ActivTrades Review

ActiveTrades is an internationally recognized online-based broker that gives traders an opportunity to invest in Forex and a variety of other financial assets. The broker has been operational for the last 20 years and has earned a strong reputation for offering state-of-the-art trading platforms, secure trading services, and access to hundreds of CFDs.

This ActivTrades review will break down all aspects of this firm. We will start off by explaining the evaluation criteria used to write this review before diving into a brief intro on what ActiveTrades is all about. You will also get details on some of the broker's key features, the trading platforms available here, and a breakdown of the fees, spreads, and other charges.

The goal of this ActivTrades review is to basically give you and other traders, of course, all the info you need to better take advantage of the services offered here. After all, success as a forex and CFD trader often comes down to the quality of brokerage services and, of course, your trading account.

It makes sense, therefore, that most traders would want to have as much info as possible before opening a forex and CFD trading account with any broker. Keep reading to learn more.

What is ActivTrades?

Activtrades broker is a financial services provider that gives folks access to forex trading. It is actually a reputable online brokerage that operates in several jurisdictions, offering thousands of retail investor accounts access to financial markets.

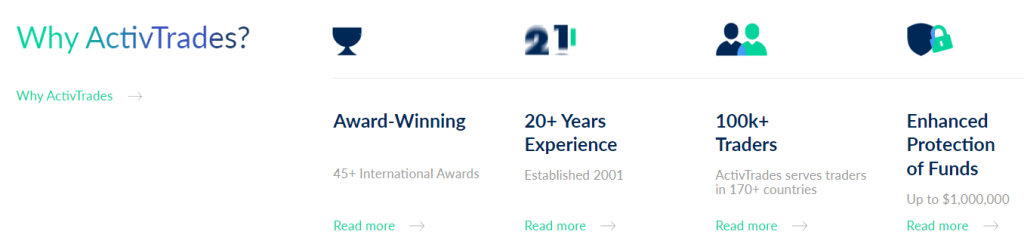

ActivTrades brings a lot of pedigree and experience to the market. The firm has actually been doing this since 2001, marking two decades of offering access to the forex market for both beginner and professional traders.

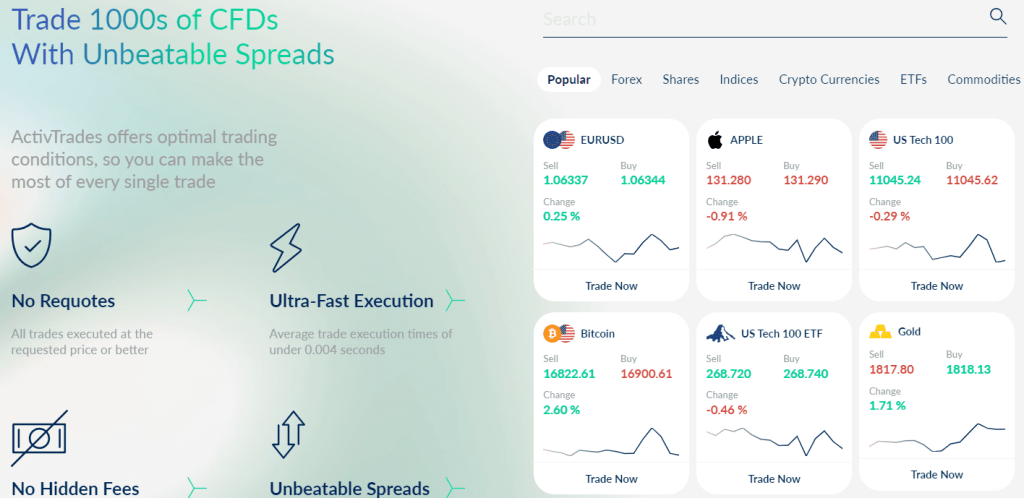

Also, since its inception in 2001, over 100,000 traders have used this CFD and forex broker, including its proprietary trading platform and other third-party platforms as well. Also, Activtrades has worked very hard over the years to expand its pool of tradable financial instruments. According to info on its main website, there are over 1000 assets available for CFD trading, including currency pairs, commodities, and so much more.

The firm also offers enhanced protection of funds, including insurance cover for bank transfers sent as customer deposits. This is also a brokerage facing multi-regulation in several jurisdictions, including the United Kingdom. Although we will discuss a few issues with its service later in this Activtrades review, overall, the brokerage is excellent.

Advantages and Disadvantages of Trading with ActivTrades

As with any broker, there will always be advantages and disadvantages involved when you trade. Here are some of the most notable ones with regards to the Activtrades broker, starting, of course, with the benefits:

Benefits of Trading with ActivTrades

ActivTrades has used the over two decades of experience it has in forex to streamline its services in a huge way. If you decide to choose and work with this brokerage, there are certain benefits that you ought to expect. Here are some of them:

Supports Large Deposit

One thing that sets this broker apart is the ability to accommodate both beginner and experienced traders. In fact, Activtrades supports large deposits in several trading accounts of up to $1 million.

This is suited for large institutional investors who are keen on developing a long-term working relationship with the broker. But don't let this put you down if you are a retail investor. There are still small accounts suited for you.

Regulated in Top tier jurisdiction

Trust is a key part of the financial services industry. Once you start the account opening process with a brokerage, you want to make sure that it has your best interest at heart. Well, Activtrades is actually regulated in three jurisdictions.

But more importantly, the broker is regulated by the UK Financial conduct authority FCA, the top regulator in the United Kingdom. This should give users the trust they need to trade forex with this provider. ActivTrades is a regulated broker in Luxembourg and the Bahamas under Activtrades plc.

Research and Analytics

It is also important for any trader out there to have the tools needed to analyze trades. ActivTrades knows this, and it has a dedicated research tab on its website for both beginner and experienced traders.

The tab features an in-depth analysis of various assets, historical data, trade ideas, charts, and a series of tools that will help you make sense of the market. There is also an economic calendar that gets updated every single day to ensure you are not blindsided by market events.

State-of-the-art trading platforms

Activtrades plc has also invested heavily in developing the required trading technology for customers around the world. To this effect, activtrades corp offers three trading platforms that you can access from your real account.

The first one is proprietary software that has been built in-house. It is easy to use, and you can take advantage of the maximum leverage offered here and its integrated trading statements to expand your trading potential. But in case you are not interested in using the in-house software, you can use the MT4 or the MT5 trading platforms. These well-known platforms will be linked to your trading account so that you can do leverage trading at ease.

Relativley Better Fees

Although Activtrades does not offer the lowest fees in the market, the fees are still reasonable from a forex trading point of view. However, please note there will be deposit and withdrawal fees depending on your method.

For example, if you decide to fund your account using a bank transfer, you will be charged a 1.5% fee of the total amount wired. There is also a currency conversion fee as well. Nonetheless, folks who use credit cards and other electronic methods to fund their accounts pay zero fees. Overall, it takes about 30 minutes to fully fund your account, regardless of the method you have decided to use.

ActivTrades Pros and Cons

Every stock index trading and forex broker has pros and cons, and Activtrades is not any differed. Here is the complete list of the pros and cons you should expect from this brokerage firm:

Pros

- Secure account opening process with proper customer support.

- You can deposit as high as $1 million into your trading account

- Offers multiple trading platforms, including the popular MT4 and MT5 platforms.

- Has over 20 years of experience in the market

- You get superior trading technology for your automated trading strategy and fast market execution

- In-depth market analysis tools for market trends, the pivot points indicator, and other indicators.

Cons

- The mobile trading version of its in-house trading app looks more cluttered than the desktop platform.

- The broker charges high nontrading fees, including a 1.5% charge in deposit and withdrawal fees

- The KYC and account opening process can be a turd too complicated for the average joe.

Analysis of the Main Features of ActivTrades

2.6 Overall Rating |

2.6 Execution of Orders |

2.6 Investment Instruments |

2.7 Withdrawal Speed |

2.8 Customer Support |

2.5 Variety of Instruments |

2.8 Trading Platform |

ActivTrades Customer Reviews

From the reviews we have managed to analyze for ActiveTrades, the general consensus is that the broker is worth it's salt in more ways than one. In fact, one user even pointed out that seeing so many people have worked with this firm and managed to get 100% satisfaction, it can only mean that the folks here are doing something right.

There is also a lot of praise for the research and analytics tools that are offered here. One user seemed to really appreciate the smart trading technology offered by the activtrades trading platform and the extent to which it can be replicated using the mobile trading platform. But there is one interesting take on trading technology from another user.

The review suggests that smart trading tech from the firm only works well when you are trading stock cfds using the in-house Activtrades software. People who choose to use MT4 and MT5 seem to be struggling to get the best possible outcomes. Despite this, we have seen mostly positive things from users who have had the pleasure of using this service.

ActivTrades Spreads, Fees, and Commissions

There is not a lot of information about fees, spreads, and commissions on the Activtrades site. However, we managed to dig up some info from other trusted sources to gauge this broker's affordability. Well, from what we can gather, the broker charges variable spreads. This means that spreads vary depending on several factors, including the type of assets and trading hours.

As a rule of thumb, spreads will often be lowest during peak trading hours when the markets are open. You can start off with demo trading to see how the spreads apply and how they vary across different asset classes. The same criteria are used to determine the commissions charged when trading forex.

Please also keep in mind that there are many non trading charges that come as part of activtrades fees. For example, you will pay a fee every time you transfer money from your bank account to your trading account. For now, this charge stands at 1.5% of the total deposit. The deposit and withdrawal fees cut across all the broker accounts, including the professional account.

Also, Activtrades charges a currency conversion fee for people who want to trade major currency pairs. Again, this totally depends on the account type and type of assets you are working with. With everything said and done, it is safe to argue that this broker does not offer low trading fees. It is one of the more expensive firms you can work with.

How ActivTrades Fees Compare to other Brokers

Account Types

In order to give users the perfect trading conditions within its own trading platform, Activtrades has set up a variety of customized accounts that suit different people. Before we get to the specifics of these accounts, it is worth pointing out that 85% of all retail investor accounts lose money when trading CFDs with this provider.

In fact, the risk of losing money rapidly due to leverage is very high. Please make sure you understand what you are getting into before jumping right in. Nonetheless, here are the primary account types at activtrades:

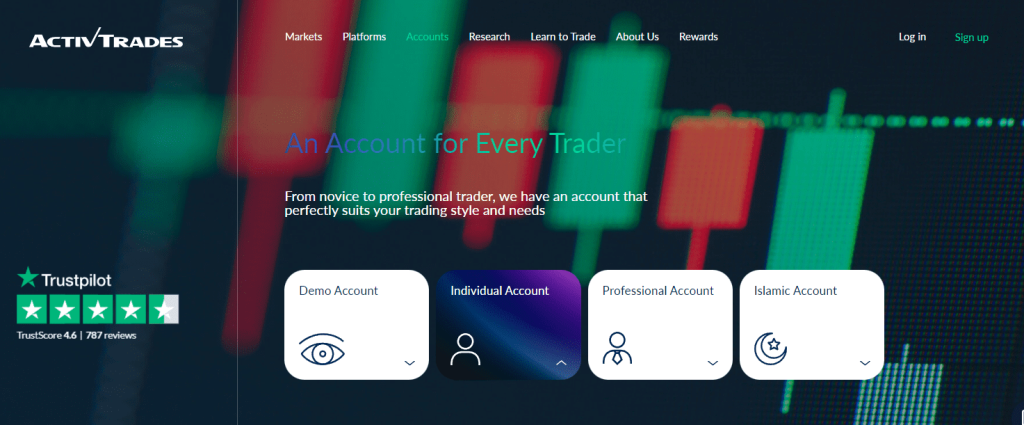

Individual Account

The individual account from this broker is actually suited for every trader. Whether you are an experienced professional trader or just a novice, this would be a great option. It features negative balance protection, ultra-fast market execution, and low spreads. There is no minimum deposit as well.

Professional Account

The pro account is ideal for the more advanced traders looking for automated trading tech and in-depth research tools. Here, you get a dedicated account manager, negative balance protection, and high leverage to maximize your positions. You also get several deposit and withdrawal options, including bank transfer and others.

Islamic Account

Activtrades is also one of the many brokers these days that offer an Islamic account. These accounts are suited for folks who want to trade within the principles of Islam. As such, there are no interest or rollover commissions. You will also get enhanced balance protection and a host of other features. As with the other accounts, no minimum deposit is needed as well.

Demo Account

Finally, you can also open a free demo account with the broker to help hone your skills. Trading is not simple, and sometimes you need to test out your strategy before jumping into the real account. The free demo account gives you a perfect chance to do this.

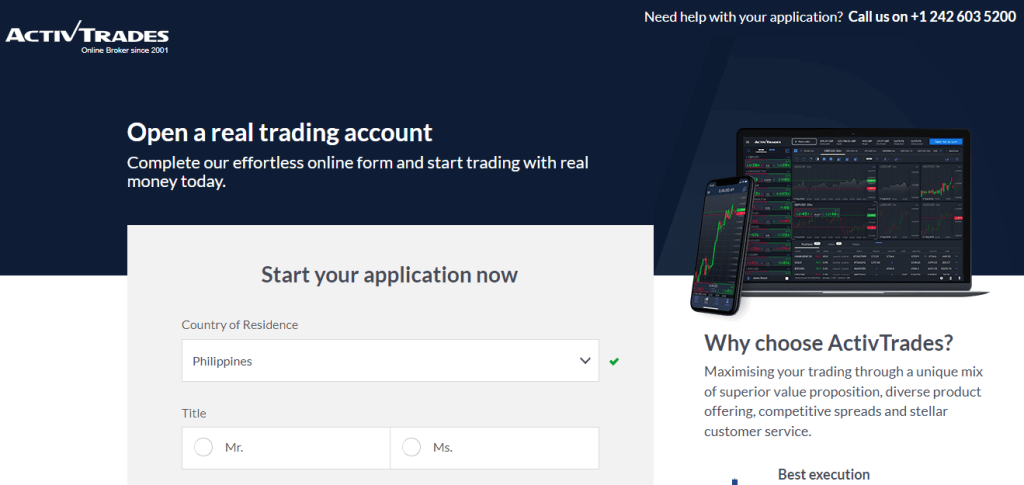

How To Open Your Account

It does not take a lot to open a trading account with this broker. In fact, the first thing you need to do is head over to their main website. On the top left corner of the screen, you will see the signup button. Simply click it, and soon, the site will redirect to the account opening page. Simply key in your personal details and hit next.

You will then be required to choose the type of account you want. There are three main options, but if you intend to practice first, perhaps you should consider a free demo account instead.

Nonetheless, once the account is chosen, the next step is verification. Here, the Activtrades team will ask you for a few documents. The KYC process is quite robust. For this reason, getting your account set up may take a bit longer.

However, most users get their accounts in 24 hours or less. Once your account is ready, deposit money using bank transfers or any other option and start trading currency pairs and other assets.

What Can You Trade on ActivTrades

As noted above, there are over 1000 tradable assets on Activtrades. However, it will not be possible to list all these assets. So, what we are going to do is basically give you a breakdown of the asset classes.

First, the biggest share of tradable assets here is forex. The forex market is a $6 trillion-a-day industry with thousands of currency pairs to explore. You can also trade commodities with Activtrades. This includes things like oil, gas, and others. Please also note a variety of precious metals are on offer here. Silver and Gold are very common options for traders, but there are others as well.

You will also be happy to know that you can buy and sell stock indices as well from some of the biggest markets in the world. However, you will not be able to trade individual stocks with this broker. It is also essential to make it clear that these are all CFDs.

Standing for Contracts for Difference, CFDs are a type of financial derivative where users profit from short-term speculation of the price action of an underlying asset. Like other financial derivatives, CFDs are highly risky and complex instruments. You are advised to fully understand how they work before trading with real money.

ActivTrades Customer Support

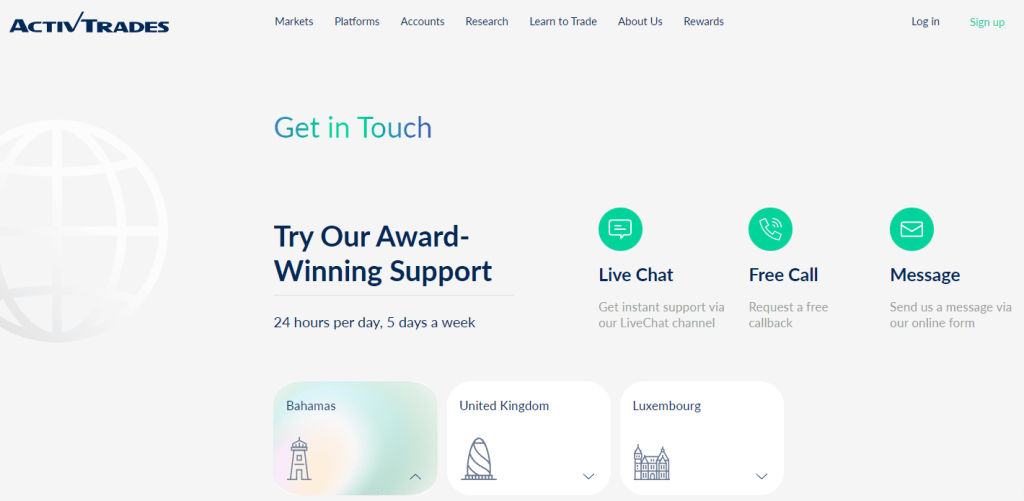

The customer support at Activtrades corp still has a long way to go to catch up with the other top brokers in the market. For starters, instead of offering 24/7 customer support, the firm offers 24/5. This means that for two whole days in a week, you will not be able to get help with anything, including market execution or issues with your desktop platform.

We also didn't see any support for multilingual support. This means that everything here is delivered in English. This can be a bit limiting for people who struggle with English or perhaps use a different first language.

Despite these shortcomings, the customer support team is relatively responsive. Whether you have issues with mobile trading, your bank account transfer, or even the Activtrades trading platform, there will be someone standing by to help address your concerns.

In addition to this, there are more ways to reach out for support. You can use a live chat feature on the website for instant help and a call back feature as well for non-urgent issues. Activtrades also offers email support and phone support as well.

Advantages and Disadvantages of ActivTrades Customer Support

Contacts Table

Security for Investors

Activtrades has also been able to take extra measures to offer investors and traders the most advanced security. Here are the advantages and disadvantages of these security measures:

Withdrawal Options and Fees

The withdrawals on Activtrades are processed fairly quickly. By default, withdrawals are sent to the original bank account they were deposited from. In some cases, the team may request a few documents to verify the account info. However, this does not typically take that long.

In case you used a different method to fund your account, the same rule will apply until the limit is reached. For example, if you deposit money using a credit card that has a limit of $500, you can only withdraw a maximum of $500. The rest will be processed through different withdrawal methods.

There is also a withdrawal fee of $10. This fee will be charged regardless of the currency you are using. In some cases, a currency conversion fee may be charged as well.

ActivTrades Vs Other Brokers

Activtrades has so much experience in the forex market. Over the years, the firm has come up against some of the leading brokers out there. So, how does the firm compare to these brokerages? Here is a breakdown:

#1. ActivTrades vs Avatrade

Activtrades and AvaTrade share several vital similarities that underpin their reputation as reliable brokerages in the world. For starters, these two firms are highly regulated, In fact, based in Ireland, Avatrade is regulated by the UK's FCA, amongst a host of other regulators in several jurisdictions. This is also the case with ActivTrades.

There is also some degree of experience and pedigree with these two firms. On one hand, Activtrades has been doing this for more than two decades while AvaTrade has been in the forex market for the last 15 years. This shows that both these firms have the needed track record of delivering value.

You will also notice that both firms have their own proprietary trading software and third-party software. But despite these similarities, there are a few areas where there is some contrast. AvaTrade has a better variety of trading instruments at over 3000. AvaTrade fees are also lower, and it has better customer support as well.

#2. ActivTrades vs Roboforex

Roboforex is also a decent brokerage that knows how to deliver value for its growing customer base. For the last decade or so, the firm has been in the forex market, it has earned a reputation for superior trading technology and innovative automated tools.

This is perhaps one area the broker shares with Activtrades. Both these firms appear to have invested a lot of resources in building quality trading technology and tools. However, unlike activtrades, Roboforex does not have its own internal trading software. Users rely fully on the MT4 and MT5. These are not necessarily bad tools and are known for their faster execution and reliability.

In addition to this, both these firms have a superb variety of CFDs to trade. However, Activtrades does way better when it comes to pedigree and safety. It is regulated in top jurisdictions, too, while Roboforex is limited in this respect. The fees, however, are way higher at Activtrades compared to roboforex.

#3. ActivTrades vs Alpari

For people who want a reliable broker that has been in business for years, then Alpari and Activtrades are excellent options. Both these firms have offered brokerage services for more than 20 years. But despite this, Alpari has a better success rate.

While Activtrades has served over 100,000 traders, Alpari has gone well above 2 million. This is a clear sign that the broker has made an indelible mark in the forex trading market and remains a trusted entity. Also, the two firms are fairly the same in terms of fees which is a big shortcoming since the fees are high.

One area, though, in which Activtrades beats Alpari is trading technology. Alpari still uses MT4 and MT5. But the automated trading tools and in-depth research offered by Activtrades are way better and much more reliable.

You will also notice that Activtrades also provides one of the best investor education programs for beginners who are just starting out. Although this education is still not as good as we hoped it to be, it is still a bit better compared to what Alpari offers.

How ActivTrades Compare against other Brokers

Conclusion: ActivTrades Review

Finding a broker you can trust to execute your trades fast and securely is not always guaranteed. Even though the market is filled with so many firms, only a handful have the ability to meet the diverse needs of different users. Well, Activtrades is one of the few firms out there that has what it takes to deliver exactly what you are looking for.

This reputable broker has been in the market for over 20 years and has earned a reputation for reliability and success. It also offers you the chance to trade over 1000 assets, including a vast variety of currency pairs, commodities, and so much more. But that's not all. You also get multiple trading platforms, including a proprietary system that has been built in-house. The others include the popular MT4 and the MT5 platforms.

Despite these amazing features, there are also some areas where Activtrades falls short. For example, the fees charged here are a bit high. Even though the spreads are relatively low, you still get to pay high fees for deposits and withdrawals. The firm also charges a currency conversion fee as well.

When you put all these charges together, they amount to a considerable sum. Also, the customer support is just 24/5, and besides, there have been complaints that it does not actually respond as fast as we hoped. But all in all, Activtrades is still a decent brokerage, and you should be able to use it for regular trading.

ActivTrades Review FAQs

Is ActivTrades legit?

Yes, ActiveTrades is a legit broker. This firm has not only been in the industry for 20 years but is also regulated by the FCA in the UK and regulators in Luxembourg and the Bahamas. You can therefore have the confidence to leverage its service.

Is ActivTrades regulated?

Yes, as noted above, this broker is regulated in three major jurisdictions. The first one is the United Kingdom under the FCA, a tier 1 jurisdiction with strict compliance requirements. The firm is also regulated in the Bahamas and Luxembourg.

Is ActivTrades an ECN broker?

Yes, Activtrades is an ECN broker that has a superb track record of reliability in the forex trading space. It is also endowed with some fantastic trading features and tools for both avid traders and pro experts.