B2Broker Review

This review will give a detailed information about B2Broker, a well-established liquidity and technology provider catering to forex brokers, exchanges, corporate and institutional clients. The company offers solutions like liquidity aggregation, white-label platforms, and payment gateway integrations designed to simplify operations for businesses in the financial markets.

B2Broker supports multiple asset classes, including forex, cryptocurrencies, and CFDs, ensuring diverse trading opportunities for its clients. Its services include custom-built technologies, such as its proprietary liquidity aggregation, which helps brokers provide seamless trading experiences.

With competitive pricing, regulatory compliance, and tailored offerings, B2Broker has positioned itself as a reliable partner for businesses aiming to scale. Its emphasis on innovation and customer-centric solutions makes it a strong choice for entities looking to enhance their financial services infrastructure.

What is B2Broker?

B2Broker is a technology and liquidity provider for CFD trading, forex and cryptocurrency markets, offering solutions to brokers, exchanges, and fintech companies. Its services include multi-asset liquidity, turnkey brokerage solutions, and payment processing technology, designed to streamline business operations in the financial sector.

The company’s offerings are tailored to meet the demands of various financial institutions, providing advanced tools like a Forex CRM, margin trading platforms, and crypto liquidity solutions. B2Broker‘s Prime Multi-Asset Liquidity service provides institutional clients with access to a comprehensive range of financial instruments, including Forex, cryptocurrencies, commodities, indices, and equities. By aggregating liquidity from multiple Tier-1 banks and non-bank liquidity providers, B2Broker ensures deep market depth, tight spreads, and rapid execution speeds.

B2Broker Regulation and Safety

B2Broker operates under multiple regulations to ensure client safety and transparency. The company is licensed by reputable authorities, including CySEC and the FCA, which reinforces its commitment to maintaining strict compliance standards. These regulations protect client funds and provide oversight of the firm’s operations.

To enhance security, B2Broker uses segregated accounts for client funds, ensuring they are kept separate from company assets. Additionally, advanced encryption and cybersecurity measures safeguard sensitive client data, offering peace of mind to users and with the overseer of government authority.

B2Broker Pros and Cons

Pros

- Regulated

- Multi-asset

- Turnkey solutions

- Crypto gateway

Cons

- Costly setup

- Complex features

- Region limits

- High entry

Benefits of Trading with B2Broker

Trading with B2Broker offers multiple advantages tailored for new and experienced traders and gives real time market data. It provides access to deep liquidity pools across forex, crypto, and CFDs, ensuring competitive pricing and fast execution enabling traders to benefit from seamless order fulfillment and minimal slippage.

B2Broker stands out with its customizable solutions, including white-label platforms, payment gateways, and multi-asset liquidity services. These features empower businesses to launch or enhance their trading operations efficiently. Additionally, the firm’s regulatory compliance adds credibility, building trust among clients in global markets.

B2Broker Customer Reviews

B2Broker has received varied feedback from users, highlighting its strengths and areas for improvement. Many customers praise its comprehensive liquidity and technology solutions, particularly for brokers and financial institutions. The platform’s range of offerings, including cryptocurrency payment systems and trading platforms, is seen as a major advantage.

However, some users have expressed concerns about customer support response times and the complexity of certain services. Despite this, B2Broker remains a popular choice for those seeking advanced tools and competitive pricing in the fintech and brokerage industries.

B2Broker Spreads, Fees, and Commissions

B2Broker offers competitive spreads across its trading platforms, tailored for institutions and brokers. Spreads vary based on account type and trading instruments, ensuring flexibility for different trading needs. These spreads are designed to accommodate a wide range of trading volumes and strategies.

Fees and commissions with B2Broker are transparent and depend on the trading model chosen by the client. The platform supports both commission-based and spread-only models, allowing brokers to align costs with their business structure. Such flexibility makes it a viable choice for professionals in the trading industry.

Account Types

B2Broker offers multiple account types designed to cater to diverse business needs in the financial industry. These accounts are tailored to provide flexibility, advanced tools, and seamless integration for brokers, exchanges, and institutions. Each type comes with unique features to suit specific operational requirements.

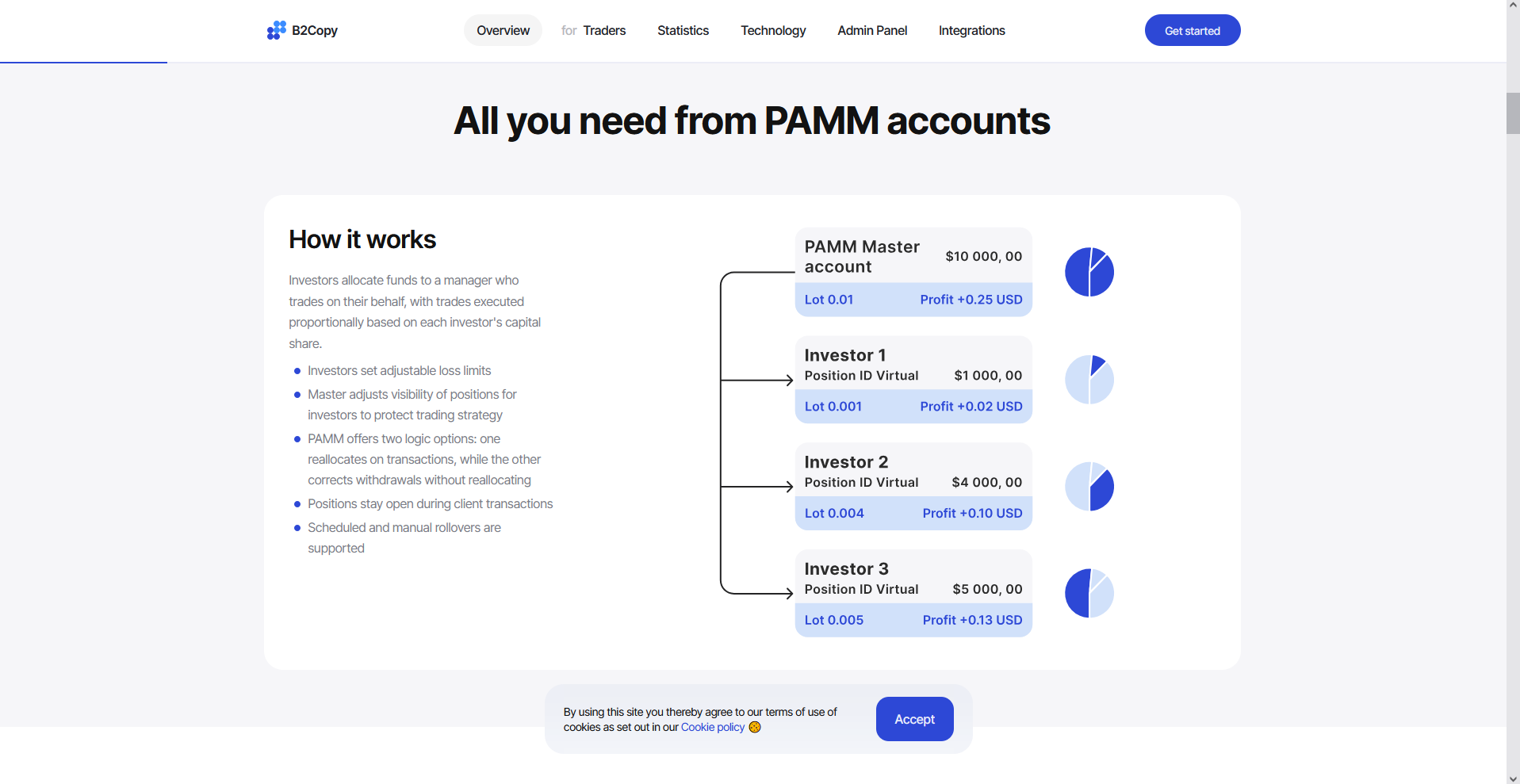

PAMM Account

B2Broker’s Percent Allocation Management Module (PAMM) accounts enable investors to allocate funds to a master trader, who manages pooled capital on their behalf. Trades are executed proportionally based on each investor’s share, allowing for collective investment strategies. This setup benefits both brokers and clients by enhancing trading activity and offering expert fund management.

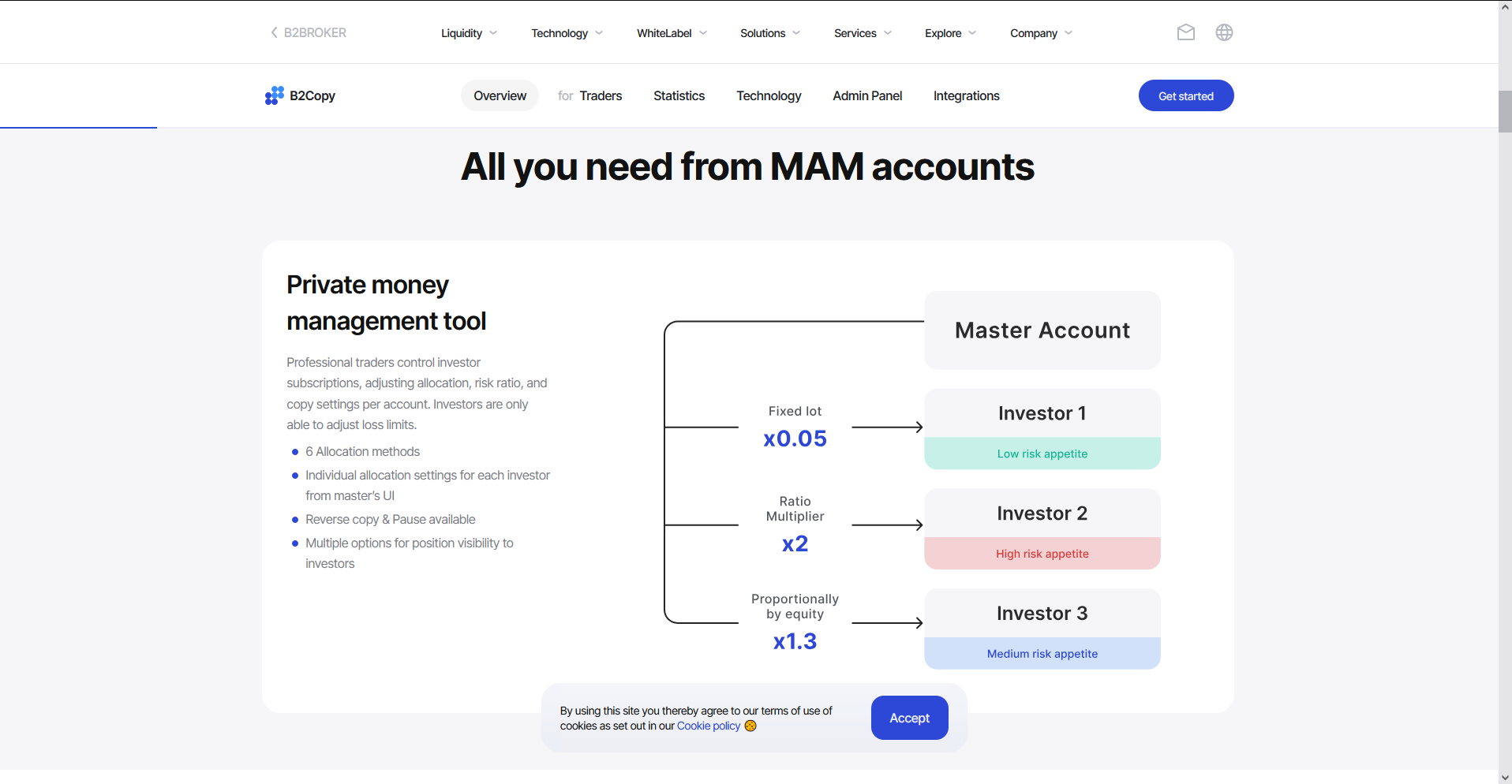

MAM Account

Multi-Account Manager (MAM) accounts by B2Broker are designed for professional money managers and hedge funds, allowing them to manage multiple client accounts with customizable allocation methods. MAM accounts offer features like seven allocation methods and the ability to activate or deactivate investors without closing positions. This flexibility makes them ideal for managing diverse investment pools.

Using Demo accounts, it’ll be beneficial for both new and experienced customers allowing traders to experience other client feedback and test the regulatory authority and the regulatory oversight. Also, copy trading has user friendly interface and diverse range of available trader with active presence providing access for easy trading.

How to Open Your Account

Opening an account with B2Broker is straightforward and designed to suit businesses in the financial and cryptocurrency industries. The process involves consultation, documentation, and setup, ensuring tailored solutions for each client. Here’s a step-by-step guide to get started with B2Broker.

Step 1: Go to B2Broker Website

Reach out to B2Broker through their website or official contact channels. Provide your business details and specify the services or solutions you need. Their team will arrange a consultation to assess your requirements.

Step 2: Discuss Your Requirements

Work with the B2Broker team to outline your business objectives and preferred services. They will present a detailed proposal based on your needs, ensuring a customized solution.

Step 3: Submit Documentation

Prepare and submit necessary documents as requested by B2Broker. These typically include identification, business registration details, and compliance forms to meet regulatory standards.

Step 4: Complete the Setup

Once documentation is verified, the B2Broker team will assist in setting up your account and integrating the required solutions. You’ll receive continuous support to ensure a smooth implementation process.

B2Broker Trading Platforms

B2Broker Trading Platforms offer a robust suite of solutions tailored to brokers, crypto exchanges, and financial institutions. These platforms provide access to a wide range of trading tools, including multi-asset support, liquidity aggregation, and advanced order execution features. Designed for both retail and institutional clients, B2Broker ensures seamless integration and high-speed performance.

The platforms are compatible with MetaTrader 4 and 5, allowing brokers to offer familiar environments to their clients. Additionally, B2Broker includes back-office systems, risk management tools, and white-label options, ensuring businesses can efficiently manage operations. Their focus on scalability and customizability makes them a preferred choice for growing financial enterprises.

Also, B2Broker offers a comprehensive cTrader White Label solution, enabling brokers to establish or enhance their Forex, cryptocurrency, or multi-asset brokerage services efficiently. This solution includes a cTrader server license, backup systems, a global network of access servers, and ongoing maintenance, allowing brokers to focus on client engagement without the complexities of technical setup.

What Can You Trade on B2Broker

B2Broker provides a wide range of trading instruments, making it a versatile platform for brokers and financial institutions. From traditional markets to emerging digital assets, the platform supports diverse options to meet trading needs effectively.

Forex

B2Broker offers access to major, minor, and exotic currency pairs. This allows traders to explore global currency markets with tight spreads and fast execution speeds.

Cryptocurrencies

The platform supports popular cryptocurrencies like Bitcoin, Ethereum, and altcoins. This feature enables trading in the fast-growing digital asset market with advanced liquidity options.

CFDs

B2Broker includes Contracts for Difference (CFDs) on indices, commodities, and stocks. These instruments provide a flexible way to trade market price movements without owning the underlying assets.

Metals

Gold, silver, and other precious metals are available for trading on B2Broker. These assets are ideal for traders seeking stability or diversification in their portfolios.

B2Broker Customer Support

B2Broker Customer Support offers comprehensive assistance tailored to meet client needs in the financial sector. The support team is available 24/7, ensuring timely responses to queries related to their products and services, including brokerage and crypto solutions.

Clients can access support via multiple channels, such as live chat, email, and phone. The company emphasizes quick problem resolution and expert guidance, making it a reliable choice for both beginners and experienced users in the industry.

Advantages and Disadvantages of B2Broker Customer Support

Withdrawal Options and Fees

B2Broker provides multiple withdrawal options to ensure convenience for its clients. These options cater to different needs, including traditional and digital payment methods. Fees and processing times vary depending on the chosen method.

Bank Transfers

Bank transfers allow users to withdraw funds directly to their bank accounts. B2Broker ensures secure transactions, but processing times may take a few business days. Fees depend on the bank and transfer region.

Cryptocurrency

B2Broker supports withdrawals in cryptocurrencies like Bitcoin and Ethereum. This option provides faster processing times compared to traditional methods. Network fees apply and vary based on blockchain activity.

E-wallets

E-wallets like Skrill and Neteller are supported for quick and straightforward withdrawals. B2Broker offers this option for those seeking convenience and speed. Transaction fees and availability depend on the service provider.

Internal Transfers

B2Broker allows internal transfers between accounts for users within its ecosystem. These transfers are typically free and processed instantly, making them ideal for fund management.

B2Broker Vs Other Brokers

#1. B2Broker vs AvaTrade

B2Broker caters to brokers and financial institutions with liquidity solutions, crypto payment gateways, and turnkey brokerage setups, emphasizing technological infrastructure. In contrast, AvaTrade is a retail broker focused on individual traders, offering user-friendly platforms, a wide range of tradable assets, and educational resources. While B2Broker targets businesses with advanced services, AvaTrade is designed for ease of use and accessibility for retail traders. Both serve different markets but share a commitment to innovation in trading.

Verdict: B2Broker is ideal for institutions seeking robust infrastructure, while AvaTrade excels for retail traders starting or expanding their portfolios. Choosing between them depends on whether the focus is on institutional needs or individual trading convenience.

#2. B2Broker vs RoboForex

B2Broker and RoboForex serve different market needs, with B2Broker catering primarily to brokers and financial institutions through its liquidity, crypto payment gateway, and turnkey solutions, while RoboForex focuses on individual traders with user-friendly trading platforms, competitive spreads, and multiple account types. B2Broker offers a comprehensive B2B infrastructure for launching brokerages, whereas RoboForex emphasizes accessibility for retail traders with lower entry costs and diverse trading tools.

Verdict: For businesses looking to build or expand a brokerage, B2Broker is the better choice with its institutional-grade solutions. Retail traders seeking affordable and accessible trading options may find RoboForex more aligned with their needs.

#3. B2Broker vs Exness

B2Broker and Exness serve different segments of the financial market. B2Broker focuses on institutional clients, offering multi-asset liquidity, crypto payment solutions, and turnkey brokerage setups. Exness, on the other hand, is tailored for retail traders, providing user-friendly platforms, flexible account types, and low entry barriers. While B2Broker is ideal for businesses requiring comprehensive solutions, Exness emphasizes accessibility and simplicity for individual traders.

Verdict: B2Broker is better suited for institutions and brokers needing advanced tools and liquidity services. Exness is a stronger choice for retail traders seeking ease of use and affordable trading options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: B2Broker Review

B2Broker stands out as a comprehensive solution provider for businesses in the financial services industry. It offers a range of services, including liquidity provision, technology solutions, and white-label platforms, making it a one-stop shop for brokers, exchanges, and hedge funds. Its user-friendly tools and competitive offerings cater to a wide array of financial market participants.

For those seeking reliable technology and liquidity services, B2Broker provides strong value backed by innovative features and extensive industry expertise. Businesses looking to scale or streamline their operations may find it an excellent partner to achieve their goals.

B2Broker Review: FAQs

What is B2Broker?

B2Broker is a technology and liquidity provider specializing in solutions for the Forex, cryptocurrency, and CFD industries. The company offers services like liquidity aggregation, payment gateway integration, and turnkey brokerage solutions, catering to brokers and financial institutions globally.

What services does B2Broker offer?

B2Broker provides multi-asset liquidity, crypto payment processing, and software for managing trading platforms. They also offer turnkey solutions that include everything needed to launch a brokerage, from trading platforms to regulatory support.

Who can benefit from B2Broker?

B2Broker’s services are tailored for brokers, cryptocurrency exchanges, and financial institutions. Their solutions help these entities improve trading operations and expand their market offerings effectively.

OPEN AN ACCOUNT NOW WITH B2BROKER AND GET YOUR BONUS