ACY Securities Review

The Forex market has attracted huge interest from the masses, and various new traders have endeavored in the trading world. If you’ve been looking for a forex broker lately, ACY securities might have appeared in social ads across your devices. The broker has allocated a significant budget to marketing, and their targeting campaign applies to all forex aspirants.

ACY securities offer its services across all continents, and they have traders residing in Australia, Saudi Arabia, Colombia, and Europe. Their services have been at par with leading brokers, but their standout trait is the easy sign-up procedure that lets any trader access the trading market within a day.

However, ACY securities are often under heat from clients due to withdrawal complications that make it cumbersome for traders to withdraw their profits. Some customers also accuse ACY securities of poor customer support that hurts the trading experience. Are you looking to sign up with ACY securities?

If yes, then this blog is a must-read. We shall comprehensively review ACY securities, their offerings, prices, trading platforms, and all other vital aspects. Our review shall guide you about the pros and cons of ACY securities and whether you should sign up.

What is ACY Securities?

ACY securities has received many accolades for its services, keeping them in the news. The broker was recently regarded as the ‘best transparent trading broker’ at the Smart investment Expo 2022. Their partnership with Tim Cahill has also attracted the attention of young traders looking to invest their time in the forex markets.

ACY securities is a forex and CFD trading broker offering services across 160+ countries. They have published their offering primarily in the pacific Asian and Australian regions, but their traders also reside in Canada, Germany, and Malaysia. Due to its offerings in different regions, the parent company has launched multiple subsidiaries focusing on particular jurisdictions and complying with their requirements.

ACY Capital Australia ltd is the parent company behind ACY AU, ACY securities, and ACY securities PTY ltd. The company started its operations in 2013 in Australia, but now, it has a registered address in Vanuatu. The company has also obtained two operations licenses; the first is from ASIC- Australian Securities and investment commission, and the second is from VFSC- Vanuatu Financial Services Commission.

Although the licenses for ACY securities aren’t highly regarded in the trading community, ACY securities have taken measures, such as Negative balance protection and multi-jurisdictional compliance, to make it a haven for traders.

ACY securities offer over 2200 different securities for their traders; it includes forex, CFDs on stocks, commodities, indices, and ETFs. They offer research reports and technical indicators for traders to evaluate the market movements and make profitable trades in the securities.

Advantages and Disadvantages of Trading with ACY Securities

Benefits of Trading with ACY Securities

ACY securities have attracted over 50000 traders over the last decade; they have received a 2.7-star rating at Trustpilot and are also popular with trading experts. ACY securities have focused on becoming a broker that traders need.

They have customized their offerings to ensure traders can enter profitable trades and make their dreams come true.

If we talk about platforms, they are a MetaTrader-only broker, meaning traders get exclusive access to MT4 and MT5. Although some traders might have preferred more options, MT4 and MT5 have everything a trader would need. MetaTrader offers industry-acclaimed platforms that are suitable for both novice and expert traders.

You can use MT4 and MT5 to study securities, analyze patterns, apply indicators, and make profitable trades. For new traders, ACY securities also trains them for the forex markets. The broker sends regular emails about their market insights, happenings, and how they perceive the market to move. It allows new traders to get a holistic market view and make suitable trades.

However, if a trader isn’t convinced by spending hours researching, they can simply trust Capitalise.Ai offered by ACY securities. It’s a code-free automated trader where traders can simply delegate their trading to AI. It takes emotional trading out of the picture, and you can avail profitable opportunities even when you sleep.

Capitalise. AI allows users to set trade specifications and backtest their strategies on historical data. If they find their trading strategies useful, they can simulate Capitalise AI to make trades for them. Nonetheless, trading automation may be a step too quick for novice traders, so they can instead opt for trading signals services offered by ACY securities.

The signals are driven by experts based on market research and have produced remarkable results previously. You can simply connect your ACY securities trading account to the signals provider and copy any signal you deem profitable for your account.

Moreover, ACY securities offer over CFD and forex trading in over 2200 different securities through industry-leading platforms that enable traders to make profits and diversify their portfolios. Their rewards at Hong Kong and World Finance Expo express their efficiency in meeting broker requirements and offering high-standard services.

ACY Securities Pros and Cons

Pros

- Signal and Copy trading are available.

- Forex VPS protects traders from fraud.

- Educational resources are updated regularly.

- A demo account is available.

Cons

- The minimum deposit starts at $50

- Some traders accuse of spread manipulation.

ACY Securities Customer Reviews

ACY securities has been in the market for the last 12 years, and they have earned customers’ trust by offering good services at decent charges. Customer reviews highlight a broker’s real-time trading experience and protect your funds from a scam or fraud. ACY securities has a 2.7-star rating at Trustpilot that has declined over the last few months. Let’s talk about the positive reviews first.

Customers acknowledge the ease of signing up and trading with ACY securities; the traders suggest that they were provided with adequate information to start their trading journey, and the broker offers a user-intuitive platform that is straightforward to understand and navigate.

Some reviewers have also heaped praises for the trading course offered by ACY securities; they claim the trainer guided them about the market movements and helped them interpret signals to make profitable trades. Moreover, clients also highlight an excellent customer support response, asset offerings, and a reliable trading environment.

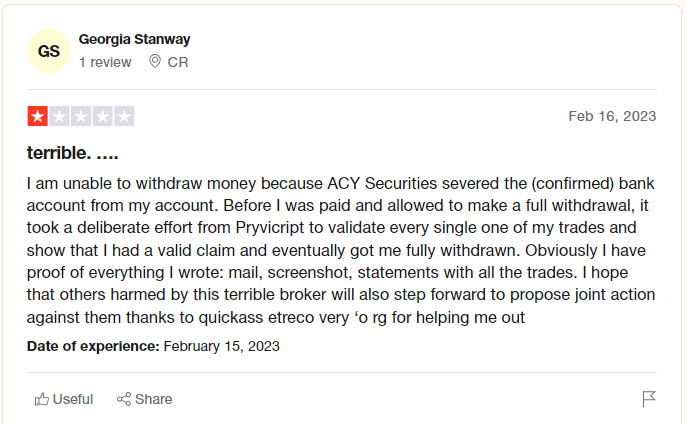

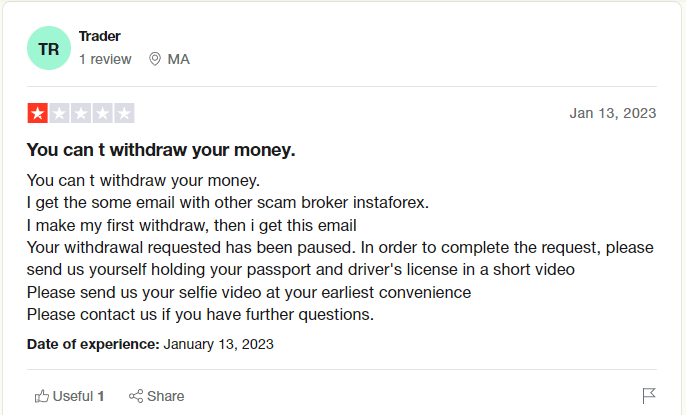

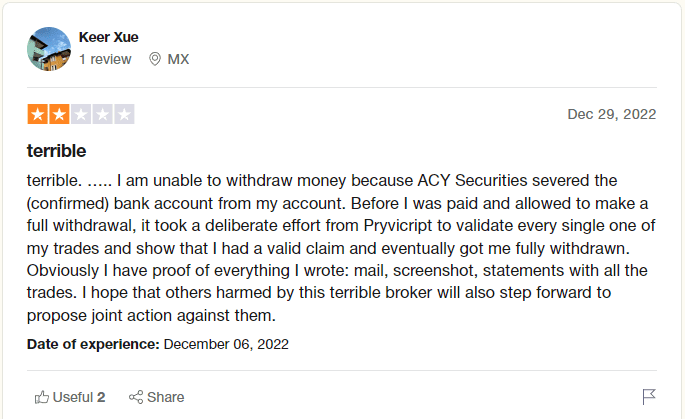

However, the negative reviews can’t be ignored because they put some serious allegations against ACY securities that can cause severe losses if turned out to be true. A significant chunk of traders suggest that they had massive difficulty withdrawing their amount; they report that the broker asked for undue documentation, making it impossible to get a quick refund.

Although ACY securities claim a 1-click 24-hour refund, reviewers say they couldn’t get their funds even after 16 days of request initiations. Some reviews also highlight a poor customer service response upon any technical inquiry, showing a lack of agent expertise.

If we dive deeper into the negative reviews, we can disregard about half due to their authentication. A significant chunk of reviews had reposted the same content as other negative reviews and publicized a chargeback service. The reviewers also had a single review profile, which suggests the profile may be fake.

Nonetheless, the withdrawal problems are reported by some credible resources as well, but ACY securities has responded to the queries at Trustpilot. We believe ACY securities should simplify their withdrawal procedure for a better trading experience.

ACY Securities Spreads, Fees, and Commissions

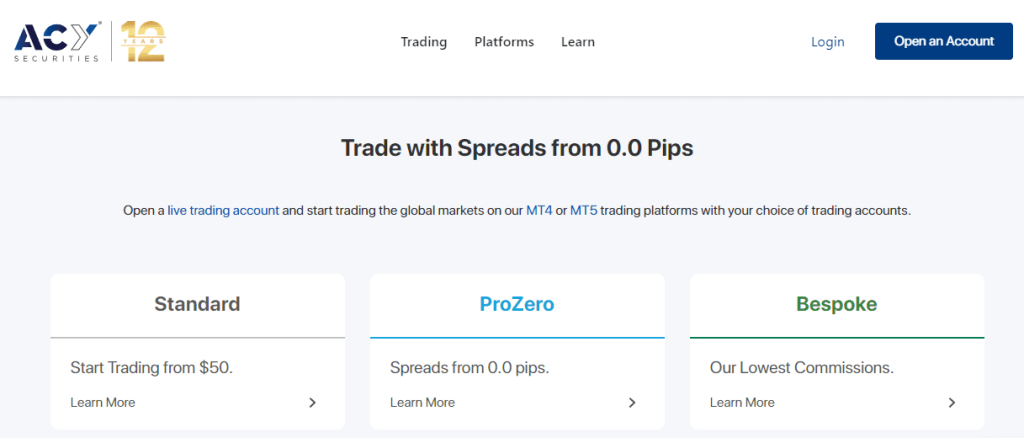

ACY securities have publicized their low trading charges in various market campaigns. They offer three different account types, and ProZero and BeSpoke accounts come with a minimum 0 pip spread. For the standard account, the pips are market competitive as well.

The EURUSD pair has a minimum spread of 1.0 pips; the spread rises to 1.2 pips for the USD JPY pair and 1.6 pip for the GBPUSD pair. The typical spreads are about 0.1-1 pip higher than the minimum, but they can breach the threshold in high-fluctuating securities. T

The standard account doesn’t have a commission, and it compensates for the slightly higher spreads. ProZero and Bespoke accounts have zero minimum spreads, but a commission is charged for every round trade. For ProZero accounts, the commission is $6 or equivalent in other currencies.

Apart from general trading fees, ACY securities also charge a swap fee for overnight trades; it will vary depending on the currency pair traded. ACY securities don’t charge a deposit fee; withdrawal fees may be charged.

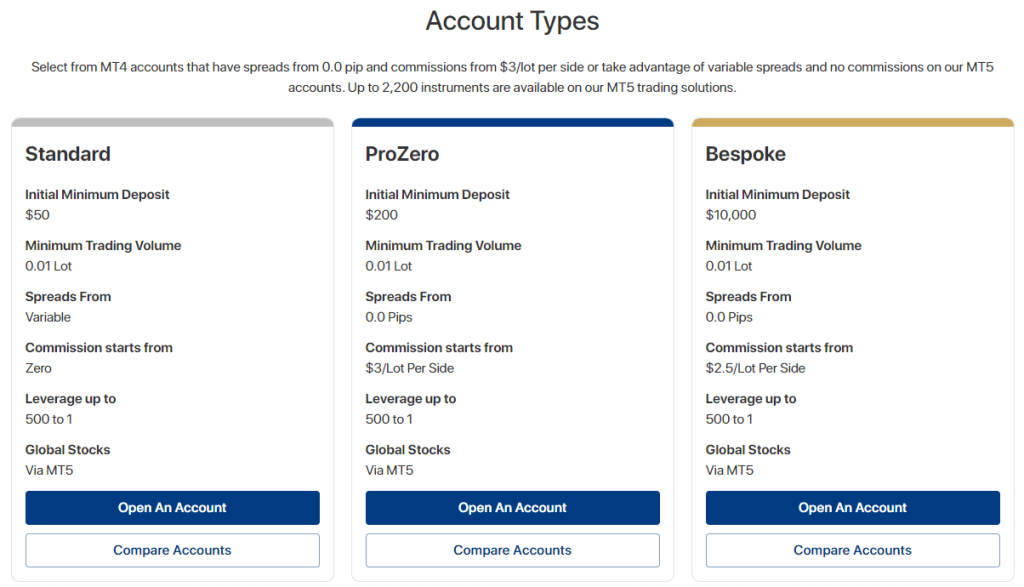

Account Types

ACY securities have impressive offerings and services; however, before signing up, you must determine whether they fit your strategic trading goals.

The simplest way is to analyze their account types; it will show you whether the account types offer spreads, platforms, and educational resources that align with your trading needs. ACY securities have created a decent account specification to suit most traders.

- The standard account has a minimum deposit of $50 and comes with MT4 trading platforms. The minimum spread starts at 1.0 pips, but the average spreads are typically 1.5 pips or higher. The leverage ratio is 1:500 but may depend on your jurisdiction. The minimum lot size is 0.01, which suits traders with lower capital.

- The Prozero account lets you trade with zero spreads and maximize your profitability. The average spreads for the account generally move around 0.5-0.7 pips per trade, but a $3 commission is charged for each entry and exit. The leverage ratio is the same as the standard account, but traders get priority access to 1-on-1 service and market research. It has a minimum deposit of $200.

- The bespoke account is the premium type offered for expert traders; it has a minimum deposit of $10000. The high deposit gives traders exclusive access to Equinix NY4 in New York, enabling superfast execution and tight spreads throughout the day. You can also access the Hongkong server, which makes trading seamless. Traders get priority access to 1-on-1 service, and customer service is also improved.

ACY securities offer a demo and swap-free account besides the three basic accounts. The swap-free account increases your spreads and general trading fees; we don’t recommend swap-free accounts until unavoidable.

Although the current specification of accounts is sufficient, ACY securities could cater to a larger audience by offering cent accounts so that traders could opt for a low-cost trading solution.

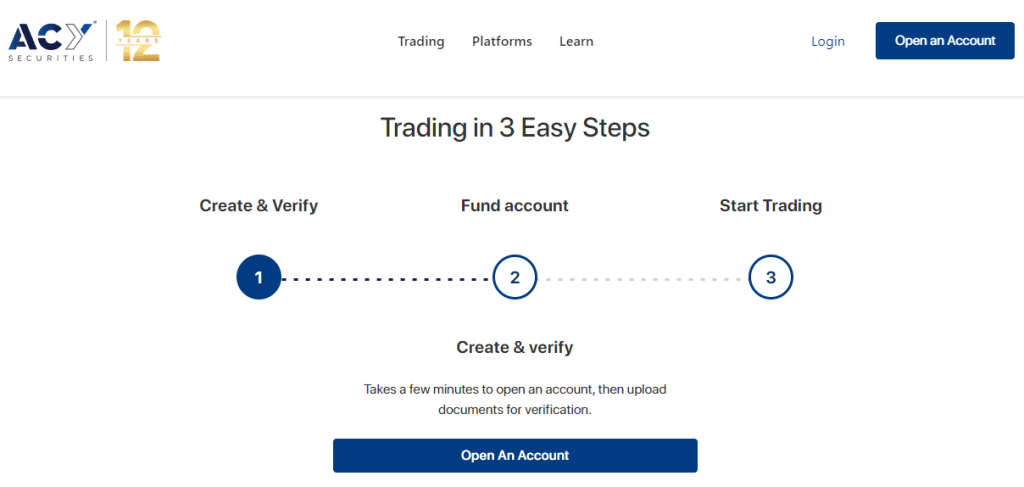

How To Open Your Account?

A popular reason for ACY securities’ popularity is the easy sign-up process. ACY has been prompt at simplifying its account sign-up process that lets traders sign quickly.

An application for an ACY securities account can be submitted within 15 minutes, and if accepted, the account is opened within 24 working hours. The process for the sign-up is as follows:

- Head to the official ACY securities website and navigate to the blue ‘Open an account’ button at the top bar.

- You’ll be directed to the ACY securities client portal. To set up your account, you can enter your personal information, such as name, phone, and password. Click ‘continue’ to proceed.

- Once the application is submitted, you can use the same email and password to access the client portal and enjoy your demo account. Once you’re ready, click on the side menu, and click on ‘deposits.’

- You will get multiple deposit options based on your selected account type. The deposit process is simple and doesn’t incur a deposit fee. Once the funds are transferred, you will receive your balance within 24 hours, depending on the selected method.

ACY securities are licensed by Vanuatu financial services commission (VFSC), which makes them a reliable spot for your investments. However, you should contact their agent to confirm their services in your jurisdiction before signing up.

What Can You Trade on ACY Securities

A common problem with everyday brokers is the lack of trading instruments preventing investors from diversifying their portfolios, leaving them riskier. Fortunately, ACY securities has got you covered.

They have a wide range of over 2200 different securities that lets you spread your portfolio in diverse segments. Forex pairs are their most popular trading instruments; ACY securities has over 50 popular currency pairs and many exotics and crosses that enable traders to benefit from changing markets.

The spreads for each instrument are also competitive; thus, traders shouldn’t be reluctant to trade in them. ACY securities also offers CFDs for stocks, indices, commodities, and precious metals. CFDs are generally riskier assets and may shoot up or plummet if the market turns unexpectedly.

We suggest traders be cautious while dealing with them. The Stock CFDs include scripts from leading stock markets such as NYSE and NASDAQ. ACY securities offer ETFs for its clients as well; although the spreads are slightly higher on ETFs, they have historically generated significant returns for their traders and can be a good option for professional traders.

ACY Securities Customer Support

Customer support plays a crucial role in a broker’s performance, and if customer support is inconsiderate, it is a major red flag. ACY securities have received mixed responses regarding its customer services. A significant chunk praises the efficiency and promptness of customer support replies. Contrarily, some traders regard customer support as slow, unresponsive, and uncooperative.

Usually, brokers with operations in different regions face customer support problems as multilingual agents are often slow at communicating and may not comprehend the correct meaning of the complaint.

Nonetheless, ACY securities should introduce better majors to promptly connect clients to the right agent. Our experience with ACY securities has been below par. We tried connecting with their agent through the live chat support, but despite waiting 15-20 minutes, no agent was connected.

The AI bot at the live chat isn’t up to the market standards; it couldn’t comprehend our search query and bought generic results that weren’t based on our requirements. Nonetheless, it’s better to connect with ACY securities through phone or email.

Connecting to an ACY agent on the phone is complex, and you may only succeed at connecting with them if you call at unusual hours. The good thing is their 24/5 service, meaning you can connect with them after midnight as well.

Advantages and Disadvantages of ACY Securities Customer Support

Security for Investors

Withdrawal Options and Fees

The easiest parameter to judge the legitimacy of a broker is by analyzing their withdrawal procedure. If the broker has a straightforward policy with instant fund transfer, they are most probably legitimate; otherwise, they are not.

The traders trusted ACY securities due to their publicized 1-click 24-hour withdrawal; it enabled traders to withdraw their payments with a single click. The broker claimed that within 24 hours, the payment would be credited to the trader’s accounts.

The website mentions that withdrawals received before 16:00 AEST are processed on the same day, while any application after that time is processed on the next day. Unlike most brokers, ACY securities charges a withdrawal fee of $25 alongside the intermediary commission. The fee is levied on your fourth withdrawal in a month, and traders could avoid it by simply waiting till the next month.

Traders can file the withdrawals- ACY securities through the ACY client portal. They can receive the transfer at their e-wallets, bank cards, VISA, or MasterCard. The transfer can also be made to a credit card if the application is processed within 20 days of the first transaction.

The customer experience with ACY securities has been mixed; some have faced incredible difficulties withdrawing money; they were asked to present pictures with their license and passports for the transfers. Other traders claim the process was pretty simple, and they received the amount in due time.

A sizable chunk has reported withdrawal problems, and they can’t be ignored as a coincidence. Nonetheless, ACY securities have responded promptly to the registered queries, and we expect them to fix the problem soon.

ACY Securities Vs. Other Brokers

#1. ACY Securities vs. AvaTrade

Avatrade has been a leading broker in the pacific Asian region over the last decades; their services and reliability have made them a trusted name amongst traders. ACY securities also operate in markets similar to Avatrade; thus, traders may find it challenging to decide which of the two brokers to opt for.

Let’s start with legitimacy. AvaTrade began its operations in the early 1990s and has captured a sizable proportion of the market in South Africa, Japan, and Europe. Their licensing with Japanese and South African regulatory bodies makes them a safer option. They also comply with the requirements of different operational jurisdictions, making them a reliable choice.

On the contrary, ACY securities doesn’t boast similar licensing claims; the company has an ASIC and VFSC license, but both have low credibility in the trading community. The recent accusation of complex withdrawal and spread manipulation also poses a negative threat to investors’ trading accounts.

The other important factor is trading instruments; ACY securities have a good variety of trading instruments, where traders can trade up to 2200 different securities. However, over 90% of the instruments offered by ACY securities are derived assets, meaning they are highly vulnerable to a change in their underlying asset.

On the contrary, AvaTrade lets you trade over 1000+ trading assets, including stocks, crypto, forex, CFDs, and ETFs. The feasibility of trading in stock and crypto markets ensures traders can benefit from market movements without taking unmanageable risks.

Regarding trading platforms, ACY securities, and AvaTrade don’t have much differentiation. Both brokers offer MT4 and MT5 trading platforms that suffice the need of most traders.

However, Avatrade also has a mobile app and access to Zulutrade, making them a more feasible option for on-the-go traders. From our viewpoint, AvaTrade is a clear winner in the contest, and traders will benefit by signing up with them. ACY securities can also be a good option for traders who want to trade forex exclusively.

#2. ACY Securities vs. Roboforex

Roboforex and ACY securities were founded during the post-recession period, and both of them capitalized on technology to offer remarkable services for their traders. Roboforex started its operations in 2009, is now spread in over 120 countries, and has over 1 million in the audience. ACY securities haven’t expanded in a similar fashion, and their growth has been relatively slow.

Both brokers are famous for their forex trading features and have enjoyed customer loyalty from their users. Roboforex and ACY securities stand in the same, but an undesired position regarding reliability. They haven’t obtained tier-1 licenses and aren’t part of a compensation scheme, leaving traders vulnerable. Nonetheless, both brokers have been around for over ten years and have built a positive reputation around them.

If we talk about platforms, Roboforex takes the lead against ACY securities; the latter is a MetaTrader-broker only, and there aren’t many options for traders. Capitalize Ai is a good automation tool, but it is only helpful if the trader has abundant knowledge about the market.

On the contrary, Roboforex has stood on their claim of offering the latest technology; they not only provide meta trader access for their traders, but traders can also use C-trader, web portal, and client cabinet based on their needs. The AI support system has simplified social trading for traders, and they can earn a passive income by selecting the best strategies.

ACY securities have a slight lead against Roboforex in terms of spreads. ACY securities have a minimum spread of 1.0 pip for standard accounts, while it starts at 2.0 pips for Roboforex.

However, Roboforex traders can get a standard account for a minimum deposit of $10 compared to $50 for an ACY securities account. If traders have higher capital, they can shift to a zero-pip account that offers market-competitive trading costs alongside other additional features.

Our primary determinant between Roboforex and ACY securities is customer support and withdrawals. While ACY securities fared poorly in both categories, Roboforex has usually shone brightly with a consistent, high-quality experience.

Hence, the winner in the contest will be Roboforex, and traders will benefit more by signing up with them. A slightly higher spread for a standard account may trouble some traders, and they must calculate their possible profits before signing up.

#3. ACY Securities vs. Alpari

Alpari is an offshore broker that offers services in over 160 countries; they have obtained an audience of over 2 million traders and are expanding rapidly in the Asian market. ACY securities may face tough competition against Alpari in the Asian and European markets.

Alpari and ACY securities compete for the same target audience; both brokers look for new entrants ready to experience forex trading and make some profits.

Alpari targets its audience by offering consistent yearly bonuses; they have over five ongoing bonuses each season, providing traders an excellent opportunity to increase their profits.

ACY securities focus on tactful marketing to find users impressed by their easy sign-up process. In terms of legitimacy, both brokers are indifferent; Alpari has an FSC SVG license that has mixed opinions amongst trading experts, and ACY securities licenses aren’t reputed any better.

Alpari offers about 250 trading instruments for their traders, while ACY securities have a significantly wider variety with over 2200 different instruments. Alpari compensates for its lower asset diversity by allowing over seven different account types.

They have accounts for everyone; you can get a cent account with as low as a $1 deposit or a premium account and invest as much as you like. Similarly, Alpari has remarkable customer service that sets them apart from ACY securities. The live chat and phone responses are adequate, and the agents are well-informed about the subject and trading markets in general.

The ultimate determinant between the two brokers is the trading costs. Overall, the spreads offered by the broker are pretty similar for the standard and premium accounts; however, the overall cost of trading is significantly lower for Alpari traders.

They don’t have to incur a withdrawal fee and can benefit from higher leverage. Our suggestion for traders between Alpari and ACY securities will be based on your requirements. If you’re looking for good educational resources and some trading automation, ACY securities will be a better choice. However, if you want an overall better trading experience with better profitable opportunities, Alpari is a better option.

Conclusion: ACY Securities Review

ACY securities, ACY Capital Australia limited, and all other ACY investment companies are owned by the ACY Group. They are an established firm in the investment industry and have been serving customers across the globe since 2011. The company has been a forerunner in introducing forex trading to young traders through its compelling ads and brand sponsorship deals.

Their standout feature includes access to 2200 trading instruments and MT4/5. Traders can use trading platforms to analyze different securities, compare ACY securities, evaluate profitable trading positions, and profit from the forex market.

The broker also offers Capitalise—AI, an automation tool for passive professional traders that lets you set thresholds for trading actions. Once the specifications are set, the AI monitors the market and decides on your behalf.

Novice traders can benefit from Signal Start, where they can receive numerous signals for trades in different securities and can simply copy and execute a trade. The downside of ACY securities is poor customer service and faulty withdrawals. They are two major red flags that put ACY securities down on our recommendation list. ACY securities should improve on their weaknesses to offer a better trading experience for their users.

ACY Securities Review FAQs

Is ACY Securities legit?

ACY securities have been in the trading market for over a decade and have received positive customer reviews across different platforms. ACY securities offer negative balance protection and segregated funds to protect investors from losses. They are also licensed by the ASIC and VFSC, which adds to their credibility.

What is ACY Securities’ minimum deposit?

ACY securities have three account types, excluding swap-free (Islamic account). ACY securities offers the standard account with a minimum deposit of $50. The Prozero and Bespoke accounts have a minimum initial deposit of $200 and $10,000, respectively.

Do ACY Securities charge withdrawal fees?

Yes, ACY securities charge a $25 withdrawal fee for the fourth withdrawal in a month. The first three withdrawals don’t incur any fee except the intermediary commission paid to third-party. ACY securities doesn’t charge deposit fees on its accounts or trading platforms.