ATC Brokers Review

Are you in the market for a forex broker that offers competitive trading conditions and a range of advanced trading tools? Then, ATC Brokers might be the right broker for your needs. With over 15 years of experience in the industry, ATC Brokers offers a wide range of trading accounts, instruments, and platforms to meet the needs of traders of all levels.

In this article, we’ll dive into the features and services offered by ATC Brokers, fees and commission structure, account types, customer service, and much more, to help you decide if this broker is the right fit for your trading needs.

What is ATC Brokers?

ATC Brokers is a global online forex and CFD broker that has been providing traders with access to the financial markets since 2005. The broker offers a wide range of currency pairs and CFDs, with competitive trading conditions and reliable trade execution. ATC Brokers is committed to providing its clients with the tools and resources they need to succeed in the financial markets, offering advanced trading platforms, educational resources, and excellent customer support.

Over the years, ATC Brokers has established a reputation as a trusted and reliable broker, serving clients from all over the world. The broker is headquartered in the United States and is registered with the US Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). ATC Brokers operates with high levels of transparency and regulatory compliance, ensuring that clients can trade with confidence and peace of mind.

With a focus on providing clients with access to the latest trading technologies and advanced trading tools, ATC Brokers is committed to helping traders of all levels of experience achieve their financial goals. Whether you are a beginner or an experienced trader, ATC Brokers provides the tools and resources you need to succeed in the fast-paced world of online trading. With a strong track record of providing excellent service and support to clients around the world, ATC Brokers is a broker you can trust to help you achieve your trading goals.

Advantages and Disadvantages of Trading with ATC Brokers?

Benefits of Trading with ATC Brokers

There are several benefits of trading with ATC Brokers that make it an attractive choice for traders of all levels of experience. Firstly, the broker offers competitive trading conditions, including tight spreads and fast trade execution speeds. This means that traders can enter and exit positions quickly, reducing the risk of slippage and maximizing their potential profits.

Secondly, ATC Brokers provides traders with access to a range of advanced trading tools and features. The broker offers two powerful trading platforms, MetaTrader 4 and NinjaTrader, which provide a range of advanced charting and technical analysis tools, as well as the ability to automate trading strategies. This allows traders to develop and test their trading strategies before deploying them in live markets, reducing the risk of costly mistakes.

Finally, ATC Brokers is a well-regulated broker that operates with high levels of transparency and security. The broker is a member of the National Futures Association (NFA) and is registered with the US Commodity Futures Trading Commission (CFTC), ensuring that it meets strict regulatory requirements. In addition, ATC Brokers uses state-of-the-art encryption technology to protect its clients’ personal and financial information, and all client funds are held in segregated accounts with top-tier banks.

Overall, trading with ATC Brokers offers traders access to competitive trading conditions, advanced trading tools, and a secure and well-regulated trading environment. Whether you are a beginner or an experienced trader, ATC Brokers provides the tools and resources you need to succeed in the financial markets.

ATC Brokers Pros and Cons

Pros:

- API Trading

- Wide range of trading platforms, including mobile and web

- More than 20 liquidity providers

- Demo account

Cons:

- Inactivity fees

- No bonuses

- Only market execution orders

- Fees for deposits and withdrawals of funds

ATC Brokers Customer Reviews

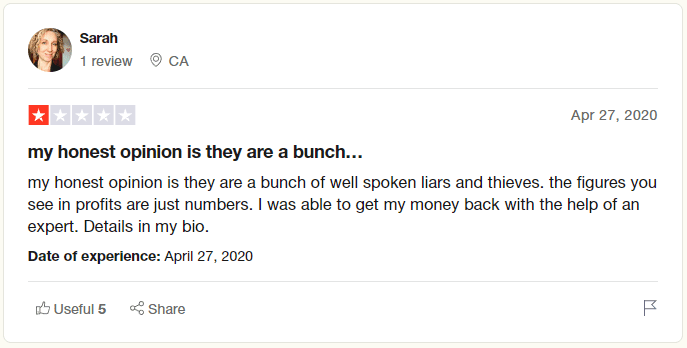

Based on the reviews on Trustpilot, ATC Brokers has an overall rating of 2.7 out of 5 stars. The reviews are mixed, with some users praising the broker for its competitive trading conditions and reliable trade execution, while others criticize it for poor customer support and technical issues.

Positive reviews highlight ATC Brokers’ competitive pricing, fast trade execution, and access to advanced trading tools. Users also appreciate the broker’s well-regulated and secure trading environment.

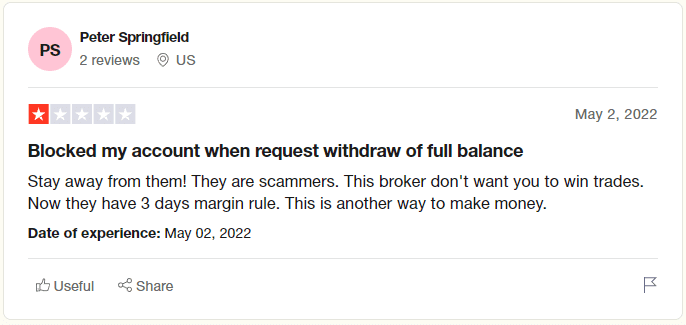

Negative reviews of ATC Brokers often highlight issues with customer support, slow processing of withdrawals, and technical problems with the trading platform. Users have reported difficulties communicating with the broker, citing unresponsive or unhelpful support staff, especially during the withdrawal process. Furthermore, some clients have gone so far as to accuse the broker of being “scammers,” claiming that their account was blocked after requesting a full withdrawal and citing concerns about the newly introduced 3-day margin rule.

Overall, while ATC Brokers has a mixed reputation on Trustpilot, which must be taken into consideration before deciding to open an account with ATC Brokers.

ATC Brokers Spreads, Fees, and Commissions

ATC Brokers offers competitive pricing for its trading services, with a range of different fees, spreads, and commissions that vary depending on the financial instrument being traded and the trading account type.

For forex trading, ATC Brokers offers tight spreads starting from as low as 0.1 pips, which can help traders reduce their trading costs and increase their potential profits. The broker also charges a commission on forex trades, with rates starting from $1 per standard lot traded. This commission-based pricing model can be beneficial for traders who are looking for transparent and fair pricing without hidden markups or additional charges.

For CFD trading, ATC Brokers offers variable spreads starting from as low as 0.3 pips for major indices and commodities, and 1.5 pips for cryptocurrencies. The broker does not charge a commission on CFD trades, which means that all trading costs are built into the spread. This can make it easier for traders to calculate their total trading costs and plan their trading strategies accordingly.

Additionally, ATC Brokers charges a range of non-trading fees in addition to its trading fees. For example, inactivity fees are charged on accounts that have been inactive for more than 6 months and the fee is $50 per month. The inactivity fee is charged until the account becomes active again, or until the account’s funds are depleted.

Other miscellaneous fees that ATC Brokers may charge include wire transfer fees, margin call fees, and overnight rollover fees. These fees vary depending on the specific trading instrument and account type, so it’s important to review the broker’s fee schedule carefully before opening an account.

Account Types

ATC Brokers offers three different types of trading accounts to suit the needs of individual traders, joint account holders, and corporate entities. These account types are the Individual Account, Joint Account, and Corporate Account.

The Individual Account is designed for individual traders who want to trade forex and CFDs. This account type requires a minimum deposit of $3,000 and offers access to ATC Brokers’ full range of trading platforms and tools. Traders can choose from a range of leverage options up to 1:100, and can trade in multiple currencies with tight spreads and competitive commissions.

The Joint Account is designed for two or more individuals who want to trade together. This account type requires a minimum deposit of $10,000 and offers the same features and benefits as the Individual Account, but with shared ownership and responsibility for the account.

The Corporate Account is designed for businesses and other corporate entities that want to trade forex and other financial instruments. This account type requires a minimum deposit of $10,000 and offers access to a range of trading platforms and tools, as well as dedicated account management and support. Corporate accounts can trade in multiple currencies with flexible leverage options up to 1:100, and can customize their trading strategies to suit their specific needs and goals.

The minimum order size of 0.01 is applicable to all account types, regardless of the balance amount. It is worth mentioning that for account balances above $1,000,000, the maximum leverage available increases to 1:200, which can provide more flexibility to traders with higher capital.

Overall, ATC Brokers’ account types are designed to provide flexibility and choice for traders of all types, whether they are individual traders, joint account holders, or corporate entities. Each account type offers a range of features and benefits to suit different trading needs and preferences and can be customized to suit specific trading strategies and goals.

How To Open Your Account

Opening an account with ATC Brokers is a straightforward process that can be completed online. Here is a step-by-step guide to the account opening process:

- Go to the ATC Brokers website and click on the “Open Account” button in the top right corner of the homepage.

- Select the type of account you want to open, either Individual, Joint, or Corporate.

- Fill out the account application form, which will require personal information such as your name, address, and contact details. You will also need to provide information about your trading experience, financial situation, and investment goals.

- Verify your identity and residency by providing a copy of your passport or government-issued ID, as well as a utility bill or bank statement that shows your name and address.

- Choose your trading platform. You can choose from a range of trading platforms including MetaTrader 4 and NinjaTrader.

- Fund your account by choosing from a range of deposit options including bank transfer, credit/debit card, or electronic wallet. The minimum deposit amount for an Individual Account is $3,000, while the minimum deposit amount for a Joint or Corporate Account is $10,000.

- Once your account is funded, you can start trading on the platform of your choice. ATC Brokers offers a range of forex pairs and CFDs with competitive spreads and low commissions.

Overall, the account opening process with ATC Brokers is relatively straightforward and can be completed online in just a few steps.

What Can You Trade on ATC Brokers

ATC Brokers offers a range of trading instruments, including 38 currency pairs and CFDs. These instruments allow traders to profit from market movements in various global markets, and can provide opportunities for diversification and risk management in a trading portfolio.

While ATC Brokers offers a comprehensive range of trading options, it’s worth noting that there are certain products that cannot be traded on their platform. These include stocks, ETFs, indexes, cryptocurrencies, and options. This focus on currency pairs and CFDs may be attractive to traders who specialize in those asset classes, or who prefer to focus on a narrower range of products.

Overall, the availability of 38 currency pairs and CFDs on ATC Brokers offers traders a solid range of options for trading in global markets, while the exclusion of other products may be seen as a potential drawback for those who wish to trade in those asset classes. However, for traders who are primarily interested in currency pairs and CFDs, ATC Brokers’ offerings may provide a suitable and flexible platform for achieving their trading goals.

ATC Brokers Customer Support

ATC Brokers offers several avenues for customer support, including phone, email support and feedback forms, as well as live chat functionality that is available 24/5. This range of support options allows traders to choose the method that is most convenient for them when seeking assistance.

The company’s support team is comprised of experienced professionals who are knowledgeable about the financial markets and ATC Brokers’ products and services. They are known to be responsive and helpful in resolving issues quickly and efficiently.

In addition to its support team, ATC Brokers provides a comprehensive FAQ section on its website that can be useful in answering common questions or issues that traders may encounter. The company also offers a range of account management tools, accessible through its trading platform or website, that can help traders manage their accounts and access relevant information easily.

Overall, it appears that ATC Brokers is committed to providing quality customer support to its clients. With several support channels available, knowledgeable staff, and helpful tools and resources, traders can be confident in receiving prompt and reliable assistance when needed.

Advantages and Disadvantages of ATC Brokers Customer Support

Security for Investors

Withdrawal Options and Fees

ATC Brokers offers several withdrawal options, including bank transfer, Visa and Mastercard bank cards, and Skrill wallets. Withdrawal applications are processed within 48 hours, with bank transfers taking up to two business days to complete.

However, ATC Brokers charges a commission for withdrawals. The fee for bank transfers is GBP 20, EUR 30, or USD 40, depending on the base currency of the account. Skrill withdrawals are subject to a 1% commission, but bank card transactions do not incur any commission fees.

It’s important to note that verification is required before deposit and withdrawal of funds at ATC Brokers. In addition to withdrawal fees, account funding is also subject to commissions, with bank transfers having no commission fee, while bank cards and Skrill are subject to a 2.9% commission.

ATC Brokers Vs Other Brokers

#1. ATC Brokers vs AvaTrade

While both ATC Brokers and AvaTrade are regulated online brokers, there are some differences between the two that traders should consider when choosing a broker. AvaTrade has a broader range of financial instruments compared to ATC Brokers, including commodities and indices, and requires a minimum deposit of just $100, while ATC Brokers’ minimum deposit is $3,000.

In terms of trading platforms, ATC Brokers offers a proprietary platform, a web trading platform, and a mobile platform, while AvaTrade offers both its own platform and the popular MetaTrader platform.

When it comes to fees and commissions, AvaTrade is known for its competitive pricing, offering commission-free trading and a floating spread starting from 0.9 pips. On the other hand, ATC Brokers has a much lower spread starting from 0.1 pips but charges an average commission of $3 per trade.

Based on our expert analysis, AvaTrade is slightly more suitable for both beginner and advanced traders due to its wider range of instruments and commission-free trading.

#2. ATC Brokers vs Roboforex

Both ATC Brokers and Roboforex are well-regulated brokers that offer a wide range of financial instruments through their proprietary trading platforms. However, while Roboforex does not offer cryptocurrencies and options, ATC Brokers offers an even smaller selection of tradable instruments.

Roboforex offers a maximum leverage of 1:2000, which is 10 times higher than the maximum leverage offered by ATC Brokers. Moreover, the minimum deposit on Roboforex is $10, significantly lower than the one imposed by ATC Brokers of $3,000.

Our review also indicates that ATC Brokers charges an average trading fee of $3, while Roboforex has an average trading fee of $1. Additionally, the minimum spread on ATC Brokers is 0.1 pips, compared to the minimum spread of 0.0 pips offered by Roboforex. Therefore, for investors seeking lower commissions, tighter spreads, and a wider selection of financial instruments, Roboforex may be the better option.

#3. ATC Brokers vs Alpari

Alpari offers a wide range of financial products, including forex, commodities, indices, stocks, and cryptocurrencies, with over 4,000 individual companies available for trading. In contrast, ATC Brokers only offers 38 currency pairs and CFDs and doesn’t offer the possibility to trade shares, options, ETFs, or cryptocurrencies.

Furthermore, Alpari offers a maximum leverage of 1:1000, which is significantly higher than the maximum leverage of 1:200 offered by ATC Brokers. Regarding trading fees, both brokers offer competitive pricing, but Alpari offers tighter spreads and lower commissions on most trading instruments, while ATC Brokers charges an average commission of $3.

Moreover, the minimum deposit on ATC Brokers is much higher than the one on Alpari. In the latter case, investors can open a Standard account with only $20, compared to the $3,000 required for ATC Brokers.

In conclusion, due to the wider range of financial instruments, higher maximum leverage, lower trading fees, and lower minimum deposit offered by Alpari, we can conclude that Alpari is a better option than ATC Brokers.

Conclusion: ATC Brokers Review

In conclusion, ATC Brokers is a reputable forex broker that offers a range of trading services for retail and professional traders. With over 15 years of experience in the financial markets, ATC Brokers has developed a strong reputation for its transparent and reliable trading services.

One of the standout features of ATC Brokers is its advanced trading technology, which includes the popular MetaTrader 4 platform. Traders also have access to a range of trading tools and resources, including educational materials, market analysis, and a demo account for practice trading.

While ATC Brokers offers competitive spreads and low commissions, there are some potential drawbacks to consider. These include the lack of diversity in available products, limited customer support options, and high minimum deposit requirements for both individual and non-individual accounts.

Overall, ATC Brokers is a trustworthy forex and CFD broker that is worth considering for traders looking for a reliable and secure trading platform. However, traders should carefully review the available services and fees before opening an account to ensure that the broker’s offerings align with their specific trading needs and preferences.

ATC Brokers Review FAQs

Is ATC Brokers legit?

Yes, ATC Brokers is a legitimate forex broker that has been operating since 2005. They are registered and regulated by the United States National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). They also have a clean regulatory record, which means that they have not faced any major regulatory violations or penalties in recent years.

They also offer various features and services, such as multiple account types, competitive spreads, and reliable trading platforms, which further demonstrate their legitimacy and commitment to providing quality services to their clients.

What is ATC Brokers minimum deposit?

The minimum deposit requirement for an individual trading account with ATC Brokers is $3,000. However, the minimum deposit requirement for joint and corporate trading accounts is higher, at $10,000. It’s important to note that the minimum deposit requirement may vary based on the account type, country of residence, and other factors, so it’s always best to check with ATC Brokers directly to confirm the current requirements.

Does ATC Brokers charge withdrawal fees?

Yes, ATC Brokers charges withdrawal fees. The amount of the fee depends on the withdrawal method used. For bank transfers, the fee is GBP 20, EUR 30, or USD 40 depending on the base currency of the account. For withdrawals to Skrill, a 1% commission is charged. However, there are no commission fees for transactions using bank cards.

It’s important to note that deposit and withdrawal of funds at ATC Brokers are possible only after passing the verification process. Additionally, it is worth to mention that the processing time for applications for withdrawal of funds is up to 48 hours, and a bank transfer can take up to two business days.