AAAFx Review

Forex brokers play a crucial role in the currency trading industry, providing a platform for both individual traders and large institutions to participate in the foreign currency exchange market. The importance of choosing the right Forex broker cannot be overstated, as it significantly impacts the efficiency and success of your trading activities.

One standout in this domain is AAAFx. This broker is dedicated to revolutionizing the Forex trading experience by focusing on cost-effective trading solutions. They set themselves apart by significantly reducing trading costs, a benefit that resonates with traders looking to maximize their potential while keeping expenses low.

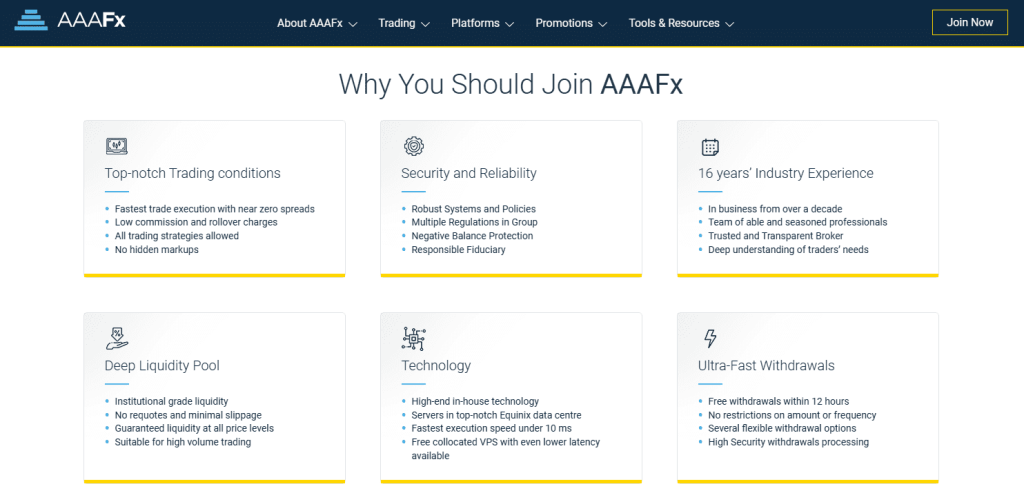

AAAFx’s commitment to reducing trading costs and easing trading stress is notable. Their use of advanced technology ensures quick transaction processing and access to a broad liquidity pool, both of which are critical in the volatile Forex market. This approach makes AAAFx a compelling choice for traders at all levels, highlighting their position as a notable participant in the Forex brokerage industry.

What is AAAFx?

AAAFx is a notable player in the Forex and CFD Trading sector. Established in 2007 and headquartered in Athens, Greece, it operates as part of the Finvasia Group Alliance. Known for its global footprint, AAAFx has successfully opened accounts for clients from over 176 countries, showcasing its wide-reaching appeal in the international trading community.

AAAFx has carved out a reputation for being a versatile trading platform, offering a range of instruments including cryptocurrencies, indices, equities, commodities, and Forex. This diverse portfolio caters to a broad spectrum of traders, from those interested in traditional forex trading to those leaning towards the burgeoning field of cryptocurrency and global equities.

In addition to its diverse offerings, AAAFx is recognized for its adherence to regulatory standards, particularly in complying with the EU’s restricted maximum leverage. This commitment to regulation underlines their focus on responsible trading practices. However, like any significant entity in the trading world, AAAFx has its share of critics. It’s important for potential traders to consider both the accolades and criticisms of AAAFx to make an informed decision.

Benefits of Trading with AAAFx

Trading with AAAFx has brought to light several key benefits that have positively impacted my trading experience. One of the standout features is their zero commission trading. This fee-free structure is a major advantage, allowing me as a trader to maximize my profits without worrying about additional costs eating into my earnings.

Having traded with AAAFx, I’ve come to appreciate their longevity and experience. With over 16 years in the industry, their depth of knowledge and understanding of market dynamics is evident. This experience translates into more informed support and services, which has been invaluable in my trading journey.

Another significant benefit I’ve noticed is AAAFx’s institutional-grade liquidity. This ensures that my orders are executed smoothly and with minimal slippage, a crucial factor in fast-moving markets. This level of liquidity efficiency is something I have come to rely on for effective trading.

Lastly, the diverse asset selection offered by AAAFx has enriched my trading options. The ability to trade in various instruments like Forex, Stock CFDs, Commodities CFDs, Indices CFDs, and Crypto CFDs has allowed me to diversify my portfolio and explore different market opportunities. This variety has been a key factor in keeping my trading experience dynamic and engaging.

AAAFx Regulation and Safety

In my experience trading with AAAFx, understanding their regulation and safety measures has been crucial. The broker is regulated by the Hellenic Capital Market Commission (HCMC) in Greece and the Financial Sector Conduct Authority (FSCA) in South Africa. This dual regulation is a significant aspect, assuring me that my trading activities are under the supervision of reputable regulatory bodies.

The presence of AAAFx under the watchful eyes of these regulatory authorities means a commitment to maintaining high standards in client protection, financial stability, and operational transparency. Trading in an environment that is regulated by such esteemed institutions gives me a sense of security and trust. It means my investments are handled with integrity and in compliance with strict financial regulations.

Knowing about AAAFx’s regulation and safety protocols is vital for any trader. It provides a layer of security and ensures that the trading platform operates with transparency and in the best interest of its clients. This assurance has been a cornerstone of my confidence while trading with AAAFx, allowing me to focus on my trading strategies without undue worry about the safety of my funds and the fairness of transactions.

AAAFx Pros and Cons

Pros

- Industry Acclaim

- Flexible Trading Options

- 16 Years of Expertise

- Regulatory Adherence

- Financial Rewards

- Competitive Rates

Cons

- Sparse Educational Material

- Absence of a Mobile Application

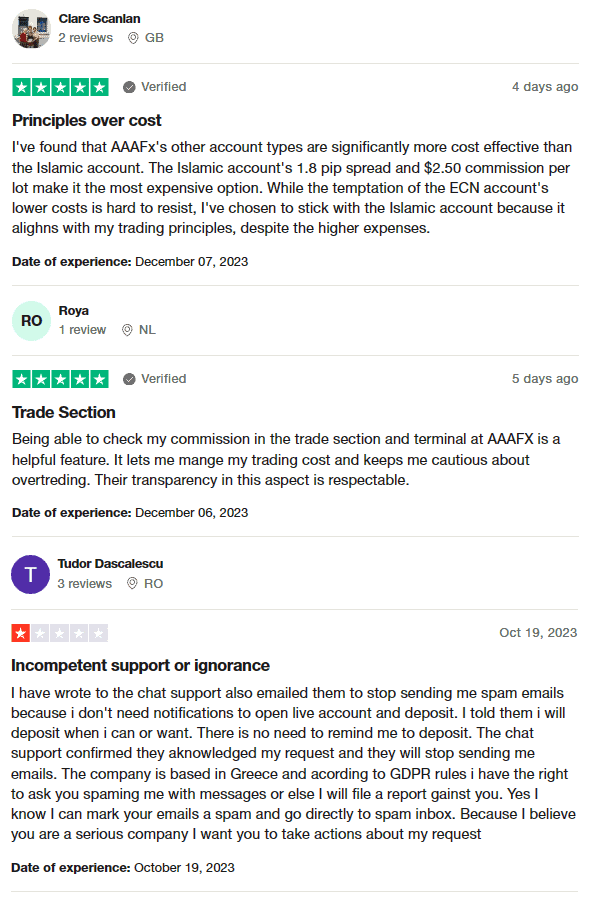

AAAFx Customer Reviews

Customers of AAAFx, which currently holds a 4.7-star rating on Trustpilot, have shared varied experiences. One user noted that while the Islamic account option aligns with their trading principles, it is more expensive due to a 1.8 pip spread and a $2.50 commission per lot, compared to other account types. Another customer appreciated the platform’s transparency, particularly in allowing them to easily track commissions within the trade section and terminal, aiding in effective cost management.

On the other hand, a concern was raised regarding the frequency of promotional emails, with one user highlighting their need to request a stop to these communications. This customer pointed out their right under GDPR rules, emphasizing the importance of respecting customer preferences in communication.

This mix of feedback reflects AAAFx’s commitment to accommodating diverse trading needs and principles, while also indicating areas for improvement in customer communication and service.

AAAFx Spreads, Fees, and Commissions

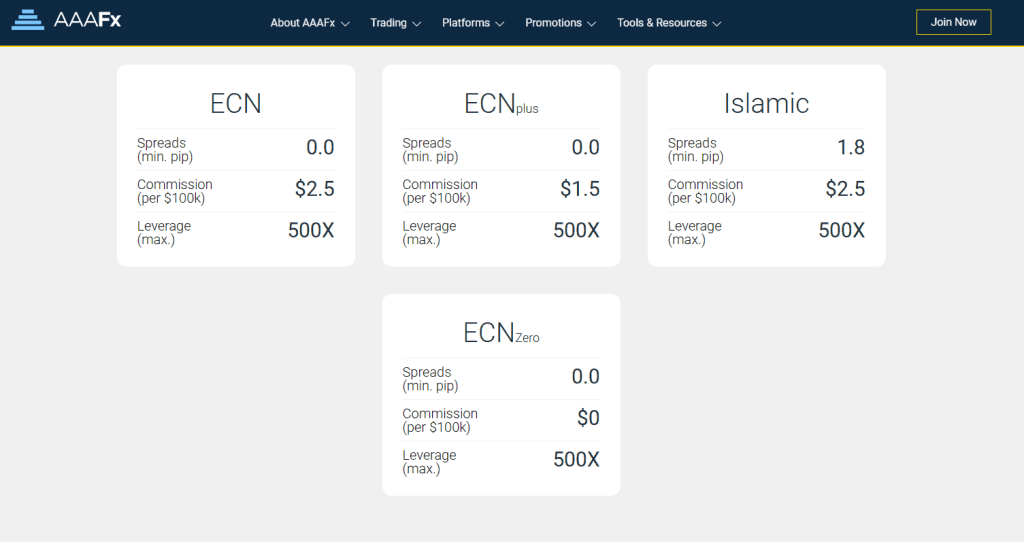

In my trading experience with AAAFx, I’ve found their fee structure to be well-suited for a variety of traders. As a recommended broker for forex trading, they stand out with their competitive and low spreads, starting from 0.0 pips for major currency pairs like EURUSD, GBPUSD, and EURGBP. This is particularly advantageous for traders focused on these major pairs.

The commission rates at AAAFx vary based on the account type. In the ECN Account, the commission is set at $2.5 per $100k traded, a reasonable rate for regular trading. The ECN Plus Account goes a step further with a lower commission of $1.5 per $100k, making it an attractive option for high-volume traders. Impressively, the ECN Zero Trading Accounts offer zero commission, a significant benefit for cost-conscious traders.

For traders of the Islamic faith, the Islamic Trading Accounts also have a commission of $2.5 per $100k. It’s important to be aware that positions held after 17:00 EST may incur overnight swap or rollover rates, which AAAFx clearly details on their website, ensuring transparency in their fee structure.

Additionally, the starting spreads for other financial instruments like indices, raw materials, and cryptocurrencies are set at 1.0 pips, 1.2 pips, and 1.3 pips respectively. This varied spread for different instruments makes AAAFx a versatile choice for trading a diverse range of financial assets beyond the Forex market.

Account Types

Having tested various account types offered by AAAFx, I’ve observed distinct features and benefits for each, tailored to different trading needs and preferences.

ECN Account

Raw ECN spreads, rapid trade execution, low swap charges, and advanced technology. No restrictions on trading strategies, making it ideal for diverse trading approaches.

- Spreads: Minimum 0.0 pips

- Commission: $2.5 per $100k traded

- Leverage: Up to 500X

ECNplus Account

Exceptional trading conditions with low commissions and thin spreads. Suitable for serious traders who manage moderate trading volumes.

- Spreads: Minimum 0.0 pips

- Commission: $1.5 per $100k traded

- Leverage: Up to 500X

- Minimum Deposit: $1,000

Islamic Account

Designed for traders of the Islamic faith. It requires a minimum deposit of $100 and offers 0 swap charges. A standard administrative fee applies to this account, which is a consideration for those following Islamic trading principles.

- Spreads: 1.8 pips

- Commission: $2.5 per $100k traded

ECNZero Account

Tailored for larger accounts, offering the best of both worlds – zero commission and raw, thin spreads without markup. This account is particularly appealing for high-volume traders seeking cost-effective solutions without compromising on trade execution speed.

- Spreads: Minimum 0.0 pips

- Commission: $0 per $100k traded

- Leverage: Up to 500X

- Minimum Deposit: $50,000

How to Open Your Account

- Start by entering your name, phone number, and email address.

- Attach a valid photo ID, like a passport or driver’s license.

- Complete the form and click on “Submit.”

- Wait for an email confirming your submitted details.

- After confirmation, choose your preferred account type.

- Adjust the trading leverage according to your strategy.

- Select a deposit method that suits you.

- Complete the initial deposit as required by your account type.

- Begin trading after your account is activated and funded.

- Set up any necessary trading tools or platforms.

- Familiarize yourself with the trading interface and start your trading journey.

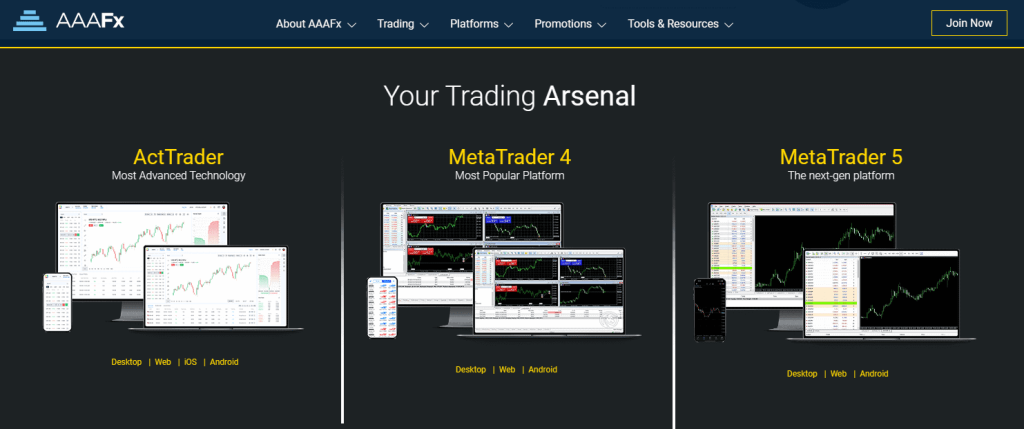

AAAFx Trading Platforms

Based on my experience, AAAFx offers a range of trading platforms, each with its own unique features and benefits. The first is Metatrader 4 (MT4), a widely recognized platform known for its user-friendly interface and robust analytical tools. It’s particularly favored by traders for its advanced charting capabilities and automated trading options, making it a top choice for both beginners and experienced traders.

Then there’s Metatrader 5 (MT5), an upgraded version of MT4. MT5 offers enhanced trading features, including more technical indicators, graphical objects, and timeframes. This platform is ideal for traders looking for more advanced trading tools and a greater depth of market analysis. Its sophisticated environment is particularly beneficial for traders seeking detailed market insights and comprehensive trading strategies.

Lastly, ActTrader is another platform available through AAAFx. It stands out for its customization options and versatile trading environment. ActTrader is designed for traders who prefer a more tailored trading experience, with features that can be adjusted to fit individual trading styles and preferences. This platform complements the more traditional offerings of MT4 and MT5, providing a well-rounded suite of tools for diverse trading needs.

What Can You Trade on AAAFx

During my trading with AAAFx, I’ve explored a variety of trading instruments they offer, each with unique features and conditions.

Forex trading on AAAFx is especially appealing due to its minimum $0 commission and ultra-fast execution time of 10ms. The spreads can be as low as 0.0, and with over 70 currency pairs available, there’s a wide range of options. Additionally, the leverage can go up to 500x, which is quite high and can amplify potential gains.

When it comes to Indices, AAAFx offers a competitive edge with a minimum commission of $0.74 and the same rapid execution of 10ms. The spread starts at 0.0, and there are more than 10 indices to trade with a leverage of up to 400x. This range provides ample opportunities for those interested in global markets.

Commodities trading with AAAFx also has attractive terms, including a minimum $0.74 commission and rapid execution. The 0.0 starting spread and the leverage of up to 100x make it an interesting option for diversifying trading strategies.

In the Stocks category, AAAFx offers trading in over 100 stocks with a minimum commission of 0.075%. The quick execution and minimal spreads are consistent here as well, but the leverage is lower, capped at 5x, which reflects the nature of stock trading.

Lastly, Cryptocurrency trading is a growing area with AAAFx. While the options are more limited, with only 6 pairs, the minimum trade size of 0.01 and leverage up to 5x, combined with the swift execution time, make it a viable platform for crypto enthusiasts.

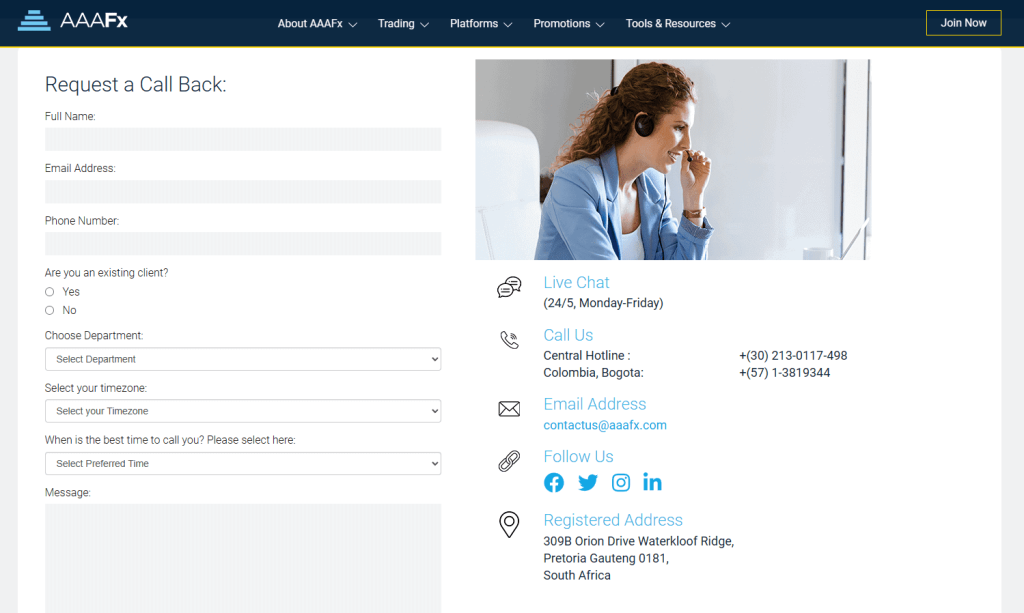

AAAFx Customer Support

From my experience, AAAFx provides a comprehensive customer support system, offering several ways for traders to get in touch with their team. This includes options like live chat, email, and phone support. These multiple channels ensure that assistance is readily available, catering to a variety of preferences and needs.

A key aspect of AAAFx’s customer support is its 24/5 availability in English. This continuous support during the trading week is crucial, especially for traders who might encounter issues or have questions outside standard business hours. Being able to access support at any time during the trading week has been a significant advantage in my trading journey.

For those preferring email communication, they can reach out at contactus@aaafx.com. Alternatively, phone support can be accessed at +(30) 213-0117-498. AAAFx also provides their physical addresses for both their EU office in Greece and their Global office in South Africa, ensuring transparency and a sense of reliability.

Advantages and Disadvantages of AAAFx Customer Support

Withdrawal Options and Fees

In my experience with AAAFx’s withdrawal options and fees, the process is quite user-friendly. They offer a variety of methods, including wire transfers via FairPay and PayRetailers, which is great for those who prefer traditional banking methods.

E-wallets are also an option for withdrawals, with AAAFx supporting popular choices like VirtualPay and Skrill. This flexibility caters well to traders who favor digital payment methods. For those interested in cryptocurrencies, Match2Pay is available, adding another convenient option.

One of the major advantages with AAAFx is that there are no minimum or maximum withdrawal limits. However, it’s essential to be verified before initiating any withdrawals. Also, it’s important to note that the method of withdrawal must match the method of deposit. For example, if you deposit funds via a wire transfer, your withdrawal must also be through wire transfer.

A point to consider is the potential for delays in withdrawals, something that some traders have reported. Additionally, there are instances where withdrawals might be split into two transactions. While these issues are relatively rare, they are aspects to keep in mind when planning your withdrawal strategy with AAAFx.

AAAFx Vs Other Brokers

#1. AAAFx vs AvaTrade

AAAFx and AvaTrade are both prominent players in the online Forex and CFD brokerage space, but they cater to different trader needs. AAAFx, known for its low spreads and diverse account types, appeals to traders looking for cost-effective options and flexibility in trading strategies. AvaTrade, established in 2006, boasts a strong regulatory framework and a wide range of financial instruments, with a client base from over 150 countries.

Verdict: For traders prioritizing a wide array of financial instruments and strong regulatory backing, AvaTrade may be the better choice. However, for those who value competitive pricing and a variety of account options, AAAFx stands out.

#2. AAAFx vs RoboForex

RoboForex, with its license number 000138/333 and FSC regulation, focuses on providing advanced technologies and trading conditions. It offers over 12,000 trading options across eight asset classes, catering to a diverse range of trading styles and volumes. AAAFx, on the other hand, emphasizes low-cost trading and a range of account types including ECN and Islamic accounts.

Verdict: RoboForex might be more suitable for traders who need a vast selection of trading instruments and platforms, including MetaTrader, cTrader, and RTrader. For those looking for lower cost trading and a variety of account types, AAAFx could be a better fit.

#3. AAAFx vs Exness

Exness, a Cyprus-based broker, offers a substantial range of CFDs, including over 120 currency pairings, and is known for its high monthly trading volume. It provides beneficial conditions like low commissions and instant order execution. AAAFx is more recognized for its low spreads and fast execution, along with a diverse range of account types.

Verdict: Traders seeking unlimited leverage and a wide range of CFDs, including cryptocurrencies, might find Exness more appealing. However, for those who value lower spreads and diverse account types, including Islamic accounts, AAAFx would be a preferable choice.

Conclusion: AAAFx Review

In conclusion, AAAFx stands out as a competitive option in the Forex and CFD trading landscape. One of its primary strengths is its low-cost trading structure, with low spreads and a variety of account types, including ECN and Islamic accounts, which cater to a wide range of trader preferences. The platform’s flexibility in trading strategies and diverse range of trading instruments further enhance its appeal, especially for those seeking a versatile trading experience.

However, it’s important for potential users to be aware of certain limitations. The primary language of customer support being English might pose a barrier for non-English speakers, and the lack of service on weekends could be inconvenient for some traders. Additionally, while the platform offers a range of withdrawal options, there have been occasional reports of delays in withdrawals and transactions being split, which should be considered when planning financial strategies.

Also Read: HonorFx Review 2024 – Expert Trader Insights

AAAFx Review: FAQs

What are the main features of AAAFx?

AAAFx is known for its low-cost trading options, offering low spreads and a variety of account types, including ECN and Islamic accounts. They also provide a diverse range of trading instruments, catering to different trading preferences.

Is AAAFx suitable for all types of traders?

Yes, AAAFx is suitable for a wide range of traders, from beginners to experienced ones. Their flexible trading strategies and multiple account types make it accessible for various trading styles and levels of experience.

Are there any notable limitations with AAAFx?

Some limitations include customer support primarily in English and no service availability on weekends. Additionally, there have been some concerns about delays in withdrawal processing.