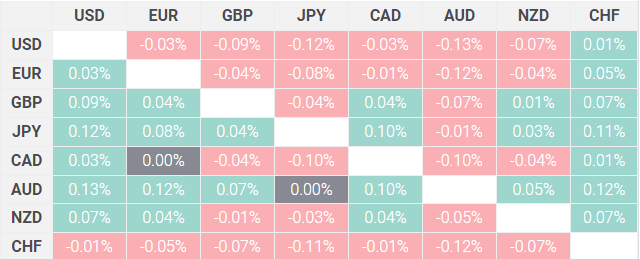

The Australian dollar remained stable on Friday, showing little reaction to the latest economic data out of China, Australia’s largest trading partner. Despite concerns over slowing growth in China, the Aussie has been supported by relatively strong domestic economic fundamentals and expectations that global commodity demand will stay robust.

China’s economic reports revealed mixed signals, with industrial production exceeding forecasts but retail sales growth falling short of expectations. This combination highlighted ongoing concerns about China’s recovery from its post-pandemic slowdown. Typically, the Australian dollar is sensitive to Chinese economic performance, given Australia's reliance on commodity exports to the region, but Friday’s numbers had a muted impact on the currency.

“The market has already priced in a soft Chinese recovery,” said Sarah Williams, a senior forex strategist at XYZ Capital. “While the data wasn’t entirely positive, it wasn’t enough to drive a significant reaction in the Aussie.”

At the same time, the U.S. dollar remains strong, limiting any potential gains for the Australian dollar. Investors are still focused on the Federal Reserve’s monetary policy and its impact on global currencies, as higher U.S. interest rates continue to dampen appetite for risk-sensitive assets like the Australian dollar.

Looking forward, traders will be keeping an eye on further Chinese economic reports and any changes in global commodity demand, both of which could affect the Aussie’s stability. Until then, the currency is expected to remain range-bound, hovering around its current levels unless there’s a significant shift in either domestic or global economic conditions.