ATFX Review

As the online trading industry continues to grow, it can be challenging for traders to identify a reliable and trustworthy broker that meets their individual needs. ATFX is one of the many brokers that claim to provide excellent trading services, but how does it stack up against the competition?

In this article, we’ll take a closer look at ATFX thanks to the meticulous framework and analysis carried out by our experts at Asia Forex Mentor to determine if it’s a suitable option for potential clients. By examining its regulatory status, account types, trading platforms, fees, and other key features, we aim to provide an objective assessment of the broker.

What is ATFX?

ATFX is a global online trading service provider that offers trading services for forex, commodities, precious metals, stock, cryptocurrencies and CFDs on indices. The company was founded in 2014 and is headquartered in London, UK.

ATFX’s goal is to provide clients with an efficient and reliable trading experience by offering competitive pricing, innovative trading technology, and exceptional customer service. They strive to make trading accessible to traders of all levels, whether they are beginners or experienced traders.

The company has since expanded its operations to various regions, including Europe, the Middle East, Asia, and Latin America. It is regulated by various financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC) in Mauritius.

ATFX’s trading platform offers clients access to various trading tools, such as advanced charting features, technical indicators, and risk management tools. They also provide clients with educational resources, including trading guides, webinars, and market analysis to help traders make informed trading decisions.

Overall, ATFX aims to provide a transparent, secure, and efficient trading environment to its clients, while also prioritizing customer satisfaction and support.

Advantages and Disadvantages of Trading with ATFX?

Benefits of Trading with ATFX

One of the major benefits of trading with ATFX is the availability of different financial instruments. The company offers a wide range of financial instruments, including forex, commodities, stocks, cryptocurrencies, and indices, providing traders with the opportunity to diversify their trading portfolios and potentially maximize their profits.

One of the benefits of trading with ATFX is their user-friendly MetaTrader 4 trading platform, which offers various trading tools, such as advanced charting features, technical indicators, and risk management tools. The platform also provides clients with access to educational resources, including trading guides, webinars, and market analysis to help traders make informed trading decisions, however, ATFX does not have neither a proprietary trading platform nor a mobile platform.

ATFX offers clients a range of trading account types to choose from, including a demo account for beginners to practice trading in a risk-free environment. The company also offers tight spreads allowing traders to maximize their profits.

In addition, ATFX provides clients with 24/7 customer support, with a team of experienced professionals available to answer any questions or concerns that traders may have. The company also prioritizes the security of its clients’ funds, with client funds kept in segregated accounts to ensure maximum protection.

ATFX Pros and Cons

Pros:

- Credit deposit and other deposit bonuses

- Education material

- PAMM accounts

- Demo account

Cons:

- No cent accounts

- High minimum deposit requirement

- No withdrawal fees under $100 for credit/debit cards

- No mobile trading platforms

ATFX Customer Reviews

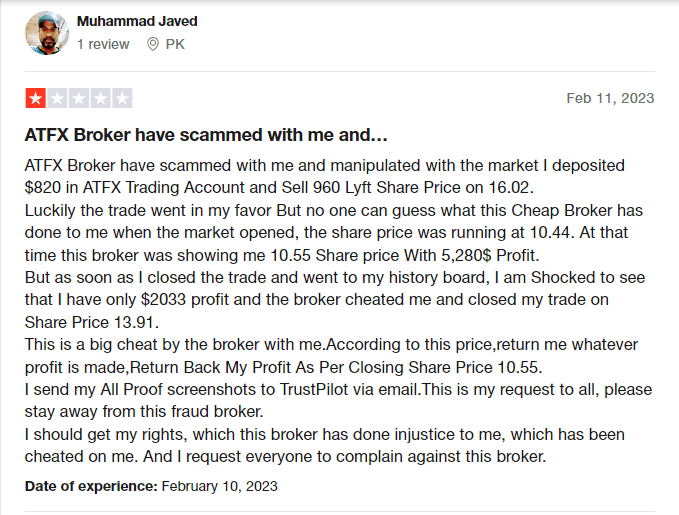

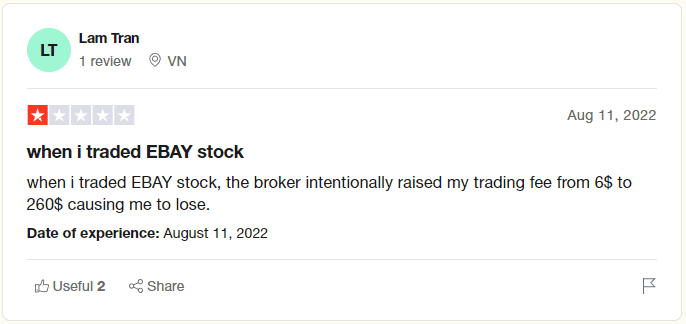

The overall rating of ATFX on Trustpilot is 2.7 stars out of 5, indicating a mixed sentiment among customers. Reading through the reviews, it’s evident that some customers have had positive experiences with ATFX, while others have had negative experiences.

Many customers who left positive reviews praised ATFX’s variety of trading tools and educational resources available on the platform, which helped them improve their skills and make better trading decisions. Furthermore, several customers noted the fast execution of trades and the low spreads offered by ATFX.

However, a few customers had very severe negative experiences with ATFX, with some complaining about the withdrawal process and others criticizing the high fees charged for certain services. Some customers have further commented that the broker has defrauded them out of several thousand dollars by either raising the commission fees to absurd amounts or by altering the stock price by a very large margin.

Because of this, potential clients must be very careful when considering ATFX as a valuable broker alternative.

ATFX Spreads, Fees, and Commissions

ATFX offers several different account types, each with different fee structures, spreads, and commissions. Here are the details for each account type:

- Standard Account: No commission is charged on trades made with the Standard Account. However, the minimum spread starts from 1.8 pips and ATFX charges a minium spread value of $18 on standard accounts.

- Edge Account: A commission of $7 is charged per lot traded with the Edge Account. Spreads start from 0.6 pips, and the minimum spread value is $6.

- Premium Account: No commission is charged on trades made with the Premium Account. The floating spread starts from 0.1 pips, and the minimum spread value is $1.

- Professional Accounts: ATFX charges a commission of $5 per lot traded on the professional acccount, plus an additional minimum spread value of $1. Professional account holders can benefit from a minimum floating spread of 0.1 pips.

It’s worth noting that ATFX operates on a variable spread model, which means that spreads may vary depending on market conditions. Additionally, swap charges may apply to positions that are held overnight, and these charges can vary depending on the currency pair being traded. Overall, our analysis shows that if we take in considerations all the fees and other charges, the average commission per trade charged by ATFX comes up to $8,77.

Account Types

ATFX offers a vast selections of trading accounts from which their clients can choose the one that best suits their needs based on their trading experience, trading strategy, and risk appetite. Each account type has its own set of features and benefits, such as different spreads, commission, leverage and minimum deposit requirements. The account types offered by ATFX are:

- Standard account: This account type is suitable for beginner traders and requires a minimum deposit of $500. The leverage offered varies between 1:30 and 1:400 and it is up to the client to decide which amount they would like to use, but the floating spread is pretty wide, starting from 1.8 pips.

- Edge account: This account type is designed for more experienced traders which require a tighter spread than the one offered by the standard account. The Edge account offers a maximum leverage of 1:30, a floating spread starting at 0.6 pips, and it requires a minimum deposit of $500.

- Premium account: This account type is classified as a “retail account” and it suitable for high-volume traders and requires a minimum deposit of $500. The leverage offered does not exceed 1:30 on popular currency pairs, but it provides its clients with a very tight spread of 0.1 pips.

- Professional account: This account type is also defined as a “retail account” and it is designed for professional traders and requires a minimum deposit of $10,000. This account offers the same exceptionally tight spreads as the premium account, but it also allows traders to benefit from a higher maximum leverage of 1:400.

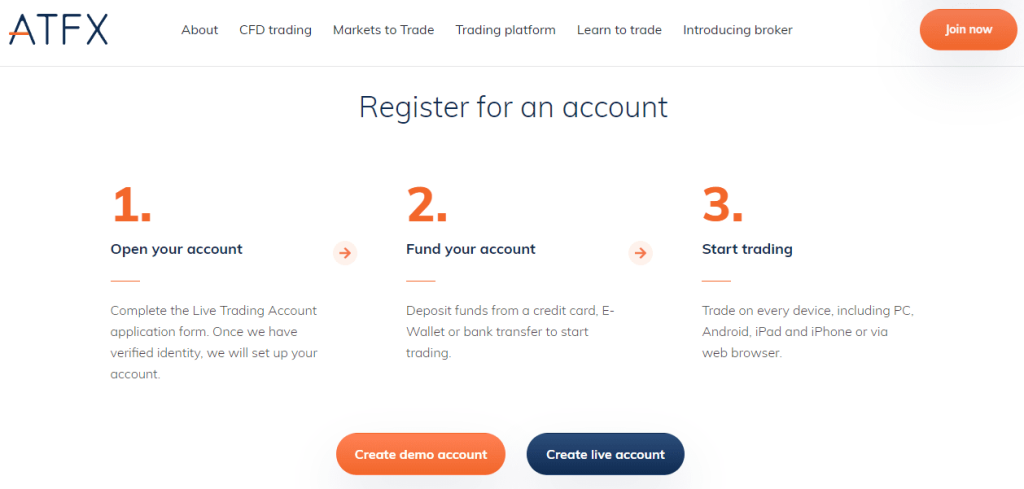

How To Open Your Account

The process of opening an account with ATFX is extremely easy and it can be done online in a few steps. Here is a step-by-step guide to the account opening process:

- Visit the ATFX website and click on the “Open Account” button.

- Fill out the online registration form with your personal information, including your name, email address, phone number, and country of residence.

- Choose the account type that you wish to open and read and agree to the terms and conditions of the broker.

- Complete the verification process by submitting the required identification documents, such as a government-issued ID, proof of address, and proof of payment method.

- Once your account has been verified, fund your account by depositing the minimum required amount or more, depending on the account type you have chosen.

- Download and install the trading platform provided by ATFX and log in with your account details.

- Start trading by selecting the financial instruments you want to trade, analyzing the market trends, and executing trades based on your trading strategy.

It’s important to note that ATFX may require additional information or documents from clients to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

What Can You Trade on ATFX

ATFX offers a range of financial instruments across all global markets that can be traded on their platform. These include:

- Forex currency pairs: ATFX provides access to major, minor, and exotic forex pairs, which can be traded on the MT4 trading platform.

- Indices: Clients can trade popular stock indices, such as the FTSE 100, S&P 500, and Nikkei 225, as CFDs on ATFX.

- Commodities: ATFX offers commodities trading in precious metals like gold and silver, as well as energy products like oil and gas.

- Cryptocurrencies: ATFX provides traders with access to popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

- Stocks: Clients can also trade stocks of popular companies such as Apple, Amazon, and Microsoft as CFDs.

Overall, ATFX provides a diverse range of financial instruments, allowing traders to access different asset classes and diversify their trading portfolios, however, it must be noted that it does not allow neither ETF nor Options trading.

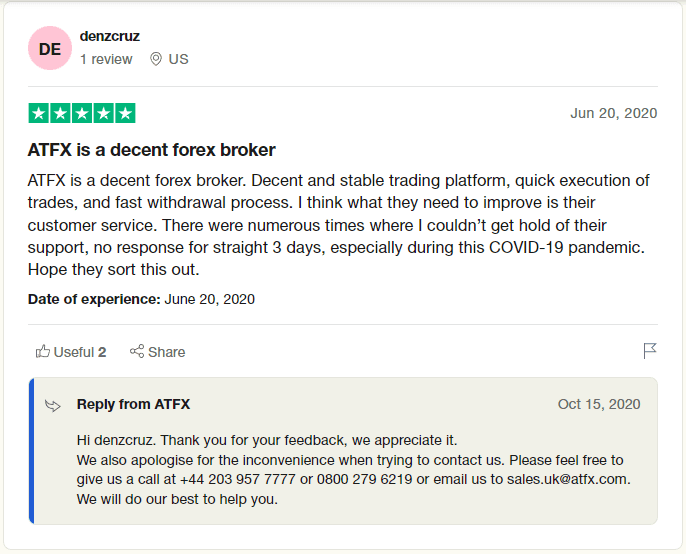

ATFX Customer Support

ATFX offers customer support through various channels, including live chat, email, and phone support. The broker’s website also features an extensive FAQ section and educational resources, such as webinars and trading guides.

However, some negative reviews on Trustpilot highlight difficulties in contacting the support team. One customer mentioned that they had sent multiple emails over several days without receiving a response, while another stated that they struggled to reach the support team via phone. These negative reviews suggest that the broker may need to improve its response times and availability for customers who require assistance.

Overall, while ATFX appears to offer a comprehensive range of customer support options, the negative reviews on Trustpilot indicate that some customers may experience difficulties in reaching the support team.

Advantages and Disadvantages of ATFX Customer Support

Security for Investors

Withdrawal Options and Fees

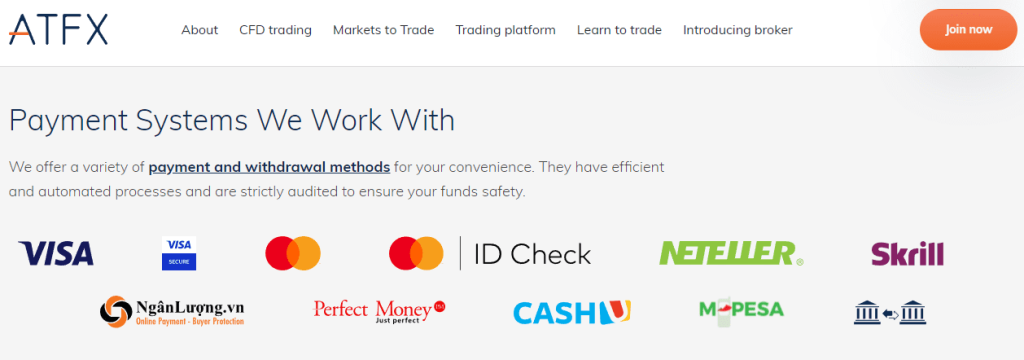

ATFX provides several convenient withdrawal options for its clients, including bank transfer, debit/credit cards, and electronic payment systems.

The most common way of withdrawing funds from the platform is through wire transfers, which can generally take up to 7 business days for the funds to arrive. Alternatively, clients can withdraw funds with Visa and Mastercard cards or via electronic payment systems, such as Skrill and Neteller, which are usually much faster. However, it must be said that the withdrawals to debit/credit cards and to electronic wallets are only performed in US dollars, as opposed to the bank wires.

The broker does not charge a withdrawal fee on withdrawals from USD 100 and more to debit/credit cards and electronic payment systems. However, if the customer withdraws a lower amount, the broker’s fee is USD 5. It’s important to note that payment systems may charge additional withdrawal fees, which can vary depending on the location and currency.

Withdrawals to a debit/credit card depend on the bank that issued it, while withdrawals to electronic payment systems take from 1 minute to 1 business day. There is no limit on the maximum per day amount for debit/credit cards, wire transfers, or electronic wallets. However, clients should be aware of the withdrawal fees charged by payment systems and banks, which may vary depending on the location and currency.

Finally, it is important to note that ATFX does not charge any deposit fees for most of its deposit methods. However, it’s important to note that some payment systems may charge their own fees for deposits, which can vary depending on the location and currency. For example, if a client chooses to deposit funds via Neteller, they may be subject up to a 4.4% deposit fee.

ATFX Vs Other Brokers

#1. ATFX vs AvaTrade

While both ATFX and AvaTrade are well regulated online brokers, there are some differences between the two that traders should consider when choosing a broker. ATFX has a broader range of financial instruments compared to AvaTrade, allowing its clients to also trade cryptocurrencies, however it requires a minimum deposit of just $500, while AvaTrade only has a minimum deposit of $100.

In terms of trading platforms, while AvaTrade offers both its own platform and the popular MetaTrader platform, ATFX only offers the MetaTrader 4 platform to its customers.

When it comes to fees and commissions, AvaTrade is known for its competitive pricing, offering commission-free trading and a floating spread starting from 0.9 pips. On the other hand, ATFX offers a much lower spread starting from 0.1 pips on its Premium and Professional accounts, but it is important to note that its standard account has a minimum floating spread starting at 1.8 pips. Additionally, the average commission charged by ATFX is $8.77, which is extremely high compared to the average commissions charged by similar brokers.

Based on our experts’ analysis, AvaTrade is slightly more suitable for both beginner and advanced traders due to its wider range of trading platforms, lower minimum depoist requirement and commission-free trading.

#2. ATFX vs Roboforex

Both ATFX and Roboforex are well-regulated brokers that offer a wide range of financial instruments. However, ATFX has a smaller selection of tradable instruments as opposed to Roboforex as it does not permit ETF trading. Additionally. ATFX only offers the MetaTrader 4 platform, as opposed to Roboforex which also offers its proprietary trading software.

Roboforex offers a maximum leverage of 1:2000, which is 5 times higher than the maximum leverage offered by ATFX. Moreover, the minimum deposit on Roboforex is $10, significantly lower than the one imposed by ATFX of $500.

Our review also indicates that ATFX charges an average trading fee of $8.77, while Roboforex has an average trading fee of $1. Additionally, the minimum spread on ATFX is 0.1 pips, compared to the minimum spread of 0.0 pips offered by the competitor. Therefore, for investors seeking lower commissions, tighter spreads, and higher leverage, Roboforex may be the better option.

#3. ATFX vs Alpari

Alpari and ATFX offer the same groups of financial instruments, including forex pairs, indices, commodities, stocks and cryptocurrencies, but Alpari offers a larger number of tradable securities in each of these categories, including over 4,000 individual companies available for trading.

Furthermore, Alpari offers a maximum leverage of 1:1000, which is significantly higher than the maximum leverage of 1:400 offered by ATFX. Regarding trading fees, both brokers offer competitive spreads, but Alpari offers lower commissions on most trading instruments, while ATFX charges, on average, a commission of $8.77.

Moreover, the minimum deposit on ATFX is much higher than the one on Alpari. In the latter case, investors can open a Standard account with only $20, compared to the $500 required for ATFX.

In conclusion, due to the wider range of financial instruments, higher maximum leverage, lower trading fees, and lower minimum deposit offered by Alpari, we can conclude that Alpari is a better option than ATFX.

Conclusion: ATFX Review

In conclusion, ATFX is a forex and CFD broker that offers a range of trading instruments, including forex, indices, commodities, stocks, and cryptocurrencies. The broker provides several account types, each with different leverage options and minimum deposit requirements. One of the most significant benefits of trading with ATFX is the availability of different financial instruments, which provides traders with multiple options for diversifying their portfolios.

The broker also offers a variety of withdrawal options, including wire transfer, Visa and Mastercard, and electronic payment systems such as Skrill and Neteller. Moreover, ATFX does not charge a withdrawal fee for amounts over USD 100 to debit/credit cards and electronic payment systems.

However, customer support is an area where ATFX could improve. Although the broker provides a live chat service, phone support, and email support, some customers have reported difficulties contacting the support team, with some left unanswered for up to three days.

Additionally, while the majority of customer reviews on Trustpilot are positive, there are some negative reviews regarding ATFX’s customer support and trading experience. Traders should do their due diligence and carefully research the broker’s offerings before deciding to trade with them.

ATFX Review FAQs

Is ATFX legit?

ATFX is a regulated Forex broker that is authorized and regulated by several reputable financial regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Services Commission (FSC) in Mauritius. The fact that ATFX is regulated by these authorities means that the broker must adhere to strict regulations and guidelines to ensure the safety and protection of its clients’ funds. Therefore, ATFX can be considered a legitimate Forex broker that operates in accordance with industry standards and regulations.

However, potential clients must be aware of the large number of negative reviews left by its customers on websites like Trustpilot. Even though the broker must adhere to a strict set of regulations, it could still have some features that are not appreciated by its clients.

What is ATFX minimum deposit?

ATFX minimum deposit requirement varies depending on the account type. The Standard, Edge and Premium Accounts requires a minimum deposit of $500, while for the professional accounts, the minimum deposit requirement is $10,000.

It’s important to note that these minimum deposit requirements are subject to change, and traders should always check the most up-to-date information on the ATFX website or by contacting customer support.

Does ATFX charge withdrawal fees?

ATFX does not charge a withdrawal fee for withdrawals of USD 100 or more made to debit/credit cards and electronic payment systems. However, if the withdrawal amount is less than USD 100, a fee of USD 5 will be charged by the broker.

However, it is important to note that payment systems may charge additional withdrawal fees, and traders should always check with their payment provider for any applicable fees.