ADSS Review

Established in 2011, ADS Securities (ADSS, ADS) has paved a remarkable trajectory as an STP broker, steadily building its reputation and client base in the competitive forex trading industry. As a comprehensive trading platform, ADSS offers a diverse portfolio of trading assets, including currency pairs, stock indices, commodities, bonds, cryptocurrencies, and global company stocks. With a primary focus on the Middle East and North Africa (MENA) initially, ADSS subsequently broadened its operational scope by opening branches in the UK and Hong Kong. Today, over 20,000 active clients trust and rely on ADSS for their trading needs.

This review will take a deep dive into ADSS, uncovering its key features, pros and cons, and presenting an objective analysis of its services. By focusing on aspects like its unique features, commission structure, account types, and transaction procedures, we will paint a complete picture of the broker, integrating expert views and real trader experiences to assist potential users in making informed decisions.

What is ADSS?

ADS Securities, colloquially known as ADSS, is a reputable CFD and Forex broker that caters to a wide spectrum of trading needs. ADSS provides access to CFDs on more than 60 foreign exchange pairs, global equities, leading indices like the FTSE and Nasdaq, commodities like gold and oil, and individual stocks such as Apple and Tesla. Cryptocurrencies also form part of their diverse offering, reflecting the broker’s commitment to staying ahead of market trends.

The company operates through a network of affiliate offices in prominent financial hubs: London, Hong Kong, and Singapore, testifying to its global presence. It is a subsidiary of ADS Holding LLC, a highly respected entity based in Abu Dhabi and established in 2011. Notably, ADS Holding LLC is among the handful of investment firms that hold a license from the Central Bank of Abu Dhabi, adding credibility to its operations.

The affiliated offices of ADSS are authorized by respective jurisdictional authorities, such as the Financial Conduct Authority (FCA) in the UK and the Securities and Futures Commission (SFC) in Hong Kong. This multilayered authorization and regulation further bolster the platform’s reliability and transparency.

Advantages and Disadvantages of Trading with ADSS?

Benefits of Trading with ADSS

ADSS has multiple advantages that distinguish it in the crowded brokerage market. One of the most significant of these is its solid regulatory framework. The platform’s operations are supervised by the Securities and Commodities Authority (SCA) and the FCA, which guarantees adherence to international standards of operation and transparency. Traders can rest assured knowing that their investments are secure.

Another distinctive benefit of ADSS is that it provides access to CFDs on shares of companies based in the United Arab Emirates and Saudi Arabia. This specific offering is not commonplace among most brokers, making ADSS an attractive choice for traders looking to diversify their portfolios.

ADSS ensures a user-friendly and efficient trading experience by offering its services through the globally popular MetaTrader 4 terminal. This platform is renowned for its user-friendly interface, advanced technical analysis tools, and automation capabilities, which enhance the trading experience significantly.

In a bid to cater to various trading styles and to facilitate profitable trading for its clients, ADSS provides an option to connect user accounts to the ZuluTrade service. ZuluTrade is a popular online platform that allows traders to follow and copy the trading strategies of experienced traders, thereby increasing their potential for successful trading.

One of the appealing aspects of ADSS is its commission-free trading feature. Traders can perform multiple trades without having to worry about additional trading fees, which is a significant advantage, particularly for frequent traders.

Finally, ADSS offers a wide array of deposit and withdrawal methods, providing flexibility and convenience to its clients. This includes traditional bank transfers, credit and debit card payments, and various e-wallet options, allowing users to choose the method that best suits their needs.

ADSS Pros and Cons

Pros:

- ADSS is a licensed broker with the FCA, backed by a strong foundation. This adds credibility to its operations and ensures traders that the broker adheres to stringent regulations set by the authorities.

- ADSS has gained international recognition and received several accolades for its exceptional services, which has elevated its status among traders worldwide.

- The trading costs and spreads offered by ADSS are competitive in the forex market, making it an attractive choice for traders.

- The platform provides a comprehensive range of trading instruments, including Forex and CFDs, offering opportunities for traders to diversify their portfolios.

- ADSS uses the MetaTrader 4 platform, which is globally recognized for its efficiency, user-friendly interface, and advanced trading tools.

Cons:

- The trading conditions at ADSS can vary depending on the regulations and entity, which might cause confusion among traders.

- The absence of 24/7 customer support might cause inconvenience to traders in different time zones or those who require immediate assistance.

- Some traders have found it challenging to obtain qualified help from the customer support team, highlighting a need for improvement in this aspect.

ADSS Customer Reviews

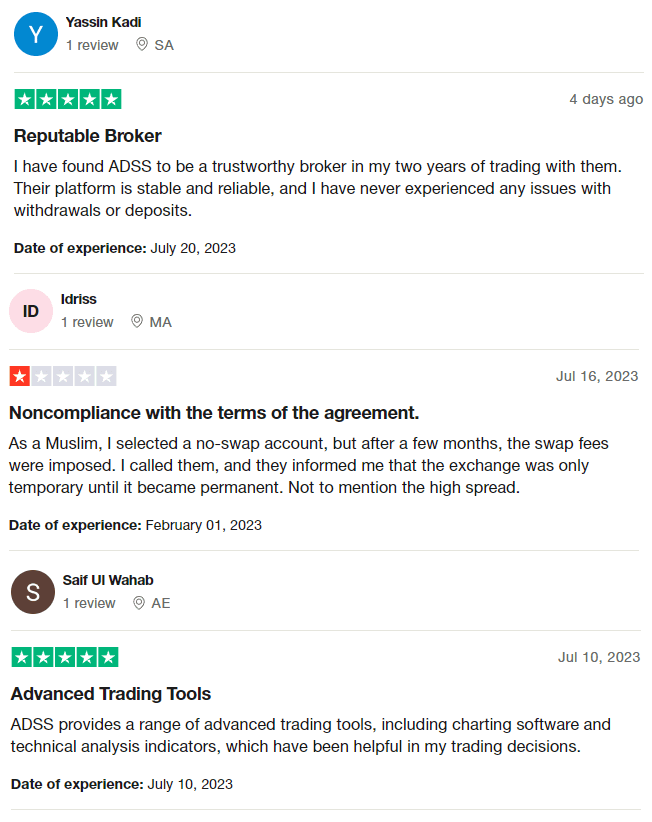

Collectively, customer reviews suggest that ADSS has a robust trading platform, noted for its stability and reliability. Users have praised its prompt and efficient handling of deposits and withdrawals, as well as the availability of advanced trading tools such as charting software and technical analysis indicators, which aid informed decision-making. However, concerns have been raised, particularly by a Muslim user who encountered issues with unexpected swap fees on a no-swap account. While ADSS resolved the issue, the incident highlights the need for clearer communication about account conditions.

ADSS Spreads, Fees, and Commissions

ADSS implements a diverse structure for its spreads, which varies depending on the account type chosen by the trader. Our analysis indicates that the average spread for EUR/USD is 1 pip, slightly below the industry average, providing competitive trading conditions.

Fees at ADSS are primarily incorporated into a spread determined by the trading instruments, and these may differ according to the entity you are trading with.

Traders should also consider overnight fees or swaps as part of their trading costs, particularly if they intend to hold open positions for more than a day. These fees can be substantial and can impact trading profitability. Additionally, other fees may be incurred, such as funding fees, which should be factored into the total cost of trading.

Account Types

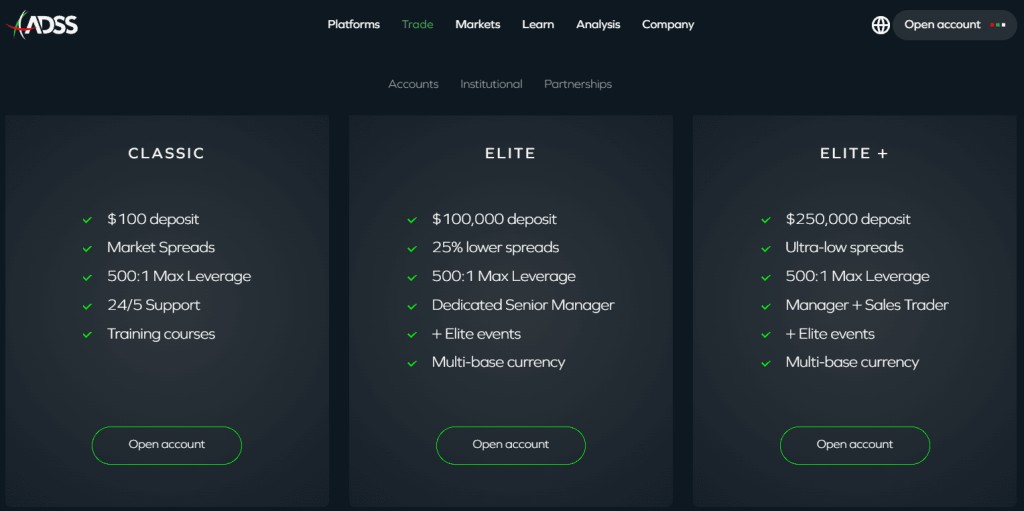

ADS Securities caters to a diverse group of traders by offering a variety of account types. These include the Classic Account, Elite Account, and Elite + Account, along with Islamic, Swap-Free, and Risk-Free Demo account options. The minimum deposit required to open a live trading account with ADS Securities is $100 USD.

ADSS Classic Account

The Classic Account is popular among investors and suitable for all types of traders. It requires a minimum deposit of $100 USD. This account offers competitive spreads and does not charge any commission. The maximum leverage available is up to 500:1, and users can trade a broad range of instruments including Forex, Metals, Crypto, Energies, Stocks, and Indices. An Islamic Swap-Free option is available, and the trading platform offered is MetaTrader 4 (MT4).

ADSS Elite Account

The Elite Account has been designed with seasoned traders in mind, requiring a significantly higher minimum deposit of $100,000 USD. This account type offers exclusive tight spreads and no commission fees. Like the Classic Account, it also provides access to leverage up to 500:1 on FX pairs and supports the same wide variety of trading instruments. The Elite Account is available as an Islamic Swap-Free option and utilizes the MT4 trading platform.

ADSS Demo Account

For beginners or those wanting to explore ADS Securities’ trading conditions risk-free, a Demo Account is offered. This account is credited with a virtual fund of US$50,000, allowing traders to practice and refine their strategies without any financial risk. It can also be used by experienced traders wishing to evaluate ADS Securities’ services or to test their trading strategies in a simulated live trading environment.

ADSS Islamic Account

The Islamic Account, catered specifically to Muslim traders in accordance with Sharia law, has some features that vary greatly from standard accounts. Differences may include minimum deposit requirements, spreads, and other factors.

Potential traders interested in opening an Islamic Account should contact ADS Securities’ customer support to verify the account’s details, as conditions may have been revised since this writing. Changes can occur due to the broker’s discretion or shifts in market conditions. It’s important to keep abreast of these potential alterations to make an informed decision.

How to Open Your Account

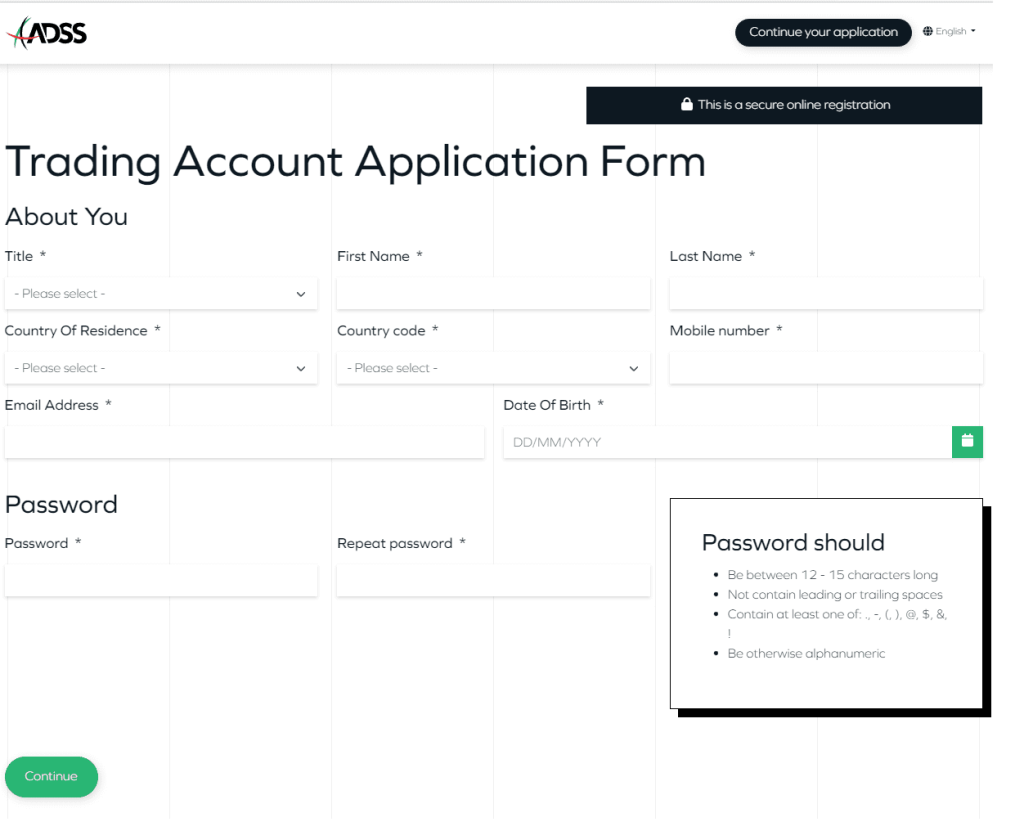

Joining the ADSS trading platform is a simple, user-friendly process designed with the convenience of individuals in mind. Here are the steps you need to follow to set up your trading account:

Visit the ADSS Website

Begin by visiting the ADSS website. You will notice an “Open Account” button prominently positioned at the top right of the homepage. Clicking this button propels you toward opening your trading account. You will then encounter two options: “Open Trading Account” for live trading, or “Open Demo Account” if you prefer to commence with a demo account.

Complete the Registration Form

Following this, you will need to fill out a registration form with your personal details. There are two ways to do this: by using UAE Pass if you are a UAE resident or by manually inputting your information. It’s vital to ensure the accuracy and currency of your data, as it will be crucial during the subsequent account verification stages. This data collection process is in accordance with international standards, designed to safeguard client security and adhere to regulatory requirements.

Verify Your Account

After successfully submitting the form, an account verification email will be sent to your registered email address. This email includes detailed instructions on how to verify your account. After completing the account verification process, you will gain access to your account, and your trading journey with ADSS can commence. Note that the platform may require additional documents such as an ID and Proof of Address to fulfill Know Your Customer (KYC) requirements.

What Can You Trade on ADSS

ADS Securities stands out as a highly versatile broker with an extensive array of trading instruments. The company offers more than 10,000 tradeable assets, providing a wide canvas for every trader, irrespective of their specific market interests or trading strategies.

Included in this vast suite of trading instruments are Contract for Differences (CFDs) across more than 60 Forex pairs. Traders can capitalize on movements in major, minor, and exotic currency pairs, accessing the most liquid market in the world.

Beyond Forex, ADSS also allows for trading in global indices. Whether it’s the FTSE, Nasdaq, or other global indices, traders can gain exposure to the world’s leading economies and sectors.

Commodity trading is another significant feature, with ADSS providing the opportunity to trade in various commodities such as oil, gold, and more. This is particularly useful for those who wish to hedge against market volatility or diversify their portfolio.

Investors seeking access to government and corporate bonds can also turn to ADSS, which offers trading in various treasuries, allowing for more diversified and risk-managed portfolios.

Single-stock trading is also available, encompassing companies like Apple, Tesla, and many more, enabling traders to capitalize on the movements of individual equities.

Lastly, recognizing the importance and growing influence of digital assets, ADSS also provides the option to trade in various cryptocurrencies. This widens the scope for traders to participate in one of the most dynamic and rapidly growing markets.

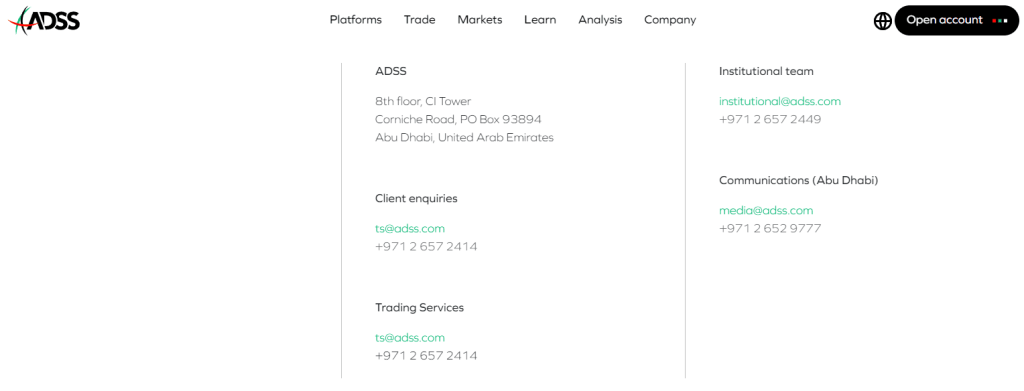

ADSS Customer Support

ADS Securities is committed to providing robust customer support, ensuring that clients can trade with confidence and get the help they need when they need it. The broker offers a comprehensive customer service setup that operates 24 hours a day, 5 days a week.

Traders can reach out to the customer support team through various means. These include direct phone lines for immediate verbal assistance. This direct contact is particularly useful for urgent or complex queries that may be harder to explain through written communication.

ADSS also offers live chat support, which can be a quick and efficient method of getting real-time help, especially for more straightforward issues or quick clarifications.

Finally, for non-urgent matters or queries that require detailed explanations, traders can reach out to the support team via email. This method is also helpful for keeping a record of the communication for future reference.

Through these multi-channel support options, ADS Securities ensures that all their client’s needs and concerns are promptly and effectively addressed. The provision of support tools and resources further showcases the broker’s commitment to client satisfaction and retention.

Advantages and Disadvantages of ADSS Customer Support

Security for Investors

Withdrawal Options and Fees

ADS Securities ensures that clients have a smooth experience not only when trading but also when it comes to managing their finances on the platform. The broker provides a variety of withdrawal options and a streamlined process to make it as hassle-free as possible.

To initiate a withdrawal, you’ll need to log into your personal trading account. ADS Securities is committed to prompt processing of withdrawal requests, generally taking between 24-48 hours to complete.

A wide array of withdrawal methods is available to suit your preferences and needs. These include traditional options like Visa and Mastercard and direct bank transfers. For those who prefer digital transaction methods, electronic payment systems such as Neteller, Skrill, GSD Pay, and BipiPay are also accessible.

It’s important to consider the fees associated with withdrawals. ADS Securities imposes a standard fee of $15 for each withdrawal, regardless of the withdrawal method chosen. However, additional charges may apply depending on the payment service used for the transaction. These potential extra fees will be determined by the respective payment service provider and not by ADS Securities.

Before you can make a withdrawal, it is required that you go through a verification process. This is standard practice across the industry designed to protect the trader and ensure financial security. This verification procedure typically involves submitting certain documents such as proof of identity and proof of address. It is recommended that you complete this step early to avoid any delays when you decide to withdraw funds.

By providing a diverse range of withdrawal options and a clear fee structure, ADSS allows traders to manage their trading finances efficiently and effectively.

ADSS Vs Other Brokers

#1. ADSS vs AvaTrade

ADSS and AvaTrade are both notable players in the world of online Forex and CFD trading. However, they each have unique attributes that make them stand out.

ADSS, with its impressive range of 10,000+ trading instruments across various asset classes, provides traders with an extensive selection of opportunities. The platform is regulated by reputable authorities and offers the advantage of trading through MetaTrader 4, one of the most popular trading platforms. Additionally, ADSS provides robust customer support, access to ZuluTrade for copy trading, and comprehensive deposit and withdrawal methods.

On the other hand, AvaTrade, headquartered in Dublin, has been serving its global clientele since 2006. It provides roughly 1,250 financial instruments and has a strong presence in over 150 countries. However, unlike ADSS, AvaTrade doesn’t allow US traders on its platform. AvaTrade is heavily regulated and licensed, ensuring a secure trading environment.

Verdict: While both brokers are heavily regulated and offer a wide array of financial instruments, ADSS has a more extensive selection of assets, accepts US traders, and offers the popular MT4 platform. This combined with their superior customer service and seamless deposit and withdrawal methods makes ADSS a compelling choice.

#2. ADSS vs RoboForex

RoboForex, regulated by FSC, has been in operation since 2009. The broker is well-known for its expansive selection of 12,000+ trading options across eight asset classes and a variety of platforms including MetaTrader, cTrader, and RTrader. It also offers unique features such as ContestFX, where winnings from demo account contests are paid into real trading accounts.

Comparatively, ADSS, although offering a slightly lesser number of instruments (10,000+), has the advantage of a solid regulatory framework from the SCA and FCA, and the utilization of the popular MetaTrader 4 platform. The broker also facilitates the copying of trades through the ZuluTrade service and ensures a smooth transaction process with a wide range of deposit and withdrawal options.

Verdict: When choosing between ADSS and RoboForex, ADSS has a slight edge due to its stronger regulation. Both brokers offer an impressive range of trading instruments, but the credibility and client protection offered by ADSS through SCA and FCA regulation can give traders an added layer of confidence.

#3. ADSS vs Exness

Exness, a Cyprus broker operating since 2008, commands a monthly trading volume of USD 325.8 billion. It offers a range of CFDs including stocks, energy, metals, and over 120 currency pairs, cryptocurrencies, and stocks. Exness also boasts infinite leverage, allowing even small deposit holders to earn profitably. However, their offerings are somewhat smaller when compared to ADSS’s extensive catalog of 10,000+ trading instruments.

In contrast, ADSS provides a stable trading platform under reliable regulatory authorities, along with a more extensive selection of trading instruments. The broker also provides a range of account types, copy trading through ZuluTrade, and an all-around well-rounded trading environment.

Verdict: Despite Exness‘s unlimited leverage offering and robust monthly trading volume, ADSS stands as the better choice. The broker’s larger selection of trading instruments, secure regulatory framework, and comprehensive suite of features contribute to a more versatile and reassuring trading experience.

Conclusion: ADSS Review

ADSS stands out as a globally recognized broker with a solid establishment and licensing from top-tier regulatory bodies, making it a reliable choice for traders. With competitive trading costs and a wide range of instruments, including Forex and CFDs, it provides ample opportunities for both novice and seasoned traders. The platform’s trading experience is further enhanced by the availability of the popular MT4 trading platform.

While there are areas for improvement such as 24/7 customer support and more accessible assistance from the support team, the advantages provided by ADSS – ranging from its extensive asset selection to its competitive spreads and powerful trading platform – make it a compelling choice for those looking to delve into the world of online trading.

ADSS Review: FAQs

What platforms does ADSS offer for trading?

ADSS primarily offers the MetaTrader 4 platform for trading. This platform is well-regarded in the industry for its advanced charting tools, customizable trading environment, automated trading capabilities, and compatibility with a wide range of devices.

Does ADSS provide an Islamic Account?

Yes, ADSS offers an Islamic Account that complies with Sharia law. This type of account is also referred to as a swap-free account and does not involve any interest or swap fees on overnight positions. However, the specifics of the account such as minimum deposit and spreads may vary and should be confirmed with ADSS’s customer support.

How long does ADSS take to process withdrawals?

ADSS typically processes withdrawal requests within 24-48 hours. However, the total time it takes for the funds to reach your account may vary depending on the withdrawal method used. Note that there is a commission of $15 charged for each withdrawal, and additional fees may apply depending on the chosen withdrawal method.