Position in Rating | Overall Rating | Trading Terminals |

1st  | 4.9 Overall Rating |  |

AvaTrade Review

Selecting the appropriate Forex broker is crucial for traders, as it directly impacts trading success and security. A reliable broker ensures transparent transactions, competitive spreads, and robust customer support, all of which are essential for effective trading. Conversely, choosing an unsuitable broker can lead to issues such as hidden fees, poor trade execution, and potential financial losses.

AvaTrade, established in 2006, is a reputable online broker specializing in CFDs on commodities, cryptocurrencies, stocks, indices, and more. With its headquarters in Dublin and regional centers in Paris, Milan, Sydney, and Tokyo, AvaTrade serves traders worldwide, offering a user-friendly platform and a wide range of trading instruments.

In this comprehensive review, our team provides an in-depth analysis of AvaTrade, highlighting its unique features and potential drawbacks. We aim to offer essential insights into the broker, including various account options, deposit and withdrawal processes, commission structures, and other critical details. By combining expert analysis with actual trader experiences, we equip you with the necessary information to make an informed decision about considering AvaTrade as your preferred brokerage service provider.

What is AvaTrade?

AvaTrade, established in 2006, is a leading online broker offering a wide range of trading instruments, including Forex and CFDs. With over 400,000 registered customers globally, the company executes more than two million trades monthly, with total trading volumes surpassing $70 billion per month.

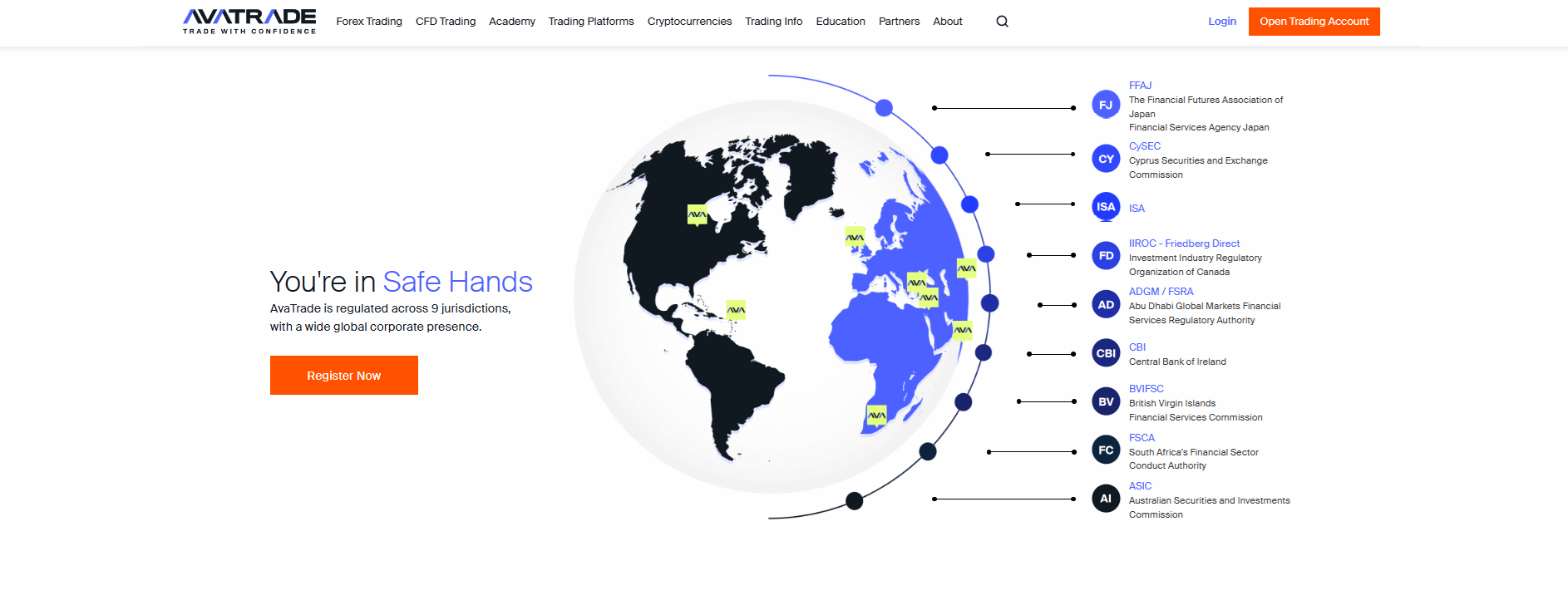

The broker is regulated across nine jurisdictions, ensuring a secure trading environment for its clients. AvaTrade provides access to various platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO app, catering to traders of all experience levels.

Clients can trade a diverse selection of assets, including Forex pairs, stocks, commodities, cryptocurrencies, and indices, all with competitive spreads and leverage options. AvaTrade also offers innovative tools like AvaProtect, a risk management feature that protects trades from losses.

AvaTrade Regulation and Safety

AvaTrade operates under the regulation of multiple respected financial authorities, ensuring the highest standards of safety for its traders. Among these regulators are the British Virgin Islands Financial Services Commission, overseeing Ava Trade Markets Ltd, and the Monetary Authority of Singapore (MAS), which ensures compliance in Singapore. Such oversight provides traders with the assurance that AvaTrade adheres to global financial norms.

Additionally, AvaTrade is regulated by the Australian Securities and Investments Commission (ASIC) in Australia, Cyprus Securities and Exchange Commission (CySEC) in Europe, and the Central Bank of Ireland, which supervises AVA Trade EU Ltd. These regulatory bodies enforce strict measures to protect client funds and maintain a transparent trading environment, making AvaTrade a trusted choice for traders worldwide.

AvaTrade Pros and Cons

Pros

- User-friendly platforms

- Diverse asset selection

- No deposit/withdrawal fees

- Comprehensive educational resources

Cons

- High inactivity fees

- Limited advanced features

- No cryptocurrency deposits/withdrawals

- Not available to U.S. and New Zealand clients

Benefits of Trading with AvaTrade

Traders have noted that AvaTrade’s user-friendly platforms and diverse asset selection enhance their trading experience. The intuitive interface and wide range of instruments make it accessible for both beginners and seasoned traders.

Additionally, AvaTrade’s comprehensive educational resources and responsive customer support have been highlighted as valuable assets. These features assist traders in making informed decisions and provide timely assistance when needed.

AvaTrade Rating Breakdown Based on Traders’ Feedback

4.8 Overall Rating |

4.5 Execution of Orders |

4.5 Investment Instruments |

4.5 Withdrawal Speed |

4.5 Customer Support |

4.5 Variety of Instruments |

5.0 Trading Platform |

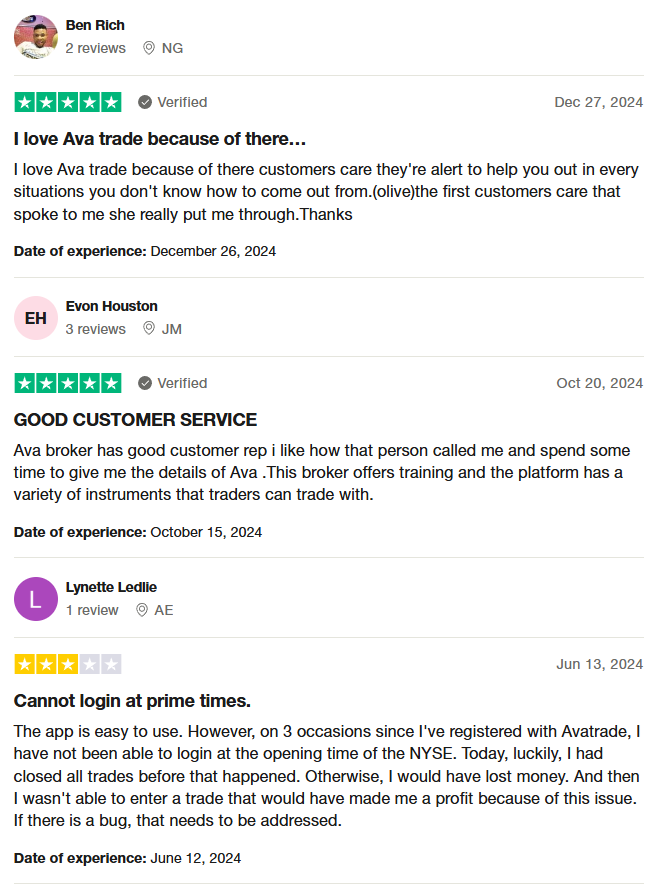

AvaTrade Customer Reviews

AvaTrade receives generally positive feedback for its responsive customer support and educational resources. Many users appreciate the guidance provided by support representatives, highlighting their patience and helpfulness in addressing concerns and explaining trading processes. The platform’s user-friendly design and variety of trading instruments are also noted as key advantages. However, some customers have reported login issues during critical trading hours, emphasizing the need for technical improvements to ensure seamless access. These reviews reflect a mix of strong support services and room for improvement in platform reliability.

AvaTrade Spreads, Fees, and Commissions

AvaTrade operates on a commission-free trading model, earning revenue through spreads, which are the differences between the bid and ask prices of trading instruments. For major currency pairs like EUR/USD, the typical spread starts at 0.9 pips, while for pairs such as GBP/USD, it averages around 1.5 pips. In the case of commodities, gold trades with a spread beginning at 0.34 pips, and for indices, the S&P 500 has an average spread of 0.5 points during peak trading hours. It’s important to note that these spreads are integrated into the quoted prices, ensuring transparency in trading costs.

While AvaTrade does not impose deposit or withdrawal fees, traders should be aware of certain non-trading charges. An inactivity fee of $50 is applied after three consecutive months of non-use, and an annual administration fee of $100 is charged after 12 months of inactivity. Additionally, overnight funding fees, also known as swap rates, are incurred for positions held open past a specific time (22:00 GMT), with a three-day swap fee applied on Wednesdays to account for weekend positions. These fees are standard in the industry and are essential for traders to consider when planning their trading strategies.

How AvaTrade Fees Compare to Other Brokers

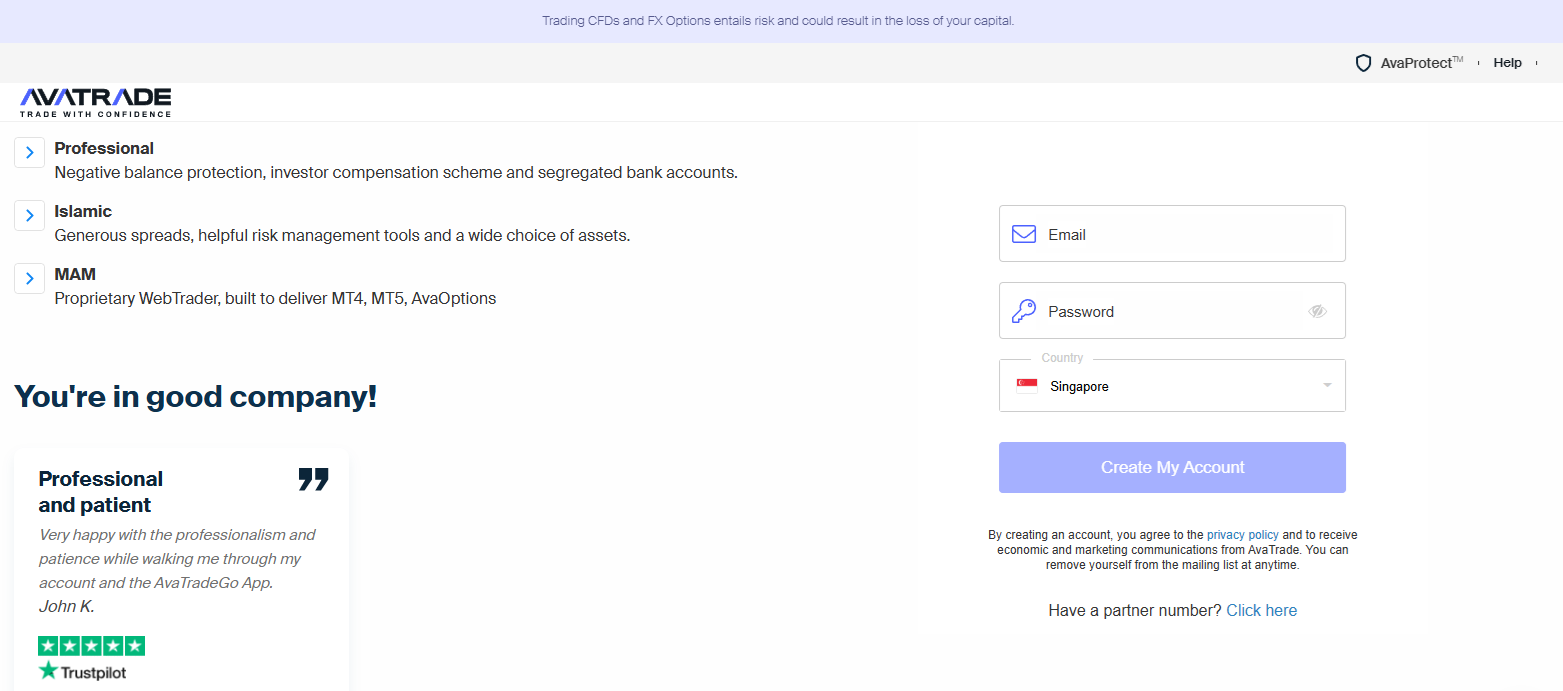

Account Types

Retail Account

-

- Designed for individual traders.

- Access to forex, commodities, stocks, cryptocurrencies, and indices.

- Competitive fixed spreads starting from 0.9 pips.

- Minimum deposit requirement of $100.

- Leverage varies by jurisdiction (up to 1:30 under Central Bank of Ireland and ASIC, up to 1:400 under BVI FSC).

Professional Account

-

- Aimed at experienced traders meeting eligibility criteria.

- Offers higher leverage up to 1:400 and reduced spreads.

- Eligibility includes sufficient trading activity, professional financial sector experience, or a portfolio exceeding €500,000.

Islamic Account

-

- Swap-free account compliant with Sharia law.

- Allows trading without interest on overnight positions.

- Access to various instruments with fixed spreads starting from 0.9 pips.

- Certain forex pairs and cryptocurrencies are excluded.

MAM (Multi-Account Manager) Account

-

- Designed for professional traders and asset managers managing multiple accounts.

- Efficiently handles multiple accounts under a single master account.

- Supports various order types, real-time monitoring, and works with MetaTrader 4 and MetaTrader 5 platforms.

How to Open your Account?

- Visit the official AvaTrade website to start the registration process.

- Complete the registration form by entering your basic details.

- Provide your email address and create a secure password for your account.

- Enter personal information, including your name, date of birth, address, phone number, and a valid photo ID number.

- Select the type of trading account that suits your needs, such as retail, professional, or Islamic.

- Share details about your occupation, income level, and net worth to help AvaTrade assess your trading profile.

- Confirm that you have read and agree to the legal documents and terms provided by AvaTrade.

- Fund your account with the required minimum deposit to begin trading on the platform.

For those who want to practice before trading live, AvaTrade also offers a demo account. This free account lets users trade in a risk-free environment with virtual funds.

AvaTrade Trading Platforms

What Can You Trade on AvaTrade?

Traders can access over 60 currency pairs, including major, minor, and exotic pairs, allowing for strategies that capitalize on global economic movements. This extensive selection enables traders to diversify their portfolios and manage risk effectively.

In addition to forex, AvaTrade provides contracts for difference (CFDs) on a variety of assets, such as commodities, indices, stocks, ETFs, bonds, and cryptocurrencies. This variety allows traders to speculate on price movements without owning the underlying assets, offering flexibility in trading strategies.

The platform’s inclusion of major stock indices like the S&P 500 and NASDAQ, as well as commodities such as gold and oil, caters to traders interested in these popular markets. Additionally, access to cryptocurrencies like Bitcoin and Ethereum enables participation in the growing digital asset space.

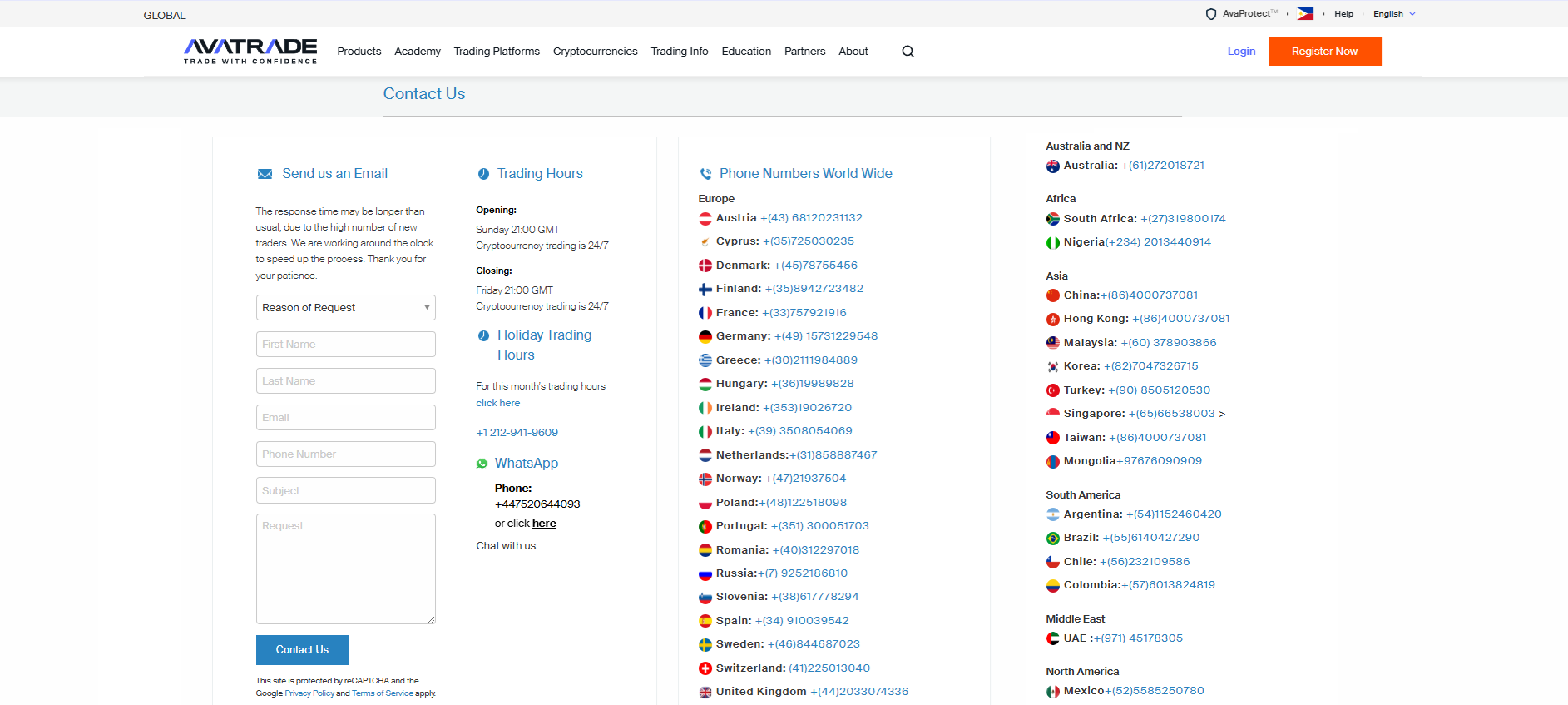

AvaTrade Customer Support

Based on the responses we got with those who traded with the broker, AvaTrade’s customer support is generally responsive and professional, offering assistance through live chat, phone, and email channels. Support is available 24/5, aligning with global trading hours, which accommodates traders across various time zones.

Traders have reported that live chat interactions are prompt, with minimal waiting times, and support agents provide relevant and detailed answers. Phone support offers localized numbers for many countries, enhancing accessibility, though some users have experienced occasional delays. Email inquiries are typically addressed within a day, though the depth of responses can vary.

While the multilingual support caters to a diverse client base, the absence of 24/7 availability means that assistance may not be accessible during weekends or certain hours, which could be a limitation for traders requiring immediate help outside standard operating times.

AvaTrade Customer Support Advantages and Disadvantages

Withdrawal Options and Fees

AvaTrade provides multiple withdrawal options, including credit/debit cards, bank wire transfers, and e-wallets like Skrill, Neteller, and WebMoney. However, availability may vary by region, and anti-money laundering regulations require withdrawals to be processed via the same method used for deposits.

Traders have noted that AvaTrade does not charge internal withdrawal fees, making fund withdrawals cost-effective. Nonetheless, some have experienced processing times ranging from 24 hours to several business days, depending on the withdrawal method and banking institutions involved.

It’s important to be aware that while AvaTrade doesn’t impose withdrawal fees, third-party charges from banks or payment processors may apply. Additionally, currency conversion fees can occur if your account currency differs from that of your withdrawal method.

AvaTrade vs Other Brokers

#1. AvaTrade vs RoboForex

AvaTrade, established in 2006, is a well-regulated broker operating under authorities such as ASIC and the Central Bank of Ireland, offering a wide range of trading instruments, including forex, commodities, and cryptocurrencies. RoboForex, founded in 2009, is regulated by the IFSC in Belize and provides a diverse selection of assets with high leverage options. AvaTrade’s user-friendly platforms and comprehensive educational resources cater to both beginners and experienced traders, while RoboForex offers competitive spreads and multiple account types to suit various trading strategies.

Verdict: AvaTrade is preferable for traders prioritizing strong regulatory oversight and a user-friendly experience, while RoboForex may appeal to those seeking higher leverage and a broader range of account options.

#2. AvaTrade vs Exness

AvaTrade is a globally recognized broker regulated in multiple jurisdictions, offering a variety of trading platforms, including MT4 and MT5, with a focus on fixed spreads and a comprehensive educational suite. Exness, regulated by authorities such as the FCA and CySEC, provides variable spreads, high leverage, and a proprietary trading platform alongside MT4 and MT5. AvaTrade’s fixed spreads provide cost predictability, beneficial for traders who prefer stable trading costs, while Exness’s variable spreads can offer lower costs during times of high market liquidity.

Verdict: AvaTrade is better suited for traders who value fixed spreads and extensive educational resources, whereas Exness may be more appealing to those seeking high leverage and potentially lower variable spreads.

#3. AvaTrade vs Alpari

AvaTrade offers a wide range of trading instruments with fixed spreads and is regulated by multiple authorities, providing a secure trading environment. Alpari, with a focus on forex trading, offers both fixed and variable spreads and provides high leverage options, but operates under less stringent regulatory oversight compared to AvaTrade. AvaTrade’s strong regulatory framework and diverse asset offerings make it a reliable choice for traders seeking security and variety, while Alpari’s flexible spread options and high leverage may attract those looking for specific forex trading advantages.

Verdict: AvaTrade is the preferable option for traders prioritizing regulatory security and a broad range of instruments, while Alpari may be suitable for those focusing on forex trading with flexible conditions.

Conclusion: Avatrade Review

Avatrade Review FAQs

Is AvaTrade a regulated broker?

Yes, AvaTrade is regulated by multiple authorities, including ASIC, the Central Bank of Ireland, and CySEC, ensuring a secure trading environment.

Does AvaTrade charge withdrawal fees?

No, AvaTrade does not charge internal withdrawal fees, but third-party fees from banks or payment processors may apply.

What platforms does AvaTrade offer?

AvaTrade provides MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions, and supports copy trading via ZuluTrade and DupliTrade.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS