TOGETHER WITH

Today’s edition is brought to you by Titan FX – the ultimate trading platform built for precision, speed, and elite performance. From forex and commodities to indices, Titan FX equips you with razor-sharp spreads and pro-level tools to stay ahead in the markets.

Hey, traders! Ezekiel here with fresh market insights (and a little something extra 🕵🏽♂️). Here’s what’s on the radar today:

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Nvidia, Tesla drag Nasdaq down as Bitcoin sinks & consumer confidence crashes

• Trump targets copper with potential tariffs, citing national security risks and escalating trade tensions

• Master the Morning Star Candlestick Pattern and learn how to spot bullish reversals for smarter trades with our video

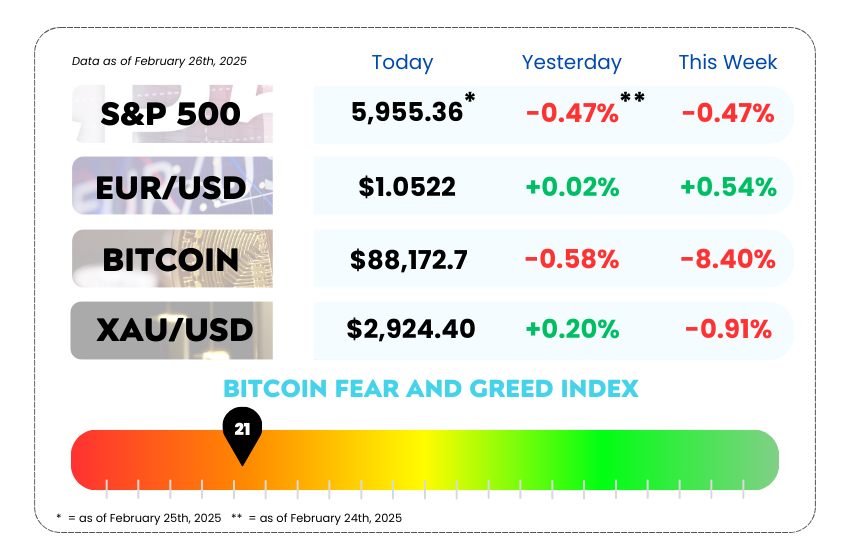

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚀 Nvidia, Tesla Drop, Bitcoin Sinks, & Confidence Crashes 💥

Tuesday was a rollercoaster for US stocks, with the market flipping between gains and losses. Investors had a lot to chew on: Trump reviving tariff talk; China trade tensions heating up; and consumer confidence taking its biggest hit in nearly four years.

📉 The Nasdaq took the hardest hit, dropping 1.3%, thanks to sell-offs in tech giants like Nvidia (NVDA) and Tesla (TSLA). The S&P 500 slipped 0.4%, while the Dow Jones managed to claw its way back into the green, closing up 0.4%.

Meanwhile, the crypto markets took a serious beating:

💰 Bitcoin (BTC) plunged below $90,000 for the first time since November, even dipping to $86,000 before stabilizing near $88,000 at market close.

🪙 Ether (ETH) wasn’t spared either, dropping 6% to just over $2,500.

📉 Crypto-related stocks like Coinbase (COIN) and MicroStrategy (MSTR) felt the pain too.

BTC/USD Daily Chart as of February 26th, 2025 (Source: TradingView)

What’s Shaking Up the Markets? 🔥

• Tariffs Are Back on the Table – Trump hinted that tariffs on Mexico and Canada could roll out next week, spooking investors worried about trade tensions slowing economic growth.

• China Chip Curbs – His administration is also eyeing stricter controls on US investments in China, which could mean trouble for AI chip king Nvidia (NVDA). This comes right as Nvidia gears up for its big earnings report on Wednesday, which is a must-watch for investors.

• Tesla in Reverse – TSLA stock nosedived over 8% after data revealed a brutal 45% drop in European sales for January. EV demand concerns are creeping back, adding more pressure to an already shaky stock.

• Recession Fears Growing – Consumer confidence fell off a cliff, marking its sharpest monthly drop in nearly four years. Inflation expectations jumped, and investors are now betting that rate cuts might come sooner than expected. The 10-year Treasury yield fell to 4.3%, its lowest level this year.

With markets rattled by trade tensions, tumbling cryptos, and shaky economic data, volatility is back in full force. The key question now: Will the Fed step in with rate cuts, or will the uncertainty keep weighing on investor sentiment?

📊 For forex traders, all eyes should be on the USD and how it reacts to these shifting dynamics. More tariff drama and weak confidence data could weaken the dollar, while any hawkish Fed pushback might strengthen it.

🚨 Trump Eyes Copper Tariffs: Trade War 2.0? 🏗️

President Donald Trump just threw copper into the tariff mix, ordering a government review on potential duties. His latest move aims to reshape global trade and curb China’s growing copper dominance.

🔊 “It will have a big impact,” Trump said before signing the executive order.

What’s behind this? White House trade adviser Peter Navarro framed it as a national security move, the U.S. wants to strengthen domestic copper mining, smelting, and refining for potential military and tech needs.

🚢 But here’s the twist, the U.S. actually runs a copper trade surplus. Last year, exports hit $11.3 billion, while imports totaled $9.6 billion. So, why the fuss? The administration worries that future supply-demand shifts could pose a security risk.

Country-Specific Headaches Piling Up

• Indonesia’s banking sector is under pressure, and investors bailed after major stocks were left out of MSCI’s index review.

• Thailand’s government is calling for rate cuts, fearing its economic recovery isn’t as strong as expected.

• The Philippines is dealing with weak economic data, making it hard to find a reason for a rally.

What Could Turn This Around?

Southeast Asian markets need a major sentiment shift—either a weaker US dollar or stronger domestic policies that give investors a reason to come back. But with US rate cuts still uncertain, markets may remain under pressure in the short term.

Copper tariffs = potential USD volatility.

If this move escalates into broader trade tensions, we could see risk-off sentiment pushing the dollar up. But if markets fear economic slowdown, the Fed might step in with rate cuts, weakening the USD. 💰

For forex traders, keep an eye on Trump’s next tariff targets, especially China and commodities. Trade smart, stay ahead, and don’t let the market catch you off guard. 🚀

MEMES OF THE DAY

The market maker saw my trade and said, ‘Not today!’ 😭

Welp… time to pray 🙏