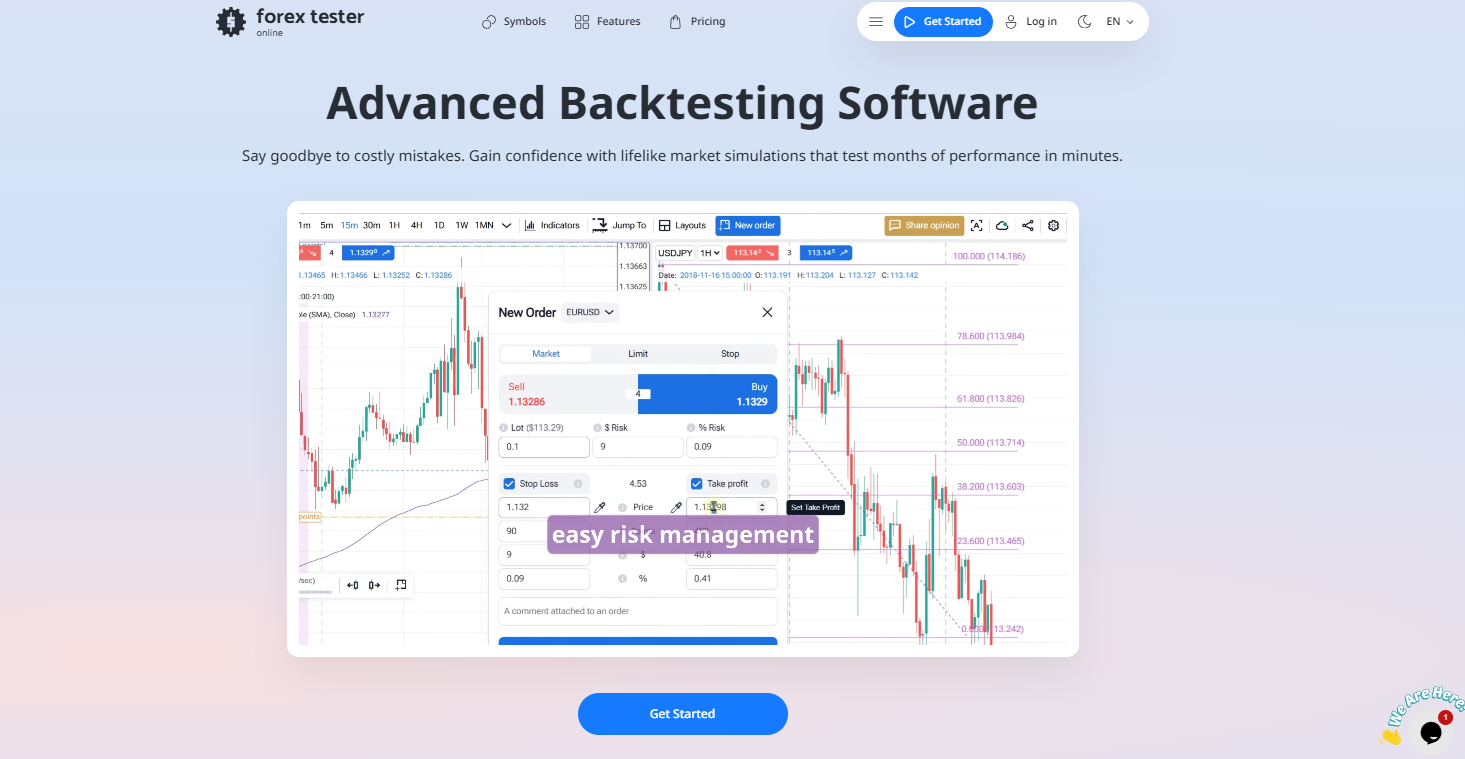

If you are looking for a good backtesting tool, you could check out Forex Tester Online. It simulates real market conditions with accurate spreads, commissions, and swaps. The platform lets you sync multiple charts and adjust testing speeds, so you can review full trading days in seconds.

TRY FOREX TESTER ONLINE FOR YOUR BACKTESTING TRADING STRATEGIES

Mark up the charts

Locate as many previous setups as possible on the charts and mark them up. Mark out your entries, stop losses, take profits, leverage and machine learning as suggested by your trading strategy. When this is done, write down the results.

Analyze the results

From the recorded data, after marking up the chart, find out the percentage return or success rate of your strategy.

This can be done by comparing the aggregated losing trades with the total winning trades. If the strategy performed poorly, then it is advisable to opt for another strategy.

On the other hand, if the trading strategy helps increase profits, deduct all trading costs and the initial capital to estimate your net profit.

If the strategy generates results, then you can implement the trading technique with a live trading account.

Backtesting and Forward Testing

Backtesting is the act of discovering trades based on historical data in order to assess a strategy's performance level during the backtesting period, while forward testing is a method of simulated trading, which is also called “paper trading” a strategy in real-world settings.

This necessitates the traders keeping a real-time eye on the market and reacting to strategy entrance and exit indications as they arise. Paper trading is most often done with demo trading accounts, it teaches traders the importance of look ahead bias.

Backtesting determines if a strategy has profit potential, whereas forward testing confirms or disproves this. Forward testing is even more time consuming because it must be done in real-time.

A trader may arrange months' worth of past deals in a single day using backtesting, whereas each day is traded as it happens. Forward testing can sometimes be called “walk forward optimization.”

Backtesting and forward testing are used to provide a more comprehensive view of a strategy's performance across time.

Backtesting and Scenario Analysis

Backtesting employs real historical data to check for suitability or performance, whereas scenario analysis uses imaginary data to model potential possibilities.

Scenario analysis, for example, would mimic particular price movements of the portfolio's assets or critical factors that occur, such as an interest rate fluctuation.

Scenario analysis is frequently used to forecast alterations in your portfolio value in reaction to a negative occurrence, and it might be used to investigate such situations using hypotheses.

Backtest Technical Indicators

Technical indicators are important for back-testing because they offer good signals for a particular moment.

For instance, a trade is initiated when the relative strength index (RSI) rises over an area of interest after falling below the level with every daily candlestick close, and the trade is entered at the next open. This is a fairly specific signal that can be readily verified, given that the exiting is likewise accurate.

Indicators might include the levels or signs that will cause a trade to execute or close. Normally, it reveals an exact moment, such as an execution or closing signal, to minimise any uncertainty about when the transaction should be performed.

On trading platforms, there are a variety of technical indicators that may be utilised to backtest a trading strategy or plan.

Moving Averages, Ichimoku Cloud, and Bollinger Bands are popular backtesting indicators.

Also Read: Most Accurate Intraday Trading Indicators

The Benefits of Backtesting

Backtesting done correctly will reveal whether or not a concept has a long-term advantage and in what circumstances it will appear.

We can pinpoint the ones that provide the greatest value for a certain concept by carefully controlling for varying characteristics.

We may assess the edge's sensitivity to changing settings and test for resilience. We may be able to identify the certain market environment where the advantage is considerable and tradeable, or a subset of the overall market trading goals where this approach works best, based on this information.

Backtesting would show the winning rate of a strategy, the need for commissions and slippage, the greatest unfavourable excursion, the longest typical winning and losing streaks, and both the maximum and average numbers of wins and losses.

With this information, we can establish where, when, and under what circumstances this concept can be traded, as well as the predicted outcomes.

We can then match real outcomes to backtest results to verify if the trades can be handled as anticipated after we move into the live market using the system model with proper risk management tools.

The Limitations of Backtesting

Backtesting has a number of drawbacks, one of which is that it can lead to a trader's cockiness in a method based on its prior performance.

Market conditions change a lot. A strategy might work for an extensive time period, then perform poorly afterward. Historical data is not a guarantee of future performance. The market can be very difficult to navigate at times.

Traders will frequently observe a huge difference between backtesting statistics and actual outcomes from real trading, even when they execute a backtest thoroughly and fully aware of the limitations of its capacity to foresee the future.

This disparity might be caused by a number of factors. Traders may sometimes backtest a strategy independently, rather than as part of a larger collection of strategies.

Backtesting frequently employs exaggerated slippage and cost levels. Often, the backtest fails to account for the human element in implementing a set of trading rules. This is one of the most ignored areas of backtesting.

In particular, backtesting or any prediction process has limitations, which is likely the most difficult concept for traders to grasp.

Backtesting is so crucial to some traders that proof of dissimilar real results will still not persuade them to believe they got something wrong. They may continue to trade a system without implementing a look-ahead bias.

The embedded belief systems of professional engineers and doctors are especially vulnerable to this issue.

Those occupations place a high value on being correct in order to succeed, but in the trading industry, the capacity to act with imperfect knowledge and a desire to be incorrect frequently leads to the best outcomes.

Backtesting has numerous benefits, a skilled trader is also aware of its limitations. Before committing to full production system risk, the professional trader should examine backtesting findings as a means to pick a system to design utilizing actual cash, in financial markets, with all human elements fully engaged to see what the real-world outcomes look like.

Backtesting Software

There are platforms that allow you to do backtesting on previous data. While choosing a backtesting solution, keep the following considerations in mind:

- You should know the assets available on the trading platform.

- You should know the compatible sources of market information.

- The supported programming language for backtesting software that can be potentially used to create your trading strategy on a platform.

Some popular backtesting Softwares are QuantConnect , Quanthouse, MetaTrader, Amibroker, and Blueshift. Most backtesting software runs on programs and codes.

Backtesting in Forex

Back-testing manually in the foreign exchange market works the same way it does in other financial markets.

However, because the foreign exchange market is open all time period day, you must only backtest at hours when you can really trade.

Unless automation or algorithmic trading is used, back-testing a forex strategy for some weeks and utilizing all moments of each day is unlikely to yield solid results.

Factor in when you would be free to trade before you start back-testing. You can be limited to trading with not enough free time.

When back-testing the foreign exchange market, all you have to do is keep track of the trades you make and the earnings and losses you make within the trading window.

Conclusion

Backtesting was once a privilege reserved only for the big fish, such as hedge funds, investment banks, and high-frequency trading businesses.

Backtesting is now available to retail traders and small-scale investors, thanks to technological advancements.

Backtesting is no longer considered a luxury. It has become a requirement if you want to properly navigate the financial markets.

In the best-case situation, trading without thorough backtesting is equivalent to making an informed estimate. The trader's homework is to backtest a trading technique.

You go out into the wild unprepared, defenseless, and ready to be exposed not only by the market but also by other traders if you don't do a thorough first study and risk assessment. Keep in mind that the majority of the traders are amateurs.

FAQs

How many times should you backtest a trading strategy?

If a strategy requires you to hold a trade for about a month, then the strategy should be backtested for 3 years or more.

What is a backtest strategy?

Backtesting is the process of determining the accuracy of a strategy or forecast model by applying it to past data. It enables traders to test trading techniques without putting their money at danger. Net profit/loss, return, risk-adjusted return, market exposure, and volatility are all common backtesting metrics.

How do you backtest a trading strategy?

There are several steps which you can take if you wish to backtest your trading strategy. These steps are manual and they require some historical data.

However, the first step to take is defining the strategy parameters. This will help you understand the level at which the backtest would go.

Next, you have to specify the financial markets and chart timeframe in which the strategy will be tested.

Also, you need to check out for trades that are based on strategy, chart timeframe and market. You can also analyze the price for entry and exit signals before finding the gross return and record of all trades.

After that, you can find the net return, deduct the commission and then get the percentage return for the whole period.

Is backtesting accurate?

Yes, backtesting is accurate and reliable as well. This type of trading strategy is like the pattern or history of the market.

You can always go back to the history to check out the pattern that has been going on for a period of time.

How accurate is tradingview backtest?

The accuracy of trading view back has not been proven yet. When calculating on every tick we can say they are in accurate. The essence of a tradingview strategy is calculating on the close of each price bar.