TOGETHER WITH

Today’s edition is sponsored by TMGM. Want to get rewarded while you trade? TMGM’s exclusive Cashback Promo lets you earn up to $700 in cashback, just for doing what you already do.

Start collecting your cashback today!

Hey traders! Ezekiel here, bringing you the latest market moves to keep you one step ahead. Let’s dive into what’s making waves today:

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Nasdaq 100 suffers worst quarter in years as AI bubble fears grow

• Currencies brace for impact ahead of U.S. trade announcement

• Spot market reversals like a pro with these must-know patterns with our video

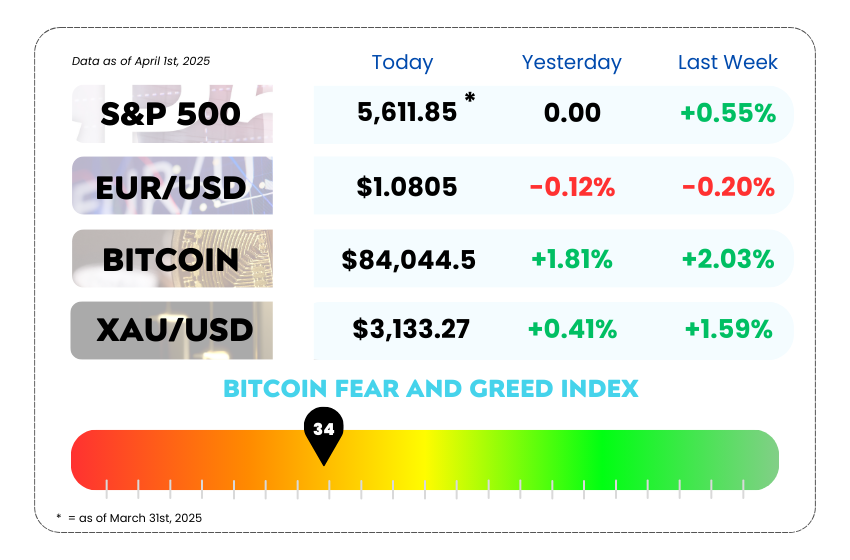

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

💥 Nasdaq 100 Just Had Its Worst Quarter in 3 Years — Blame It on the AI Jitters 💥

The AI hype train hit a red light this quarter… and the Nasdaq 100 felt the whiplash. 😵💫

After a wild 2-year ride powered by Big Tech and AI dreams, the Nasdaq 100 just faceplanted 8.3%, its worst quarter since 2020. What popped the balloon? A mix of recession fears, spending cuts, and some real anxiety about the AI boom turning into a bubble. 🫧

💻 Big Tech Ain’t Looking So Big Right Now…

Some of the biggest names in the AI arms race took it on the chin:

- Nvidia (NVDA): Down 28% from its January peak 💥

- Broadcom: -33% since December 🚨

- Microsoft, Amazon, Alphabet, and Meta: All down 20%+ from their highs 🫣

Investors are realizing that pouring hundreds of billions into data centers doesn’t mean infinite profits… especially if demand for AI services starts to slow.

And just to keep things spicy, there are fresh worries that Trump might roll out new tariffs, another body blow for markets. 🇺🇸📉

NVIDIA Corporation (NASDAQ) 6-Month Stock Chart as of April 1st, 2025 (Source: TradingView)

🚨 The AI Spending Spree Might Be… Too Much?

Things got even weirder last week:

- Alibaba’s co-founder said AI infrastructure is growing faster than AI demand. 🏗️➡️🫥

- A report claimed Microsoft is canceling new data center projects in the US and Europe.

- And some new AI models out of China are doing more with less, challenging the whole “we need more chips!” narrative. 🧠💡

Tech giants like Microsoft, Amazon, Alphabet, and Meta are still planning to spend over $300 billion this year on AI-related infrastructure… but investors are starting to ask: “Is the juice worth the squeeze?” 🍊🤔

🐂 Bulls vs Bears: Who Ya Got?

On the bright side, AI bulls say this is just a bump in the road. Companies like OpenAI are still growing fast, rumor has it they’re trying to raise $40B with Softbank. 🐮💸

Even Nvidia’s current valuation (23x forward earnings) is being called defensive by some analysts, which is wild considering it was the poster child of the AI boom just a few months ago.

Still… the mood is gloomy. The much-hyped IPO of CoreWeave (an AI cloud company backed by Nvidia) flopped hard, down 7% already after pricing below its target. In last year’s AI mania? That thing would’ve gone full rocket emoji. 🚀

- Overheated narratives always cool off, and AI is no exception. We’re seeing a healthy correction that may bring better entries for long-term plays.

- The broader tech pullback offers clues for FX markets, too. Watch USD strength, global recession signals, and tariff talk for ripple effects.

- AI demand vs infrastructure overspend? That tension will be a theme to trade in the quarters ahead. Stay sharp. 💹

🚀 Trade More, Earn More: TMGM’s Giving Out Cashback Just for Trading 💰

With TMGM’s Cashback Promo, you can pocket up to $700 just by doing what you already love — trading.

Here’s how you can stack up the rewards:

✅ Trade more, earn more – The more action you take, the more cashback lands in your account.

✅ Fuel your trades – Get bonus funds without needing to top up your deposits. 🔥

✅ Level up your strategy – Enjoy ultra-tight spreads and cutting-edge trading tools.

✅ Fast, smooth, powerful – Experience lightning-speed execution on TMGM’s premium platforms.

👉 Don’t miss out — Claim your cashback now!

🌀 Dollar Goes Nowhere Fast As Markets Wait On Trump’s Tariff Bombshell 🌀

The U.S. dollar is pacing in circles, nervously sipping coffee before tomorrow’s main event: Trump’s long-promised “reciprocal tariffs.” ☕💣

Traders are basically staring at their screens like: “Is it gonna be food? Pharma? Maple syrup?” No one knows. Trump dropped a teaser Sunday night saying “almost all countries” would get hit… and then ghosted the details. Classic.

With that, the dollar’s stuck in limbo, barely budging at 104.24 against a basket of rivals. Everyone’s waiting on two big numbers to drop today: JOLTS Job Openings and the ISM Manufacturing Index. Either could give markets a clue on whether these trade jitters are starting to hit the real economy. 📉

🧀 Europe’s Holding Its Breath Too…

The euro dipped 0.1% to $1.0805 after a strong Q1. Investors are now bracing for tariffs, weak data, and — oh yeah — potential ECB rate cuts. 👀

- Markets are pricing in a 70% chance the ECB cuts rates this month

- Policymakers are sending mixed signals

- Meanwhile, Germany’s fiscal pump-up is keeping things from totally unraveling

TLDR: Europe’s ready to negotiate, but also ready to clap back. 🫱🧨

EUR/USD Daily Chart as of April 1st, 2025 (Source: TradingView)

🐉 Asia Watch: Yen Firms Up, Aussie Crawls Back

In Asia, things are moving — just not fast:

- The Japanese yen ticked up to 149.92. It’s been flexing lately thanks to bets the BOJ might hike rates again 💪

- But sentiment among Japan’s big manufacturers? Yeah… not great. Trade tensions aren’t helping 🇯🇵📉

- The Aussie dollar rose 0.1% after the RBA did nothing, keeping rates steady

- Analysts say the RBA’s waiting on inflation data… or maybe just the election in May 🗳️🇦🇺

- The dollar’s in holding pattern mode, but tomorrow’s tariff announcement could be a major FX catalyst — especially if the U.S. takes an aggressive stance.

- Watch EUR/USD closely. ECB dovishness and U.S. uncertainty may pressure the euro further, but any upside surprises in U.S. data could flip the script fast.

- AUD and JPY are both in play, especially as Asia reacts to the global tariff drama. Yen strength signals risk-off vibes, while the Aussie is still tied to domestic politics and inflation trends.

MEMES OF THE DAY

Just one more peek, I swear

Just hit buy when the vibes are good! 😎