Position in Rating | Overall Rating | Trading Terminals |

201th  | 2.4 Overall Rating |

AdroFX Review

Choosing the right Forex broker is a critical step for any trader. A Forex broker acts as an intermediary between you and the interbank market, where currency pairs are traded. The right broker can provide the necessary platform and tools for successful trading, while the wrong one can hinder your progress and compromise your funds. It’s essential to consider factors such as regulation, trading platforms, spreads, commissions, and customer support when making your decision.

AdroFX is a noteworthy broker in the Forex market, known for its competitive trading conditions and user-friendly platforms. Established in 2018, AdroFX offers a wide range of trading instruments, including Forex pairs, commodities, indices, and cryptocurrencies. The broker is regulated and provides various account types to cater to different trading styles and experience levels.

In this detailed review, I’ll provide a comprehensive evaluation of AdroFX, focusing on its unique selling points and potential drawbacks. I’ll cover essential aspects such as account options, deposit and withdrawal processes, commission structures, and other critical details. By combining expert analysis with actual trader experiences, I aim to equip you with the necessary information to make an informed decision about considering AdroFX as your preferred brokerage service provider.

What is AdroFX?

AdroFX is a reliable online retail broker established in 2018, offering over 115 trading instruments including Forex, commodities, indices, metals, and cryptocurrencies. The broker provides access to the widely respected MetaTrader 4 platform, which is known for its user-friendly interface and extensive customization options, making it suitable for both beginners and experienced traders. Additionally, AdroFX offers a cloud-based Allpips platform for mobile and on-the-go trading, enhancing flexibility for its users.

AdroFX stands out with its customer-centric approach and a variety of account types tailored to different trading styles, with minimum deposits starting as low as $25. The broker offers competitive trading conditions, such as low spreads from 0.3 pips and leverage up to 1:500, which can significantly enhance trading potential. AdroFX also supports social trading through its copy trading feature, allowing traders to replicate the trades of successful investors. Its crypto-friendly approach allows account funding with cryptocurrencies and CFD trading on these digital assets. The broker provides a range of educational resources and 24/5 customer service to support traders in making informed decisions.

AdroFX Regulation and Safety

When evaluating AdroFX, one of the critical aspects to consider is its regulation and safety. AdroFX is regulated by the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA) in St. Vincent and the Grenadines. These regulatory bodies enforce stringent rules, including the requirement to keep client funds in segregated accounts, ensuring that trader funds are secure and separate from the broker’s operational funds. This level of regulation helps to ensure transparency and protect traders from potential fraud.

Understanding the regulatory framework of a broker like AdroFX is vital because it directly impacts the safety of your investments. The broker’s compliance with regulatory standards ensures that it operates under strict guidelines, providing a safer trading environment. AdroFX’s adherence to these regulations gives traders confidence that their funds are managed responsibly and that there is oversight to prevent malpractices. This is particularly important in the volatile world of Forex trading, where the security of funds and fair trading practices are paramount.

AdroFX Pros and Cons

Pros

- Low deposit requirement

- No trading commissions

- High leverage available

- Various payment methods

- Supports all trading strategies

Cons

- Offshore regulation

- Limited educational tools

- Restricted support hours

- Few asset options

Benefits of Trading with FXNovus

Trading with AdroFX has offered several benefits that have enhanced my trading experience significantly. One of the standout features is the low minimum deposit requirement of just $25, which makes it accessible for new traders like me who are starting with limited capital. This flexibility has allowed me to get started in Forex trading without a hefty financial commitment.

Another advantage is the commission-free trading environment. This has been particularly beneficial for maintaining cost-efficiency in my trades. By not having to worry about additional costs eating into my profits, I have been able to focus more on my trading strategies and market analysis.

The high leverage up to 1:500 offered by AdroFX has also been a game-changer. It has allowed me to open larger positions than my initial deposit would typically allow. This feature has enabled me to maximize potential returns on my trades, though I remain mindful of the associated risks.

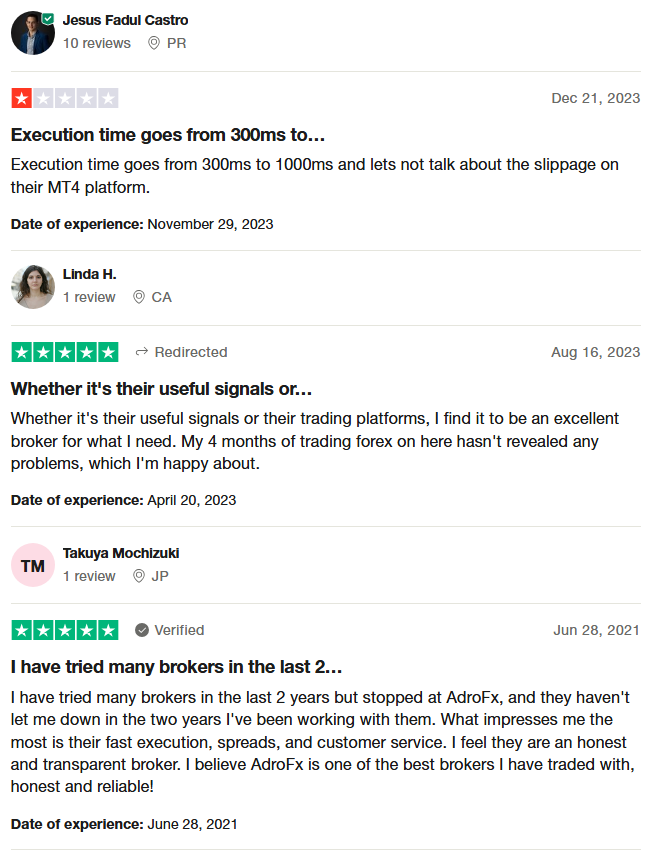

AdroFX Customer Reviews

Customer reviews for AdroFX highlight a mix of experiences. Some users report variable execution times ranging from 300ms to 1000ms and occasional slippage on the MT4 platform, indicating areas for improvement in trade execution. However, many traders appreciate the broker’s useful trading signals and find the platforms reliable, with no major issues during several months of trading. Long-term users praise AdroFX for its fast execution, competitive spreads, and responsive customer service, describing the broker as honest and transparent.

AdroFX Spreads, Fees, and Commissions

rading with AdroFX provides clear benefits, especially in terms of its spreads, fees, and commissions. One of the standout aspects is that AdroFX offers zero commissions on trades, making it a cost-effective option for traders. This means the primary cost to traders is the spread, which varies depending on the account type. For example, the spreads start from 0.4 pips on Premium and Pro accounts, which is quite competitive in the market.

Additionally, AdroFX has a transparent fee structure with no hidden charges. The broker ensures that most trading costs are embedded in the spread, and it doesn’t charge deposit fees, making it easier to manage funds. However, it’s important to note that there are withdrawal fees, such as 1.99% for Visa and Mastercard withdrawals, and an inactivity fee of $5 if the account is dormant for six months or more. This level of transparency helps in planning and managing trading expenses effectively.

Moreover, AdroFX provides tight spreads and a low minimum deposit requirement of just $25, which is beneficial for new traders who want to start with minimal capital. The broker also offers leverage up to 1:500, allowing traders to maximize their market exposure. While this high leverage can amplify both gains and losses, it provides experienced traders with significant trading flexibility.

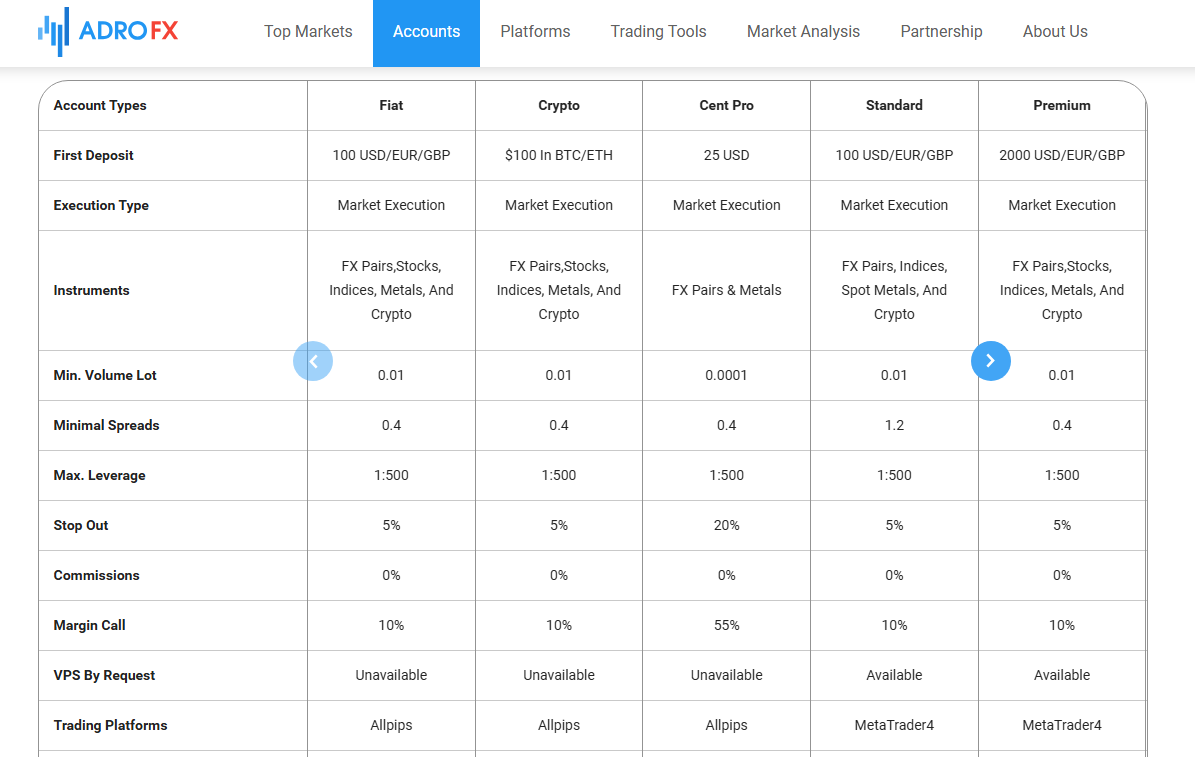

Account Types

Fiat Account

- Minimum deposit: $100

- Instruments: Forex, stocks, indices, metals, and crypto

- Spreads: From 0.4 pips

- Leverage: Up to 1:500

Crypto Account

- Minimum deposit: $100 (BTC/ETH)

- Instruments: Forex, stocks, indices, metals, and crypto

- Spreads: From 0.4 pips

- Leverage: Up to 1:500

Cent Pro Account

- Minimum deposit: $25

- Instruments: Forex and metals

- Spreads: From 0.4 pips

- Leverage: Up to 1:500

Standard Account

- Minimum deposit: $100

- Instruments: Forex, indices, metals, and crypto

- Spreads: From 1.2 pips

- Leverage: Up to 1:500

Premium Account

- Minimum deposit: $2000

- Instruments: Forex, stocks, indices, metals, and crypto

- Spreads: From 0.4 pips

- Leverage: Up to 1:500

Pro Account

- Minimum deposit: $10,000

- Instruments: Forex, stocks, indices, metals, and crypto

- Spreads: From 0.3 pips

- Leverage: Up to 1:500

Micro Pro Account

- Minimum deposit: $100

- Instruments: Forex and metals

- Spreads: From 0.8 pips

- Leverage: Up to 1:500

Micro Account

- Minimum deposit: $25

- Instruments: Forex and metals

- Spreads: From 1.4 pips

- Leverage: Up to 1:500

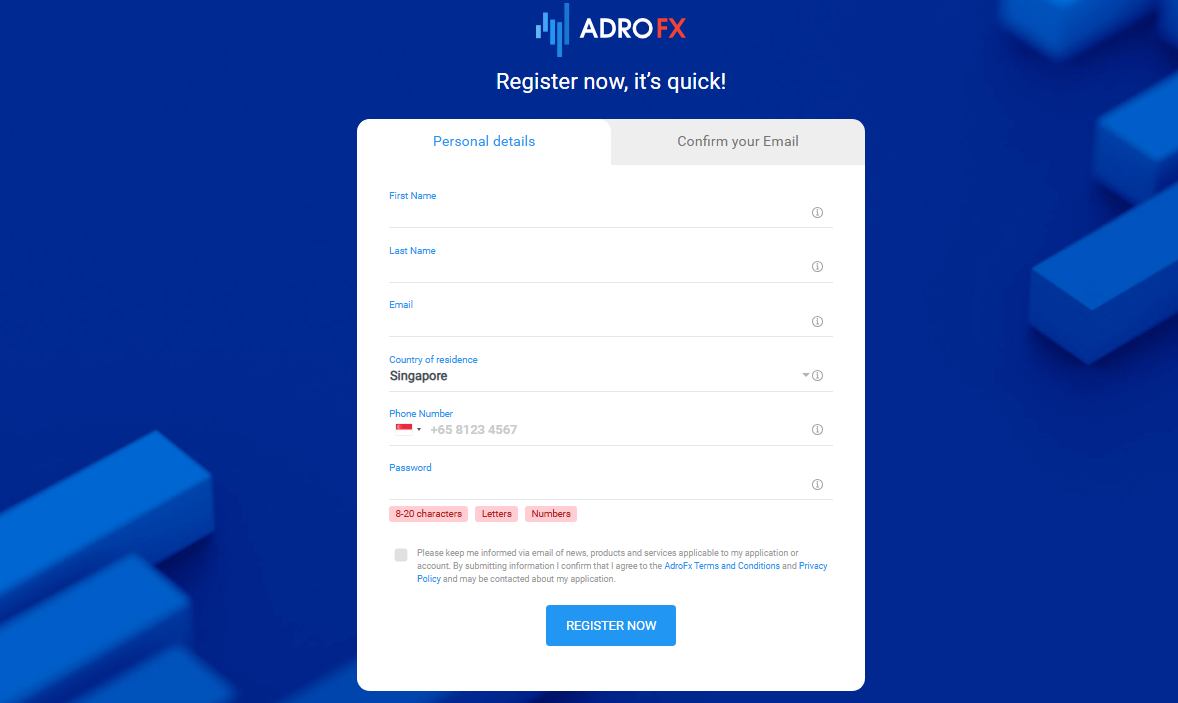

How to Open Your Account

- Visit the AdroFX website and choose your preferred interface language, then click “Start Trading.”

- Fill in your first and last names, country of residence, email address, and phone number, create a secure password, agree to the terms, and click “Register Now.”

- Check your email for a confirmation link and click it to verify your address.

- In your user account, go to the “Documents” section and upload the required personal identification documents.

- Wait for your documents to be verified.

- Once verified, go to the “Accounts” section, click “Open Account,” and select your desired account options, then confirm.

- Navigate to the “Funding” section and choose a deposit method to fund your account.

- After your deposit is credited, download the trading platform and begin trading.

AdroFX Trading Platforms

AdroFX offers two main trading platforms, MetaTrader 4 (MT4) and Allpips. MT4 is well-known for its advanced charting tools and technical analysis capabilities, making it a preferred choice among experienced traders. It provides various features like automated trading with Expert Advisors (EAs), multiple order types, and extensive customization options, which have significantly enhanced my trading efficiency.

On the other hand, Allpips is a web-based platform designed for ease of use and accessibility. It integrates well with modern technology, allowing me to trade from any device with an internet connection. The platform offers essential features like real-time quotes, various chart types, and technical indicators, making it a reliable option for traders of all levels.

What Can You Trade on AdroFX

Trading on AdroFX offers a wide range of instruments that cater to various trading preferences. The Forex market is particularly robust, with over 60 currency pairs available, including major, minor, and exotic pairs. This variety allows for flexible trading strategies and opportunities to profit from different market conditions.

In addition to Forex, AdroFX provides access to trading CFDs on stocks, indices, metals, and cryptocurrencies. You can trade popular stocks from companies like Apple and Amazon, major indices like the S&P 500, and commodities such as gold and silver. The availability of cryptocurrencies like Bitcoin and Ethereum adds another layer of trading options, appealing to those interested in digital assets. This broad selection ensures that I can diversify my portfolio and explore different markets, all from a single platform.

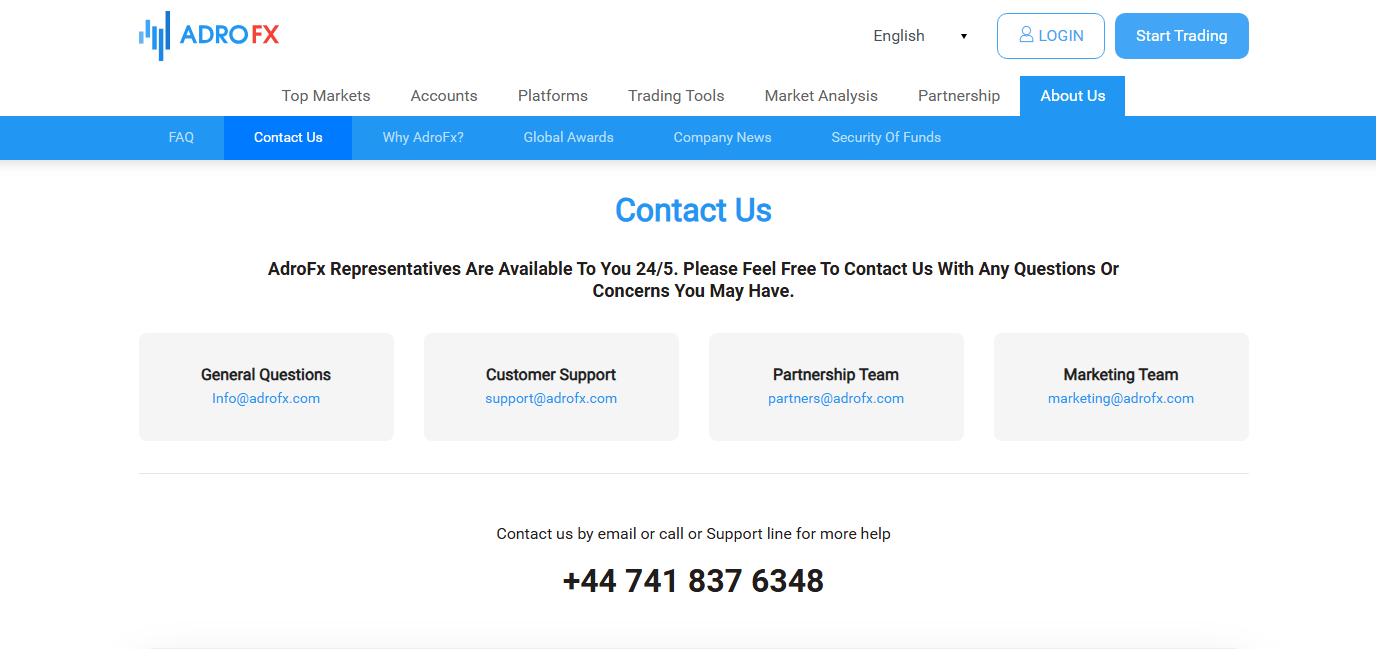

AdroFX Customer Support

AdroFX provides reliable customer support that has greatly assisted me during my trading experience. Their support team is available 24/5, ensuring that any issues I encounter are addressed promptly throughout the trading week. I can easily reach them through various methods, including live chat, email, and phone, which makes getting help convenient and efficient.

The customer service representatives are knowledgeable and responsive, always ready to help with my queries or technical difficulties. This level of support has been invaluable, especially when navigating complex trading platforms or resolving account-related issues. Their professional and friendly approach has made my trading experience smoother and more enjoyable.

Advantages and Disadvantages of AdroFX Customer Support

Withdrawal Options and Fees

AdroFX offers a variety of withdrawal options, providing flexibility and convenience for traders. You can withdraw funds via bank wire, credit/debit cards, Bitcoin, Ethereum, Skrill, Neteller, Perfect Money, Sticpay, Payeer, and PayRedeem. Each withdrawal method has specific minimum withdrawal amounts and associated fees, ensuring you can choose the most suitable option for your needs. For example, bank wire withdrawals typically have a minimum amount of $100 with bank fees, while e-wallets like Skrill and Neteller have lower minimums around $10 with fees ranging from 0.5% to 1%.

One of the benefits I’ve noticed with AdroFX is the relatively quick processing times for withdrawals. Most withdrawal requests are processed within 24 hours during business days, and e-wallet transactions are often completed within the same day. However, bank transfers can take 4-7 business days to reflect in your account, depending on your bank’s processing times. The platform’s transparency about these timelines and fees has helped me plan my withdrawals more effectively, ensuring I can access my funds when needed.

AdroFX Vs Other Brokers

#1. AdroFX vs AvaTrade

AdroFX and AvaTrade both offer extensive trading options, but they differ significantly in their platforms and regulatory frameworks. AdroFX provides access to the MetaTrader 4 (MT4) platform and its own Allpips web-based platform, with leverage up to 1:500. AvaTrade, on the other hand, offers multiple platforms including MT4, MT5, and its proprietary AvaTradeGO, with leverage up to 1:400. AvaTrade is more heavily regulated, with oversight from several tier-one regulators such as the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC). AdroFX operates under offshore regulations from the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA) of Saint Vincent and the Grenadines.

Verdict: AvaTrade is better due to its higher regulatory standards and broader platform options, providing a more secure and versatile trading environment compared to AdroFX.

#2. AdroFX vs RoboForex

Both AdroFX and RoboForex offer robust trading environments with multiple account types and access to MT4. AdroFX provides leverage up to 1:500, while RoboForex offers even higher leverage up to 1:2000. RoboForex also features a wider range of platforms, including MT4, MT5, cTrader, and its own R Trader. Regulatory-wise, RoboForex is regulated by the International Financial Services Commission (IFSC) in Belize, which is similar to AdroFX’s offshore regulation by VFSC and FSA. However, RoboForex has a more extensive range of trading instruments and advanced trading tools, including a VPS service and automated trading solutions.

Verdict: RoboForex is superior because of its higher leverage options and broader range of trading platforms, which cater better to advanced traders seeking diverse tools and flexibility.

#3. AdroFX vs Exness

AdroFX and Exness both offer the MT4 platform and high leverage options, with AdroFX providing up to 1:500 and Exness up to 1:2000. Exness stands out with its MT5 platform availability and a broader regulatory oversight, including licenses from the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). AdroFX, regulated by VFSC and FSA, lacks the same level of regulatory credibility. Additionally, Exness offers more extensive market analysis tools and 24/7 customer support, which enhances the trading experience.

Verdict: Exness is preferable due to its stronger regulatory framework and superior platform offerings, ensuring a safer and more resource-rich trading environment compared to AdroFX.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: AdroFX Review

Based on my experience and user feedback, AdroFX stands out as a versatile broker offering a wide range of trading instruments and platforms. The availability of MetaTrader 4 and the Allpips platform, combined with leverage up to 1:500, provides flexibility for various trading strategies. Users appreciate the low minimum deposit requirements and the commission-free trading environment, which makes it accessible for new traders.

However, it’s important to note that AdroFX operates under offshore regulations, which may not provide the same level of protection as brokers regulated by tier-one authorities. Some users have reported issues with execution times and occasional slippage on the MT4 platform. Additionally, while the customer support is available 24/5 and generally responsive, the lack of 24/7 availability might be a drawback for some traders.

Also Read: Crystal Ball Markets Review 2024 – Expert Trader Insights

AdroFX Review: FAQs

What trading platforms does AdroFX offer?

AdroFX provides the MetaTrader 4 (MT4) platform and the web-based Allpips platform, offering a range of tools for both beginners and experienced traders.

Is AdroFX regulated?

Yes, AdroFX is regulated by the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA) in Saint Vincent and the Grenadines. However, these are offshore regulators, which may offer less stringent oversight compared to tier-one regulators.

What are the withdrawal options and fees at AdroFX?

AdroFX offers multiple withdrawal options including bank wire, credit/debit cards, Bitcoin, Ethereum, Skrill, Neteller, Perfect Money, Sticpay, and Payeer. Fees vary by method, with bank transfers typically incurring bank fees and e-wallets charging between 0.5% to 1.99%. Most withdrawals are processed within 24 hours during business days.

OPEN AN ACCOUNT NOW WITH ADROFX AND GET YOUR BONUS