Atr

The average true range (ATR) is a technical analysis indicator, introduced by market technician J. Welles Wilder Jr. in his book New Concepts in Technical Trading Systems, that measures market volatility by decomposing the entire range of an asset price for that period. The ATR reflects the market volatility in terms of average price movement of the security per period. Hence, overtime, people recognised that it is an extremely useful indicator for setting stop losses. Even for beginners, the ATR has been a simple yet realistic stop loss determining factor rendering it very effective. However, there are strategies designed for trading with the ATR on its own as well. The more commonly used ATR trading strategy will be explored in depth as the objective of this article in terms of profitability.

Content

How to use ATR and what it means

The ATR reflects volatility in terms of average price fluctuations of the security in a certain period. Many traders of different calibres utilise the ATR to help determine stoploss positions for their trades. The rationale is to put a stop loss level that is safe according to the average movement of price at the same time making it not too wide such that if the trade plan is wrong, minimal losses can be taken. However, the stop loss cannot be too tight such that any unusual volume, for example due to news, in the wrong direction, can trigger your stop loss before reversing to the planned direction. In other words, avoiding a dead cat bounce. Hence, as a rule of thumb, traders would usually modify their stop loss thresholds in multiples of the ATR value. The most commonly used ATR multiple for stop losses is 2. However, since the ATR is an indicator of volatility, trading with it alone would mean that the information provided by the indicator must be filtered in such a way that it allows traders to take trades only when volatility is relatively high.

How to trade with ATR rules

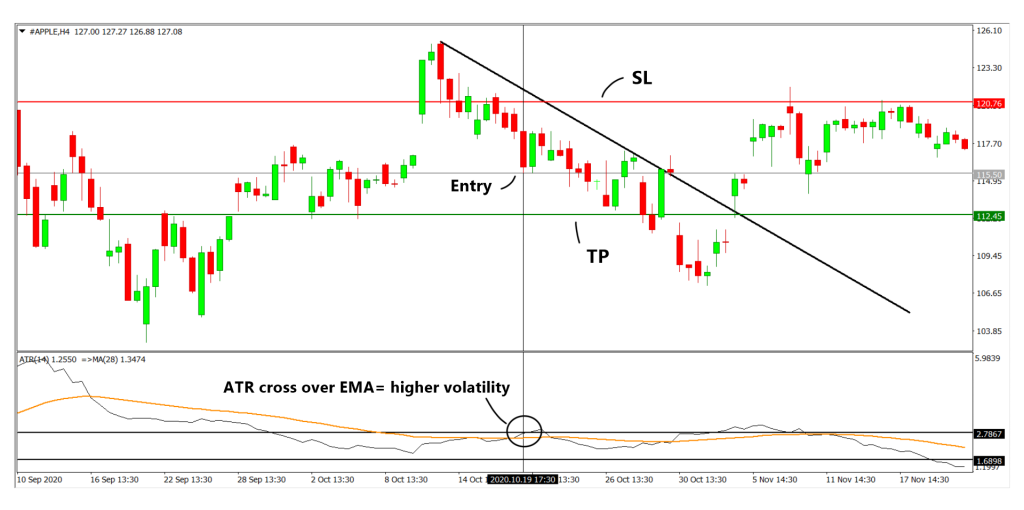

Since volatility ranges differently throughout, it is hard to find a benchmark that shows the median. Hence, to overcome this, we have decided to use EMA with period 28, to help us gauge the median volatility. The strategy is basically an ATR-EMA cross above with price action. Long entries are determined when the ATR crosses above the EMA upon candle closing, while the setting a pending order on the high of a bullish candle in an uptrend. The stop loss order is set at 2 times ATR value. The profit target will be set at 1 times ATR value, which will supposedly give us more wins since the targets are tantamount to the average price movement.

Short entries are determined when the ATR crosses above the EMA upon candle closing, while the setting a pending order on the low of a bearish candle in a downtrend. The stop loss order is set at 2 times ATR value. The profit target will be set at 1 times ATR value.

Also read: Head and shoulders pattern

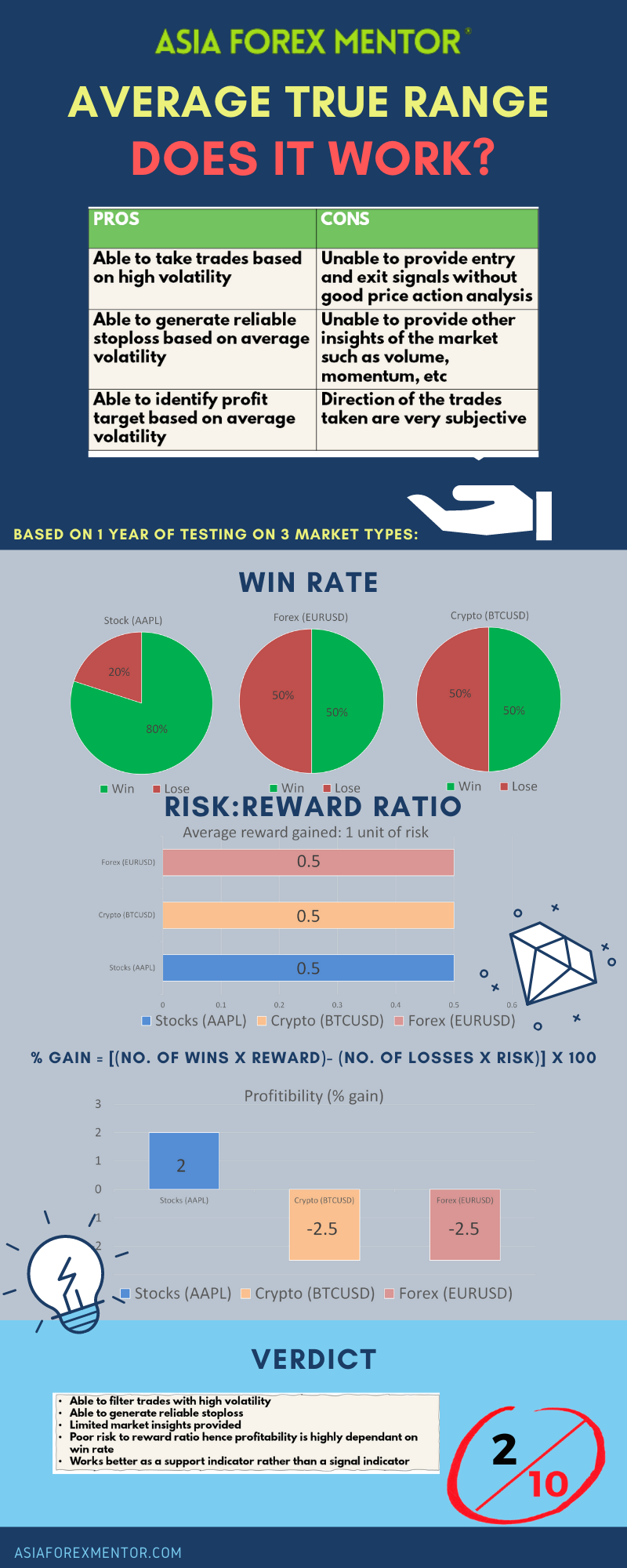

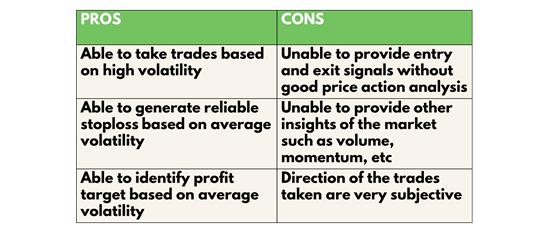

Pros and cons

The benefits of using the ATR trading strategy is that it filters out trades such that only trades with relatively higher volatility will be taken, giving even beginners a slightly better chance of reading the market and hence entering better trades with a better chance of winning. Also, the ATR is able to easily generate a safe and reliable stop loss while not being too excessive. Lastly, it is able to identify a profit target that will most likely hit as it takes the average price movement as a benchmark. However, it is unable to provide entry and exit signals on its own and requires good knowledge and understanding of price action to be effective. The insights provided by the ATR on the market is also very limited and is solely based on volatility alone, rendering the trades taken to be heavily biased, without taking other important factors into consideration. Lastly, this strategy does not provide a direction to trade in, hence, it heavily depends on the market sentiments of the trader to identify if the trade would be long or short. In our examples, we have overcome this issue with trendlines. However, one limitation of using trendlines is that one would not have known if a reversal is approaching especially when it comes subtly.

Also read: Best forex strategy for consistent profits

Analysis

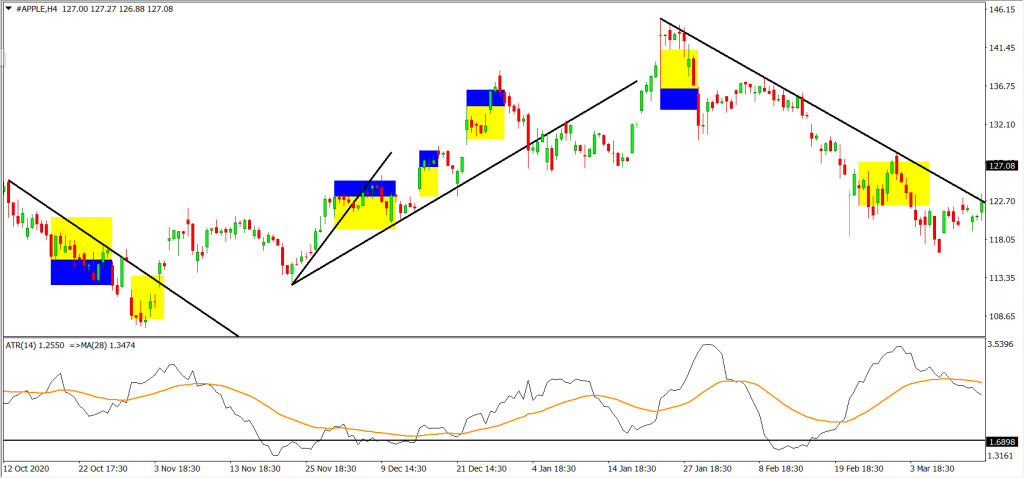

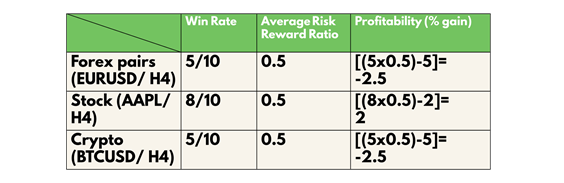

To find out the profitability of the ATR trading strategy, we decided to do a back test based on the past 10 trades from 16 Jun 21 on the H4 timeframe. The rules for entry will be the same as what was mentioned above. We will be back testing this throughout 3 types of trading vehicles, namely, EURUSD for forex, AAPL for stocks and BTCUSD for cryptocurrency. For simplicity, we will assume that all trades taken have a risk of 1% of the account.

Definitions: Avg Risk reward ratio= ( Total risk reward ratio of winning trades/ total no. of wins) Profitability (% gain)= (no. of wins* reward)- (no of losses* 1) [ Risk is 1%]

An example of the application of the strategy is as shown:

For the Backtest results, trades with blue and yellow zones indicate an overall win with the blue zone as reward and the yellow zone as the risk taken.

As shown in our backtest, the win rate of this strategy for EURUSD (Forex) is 50%, AAPL (Stocks) is 80% and BTC (Crypto) is 50%

The average risk reward ratio of this strategy for all vehicles is 0.5 due to the way trades are carried out by using multiples of the values of ATR.

The profitability of this strategy for EURUSD (Forex) is -2.5, AAPL (Stocks) is 2 and BTC (Crypto) is -2.5.

Also read: Bull flag bear flag and pennants

Conclusion

In conclusion, the ATR although is supposed to increase win rate by isolating high volatility trades and a realistic profit target, still resulted to be unprofitable as the win rate is also influenced by other factors such as trend identification and the degree of price action. Overall, this trading strategy can be further improved by altering the rules of the profit targets and the stop loss levels, such as using other multiples of the ATR values or indicators. Otherwise, the ATR trading strategy is better recommended as a scalping strategy in lower timeframes to be able to capture smaller profits while using a non-excessive yet safe stop loss settings. Also, upon hitting the profit target, the trader can use trail stops to widen the risk to reward ratio taken such that the profitability of trades can be improved. Ultimately, the ATR is definitely a useful supporting tool for traders of all calibres. With a few alterations, coupled with other indicators, it is bound to value add to any trading strategies.

info