AssetsFX Review

When you’re dabbling in Forex, picking the right broker is like finding the perfect pair of shoes; it’s gotta fit just right. Your broker is your link to the currency markets, a buddy who should have your back with speedy trades and solid tools.

AssetsFX pops up on the radar with its ECN and STP execution, which is pretty much trader-speak for making trades smoother and faster. But it’s not all sunshine; they’re not cozying up with any regulators, so if you’re fresh to Forex, this might not be your playground. They’re all about the trade, not the tutorial.

I’ll be rolling up my sleeves to give you the lowdown on AssetsFX. Picture this review as a blend of my own trading know-how with a side of real talk from folks who’ve traded there. We’re going to poke around their features, cost stuff, and how you get your money in and out, all to give you the skinny on how they really stack up.

What is AssetsFX?

AssetsFX is not your average Forex broker; they’ve mastered the art of ECN and STP executions, ensuring traders get in and out of trades with the efficiency and speed of a high-caliber commercial operation. This approach links traders directly with the markets, cutting out the middleman for faster transactions and potentially lower costs.

Founded in 2013, AssetsFX began as a platform for online currency trading and quickly shifted gears to become a well-oiled brokerage machine by 2018. Now, they’re in the big leagues, offering a whole menu of trading options, from currencies to CFDs on metals, indices, and even stocks from the US and EU markets. Their service has captivated over 180,000 traders worldwide and snagged some shiny awards along the way.

This global footprint and accolade-studded track record paint a picture of AssetsFX as a broker that’s not just playing the game but changing how it’s played in the online trading arena.

Benefits of Trading with AssetsFX

Trading with AssetsFX, I’ve found that topping up my account is a breeze with instant deposits, and when it’s time to cash out, the fast withdrawals keep things smooth. There’s no sitting around waiting for funds to clear, which is a game-changer for keeping up with the fast-paced Forex market.

They’ve tailored their accounts to suit different trading styles and goals, so whether you’re in it for the long haul or looking for a quick trade, there’s a fit for you. It’s a flexible setup that acknowledges we’re not all trading with the same plan in mind.

Starting up doesn’t require a big investment either. With just $10, you can get the ball rolling on a Standard account, or if you’re eyeing the ECN setup, $50 gets you in the door. This low entry barrier is great for traders who are testing the waters or looking to trade with limited capital.

AssetsFX Regulation and Safety

In my time trading with AssetsFX, I’ve learned that while they’re housed under AssetsFX Global Ltd in St. Vincent and the Grenadines, they step outside the usual safety nets since this locale doesn’t demand a brokerage license. Knowing this is critical because it points to a lack of regulatory oversight—a pretty big deal when you’re trusting someone with your money.

The fact that AssetsFX is not regulated and license-free sets off alarm bells because there are no regulatory watchdogs keeping an eye on their operations. As a trader, you want the peace of mind that comes from knowing someone’s ensuring fair play, and here, that’s missing.

That’s why, from a place of experience and caution, I’d say steering clear of unregulated brokers is usually wise, and unfortunately, AssetsFX falls into that category. Without regulation, we’re left in the dark about whether they use segregated accounts or take other steps to safeguard client funds, and that’s a risk you need to weigh.

AssetsFX Pros and Cons

Pros

- Quick and easy deposit and withdrawal

- Variety of account types for every strategy

- Accessible minimum deposits

- Competitive spreads on professional accounts

- Attractive bonus selection

- 24/7 support in various languages

- Partnership programs for different client types

Cons

- Operates in a non-regulatory jurisdiction

- Lacks investment service offerings

- No trader education or prepared training materials

AssetsFX Customer Reviews

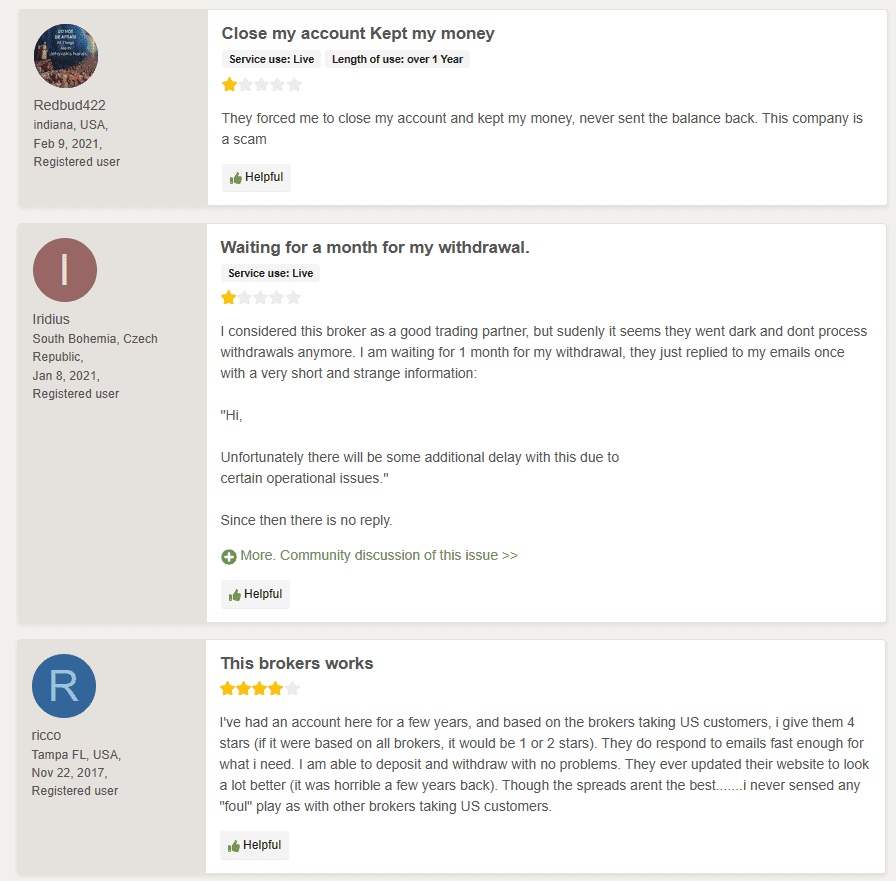

On the website forexpeacearmy.com, reviews about AssetsFX reveal a mixed bag of experiences. Some users allege serious issues, like accounts being closed and funds withheld without a clear explanation. There are reports of abrupt communication breakdowns after facing withdrawal delays, leaving traders in the lurch with only vague mentions of “operational issues.”

However, other users have had more positive interactions, highlighting prompt email responses and reliable deposit and withdrawal processes. One long-term user even acknowledges that while AssetsFX may not compete with the top-tier brokers globally, it stands out positively among those available to U.S. customers, specifically noting an absence of suspicious activities.

The revamped website design also receives a nod, marking an improvement from its earlier state, despite spreads that are not necessarily the most competitive.

AssetsFX Spreads, Fees, and Commissions

As I’ve navigated the trading landscape with AssetsFX, I’ve noticed that the spreads and fees you encounter are tied to the type of account you hold. For the cent and Standard accounts, spreads can kick off from 2.2 pips and 1 pip, respectively, which is pretty straightforward.

However, when you step into the realm of ECN accounts, you’re looking at spreads that can slim down to 0 pips, but here’s the kicker: there’s a $6 commission per lot on the standard ECN and a slightly softer hit of $4 on the ECN Pro.

One perk that caught my eye is that AssetsFX doesn’t tack on extra charges for deposits or withdrawals. Yet, it’s worth keeping in mind that the payment systems you use might have their own fees. And then there’s the swap fees—these are costs you’ll have to cover for holding positions overnight on all account types, except if you’re trading on an Islamic account.

Now, let’s talk commissions. At an average of $2.6 USD, it’s not the lowest I’ve encountered in my trading career, suggesting that while AssetsFX might be competitive in some areas, it’s a touch pricier in others when stacked against rival brokers.

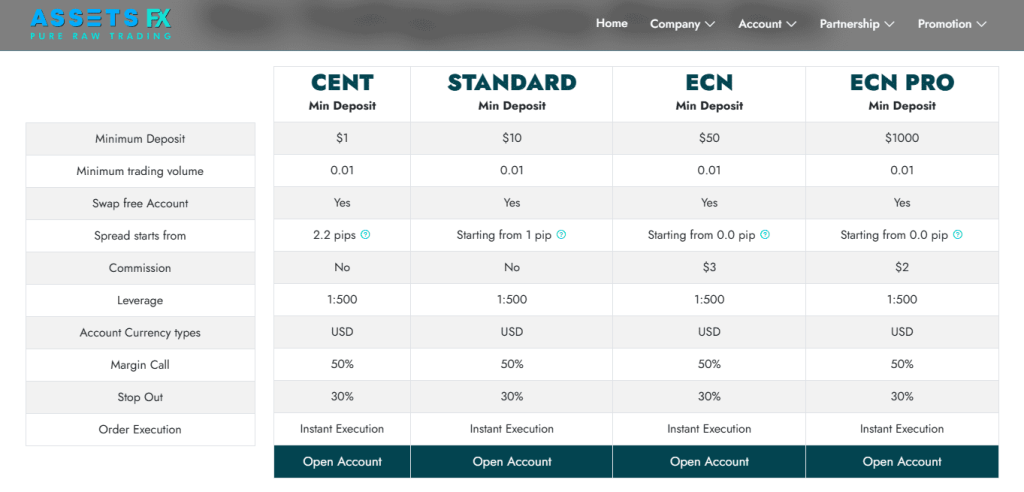

Account Types

From my hands-on experience, AssetsFX lays out a straightforward lineup of account types, designed to cater to a broad spectrum of traders, whether you’re starting out or scaling up your investments. Here’s the breakdown:

- Cent Account: Dive in with just $1 to start, and you’ll work with spreads from 2.2 pips. It’s commission-free and you’ve got leverage that can stretch up to 1:500, with the bonus of instant execution speeds.

- Standard Account: This one steps it up with a $10 minimum deposit. Spreads here are tighter, starting at just 1 pip, and you still get that generous 1:500 leverage.

- ECN Account: Aimed at those looking to get a little closer to the market action with spreads from 0 pips and a $50 entry point. Leverage remains high at 1:500, but there’s a $6 commission to account for, reflecting the direct market access.

- ECN Pro Account: Now we’re in serious territory – this is for traders ready to deploy $1,000 or more. You’ll see spreads from 0 pips here too, but the commission drops to $4, keeping costs in check even as you trade large volumes, with the same 1:500 leverage as the other accounts.

How to Open Your Account

- Initiate the registration by clicking on “Open Account” or “Start Trading” on the AssetsFX website.

- Fill in your personal details and set a strong password for security.

- Check your email for a confirmation PIN and use it to activate your account.

- Access your user account with your email and password.

- Complete identity verification as required by the broker’s security protocols.

- Fund your account by making a deposit to kick-start your trading journey.

- Set up two-factor authentication for an added layer of security on your account.

- Use your user account to submit withdrawal requests, view your transaction history, and explore bonus offers.

AssetsFX Trading Platforms

In my trading journey with AssetsFX, I’ve navigated the markets using both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are the traders’ go-to tools, offering a reliable and intuitive trading experience.

MT4 stands out for its user-friendly interface, making it a great fit for beginners and veterans alike, while MT5 caters to those looking for a more advanced setup, with additional timeframes, indicators, and a depth of market feature.

Also Read: Best Forex Trading Platform 2023 – From An Expert Trader

What Can You Trade on AssetsFX

In my experience, AssetsFX doesn’t drag its feet when it comes to updating its offerings. They started strong with MetaTrader 4 back in 2014—yes, that old reliable platform many traders are familiar with. By 2015, they introduced cent accounts, which are great for folks just starting out and not wanting to bet the farm. When 2020 hit, they brought in ECN accounts for the seasoned traders looking for a more direct connection to the markets.

By 2018, AssetsFX jazzed up their inventory, letting traders dabble in an assortment of currencies and CFDs—ideal for traders who want variety in their game. Jump to 2023, they’re totally on board with MetaTrader 5 and offering crypto trading without slapping on extra fees.

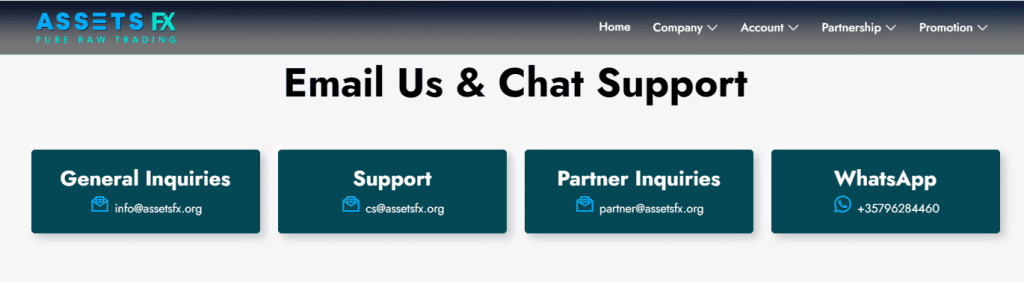

AssetsFX Customer Support

When it comes to customer support, AssetsFX is a bit of a jumble. Only offering support in English can be a stumbling block if they’re trying to reel in traders from around the globe. You can buzz them or drop a note through their contact form, but the lack of local support hubs might not sit well with everyone.

They’ve got live chat, which is great for instant help. Still, the slim pickings when it comes to support options could leave some traders wanting more. Props to them for being on the clock 24/7, but the narrow language offerings and the no-regulation thing could throw a wrench in the works for a global audience. It’s pretty important for folks to think about this stuff before jumping in with AssetsFX.

Advantages and Disadvantages of AssetsFX Customer Support

Withdrawal Options and Fees

Starting with AssetsFX felt pretty straightforward. I popped in with just a $1 minimum deposit, which is on par with what you’d expect from similar brokers. The funding options are a bit narrow, focused on wire transfers and cryptocurrencies—a line-up that some traders might find limiting.

When it came time to pull funds out, I had a few choices. Perfect Money, international bank transfers, and cryptos were on the table for withdrawing dollars. If you’re dealing with other currencies, you’ll need a local bank account. I noticed that my crypto wallet and Perfect Money got credited without delay, but bank transfers took a business day to reflect. A plus was that AssetsFX didn’t tack on extra withdrawal fees, but just be ready to cover any charges from your payment system or bank.

Here’s where it got a bit tricky for me: no VISA or MasterCard, and forget about Neteller or Skrill. That meant no bank cards or e-wallets, which honestly threw up a couple of red flags. Just cryptos and wire transfers—not the versatility I was looking for.

AssetsFX Vs Other Brokers

#1. AssetsFX vs AvaTrade

When comparing AssetsFX to AvaTrade, the main differentiator lies in regulatory oversight and global reach. AvaTrade holds a strong advantage in terms of heavy regulation and diverse instrument offerings. With over 1,250 financial instruments and a long-standing reputation since 2006, AvaTrade provides a comprehensive trading environment, supported by its international presence in multiple jurisdictions, excluding the US. AssetsFX, while it supports MetaTrader platforms and cryptocurrency transactions, lacks AvaTrade’s extensive regulatory framework and global customer base.

Verdict: In this matchup, AvaTrade edges out as the better broker for traders prioritizing regulatory security and market variety.

#2. AssetsFX vs RoboForex

RoboForex and AssetsFX cater to different parts of the forex industry. RoboForex distinguishes itself with over 12,000 trading instruments and a variety of platform options, including MetaTrader, cTrader, and RTrader. It also offers specialized trading conditions to a wide range of clientele. AssetsFX, on the other hand, provides direct market access through ECN accounts as well as fee-free bitcoin transactions. However, RoboForex has the upper hand due to the FSC’s strict regulation and creative trading contests.

Verdict: RoboForex is the better option for traders looking for a variety of trading platforms and a large selection of instruments.

#3. AssetsFX vs Exness

Both AssetsFX and Exness are competitive brokers, however Exness stands out due to its high trading volume and diversified CFD offers. Exness’ low commission structures, rapid order executions, and variable leverage up to infinite on small deposits are especially enticing to traders seeking cost-effective and flexible trading circumstances. While AssetsFX provides an entrance point into forex trading with cent accounts and modern platform options, Exness comes out on top due to its good forex rating and easy trading circumstances.

Verdict: Exness is the best broker for traders that value strong trading conditions and a diverse choice of CFDs.

Conclusion: AssetsFX Review

So, here’s the scoop on AssetsFX – its trading platform got some perks, especially if you’re not looking to drop a lot of dough to start. You can jump in with just a buck, which is pretty sweet. Plus, they’ve got these fancy ECN accounts and let you trade cryptos without hitting you with extra charges. That’s pretty in tune with what traders are digging these days.

But, and it’s a big but, they’re flying solo without the watchful eye of the big regulator bosses. That might make some folks nervous about where their money’s hanging out. And if you’re the kind of trader who likes to have a bunch of tools in your belt, like a variety of payment options and being able to gab in your own language, AssetsFX might feel a bit limited.

In plain talk – if you’re thinking about giving AssetsFX a whirl, just hit the pause button for a sec. It’s cool for some things like getting into crypto and if you’re okay with just the basics. But those red flags about rules and support are kinda hard to ignore. Do your homework, weigh it out, and don’t rush into anything without checking it out from all angles.

Also Read: Windsor Broker Review 2023 – Expert Trader Insights

AssetsFX Review: FAQs

What is the minimum deposit required to open an account with AssetsFX?

The minimum deposit required to open an account with AssetsFX is as low as $1, making it accessible for traders with various budgets.

Does AssetsFX offer a wide range of trading instruments?

AssetsFX offers a range of trading instruments, including forex pairs, and various CFDs, and provides the option to trade via MetaTrader 4 and MetaTrader 5 platforms. However, their selection may not be as extensive as some other brokers.

Is AssetsFX regulated?

AssetsFX does not have strong regulatory oversight, which is a crucial consideration for traders who prioritize security and regulatory protection in their trading endeavors.