TOGETHER WITH

Today’s edition is sponsored by AvaTrade, a trusted name in online trading since 2006!

Looking to trade Bitcoin CFDs in just seconds? With AvaTrade, you can open a position in under 5 seconds and ride crypto’s wild volatility, all with a trusted, regulated broker.

Claim an exclusive 20% bonus and start capitalizing on crypto volatility today!

Hey traders! Ezekiel here with latest market insights (and more 🔍). Here’s what’s catching attention today:

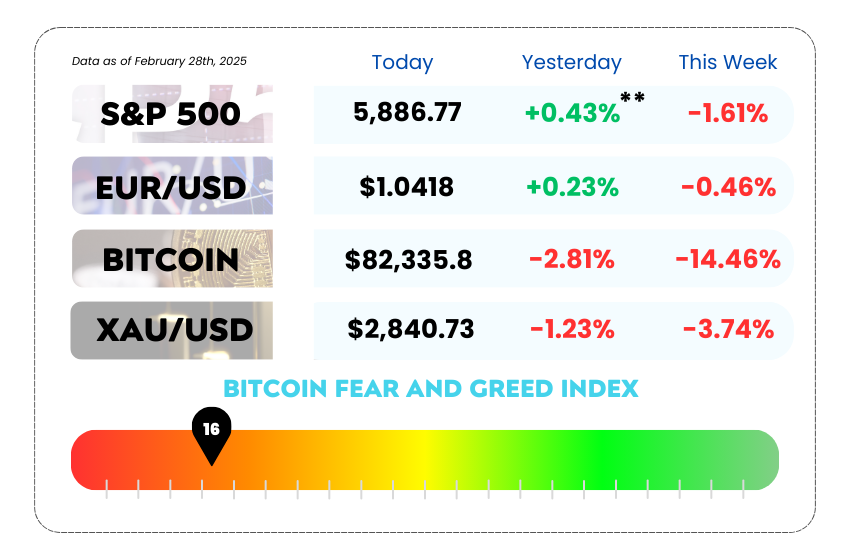

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Fed holds steady as inflation cools, but rate cuts remain a distant dream

• DeepSeek’s success sparks a surge in Chinese tech funding, fueling AI and innovation

• Bitcoin tanks as Trump’s crypto hype fades, wiping out nearly $1 trillion from the market

• Learn 3 powerful swing trading strategies to maximize your profits with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚨 PCE Inflation Matches Forecasts – Fed Can Breathe (For Now) 🚨

Good news, traders! The Federal Reserve’s favorite inflation gauge, the Personal Consumption Expenditures (PCE) index, just dropped, and it’s looking… not too spicy, not too cold, but juuust right. 📊

Here’s the deal:

✅ Core PCE (strips out food & energy) rose 0.3% in January – exactly what economists predicted. December? A cooler 0.2%.

✅ On a yearly basis, core prices rose 2.6%, which is a drop from 2.9% in December.

✅ Compared to the CPI report, which had some hotter-than-expected numbers, this PCE reading is looking pretty tame.

So, what’s the Fed thinking? 🤔

With inflation not spiraling out of control and this being the last major inflation report before the next March 18-19 Fed meeting, it’s pretty much locked in, rates are staying put. 🏦

But wait, there’s more…

📉 Rate cuts? Not so fast. The markets aren’t pricing in any cuts until June, and even then, it’s looking shaky. Some Fed officials still aren’t convinced inflation is tamed, and they don’t want a repeat of the 1970s inflation spiral.

💬 Richmond Fed President Tom Barkin says he’s keeping rates “modestly restrictive” until he’s really, really sure inflation is headed to 2%. Kansas City Fed’s Jeff Schmid is also getting a little nervous, saying inflation expectations have surged lately.

🚨 St. Louis Fed’s Alberto Musalem? He’s in watch mode – keeping an eye on the data before making any calls on rate changes.

What does this mean for traders?

The Fed isn’t in a rush to cut rates, which means the strong dollar trend could continue. Expect interest rate-sensitive assets (think forex pairs like USD/JPY and USD/EUR) to stay volatile as markets adjust to fewer rate cuts on the table.

Stay sharp, stay nimble! ⚡

🚀 Trade Bitcoin CFDs in Just Seconds! 🚀

Why wait when you can jump into the crypto action in less than 5 seconds? With AvaTrade, you can capitalize on Bitcoin’s wild moves ⚡ without the hassle.

📈 Instant execution – no delays, no FOMO

📊 Ride the volatility and catch market swings

🔒 Trade with a globally trusted, regulated broker

The crypto market moves fast… why shouldn’t you? Start trading with AvaTrade now! 🔥

🚀 DeepSeek’s Success is Supercharging Chinese Tech Funding – Here’s How 🚀

DeepSeek’s rapid rise is reshaping China’s tech investment landscape. With investors, VCs, and state funds flooding key sectors like AI, quantum computing, and EVs, the industry is experiencing a major funding boom.

As the Chinese government doubles down on tech innovation, national interests, intellectual property concerns, and competition with the West are driving massive capital inflows.

The question now is:

Is this just the beginning of China’s next tech revolution, or will external pressures slow the momentum?

🔍 Read the full story here.

🚨 Crypto Prices Crash as Trump Hype Fizzles 🚨

Well, that was fun while it lasted. Bitcoin just took a 6% nosedive on Friday, officially erasing nearly all the gains it made when Trump-mania first pumped the markets. 🏛️🚀

Remember when traders thought Trump would be the “Crypto President”? Yeah… about that. So far, the big moves have been more talk than action. Sure, he’s appointed some crypto-friendly officials, and regulators have backed off on certain probes (RIP Coinbase investigation). But let’s be real, he hasn’t exactly ordered the U.S. Treasury to stack sats.

Instead, all we got was a “working group” to study a national crypto reserve and “consider” new digital asset rules. 😴 Not exactly the rocket fuel bulls were hoping for.

🔻 Bitcoin is down nearly 20% from its peak

📉 Ether is down over 40% since December

💀 Trump’s own memecoin? Down 80% since launch

BTCUSD 5-Day Chart from February 24th to February 28th, 2025 (Source: TradingView)

And just like that, nearly $1 trillion has been wiped off the global crypto market. 💸 Oof.

Meanwhile, inflation worries are creeping back in, meaning those juicy rate cuts traders were banking on might not come as soon as expected.

So, was the Trump-fueled crypto boom just hopium? Or is this just a dip before the next leg up? 🤔

The crypto market is learning a hard lesson: hype alone doesn’t sustain rallies.

While Trump’s pro-crypto stance initially fueled optimism, the reality is his administration hasn’t delivered any game-changing policies.

The lack of regulatory clarity and concrete action is making institutional investors hesitant, keeping liquidity low and volatility high.

Meanwhile, inflation risks are creeping back, and if the Fed holds off on rate cuts, risk assets like Bitcoin will struggle to regain momentum. Institutional players were eyeing lower rates as a catalyst for fresh inflows, but with that window closing, expect more downward pressure on crypto until clearer policy signals emerge.

Bottom line? Without real policy shifts or macro tailwinds, this correction might not be over yet.

MEMES OF THE DAY

How to Defend Your Portfolio from the Trump Crypto Crash 101 😆

You meant 100% chance of emotional damage? 💀