Australia's Economic Growth Falls Short in Q2

Australia's Economic Growth Falls Short in Q2

Australia's Gross Domestic Product (GDP) increased by 0.2% QoQ in Q2 2024, up from 0.1% in Q1 but below the expected 0.3%, according to the Australian Bureau of Statistics (ABS). Year-over-year growth was 1.0%, aligning with forecasts but lower than Q1's 1.1%

Despite slower growth, the Reserve Bank of Australia (RBA) maintains high interest rates at 4.35% due to persistent inflation. Market participants are watching the GDP report's impact on future RBA policy, especially regarding rate cuts.

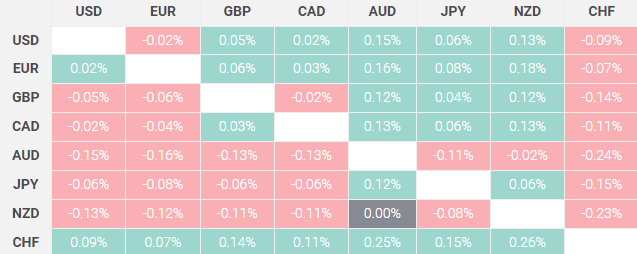

Following the release, the Australian Dollar (AUD) saw modest gains but remained under pressure, with AUD/USD trading around 0.6700, down 0.15%.

Potential Implications of GDP Figures

If economic growth exceeds expectations, it could bolster the AUD and signal potential rate hikes. Conversely, weaker growth may heighten concerns about economic stability, prompting further rate cuts and weakening the AUD.

Market focus remains on the JOLTS Job Openings and Fed Beige Book data, set for release on Wednesday. These, along with US Nonfarm Payrolls (NFP), will heavily influence future RBA decisions and potential movements in the AUD.