Admiral Markets Review

Forex trading entails purchasing and selling currencies in an effort to turn a profit. Selecting the appropriate broker is essential for a profitable trading endeavor. One such broker that has established a strong reputation since its founding in 2001 is Admiral Markets. The Australian Securities and Investments Commission oversees this company, guaranteeing the legality and security of its operations.

Admiral Markets now operates in more than 40 countries as part of its global expansion. Its cash flow is more than $40 billion USD, which suggests a strong financial foundation. The Federal Financial Markets Service has granted the Financial Conduct Authority a permanent license, and it also keeps an eye on the broker. The FX+ Project is one of its distinctive products.

I’ll be diving into a comprehensive review of Admiral Markets in this article. We’ll take a close look at what sets this broker apart, as well as any areas where it could improve. Through this analysis, which includes expert evaluations and customer reviews, you’ll gain a well-rounded understanding of Admiral Markets. This information will be valuable in helping you make an informed decision about whether this broker aligns with your trading needs.

What is Admiral Markets?

Admiral Markets, recently rebranded as Admirals, has been a significant player in financial investment services since 2001. It ranks as one of the world’s largest Forex and CFD brokers. Although its main office is in the UK, the company has a global presence with additional offices in Cyprus, Estonia, and Australia.

Admirals focuses on providing traders top-notch software and services. The broker offers transparent pricing and execution, setting it apart in the industry. It specializes in high-frequency trading with low latency, a key feature for traders looking for quick and efficient transactions.

The trading conditions at Admirals are optimized for the benefit of the traders. This is achieved by aggregating data from various banks and trading venues into a single liquidity pool. By doing so, the broker ensures that traders receive the most favorable conditions possible for their trading activities.

Advantages and Disadvantages of Trading with Admiral Markets?

Benefits of Trading with Admiral Markets

After trading with Admiral Markets, I found it to be one of the highly reputable brokers in the industry. The company is tightly regulated and has a solid reputation. Opening an account is a straightforward, digital process, making it convenient for traders to get started.

What stood out for me were the spreads, which are among the lowest in the industry. This means cost-effective trading, which is a significant benefit for traders looking to maximize profits. All kinds of trading strategies are welcomed, giving traders the flexibility to operate as they prefer.

Platform choice is another area where Admiral Markets excels. You can opt between MT4 and MT5 platforms, both of which offer robust features. These platforms come with comprehensive education and research materials, plus 24/7 customer support, enhancing the trading experience.

Beginners are not left out either. The broker provides strategies like auto trading and copy trading, making it easier for newcomers to navigate the forex market. This inclusive approach makes Admiral Markets a go-to option for traders at all levels.

Admiral Markets Pros and Cons

Pros

- Strong track record and long history

- Highly regulated, reputable broker

- Open to all trading strategies

- Available on MT4 and MT5, with advanced options

- Round-the-clock customer support

- Suitable for beginners and pros alike

- Free high-quality education and Dow Jones analysis

Cons

- Entity-specific rules can alter conditions

- Commission on some deposit methods

- Some traders report negative experiences

- E-wallet deposits incur processing fees

Admiral Markets Customer Reviews

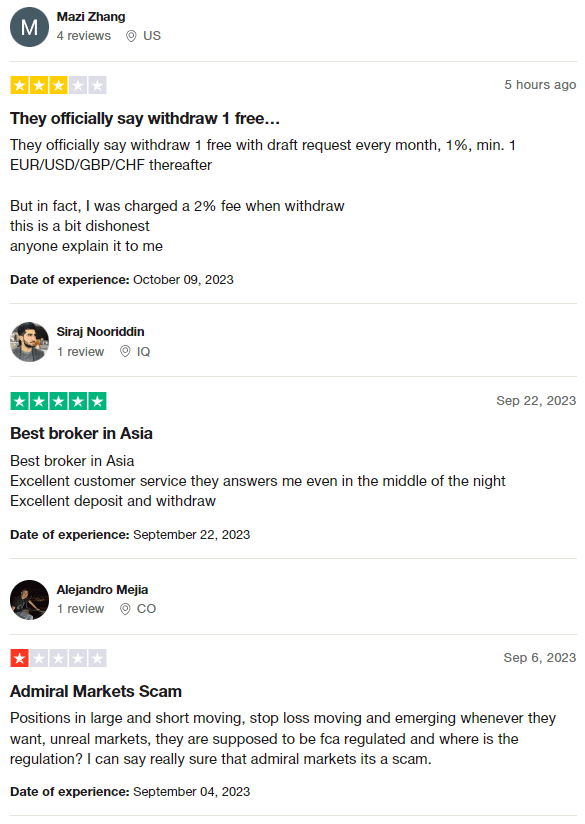

Admiral Markets currently holds a 4.4-star rating on Trustpilot, showcasing a generally positive customer experience. Reviews highlight various aspects of the service. For instance, some users commend the broker for its excellent customer support and smooth deposit and withdrawal processes.

However, there are criticisms, including issues with withdrawal fees and concerns about market regulation. Some customers have even called into question the broker’s regulatory compliance. Overall, while the majority of the feedback leans positive, prospective traders should be aware of these mixed reviews when considering Admiral Markets.

Admiral Markets Spreads, Fees, and Commissions

In my experience trading with Admiral Markets, the broker’s spreads and commission fees differ depending on the account type and the assets being traded. For example, Forex & Metals come with a commission that can range from 1.8 to 3.0 USD per 1.0 lots, specifically on the Zero MT4 account. Cash Indices have their own commission structure, as do Energies, making it crucial for traders to understand these costs upfront.

Another charge that’s typical in Forex or CFD trading is the overnight or swap fee. These fees kick in when you hold a position for more than a single trading day. It’s something traders need to budget for, especially if they plan to maintain positions for an extended period.

Admiral Markets offers a unique solution for its Muslim traders through its Islamic Account option. This eliminates the standard swap fees and is available exclusively on the Trade.MT 5 platform. But it’s worth noting that this account isn’t entirely free of costs. Instead of the swap fees, an administrative fee is applied for positions held over a certain period. This way, Admiral Markets ensures transparency and fairness, catering to a diverse range of traders.

Account Types

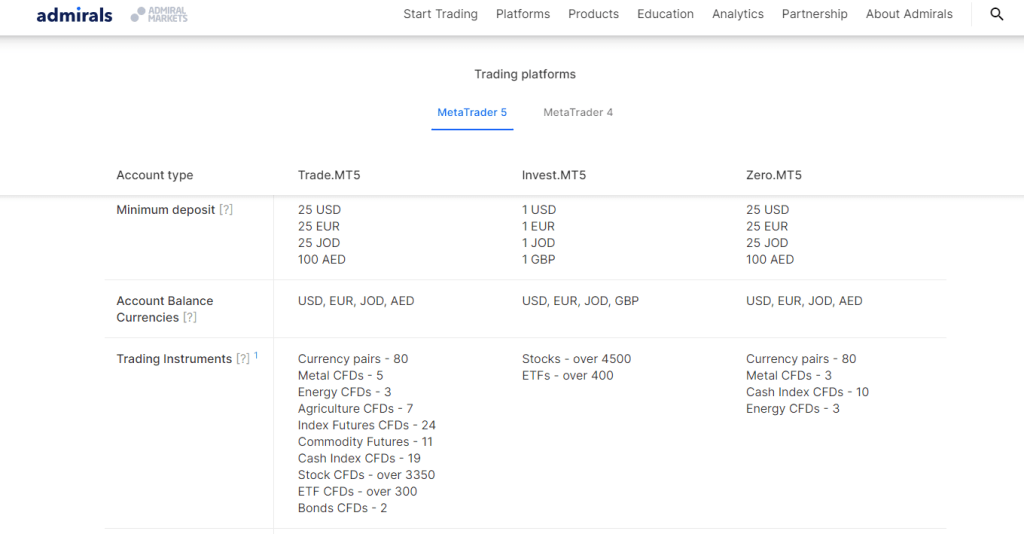

After testing various account options, it’s clear that Admiral Markets offers a diverse range of trading account types to meet different trading needs. Admiral Markets broker account has a minimum deposit of $100. These accounts fall under two main categories: Admiral Markets Account and Admiral MT5 Account. Each of these categories further divides into specific account types with unique features and fee structures.

Admiral Markets Account (MT4 Platform)

- Trade.MT4 Account: Tailored for MetaTrader4 users, this account appeals to a wide range of traders.

- Zero.MT4 Account: Best suited for Forex traders who want minimal spreads, this account is designed for users of the MetaTrader4 platform.

Admiral MT5 Account

- Trade.MT5 Account: Ideal for traders using the MetaTrader5 platform, this account offers competitive spreads, starting at 0.5 pips. You can trade in various currencies, including USD, EUR, and GBP.

- Invest.MT5 Account: Targeted at investors, this account requires a minimal deposit of just $1, making it budget-friendly for newcomers or small-scale investors. It allows for investments in Stocks and ETFs.

- Zero.MT5 Account: Offers minimal spreads but lacks access to commodity futures and cryptocurrency CFDs.

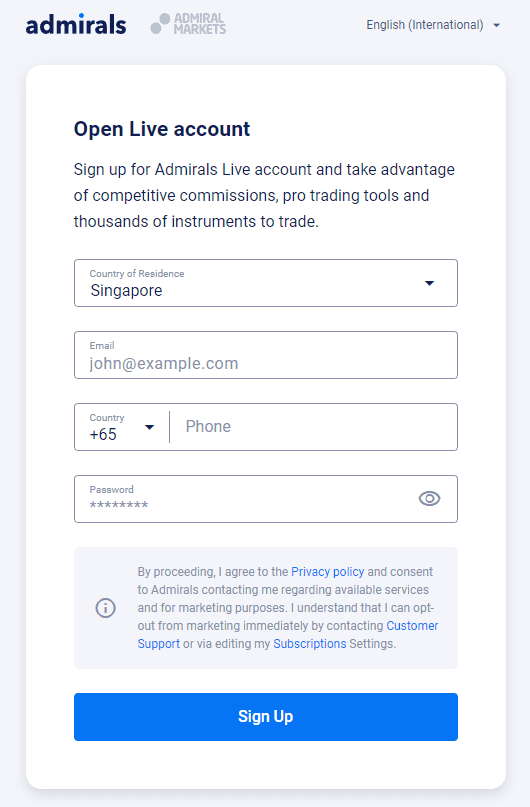

How to Open Your Account

- Visit the Admiral Markets website and fill out the registration form with essential personal details and a secure password.

- After filling out the form, read the Important Notification message that appears. This message contains terms and conditions for using the platform.

- Confirm agreement with the terms by clicking the “confirm” button.

- Check your email for an account activation message from Admiral Markets.

- If the email isn’t in your inbox, check your spam or junk folders.

- Follow the instructions in the email to complete the account activation process.

- Once activated, you can start setting up your trading platform and choose your account type.

- Complete any remaining verification processes required by Admiral Markets to fully secure and use your account.

What Can You Trade on Admiral Markets

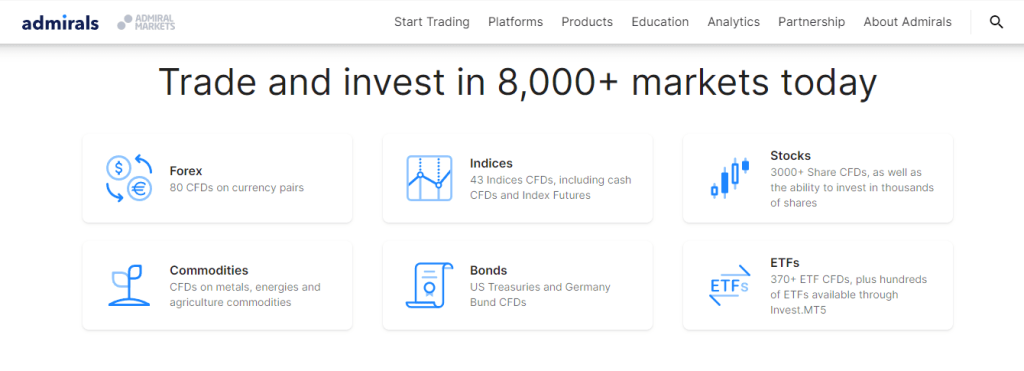

Based on my experience, Admiral Markets offers a wide range of trading instruments. You can trade metals like gold and silver, along with various currencies. Trading CFDs on indices, energies, bonds, and stocks are also available.

What caught my attention was their expanding crypto offerings. Not only do they offer Bitcoin, Litecoin, and Ethereum, but they’ve also recently added Monero, Dash, and Zcash. This shows that Admiral Markets is committed to diversifying its trading instrument range, giving traders more options to choose from.

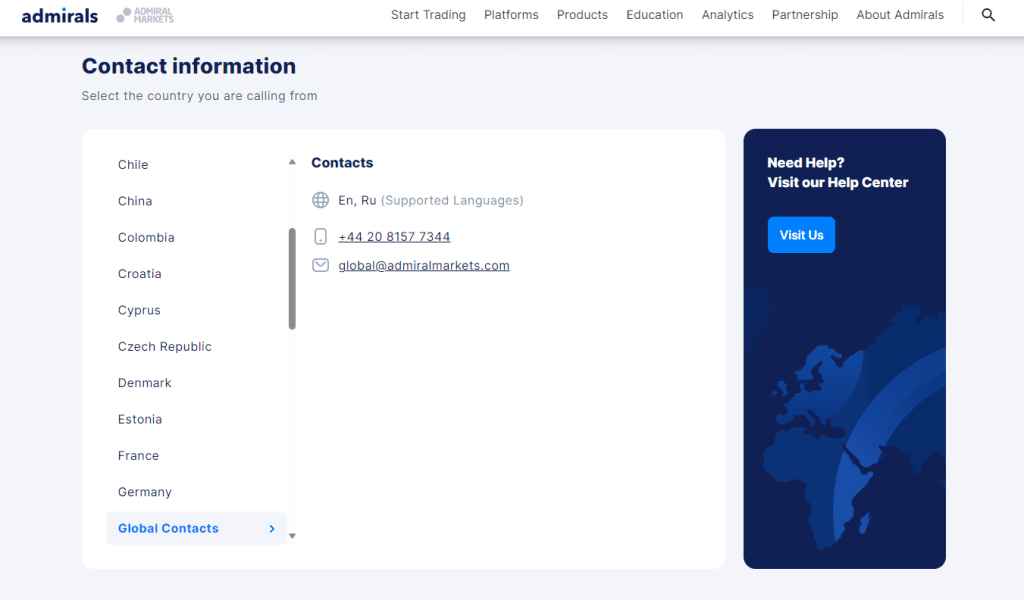

Admiral Markets Customer Support

In my experience, Admiral Markets places a strong emphasis on customer support. They offer a variety of communication channels that are not only diverse but also easily accessible. This ensures you can get the help you need when you need it.

One standout feature is phone support. This lets you talk directly to a customer service representative. It’s particularly useful for urgent matters or issues that require detailed discussion.

Another useful channel is live chat. This feature allows you to get immediate responses for quick questions or pressing issues. It’s a great way to get real-time assistance without any delays.

For less urgent concerns, email support is available. This method allows for detailed queries and provides the time for a comprehensive answer. It ensures that both the trader and customer service representative can understand the issue fully.

Advantages and Disadvantages of Admiral Markets Customer Support

Security for Investors

Withdrawal Options and Fees

Admiral Markets offers a wide range of funding options, giving traders a lot of choices. These options include bank transfers, card payments, and various localized solutions like Klarna and Przelewy. Best of all, these deposit methods come without additional fees, making it easier for traders to fund their accounts.

When it comes to costs, it’s important to know that using e-wallets like Skrill and Neteller could incur fees. Specifically, you’ll face a 0.9% fee for deposits and a 1% fee for withdrawals. The fees depend on your chosen payment method and the entity you’re trading with.

Withdrawals offer some perks too. You get two free bank wire withdrawals each month. Any additional withdrawals in the same month might come with a fee. The methods for withdrawals are the same as for deposits, maintaining a consistent experience for traders.

Admiral Markets Vs Other Brokers

#1. Admiral Markets vs AvaTrade

Admiral Markets and AvaTrade both offer a broad spectrum of trading instruments. While Admiral Markets has a strong focus on platform flexibility, including MT4 and MT5 platforms, AvaTrade is distinguished by its customer base, spread across over 150 countries. Admiral Markets is overseen by multiple regulatory bodies, providing a multi-layered security framework. In contrast, AvaTrade is heavily regulated but primarily operates from four locations worldwide.

Verdict: Admiral Markets is better for those who prioritize security and platform choices. AvaTrade excels in its global reach but falls short on the variety of trading platforms offered.

Also Read: AvaTrade Review – Expert Trader Insights

#2. Admiral Markets vs RoboForex

RoboForex is known for its advanced technology and wide selection of trading platforms, including MetaTrader, cTrader, and RTrader. Admiral Markets focuses more on a balance between user-friendly platforms and diverse trading options. RoboForex offers an extensive range of asset classes and even runs trading contests. Admiral Markets provides the safety of being regulated by multiple prestigious global regulatory bodies.

Verdict: RoboForex is better for traders looking for more variety in trading platforms and contests. Admiral Markets outshines in regulatory oversight and is a more secure option for conservative traders.

#3. Admiral Markets vs Exness

Exness offers various trading options like CFDs for stocks, metals, energy, and over 120 currency pairings, including cryptocurrencies. It also offers benefits like low commissions and immediate fund withdrawal. Admiral Markets has a diverse trading offering but adds an extra layer of security by being overseen by multiple regulatory bodies, including the FCA and CySEC.

Verdict: Admiral Markets is better for those who prioritize security features and regulatory oversight. Exness, although offering a wide range of assets and low commissions, doesn’t have the same level of multi-jurisdictional regulation.

Conclusion: Admiral Markets Review

Admiral Markets stands out for its robust platform options and diverse trading instruments. It’s particularly strong in the area of regulatory oversight, being governed by multiple top-tier financial authorities. These features make it a secure and versatile choice for traders of all levels.

However, it’s important to note that customer reviews have shown some dissatisfaction with the customer support. So, while the platform offers multiple channels for assistance, the quality may vary according to user feedback.

When it comes to withdrawals and deposits, Admiral Markets offers a range of options without additional fees for most methods. But, traders should be cautious of potential charges when using e-wallets like Skrill and Neteller.

Also Read: Scope Markets Review 2024 – Expert Trader Insights

Admiral Markets Review: FAQs

What trading platforms does Admiral Markets offer?

Admiral Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Is Admiral Markets regulated?

Yes, it is regulated by several prestigious bodies including the FCA, CySEC, and ASIC.

What types of accounts are available?

There are five types: Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.