Learn To Trade Forex • Best Forex Trading Course • AsiaForexMentor

AFM PROFESSIONAL

GRADE TRADING PROGRAM

#1 Professional Grade Trading Academy

The one core program is the most comprehensive, most powerful trading program ever produced. It's the same system that I train the banks with and the same one I use to make 6 figures per trade

- Ezekiel Chew

If You Want To Make An Income From Trading, And I’m Not Talking About Measely Returns, I’m Talking About Big Money And Huge ROI… Read Every Word Of This Letter…

My name is Ezekiel Chew, and I teach bank traders, fund managers, prop traders and also ordinary people how to make money from trading. I trade forex, stocks, indexes, commodities (e.g. gold, silver, crypto) and anything that is tradable. And you are going to learn all of these. Because it doesn’t matter what vehicle it is, what we are looking for is high-probability winning trades that make big money. And with a secure system that guards the risk and money as carefully as my wife does.

For a limited time, I will share with you my secret for making more money in a month than most people make in a year. On this page is some of the most valuable information anyone can receive. And that is: How to make money on demand. And not just any money. But BIG money on demand.

Give me just 20 minutes a day of your time, and I will show you a road to wealth most people could only dream about taking.

I’ll show you how my proprietary system has made me and my students millions of dollars and have how you can do the same.

In a minute, you’re going to have a chance to put some real cash in your account later today. Because the system that I’ll show you is focused on ROI, where you put in $1 and it returns you $3. It’s not about fanciful strategies or flashy methods.

This is a real system that professional traders and banks use. I know that, because I’m the man behind the scenes. The one who trains the bank traders. And I’ve made it so easily comprehensible that my 7- and 8-year-old kids understand it. And if they can understand it at such a young age, anyone can grasp this system if they put the effort into learning it.

This system is so powerful that I’ve created many full-time traders who started the program with zero knowledge in trading. Some even went on to become fund managers, and I’m so proud of them!

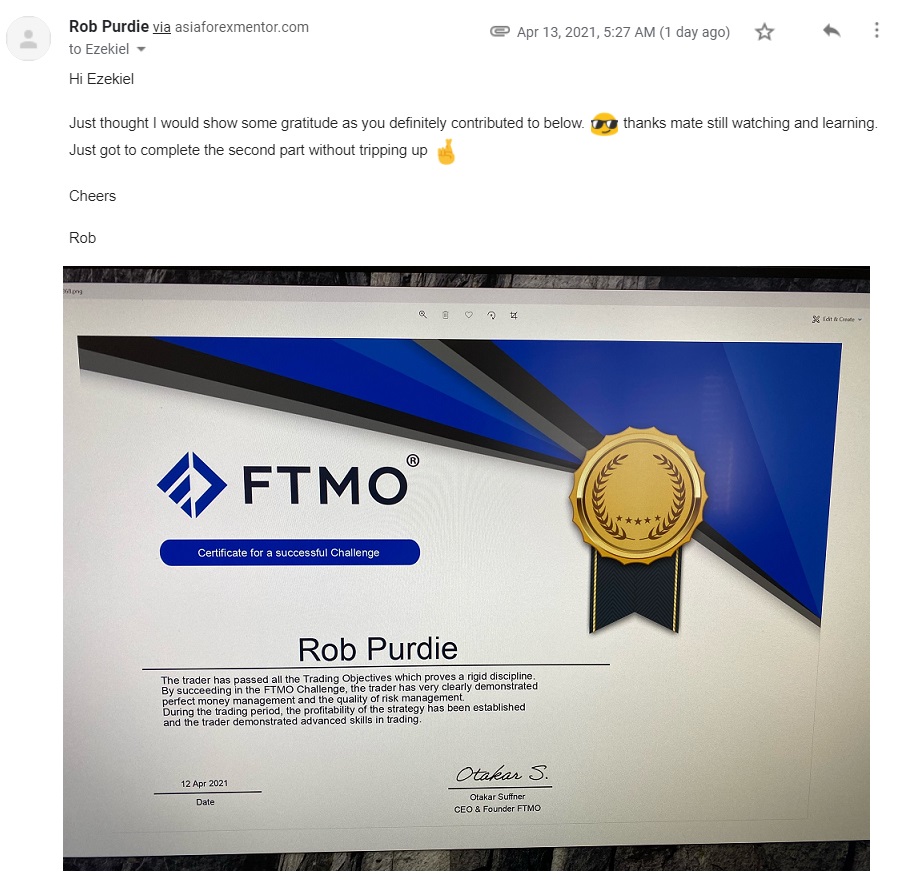

Here’s A Snippet Of The Testimonials That I’ve Received From My Students

-Paing Soe

With further experience, I will accelerate my rate of return.

This is in essence a license to print money

-Wayne Cressy

-Maggie Hiew

-Zack Lee

-Adrian

-Steve Izom

I CAN GUARANTEE YOU THREE THINGS

- You will be crystal clear on what you have to do to get the results you want

- You will leave today with the confidence to take action. OR

- Nothing in your life will change, and your tomorrow will be the same as today.

It takes courage to act, but I am going to show you how I did it and have helped thousands of others make money. Basically…

I’M HERE TO MAKE YOU MONEY… AND WHEN I SAY MONEY, I MEAN LOTS OF IT…

All you need to do is get rid of any distractions as you read this page and focus on what I consider to be the best use of the next 10 minutes you will ever experience. Because you are about to learn how you could solve all your financial worries.

“Ezekiel’s ROI-driven approach is very different from the one used by most trainers. It is a scientific, numbers-driven way of beating the market that is not taught anywhere.”

RAYMOND WONG(NEWBIE TURNED FULL TIME TRADER

– A MENTEE OF EZEKIEL CHEW)

Here’s Why You are Here Today

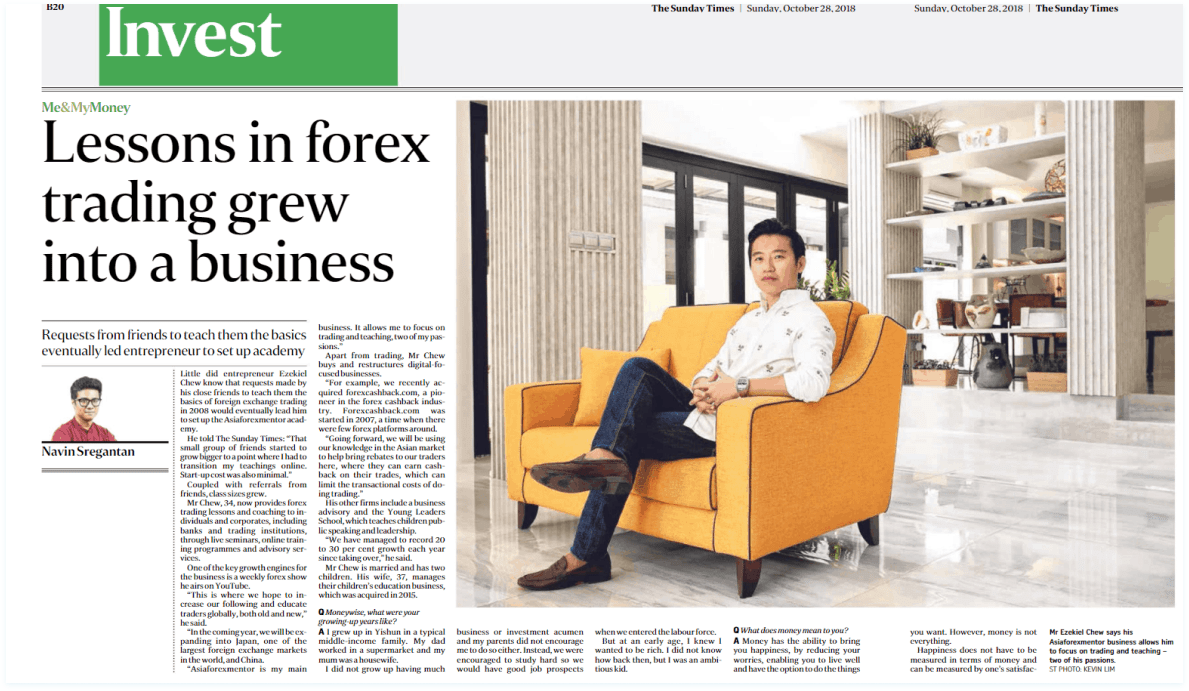

I have been a professional trader for most of my adult life. It actually started when I was very young, and I was what some people would have called an entrepreneur.

I taught myself how to trade when I was around 16 and started my forex trading account with $500. Coming from a middle-income family, this was hard-earned money made from part-time jobs during school breaks.

Like many others, I depleted several accounts during my early days before I discovered my own proprietary trading system.

Throughout the years, this system has generated millions of dollars for me and my students.

I got hooked on trading and I haven’t looked back since. I have appeared on TV, blogs, interviews, and some of the best-known trading and investing websites in the world.

DBP – THE 2ND LARGEST STATE-OWNED BANK IN

PHILIPPINES WITH ASSETS OF MORE THAN USD13 BILLION

ARE TRAINED BY US

ASIA BEHIND THE SCENES, WE TRAIN THE TRADERS WORKING IN BANKS, PROP TRADING FIRMS AND FUND MANAGEMENT COMPANIES

Banks and institutions pay me up to $25,000 just for in-depth analysis using my method of interpreting the market.

I am what they say – the mentor behind the gurus out there.

To date, I’ve traded for close to 20 years and have been mentoring traders for over 12 years now. As I said, some of them became gurus, full-time traders and also fund managers.

Moreover, a lot of my students are now good friends of mine.

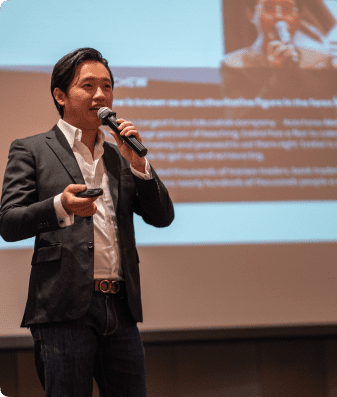

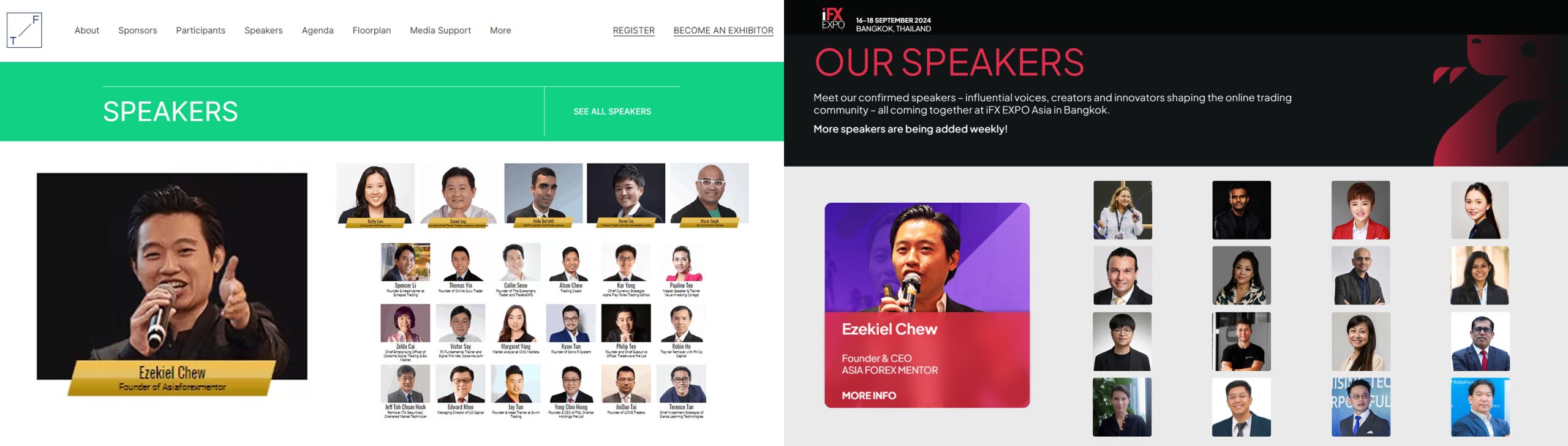

Above are some of the events where I’ve been engaged to speak. These events are where I share my views, thoughts and opinions on the market. You may have seen me at such financial events around the world.

I’m not trying to show off. My point is you will have the time to do what you want when you can control your own financial destiny.

I don’t make my living from selling forex trading courses or consulting – I make a living from trading.

But like all things, if you go at it too hard, you need a break for a while, and that’s why every few years I teach.

When I teach, the results my students achieve are phenomenal, and I am very proud of them.

The last time I taught full time, they said it was the best forex trading course they have ever attended. And that’s coming from people who had been through lots of forex trading courses, stock courses and seminars.

When I say I know my stuff, and I train the professionals, it’s

true. Because it’s not often you hear of a trader who makes 6

figures a trade.

Here’s a published example of how I turned 950% in 2 weeks.

Part 1

1 month later, with a capital of $24k, I turned it into $300k – That’s a 1250% return on investment.

Part 2

Here’s another example of a trade I took that made

$159,432.25 in a day

And another example of me making $100K during Donald Trump Presidential Election within hours

My students have achieved incredible results of their own

-David Ang

-Adrian

-Capt John

-Royston Poh

-Mulia

-Casey Chong

THE ONE CORE PROGRAM

I used to spend my time teaching via physical live seminars. But there’s only so many people that I can reach in this way. That’s why I’ve decided to make the transition to teaching online. I’ve put an insane amount of effort into crafting the program, the learning structure and methods in order to make it as effective as possible. In fact, it’s even more effective than a live seminar. This is because of the simple fact that you can pause and repeat at certain points where you need time to digest.

The One Core Program is a program where I leave nothing out. I wanted to put my very best into creating something that can last for generations. And perhaps even to be called an industry classic 40 years down the road.

In this program, I share all my proprietary methods and the tools that I personally use. I have spent thousands of dollars on getting it customized for myself and I’m giving my all in this program.

So when I say I truly hold nothing back, it’s entirely true. This is where I share all my years of wins and losses. The lessons I’ve learnt, the things that work and what simply doesn’t. This encompasses the making of a professional trader, the things we do behind the scenes, the mentality, the execution methods, the exit methods… How to make really big money in trading (very few traders actually do this).

Most traders and gurus teach you systems where they make around 10% return a year. Now, by market standards, that’s pretty good. Because it’s better than the fixed deposit rates that our banks give us.

But will it make you rich? Hardly…

And if you spend your time learning this craft of trading only to make such returns, you might as well put your money in the stock index, such as the S&P500. That has averaged an annual return of 9.8% for the last 90 years.

Why spend time learning something that doesn’t give you a better return than the market?

The only reason why we trade is that, when done right, it has the ability to make you really big money.

That’s what you are here for. And that’s why I’ve put so much effort into creating this program.

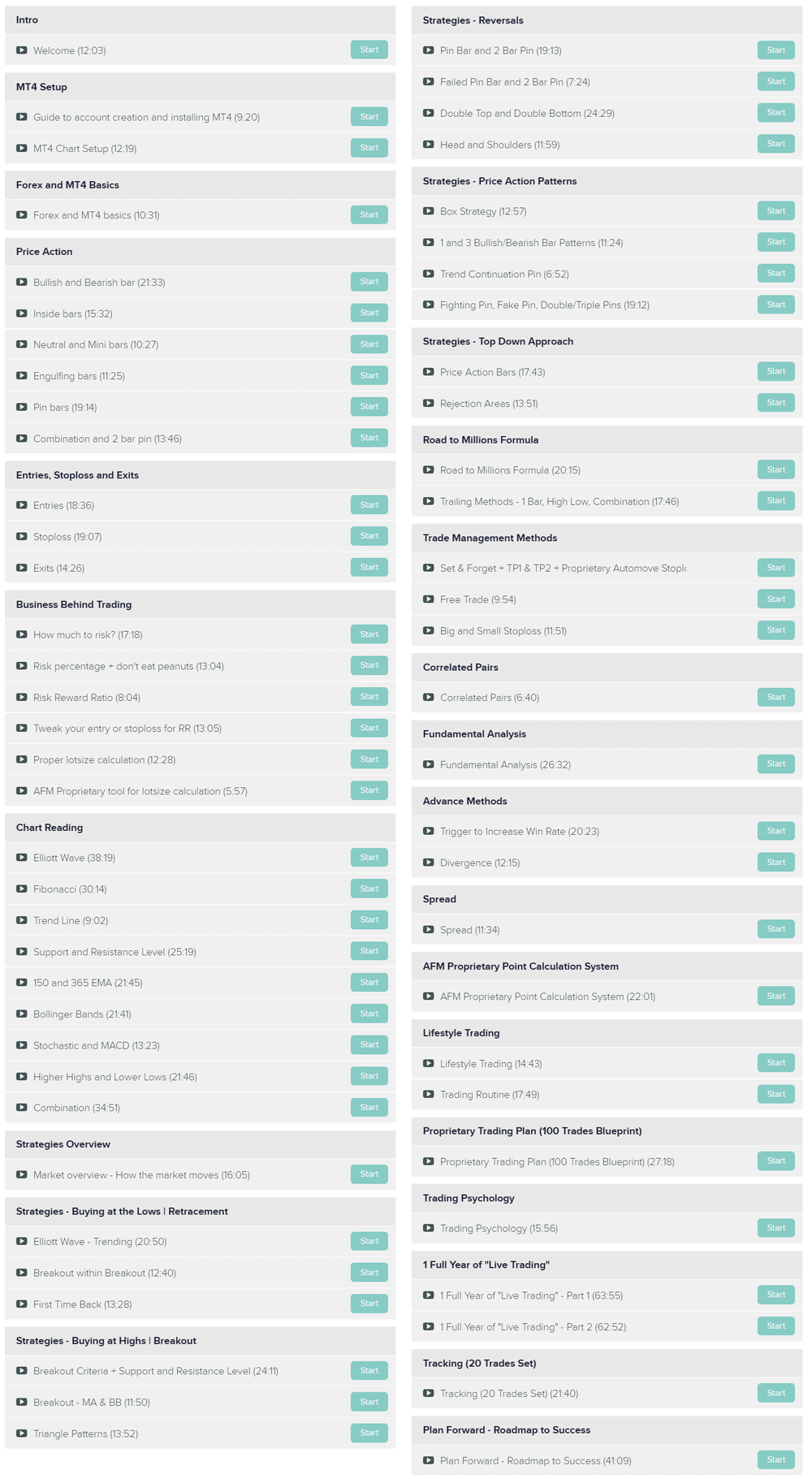

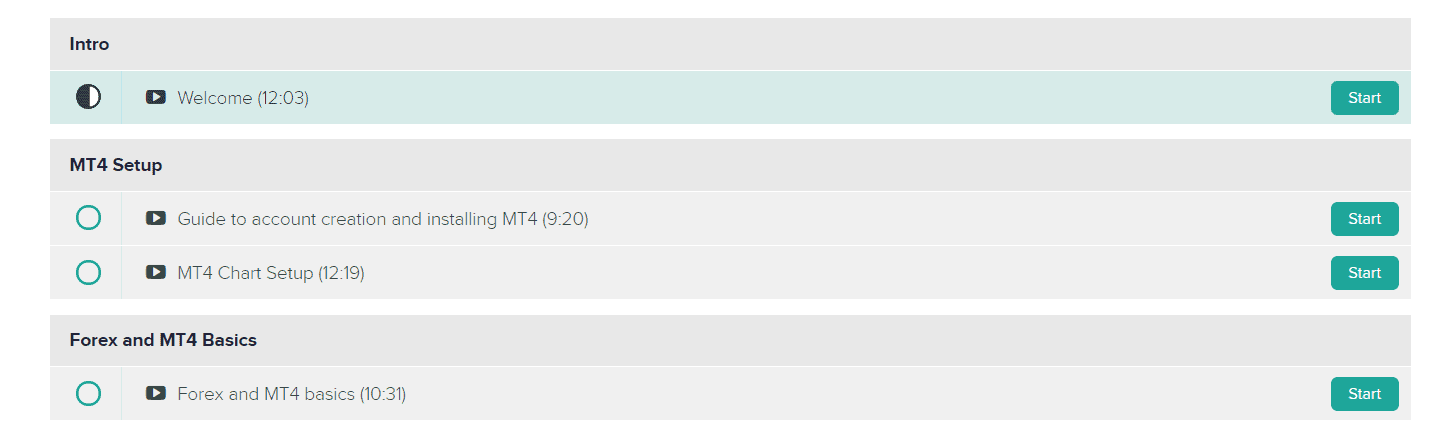

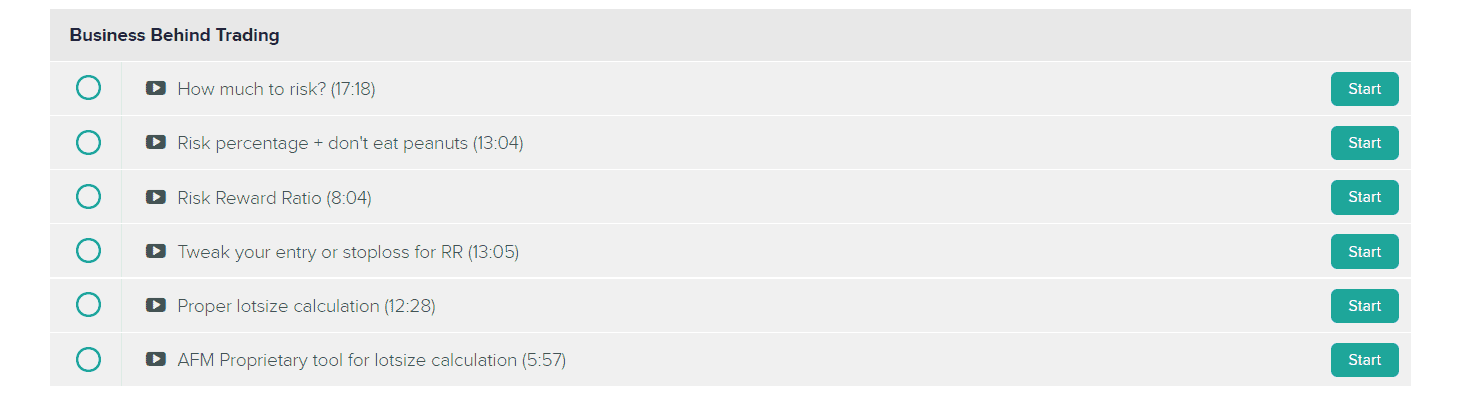

HERE’S HOW ONE CORE PROGRAM RUNS WHEN YOU GET ACCESS TO IT:

Click on the + button at the left of each section to learn what is covered

The welcome video is where I go through the structure of the program and the things that you need to do in order to make your learning process as effective as possible.

This is a very important video as it depicts your learning journey and how to make the best out of it. Because I’m serious about wanting to create the best learning experience for you to get the most out of the program.

For new traders, I will go through in detail on how you set up the account, the trading platform, how to manoeuvre around the platform, setting up the chart, etc. So don’t worry if you are entirely new to trading, I’ve got you covered. Experienced traders can, of course, skip this segment.

The welcome video is where I go through the structure of the program and the things that you need to do in order to make your learning process as effective as possible.

This is a very important video as it depicts your learning journey and how to make the best out of it. Because I’m serious about wanting to create the best learning experience for you to get the most out of the program.

For new traders, I will go through in detail on how you set up the account, the trading platform, how to manoeuvre around the platform, setting up the chart, etc. So don’t worry if you are entirely new to trading, I’ve got you covered. Experienced traders can, of course, skip this segment.

PRICE ACTION –THE KING OF CHART READING

Next, we dive right into the most important aspect of trading – Price Action. Price action is the King of Chart Reading. Every professional trader knows this and is a master at price action in some way or another.

I have broken down the study of price action into simple steps, making this complicated topic into an easy-to-understand learning method. Once you go through my way of reading the chart with price action, every time you see a new chart, you will be able to read it with ease – just like reading a book. Learning price action is like learning a new language – the language of charts.

It fundamentally involves dissecting what the chart is trying to tell us. Once you go through the price action section, you will know with a good degree of certainty why the market is going sideways, trending up or down, whether it is a real reversal or just a retracement. You will be able to tell the story of the chart and anticipate with a good level of confidence where will it head next.

Price action is the skill that every trader who wants to be professional needs to acquire. That’s why I placed learning it right at the start of the program. Because once you learn it, the rest of the chart reading and execution will fall into place.

This is why some traders just randomly learn some trading strategy online and, after trying it out in the live market, it didn’t work as it “should”. The real reason is that you can’t simply just apply any strategy any time you see the pattern occurring. You must first read the chart using price action and to generate a good understanding of where the price is likely to head.

For example, with good chart reading skills, you will be able to tell that the current movement is likely just a retracement, not a real reversal that shoots down. If that’s the case, you shouldn’t be selling, but instead, be looking for an opportunity to buy. But without chart reading with price action and seeing that it’s the same pattern that tells you to sell, you will probably end up losing that trade.

This is why learning chart reading and especially price action comes first. Once you know how to read the charts like a book, this is when you’ll know when to apply the right strategy and when to skip the trade.

PRICE ACTION –THE KING OF CHART READING

Next, we dive right into the most important aspect of trading – Price Action. Price action is the King of Chart Reading. Every professional trader knows this and is a master at price action in some way or another.

I have broken down the study of price action into simple steps, making this complicated topic into an easy-to-understand learning method. Once you go through my way of reading the chart with price action, every time you see a new chart, you will be able to read it with ease – just like reading a book. Learning price action is like learning a new language – the language of charts.

It fundamentally involves dissecting what the chart is trying to tell us. Once you go through the price action section, you will know with a good degree of certainty why the market is going sideways, trending up or down, whether it is a real reversal or just a retracement. You will be able to tell the story of the chart and anticipate with a good level of confidence where will it head next.

Price action is the skill that every trader who wants to be professional needs to acquire. That’s why I placed learning it right at the start of the program. Because once you learn it, the rest of the chart reading and execution will fall into place.

This is why some traders just randomly learn some trading strategy online and, after trying it out in the live market, it didn’t work as it “should”. The real reason is that you can’t simply just apply any strategy any time you see the pattern occurring. You must first read the chart using price action and to generate a good understanding of where the price is likely to head.

For example, with good chart reading skills, you will be able to tell that the current movement is likely just a retracement, not a real reversal that shoots down. If that’s the case, you shouldn’t be selling, but instead, be looking for an opportunity to buy. But without chart reading with price action and seeing that it’s the same pattern that tells you to sell, you will probably end up losing that trade.

This is why learning chart reading and especially price action comes first. Once you know how to read the charts like a book, this is when you’ll know when to apply the right strategy and when to skip the trade.

Now that you know how to read the chart with price action, I’m going to show you how exactly to enter, exit and place your stop loss with price action.

Please note that I haven’t started talking about strategy yet. This section is to give you a good understanding right from the start to show you how to execute trades with price action in the right way.

In this section, I cover many different entry methods and stop loss methods – the different methods to use in different situations. This is intended to lead you to becoming a professional trader where there isn’t a one-size-fits-all method but it’s more about applying the right method in the right situation. It’s really not complicated once you learn it and, if anything, it’s rather straightforward.

The reason why we have different methods is that I do not just want to teach you just one method. Because the market is live, it’s moving. Therefore, in order for you to be a professional, you must have a series of tools and know which one to use in different scenarios. That’s what makes a good trader and of course a good program.

That’s why this is the One Core Program –the only program you’ll ever need.

Now for the exit methods – this is the easy part. And our way of exiting is very defined plus it makes us good profits. Our exit methods allow us to win with good probability and profitability. That’s part of the key to being a profitable trader.

Now that you know how to read the chart with price action, I’m going to show you how exactly to enter, exit and place your stop loss with price action.

Please note that I haven’t started talking about strategy yet. This section is to give you a good understanding right from the start to show you how to execute trades with price action in the right way.

In this section, I cover many different entry methods and stop loss methods – the different methods to use in different situations. This is intended to lead you to becoming a professional trader where there isn’t a one-size-fits-all method but it’s more about applying the right method in the right situation. It’s really not complicated once you learn it and, if anything, it’s rather straightforward.

The reason why we have different methods is that I do not just want to teach you just one method. Because the market is live, it’s moving. Therefore, in order for you to be a professional, you must have a series of tools and know which one to use in different scenarios. That’s what makes a good trader and of course a good program.

That’s why this is the One Core Program –the only program you’ll ever need.

Now for the exit methods – this is the easy part. And our way of exiting is very defined plus it makes us good profits. Our exit methods allow us to win with good probability and profitability. That’s part of the key to being a profitable trader.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

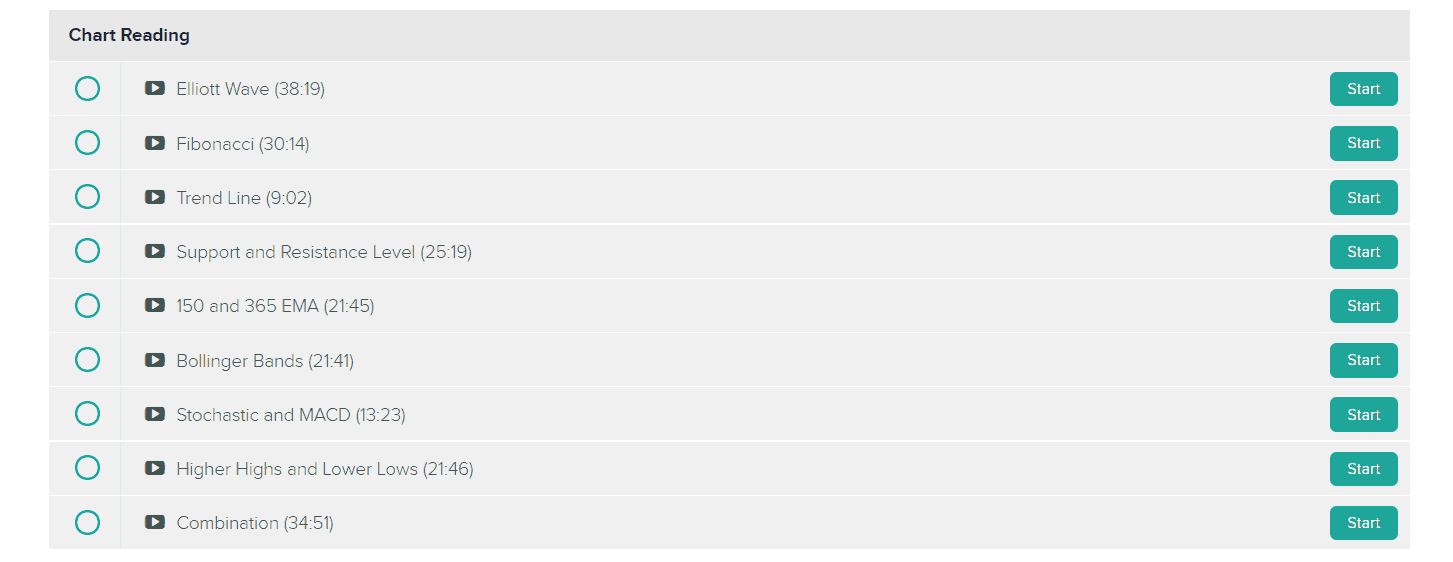

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

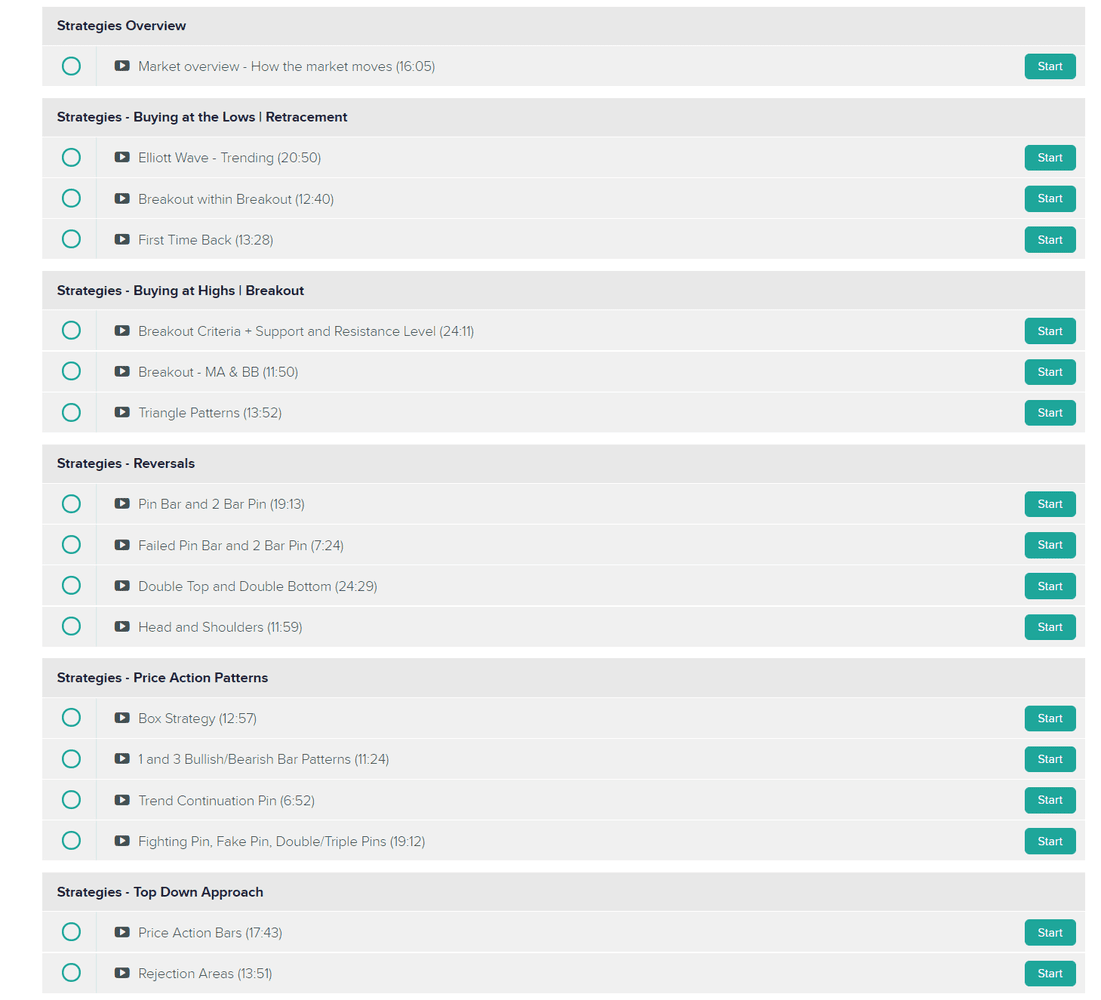

Now that you have learnt how to read the chart like a professional, it’s time to start executing the trades. This will involve using nothing but the best strategies that I have broken down for you below in the exact steps, criteria and requirements for it to be a good trade.

When we trade, we don’t just enter a trade because we think it’s has a chance of going up or down, we enter it because it meets our series of criteria. This way, you have a very systematic set of rules of entry and exits. Leaving nothing to emotion.

First off, we start with the Strategies Overview module – here’s where I do things differently from others. As one of my students says: “The way you look at charts here is unlike anything I’ve seen before. It’s very unique!” – Martin, trader based in Singapore.

I start this off by breaking down the charts into different scenarios and price movements. In essence, how the market moves. Through it, we then zoom in on the best location to buy or sell or hold. By understanding this section, you will now know whether or not that location is good for an entry and, if yes, whether it is time to buy or to sell. With this broader picture point of view, you now know that location comes first where you follow up on it by applying the right strategy at that location coupled with chart reading.

As you can see, the way we trade is very different. It comes in from my experience of building and growing businesses, where you first look at the big picture and then execute the smaller picture and details.

Our first strategy category is Buying at the Lows (retracement)

In this category, I have laid out three different ways of entering three different locations. We start off with the Elliott wave, where we enter on the move of the market, identify when the market is moving and likely to trend further, and execute it at the optimal low spot for maximum rewards.

That is followed by one of my favorite strategies – breakout within breakout. With our set of criteria and our way of analyzing the chart and completing it by proper execution, this strategy will enable you to enter before others enter. I love it!

Next up in this category is a retracement method that I call first time back. A strategic position primed for everyday usage. When coupled with our criteria, it becomes a nice daily salary.

The second strategy category is Buying at the Highs (breakouts)

Many traders know breakouts, but the difference here is our criteria. How do we qualify it as a good breakout and a high probability one? How do we enter our trade? How do we avoid false breakout? Where do we place our stop loss? What about our exit target? And so much more. Breakouts are without a doubt one of the most powerful strategies that make traders lots of money – when done right that is. The key behind it is “when done right”. How exactly do you do it right?

That’s all covered in this section. This is through my 20 years of findings, analyzing, testing and lots of burnt accounts. Don’t waste your time figuring this out on your own, I’ve done it for you here, where I list everything down, step by step.

And in this category, there are three main different methods and locations of entry. This is powerful stuff that forms the foundation of our trading. When you learn the methods and the steps, everything becomes clear for you, leaving nothing to guesswork or gut feeling.

The third strategy category is Reversals.

Most people love reversals… don’t they? It’s because by entering on reversals, you are getting in at the position with either the highest or the lowest point. You are getting in at the best possible entry to reap the highest possible return the market can give.

Now as much as traders love reversals, it’s not easy to spot the right one. Too often we hear stories of traders trying the catch the low only for it to go lower. And then they try to catch the next low, only for it to make a lower low.

So right here, we break things down into my set of criteria of catching reversals at optimal spots with easily recognizable setups such as double top and head and shoulders. But with a twist…

We know those patterns are powerful on their own. If not, they wouldn’t be so widely known. But the key is knowing when the pattern will work and when it won’t. When is it good, when is it not? How to avoid false entry. And executing it to get the full returns that the move can give. That’s what makes it different.

Everyone can teach you the patterns above. But it’s the criteria, combination and everything that makes it powerful. The pattern alone will not make you profitable. If it does, the whole world would be rich.

The fourth strategy category is Advance Price Action Patterns and Setups.

By now, you should know that price action is powerful. That’s why we base our trading on using price action as the foundation. Because it is the market that moves first and the indicator will then derive the information from the market price action movements and create its signal. So it’s always price action that starts first, followed by the signal. And a lot of the reading of volume and strength of the market can be done via price action.

Here, we move on to the combination of price action bars and patterns. This is advanced stuff that really takes your chart reading and trade execution skill to the next level.

There are certain price action patterns that are so powerful that, when you spot them, the win rate and the effect of such setups are phenomenal.

This module here will take your game to the next level, enabling you to find great entries all the time through the box strategy, trend continuation methods and more besides. If you want to be a full-time trader and like entering on many good trades, this is the module for you.

The fifth strategy category is my favorite money maker – Top Down Approach.

I created and honed this method to perfection. It’s like being a chef where you create your own recipe and keep tweaking it until its perfect. I’ve adapted and tweaked this method to the point where it’s like my reliable pair of boots. This is my stable big money maker.

High probability winning trades with huge rewards – you can’t beat this combination. Master this alone and you won’t have to work for money ever again. I don’t want to overhype this, but it really is that good.

So there you have it. I have laid out 16 of my top strategies. I’m sharing everything with you. I’m not holding back anything here. So anytime and anywhere the market moves, you will have a strategy to enter. When added together with my list of criteria and methods of entries, stop loss and exits, you will be a formidable professional trader.

Here’s the best part, the reason why I am sharing a whopping 16 top strategies is not because I expect you to master them all. Of course, if you have the determination and drive to do that, I truly applaud you for that.

Yet part of the reason why I have shared so many strategies is that I know for a fact that different people “click” with different strategies. It’s all about finding which strategy works for you. All you have to do is to just master one. Just one. Once you have mastered one strategy, it will feed you for life. Then go on to add another, then another. That’s how it should be. Ask anyone on the street if they have only mastered one strategy that makes them money. Is it good enough for them? I think it is.

Now that you have learnt how to read the chart like a professional, it’s time to start executing the trades. This will involve using nothing but the best strategies that I have broken down for you below in the exact steps, criteria and requirements for it to be a good trade.

When we trade, we don’t just enter a trade because we think it’s has a chance of going up or down, we enter it because it meets our series of criteria. This way, you have a very systematic set of rules of entry and exits. Leaving nothing to emotion.

First off, we start with the Strategies Overview module – here’s where I do things differently from others. As one of my students says: “The way you look at charts here is unlike anything I’ve seen before. It’s very unique!” – Martin, trader based in Singapore.

I start this off by breaking down the charts into different scenarios and price movements. In essence, how the market moves. Through it, we then zoom in on the best location to buy or sell or hold. By understanding this section, you will now know whether or not that location is good for an entry and, if yes, whether it is time to buy or to sell. With this broader picture point of view, you now know that location comes first where you follow up on it by applying the right strategy at that location coupled with chart reading.

As you can see, the way we trade is very different. It comes in from my experience of building and growing businesses, where you first look at the big picture and then execute the smaller picture and details.

Our first strategy category is Buying at the Lows (retracement)

In this category, I have laid out three different ways of entering three different locations. We start off with the Elliott wave, where we enter on the move of the market, identify when the market is moving and likely to trend further, and execute it at the optimal low spot for maximum rewards.

That is followed by one of my favorite strategies – breakout within breakout. With our set of criteria and our way of analyzing the chart and completing it by proper execution, this strategy will enable you to enter before others enter. I love it!

Next up in this category is a retracement method that I call first time back. A strategic position primed for everyday usage. When coupled with our criteria, it becomes a nice daily salary.

The second strategy category is Buying at the Highs (breakouts)

Many traders know breakouts, but the difference here is our criteria. How do we qualify it as a good breakout and a high probability one? How do we enter our trade? How do we avoid false breakout? Where do we place our stop loss? What about our exit target? And so much more. Breakouts are without a doubt one of the most powerful strategies that make traders lots of money – when done right that is. The key behind it is “when done right”. How exactly do you do it right?

That’s all covered in this section. This is through my 20 years of findings, analyzing, testing and lots of burnt accounts. Don’t waste your time figuring this out on your own, I’ve done it for you here, where I list everything down, step by step.

And in this category, there are three main different methods and locations of entry. This is powerful stuff that forms the foundation of our trading. When you learn the methods and the steps, everything becomes clear for you, leaving nothing to guesswork or gut feeling.

The third strategy category is Reversals.

Most people love reversals… don’t they? It’s because by entering on reversals, you are getting in at the position with either the highest or the lowest point. You are getting in at the best possible entry to reap the highest possible return the market can give.

Now as much as traders love reversals, it’s not easy to spot the right one. Too often we hear stories of traders trying the catch the low only for it to go lower. And then they try to catch the next low, only for it to make a lower low.

So right here, we break things down into my set of criteria of catching reversals at optimal spots with easily recognizable setups such as double top and head and shoulders. But with a twist…

We know those patterns are powerful on their own. If not, they wouldn’t be so widely known. But the key is knowing when the pattern will work and when it won’t. When is it good, when is it not? How to avoid false entry. And executing it to get the full returns that the move can give. That’s what makes it different.

Everyone can teach you the patterns above. But it’s the criteria, combination and everything that makes it powerful. The pattern alone will not make you profitable. If it does, the whole world would be rich.

The fourth strategy category is Advance Price Action Patterns and Setups.

By now, you should know that price action is powerful. That’s why we base our trading on using price action as the foundation. Because it is the market that moves first and the indicator will then derive the information from the market price action movements and create its signal. So it’s always price action that starts first, followed by the signal. And a lot of the reading of volume and strength of the market can be done via price action.

Here, we move on to the combination of price action bars and patterns. This is advanced stuff that really takes your chart reading and trade execution skill to the next level.

There are certain price action patterns that are so powerful that, when you spot them, the win rate and the effect of such setups are phenomenal.

This module here will take your game to the next level, enabling you to find great entries all the time through the box strategy, trend continuation methods and more besides. If you want to be a full-time trader and like entering on many good trades, this is the module for you.

The fifth strategy category is my favorite money maker – Top Down Approach.

I created and honed this method to perfection. It’s like being a chef where you create your own recipe and keep tweaking it until its perfect. I’ve adapted and tweaked this method to the point where it’s like my reliable pair of boots. This is my stable big money maker.

High probability winning trades with huge rewards – you can’t beat this combination. Master this alone and you won’t have to work for money ever again. I don’t want to overhype this, but it really is that good.

So there you have it. I have laid out 16 of my top strategies. I’m sharing everything with you. I’m not holding back anything here. So anytime and anywhere the market moves, you will have a strategy to enter. When added together with my list of criteria and methods of entries, stop loss and exits, you will be a formidable professional trader.

Here’s the best part, the reason why I am sharing a whopping 16 top strategies is not because I expect you to master them all. Of course, if you have the determination and drive to do that, I truly applaud you for that.

Yet part of the reason why I have shared so many strategies is that I know for a fact that different people “click” with different strategies. It’s all about finding which strategy works for you. All you have to do is to just master one. Just one. Once you have mastered one strategy, it will feed you for life. Then go on to add another, then another. That’s how it should be. Ask anyone on the street if they have only mastered one strategy that makes them money. Is it good enough for them? I think it is.

This is where I change your entire frame of thinking and trading. It’s a paradigm shift from here on. Here I share my story of how I lost it all, figured this new way of trading and changed my perspective from then on. This is the Road to Millions Formula. This is the method that took me from ground zero, from scratch and grew my account size again to way bigger than it was before and faster.

I don’t want to reveal too much here. But it’s a shift in mentality and trading approach that puts you right at the top of the game. If I can attribute my success to a single thing. It is this. The Road to Millions Formula. This is gold.

This is where I change your entire frame of thinking and trading. It’s a paradigm shift from here on. Here I share my story of how I lost it all, figured this new way of trading and changed my perspective from then on. This is the Road to Millions Formula. This is the method that took me from ground zero, from scratch and grew my account size again to way bigger than it was before and faster.

I don’t want to reveal too much here. But it’s a shift in mentality and trading approach that puts you right at the top of the game. If I can attribute my success to a single thing. It is this. The Road to Millions Formula. This is gold.

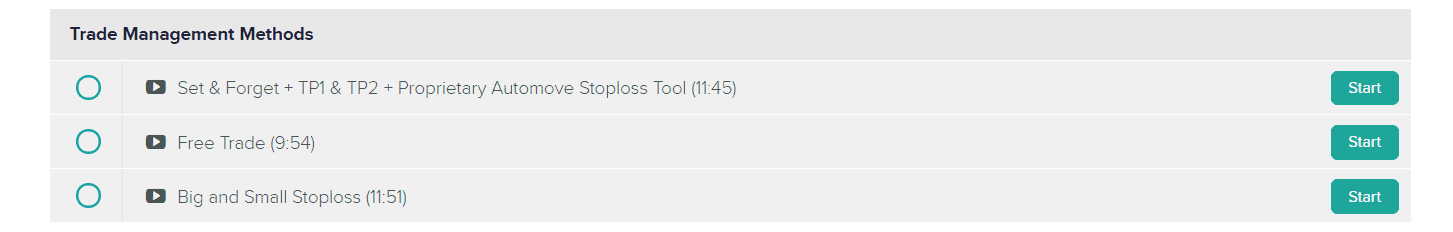

A lot of traders find it tough to figure out whether or not should they hold on to a trade – when should they just enter a trade, set the entry, stop loss and profit target and forget it. When should they actively manage the trade? And how do you properly manage the trade? These are the key to successful traders. But note that when I say actively manage, don’t worry… You don’t have to look at your computer all the time. We have a way of doing it and yet, at the same time, have a life.

The trade management methods here give you the different options and perspectives for you to use and to choose the right one for yourself. I like to give people options, so that you’ll know the methods available and what works for you, rather than joining a course only to realize that your method doesn’t “click” or work for you and to then have to find another program and then another.

This is it. Here’s where I lay down everything that I’ve learnt that works and when to use it. You can use all these techniques in combination or you can use the one that fits your life, your schedule and your personality – whether you are a more conservative or aggressive trader or somewhere in the middle.

This section here can turn an existing trader from being non-profitable to becoming very profitable – even without learning and implementing the strategies above.

A lot of traders find it tough to figure out whether or not should they hold on to a trade – when should they just enter a trade, set the entry, stop loss and profit target and forget it. When should they actively manage the trade? And how do you properly manage the trade? These are the key to successful traders. But note that when I say actively manage, don’t worry… You don’t have to look at your computer all the time. We have a way of doing it and yet, at the same time, have a life.

The trade management methods here give you the different options and perspectives for you to use and to choose the right one for yourself. I like to give people options, so that you’ll know the methods available and what works for you, rather than joining a course only to realize that your method doesn’t “click” or work for you and to then have to find another program and then another.

This is it. Here’s where I lay down everything that I’ve learnt that works and when to use it. You can use all these techniques in combination or you can use the one that fits your life, your schedule and your personality – whether you are a more conservative or aggressive trader or somewhere in the middle.

This section here can turn an existing trader from being non-profitable to becoming very profitable – even without learning and implementing the strategies above.

I’m leaving no stone unturned here. So I’ll talk about the rules of trading, including correlated pairs. I also talk about fundamental analysis. How I approach these, how I use or don’t use them. Here’s the fact, I’m at a stage of trading now whereby I’m not a very fundamental news-oriented person. I was at the start, during my early years of trading, but I’ve learnt to use the chart to tell me what and how the market is reacting to certain news. And I show you the method to do that so that it doesn’t become what they call analysis-paralysis with news.

I also talk about spreads and how do you properly incorporate them into trading. The funny thing about spreads is, even some experienced traders don’t apply them correctly.

I’m leaving no stone unturned here. So I’ll talk about the rules of trading, including correlated pairs. I also talk about fundamental analysis. How I approach these, how I use or don’t use them. Here’s the fact, I’m at a stage of trading now whereby I’m not a very fundamental news-oriented person. I was at the start, during my early years of trading, but I’ve learnt to use the chart to tell me what and how the market is reacting to certain news. And I show you the method to do that so that it doesn’t become what they call analysis-paralysis with news.

I also talk about spreads and how do you properly incorporate them into trading. The funny thing about spreads is, even some experienced traders don’t apply them correctly.

Now here’s something that I’ve kept to myself for a long time… The 16 top strategies are powerful without a doubt, but: I have this advance trigger that you can apply to ANY strategy. And once applied, it will increase your win rate at least by 50%! That’s how revolutionary this is.

Because it’s so powerful, I have been keeping this to myself for a long time. But as this is the One Core Program where I’ve decided to share everything I know and to create a legacy program, I will be teaching you this method. This stuff is powerful. REALLY powerful.

Regardless of what methods or strategies that you may already be using or trading with, just add in this advance trigger. And you will see your win rate increase. You will know when to trade and when not to trade with CERTAINTY. And usually the trades that you didn’t enter, they move in the opposite direction. All because the advance trigger told you so…

This advance trigger method alone has been the final filter for all my 6-figure trades and has made me and my students millions of dollars.

This is the real deal. You will thank me for it.

Now here’s something that I’ve kept to myself for a long time… The 16 top strategies are powerful without a doubt, but: I have this advance trigger that you can apply to ANY strategy. And once applied, it will increase your win rate at least by 50%! That’s how revolutionary this is.

Because it’s so powerful, I have been keeping this to myself for a long time. But as this is the One Core Program where I’ve decided to share everything I know and to create a legacy program, I will be teaching you this method. This stuff is powerful. REALLY powerful.

Regardless of what methods or strategies that you may already be using or trading with, just add in this advance trigger. And you will see your win rate increase. You will know when to trade and when not to trade with CERTAINTY. And usually the trades that you didn’t enter, they move in the opposite direction. All because the advance trigger told you so…

This advance trigger method alone has been the final filter for all my 6-figure trades and has made me and my students millions of dollars.

This is the real deal. You will thank me for it.

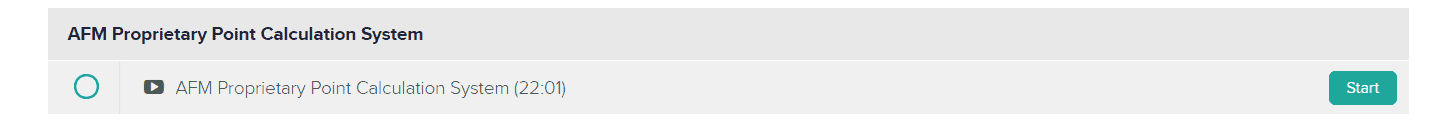

Now that you have learnt it all… it’s time to put trading into mathematical probability. Not gut feeling, not instinct, but a proper point calculation system so that you know with certainty whether or not the trading setup that you are looking at is up to the mark.

This point calculation system is formulated by me and is something that really helps you to filter out a grade-B trade from a grade-A trade. Because as traders, we only want to take the best of the best trades. If every trade you take meets the point calculation system method, you will know with certainty that you will be profitable at the end of a trading set.

But if you are taking trades that are random and mixing trades of some that meet the system and some that don’t, this will affect the winning profitability of your trading set.

Traders usually understand the above, but when they are pushed further when asked questions like “Are you taking the really good trades?” they will be like, “Honestly, I don’t know exactly if some of the trades that I’m taking are really good” or “I don’t really have a definition of good trades, a lot of times it is based on how I feel about that trade. And that’s how I trade…”

That’s why with this proprietary point calculation system you will know with certainty that if a certain trade doesn’t meet the mark, you should just skip it. And because of such a disciplined point calculation approach, you are taking the best kind of trades. When coupled with our entire trading system – it’s hard not to be a profitable trader like this.

Now that you have learnt it all… it’s time to put trading into mathematical probability. Not gut feeling, not instinct, but a proper point calculation system so that you know with certainty whether or not the trading setup that you are looking at is up to the mark.

This point calculation system is formulated by me and is something that really helps you to filter out a grade-B trade from a grade-A trade. Because as traders, we only want to take the best of the best trades. If every trade you take meets the point calculation system method, you will know with certainty that you will be profitable at the end of a trading set.

But if you are taking trades that are random and mixing trades of some that meet the system and some that don’t, this will affect the winning profitability of your trading set.

Traders usually understand the above, but when they are pushed further when asked questions like “Are you taking the really good trades?” they will be like, “Honestly, I don’t know exactly if some of the trades that I’m taking are really good” or “I don’t really have a definition of good trades, a lot of times it is based on how I feel about that trade. And that’s how I trade…”

That’s why with this proprietary point calculation system you will know with certainty that if a certain trade doesn’t meet the mark, you should just skip it. And because of such a disciplined point calculation approach, you are taking the best kind of trades. When coupled with our entire trading system – it’s hard not to be a profitable trader like this.

Now it’s time to make trading work for you. My philosophy of trading is that I tune my trading to my lifestyle and not my lifestyle to my trading.

Now, of course, if you are the type that loves reading and looking at the charts the whole day, then I truly salute you because it’s not easy. Having said that, the entire system works for all kinds of trader. And if you don’t mind staring at your charts nonstop the entire day, you can skip this segment.

But if you like to make money and yet still have a life, this module is where I show you in exact detail the things that I do; the tools that I use (which are free), to make trading as effective as possible.

Nowadays, I spend just around 30 minutes to 1 hour a day to trade. That’s it. So if you ask me, is trading a full-time job for me? No it’s not. But is it making a full-time income? Then yes it definitely is and more.

This segment is for retail traders who want to make a full-time income trading from home. If you are a trader working in a bank or a fund management company, you can simply skip this segment.

Here, I’ll also show you my routine on what I do monthly, weekly and daily. How exactly do I systemize trading? What are the things that I do, the notes that I take… essentially the back-end things that a professional would do. These are the golden nuggets that few professionals will tell you.

Now it’s time to make trading work for you. My philosophy of trading is that I tune my trading to my lifestyle and not my lifestyle to my trading.

Now, of course, if you are the type that loves reading and looking at the charts the whole day, then I truly salute you because it’s not easy. Having said that, the entire system works for all kinds of trader. And if you don’t mind staring at your charts nonstop the entire day, you can skip this segment.

But if you like to make money and yet still have a life, this module is where I show you in exact detail the things that I do; the tools that I use (which are free), to make trading as effective as possible.

Nowadays, I spend just around 30 minutes to 1 hour a day to trade. That’s it. So if you ask me, is trading a full-time job for me? No it’s not. But is it making a full-time income? Then yes it definitely is and more.

This segment is for retail traders who want to make a full-time income trading from home. If you are a trader working in a bank or a fund management company, you can simply skip this segment.

Here, I’ll also show you my routine on what I do monthly, weekly and daily. How exactly do I systemize trading? What are the things that I do, the notes that I take… essentially the back-end things that a professional would do. These are the golden nuggets that few professionals will tell you.

This is the exact blueprint that I’ve personally constructed for myself after I had the paradigm shift. And I can tell you, this is the blueprint that I’ve been using and will always continue to use for my trades.

It’s like the treasure map. Follow the 100 Trades Blueprint map and you will achieve your quest.

It doesn’t get easier than that. Because I have laid it out with mathematical probability, the exact plan for you to win BIG in this game.

As I mentioned, I look at trading from a business perspective. This is where I incorporate the business part into trading. Trading in the live market can be messy and wild at times. But with this blueprint, it will keep you going in the right direction; you know exactly what trades to take and whether will you be profitable or not at every single stage.

If you have been trading, you will know that there will be times where you do not know if you will be profitable at the end of the set or at the end of the month.

With my proprietary trading plan, you now have certainty: the certainty of knowing what stage you are at currently and what are the trades to take. Whether or not you are going in the right direction so that you can make amendments along the way if needed.

This 100 Trades Blueprint has truly been a life-changer to me. And I know it will do the same for you.

This is the exact blueprint that I’ve personally constructed for myself after I had the paradigm shift. And I can tell you, this is the blueprint that I’ve been using and will always continue to use for my trades.

It’s like the treasure map. Follow the 100 Trades Blueprint map and you will achieve your quest.

It doesn’t get easier than that. Because I have laid it out with mathematical probability, the exact plan for you to win BIG in this game.

As I mentioned, I look at trading from a business perspective. This is where I incorporate the business part into trading. Trading in the live market can be messy and wild at times. But with this blueprint, it will keep you going in the right direction; you know exactly what trades to take and whether will you be profitable or not at every single stage.

If you have been trading, you will know that there will be times where you do not know if you will be profitable at the end of the set or at the end of the month.

With my proprietary trading plan, you now have certainty: the certainty of knowing what stage you are at currently and what are the trades to take. Whether or not you are going in the right direction so that you can make amendments along the way if needed.

This 100 Trades Blueprint has truly been a life-changer to me. And I know it will do the same for you.

Now if you have heard people saying that psychology has a strong importance in trading. Well, that’s definitely true.

For example, when I first started trading, I was really aggressive. But along the way, I’ve learnt that aggressiveness without proper planning and a structured system can’t last me long in this game. And that’s why I’ve blown so many accounts in my early days.

But I not saying you should be entirely conservative either. It’s all about having the right balance – knowing when to strike when the trade setup meets the point calculation system and skipping it when it doesn’t. Trading is really so much simpler now when I’ve broken them down into precise steps.

Therefore, in this segment, I talk about the different ways to go about managing our trading psychology; you are going to find this segment – FUN!

Now if you have heard people saying that psychology has a strong importance in trading. Well, that’s definitely true.

For example, when I first started trading, I was really aggressive. But along the way, I’ve learnt that aggressiveness without proper planning and a structured system can’t last me long in this game. And that’s why I’ve blown so many accounts in my early days.

But I not saying you should be entirely conservative either. It’s all about having the right balance – knowing when to strike when the trade setup meets the point calculation system and skipping it when it doesn’t. Trading is really so much simpler now when I’ve broken them down into precise steps.

Therefore, in this segment, I talk about the different ways to go about managing our trading psychology; you are going to find this segment – FUN!

Nothing is better than watching your mentor trade with the methods taught – LIVE.

Putting everything you have learnt into trading live.

That’s why this segment is a whopping 2 hours!

I show you exactly how I structure the trade setups, how I plan my entries, stop loss and exits.

What’s my thought process, the point calculation system, how exactly I perform trade management and the complete process of planning, entering and exiting the trade.

This will show you how to be a profitable trader by entering trades that follow the 100 Trades Blueprint.

Through this 1 full year of live trading, you will SEE trading with a very clear point of view. You will know exactly what to do on your own if you are a new trader. And of course, if you are an experienced trader, this segment will really show you how to make your business not just profitable but very profitable.

I’ve put a lot of work into this segment so that you can watch it over and over again, knowing exactly how to trade the live charts as you go forward.

This entire 1 full year of live trading is where I put all the 16 Top Strategies and chart reading skills into action.

In this ENTIRE year of trading. You can see ALL the different scenarios that appear throughout the year and how we trade and react to them accordingly. No screenshots, no specially selected examples, because it’s the entire 1 year of live trading.

This is unlike other trading courses where they show you examples of strategies that work in their finely selected trade example, but when you use them in the live market, it doesn’t work as well as it’s shown.

Throughout this entire year of trading, you can see exactly what and how we trade in all the actual scenarios throughout the year. It doesn’t get better than that! Knowing the stuff that you learn are things that actually work in the market and not just theory.

You are really going to learn a tremendous amount from this segment. And from here, you will know exactly what to do next and how to trade with certainty in the live charts as you go forward.

Nothing is better than watching your mentor trade with the methods taught – LIVE.

Putting everything you have learnt into trading live.

That’s why this segment is a whopping 2 hours!

I show you exactly how I structure the trade setups, how I plan my entries, stop loss and exits.

What’s my thought process, the point calculation system, how exactly I perform trade management and the complete process of planning, entering and exiting the trade.

This will show you how to be a profitable trader by entering trades that follow the 100 Trades Blueprint.

Through this 1 full year of live trading, you will SEE trading with a very clear point of view. You will know exactly what to do on your own if you are a new trader. And of course, if you are an experienced trader, this segment will really show you how to make your business not just profitable but very profitable.

I’ve put a lot of work into this segment so that you can watch it over and over again, knowing exactly how to trade the live charts as you go forward.

This entire 1 full year of live trading is where I put all the 16 Top Strategies and chart reading skills into action.

In this ENTIRE year of trading. You can see ALL the different scenarios that appear throughout the year and how we trade and react to them accordingly. No screenshots, no specially selected examples, because it’s the entire 1 year of live trading.

This is unlike other trading courses where they show you examples of strategies that work in their finely selected trade example, but when you use them in the live market, it doesn’t work as well as it’s shown.

Throughout this entire year of trading, you can see exactly what and how we trade in all the actual scenarios throughout the year. It doesn’t get better than that! Knowing the stuff that you learn are things that actually work in the market and not just theory.

You are really going to learn a tremendous amount from this segment. And from here, you will know exactly what to do next and how to trade with certainty in the live charts as you go forward.

Tracking is an essential part, whether is it in business or trading, you need to track. In business, you need, for example, to know exactly that if the money you are spending on your marketing is truly effective. Is it making you money? What is the conversion rate? How much exactly are you making for every dollar you put in?

Here in trading, it’s similar and if not… even more important. I’ll show you exactly what to track and how to track using our 20 Trades Set method.