TOGETHER WITH

Today’s edition is sponsored by TMGM. Ready to earn while you trade? With TMGM’s exclusive Cashback promotion, you can get up to $700 in cashback rewards!

Hey traders! Ezekiel here, back with fresh insights to keep you ahead of the game. Let’s see what’s shaking up the markets today:

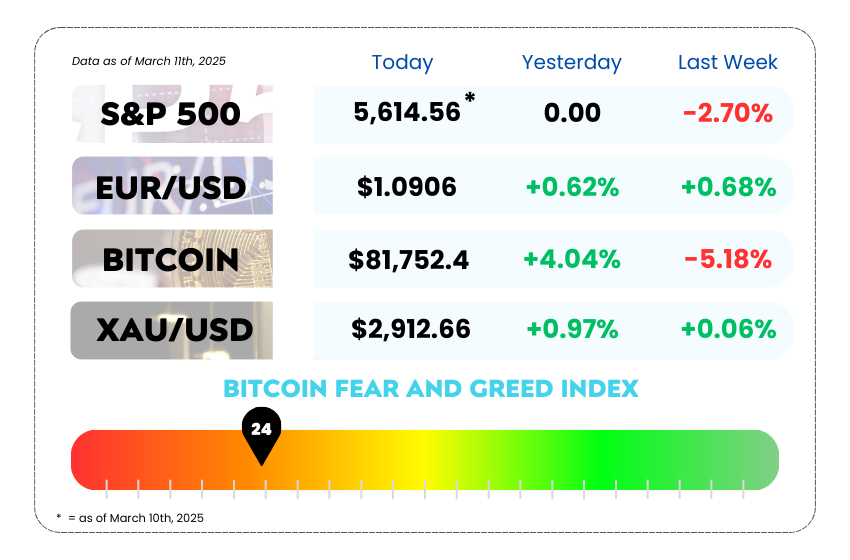

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Wall Street’s 2025 forecasts are crumbling as economic growth slows and market risks rise

• Coinbase is making a second attempt at India’s crypto market

• Fix your RSI strategy and maximize profits with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚨 Wall Street’s 2025 Forecasts Are Falling Apart – Here’s Why 🚨

The stock market took a Monday meltdown 💥, and suddenly, Wall Street’s rosy 2025 outlook is looking as shaky as a Jenga tower in an earthquake.

What happened? In simple terms: expectations were too high, reality just hit.

Former PIMCO CEO Mohamed El-Erian summed it up best:

👉 “We’ve had a complete upending of conventional wisdom.”

Just a few months ago, the big brains at Goldman Sachs, Morgan Stanley, and friends were all predicting another strong year of economic growth. But fast forward to today, and they’re dialing those numbers down. 📉

The New Reality Check

- Economic growth forecasts are shrinking – Morgan Stanley now expects just 1.5% growth in 2025, while Goldman Sachs is calling for 1.7%.

- Market strategists are sweating – The S&P 500 was supposed to cruise to 6,600 this year, but now, analysts fear a 14-20% drop could be in play. 📉

- The ‘Growth Scare’ Factor – RBC Capital’s Lori Calvasina says there’s a real chance the market could slip into a bear case if this slowdown snowballs.

US Dollar Index Daily Chart as of March 7th, 2024 (Source: TradingView)

What’s Spooking Investors?

Besides the usual suspects (inflation, interest rates, and the Fed playing guessing games), politics is adding fuel to the fire. 🔥

Last week, President Trump told Congress that his tariff policies might cause a “little disturbance” in the economy but insisted it’s all part of a “big transition.” 😬

Economists, however, aren’t convinced. Neil Dutta from Renaissance Macro points out that the economy was already slowing before Trump even took office, and the market’s been on a rollercoaster since August 2024.

So, while nobody’s calling for a full-blown recession yet, the market is definitely pricing in some turbulence.

What Happens Next?

Wall Street is basically saying: “Brace for impact, but don’t panic… yet.”

📌 Morgan Stanley’s Mike Wilson still has his year-end 6,500 target for the S&P 500 but warns that the road there will be bumpy as hell.

📌 History tells us that stocks tend to perform worst when GDP growth is between 0% and 2% – and guess where we’re headed? Yep, right into that danger zone. 🚧

📌 The silver lining? If GDP actually goes negative, stocks could rebound fast. (Yeah, weird, but that’s how markets work.)

So, is this just a speed bump or a full-blown detour? Traders will be watching the next few months closely. 👀

This is a textbook case of why traders need to stay flexible. Markets never move in a straight line, and the biggest profits come from navigating volatility, not fearing it.

✅ Watch GDP and market sentiment closely – if things start slipping too fast, opportunities will open up.

✅ Stay ready for pullbacks – smart traders know how to capitalize on dips instead of panicking.

✅ Adapt, don’t predict – As we’re seeing now, even the biggest firms get their forecasts wrong.

The market’s changing fast – make sure your trading game is, too. 🚀

🚀 TMGM’s Cashback Bonanza: Earn While You Trade! 💰

What’s better than trading? Getting paid to trade. TMGM’s Cashback Promotion is your chance to earn up to $700 just for doing what you already do, which is trading.

Here’s how you win big:

✅ Trade more, earn more – The more you trade, the more cashback you collect.

✅ Boost your trading capital – Extra funds without making additional deposits. 🔥

✅ Enjoy top-tier trading conditions – Benefit from tight spreads and advanced tools to sharpen your edge.

✅ Seamless experience – Trade on TMGM’s state-of-the-art platforms with lightning-fast execution. ⚡

Coinbase is back for round two in India. The US-based crypto exchange just registered with India’s Financial Intelligence Unit (FIU), clearing the way to finally launch trading services in the country. 🎉

If this sounds familiar, that’s because Coinbase already tried this in 2022, but let’s just say it didn’t go as planned. They rolled out UPI payments for crypto buys, but within three days, regulators hit the brakes. 🚧

Now, with a new strategy and a fresh commitment to playing by India’s rules, Coinbase is gearing up for a full retail trading launch later this year.

BTC/USD Daily Chart as of March 11th, 2024 (Source: TradingView)

Why India? 🇮🇳

According to Coinbase, India is a crypto powerhouse in the making. The country’s blockchain developer share has skyrocketed from 3% in 2018 to 12% in 2023, making it the top emerging market for crypto talent. That’s a big deal. 🔥

But it’s not all sunshine and rainbows. India’s tax policies on crypto are brutal, a 30% tax on digital asset income and a 1% TDS on every transaction have scared off many traders. 💸

Still, Coinbase is diving in, joining big-name exchanges like Binance, Bybit, and KuCoin in registering with the FIU to get a piece of the Indian market. Will traders bite? That’s the million-dollar question.

Coinbase’s India comeback is a bold move, but they’re stepping into a highly taxed and heavily regulated market.

✅ Short-term: Expect a slow, cautious rollout as Coinbase tries to win back trader confidence.

✅ Long-term: India’s developer boom could make it a crypto hub, but for now, high taxes = low local trading volume.

✅ What traders should watch: If India eases tax policies or offers regulatory clarity, we could see a major crypto revival in the region.

The lesson? Big exchanges are playing the long game in India. Traders should do the same. 🏆

MEMES OF THE DAY

Ah yes, the classic ‘stop-hunt while I sleep’ special. Thanks, market makers 😭

No stop-loss, max leverage… what could go wrong 💀📊