AVFX Capital Review

n the vast and complex world of forex trading, choosing the right forex broker is paramount. A broker acts as an intermediary between traders and the global currency markets, providing access to trading platforms where currencies are bought and sold. The significance of selecting a reliable broker cannot be overstated; it directly impacts your trading experience, the safety of your funds, and your overall success in the forex market.

AVFX Capital has been making waves as an international broker since 2018. Operating in the financial markets, it offers a blend of innovative technology and user-friendly services tailored to meet the needs of both novice and experienced traders.

This review will dive deep into AVFX Capital, highlighting what sets it apart in the competitive forex brokerage industry. From its comprehensive account options to its streamlined deposit and withdrawal processes, and competitive commission structures, we aim to cover all angles. By combining expert analysis with real trader experiences, we’ll provide a balanced view that gives you the insights needed to decide if AVFX Capital is the right choice for you.

What is AVFX Capital?

AVFX Capital is a renowned international broker, making its mark in the financial markets since 2018. It provides traders with the opportunity to trade across a diverse range of instruments, including currencies, cryptocurrencies, stocks, indices, energies, metals, and commodities. This variety ensures that traders of all interests and expertise levels have access to the global markets through AVFX Capital.

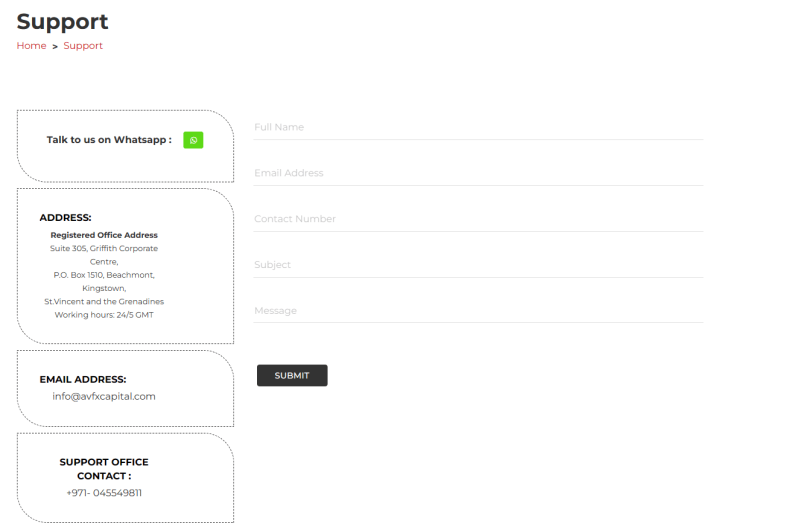

With its registration in Kingstown (Saint Vincent and the Grenadines) and a significant presence in Dubai (United Arab Emirates), AVFX Capital has established a strong foothold in the international trading community. This strategic positioning underscores its commitment to offering secure and accessible trading options to its global clientele.

Benefits of Trading with AVFX Capital

Trading with AVFX Capital has presented a number of benefits based on my experience. First and foremost, the diversity of financial instruments available for trading is impressive. Whether it’s forex, stocks, commodities, or cryptocurrencies, the range of options provides ample opportunity for diversification and engaging in various markets, which is essential for managing risk and exploring different investment avenues.

Another significant advantage is the access to MetaTrader 4 and MetaTrader 5 platforms. These platforms are industry leaders for a reason, offering advanced charting tools, numerous technical indicators, and the ability to use expert advisors. This has greatly enhanced my trading efficiency and allowed for a more in-depth market analysis, which is crucial for making informed decisions.

The process of withdrawals and deposits is another area where AVFX Capital shines. Not being charged a withdrawal fee is a relief, as it means more of the profits stay in my pocket. The variety of payment methods, including bank transfers and electronic wallets, adds a layer of convenience, ensuring that moving money in and out of the account is seamless and straightforward.

Lastly, the customer support experience has been satisfactory. Having multiple channels to reach out for help, including online chat and social media, has made resolving issues quick and efficient. The ability to access support without being registered is particularly beneficial for new traders considering AVFX Capital as their broker.

AVFX Capital Regulation and Safety

As someone who has traded with AVFX Capital, understanding its regulation and safety measures is crucial. AVFX Capital is headquartered in Kingstown, St. Vincent and the Grenadines, holding a registration number 24760 IBC, and operates a support office in Dubai, U.A.E. This information is vital for traders looking to gauge the broker’s credibility and operational base.

One key aspect to note is that AVFX Capital does not fall under the oversight of any regulatory body. This lack of regulation might raise questions about the safety of the trading environment and the protection of trader rights. Knowing this helps in making an informed decision about the risk associated with trading through AVFX Capital.

Despite the absence of regulatory oversight, AVFX Capital takes steps to ensure client fund safety. Client funds are segregated from the company’s capital, held in accounts with major banks, which is a positive practice. Additionally, the broker offers protection against negative balances, reducing the risk of losing more than your account balance.

It’s important to be aware that account opening and trading with AVFX Capital can be done without undergoing a verification process. However, this convenience comes with a caveat: unverified clients cannot withdraw funds. This policy underscores the importance of completing the verification process to access full account functionalities.

AVFX Capital Pros and Cons

Pros

- Wide range of trading assets

- Multiple account options with different trading terms

- Flexible leverage customization

- Separate accounts for client funds at leading banks

- Practice trading with demo accounts

Cons

- Not regulated by SVG FSA or any regulatory authority

- Limited educational and analysis tools available

AVFX Capital Customer Reviews

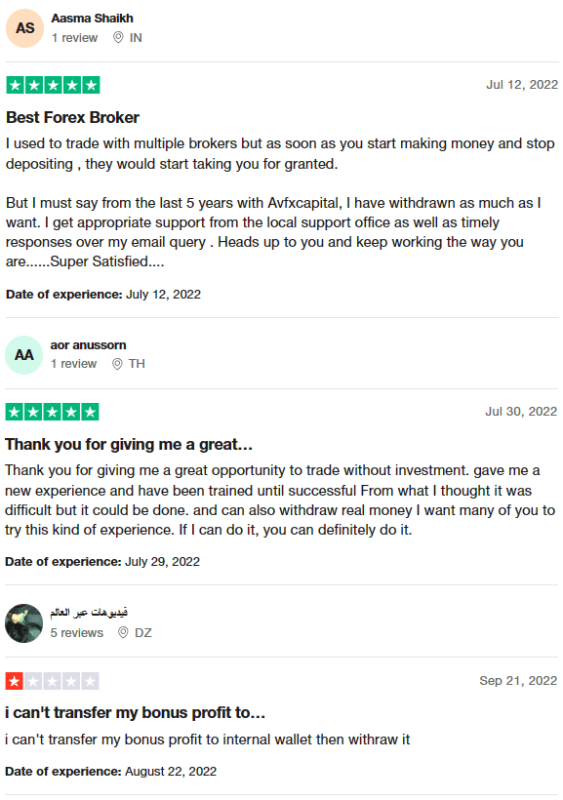

Customers have shared mixed experiences with AVFX Capital, highlighting both strengths and areas for improvement. Many traders appreciate the broker’s supportive environment, noting the ease of withdrawing funds and the responsive customer service, particularly praising the local support office and efficient email communication. Some traders have expressed satisfaction with the unique opportunities AVFX Capital offers, such as trading without initial investment and receiving training until they achieve success, emphasizing the broker’s role in facilitating accessible trading experiences.

However, there are concerns regarding the transfer of bonus profits, with some users facing difficulties in moving their bonus profit to their internal wallet and then withdrawing it. This blend of feedback underscores AVFX Capital’s commitment to customer satisfaction, though it also indicates areas where enhancements could further elevate the trading experience.

AVFX Capital Spreads, Fees, and Commissions

At AVFX Capital, I noticed that they don’t charge any commissions on deposits and withdrawals, which is a big plus. However, it’s important to keep in mind that banks and payment services might apply their own fees, so it’s not entirely free of charges. When it comes to trading, all accounts come with spreads. I found that the Raw Spread account offers spreads that are nearly zero, which is great for traders looking to minimize trading costs. However, there’s a catch: trading with this account comes with a broker commission of $7 per lot, which is something to consider when calculating overall trading expenses. Additionally, most accounts are subject to swap fees, except for the swap-free account, offering flexibility for those looking to avoid such charges.

Account Types

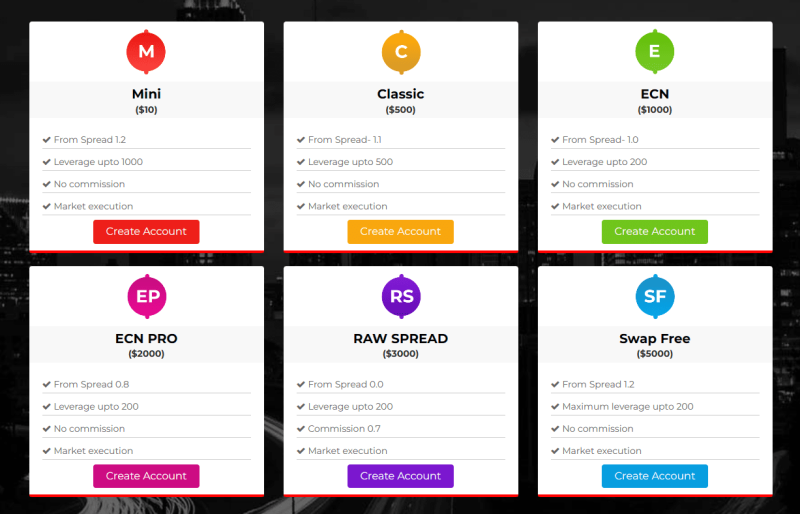

AVFX Capital offers a variety of account types to cater to the diverse needs of traders, each designed with specific features to match different levels of trading experience and strategies. Here’s a breakdown of the account types available:

- Mini: Ideal for beginners with leverage up to 1:1000, a minimum deposit of $10, and spreads starting from 1.2 pips.

- Classic: Best suited for traders with real experience, requiring a minimum account balance of $500, offering leverage up to 1:500, and spreads beginning at 1.1 pips.

- ECN: Designed for direct trading with liquidity providers, with a minimum deposit of $1,000, spreads from 1 pip, and leverage up to 1:200.

- ECN PRO: Offers enhanced conditions for serious traders, with leverage up to 1:200, spreads from 0.8 pips, and a minimum deposit of $2,000.

- Raw Spreads: Tailored for professional traders, featuring spreads from 0 pips, a commission of $7 per lot, leverage up to 1:200, and a minimum deposit of $3,000.

- Swap Free: Optimal for those holding positions long term, with leverage of 1:200, spreads starting from 1.2 pips, and a minimum deposit requirement of $5,000.

Each account type is designed to meet the specific needs and preferences of traders, ranging from novices to seasoned professionals, ensuring a tailored trading experience.

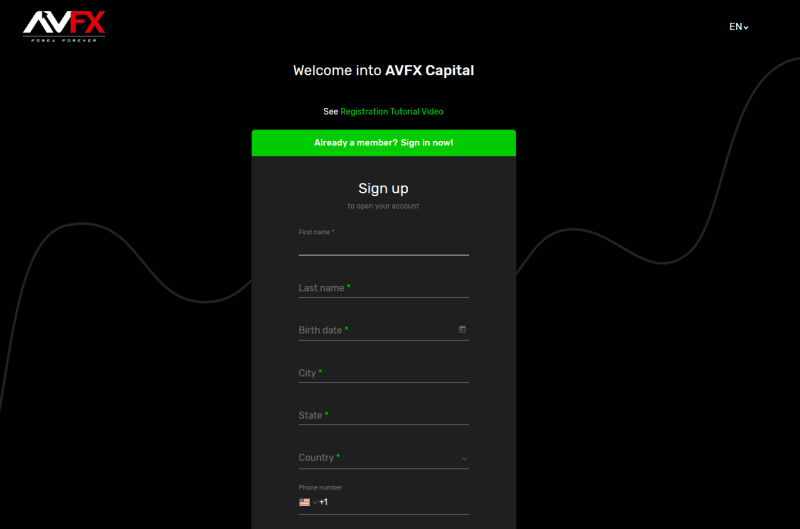

How to Open Your Account

- Visit the broker’s website and select “Create Account” to begin the registration process with AVFX Capital.

- Complete the registration form by entering your personal information, including your first and last name, date of birth, city, state, country, phone number, and email address.

- Create a secure password for your account.

- Agree to the broker’s rules and conditions to proceed.

- Click on “Continue” to move to the next step of the account setup.

- You will then need to provide additional details or documentation required for verification purposes.

- Once your information is verified, you will receive a confirmation email or notification.

- Follow the instructions in the confirmation to activate your account and start trading.

AVFX Capital Trading Platforms

Based on my experience, AVFX Capital offers access to two of the most acclaimed trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms cater to traders of all levels, providing a robust set of tools and features that enhance trading efficiency and analysis.

MetaTrader 4 is renowned for its user-friendly interface, advanced charting tools, and a wide array of technical indicators and expert advisors. It’s particularly favored by those new to trading, as well as experienced traders who appreciate its reliability and comprehensive analysis capabilities.

On the other hand, MetaTrader 5 steps up the game with additional features, such as more technical indicators, advanced charting tools, and improved order management capabilities. It’s designed to cater to traders looking for a more sophisticated trading environment with access to more markets and trading instruments.

What Can You Trade on AVFX Capital

Based on my experience, AVFX Capital offers a wide range of trading instruments that cater to various interests and trading strategies. This diversity allows traders to explore and engage in different markets from a single platform.

You can trade currency pairs, including major, minor, and exotic pairs, providing ample opportunities for forex trading. The availability of different pairs enables traders to take advantage of forex market volatility and liquidity.

CFDs on stocks are another option, allowing traders to speculate on the price movements of leading companies without owning the actual shares. This can include a variety of global corporations, offering exposure to different sectors and industries.

For those interested in commodities, AVFX Capital provides the opportunity to trade CFDs on commodities, such as gold, oil, and agricultural products. This variety offers a way to diversify one’s portfolio and hedge against inflation.

The platform also includes CFDs on indices and metals, offering further diversification options. Indices provide a snapshot of market sentiment, while metals, such as gold and silver, are traditional safe havens during times of economic uncertainty.

Energies, including oil and natural gas, reflect global economic health and geopolitical tensions, offering dynamic trading opportunities.

Lastly, the growing interest in digital assets is catered to with CFDs on cryptocurrencies. This allows traders to engage in the volatile crypto market without the need for a digital wallet.

AVFX Capital Customer Support

Based on my experience, AVFX Capital offers a comprehensive customer support system that is easily accessible through various channels. This ensures that traders can get assistance whenever needed, enhancing the overall trading experience.

You can contact support representatives via a feedback form on the broker’s website, which is a straightforward method for submitting inquiries or feedback directly to the team. For more immediate assistance, there’s also the option to reach out by phone or email, providing flexibility in how you can communicate with the support team.

The online chat feature is particularly convenient for quick questions or issues, offering real-time responses during trading hours. This feature is invaluable for resolving urgent matters efficiently.

Moreover, AVFX Capital has embraced modern communication methods by being available on messengers and social media platforms like Telegram, WhatsApp, Instagram, Facebook, and Twitter. This wide range of contact options signifies the broker’s commitment to providing accessible and responsive customer support, catering to the preferences of a diverse clientele.

Advantages and Disadvantages of NS Broker Customer Support

Withdrawal Options and Fees

From my experience with AVFX Capital, withdrawals are straightforward but require completed account verification. This is a standard practice aimed at ensuring security and compliance. Once verified, clients have a variety of withdrawal options including bank transfers, Visa, Mastercard, Diners Club cards, cryptocurrency wallets, and electronic payment systems like PayPal, Perfect Money, and WebMoney.

The processing time for withdrawal requests is up to three business days, which is relatively quick and ensures that you have access to your funds in a timely manner. Impressively, AVFX Capital does not charge a withdrawal fee, making it cost-effective to access your money.

For those who prefer bank transfers for their transactions, it’s convenient that if your initial deposit was made via this method, your first withdrawal needs to be processed the same way. This policy aligns with financial security measures and anti-money laundering regulations.

AVFX Capital Vs Other Brokers

#1. AVFX Capital vs AvaTrade

AVFX Capital and AvaTrade cater to different segments of the forex and CFD trading community. AVFX Capital, established in 2018, offers a diverse range of trading instruments and is known for its flexible withdrawal options and lack of withdrawal fees. In contrast, AvaTrade, operational since 2006, boasts a larger base of over 300,000 registered customers from more than 150 countries and a wider array of over 1,250 financial instruments. AvaTrade stands out for its heavy regulation and licensing, with four global locations, providing a highly secure trading environment.

Verdict: AvaTrade might be better for traders looking for a more established broker with a broader range of instruments and stronger regulatory oversight. Its extensive experience and global presence offer a higher level of security and a rich trading experience.

#2. AVFX Capital vs RoboForex

AVFX Capital offers a straightforward trading experience with its range of account types and trading platforms. RoboForex, on the other hand, emphasizes technology and diverse trading conditions since 2009. With over 12,000 trading options across eight asset classes and a variety of platforms including MetaTrader, cTrader, and RTrader, RoboForex caters to a wide range of trading styles and preferences. Additionally, RoboForex’s innovative ContestFX offers a unique way for traders to engage and start their trading careers.

Verdict: RoboForex could be more appealing for traders who value technological innovation, a wide selection of trading platforms, and a variety of trading instruments. Its diverse offerings and specialized contests make it a compelling choice for both new and experienced traders.

#3. AVFX Capital vs Exness

AVFX Capital and Exness provide distinct trading experiences tailored to different trader needs. Exness, with its inception in 2008, offers an impressive monthly trading volume and a wide selection of CFDs on stocks, energy, metals, and over 120 currency pairs. Exness is renowned for its low commissions, instant order execution, and the unique offer of unlimited leverage on small deposits, catering to a wide spectrum of trading strategies and styles.

Verdict: Exness stands out as a better option for traders looking for low commission costs, instant execution, and the flexibility of unlimited leverage. Its long-standing reputation and diverse account types tailored to trader needs make it a strong contender for those prioritizing trading conditions and leverage options.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: AVFX Capital Review

Based on the insights and user feedback gathered, AVFX Capital emerges as a competitive player in the forex and CFD brokerage market, catering to a broad spectrum of traders with its diverse range of financial instruments and account types. The broker’s commitment to providing accessible trading platforms, like MetaTrader 4 and MetaTrader 5, alongside flexible withdrawal options and responsive customer support, underscores its dedication to enhancing the trading experience for its clients.

However, potential traders should approach with caution due to the lack of regulation by a recognized financial authority, which raises concerns about the safety and security of traders’ funds and the integrity of trading practices. While the absence of withdrawal fees and the provision of multiple support channels are significant advantages, the limitations in customer support availability and the absence of educational resources may pose challenges, especially for novice traders.

Also Read: Exness Review 2023 – Expert Trader Insights

AVFX Capital Review: FAQs

What is AVFX Capital?

AVFX Capital is an international brokerage firm that has been operating in the financial markets since 2018. It offers a wide range of trading instruments, including currency pairs, CFDs on stocks, commodities, indices, metals, energies, and cryptocurrencies, catering to a diverse clientele.

Is AVFX Capital regulated?

No, AVFX Capital is not regulated by any major financial regulatory body. It is registered in Kingstown, St. Vincent and the Grenadines, with a support office in Dubai, U.A.E. This lack of regulation raises questions about the safety and security of client funds and trading practices.

What trading platforms does AVFX Capital offer?

AVFX Capital provides access to two of the industry’s leading trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their advanced trading features, including various analytical tools, technical indicators, and expert advisors.

OPEN AN ACCOUNT NOW WITH AVFX CAPITAL AND GET YOUR BONUS