Axiory Review

Axiory is a dependable and well-known Forex broker that provides traders with a number of features and services. Axiory is governed by the International Financial Services Commission (IFSC) in Belize, assuring a secure trading environment and placing a heavy emphasis on transparency and security.

To give you a thorough knowledge of what Axiory has to offer, we will examine the essential features, trading platforms, account kinds, customer care, and more in this in-depth research.

This review attempts to arm you with the knowledge you need to make an informed decision, whether you’re a novice trader searching for a trustworthy broker to begin your trading adventure or a seasoned trader looking for a competitive edge.

Join us as we explore the world of Axiory to help you confidently navigate the changing Forex market. We’ll reveal its capabilities, advantages, and potential considerations.

What is Axiory?

Axiory, a reputable Forex broker established in 2011, has built a strong name in the sector. Axiory, which has its headquarters in Belize, is governed by the International Financial Services Commission (IFSC), which guarantees compliance with global financial norms and provides a safe trading environment for its customers.

Axiory provides two well-liked solutions for trading platforms: MetaTrader 4 (MT4) and cTrader. The user-friendly interface, extensive charting capabilities, and adaptable features of MT4 are well known.

On the other side, cTrader offers streamlined operations and sophisticated trading tools. Because both platforms are usable on desktop, web, and mobile devices, traders may easily access their accounts from any location.

Axiory caters to the diverse needs of traders by offering multiple account types. The Nano account is tailored for beginners, with smaller trade sizes and lower minimum deposit requirements. The Standard account caters to intermediate traders, while the Max account is designed for advanced traders seeking enhanced trading conditions, such as lower spreads.

With a broad range of trading instruments, Axiory ensures traders have ample options to diversify their portfolios. Currency pairs, including major, minor, and exotic pairs, are available for trading, along with precious metals like gold and silver.

Additionally, Axiory provides access to various Contracts for Difference (CFDs), enabling traders to capitalize on different market opportunities.

Axiory takes pride in its competitive spreads and transparent fee structure, which are vital considerations for traders. The broker offers both fixed and variable spreads, depending on the chosen account type. Fixed spreads provide consistent pricing, while variable spreads offer tighter spreads during periods of high market liquidity.

When it comes to security, Axiory places a strong emphasis on safeguarding client funds. By keeping clients’ funds in segregated accounts with reputable banks, Axiory ensures that these funds are kept separate from the company’s operational funds.

Furthermore, the broker employs advanced encryption technology to protect clients’ personal and financial information, ensuring a secure trading environment.

Axiory is committed to providing exceptional customer support. With multilingual customer support available through email, live chat, and telephone, traders can seek assistance whenever required.

In addition, Axiory offers a range of educational resources, including trading guides, webinars, and video tutorials, to empower traders with knowledge and skills to enhance their trading journey.

Advantages and Disadvantages of Trading with Axiory

Benefits of Trading with Axiory

When choosing a broker, it’s essential to consider the various benefits they offer to ensure you have the best trading experience possible.

Axiory is an excellent option for many traders due to its extensive range of advantages. Some of the standout benefits of trading with Axiory include:

Axiory has established a reputation as a reliable and trusted Forex broker, prioritizing transparency and client satisfaction.

Axiory is regulated by the International Financial Services Commission (IFSC) in Belize, ensuring compliance with international financial standards and providing clients with a secure trading environment.

Axiory offers popular and robust trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Traders have the flexibility to choose the platform that best suits their trading style and preferences.

Axiory provides a range of account types, catering to traders of different levels of experience and trading strategies. This includes options such as Nano, Standard, and Max accounts, each with its own set of features and trading conditions.

Axiory offers a diverse selection of trading instruments, including major, minor, and exotic currency pairs, as well as precious metals and CFDs. Traders have access to a broad range of markets to diversify their trading portfolios.

Axiory prides itself on offering competitive spreads and a transparent fee structure. Traders can benefit from favorable trading conditions and know exactly what costs to expect when executing trades.

Axiory prioritizes the security of client funds. The broker keeps client funds in segregated accounts with reputable banks, ensuring they are separated from the company’s operational funds. This adds an extra layer of protection for traders.

Axiory provides multilingual customer support to assist traders in their native languages. Support is available through various channels, including email, live chat, and telephone, ensuring prompt and efficient assistance.

Axiory offers a range of educational resources to support traders in their journey. These resources include trading guides, webinars, and video tutorials, helping traders enhance their knowledge and skills in the Forex market.

Axiory Pros and Cons

Pros

- Regulated by multiple international authorities

- Competitive spreads and low trading fees

- Wide range of trading instruments

- Extensive educational resources

- Excellent customer support

Cons

- Limited product range compared to some competitors

- No proprietary trading platform

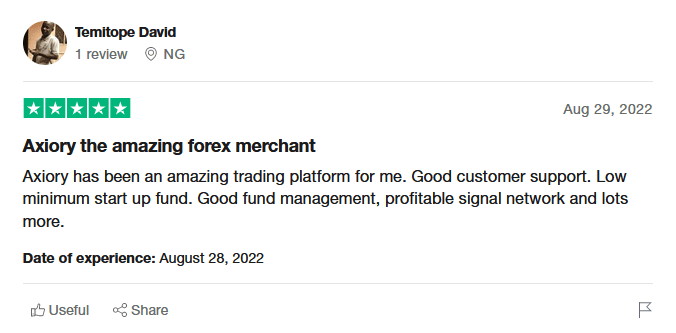

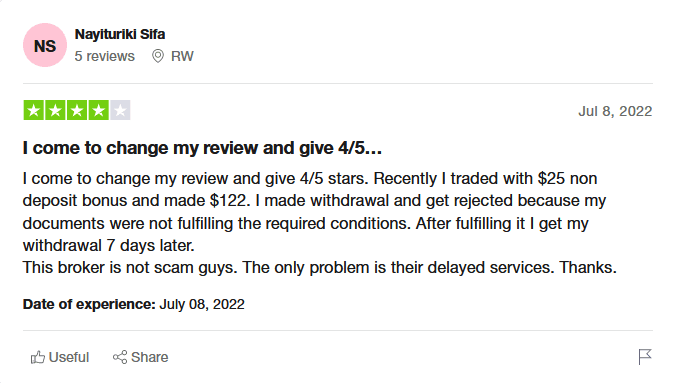

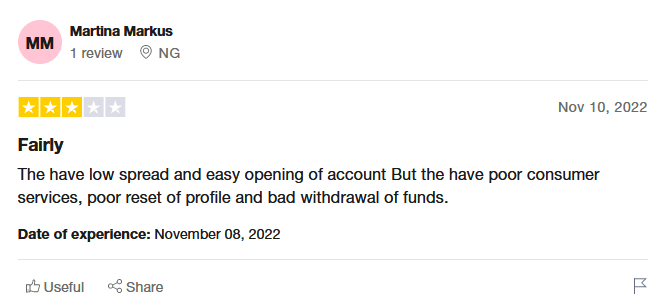

Axiory Customer Reviews

Most customer reviews praise Axiory for its competitive trading conditions, excellent customer service, and user-friendly trading platforms. However, some traders express concerns about the limited product range compared to other brokers.

Keep in mind that individual experiences may vary, and it’s always recommended to do your research and test the platform using a demo account before committing to a live trading account.

Axiory Spreads, Fees, and Commissions

Axiory offers a range of account types with competitive spreads. The Nano Account provides an average EUR/USD spread of 0.2 pips, the Standard Account has an average spread of 1.2 pips, and the Max Account offers an average spread of 1.8 pips.

The Terra Account, similar to Nano, has an average spread of 0.2 pips on EUR/USD. The specific spread for the Alpha Account is not specified.

On Axiory’s Standard and Max accounts, the spread itself serves as the brokerage fee, and there are no separate commissions for trades. However, for Nano and Tera accounts, there is an additional fee of $6 per lot charged (may vary by asset).

Additionally, when trading CFDs on shares, there is an additional commission set by the broker. Notably, there are no inactivity fees for any of these accounts.

Axiory does not charge fees for deposits or withdrawals, but it’s essential to consider any costs that may be associated with your chosen payment system.

Account Types

Axiory provides a variety of account types to cater to different trader needs, including:

Standard Account

This account type features average market spreads without commissions. The broker fees are included in the spreads. However, when trading CFDs on shares, there is an additional brokerage commission of 4 cents (minimum $6). The average spread for EUR/USD is 1.2 pips, and the maximum leverage is up to 1:400.

Max Account

The Max account offers increased leverage compared to the Standard account. Like the Standard account, broker fees are included in the spread. When trading CFDs on shares, there is an additional brokerage fee (e.g., 6 cents, minimum $8). The average spread for EUR/USD is 1.8 pips, and the maximum leverage is up to 1:777.

Nano Account

The Nano account is designed for traders seeking narrow market spreads. The average spread for EUR/USD is 0.2 pips, which is significantly low. Similar to the other account types, an additional brokerage fee is charged when trading CFDs on shares (e.g., 4 cents, minimum $6). The leverage for the Nano account goes up to 1:400.

Tera Account

The Tera account is similar to the Nano account in terms of narrow market spreads (0.2 pips for EUR/USD). The key distinction is that trading on the Tera account is done through the MT5 platform instead of other platforms. The leverage offered is up to 1:400.

Alpha Account

The Alpha account is unique as it allows traders to buy real stocks and ETFs. For specific details about the available instruments and trading conditions on the Alpha account, it is best to contact Axiory’s support department for further information.

How To Open Your Account?

Opening an account with Axiory is a user-friendly process that can be completed in just a few steps. Here is a detailed, step-by-step guide to help you get started:

Step 1: Visit the Axiory website

Navigate to the Axiory website and locate the “Open Live Account” or “Open Demo Account” button, depending on your preference. Click the button to begin the registration process.

Step 2: Complete the online registration form

Fill out the online registration form with your personal information, including your name, email address, country of residence, phone number, and preferred account currency. You will also need to create a password for your account and agree to the terms and conditions.

Step 3: Confirm your email address

After completing the registration form, you will receive a confirmation email from Axiory. Click the link in the email to verify your email address and activate your account.

Step 4: Verify your identity

Log in to your newly created Axiory account and navigate to the account verification section. You will be required to submit identification documents to verify your identity and residence. Typically, this includes a copy of your passport or driver’s license, as well as a recent utility bill or bank statement showing your full name and address.

Step 5: Choose your account type and leverage

Select the account type that best suits your trading needs and preferences, such as a Standard, Nano, Max, and Tera. Spread account. Also, choose your desired leverage level, which will determine the amount of margin required for your trades.

Step 6: Deposit funds into your account

Once your identity has been verified, you can deposit funds into your trading account. Axiory offers multiple deposit options, including bank wire transfers, credit/debit cards, and various e-wallets. Choose your preferred method and follow the on-screen instructions to complete the deposit process.

Step 7: Set up your trading platform

Download and install the trading platform of your choice, such as MetaTrader 4 or MetaTrader 5. Log in using your Axiory account credentials and familiarize yourself with the platform’s features and functions.

Step 8: Start trading

With your account funded and your trading platform set up, you are now ready to begin trading a wide range of financial instruments offered by Axiory. Monitor the markets, analyze trends, and execute trades according to your trading strategy.

What Can You Trade on Axiory?

On Axiory, traders have access to a diverse range of trading instruments to build their portfolios. The platform offers various currency pairs, allowing traders to participate in the forex market and take advantage of currency fluctuations.

Additionally, Axiory provides the option to trade CFDs (Contracts for Difference) on stocks, giving traders the opportunity to speculate on the price movements of individual stocks without owning the underlying asset. Traders can also engage in trading indices, which represent a basket of stocks and provide exposure to a specific market or sector.

Furthermore, Axiory offers trading opportunities in metals, such as gold and silver, allowing traders to diversify their investments. Lastly, the platform provides access to energy resources, enabling traders to trade commodities like oil and natural gas, which are influenced by global supply and demand dynamics.

With this wide range of trading instruments, Axiory offers traders the flexibility to explore different markets and diversify their trading strategies.

Axiory offers a wide range of trading instruments, including:

- Currency pairs

- CFDs on stocks

- Indices

- Metals

- Energy resources

Axiory Customer Support

Axiory’s customer support has both advantages and disadvantages. Some of the advantages include the ability to ask questions in the online chat even without being a client of the company, allowing potential customers to gather information and clarify doubts.

The support team is known for providing informative and quick responses, ensuring efficient communication with clients.

There are various ways to get in touch with support, including:

- Online chat

- Phone number listed on the website

- Feedback form

Advantages and Disadvantages of Axiory Customer Support

Effective customer support plays a pivotal role in the overall trading experience on an online platform. In this section, we will discuss the advantages and disadvantages of Axiory’s customer support, helping you gain a better understanding of what to expect when seeking assistance from the platform’s support team.

Security for Investors

Axiory prioritizes the security and protection of its investors through its regulatory compliance and auditing practices. The broker is regulated by the Belize International Financial Services Commission (IFSC) and holds the license number 000122/15, ensuring that it operates within the framework of established financial regulations.

Additionally, Axiory undergoes regular audits conducted by leading auditing firms in the industry, providing an extra layer of assurance regarding the broker’s financial integrity and adherence to industry standards.

These audits occur once every two years, further reinforcing the commitment to maintaining a secure trading environment for investors. By subjecting itself to regulatory oversight and independent audits, Axiory demonstrates its dedication to ensuring the safety and protection of its clients’ investments.

Withdrawal Options and Fees

Axiory offers a range of withdrawal options for its clients. Withdrawal requests are processed within 24 hours during business hours. Clients can withdraw funds to Visa or Mastercard (debit and credit), bank transfers, or various payment systems like Neteller, Skrill, SticPay (not available for corporate clients), BitPay, or VLoad. The minimum withdrawal amount is $11, except for bank wire withdrawals which have a minimum of $100.

Bank transfers and withdrawals to credit/debit cards may take up to 10 business days to be processed, while withdrawals to electronic payment systems are typically received within minutes after approval by the broker. It’s important to note that verification is required to make deposits on the platform.

Axiory Vs Other Brokers

#1. Axiory Vs AvaTrade

Axiory and AvaTrade are both well-known online forex and CFD brokers with their own strengths. Axiory is regulated by the Belize International Financial Services Commission (IFSC) and offers popular trading platforms like MT4, MT5, and cTrader.

It provides a wide range of trading instruments, including currency pairs, CFDs on stocks, indices, metals, and energy resources. Axiory also offers different account types with competitive spreads and has informative customer support available during weekdays.

On the other hand, AvaTrade is regulated by multiple reputable authorities such as the Central Bank of Ireland, ASIC, and FSCA. It offers a variety of trading platforms including MT4, MT5, AvaTradeGO, and AvaOptions.

AvaTrade provides an extensive range of tradable instruments, including currency pairs, CFDs on stocks, indices, commodities, and cryptocurrencies. The broker has a strong reputation for customer support, offering multilingual assistance 24/5 through various channels.

Verdict: In terms of regulation, AvaTrade’s multiple regulatory licenses provide a stronger regulatory framework. Additionally, AvaTrade’s wider range of tradable instruments, including cryptocurrencies and proprietary trading platforms, offers more diverse trading opportunities.

AvaTrade’s reputation for customer support and its availability in multiple languages is also a notable strength. Therefore, AvaTrade is considered better overall, providing traders with a broader range of options and a stronger regulatory backing.

#2. Axiory Vs RoboForex

Axiory and RoboForex are both well-established online forex and CFD brokers, each with its own strengths. Axiory is regulated by the Belize International Financial Services Commission (IFSC) and offers popular trading platforms like MT4, MT5, and cTrader.

It provides a range of trading instruments, competitive spreads, and informative customer support. Axiory’s focus on narrow market spreads and its diverse account types make it attractive to traders looking for specific trading conditions.

RoboForex, on the other hand, is regulated by several reputable authorities, including CySEC and IFSC. It offers a wide range of trading platforms, including MT4, MT5, and cTrader, along with a proprietary platform called R Trader.

RoboForex provides an extensive range of tradable instruments, including currency pairs, CFDs on stocks, indices, commodities, and cryptocurrencies. It also offers various account types and trading conditions suitable for different trader preferences.

Verdict: Both Axiory and RoboForex have their strengths, but the choice between them depends on individual trading preferences. Axiory’s focus on narrow market spreads and diverse account types makes it appealing to traders looking for specific trading conditions.

On the other hand, RoboForex’s wide range of tradable instruments, multiple regulatory licenses, and diverse trading platforms provide traders with more options and flexibility. Ultimately, the better choice between the two brokers depends on the trader’s specific requirements and priorities.

#3. Axiory Vs FX Choice

Axiory and FX Choice are two reputable forex and CFD brokers, each with its own strengths. Axiory is regulated by the Belize International Financial Services Commission (IFSC) and offers a range of trading platforms, including MT4, MT5, and cTrader. It provides competitive spreads, informative customer support, and a focus on narrow market spreads. Axiory’s diverse account types cater to traders with different needs and preferences.

FX Choice, on the other hand, is regulated by the International Financial Services Commission of Belize (IFSC) and offers the MT4 and MT5 trading platforms. It provides a wide range of tradable instruments, including forex, cryptocurrencies, indices, and commodities. FX Choice also offers different account types and provides traders with access to high leverage.

Verdict: Both Axiory and FX Choice have their strengths, but the choice between them depends on individual trading preferences. Axiory’s focus on narrow market spreads and diverse account types make it attractive to traders who prioritize specific trading conditions.

On the other hand, FX Choice’s wide range of tradable instruments and access to high leverage may be appealing to traders looking for diverse investment opportunities. Ultimately, the better choice between the two brokers depends on the trader’s specific needs, trading strategy, and preferred trading instruments.

Conclusion: Axiory Review

In conclusion, Axiory is a Belize-based ECN and STP broker that has been operating since 2007 and is regulated by the IFSC. With a strong focus on innovation, Axiory collaborates with Purple Technology, a global fintech company, to provide advanced trading solutions.

By leveraging cutting-edge technology and infrastructure, Axiory ensures fast trade execution with servers located in Equinix datacentres in major financial hubs. The inclusion of fix protocol 4.4 trading solutions further enhances trading capabilities, allowing direct trade execution in Equinix London.

Axiory operates through STP, ECN, and NND models, ensuring efficient order routing to interbank liquidity pools. With real-time server backups and a commitment to stability, Axiory creates a reliable trading environment for its clients.

Overall, Axiory stands out as a reputable broker that combines technological innovation with a strong commitment to delivering exceptional trading experiences.

Axiory Review FAQs

What educational resources does Axiory provide to help traders improve their skills?

Axiory offers a range of educational resources to support traders in their journey. These resources include trading articles, tutorials, webinars, and video lessons. Traders can access these materials to enhance their knowledge and develop effective trading strategies.

Are there any restrictions on trading strategies or techniques with Axiory?

Axiory allows traders to employ a wide range of trading strategies, including scalping, hedging, and expert advisors (EAs). There are no specific restrictions on these trading techniques, giving traders the flexibility to implement their preferred strategies based on their trading goals and preferences.

Does Axiory offer any bonuses or promotions to its clients?

Axiory periodically introduces various bonuses and promotions to provide additional benefits to its clients. These promotions may include deposit bonuses, cashback offers, or loyalty programs. Traders can stay updated with the latest promotions on the Axiory website or by contacting their customer support.