ATC Brokers Review

Forex brokers play a crucial role in the world of currency trading and Forex market, acting as intermediaries between retail traders and the global foreign exchange markets. Selecting the right Forex broker is vital for ensuring a smooth trading experience, optimal trading conditions, and access to necessary tools and resources. It’s about finding a partner that aligns with your trading style, goals, and preferences, ensuring that your investments are handled efficiently and effectively.

ATC Brokers stands out in the competitive Forex brokerage landscape for its commitment to providing transparent and direct market access through ECN (Electronic Communication Network) and STP (Straight Through Processing) models. Since its inception in 2005, ATC Brokers has been dedicated to offering high-quality services to both individual traders and institutional investors. With a headquarters in the United States and regulatory oversight from reputable bodies like the FCA in the UK and CIMA in the Cayman Islands, ATC Brokers boasts a strong foundation of trust and reliability.

In this review, we delve deep into ATC Brokers’ offerings, highlighting what sets it apart from the competition. From its diverse account options and straightforward deposit and withdrawal processes to its competitive commission structures, we aim to provide a comprehensive evaluation. Combining expert analysis with real-world trader feedback, our goal is to equip you with all the necessary information to consider ATC Brokers as your go-to for Forex trading needs. Our balanced review seeks to give you the insights needed to make an informed decision about partnering with ATC Brokers.

What is ATC Brokers?

ATC Brokers is a leading ECN and STP broker, established in 2005. It serves a wide range of clients, from individual traders to institutional investors, highlighting its ability to cater to various trading needs and preferences. Based in the United States, ATC Brokers is renowned for its stringent regulatory compliance, being licensed by the FCA in the UK and the CIMA in the Cayman Islands. This strong regulatory framework ensures that traders can rely on a secure and transparent trading environment.

The brokerage’s ECN and STP model offers clients direct access to interbank trading prices, promoting tighter spreads and more transparent pricing. This feature is crucial for traders seeking efficient and fair trading conditions. ATC Brokers’ commitment to serving both individual and institutional clients underscores its flexibility and dedication to meeting the varied requirements of the global trading community. Furthermore, adherence to regulations by FCA and CIMA highlights ATC Brokers’ focus on maintaining high standards of financial integrity and ensuring the security of client funds.

Benefits of Trading with ATC Brokers

Trading with ATC Brokers has provided me with a clear insight into the benefits of their service. First and foremost, the low spreads on major currency pairs, such as EUR/USD, significantly reduce trading costs, enhancing profitability. This, combined with the transparent commission structure, makes it easy to understand and manage trading expenses, a crucial factor for any trader focusing on forex and metals.

The access to ECN and STP models ensures that I am directly connected to the liquidity providers, offering me real-time pricing and the ability to execute trades swiftly. This direct market access is invaluable for executing strategies effectively, especially in volatile markets.

Moreover, regulatory compliance with reputable authorities like the FCA and CIMA provides a layer of security and peace of mind. Knowing that my funds are segregated and protected by negative balance protection allows me to trade with confidence, focusing on strategy rather than safety concerns.

ATC Brokers Regulation and Safety

Trading with ATC Brokers, I’ve learned firsthand about its regulatory compliance and safety measures. The broker operates under strict licenses from the Financial Conduct Authority (FCA) in Great Britain and the Cayman Islands Monetary Authority (CIMA). Understanding the regulatory framework is essential as it assures traders of the broker’s commitment to operating within established legal and ethical standards, providing a secure trading environment.

Client funds are treated with utmost care, being segregated from ATC Brokers’ capital. This means that the funds are kept in separate bank accounts, ensuring they are protected and cannot be used for any other purpose. This segregation is a critical aspect of the broker’s safety measures, offering an additional layer of security for traders’ investments.

Another safety feature I value is the negative balance protection. This safeguard prevents traders from losing more money than they have in their accounts, offering peace of mind, especially during volatile market conditions. Should there ever be a dispute or a concern regarding the broker’s obligations, the presence of regulatory bodies like the FCA and CIMA means I have the right to file a complaint. This accountability is a significant reason why knowing about ATC Brokers’ regulation and safety is crucial for anyone considering trading with them.

ATC Brokers Pros and Cons

Pros

- EUR/USD spreads start at 0.3 pips.

- Trade Copier and PAMM accounts available for investment.

- Supports 38 Forex currency pairs.

- Licensed by reputable regulators in the USA and Great Britain.

- Direct liquidity provider access via ECN and STP.

- Active negative balance protection.

Cons

- Limited to two categories of trading instruments.

- Fees for depositing and withdrawing funds, plus an inactivity fee.

- No bonuses offered.

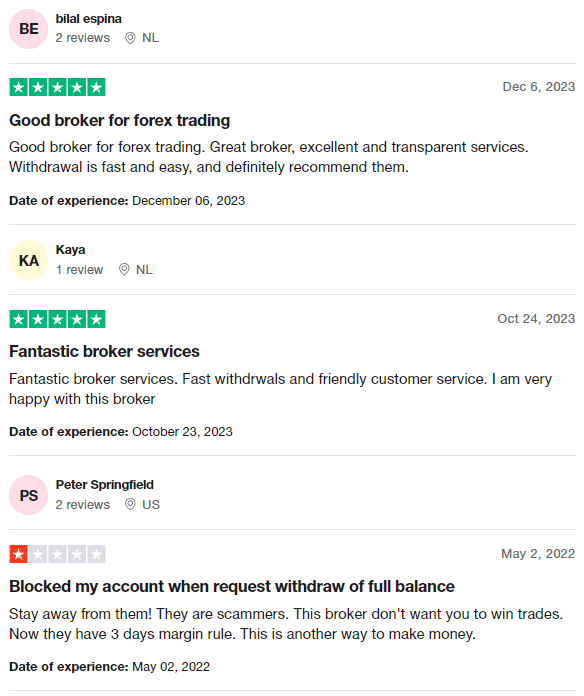

ATC Brokers Customer Reviews

Customer reviews of ATC Brokers present a mixed picture, with the majority highlighting their positive experiences, praising the broker for its excellent and transparent forex trading services. Many users appreciate the fast and easy withdrawal processes, along with friendly customer service, recommending ATC Brokers for these strengths. However, a contrasting viewpoint exists, with a minority labeling the broker as less favorable, accusing it of being unfair in trade practices and criticizing its margin rules as a means to profit. This diverse feedback underscores the importance of due diligence and considering a range of user experiences when evaluating ATC Brokers.

ATC Brokers Spreads, Fees, and Commissions

At ATC Brokers, the cost of trading includes both spread and fixed commission fees. Specifically, the average spread for the EUR/USD currency pair is notably low at 0.3 pips. Additionally, traders are subject to a fixed commission of USD 30 per USD 1,000,000 traded. This pricing structure is crucial for traders to understand as it directly affects trading costs and potential profitability.

Moreover, there’s an inactivity fee to be aware of. After 6 months of no trading activity, ATC Brokers charges 50 units of the base currency, leading to the automatic blocking of the account if funds are insufficient. This is an essential consideration for those who may not trade frequently.

Beyond trading costs, ATC Brokers also imposes fees for non-trading activities, such as account deposits and withdrawals. These mandatory payments are an important factor to consider when calculating the overall cost of using ATC Brokers’ services. Being informed about all potential charges is vital for effective financial planning and management of one’s trading account.

Account Types

After testing the different account types offered by ATC Brokers, I’ve found that they provide three main options: Individual, Joint, and Corporate accounts. Here’s a clear breakdown of each:

- Individual Account: This is the standard account type aimed at private traders using their own funds. The trading conditions are quite competitive, with an average spread for EUR/USD at just 0.3 pips and for XAU/USD at 0.4 pips. Leverage can go up to 1:200, offering flexibility in trading strategies with market execution as the type of trade execution.

- Joint Account: Designed for use by multiple individuals, this account offers similar terms to the Individual account. It’s an ideal option for partners or traders looking to manage a single account collectively.

- Corporate Account: Tailored for legal entities, the specific trading conditions for this account are not disclosed publicly by the broker. This account type is suited for corporate clients with specific trading needs and requirements.

ATC Brokers maintains uniform trading conditions across the Individual and Joint accounts, ensuring a level playing field for private and shared account holders alike. My experience with these accounts has shown that regardless of the account type chosen, traders can expect a robust trading environment.

How to Open Your Account

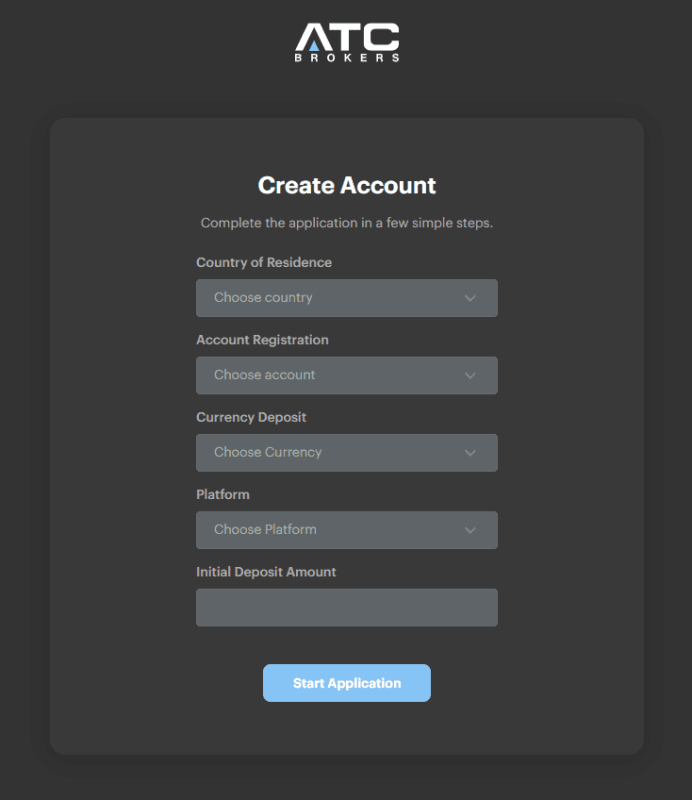

-

- Visit the broker’s website and access the trading account creation form on the main page.

- Fill out the basic registration form, including your country of residence, preferred account type and currency, trading terminal preference, and planned investment amount.

- Provide your personal information, such as name, surname, date of birth, residence address, email, and phone number.

- Set up a password for your account along with a four-digit pin code for additional security and support purposes.

- Acknowledge the commission fees information provided by the company by confirming you have read and understood these charges.

- Complete a detailed identification form, including personal data, residential address, and contact information, which will be verified later.

- Add further details in the identification form regarding your citizenship, place of birth, and tax information, including your country of tax residence and tax identification number.

- Submit documents for verification, including your ID and proof of residential address, to complete the account opening process.

ATC Brokers Trading Platforms

Based on my experience, ATC Brokers provides traders with access to the MetaTrader 4 (MT4) trading platform. This platform is widely recognized for its user-friendly interface, robust analytical tools, and flexibility in trading strategies. MT4 supports a variety of order types, indicators, and expert advisors, making it suitable for traders of all levels of experience. Its reliability and comprehensive features ensure that I have the necessary tools at my disposal to analyze markets, execute trades, and manage my portfolio efficiently.

What Can You Trade on ATC Brokers

From my experience trading with ATC Brokers, the range of trading instruments available caters to those interested in both forex and commodities markets. Specifically, traders have access to 38 currency pairs, encompassing major, minor, and some exotic pairs. This variety offers ample opportunity for forex trading strategies across different global currencies, allowing for diversification and leveraging of market movements.

Additionally, ATC Brokers provides the option to trade CFDs on 2 metals, which includes precious metals like gold and silver. Trading these CFDs is a way to speculate on the price movements of these commodities without owning the physical metal. This can be particularly appealing for those looking to hedge against inflation or diversify their investment portfolio beyond just currency pairs.

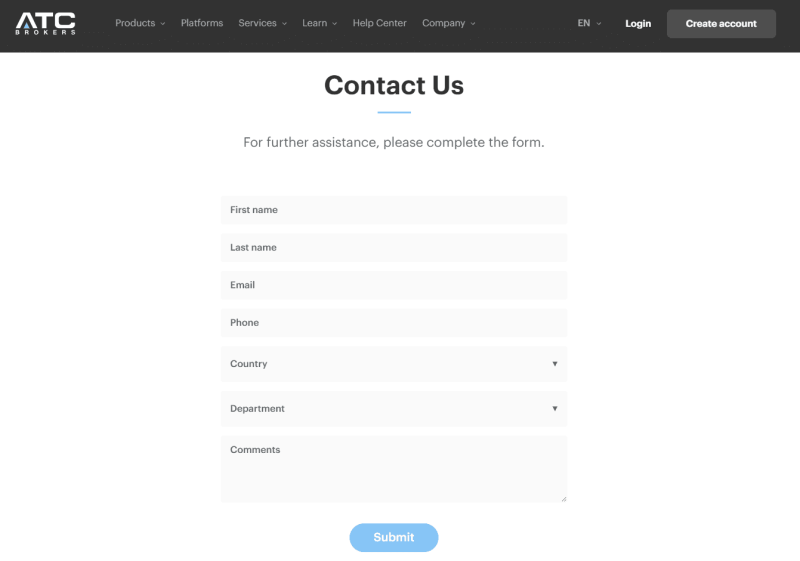

ATC Brokers Customer Support

Based on my interactions, ATC Brokers offers a variety of communication channels for reaching out to their customer support specialists, ensuring that assistance is readily available when needed. You can contact them via a phone number listed in the Contact section of their website, providing a direct line for urgent inquiries or detailed discussions. This method proved efficient for immediate support.

Email communication and a feedback form are also available, ideal for less urgent matters where detailed information or documentation might need to be shared. Responses through these channels were timely and helpful. Additionally, the online chat feature on the site offers instant support for quick questions or technical issues. This variety in support options significantly enhanced my trading experience, offering reassurance that help is always just a few clicks or a phone call away.

Advantages and Disadvantages of ATC Brokers Customer Support

Withdrawal Options and Fees

In my experience with ATC Brokers, the withdrawal process is quite straightforward, with applications processed within up to 48 hours. The broker offers several withdrawal methods, including bank transfer, Visa and Mastercard bank cards, and Skrill wallets. This flexibility allows for choosing the most convenient option based on personal preferences or availability.

For bank transfers, it typically takes up to two business days for the transaction to complete. However, it’s important to note that ATC Brokers does charge a withdrawal fee. The fee varies depending on the base currency of your account: GBP 20, EUR 30, or USD 40 for bank transfers and a 1% commission for withdrawals to Skrill. Fortunately, withdrawals using bank cards are exempt from commission fees, offering a cost-effective option.

Another key point is that both deposit and withdrawal transactions require prior verification of your account. This is a standard practice aimed at enhancing security and complying with financial regulations, ensuring that all financial transactions are legitimate and secure.

ATC Brokers Vs Other Brokers

#1. ATC Brokers vs AvaTrade

ATC Brokers and AvaTrade cater to different trader needs through their offerings. ATC Brokers, known for its ECN and STP brokerage services since 2005, offers direct access to interbank trading prices and a focused selection of trading instruments, including 38 currency pairs and CFDs on metals. On the other hand, AvaTrade, established in 2006, provides a broader range of over 1,250 financial instruments across various markets, making it a go-to for traders seeking diversity. AvaTrade’s global presence and regulatory compliance in multiple jurisdictions offer a robust trading environment.

Verdict: For traders prioritizing direct market access and those trading mainly in forex and metals, ATC Brokers is superior. However, for those seeking a wider range of financial instruments and global market access, AvaTrade stands out.

#2. ATC Brokers vs RoboForex

RoboForex, since 2009, distinguishes itself with a vast selection of over 12,000 trading options across eight asset classes, coupled with its emphasis on cutting-edge technology and flexible trading platforms, including MetaTrader, cTrader, and RTrader. It caters to a broad spectrum of traders, offering personalized trading terms. ATC Brokers, with its focus on forex and CFDs on metals through ECN and STP models, appeals to traders looking for transparent pricing and direct market access.

Verdict: If you’re seeking technological diversity and a wide range of trading instruments, RoboForex is the better choice. For those valuing transparent, direct market access for forex and metal trading, ATC Brokers is preferable.

#3. ATC Brokers vs Exness

Exness and ATC Brokers both offer competitive forex trading environments but with distinct advantages. Exness, started in 2008, boasts a high monthly trading volume and offers a vast selection of more than 120 currency pairs, along with CFDs on stocks, energy, and metals. Its unique selling point is the provision of infinite leverage and low commission rates, catering especially to traders looking to maximize their trading volume on small deposits. ATC Brokers provides a more focused forex trading experience with its ECN/STP model, appealing to those seeking minimal trading costs with direct access to liquidity providers.

Verdict: For traders emphasizing leverage and a wide range of trading instruments, Exness is the better option. For those who prioritize direct market access with competitive spreads in forex and metal CFDs, ATC Brokers is more suitable.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH ATC BROKERS

Conclusion: ATC Brokers Review

ATC Brokers offers a solid forex trading platform that appeals to both novice and professional traders looking for direct market access through ECN and STP models. With competitive spreads, particularly on EUR/USD, and a transparent commission structure, it’s a strong choice for traders focused on forex and metals. The brokerage is well-regulated, providing a secure trading environment with the added peace of mind of negative balance protection and segregated client funds.

However, potential users should be aware of the limitations, including the restricted range of trading instruments and the fees associated with withdrawals and inactivity. While these cons may deter some traders, those who prioritize the quality of execution and regulatory assurance may find ATC Brokers to be a fitting choice.

Also Read: IronFX Review 2023 – Expert Trader Insights

ATC Brokers Review: FAQs

What trading platforms does ATC Brokers offer?

ATC Brokers provides the MetaTrader 4 (MT4) platform, known for its user-friendly interface, comprehensive analytical tools, and flexibility in trading strategies.

Are there any fees for depositing or withdrawing funds at ATC Brokers?

Yes, ATC Brokers charges a commission for withdrawing funds, with specific fees depending on the method: GBP 20, EUR 30, or USD 40 for bank transfers and a 1% commission for Skrill withdrawals. There are no commission fees for transactions using bank cards.

Is ATC Brokers regulated?

Yes, ATC Brokers is regulated by reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Cayman Islands Monetary Authority (CIMA), ensuring a secure and transparent trading environment.

OPEN AN ACCOUNT NOW WITH ATC BROKERS AND GET YOUR BONUS