AxiTrader Review

AxiTrader is a well-known online trading platform that has been providing financial services to clients worldwide for several years. As one of the leading forex brokers in the industry, AxiTrader provides traders with access to a wide range of financial markets, including forex, commodities, indices, and cryptocurrencies. With a user-friendly interface and a variety of trading tools, AxiTrader has become a popular choice among traders of all levels, from novice to professional.

In this review of AxiTrader, we will take a closer look at its offerings, including its trading platforms, account types, fees, and customer support, to help you determine if this broker is the right fit for your trading needs, thanks to the help of our financial experts at Asia Forex Mentor.

What is AxiTrader?

AxiTrader is a global online forex and CFD trading provider that was founded in 2007. The company is headquartered in Australia and is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. AxiTrader provides traders with access to a wide range of financial markets, including forex, commodities, indices, and cryptocurrencies, through the popular MetaTrader 4 trading platform, plus a web station and a mobile trading application.

The goal of AxiTrader is to provide traders with the tools and resources they need to trade the financial markets with confidence. The company’s core values are transparency, integrity, and excellence, and it strives to provide its clients with the best possible trading experience through its cutting-edge technology, competitive pricing, and top-notch customer support.

In addition to its trading services, AxiTrader also provides a range of educational resources to help traders improve their skills and knowledge. These resources include webinars, articles, and trading guides, as well as a free demo account that traders can use to practice their trading strategies in a risk-free environment.

Advantages and Disadvantages of Trading with AxiTrader

Benefits of Trading with AxiTrader

Trading with AxiTrader has several benefits that can help traders improve their trading experience and performance. AxiTrader is a regulated broker, which means that it adheres to strict regulatory requirements and standards to protect clients’ funds and provide a safe trading environment.

One of the main benefits of trading with AxiTrader is its competitive pricing. The broker offers low spreads and no commission charges on forex trades, which helps traders to save on trading costs and improve their profitability.

AxiTrader also provides traders with access to a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of different market conditions.

The broker offers the popular MetaTrader 4 trading platform, a web station, and a mobile trading application, which are user-friendly and provide traders with advanced charting tools, trading indicators, and automated trading capabilities.

AxiTrader also provides a range of educational resources, including webinars, articles, and trading guides, to help traders improve their skills and knowledge. This can help traders to make more informed trading decisions and improve their trading performance.

Finally, AxiTrader offers excellent customer support, with a team of experienced and knowledgeable support staff available 24/5 to assist traders with any questions or issues they may have.

AxiTrader Pros and Cons

Pros

- Educational material and video tutorial.

- Demo account.

- AxiTrader offers referral programs.

Cons

- Only two account types.

- No guaranteed stop loss.

- The demo account is limited to 30 days.

AxiTrader Customer Reviews

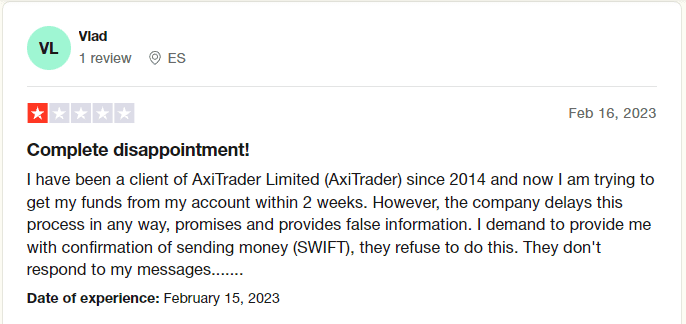

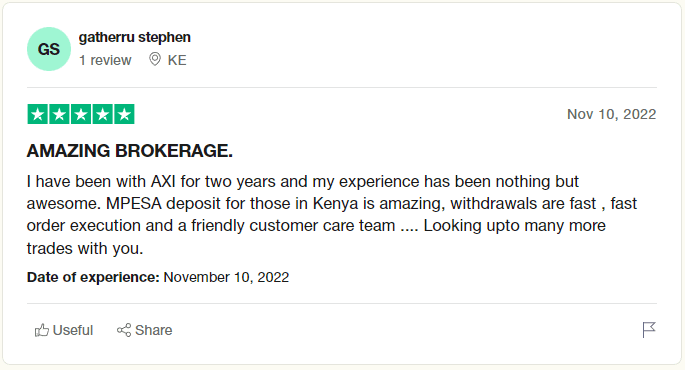

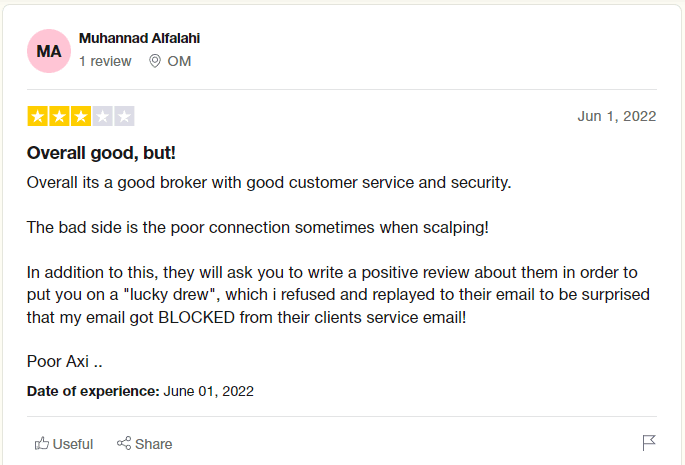

AxiTrader boasts a “Great” rating on Trustpilot, with a 4.0 out of 5-star rating based on over 1,200 reviews. The majority of customers who shared their experiences praised AxiTrader for its speedy and dependable customer support, efficient platform, and transparent pricing.

Many clients also appreciated the ease of account opening and funding, as well as the broad range of trading instruments available. The broker’s stringent regulatory compliance received high marks, with several clients expressing confidence in the safety of their funds with AxiTrader.

However, there were also some negative reviews from clients who encountered platform instability issues or experienced delays with withdrawals. Some clients also mentioned high spreads for particular currency pairs or the absence of educational resources and market research tools. Finally, some clients have reported poor connectivity issues when scalping, resulting in slower order execution.

Overall, AxiTrader maintains a generally positive reputation among customers on Trustpilot, with many clients reporting a positive trading experience. However, traders should be aware of potential delays that may arise, particularly when scalping or withdrawing funds.

AxiTrader Spreads, Fees, and Commissions

AxiTrader charges its clients fees in the form of spreads, commissions, and overnight financing. Spreads offered by AxiTrader start from as low as 0.0 pips for the Pro account, and the minimum spread for the Standard account is 0.4 pips. Additionally, the Standard account has a minimum spread value of $4, whereas there is no minimum spread value for the Pro account.

Commissions are charged by AxiTrader at a rate of $7 per lot round-turn for clients trading on the Pro account. This commission is charged for both opening and closing a position. There is no commission charged for trades made on the Standard account.

Overnight financing fees, also known as “rollover” or “swap” fees, are charged by AxiTrader for positions held overnight or over the weekend. The amount charged varies depending on the asset being traded and whether the position is a buy or a sell.

It’s important to note that AxiTrader does not charge any deposit or withdrawal fees. However, clients may incur fees from their payment provider, such as bank fees or credit card fees.

Furthermore, traders should be aware that Axitrader charges a $10 inactivity fee per month, after one year of inactivity.

Overall, AxiTrader offers competitive spreads and low commissions for traders, while the overnight financing fees are standard for the industry. Clients should be aware of the fees charged by AxiTrader and should factor them into their trading strategy.

Account Types

AxiTrader offers two types of trading accounts: the Standard Account and the Pro Account. The Standard Account is designed for beginner and intermediate traders, while the Pro Account is tailored to the needs of experienced traders.

The Standard Account offers a minimum floating spread requirement of 0.4 pip for forex trades, but it has a minimum spread value of $4 per trade. There is no minimum deposit required to open a Standard Account is $0, and the maximum leverage offered is 1:500. Most importantly, the standard account does not charge any commission on trades.

On the other hand, the Pro Account has a minimum floating spread starting at 0.0 pips for forex trades and has a minimum spread value of $0. The minimum deposit required to open a Pro Account is the same, at $0, but traders are charged a commission of $7 per trade. The Pro account offers the same leverage as the Standard one, up to 1:500.

Both account types offer access to the popular MetaTrader 4 trading platform, a web trading station, and a mobile application, as well as a range of educational resources and excellent customer support.

The Standard Account is suitable for traders who are looking for a user-friendly trading environment with competitive pricing and a wide range of financial instruments, while the Pro Account is tailored to traders who require tighter spreads and access to advanced trading tools and features.

How To Open Your Account?

Opening an account with AxiTrader is a simple process that can be completed online in just a few steps. Here is a step-by-step guide on how to open an account with AxiTrader:

- Visit the AxiTrader website: Go to the AxiTrader website at www.axi.com and click on the “Open Account” button.

- Select Account Type: Choose the account type that best suits your trading needs, either the Standard or Pro account.

- Complete Registration Form: Fill in the registration form with your personal information, such as your name, email address, and phone number. You will also need to provide your country of residence, date of birth, and employment details.

- Provide Identification Documents: To comply with regulatory requirements, you will need to provide identification documents such as a passport, driver’s license, or national ID card. You may also need to provide proof of address, such as a utility bill or bank statement.

- Agree to Terms and Conditions: Read and accept the terms and conditions of the AxiTrader trading agreement.

- Verify Your Account: After submitting your registration form, you will need to verify your account by following the instructions provided by AxiTrader.

- Fund Your Account: Once your account is verified, you can fund it to start trading. You can fund your account using a range of payment methods, including bank transfer, credit card, and e-wallets.

- Start Trading: Once your account is funded, you can start trading on the AxiTrader platform. You can access the platform using the login details provided to you by AxiTrader.

Overall, opening an account with AxiTrader is a straightforward process that can be completed online in just a few steps. If you have any questions or need assistance, the AxiTrader customer support team is available 24/5 to assist you.

What Can You Trade on AxiTrader

AxiTrader offers a wide range of financial instruments that can be traded by its clients. These include:

- Forex: Clients can trade over 70 currency pairs on the forex market, including majors, minors, and exotic pairs.

- Indices: AxiTrader offers trading on a range of global stock indices, such as the S&P 500, NASDAQ, FTSE 100, and DAX 30.

- Commodities: Clients can trade popular commodities such as gold, silver, oil, and natural gas.

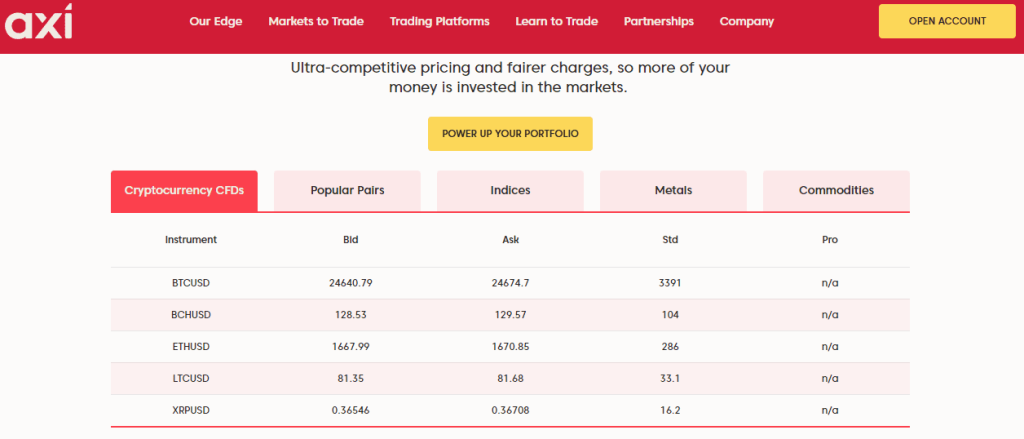

- Cryptocurrencies: AxiTrader offers trading on popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple.

- Bonds: AxiTrader offers trading on a range of government bonds and corporate bonds from around the world.

Overall, AxiTrader provides its clients with access to a diverse range of financial instruments across multiple markets, allowing them to build a diversified portfolio and take advantage of various market opportunities. However, AxiTrader does not provide its clients the possibility to trade ETFs, Stocks and Options.

AxiTrader Customer Support

AxiTrader offers 24/5 customer support to its clients, which is available via phone, email, and live chat. The customer support team consists of experienced professionals who are knowledgeable about the markets and the broker’s offerings, and who are able to assist clients with any questions or issues they may have.

In addition to its general customer support services, AxiTrader also provides clients with access to dedicated account managers who can provide personalized support and guidance based on their individual trading needs and preferences.

AxiTrader also offers an extensive FAQ section on its website, which covers a wide range of topics related to trading, account management, and technical issues. The FAQ section is regularly updated with new information, and clients can search for specific topics using keywords or browse the different categories.

Overall, AxiTrader’s customer support is considered to be of high quality, with many clients noting that the support team is responsive, helpful, and efficient in resolving issues. The availability of multiple channels for communication, including phone, email, and live chat, also makes it easy for clients to get in touch with the support team when needed.

Advantages and Disadvantages of AxiTrader Customer Support

Security for Investors

Withdrawal Options and Fees

AxiTrader offers a variety of withdrawal options for clients to choose from. These include bank transfer, credit/debit cards, and e-wallets such as Neteller, Skrill, and Fasapay. The availability of these options may vary depending on the client’s location and account type.

AxiTrader does not charge any fees for withdrawals. However, clients may be subject to fees charged by their payment provider or bank, which are outside of AxiTrader’s control. It’s recommended that clients check with their payment provider to confirm any fees that may be charged before making a withdrawal request.

It’s important to note that AxiTrader may require additional documentation from clients to verify their identity and prevent fraud, which may delay the withdrawal process. Clients should also ensure that they have sufficient funds in their account to cover any open positions and any margin requirements before making a withdrawal request, as this could affect their trading activity.

Additionally, AxiTrader does not charge any deposit fees for most payment methods. However, clients may be subject to fees charged by their payment provider or bank, which are outside of AxiTrader’s control. It’s recommended that clients check with their payment provider to confirm any fees that may be charged before making a deposit.

For example, deposits made via China UnionPay are subject to a 1.5% fee, and deposits made via Neteller and Skrill may be subject to a 2% fee.

AxiTrader Vs Other Brokers

#1. AxiTrader vs Avatrade

In terms of trading platforms, AxiTrader provides MetaTrader 4, a web platform, and a mobile platform, whereas AvaTrade offers a wider selection, including MetaTrader 4, MetaTrader 5, and their proprietary AvaTradeGo and AvaOptions platforms.

While AvaTrade is renowned for its competitive pricing, AxiTrader offers highly competitive spreads, with some forex pairs starting from as low as 0.0 pips. Moreover, AxiTrader’s Standard account does not charge any commissions, unlike AvaTrade. Additionally, AxiTrader has a lower minimum deposit requirement of $0 compared to the $100 requirement imposed by AvaTrade.

Finally, the two brokers offer a similar variety of tradable financial instruments, except for shares, which are not available on AxiTrader, and cryptocurrencies, which are not offered by AvaTrade. Furthermore, AxiTrader provides a wider selection of currency pairs, including many exotic pairs.

In conclusion, after conducting a thorough analysis, our team of experts believes that AxiTrader is a slightly better alternative than AvaTrade, primarily due to the lower commissions and spreads they offer.

#2. AxiTrader vs Roboforex

Both AxiTrader and RoboForex offer a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies. However, AxiTrader has a broader selection of forex pairs, while RoboForex offers more cryptocurrencies, as well as the ability to trade shares and ETFs, which is not available on AxiTrader.

In terms of trading platforms, AxiTrader provides the popular MetaTrader 4 platform, as well as mobile and web trading platforms. On the other hand, RoboForex offers MetaTrader 4 and MetaTrader 5, along with their own R Trader platform and others, offering more options for their clients.

While both brokers offer floating spreads that start at 0.0 pips, AxiTrader has a lower maximum leverage of 1:500, while RoboForex offers a higher maximum leverage of up to 1:2,000.

Overall, AxiTrader and RoboForex are similar, but RoboForex has more trading opportunities due to the higher maximum leverage, a wider range of trading platforms, and a greater variety of trading instruments.

#3. AxiTrader vs Alpari

AxiTrader and Alpari offer a similar selection of tradable financial instruments, including forex, indices, and cryptocurrencies. However, there are also some differences as Alpari also offers ETFs and stocks, while their selection of forex pairs is significantly smaller than the one offered by AxiTrader.

Moreover, AxiTrader provides a more suitable trading environment for both beginner and advanced traders. AxiTrader offers a commission-free account, with exceptionally tight spreads and a $0 minimum deposit requirement. The only clear downside of AxiTrader’s trading conditions, when compared to Alpari, is the much lower maximum leverage, which is exactly half the 1:1,000 leverage offered by Alpari.

After our experts’ analysis, it is clear that these two brokers are quite similar, offering almost the same variety of tools and features, with only minor differences. Due to this, we must conclude that AxiTrader is a better option due to its lower fees, commissions, and spreads.

Conclusion: AxiTrader Review

In conclusion, AxiTrader is a well-established and reputable broker that offers a wide range of financial instruments for clients to trade across multiple markets. With its advanced trading platforms, competitive pricing, and reliable customer support, AxiTrader is an attractive option for both novice and experienced traders alike.

One of the standout features of AxiTrader is its strict regulatory compliance, which ensures the safety of client funds and promotes fair trading practices. The broker is authorized and regulated by reputable regulatory authorities such as ASIC, FCA, and DFSA, which adds an extra layer of trust and credibility to its operations.

While there are some potential downsides to consider, such as the inactivity fees and minim spread requirements, overall, AxiTrader offers a comprehensive and reliable trading experience for clients. With its flexible account options, transparent pricing, and convenient withdrawal options, AxiTrader is a broker worth considering not only for anyone looking to enter the world of online trading, but also for more experienced traders looking for advanced trading tools and a large selection of financial instruments.

AxiTrader Review FAQs

Is AxiTrader regulated?

Yes, AxiTrader is a regulated broker. AxiTrader is the trading name of AxiCorp Financial Services Pty Ltd, which is authorized and regulated by the Australian Securities and Investments Commission (ASIC) and by the Financial Conduct Authority (FCA) in the UK.

As a regulated broker, AxiTrader is required to adhere to strict regulatory standards and guidelines, which are designed to protect clients’ funds, ensure fair trading practices, and promote market integrity. This includes maintaining adequate capitalization, segregating client funds, implementing risk management and compliance policies, and submitting to regular audits and inspections by the regulatory authorities.

What is AxiTrader minimum deposit?

AxiTrader’s has a $0 minimum deposit requirement on their Standard and Pro accounts, which is a unique feature that allows clients to open an account with the broker without the need for a large initial deposit. This can be especially attractive for those who want to test out the broker’s features and platform before committing a larger amount of funds.

How long does AxiTrader withdrawal take?

For bank transfer withdrawals, it can take up to 3-5 business days for the funds to appear in the client’s bank account. Credit/debit card and e-wallet withdrawals are typically processed within 24-48 hours, but it may take an additional 2-5 business days for the funds to appear in the client’s account.

Additionally, the time it takes for a withdrawal to be processed may also depend on the withdrawal amount and the client’s account status. Larger withdrawals or withdrawals from accounts that have not been actively traded may require additional processing time to ensure compliance with anti-money laundering regulations and other legal requirements.

Overall, AxiTrader strives to process withdrawals as quickly as possible, but clients should be aware that there may be factors that can affect the processing time of their withdrawals.