AximTrade Review

Forex trading has become a pivotal arena for investors seeking to diversify their portfolios. The significance of selecting the right Forex broker cannot be overstated, as it directly impacts the trading experience, the safety of funds, the efficiency of transactions, and the overall success in the forex market. With countless brokers available, choosing one that aligns with your trading needs and goals is crucial.

AximTrade stands out in the crowded Forex brokerage landscape. Regulated by both the ASIC and SVGFSA, it has garnered a global reputation for offering unparalleled services, cutting-edge solutions, and highly competitive trading conditions. These attributes not only underscore its commitment to excellence but also to providing traders with a robust platform for navigating the forex markets.

In this comprehensive AximTrade review, we delve deep into what sets AximTrade apart. We aim to offer a thorough evaluation, highlighting both the unique advantages and the potential areas for improvement. From the variety of account options to the efficiency of the deposit and withdrawal processes, and the structure of commissions, we provide insights that balance expert analysis with real trader experiences. This approach ensures you receive a well-rounded perspective, empowering you to make an informed decision on whether AximTrade is the right brokerage for your trading endeavors.

What is AximTrade?

AximTrade is a prominent name in the realm of forex and CFD trading, catering to a wide audience of investors and traders worldwide. It positions itself as a dynamic broker by offering the MT4 trading platform, widely regarded as the gold standard for forex trading. With a portfolio that includes over 30 forex currency pairs, equity, gold, and silver, AximTrade aims to meet various personal investment and trading needs.

This broker prides itself on being fully regulated in Australia and New Zealand, countries celebrated for their stringent financial regulations and dependable government agencies that protect traders. Additionally, AximTrade operates an offshore entity in Saint Vincent and the Grenadines, a jurisdiction with a more relaxed regulatory environment for forex brokers. This diversified regulatory framework underscores AximTrade’s commitment to offering secure and flexible trading options to its clients.

The regulatory environment significantly influences the trading conditions at AximTrade. For example, under Australian regulations, the maximum leverage is capped at 1:30, adhering to the country’s effort to protect traders from the high risks associated with leverage. Conversely, in New Zealand (for international users) and in its offshore jurisdictions, AximTrade can offer substantially higher leverage, catering to traders seeking to maximize their trading potential. This flexibility in leverage and regulatory oversight makes AximTrade an appealing choice for traders with varying risk appetites and trading strategies.

Benefits of Trading with AximTrade

After trading with AximTrade, I’ve gathered some insights into the benefits it offers to traders. One of the standout features of AximTrade is its low minimum deposit requirement, which makes it accessible for beginners or those on a tight budget. This, combined with the option to start live trading with as little as $1, provides an excellent entry point for new traders looking to test the waters without a significant financial commitment.

Another significant advantage is the access to the popular MetaTrader 4 (MT4) platform. This platform is renowned for its user-friendly interface, advanced charting tools, and comprehensive trading capabilities. It supports fast trade executions without requotes and offers very high leverage, which can be particularly appealing to experienced traders looking for high-risk, high-reward opportunities.

Furthermore, AximTrade offers a range of account types including Standard, Cent, ECN, and Infinite accounts, catering to different trader needs and preferences. The flexibility in account types, along with the option for swap-free accounts in certain regions, demonstrates AximTrade’s commitment to accommodating a diverse client base. The broker also emphasizes fund safety through practices like the segregation of client funds from company funds.

AximTrade has also been recognized with awards, highlighting its reliability and the quality of services provided. Particularly, its regulation by the Australian ASIC adds a layer of credibility, ensuring that it adheres to stringent standards in the financial industry. However, it’s important to note that AximTrade also operates under a license in Saint Vincent and the Grenadines, which might offer different protections compared to Australian regulations.

AximTrade Regulation and Safety

Understanding the regulation and safety measures of AximTrade is crucial before you decide to trade with the broker. The AximTrade Group operates under multiple jurisdictions, showcasing a broad regulatory framework. Specifically, AximTrade Pty Limited is regulated by the Australian Securities and Investments Commission (ASIC), ensuring adherence to stringent financial standards and practices.

Huntington Services Limited, registered in New Zealand, operates as a Financial Service Provider (FSP), offering an additional layer of credibility. Furthermore, AximTrade LLC is registered by the Financial Services Authority of Saint Vincent and the Grenadines and by the National Futures Association, expanding its regulatory footprint across different regions.

The segregation of client funds into separate bank accounts is a fundamental aspect of AximTrade’s commitment to client safety. This practice is pivotal in ensuring that clients’ investments are not used for any other purposes by the broker. The activation of negative balance protection is another critical safety measure, protecting clients from losing more money than they have deposited, which is especially important in the volatile world of forex trading.

The parent company, Thara Heights Owner’s Corporation, has been operational since 2010, which adds a layer of trust due to its longstanding presence in the industry. The availability of electronic wallets for depositing and withdrawing funds, including options for cryptocurrency transactions, speaks to AximTrade’s modern approach to banking and finance, catering to the diverse preferences of traders globally.

AximTrade Pros and Cons

Pros

- Recognized globally with strict regulations

- Only $1 needed to open cent/standard accounts

- ECN accounts available from $50

- Offers low spreads and commissions

- Provides leverage as high as 1:Unlimited

- Supports cryptocurrency and e-wallet transactions

- Enables social trading for additional earnings

- Grants free MT4 platform access

Cons

- No services for traders from the US, UK, Canada

- Missing a web-based trading platform

AximTrade Customer Reviews

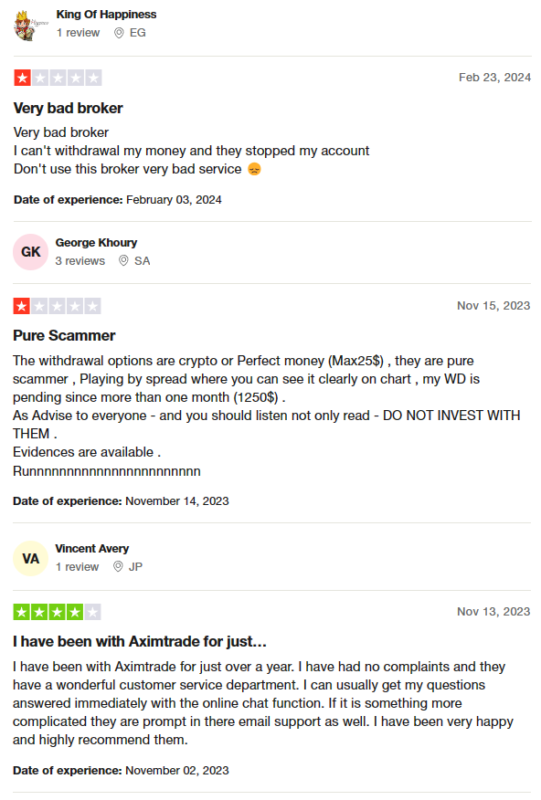

Customer reviews on AximTrade present a mixed bag of experiences. Some users have expressed significant dissatisfaction, citing issues with withdrawal processes and account management, labeling the service as poor, and cautioning others against investing with them. Complaints include difficulties withdrawing funds, with allegations of the broker engaging in manipulative practices such as spread manipulation. On the other hand, there are customers who commend AximTrade, particularly praising the customer service department for its efficiency. These satisfied users highlight the prompt support received via both online chat and email, underscoring their positive trading experience over a year or more. This polarity in reviews suggests a varied user experience, underlining the importance of due diligence and careful consideration when choosing to trade with AximTrade.

AximTrade Spreads, Fees, and Commissions

When dealing with AximTrade, it’s crucial to understand the structure of spreads, fees, and commissions that might affect trading costs. AximTrade does not impose commissions on deposits and withdrawals, yet it’s important to note that some payment methods, including Skrill and Neteller, apply a 4% fee on withdrawals. This aspect is vital for financial planning, ensuring traders account for any potential deductions from their transactions.

Furthermore, account maintenance with AximTrade comes without any fees, offering an additional layer of financial efficiency for traders. The broker employs a floating spread system, starting from 1 pip on cent and standard accounts. This competitive spread can significantly impact the profitability of trades. For those utilizing ECN accounts, spreads can begin as low as 0.0 pips, accompanied by a $3 commission per lot for both opening and closing positions. Such a structure is particularly appealing to active traders looking for tight spreads combined with clear commission rates.

Additionally, AximTrade applies swap fees for positions held overnight, a standard practice in forex trading that should be factored into long-term trading strategies. This comprehensive fee structure allows traders to make informed decisions based on transparent cost considerations, enhancing the trading experience with AximTrade.

AximTrade Account Types

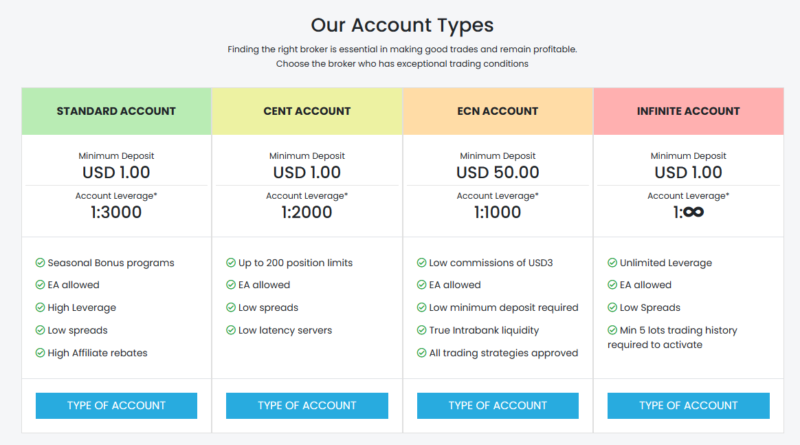

AximTrade caters to both Forex beginners and professional traders with a variety of account types, each designed to meet different trading needs and strategies. Here’s a breakdown of the account types offered:

- Cent Account: Tailored for micro trading with a minimum deposit of just $1 and a contract size of 1,000 units. It offers leverage up to 1:2,000 but does not support trading in indices and cryptocurrencies. Spreads for major currency pairs start at 1 pip.

- Standard Account: This is the go-to account for most traders, allowing trading in currencies, cryptocurrencies, CFDs on indices, metals, and energy resources. With a minimum deposit of $1, it provides leverage up to 1:3,000 and floating spreads from 1 pip for major pairs.

- ECN Account: Designed for professional traders, offering the tightest spreads from 0.0 pips on major currency pairs and a $3 commission per lot each way. The minimum deposit is $50, and leverage is up to 1:100, similar to the standard account in terms of trading assets.

- Infinite Account: Offers spreads as low as 3 Pips and the unique feature of unlimited leverage, with a very low margin call/stop out level of 60%/0%. Like the standard account, a minimum deposit of $1 is required.

- Pro Account: This account is suited for professional traders seeking higher spreads starting at 5 pips, with a significant minimum deposit of $300 and leverage up to 1:1000.

All accounts feature negative balance protection and position hedging, with margin calls and stop out levels set at 60%/30%, ensuring a safe trading environment.

How to Open Your Account

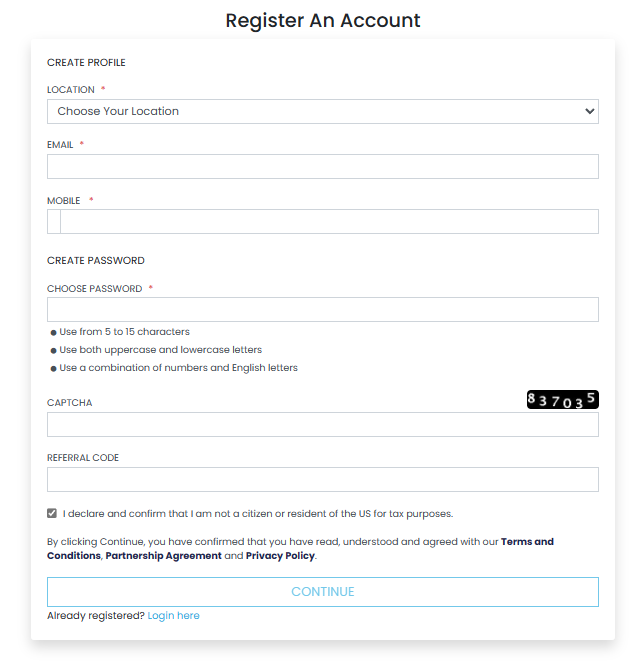

- Visit the AximTrade website and click on “New Account” on the right side to start your account setup by entering your country, email, phone number, creating a password, and, if applicable, a referral code.

- After submitting your information and confirming you’re not a US tax resident, you’ll see a confirmation screen. You’ll receive an OTP code on your phone next.

- Confirm your email by clicking the link sent to you, then head back to the AximTrade homepage.

- Click on “Member Login” and sign in using your email, the password you created, and complete the CAPTCHA challenge.

- Once logged in, you’ll need to complete your profile with personal details such as your full name and date of birth.

- The next step involves verifying your identity and residence by uploading the required documents, like an ID and a utility bill.

- After your documents are reviewed and approved, you’ll be asked to make your first deposit to activate the account.

- Finally, once your deposit is processed, you can start trading by selecting your preferred trading platform and instruments.

AximTrade Trading Platforms

Based on my experience, AximTrade offers access to MetaTrader 4 (MT4), one of the most widely recognized trading platforms in the forex community. MT4 is known for its user-friendly interface and robust features that cater to both novice and experienced traders. Its ability to support a wide range of trading instruments, including forex pairs, commodities, and indices, makes it a versatile choice for diverse trading strategies.

One of the standout features of MT4 on AximTrade is its customizability and advanced charting tools. Traders can personalize the platform to fit their trading needs, using a variety of technical indicators and graphical objects to analyze market trends. Additionally, MT4’s automated trading capabilities through Expert Advisors (EAs) allow for algorithmic trading, enabling users to automate their strategies and potentially enhance their trading efficiency.

Moreover, the mobile compatibility of MT4 ensures that AximTrade users can trade on the go. The mobile app provides essential functions, such as real-time quotes, charting options, and the ability to execute trades, which is crucial for staying connected to the markets anytime, anywhere. This level of accessibility, combined with MT4’s comprehensive features, underscores why it’s a preferred platform among AximTrade clients.

What Can You Trade on AximTrade

Trading on AximTrade has allowed me to explore a wide array of trading instruments that cater to various interests and strategies. Here’s a brief overview based on my personal trading experience:

Currency Pairs: AximTrade offers an extensive selection of forex pairs, allowing traders to engage in the world’s largest financial market. From major pairs like EUR/USD to more exotic options, the diversity in forex trading on AximTrade is suitable for currency traders at all levels, providing ample opportunities for speculation on currency value fluctuations.

CFDs on Indices: Trading Contracts for Difference (CFDs) on indices through AximTrade enables access to global stock markets without directly owning the underlying stocks. This is ideal for gaining exposure to the broader market movements and capitalizing on the performance of top companies aggregated in major indices.

Metals and Energies: The platform also provides the ability to trade precious metals like gold and silver, along with energy commodities such as oil and natural gas. These instruments are often used for hedging against inflation or currency devaluation, making them a valuable component of a diversified trading portfolio.

Cryptocurrencies: Given the rising interest in digital currencies, AximTrade’s offering of cryptocurrency trading is particularly appealing. It allows traders to speculate on the price movements of popular cryptocurrencies without the need for digital wallets or direct ownership, encompassing the dynamic and volatile nature of this relatively new market.

Stocks: Lastly, the availability of stock CFDs on AximTrade makes it possible to trade shares of leading companies. This option is great for traders looking to benefit from the price movements of individual company stocks, leveraging the potential for significant gains from stock-specific news and events.

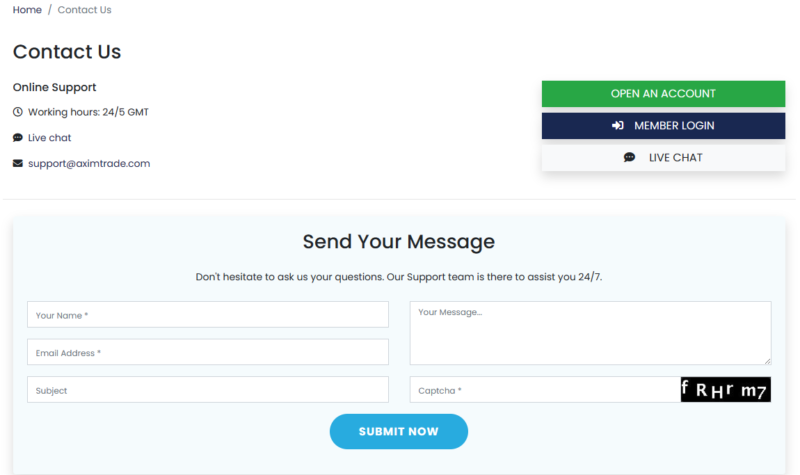

AximTrade Customer Support

Based on my experience, AximTrade stands out for its comprehensive customer support options, designed to accommodate various preferences and urgent needs. The broker ensures clients can reach out through multiple communication channels, including live chat, a convenient form on their website for quick inquiries, direct email support, and even through social media platforms like Instagram, Facebook, Twitter, and LinkedIn. This variety guarantees that assistance is readily available, offering multiple avenues to seek help or guidance.

The availability of the online chat feature is particularly noteworthy, accessible not only on the main website but also within the user’s personal account. This seamless integration ensures that help is just a few clicks away, whether you’re navigating the site or managing your trades. The promptness and efficiency of the live chat have been commendable, providing swift responses to queries and technical issues, thereby enhancing the trading experience on AximTrade. This level of support reflects the broker’s commitment to client satisfaction and operational transparency.

Advantages and Disadvantages of AximTrade Customer Support

Withdrawal Options and Fees

AximTrade streamlines the withdrawal process, ensuring all requests are processed within 24 working hours once a trader’s verification is complete. The funds are credited instantly across all available channels, providing a seamless experience for accessing your earnings.

The platform currently supports withdrawals via Neteller, Skrill, and USDT (ERC20), catering to a broad range of preferences among traders. For those in Indonesia, FasaPay is an option, while clients in Malaysia, Indonesia, Thailand, Vietnam, China, and India can use bank transfers. AximTrade is also in the process of expanding its withdrawal methods to include Bitcoin, MomoPay, Zalopay, Visa, and Mastercard, promising even greater flexibility in the future.

Notably, AximTrade does not impose a withdrawal fee, although payment systems like Skrill and Neteller charge a 4% fee on transactions. Other systems offer fee-free withdrawals, highlighting AximTrade’s commitment to cost-effective trading for its clients. The minimum withdrawal amounts vary by method, ensuring accessibility for traders with different financial capacities. For instance, the minimum for USDT withdrawals is ₮10, while bank transfers and other methods have their own specified minimums, making it straightforward for traders to manage their funds effectively.

AximTrade Vs Other Brokers

#1. AximTrade vs AvaTrade

AvaTrade excels with its extensive experience since 2006, offering a broad range of financial instruments across global markets. It’s well-regulated with a strong presence in multiple countries, providing a robust trading experience for a diverse clientele. AximTrade, while offering competitive trading conditions and diverse account types, may not match AvaTrade’s global reach and regulatory framework.

Verdict: AvaTrade is better for traders looking for a well-established broker with a broad regulatory compliance and a wide range of trading instruments. Its longevity and commitment to regulation provide a secure trading environment.

#2. AximTrade vs RoboForex

RoboForex distinguishes itself with a wide selection of trading platforms and a vast array of trading options, catering to a global audience with diverse trading needs. Its emphasis on cutting-edge technology and customizable trading conditions make it appealing for both new and experienced traders. AximTrade, known for its favorable trading conditions and accessibility, might not offer the same level of platform diversity or the extensive range of assets as RoboForex.

Verdict: RoboForex is better for traders who prioritize a wide variety of trading platforms and an extensive selection of trading instruments. Its technological edge and customizable trading environment offer a more tailored trading experience.

#3. AximTrade vs Exness

Exness stands out for its high trading volume and a wide range of CFDs, including over 120 currency pairs and other assets like stocks and cryptocurrencies. It offers conditions favorable for both new and experienced traders, such as low commissions and instant order execution. AximTrade provides competitive services but may not compete with the sheer volume and variety of trading options that Exness offers.

Verdict: Exness is better for traders looking for a high-volume trading environment with a wide range of assets. Its capability to offer beneficial conditions across a diverse asset portfolio makes it a strong choice for traders seeking versatility and scalability in their trading activities.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH AXIMTRADER

Conclusion: AximTrade Review

Based on the insights and user feedback, AximTrade emerges as a broker with a strong appeal for traders at various levels. It offers a broad spectrum of account types and trading platforms, notably MetaTrader 4, which caters to a wide range of trading strategies and preferences. The accessibility of a $1 minimum deposit for cent and standard accounts, alongside competitive spreads and the option for high leverage, positions AximTrade as an attractive choice for traders looking to enter the forex and CFD markets with low initial investment.

The broker’s commitment to customer support through multiple channels, including 24/7 availability, underscores its dedication to providing a supportive trading environment. However, potential clients should be aware of the limitations, such as the focus on general queries in chat support and the absence of phone support, which may affect traders requiring more immediate or complex assistance.

Also Read: Skilling Review 2024 – Expert Trader Insights

AximTrade Review: FAQs

What are the minimum deposit requirements for AximTrade accounts?

The minimum deposit for AximTrade accounts is $1, making it accessible for traders at all levels.

What trading platform does AximTrade offer?

AximTrade provides access to the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and comprehensive trading tools.

Does AximTrade offer 24/7 customer support?

Yes, AximTrade offers 24/7 customer support through various channels, including live chat, email, and social media platforms, ensuring assistance is available whenever traders need it.

OPEN AN ACCOUNT NOW WITH AXIMTRADE AND GET YOUR BONUS