ALB Prime Review

ALB Prime is a renowned Contract for Difference (CFD) and Forex trading brokerage firm. With a vast variety of financial products at its disposal, ALB Prime is known for trading over 100 Forex pairs, be they major or exotic, as well as stock indices, commodity and crypto CFDs, metals, bonds, and more.

ALB Prime, headquartered in Malta, operates under the jurisdiction of the Malta Financial Services Authority (MFSA) and abides by the regulations set by European CONSOB and BaFin as cross-border registers.

Although ALB used to operate under the top-tier Financial Conduct Authority (FCA) in the UK, this regulation ceased after Brexit since ALB is based in the EEA. This review seeks to provide an in-depth look at ALB Prime, discussing its strengths and weaknesses, the service it offers, and other relevant aspects that could influence your decision as a potential investor.

What is ALB Prime?

As an entity, ALB Prime finds its roots in Malta and operates under the authorization of the Malta Financial Services Authority (MFSA). It also complies with the European CONSOB and BaFin regulations that govern cross-border registers.

Despite its previous regulation by the UK’s top-tier Financial Conduct Authority (FCA), it lost its authorization due to Brexit, given its EEA location. At its core, ALB Prime is a CFD and Forex trading brokerage firm, offering an expansive range of trading instruments, from over 100 major and exotic Forex pairs to stock indices, commodity and crypto CFDs, metals, bonds, and more.

Advantages and Disadvantages of Trading with ALBPrime

Benefits of Trading with ALB Prime

- Multi-Asset Class: Renowned as a high-ranking online trading provider, ALB Prime showcases an extensive array of financial instruments, including major and exotic FX pairs, equity indices, and commodity CFDs. In addition, ALB Prime features single-share CFDs with a low flat commission, providing traders with the opportunity to maximize their potential. Catering to various trading needs of its diverse clientele, ALB Prime is dedicated to service.

- Investor Protection: ALB Limited is a proud member of the Investor Compensation Scheme (ICS). When depositing funds into an ALB Prime account, clients can rest assured that their money is safe, being held in segregated client bank accounts at regulated banks, separate from ALB Prime’s funds. Moreover, ALB Prime refrains from using client money for business activities. Investors also have the option to withdraw or deposit funds via cryptocurrencies.

- Cutting Edge Technology: ALB Prime’s offer extends beyond the MetaTrader 4 platform, providing its investors with access to the more sophisticated MetaTrader 5 trading platform developed by the market-leading trading software company. Available in web, desktop, and mobile versions for Android and iOS devices, it allows traders to implement the most advanced trading strategies.

Also Read: Best Forex Trading Platform 2023

ALB Prime Pros and Cons

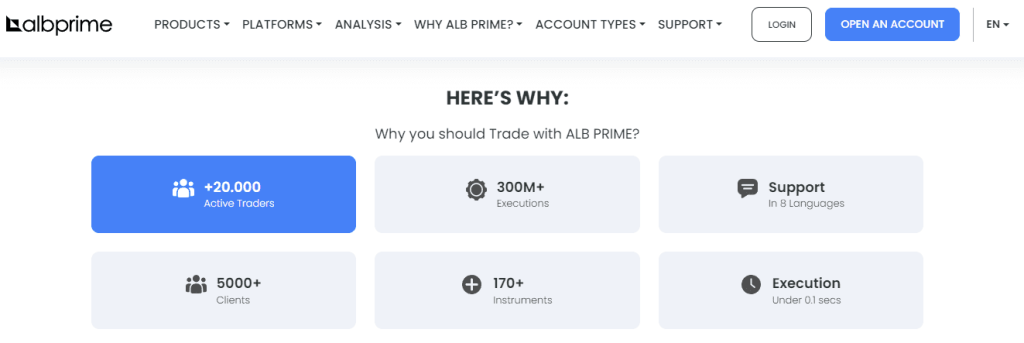

When choosing ALB as your Forex trading broker, several strengths and weaknesses come into play. On the strengths side, the company delivers an assortment of trading instruments, competitive trading fees, and accessibility to renowned MT4 and MT5 trading platforms. The broker also offers around-the-clock customer service in multiple languages, solid research tools, and valuable features such as Autochartist, among others.

However, the firm has its share of weaknesses as well. The website is notably missing comprehensive educational resources and seminars, which might not appeal to traders seeking extensive learning materials. In addition, despite being regulated in Europe, ALB does not hold a top-tier license. This factor might raise concerns among traders who place a premium on brokers with higher regulatory credentials.

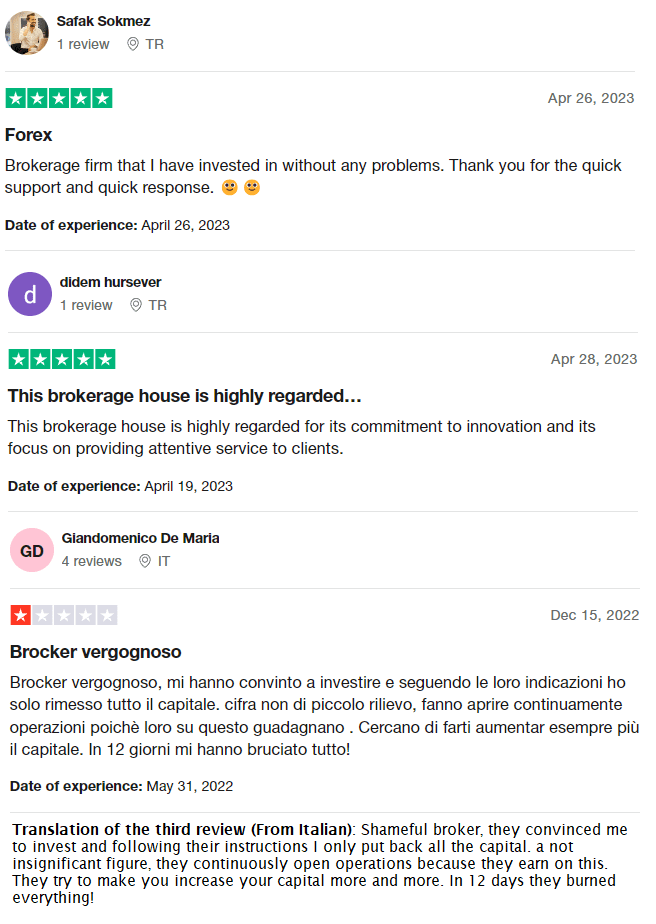

ALB Prime Customer Reviews

The reviews for ALB Prime reveal a mix of satisfaction and frustration among its customers. Several have appreciated the firm’s rapid support and response time, and its dedication to innovation and providing excellent client service. However, some users have criticized the broker for its approach toward increasing the capital of investors, indicating that their investment was lost due to continuous trades made on their behalf.

ALB Prime Spreads, Fees, and Commissions

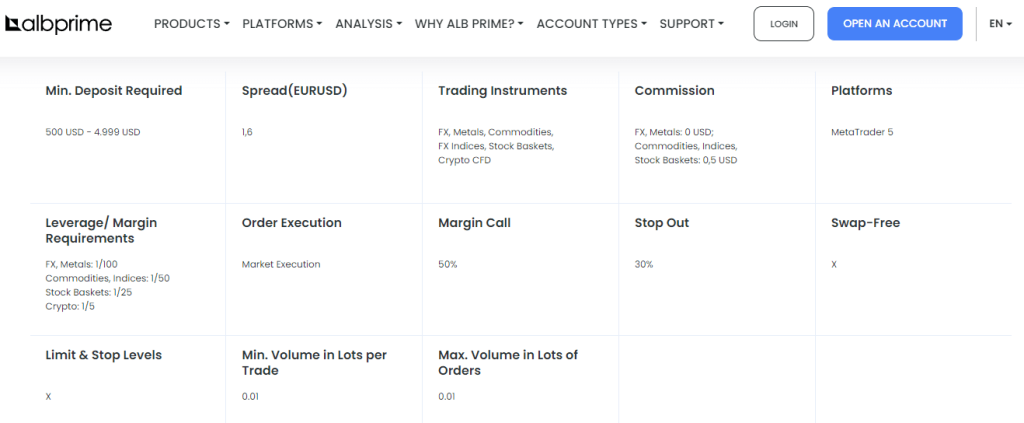

ALB sets itself apart by offering competitive and narrow spreads, with the average spread for the EUR/USD currency pair in the Forex market standing at around 0.7 pips. However, spreads can fluctuate based on market conditions, volatility, and liquidity. As such, it is advisable to refer to the broker’s website or reach out to their customer service for accurate information.

In terms of pricing and commission, ALB’s offerings are generally competitive across its range of trading services. However, there may be fees related to deposits and withdrawals, as well as swap fees, depending on the funding method and account type selected. Therefore, it is crucial to thoroughly examine the broker’s fee structure to understand fully the charges involved and how they could potentially affect your trading activities.

Account Types

ALB Prime makes available three distinct account types to cater to the various needs and preferences of its clients. These are the Mini Account, Gold Account, and VIP Account. Regardless of the account type chosen, the broker provides low spreads and commissions.

For the Mini Account, an initial deposit of at least $500 is required, which is not particularly low. However, each account type offers its own set of benefits, and traders should carefully consider their individual trading needs and resources before choosing an account type.

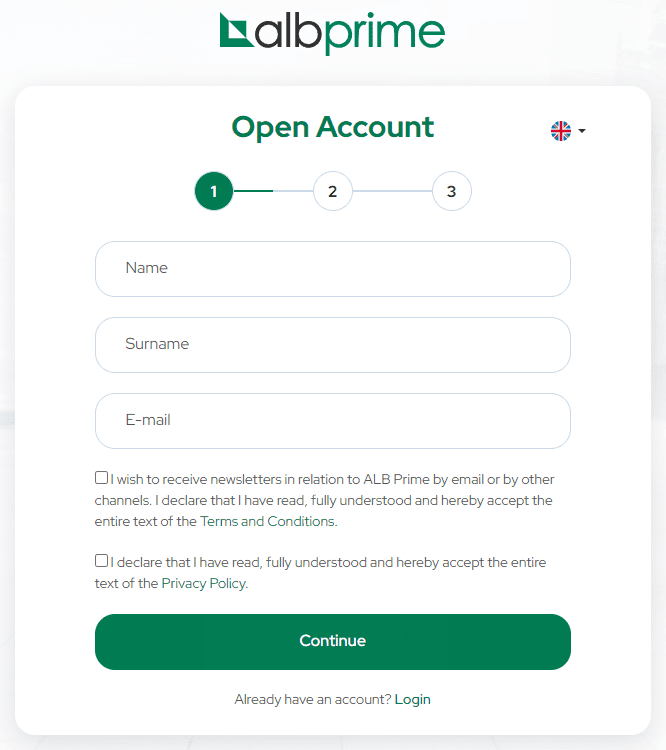

How to Open Your Account

Opening an account with ALB is a straightforward and convenient process that can be completed within a few minutes. Below is a step-by-step guide:

- Navigate to and click on the “Open an Account” page.

- Fill in the necessary personal details such as your name, email address, and phone number.

- Confirm your personal data by uploading the required documents, which include proof of residence and identification.

- Take the electronic quiz designed to confirm your trading experience.

- Once your account is activated and verified, proceed with depositing funds.

What Can You Trade on ALB Prime

ALB Prime offers its clients an extensive array of trading options. These include more than 100 Forex pairs, indices for major stock markets, Contract for Differences (CFDs) for commodities and cryptocurrencies, metals, futures, bonds, and more. This expansive selection empowers traders to diversify their portfolios and engage in a variety of markets based on their individual preferences and trading strategies.

From major to exotic Forex pairs, ALB Prime’s offerings cater to both conservative and adventurous traders. Those interested in digital currencies can also take advantage of the crypto CFDs. Meanwhile, the availability of commodities, metals, and futures, adds an extra layer of diversification. Moreover, those who prefer more traditional assets can benefit from trading bonds and equity indices. In essence, ALB Prime’s broad selection of financial instruments can accommodate a wide array of trading styles and risk tolerances.

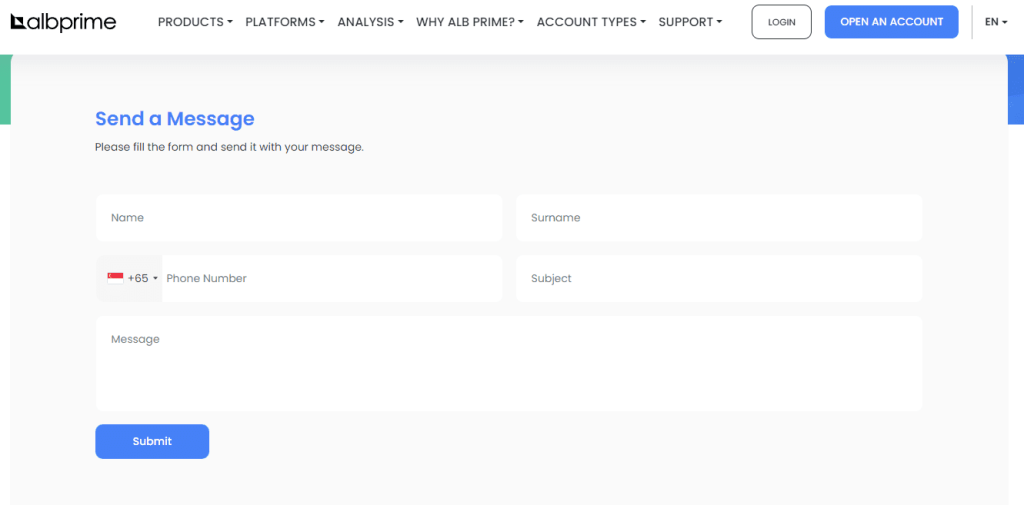

ALB Prime Customer Support

ALB Prime offers dedicated customer support that is available 24/7 to assist clients with their needs. The support can be accessed through various channels, including phone, email, live chat, and multiple social media platforms. This wide range of channels guarantees that clients can reach out for help in a way that is most convenient to them.

The customer support team at ALB is skilled in addressing a variety of concerns. This includes resolving technical issues, providing analysis recommendations, responding to general inquiries, and assisting with operational concerns. Their commitment to support ensures that clients’ trading experiences are as smooth as possible.

Moreover, multilingual support ensures that language barriers do not hinder clients from receiving the help they need. This focus on customer service reflects ALB Prime’s commitment to putting its client’s needs first and ensuring a seamless trading experience. Whether you’re a novice trader needing guidance or an experienced trader with advanced inquiries, ALB Prime’s customer support is ready to assist.

Advantages and Disadvantages of ALB Prime Customer Support

Security for Investors

Withdrawal Options and Fees

ALB Prime offers various funding methods for depositing funds into your trading account, including Bank Wire, Credit/Debit cards, and Crypto payments. However, please note that certain payment methods may have specific requirements or limitations based on the client’s bank or other involved financial institutions. To withdraw funds from your account, simply select the trading account and enter the desired withdrawal amount. Currency conversion will take place if your bank operates in a different currency than your trading account.

ALB Prime Vs Other Brokers

#1. ALB Prime vs AvaTrade

In terms of trading platforms, AvaTrade excels by offering an array of choices including MetaTrader 4 and 5, AvaTradeGO, and AvaOptions. This grants traders more versatility than the MetaTrader 4 and 5 platforms provided by ALB Prime.

While both brokers have a commendable selection of trading instruments, AvaTrade slightly nudges ahead by offering a more varied portfolio that includes Forex, CFDs, cryptocurrencies, commodities, indices, stocks, bonds, ETFs, and options.

Verdict: AvaTrade, with its superior regulatory oversight, a rich suite of educational resources, broader platform choices, and a slightly more diverse portfolio, stands as a superior option when compared to ALB Prime.

#2. ALB Prime vs RoboForex

When comparing ALB Prime and RoboForex, the latter steals the show with its wide-ranging account options designed to suit a variety of trading needs. RoboForex offers an array of six account types, such as Prime, ECN, Pro-Standard, Pro-Cent, R Trader, and Demo accounts, which provide more adaptability compared to the three account types offered by ALB Prime.

In relation to trading platforms, RoboForex not only offers both MetaTrader 4 and 5 and cTrader but also has a proprietary R Trader platform that supports algorithmic trading and is versatile across multiple devices.

Additionally, RoboForex is significantly more accessible in terms of the initial deposit. With a minimum deposit of just $10 for the Pro-Cent and Pro-Standard accounts, it’s much lower than the $500 required for ALB Prime’s Mini Account.

Verdict: Considering its extensive variety of account types, more flexible trading platforms, and a much lower entry barrier in terms of the initial deposit, RoboForex is a more advantageous choice than ALB Prime.

#3. ALB Prime vs Exness

Exness comes out as a winner when comparing it to ALB Prime due to its transparent fee structure and tighter spreads. It boasts an average spread of 0.6 pips for the EUR/USD currency pair on its Raw Spread account, which is slightly tighter than the 0.7 pips offered by ALB Prime.

Additionally, Exness offers a more comprehensive selection of deposit and withdrawal methods, which include bank wire, credit/debit cards, Neteller, Skrill, and cryptocurrencies. This gives traders more flexibility than the bank wire, credit/debit cards, and crypto payments offered by ALB Prime.

Verdict: Given its competitive spreads, and a wider range of payment methods, Exness solidly presents itself as a preferable choice over ALB Prime.

Conclusion: ALB Prime Review

In concluding our comprehensive review of ALB Prime, it’s evident that the broker offers a number of attractive features that could potentially cater to a wide range of traders. With over 100 trading instruments available including Forex pairs, stock indices, commodity and crypto CFDs, metals, bonds, and more, ALB Prime allows for a significant degree of diversification in one’s trading portfolio. Coupled with its MetaTrader 4 and 5 platforms, ALB Prime is technologically equipped to satisfy both novices and experienced traders alike.

However, despite its strengths, ALB Prime isn’t without its shortcomings. The broker’s education resources are limited, and it could certainly benefit from investing in comprehensive and accessible learning materials to aid its clientele in developing their trading skills. Also, its regulatory status, although secured within Europe, doesn’t match up to the top-tier credentials that other brokers boast, raising concerns for those who prioritize robust regulatory standards.

Therefore, while ALB Prime proves to be a viable choice for some, it may not be the ultimate solution for all types of traders. When choosing a broker, it’s crucial to consider multiple factors including their regulation, product portfolio, platform quality, customer service, and above all, whether or not they align with your specific trading needs and objectives.

ALB Prime Review: Frequently Asked Questions (FAQs)

Where is ALB Prime regulated?

ALB Prime is regulated by the Malta Financial Services Authority (MFSA) and is authorized to operate in the European Union. The firm is also included in the European CONSOB and BaFin’s cross-border registers. However, following Brexit, ALB Prime’s authorization with the UK’s Financial Conduct Authority (FCA) was canceled.

What trading platforms does ALB Prime offer?

ALB Prime provides its traders with the popular MetaTrader 4 and MetaTrader 5 platforms. These platforms are renowned for their robust features, including advanced charting tools, numerous built-in indicators, and the ability to employ automated trading strategies.

What instruments can be traded with ALB Prime?

ALB Prime offers a wide variety of financial instruments for trading. These include over 100 major and exotic Forex pairs, stock indices, commodity and crypto CFDs, metals, bonds, and more.

What types of accounts does ALB Prime offer?

ALB Prime offers three types of accounts to its clients: Mini Account, Gold Account, and VIP Account. Each account type is designed to cater to different trading styles and levels of experience.